UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | | | | | | | | | | | | |

| Filed by the Registrant | ☒ | | Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

SEZZLE INC.

(Name of Registrant as Specified in Its Charter)

Not applicable.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| ☒ | No fee required. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

☐ | Fee paid previously with preliminary materials. |

Letter from our Executive Chairman and Chief Executive Officer

Dear Fellow Shareholders,

2023 was nothing short of extraordinary for Sezzle as a Buy Now, Pay Later (BNPL) company. Reflecting on the past year, I’m inspired by our innovations, achievements, and our dedication to superior execution. Our journey over the last several years has certainly been challenging, but these challenges transformed Sezzle to produce the results you’re seeing today.

We began 2023 with a clear goal: to attain full-year GAAP net income. I am thrilled to report that we successfully achieved this goal. In a remarkable show of consistency, we even reported four consecutive quarters of net income. Sezzle is reshaping the BNPL narrative with a sustainable and prosperous business model, as evidenced by our achievement of full-year net income in 2023. We believe Sezzle is leading the way to a new era for the BNPL sector as a model for sustainable growth and profitability.

Delivering on Our Promise of Profitability Through Innovation and Operational Efficiency

Our achievement of full-year profitability not only reflects our commitment to driving value and fostering growth but also our ability to deliver on promises we make to the market. During 2022, we made it our primary focus to attain profitability amidst a challenging economic environment, a goal we successfully attained in the back half of the year. We maintained this momentum in 2023 by successfully executing several key strategic initiatives that catapulted us from a net loss of $38.1 million in 2022 to a net income of $7.1 million in 2023. This marks a $45.2 million year-over-year improvement and a $82.3 million turnaround from 2021. These results prove our business is on a solid foundation for sustainable growth in the future.

Innovation was crucial to our success. Roughly one year after the launch of Sezzle Premium, our first subscription product, we launched Sezzle Anywhere, which was taken in by our customer base as a highly valued subscription offering. Our Anywhere product emerged as the flagship offering, forming an integral part of our subscription suite alongside Premium. The engagement of our subscriber base is astonishing. Our subscribers leveraged this product 2.2 times more frequently than non-subscribers, with the top 10% of Sezzle Anywhere subscribers making a staggering 37 purchases every 90 days1. These statistics underscore the significant value our subscription suite brings to our consumers, solidifying our position as a top-of-wallet payment option for many.

Amidst our efforts pioneering new payment capabilities for our consumers, we remained persistent in our commitment to operational efficiency. Through rigorous cost reduction initiatives implemented in 2022 and a continued focus on efficiency throughout 2023, we accomplished our growth goals while significantly cutting our overhead costs. We intend to uphold our commitment to lean operations to balance efficiency with sustainable growth.

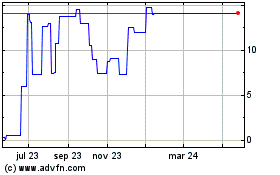

Departing the ASX for Our New Home - Nasdaq

The achievement of these milestones coincided with our listing on the Nasdaq Capital Market (Nasdaq) in August and subsequent delisting from the Australian Securities Exchange (ASX). This strategic move aligns our listing location with our primary operational hub in the United States and reduces the financial and operational burdens of a dual list. We are thrilled to embark on this new chapter in our journey as a public company. At this juncture, I would like to express my deepest gratitude to our Australian investors for their support since our ASX listing in 2019. Our time as a public company on the ASX will always be remembered as a key milestone of Sezzle’s growth story, and we thank you for being a part of it.

1 Frequency corresponds to 90-days ending February 5, 2024.

Setting the Stage for the Next Phase of Growth

Our past accomplishments leave me filled with optimism and enthusiasm for the journey that lies ahead. 2022 marked the beginning of an exceptional turnaround journey for our company, while 2023 validated our strategic roadmap. In 2024, we will continue to innovate with a hyperfocus on profitability, with the expectation of increasing our net income by over two-fold to $20.0 million. And it isn’t just about the numbers. We also plan to renew our B Corporation certification in 2024, reaffirming our dedication to improving the lives of all our stakeholders, in line with our commitment as a Public Benefit Corporation.

Yet none of this could have been achieved without the hard work and dedication of our Sezzlers and the trusted support from our Board of Directors. I extend my heartfelt gratitude to each and every one of you for your tireless efforts and commitment to our shared mission of Financially Empowering the Next Generation. Thank you.

As we evolve into a premier, all-encompassing financial services provider for the Next Generation of consumers, our commitment to driving value for our stakeholders and shareholders alike is unwavering. I am confident that with our collective efforts and determination, the best is yet to come.

Thank you for your continued trust and support. Your faith in us fuels our determination to achieve more and propels us towards greater heights.

Sincerely,

Charles Youakim

Executive Chairman and Chief Executive Officer

| | | | | |

| NOTICE OF THE 2024 ANNUAL GENERAL MEETING OF STOCKHOLDERS |

TO BE HELD ON

THURSDAY, JUNE 13, 2024 AT 5:00 P.M. (U.S. EASTERN TIME)

TO THE STOCKHOLDERS OF SEZZLE INC.:

Please take notice that the Annual Meeting of Stockholders (the “Annual Meeting”) of Sezzle Inc. (the “Company”) will be held on Thursday, June 13, 2024 at 5:00 p.m. (US Eastern Time), via virtual meeting conducted exclusively online via live webcast at https://meetnow.global/MFH4YSX, for the following purposes, as more fully described in the accompanying proxy statement (the “Proxy Statement”):

1.The election of six directors named in the Proxy Statement to serve until their successors are duly elected and qualified;

2.The ratification of the appointment of Baker Tilly US, LLP as our independent registered public accounting firm for the fiscal year ending 2024; and

3.The transaction of any other business as may properly come before the Annual Meeting or any adjournments thereof.

Pursuant to due action of the Board of Directors, stockholders of record on Monday, April 15, 2024 at 5:00 p.m. (US Eastern Time) will be entitled to vote at the Annual Meeting or any adjournments thereof.

This Notice is accompanied by a Proxy Statement, Explanatory Notes, a Proxy Form and Voting Instructions Form, which all form part of this Notice.

The Proxy Statement and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, each of which is included with this Notice, are also available to you on the Internet. To view the proxy materials on the Internet, visit investors.sezzle.com.

We encourage you to review all of the important information contained in the proxy materials before voting.

| | |

By Order of the Board of Directors |

|

|

| Charles Youakim |

| Executive Chairman and Chief Executive Officer |

|

| Minneapolis, Minnesota |

| April 23, 2024 |

IMPORTANT INFORMATION

Record Date

You are entitled to notice of, and to vote at, the Meeting (and any adjournment or postponement thereof) if you were a Stockholder on Monday, April 15, 2024 at 5:00 p.m. (US Eastern Time) (the Record Date).

Voting by Proxy

Whether or not you plan to participate in the virtual Meeting, you can ensure that your Shares are represented at the Meeting by promptly completing, signing and returning the Proxy Form or voting and submitting your Proxy Form online, in each case in accordance with the instructions on the Proxy Form, as soon as possible. If you later decide to participate in the virtual Meeting, you may withdraw your proxy and vote in person.

Forward-Looking Statements

This Notice and the Proxy Statement and accompanying materials may contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, which statements are subject to substantial risks and uncertainties and include statistical data, market data and other industry data and forecasts, which we obtained from market research, publicly available information and independent industry publications and reports that we believe to be reliable sources. All statements other than statements of historical facts included in the Proxy Statement are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “expect,” “estimate,” “may,” “might,” “will,” “could,” “can,” “shall,” “should,” “would,” “leading,” “objective,” “intend,” “contemplate,” “design,” “predict,” “potential,” “plan,” “target” or the negative of these terms, and similar expressions intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from the forward-looking statements expressed or implied in the Proxy Statement. Such risks, uncertainties, and other factors include those risks described in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the U.S. Securities and Exchange Commission (“SEC”) and other subsequent documents we file with the SEC.

