NZ Dollar Extends Gain On Faster-than-expected US Economic Growth

29 Noviembre 2016 - 6:52PM

RTTF2

The New Zealand dollar continued to be strong against the other

major currencies in the Asian session on Wednesday, as Asian shares

are trading mostly higher after data showed the U.S. economy grew

faster than initially estimated in the third quarter.

U.S. third-quarter GDP growth was revised up more than expected,

consumer confidence soared in November to a post-recession high and

a gauge of home prices for September topped its previous peak set

in July 2006, bolstering the case for the Federal Reserve to raise

interest rates next month.

Traders bet the U.S. Federal Reserve will raise interest rates

next month and gradually tighten monetary policy in 2017.

Meanwhile, the crude oil prices recovered as investors brace up

for the possible OPEC output cut deal at today's OPEC meeting in

Vienna.

Crude oil prices for January delivery is currently up by 0.29

percent or $45.52 per barrel.

In economic news, data from ANZ Bank of New Zealand showed that

the business confidence in New Zealand took a big hit in November,

with an index score of 20.5. That's down sharply from 24.5 in

October.

The outlook also was not encouraging, slipping to a reading of

37.6 in November from 38.4 in the previous month.

Also, data from the Reserve Bank of New Zealand showed that New

Zealand's money supply growth quickened in October, after easing in

the previous two months. The broad money supply, or M3, rose 7.1

percent year-over-year in October, faster than the 4.8 percent

climb in September.

Tuesday, the NZ dollar rose 0.42 percent against the U.S.

dollar, 0.95 percent against the yen, 0.41 percent against the

euro, and 0.69 percent against the Australian dollar.

In the Asian trading, the NZ dollar rose to nearly a 1-year high

of 80.43 against the yen and a 3-week high of 1.4869 against the

euro, from yesterday's closing quotes of 80.07 and 1.4940,

respectively. If the kiwi extends its uptrend, it is likely to find

resistance around 83.00 against the yen and 1.46 against the

euro.

Against the U.S. and the Australian dollars, the kiwi advanced

to nearly a 3-week high of 0.7159 and an 8-day high of 1.0453 from

yesterday's closing quotes of 0.7126 and 1.0501, respectively. The

kiwi may test resistance around against 0.75 against the greenback

and 1.02 against the aussie.

Looking ahead, the German retail sales data for November and

Swiss UBS consumption indicator for October are due to be released

in the pre-European session at 2:00 am ET. At the same time, Bank

of England publishes financial stability report.

Swiss KOF leading indicator, German unemployment rate and

Eurozone CPI data, all for November, are slated for release later

in the day.

At 7:30 am ET, European Central Bank President Mario Draghi is

expected to speak about the future of Europe at the University of

Deusto Business School, in Madrid.

At 8:00 am ET, Federal Reserve Bank of Dallas President Robert

Kaplan is expected to speak before the Economic Club of New

York.

In the New York session, U.S. ADP private sector jobs data for

November, U.S. personal income and spending data for October, U.S.

Chicago PMI for November, U.S. pending home sales data for October,

U.S. crude oil inventories data, Canada GDP data for September,

industrial products and raw materials price indexes for October are

set to be announced.

At 11:00 am ET, German Bundesbank President Jens Weidmann is

expected to speak at the Axica Conference Center, in Berlin.

At 11:45 am ET, Federal Reserve Governor Jerome Powell will

deliver a speech titled "The View from the Fed" at the Brookings

Institution, in Washington DC.

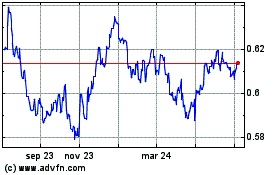

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

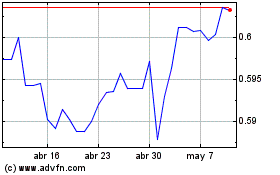

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024