The Company expressly disclaims any obligation to update or alter any statements as a result of new information, future events or otherwise, except as required by law. While the Company believes that the expectations reflected in the forward-looking statements are reasonable, neither the Company nor any other person gives any representation, assurance or guarantee that the occurrence of an event expressed or implied in any forward-looking statements in this Notice and its accompanying documents will actually occur.

Disclaimer

No person is authorized to give any information or make any representation in connection with the subject matter of an item which is not contained in this Notice or its accompanying documents. Any information which is not contained in this Notice or accompanying documents may not be relied on as having been authorized by the Company or the Board.

Electronic Copy

An electronic copy of this Notice and accompanying documents is available on the Company’s website at investors.sezzle.com.

Virtual Meeting

This year’s Annual Meeting will be conducted virtually using an online meeting platform accessible at https://meetnow.global/MFH4YSX.

Stockholders will not be able to attend the Annual Meeting in person. Stockholders, proxyholders, attorneys and authorized corporate representatives must log into the online Annual Meeting platform to participate in the Meeting. By participating in the Annual Meeting online, you will be able to:

•hear the Meeting discussion and view presentation slides;

•submit written questions while the Meeting is progressing; and

•vote during the Meeting.

We recommend logging into the online platform at least 15 minutes prior to the scheduled start time for the Meeting using the instructions below:

Access: Once the webpage above has loaded into your web browser, click “JOIN MEETING NOW.” Then select Shareholder on the login screen and enter your Control Number, or if you are an appointed proxy, select Invitation and enter your Invite Code.

If you have trouble logging in, contact the virtual hosting company using the telephone number provided at the bottom of the screen.

Important Notice for Non-Registered Holders: Non-registered holders (shareholders who hold their shares through a broker, investment dealer, bank, trust company, custodian, nominee or other intermediary) who have not duly appointed themselves as proxy will not be able to participate at the meeting. Non-registered holders that wish to attend and participate should follow the instructions on the voting information form and in the management information circular relating to the meeting to appoint and register themselves as proxy, otherwise you will be required to login as a guest.

If you are a guest: Select Guest on the login screen. As a guest, you will be prompted to enter your name and email address. Please note, guests will not be able to ask questions or vote at the meeting.

Online voting will be open between the commencement of the Annual Meeting and the time at which the Chairman announces voting closure.

You may still attend the Annual Meeting virtually if you have completed a Proxy Form, but in that case, you will not vote directly; rather, the person you have appointed as proxy will cast your vote on your behalf.

Stockholders are also encouraged to submit any questions in advance of the Annual Meeting to the Company. Questions must be submitted in writing to the Company by email to investorrelations@sezzle.com at least 48 hours prior to the Annual Meeting.

Stockholders will also have the opportunity to submit written questions during the Annual Meeting in respect to the formal items of business, however it would be preferable for questions to be submitted to the Company in advance of the Meeting. In order to ask a question during the Annual Meeting, please follow the instructions from the Chair.

The Chair will attempt to respond to the questions during the Annual Meeting. Stockholders are limited to a maximum of two questions each (including any questions submitted in advance of the Annual Meeting).

IMPORTANT: To assure that your shares are represented at the meeting, please vote your shares over the telephone, via the Internet or by marking, signing, dating and returning the enclosed proxy card or applicable voting instruction form to the address specified. If you attend the meeting, you may choose to vote in person even if you have previously voted your shares, except that beneficial owners may only instruct their broker, bank or other holder of record to vote on their behalf by following the instructions on the enclosed applicable voting instruction form. Beneficial owners may not vote in person at the Meeting unless a valid proxy has been obtained from their broker, bank or other holder of record, as the case may be, with respect to their ownership interests.

TABLE OF CONTENTS

Proxy Summary

Annual Meeting

| | | | | | | | | | | | | | |

| | | | |

| Date and Time: | | Location: | | Record Date: |

June 13, 2024

5:00pm (US Eastern Time) | | meetnow.global/MFH4YSX | | April 15, 2024 |

Items of Business

| | | | | | | | |

| Item | Board Recommendation | Page |

Items 1–6: Election of Directors | FOR each Director Nominee | |

Item 7: Ratification of Independent Accounting Firm Selection | FOR | |

How to Vote

| | | | | | | | | | | | | | |

| | | | |

| By Mail | | Online | | During the Meeting |

| Sign, date and return your proxy card in the enclosed envelope. | | Visit the website on your

proxy card. | | |

Board of Directors

| | | | | | | | | | | | | | |

| | Committee Membership |

| Name | Director Since | Compensation | Nominating and Corporate Governance | Audit and Risk |

| Mike Cutter | 2020 | ☑ | ☑* | ☑ |

| Paul Lahiff | 2019 | ☑* | ☑ | ☑* |

| Paul Paradis | 2018 | | | |

| Paul Purcell | 2019 | ☑ | ☑ | ☑ |

| Karen Webster | 2024 | ☑ | ☑ | ☑ |

| Charles Youakim | 2016 | | | |

*Indicates committee chair.

About Sezzle

Sezzle is a purpose-driven payments company on a mission to financially empower the next generation. Launched in 2017, Sezzle has built a digital payments platform that allows merchants to offer their consumers a flexible alternative to traditional credit. Sezzle aims to enable consumers to take control over their spending, be more responsible, and gain financial freedom. Sezzle's vision is to create a digital ecosystem benefiting all of our stakeholders—including merchants, partners, consumers, employees, communities, and investors—while continuing to drive ethical and sustainable growth.

Key Performance Highlights

1.UMS is defined as the total value of sales made by merchants based on the purchase price of each confirmed sale where a consumer has selected the Sezzle Platform as the applicable payment option. UMS does not represent revenue earned by us, is not a component of our income, nor is included within our financial results prepared in accordance with U.S. GAAP.

2.Active Consumers is defined as unique consumers who have placed an order with us within the last twelve months.

3.Active Subscribers is defined as unique consumers who have an active subscription for either Sezzle Premium or Sezzle Anywhere.

Our Board of Directors and Corporate Governance

Our directors, their respective ages as of April 15, 2024, and certain other information are as follows:

| | | | | | | | | | | | | | | |

| | | | | |

| Name | | Age | Director Since | Position | Committee Membership |

| Mike Cutter | | 58 | 2020 | Independent Non-Executive Director | Audit and Risk Committee (Member), Compensation Committee (Member), and Nominating and Corporate Governance Committee (Chair) |

| Paul Lahiff | | 71 | 2019 | Independent Non-Executive Director | Audit and Risk Committee (Chair), Compensation Committee (Chair), and Nominating and Corporate Governance Committee (Member) |

| Paul Paradis | | 40 | 2018 | Co-Founder, Executive Director, and President | — |

| Paul Purcell | | 49 | 2019 | Independent Non-Executive Director | Audit and Risk Committee (Member), Compensation Committee (Member), and Nominating and Corporate Governance Committee (Member) |

| Karen Webster | | 67 | 2024 | Independent Non-Executive Director | Audit and Risk Committee (Member), Compensation Committee (Member), and Nominating and Corporate Governance Committee (Member) |

| Charles Youakim | | 47 | 2016 | Co-Founder, Executive Chairman, and Chief Executive Officer | — |

Director Biographies

| | | | | |

| Mike Cutter Independent Non-Executive Director |

Mr. Cutter has served as a member of our Board of Directors since June 2020. Prior to serving as a director, Mr. Cutter served as an advisor to the Board from May 2019 until joining as a member of the Board of Directors. Mr. Cutter has more than 33 years’ experience in a wide range of financial services businesses in Australia, New Zealand, Asia and Europe.

Most recently from 2015 to 2019 he served as the Group Managing Director for the information services business Equifax ANZ. Prior to that he held various CEO, CRO, Product and Operations roles with GE, ANZ, Wesfarmers, Halifax/BankOne and NAB.

Mr. Cutter is a Graduate of the Australian Institute of Company Directors (GAICD) and a Senior Fellow of the Financial Services Institute of Australia and has previously served on the board of directors of the Women’s Cancer Foundation, Ovarian Cancer Institute, the Australian Finance Congress, the National Insurance Brokers Association and the Australian Retail Credit Association.

In addition to his role with Sezzle, Mr. Cutter is currently a director for Pepper Money Australia New Zealand, the Chair of Arteva Premium Funding, the Chair of Panthera Finance, a Board Advisor to Revolut Australia and serves as a Director for Kadre Consulting. Mr. Cutter has a Bachelor of Science (Hons) from Hertfordshire University. We believe Mr. Cutter is well-qualified to serve as a member of our Board of Directors due to his experiences in the financial services industry across varied geographical locations. |

Age: 58 Director since 2020

Committees: •Compensation •Nominating and Corporate Governance (Chair) •Audit and Risk |

| | | | | |

| Paul Lahiff Independent Non-Executive Director |

Mr. Lahiff has served as a member of our Board of Directors since May 2019. Mr. Lahiff was previously Chief Executive Officer of Mortgage Choice and prior to that, Chief Executive Officer of Permanent Trustee and Heritage Bank. He previously held roles on the Boards of directors with Sunsuper, Thorn Group, New Payments Platform Australia, RFi, Cuscal and Cancer Council NSW. Mr. Lahiff holds a Bachelor of Agricultural Science from the University of Sydney and is a graduate of the Australian Institute of Company Directors. Mr. Lahiff is the Chairman of Harmoney, NESS Superannuation, and UBank. We believe Mr. Lahiff is well-qualified to serve as a member of our Board of Directors due to his senior management experience and prior and other director roles. |

Age: 71 Director since 2019

Committees: •Compensation (Chair) •Nominating and Corporate Governance •Audit and Risk (Chair) |

| | | | | |

| Paul Paradis Executive Director and President |

Mr. Paradis co-founded Sezzle and has served as a member of our Board of Directors since May 2018. Mr. Paradis has served as President since July 2020 and, prior to serving as President, Mr. Paradis was our Chief Revenue Officer starting in May 2016. Mr. Paradis has extensive experience in sales and marketing. He began his career in sales with the Minnesota Timberwolves. He left the Timberwolves to attain his MBA from the Carlson School of Management at the University of Minnesota, where he focused on marketing and strategy. After graduating from the Carlson School of Management, Mr. Paradis spent six years leading sales and marketing at Dashe & Thomson and the Abreon Group, boutique management consultancies focused on IT transformation adoption. Mr. Paradis left the Abreon Group in 2016 when he co-founded Sezzle. At Sezzle, Mr. Paradis oversees sales, account management, strategic partnerships, and customer and merchant support.

Mr. Paradis has a Bachelor of Arts in Political Science from Davidson College and an MBA from the University of Minnesota. Mr. Paradis does not currently hold any other directorships. We believe Mr. Paradis is well-qualified to serve as a member of our Board of Directors due to his experience from serving as co-founder and President at Sezzle, in addition to his experience in IT transformation. |

Age: 40 Director since 2018

Committees: None. |

| | | | | |

| Paul Purcell Independent Non-Executive Director |

Mr. Purcell has served as a member of our Board of Directors since April 2019. Mr. Purcell has invested in financial services companies (public and private markets) for over 20 years. He retains a specific specialization in emerging financial innovation as well as non-bank financial services. He has been the Chief Investment Officer of Jupiter Management since January 1, 2019 and prior to assuming that position led the sourcing and origination of investments at Continental Investors since 1999. Mr. Purcell is a frequent panelist at industry conferences and has published several articles on the trends and developments in the emerging commerce and financial services marketplaces.

Before joining Continental Investors, Mr. Purcell was a co-founder of Continental Advisors, a manager of two sector-based hedge funds. He was also Manager of Internet Marketing at the Chicago Board Options Exchange (CBOE).

Mr. Purcell is a graduate of the University of San Diego where he is a member of the Board of Trustees. He currently serves on the board of directors of AeroPay, GigWage, Prizeout, thedrop.com, Winestyr, CarHop, and What’s Next Media. We believe Mr. Purcell is well-qualified to serve as a member of our Board of Directors due to his various experiences in the financial services industry and his service as a director at numerous companies. |

Age: 49 Director since 2019

Committees: •Compensation •Nominating and Corporate Governance •Audit and Risk |

| | | | | |

| Karen Webster Independent Non-Executive Director |

Karen Webster was appointed and has served as a member of the Board of Directors since February 2024. Ms. Webster is the founder and has served as Chief Executive Officer of What’s Next Media & Analytics LLC since July 2009 and has been a consultant and managing director of Berkeley Research Group, LLC since 2023. Ms. Webster also has been a co-founder and executive of Market Platform Dynamics LLC since 2004.

Ms. Webster has a Master of Science in Strategy and Marketing from Johns Hopkins University. We believe Ms. Webster is well-qualified to serve as a member of our Board of Directors due to her senior management experience and her expertise in the payments industry. |

Age: 67 Director since 2024

Committees: •Compensation •Nominating and Corporate Governance •Audit and Risk |

| | | | | |

| Charles Youakim Chairman and Chief Executive Officer |

Mr. Youakim is our co-founder, Executive Chairman, and Chief Executive Officer of Sezzle. Mr. Youakim is a serial technology entrepreneur with over ten years of experience in growing fintech companies from inception to large-scale businesses. Mr. Youakim began his career as an engineer and software developer. After successfully advancing in his early career, he returned to business school where he was able to focus on expanding his knowledge of finance, marketing, and business strategy.

In 2010, after completing business school, Mr. Youakim founded his first payments company, Passport Labs, Inc. (“Passport”). Passport became a leader in software and payments for the transportation industry. At Passport, Mr. Youakim led the construction and the original technology and led the company as it disrupted the industry through the introduction of white label systems and payment wallets. Passport is the technology behind enterprise transportation installations like ParkChicago, ParkBoston, and the GreenP in Toronto.

Mr. Youakim co-founded Sezzle in 2016 and also planned much of the business’ technology architecture. Mr. Youakim has a degree in Mechanical Engineering from the University of Minnesota and an MBA from the Carlson School of Management at the University of Minnesota. Mr. Youakim does not currently hold any other directorships. We believe Mr. Youakim is well-qualified to serve as a member of our Board of Directors due to his perspective and experience from serving as co-founder and Chief Executive Officer of Sezzle, as well as his experience leading other technology companies. |

Age: 47 Director since 2016

Committees: None. |

Director Independence

Our Board currently consists of six members: Mr. Cutter, Mr. Lahiff, Mr. Paradis, Mr. Purcell, Ms. Webster, and Mr. Youakim. Under the Nasdaq listing standards, a director will only qualify as “independent” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In addition, audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and compensation committee members must satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and the listing standards of Nasdaq. Our Board conducts a periodic review of the independence of the directors and, based upon information provided by each member of the Board regarding his or her background, employment, affiliations, and beneficial ownership, the Board of Directors has determined that each of Mr. Cutter, Mr. Lahiff, Mr. Purcell, and Ms. Webster are “independent” as defined under the applicable rules, regulations, and listing standards of Nasdaq and the applicable rules and regulations promulgated by the SEC.

There are no family relationships among any of our directors or executive officers.

Board Leadership

The Chairman of the Board is also the Chief Executive Officer of the Company, Charlie Youakim. Our Board believes that we are best served at this stage of our growth and operations by Mr. Youakim serving in both roles. Our Board is comprised of a majority of independent directors under the Nasdaq listing standards and, while our independent directors bring valuable oversight and outside experience, Mr. Youakim provides current Company-specific experience and insight developed from co-founding and leading the Company since its inception.

Mr. Youakim is not a member of the Compensation Committee, Nominating and Corporate Governance Committee, or the Audit and Risk Committee. Because the roles of Chairman and Chief Executive Officer are combined, Mr. Lahiff was appointed and has served as the Company’s Lead Independent Director since October 2022.

Board Committees

Our Board of Directors has established a Compensation Committee, Nominating and Corporate Governance Committee, and Audit and Risk Committee, each of which operates pursuant to a committee charter, available at our website (investors.sezzle.com) under the "Governance" heading. Each committee is comprised of Mr. Cutter, Mr. Lahiff, Mr. Purcell, and Ms. Webster, each of whom the Board has determined is independent under the definitions of independence prescribed by Nasdaq and the SEC. Further, our Board of Directors has determined that each member of our Audit and Risk Committee can read and understand fundamental financial statements in accordance with Nasdaq audit committee requirements. Our Board of Directors has determined that Mr. Lahiff is an “audit committee financial expert” within the meaning of the SEC regulations.

| | | | | |

Compensation Committee

Members: •Paul Lahiff (Chair) •Mike Cutter •Paul Purcell •Karen Webster | Our Compensation Committee charter is available on our website at https://investors.sezzle.com/leadership-and-governance/. Our compensation committee has overall responsibility for evaluating and approving the structure, operation, and effectiveness of the Company’s compensation plans, policies, and programs for officers and directors, including but not limited to:

•Assisting the Board of Directors in developing and evaluating potential candidates for executive officer positions, and overseeing the development of executive succession plans; •Reviewing the Company’s overall compensation strategy to provide for appropriate rewards and incentives for the Company’s management and employees; •Reviewing and approving corporate goals and objectives relevant to the Chief Executive Officer and other executive officer compensation, and evaluating the performance of the executive officers of the Company in light of those goals and objectives; •Reviewing, assessing, and making recommendations to the Board of Directors regarding the compensation of the independent directors; •Considering and making recommendations to the Board of Directors regarding whether to seek shareholder approval for any executive officer compensation; •Overseeing the Company's policies and practices regarding the deferral of performance-based remuneration and the reduction, cancellation, or clawback of performance-based remuneration in the event of serious misconduct, a material misstatement in the Company's financial statements, or as otherwise set forth in policies of the Committee or Board; •Overseeing and monitoring the remuneration of non-executive directors, including the Company's policies and practices regarding any minimum shareholding requirements; •Administering the Company’s equity-based plans, deferred compensation plans and management incentive compensation plans, granting awards under such plans and making recommendations to the Board of Directors about amendments to such plans (or approve amendments to such plans, to the extent authority to approve such amendments is provided therein) and the adoption of any new equity-based incentive compensation plans; •Reviewing, considering, and selecting, to the extent determined to be advisable, a peer group of appropriate companies for purposes of benchmarking and analysis of compensation for executive officers and directors; •In its sole discretion, appointing, retaining, or obtaining the advice of a compensation consultant, legal counsel, or other adviser; •Producing a compensation committee report on executive compensation for inclusion in the Company’s annual proxy statement in accordance with the proxy rules and such rules as required by the SEC; •Monitoring the Company's compliance with the requirements under the Sarbanes-Oxley Act of 2002 relating to loans to directors and officers, and with all other applicable laws affecting employee compensation and benefits; •Overseeing the Company's compliance with applicable rules and regulations promulgated by the SEC regarding shareholder approval of certain executive compensation matters, including advisory votes on executive compensation and the frequency of such votes, and the requirement under Nasdaq rules; |

| | | | | |

Compensation Committee (continued)

Members: •Paul Lahiff (Chair) •Mike Cutter •Paul Purcell •Karen Webster | •Reviewing the risks associated with the Company’s compensation policies and practices, including an annual review of the Company’s risk assessment of its compensation policies and practices for its employees; •Reviewing whether there is any gender or other inappropriate bias in remuneration for directors, executives, or other employees; •Reviewing and assessing the adequacy of its charter and submitting any changes to the Board of Directors for approval on an annual basis; •Reporting its actions and any recommendations to the Board on a periodic basis; and •Annually performing, or participating in, an evaluation of the performance of the committee, the results of which shall be presented to the Board of Directors.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is or has been an officer or employee of our Company. None of our executive officers currently serve, or in the past year has served, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of any entity that has one or more executive officers serving on our Board or Compensation Committee. |

Nominating and Corporate Governance Committee

Members: •Mike Cutter (Chair) •Paul Lahiff •Paul Purcell •Karen Webster | Our Nominating and Corporate Governance Committee charter is available on our website at https://investors.sezzle.com/leadership-and-governance. Our Nominating and Corporate Governance Committee provides oversight with respect to corporate governance and ethical conduct, and monitors the effectiveness of our corporate governance guidelines. Our Nominating and Corporate Governance Committee is responsible for, among other things:

•Identifying individuals qualified to become directors, consistent with criteria approved by the Board, receiving nominations for such qualified individuals, and reviewing recommendation put forward by the Chief Executive Officer; •Establishing criteria for Board of Directors composition and identifying individuals qualified to become members of our Board of Directors and its various committees; •Establishing a policy under which stockholders of the Company may recommend a candidate to the committee for consideration for nomination as a director; •Recommending to the Board qualified individuals to serve as committee members; •Developing and recommending to the Board of Directors a set of corporate governance principles applicable to the Company; •Reviewing the Company’s practices and policies with respect to directors, including retirement policies, the size of the Board, the ratio of employee directors to nonemployee directors, the meeting frequency of the Board and the structure of Board meetings and make recommendations to the Board with respect thereto; •In concert with the Board of Directors, reviewing the Company policies with respect to significant issues of corporate public responsibility, including contributions; •Recommending to the Board of Directors or to the appropriate committee thereto processes for annual evaluations of the performance of the Board of Directors, the Chairperson of the Board and the Chief Executive Officer and appropriate committees of the Board of Directors; •Considering and reporting to the Board any questions of possible conflicts of interest of directors; •Providing for new director orientation and continuing education for existing directors on a periodic basis; •Overseeing the maintenance and presentation to the Board of Directors of management’s plans for succession to executive and senior management positions in the Company, and reviewing succession planning for directors; •Reviewing and assessing the adequacy of its charter and submitting any changes to the Board of Directors for approval; •Performing, or participating in, as frequently as necessary or advisable, an evaluation of the performance of the committee, the results of which shall be presented to the Board of Directors;

|

| | | | | |

Nominating and Corporate Governance Committee (continued)

Members: •Mike Cutter (Chair) •Paul Lahiff •Paul Purcell •Karen Webster | •Establishing objectives to promote the Company’s stated public benefits and support the operation of the Company in a responsible and sustainable manner consistent with its status as a public benefit corporation; •Adopting standards to measure the Company’s progress in promoting its stated public benefits; •At the appropriate time and subject to the Company’s size and operations, develop measurable objectives to achieve diversity in the composition of the Board, senior executives and workforce generally in accordance with the Company’s Diversity Policy; •Monitor, review, and report to the Board on the Company’s diversity performance, including disclosing the measurable objectives set for that period, and its satisfaction of any listing standards of NASDAQ; and •Review and make recommendations to the Board on remuneration levels by gender, as well as other facets of diversity in addition to gender, including different ages, ethnicities and backgrounds.

The Nominating and Corporate Governance Committee is responsible for developing and recommending to our Board of Directors the desired and essential qualifications, expertise, and characteristics of members of the Board, including any specific qualities or skills that the Nominating and Corporate Governance Committee believes are necessary for one or more of the members of the Board to possess. The Nominating and Corporate Governance Committee has developed a skills matrix to assist it in consideration of the appropriate balance of experience, skills and attributes required of a member of the Board and to be represented on the Board as a whole. The skills matrix was developed after considering the Company’s near and long-term strategies and is intended to identify skills and attributes that will assist the Board in exercising its oversight function. The skills matrix reflects the core director criteria that should be satisfied by each director or nominee and includes:

•Experience in developing, implementing and delivering strategic business objectives; •Qualifications and/or proficiency in financial accounting; •Proven ability and understanding in the application of legal principles, including financial services law; •Ability to identify key risks in a wide range of areas including legal and compliance; •Knowledge and experience in the strategic use and governance of information management and information technology including digital strategies, disruption and innovation; •Ability to comprehend and communicate developments in the Company’s industry; •A broad range of commercial/business experience, preferably in the small to medium enterprise context; •Formal training in directorship or governance; and •Experience at an executive level, including the ability to oversee strategic human resource management and evaluate the performance of senior executives.

The Committee first evaluates the current members of the Board of Directors willing to continue in service as well as the results of periodic Board and committee self-evaluations. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are considered for nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective.

The Committee considers diversity as a factor in its evaluation of director candidates. Our Board maintains a diversity policy applicable to all of our employees, executives and directors that establishes the responsibility to consider appropriate and measurable (as applicable) diversity objectives, to assess regularly the overall effectiveness of the objectives and to review annually the progress in achieving the diversity objectives. This policy does not intend to set specific diversity goals with respect to the composition of our Board, but provides a mechanism for our company to evaluate diversity more broadly. A copy of the Diversity Policy is available on the corporate governance section of our website at https://investors.sezzle.com/leadership-and-governance. |

| | | | | |

Nominating and Corporate Governance Committee (continued)

Members: •Mike Cutter (Chair) •Paul Lahiff •Paul Purcell •Karen Webster | Candidates for nomination to our Board of Directors are selected by our Board of Directors based on the recommendation of the Nominating and Corporate Governance Committee in accordance with the committee’s charter, our Certificate of Incorporation and our Bylaw; and the skills matrix approved by our Board of Directors regarding director qualifications. In recommending candidates for nomination, the Nominating and Corporate Governance Committee considers candidates recommended by directors, officers, employees, stockholders, and other uses, using the same criteria to evaluate all candidates. Evaluations of candidates generally involve a review of background materials, internal discussions, and interviews with selected candidates as appropriate. In addition, the Nominating and Corporate Governance Committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

The Nominating and Corporate Governance Committee will consider recommendations by stockholders of candidates for election to the Board of Directors. Any stockholder who wishes that the Committee consider a candidate must follow the procedures set forth in our bylaws. Under our Bylaws, if a stockholder plans to nominate a person as a director at a meeting, the stockholder is required to place a proposed director’s name in nomination by written request delivered to or mailed and received at our principal executive offices not less than 90 nor more than 120 calendar days prior to the first anniversary of the date on which we first mailed proxy materials for the preceding year’s annual meeting. However, in the event that the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, notice by the stockholder must be so delivered not less than 90 nor more than 120 calendar days prior to the date of such annual meeting, or if the first public announcement of the date of such annual meeting is less than 100 days prior to the date of such annual meeting, the tenth day following the day on which public announcement is made. The Committee is not aware of any properly submitted nominees for director elections at the 2024 Annual Meeting. |

Audit and Risk Committee

Members: •Paul Lahiff (Chair) •Mike Cutter •Paul Purcell •Karen Webster | Our Audit and Risk Committee charter is available on our website at https://investors.sezzle.com/leadership-and-governance. The charter sets forth the oversight responsibilities of the committee which include, among other things: (i) assisting the Board of Directors in its oversight of (a) the integrity of the consolidated financial statements of the Company, (b) the Company’s compliance with legal and regulatory requirements, (c) the independent auditor’s qualifications and independence, (d) the performance of the Company’s internal audit function and independent auditors, and (e) the Company’s internal control over financial reporting; (ii) deciding whether to appoint, retain or terminate the Company’s independent auditors and to pre-approve all audit, audit-related, tax and other services, if any, to be provided by the independent auditors; and (iii) preparing the disclosure required by Item 407(d)(3)(i) of Regulation S-K and the report required by the SEC rules. Duties of the committee include:

•Overseeing the preparation of disclosures required by applicable rules and regulations in the Company’s proxy and annual reports; •To the extent the committee deems necessary, engaging and overseeing any specialists to support its role and responsibilities; •Appointing, evaluating, overseeing, retaining, compensating, terminating, or changing the Company’s independent auditor; •Reviewing and discussing the Company’s annual, semi-annual, and quarterly financial statements, whether or not audited; •Reviewing and discussing any material issues regarding accounting principles and financial statement presentations, including significant changes in the Company’s selection or application of accounting principles; •Reviewing and discussing earnings press releases, along with any financial information and earnings guidance provided to analysts and rating agencies; •Reviewing with the independent auditor the audit, including discussing applicable audit standards and any challenges encountered in the course of the audit work; •Discussing with management and the auditor any correspondence with regulators or governmental agencies and any published reports that raise material issues regarding the Company’s accounting practices; |

| | | | | |

Audit and Risk Committee (continued)

Members: •Paul Lahiff (Chair) •Mike Cutter •Paul Purcell •Karen Webster | •Reviewing and discussing with management, internal audit staff, and the independent auditor, the adequacy of the Company’s internal controls; •Establishing procedures for the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters; •Reviewing, and, if appropriate, approving related party transactions; •Overseeing the Company’s ethics and compliance functions, including the Company’s Code of Conduct and other procedures established with regard to ethical behavior; •Conferring with the Company’s general counsel about legal matters that may have a material impact on the financial statements or the Company’s compliance; •Reviewing and discussing with management and the internal auditor, the Company’s procedures and practices designed to provide reasonable assurance that the Company’s books, records, accounts and internal accounting controls are established and maintained in compliance with the Foreign Corrupt Practices Act of 1977, the UK Bribery Act 2010 and similar laws and regulations to which the Company is subject; •Overseeing the integrity of the Company’s information technology systems, processes, and data; •Reviewing and assess the adequacy of its charter and submitting any changes to the Board for approval; and •Performing, or participating in, as frequently as necessary or advisable, an evaluation of the performance of the committee, the results of which shall be presented to the Board of Directors.

In connection with the Audit and Risk Committee’s responsibilities set forth in its charter, the Audit and Risk Committee has:

•Reviewed and discussed the audited financial statements for the year ended December 31, 2023 with management and Baker Tilly US, LLP, the Company’s independent auditors; •Discussed with Baker Tilly US, LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board ("PCAOB") and the SEC; and •Received the written disclosures and the letter from Baker Tilly US, LLP required by the applicable requirements of the PCAOB regarding Baker Tilly US, LLP’s communications with the Audit and Risk Committee concerning independence, and has discussed with Baker Tilly US, LLP its independence. The Audit and Risk Committee also considered, as it determined appropriate, tax matters and other areas of financial reporting and the audit process over which the Audit and Risk Committee has oversight.

Based on the Audit and Risk Committee’s review and discussions described above, the Audit and Risk Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 for filing with the SEC.

Our Board of Directors has determined that Mr. Lahiff is an “audit committee financial expert” within the meaning of the SEC regulations. Further, our Board of Directors has determined that each member of our audit and risk committee can read and understand fundamental financial statements in accordance with Nasdaq audit committee requirements. |

Executive Sessions

Our independent directors meet at least twice annually without management or our executive directors to promote open and honest discussion. Our Lead Independent Director, Mr. Lahiff, is the presiding director at these meetings.

Risk Oversight

Our Audit and Risk Committee is responsible for overseeing our risk management process. Our audit committee focuses on our general risk management policies and strategy, the most significant risks facing us, and oversees the implementation of risk mitigation strategies by management. Our Board of Directors is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters and significant transactions.

Stockholder Communications

Stockholders and other interested parties may communicate with our Board by sending a letter addressed to the Board to our Corporate Secretary at 700 Nicollet Mall, Ste 640, Minneapolis, MN 55402, or via the Investor Relations email address provided on our website. These communications will be compiled and reviewed by our Senior Vice President of Corporate Development and Operational Excellence, who will determine whether the communication is appropriate for presentation to the Board. The purpose of this screening is to allow the Board to avoid having to consider irrelevant or inappropriate communications (such as advertisements, solicitations and hostile communications).

To enable the Company to speak with a single voice, as a general matter, senior management serves as the primary spokesperson for the Company and is responsible for communicating with various constituencies, including stockholders, on behalf of the Company. Directors may participate in discussions with stockholders and other constituencies on issues where Board-level involvement is appropriate. In addition, the Board is kept informed by Company management of the Company’s stockholder engagement efforts.

Code of Conduct

Our Board of Directors has adopted a Code of Conduct applicable to all officers, directors and employees, including our principal executive and principal financial officers and controller, which is available on our website (investors.sezzle.com) under the "Governance" heading.

Securities Trading Policy

Pursuant to our Securities Trading Policy, directors, officers, and employees are prohibited from engaging in short sales and certain short-term trading. Further, directors, officers, and employees are prohibited from entering into arrangements or transactions that would have the effect of limiting the economic risk related to the Company’s securities (including, but not limited to, variable forward contracts, equity swaps, collars, and exchange funds) without express written approval by the Company’s notification officer. We also prohibit margin loans by our executives and Board members without consent of the Board Chairperson (or, in the case of the Board Chairperson, of the Board).

Director Attendance

The Board met eight times during the year ended December 31, 2023. During 2023, each member of our Board of Directors attended at least 75% of the aggregate of the total number of meetings of our Board of Directors held during the period for which he or she has been a director.

Directors are encouraged to attend the annual meeting of stockholders absent unusual circumstances. Four members of our Board of Directors attended the 2023 annual meeting of stockholders.

Director Compensation

Under our bylaws, the Board of Directors establishes the fees for non-executive directors based on recommendations of the Compensation Committee. The Board of Director’s policy is to compensate non-executive directors at competitive market rates to attract and retain individuals of high caliber and quality, having regard to fees paid and/or equity awards granted for comparable companies and the size, complexity, and spread of our operations.

We have entered into an individual appointment letter or agreement with each of our non-executive directors. Unless otherwise provided in such letter or agreement, our compensation structure for non-executive directors is to provide annual compensation in an amount equal to $60,000 for serving as a member of the Board of Directors, $15,000 for serving as the Chair of the Audit and Risk Committee, $7,500 for serving as either the Chair of the Compensation Committee or Chair of the Nominating and Corporate Governance Committee, $7,500 for serving as a member of the Audit and Risk Committee, and $3,750 for serving as a member of the Compensation Committee or Nominating and Corporate Governance Committee. In addition, in 2023 each member of the Board of Directors was issued 2,632 in equity awards (in the form of restricted stock awards or restricted stock units). Mr. Lahiff earned $15,000 for serving as lead independent director in 2023.

The fees earned by the non-executive directors for the year ended December 31, 2023 are as set forth below:

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Fees earned or paid in cash(1) | Stock awards(2) | Option awards(3) | Non-equity incentive plan compensation | Nonqualified deferred compensation earnings | All other compensation(4) | Total |

| Mike Cutter | $ | 75,000 | | $ | 46,292 | | $ | — | | $ | — | | $ | — | | $ | 22,500 | | $ | 143,792 | |

| Paul Lahiff | 105,000 | | 46,292 | | — | | — | | — | | 22,500 | | 173,792 | |

Kathleen Pierce-Gilmore(5) | 25,000 | | — | | — | | — | | — | | 2,500 | | 27,500 | |

| Paul Purcell | 75,000 | | 46,292 | | — | | — | | — | | 7,500 | | 128,792 | |

Karen Webster(6) | — | | — | | — | | — | | — | | — | | — | |

(1)On August 17, 2023 the Board of Directors implemented the Compensation Committee and Nominating and Corporate Governance Committee. Prior to this date, members of the Remuneration and Nomination Committee were compensated $7,500 on an annual basis, and the Chair of the Committee was compensated $15,000 annually.

(2)Restricted stock units totaling 2,632 were issued on June 14, 2023 to both Mr. Cutter and Mr. Lahiff. Restricted stock awards totaling 2,632 were issued on June 14, 2023 to Continental Investment Partners, LLC. Mr. Purcell may be deemed to beneficially own such awards as a manager of Continental Investment Partners, LLC. The grant date fair value of the equity awards issued to the non-executive directors was A$25.90, or US$17.59 (converted at AUD:USD of 1.47259:1.00).

(3)As of December 31, 2023, the following non-executive directors had stock options outstanding with respect to the following number of shares: Mr. Cutter – 6,579; and Mr. Lahiff – 5,264. The amounts reported in this column reflect the accounting cost for these awards in the year of grant and do not correspond to the actual economic value that may be received by the director upon the sale of any of the underlying shares of common stock.

(4)Amounts represent a stipend paid to each director for Company-related travel expenses and to support educational resources for each director.

(5)Ms. Gilmore resigned from the Board of Directors on April 24, 2023.

(6)Ms. Webster was appointed to the Board of Directors on February 5, 2024.

ITEMS 1–6: Election of Directors

Our Board of Directors is currently comprised of six members. Clause 3.3 of the Bylaws provides that each Director shall be elected at each Annual Meeting of Stockholders and shall hold office until the next Annual Meeting of Stockholders and until his or her successor has been duly elected and qualified or until his or her earlier resignation or removal. All Directors seek re-election in accordance with the Certificate of Incorporation and the By-laws.

Nominees

Our Board of Directors has nominated Mike Cutter, Paul Lahiff, Paul Paradis, Paul Purcell, Karen Webster, and Charles Youakim for election as Directors. Each of the nominees is currently a Director of the Company. Refer to the section entitled "Our Board of Directors and Corporate Governance" for information regarding each of the nominees.

The Board of Directors (in the case of each Item, with the applicable candidate abstaining) recommend that the Stockholders eligible to vote on this Item vote FOR each of these Items. The Chairman intends to vote undirected proxies FOR each of these Items.

ITEM 7: Ratification of Independent Accounting Firm Selection

Proposed Resolution: “That the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for fiscal year 2024 be ratified.”

Our Board of Directors and management are committed to the quality, integrity and transparency of our financial reports. In accordance with the duties set forth in its written charter, the Audit and Risk Committee of our Board of Directors has appointed Baker Tilly US, LLP as our independent registered public accounting firm for the 2024 fiscal year. During our fiscal year ended December 31, 2023, Baker Tilly US, LLP served as our independent registered public accounting firm. A representative of Baker Tilly US, LLP is expected to be present at the annual meeting, with the opportunity to make a statement if the representative desires to do so. It is also expected that they will be available to respond to appropriate questions.

Stockholder ratification of the selection of Baker Tilly as the Company’s independent registered public accounting firm is not required by law or our Bylaws. However, we are seeking stockholder ratification as a matter of good corporate practice. If our stockholders fail to ratify the selection, the committee may reconsider its selection for this and future fiscal years. Even if the selection is ratified, the committee, in its discretion, may direct the selection of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders.

Principal Accountant Fees And Services

The following table summarizes fees for professional audit services and other services rendered to us by Baker Tilly US, LLP for our years ended December 31, 2023 and 2022:

| | | | | | | | |

| 2023 | 2022 |

Audit Fees(1) | $ | 702,325 | $ | 673,337 |

Audit-Related Fees(2) | 20,000 | — |

| Tax Fees | — | — |

All Other Fees(3) | 1,495 | — |

| Total Fees | $ | 723,820 | | $ | 673,337 | |

(1)“Audit Fees” consisted of fees for professional services provided in connection with the audit of our consolidated financial statements, quarterly reviews of interim condensed consolidated financial statements, and related administrative fees.

(2)"Audit-Related Fees" consists of fees for professional services provided with Sezzle's Form S-1 filings during 2023.

(3)"All Other Fees" consists of fees for permissible non-audit services provided by Baker Tilly US, LLP.

Auditor Independence

The Audit Committee considered the non-audit services performed by, and fees paid to, Baker Tilly US, LLP in 2023 and determined that such services and fees are compatible with the independence of Baker Tilly US, LLP.

Audit and Risk Committee Policy on Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our Audit and Risk Committee has established a policy governing the use of our independent registered public accounting firm’s services. Under the policy, our Audit and Risk Committee is required to pre-approve all audit and permissible non-audit services performed by our independent registered public accounting firm to ensure that the rendering of such services does not impair the accounting firm’s independence. Pursuant to the Sarbanes-Oxley Act of 2002, we do not employ our independent registered public accounting firm for engagements related to:

•Bookkeeping;

•Financial information systems design and implementation;

•Appraisal or valuation services, fairness opinions, or contribution-in-kind reports;

•Actuarial services;

•Internal audit outsourcing services;

•Management functions or human resources;

•Broker-dealer, investment adviser, or investment banking services; or

•Legal services and expert services unrelated to the audit.

All fees paid to Baker Tilly US, LLP for the years ended December 31, 2023 and 2022 were pre-approved by our Audit and Risk Committee.

Report of the Audit and Risk Committee

In connection with the Audit and Risk Committee’s responsibilities set forth in its charter, the Audit and Risk

Committee has:

•Reviewed and discussed the audited financial statements for the year ended December 31, 2023 with management and Baker Tilly US, LLP, the Company’s independent auditors;

•Discussed with Baker Tilly US, LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board ("PCAOB") and the SEC; and

•Received the written disclosures and the letter from Baker Tilly US, LLP required by the applicable requirements of the PCAOB regarding Baker Tilly US, LLP’s communications with the audit committee concerning independence, and has discussed with Baker Tilly US, LLP its independence.

The Audit and Risk Committee also considered, as it determined appropriate, tax matters and other areas of financial reporting and the audit process over which the Audit and Risk Committee has oversight.

Based on the Audit and Risk Committee’s review and discussions described above, the Audit and Risk Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 for filing with the SEC.

THE AUDIT AND RISK COMMITTEE OF THE BOARD OF DIRECTORS

Paul Lahiff, Chair

Michael Cutter

Paul Purcell

Karen Webster

Executive Officers

Our executive officers, other than Charles Youakim and Paul Paradis, and their respective ages as of April 15, 2024 are as follows:

| | | | | | | | | |

| | | |

| Name | | Age | Position |

| Karen Hartje | | 66 | Chief Financial Officer |

| Amin Sabzivand | | 36 | Chief Operating Officer |

| | | | | |

| Karen Hartje Chief Financial Officer |

Ms. Hartje has served as our Chief Financial Officer since April 2018. Ms. Hartje occupied finance and credit management roles at Bluestem Brands, a retail finance company that was a reboot of Fingerhut Direct Marketing and generated well over $1 billion in retail sales. Ms. Hartje was on the founding team of Bluestem Brands, where she led the finance department. During her tenure, she led financial planning and analysis, management of credit policies, and forecasting. Before Bluestem Brands, Ms. Hartje started her career with KPMG and has held senior leadership positions at US Bank and Lenders Trust. Ms. Hartje currently serves on Conn’s, Inc. Board of Directors and is Treasurer for the Saint Paul Figure Skating Club, Inc. Ms. Hartje has a Bachelor of Arts in accounting from the University of Minnesota and was a certified public accountant (expired).

|

|

| | | | | |

| Amin Sabzivand Chief Operating Officer |

Mr. Sabzivand has been serving as our Chief Operating Officer at Sezzle since March 2023, overseeing engineering, product, risk, operations, and business analytics functions. He is responsible for defining and executing organizational strategies, objectives, and goals for Sezzle's operations in the United States and Canada. Prior to this role, Mr. Sabzivand was Senior Vice President of Product and Vice President/Head of Data, where he designed different payment and e-commerce solutions, and developed machine-learning algorithms for credit risk and fraud detection, along with designing various business analytics tools and key performance indicator reports. Mr. Sabzivand holds two Master's degrees in Financial Mathematics and Engineering Management from the University of Minnesota. Before joining Sezzle, he held roles within the Mathematics department at the University of Minnesota. |

|

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors, and persons who own more than 10% of our common stock, to file reports of ownership and changes in ownership with the SEC. The SEC has designated specific due dates for these reports and we must identify in this Form 10-K those persons who did not file these reports when due. We assist our directors and officers by completing and filing reports on their behalf. Based solely on our review of copies of the reports filed with the SEC and the written representations of our directors and executive officers, we believe that each person who at any time during the 2023 fiscal year was a director or an executive officer of the Company, or held more than 10% of our common stock, complied with all reporting requirements for fiscal year 2023, except for the following:

1.One report on Form 4 was filed late for Paul Purcell on November 30, 2023. The Form 4 disclosed a single transaction involving Mr. Purcell’s purchase of 25,427 shares of common stock at $9.94 per share.

2.One report on Form 4 was filed late for Paul Paradis on January 3, 2024. The Form 4 disclosed a gift of 84,211 shares of common stock from Paul Paradis to Paradis Family LLC on July 31, 2021, and the forfeiture of 109 shares of common stock on December 15, 2021 withheld to satisfy tax withholding obligations upon vesting of restricted stock units at $89.68 per share.

3.One report on Form 4 was filed late for Charlie Youakim on February 6, 2024. The Form 4 disclosed a gift of 157,895 shares of common stock from Charlie Youakim to Cerro Gordo LLC on June 15, 2021, and the forfeiture of 123 shares of common stock on December 15, 2021 to satisfy tax withholding obligations upon the vesting of restricted stock units at $89.68 per share.

Executive Compensation

The following discussion and analysis of compensation arrangements should be read with the compensation tables and related disclosures set forth below. This discussion contains forward looking statements that are based on our current plans and expectations regarding future compensation programs. The actual compensation programs that we adopt may differ materially from the programs summarized in this discussion.

This section describes the material elements of the compensation awarded to, earned by, or paid to our Executive Chairman and Chief Executive Officer, Charles Youakim, and our two most highly compensated executive officers (other than our Executive Chairman and Chief Executive Officer), Paul Paradis, our Executive Director and President, and Karen Hartje, our Chief Financial Officer, for our fiscal year ended December 31, 2023. These executives are collectively referred to in this “Executive Compensation” section as our named executive officers. As an “emerging growth company” as defined in the JOBS Act, we are not required to include a Compensation Discussion and Analysis section or a Pay Versus Performance section, and have elected to comply with the scaled disclosure requirements applicable to emerging growth companies.

Summary Compensation Table

The following table sets forth the compensation paid to, received by, or earned during each of fiscal year 2023 and 2022 by each of our named executive officers.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and principal position | Year | Salary | Bonus | Stock awards(1)(2) | Option awards | Nonequity incentive plan compensation(3) | All other compensation(4) | Total ($) |

| Charles Youakim, Executive Chairman and Chief Executive Officer | 2023 | $ | 514,423 | | $ | — | | $ | 1,168,691 | | $ | — | | $ | 260,000 | | $ | 325 | | $ | 1,943,439 | |

| 2022 | 250,000 | | — | | — | | — | | — | | 56,687 | | 306,687 | |

| Paul Paradis, Executive Director and President | 2023 | 351,923 | | — | | 719,739 | | — | | 140,000 | | 13,135 | | 1,224,797 | |

| 2022 | 266,347 | | — | | — | | — | | — | | 5,990 | | 272,337 | |

| Karen Hartje, Chief Financial Officer | 2023 | 327,884 | | — | | 577,412 | | — | | 85,000 | | 20,018 | | 1,010,314 | |

| 2022 | 266,347 | | — | | — | | — | | — | | 16,670 | | 283,017 | |

(1)Amounts reported represent the grant date fair value, computed in accordance with FASB ASC Topic 718, of restricted stock units (“RSUs”) granted under the 2021 Equity Incentive Plan, disregarding the effects of estimated forfeitures.

(2)The amounts reported in this column reflect the accounting cost for these awards and do not correspond to the actual economic value that may be received by the applicable officer upon the sale of any of the underlying shares of common stock.

(3)Amounts reported represent Profit-sharing Incentive Plan ("PSIP") cash awards earned by the respective officer for the year ended December 31, 2023.

(4)Amounts reported partially reflect the value of matching contributions made by the Company in 2022 and 2023 under its 401(k) retirement plan. Amounts also reflect the payment by the Company during 2022 of an aggregate of $56,037 to Mr. Youakim, reflecting legal fees (and associated tax gross-ups) attributable to counsel provided to him in his personal capacity in relation to the Company’s merger negotiations with ZipCo Limited in the first half of 2022. Although reported in this column as compensation paid to Mr. Youakim, the Company considers the cost of these services to be a business expense and not a personal benefit to Mr. Youakim.

Narrative Disclosure to Summary Compensation Table

Compensation Philosophy and Structure

Our performance depends upon our ability to attract and retain executives and directors. To prosper, we must attract, motivate and retain these highly skilled individuals. To that end, we embrace the following principles in our compensation framework:

•Offer competitive rewards to attract high caliber executives;

•Clear alignment of compensation with strategic objectives;

•Focus on creating sustainable value for all of our stakeholders;

•Merit-based compensation across a diverse workforce; and

•Ensure total compensation is competitive by market standards.

Our compensation committee is responsible, in part, for reviewing and making recommendations for our executive directors, non-executive directors, executive officers, and employee base. The compensation committee assesses the appropriateness of the nature and amount of compensation for these individuals on a periodic basis by reference to relevant market conditions with the overall objective of ensuring maximum stakeholder benefit from the retention of high-quality directors, executives, and employees. In 2022, we engaged FW Cook as a compensation consultant to review current compensation for directors and senior executives, benchmark the same against industry peers, and make recommendations for appropriate adjustments to salary, short-term and long-term equity-based compensation plans. Following consultation with senior executives, the compensation consultant made a presentation to the remuneration and nominating committee, which subsequently was approved in substantially the form proposed.

Our Board believes the compensation framework to be appropriate and effective in attracting and retaining the best executives and directors to operate and manage the Company.

The executive and director compensation framework is designed to support our reward philosophies and to underpin our growth strategy and is based on the following:

•Base Salary

•Profit-sharing Incentive Plan

•Long-Term Incentive Plan

Base Salary

The initial base salaries of our named executive officers were set forth in their respective employment agreements and have been periodically reviewed by the Compensation Committee (formerly the Remuneration and Nomination Committee). For 2023, the salary for Mr. Youakim was increased to $525,000. The salaries for Mr. Paradis and Ms. Hartje were each increased to $355,000 and $330,000, respectively. The actual amounts paid as base salaries to each named executive officer for 2022 and 2023 are set forth above in the Summary Compensation Table in the column entitled “Salary”.

Profit-sharing Incentive Plan ("PSIP")

Our named executive officers are eligible to participate in our PSIP, which provides an annual bonus opportunity based on a combination of Company financial performance as well as individual performance. Baseline payout targets, ranging from a 0% to 100% payout, were established at the beginning of 2023 and were based on the Company's adjusted pre-tax income goals for the year ended December 31, 2023. For the year ended December 31, 2023, the PSIP cash payout was determined to be at 50% of goal. Amounts paid out for the PSIP for 2023 are included within the summary above under 'Nonequity incentive plan compensation'.

In 2022 the Company had a Short-term Incentive Plan ("STIP") in place, which provided for an annual bonus opportunity based on a combination of a Company Performance Score (“CPS”) and individual performance. For 2022, CPS was determined by the Remuneration and Nomination Committee based on Company performance within four weighted categories: growth (50%), stakeholder satisfaction (20%), optimization (15%), and innovation (15%). The Remuneration and Nomination Committee determined that the relevant Company performance metrics for the STIP were not met in 2022; therefore no STIP award was granted.

Long-Term Incentive Plan (“LTIP”)

Our named executive officers are also eligible to participate in our LTIP, which in 2023 provided for grants of restricted stock units under the 2021 Equity Incentive Plan, with vesting subject to service-based conditions over a four-year period.

The LTIP plan in place for 2022 included a performance-based vesting condition for LTIP stock options consisting of the Company’s total shareholder return (“TSR”) measured against that of the S&P/ASX All Technology Index (excluding materials and energy companies) for each one-year period within the three-year performance period starting on January 1, 2020 and ending on December 31, 2022. For comparative purposes, our volume weighted average price (“VWAP”) over a 30-day period up to the end of the relevant performance period was used and compared to the average S&P/ASX All Technology Index price over that same period. One-third of the total number of LTIP Options, as defined below, were eligible to be earned each year within the three-year performance period based on the following TSR performance for the applicable year:

| | | | | |

| Comparative TSR Target | Percentage of LTIP Options Earned

(Measured on an Annual Basis) |

| Less than 51st percentile of companies in S&P/ASX All Technology Index (excluding materials and energy companies) | 0% |

| Greater than or equal to 51st percentile but less than the 90th percentile of companies in S&P/ASX All Technology Index (excluding materials and energy companies) | Pro rata between 1% and 100% |

| Greater than or equal to 90th percentile of companies in S&P/ASX All Technology Index (excluding materials and energy companies) | 100% |

The Board of Directors had the discretion to amend the comparative TSR performance condition at any time during the performance period applicable to the LTIP Options if the Board of Directors believes it is appropriate to do so to reflect the Company’s circumstances. Any LTIP Options that were earned for a measurement year within the three-year performance period remain subject to a time-based vesting condition, which is satisfied upon the named executive officer’s continued employment with the Company through December 31, 2022.

The Remuneration and Nomination Committee has determined that the relevant Company performance metrics for the LTIP were not met in 2022; therefore no portion of LTIP awards vested for that period.

Agreements with our Named Executive Officers