GE's Profit Falls as Power Division Remains a Drag--Update

20 Julio 2018 - 7:13AM

Noticias Dow Jones

By Thomas Gryta

General Electric Co.'s second-quarter profit dropped 30% as the

company's power division continued to offset growth in other major

units.

While the industrial conglomerate backed its 2018 profit goal,

it said free cash flow would be at the low end of its previous

estimate. The company's adjusted earnings of 19 cents a share for

the period beat Wall Street expectations, 17 cents a share

according to Thomson Reuters. Revenue of $30.1 billion also topped

consensus projections of $29.3 billion.

GE recently unveiled its road map for restructuring under new

Chief Executive John Flannery, a series of moves to significantly

dismantle the conglomerate without a complete breakup of the

onetime bellwether. Over several years, GE plans to separate its

Healthcare unit into its own company and exit its majority holding

in oil-and-gas firm Baker Hughes. GE said Friday that its plan to

sell $20 billion in assets is "substantially complete."

"We saw continued strength across many of our segments,

especially in Aviation and Healthcare," Mr. Flannery said in

prepared remarks, noting that GE cut costs in its industrial

divisions by $1.1 billion in the first half of 2018.

"We expect the power market to remain challenging, and we

continue our focus on operational improvement," he said.

GE reported second-quarter net income of $615 million, down from

$875 million in the same period the year before. Over all, GE said

revenue in the three months ended June 30 rose 3% from $29.1

billion, including a boost from the merger of its Oil & Gas

business with Baker Hughes a year ago. GE still owns a majority

stake in the combined company.

The company's shares were roughly flat in premarket trading

Friday.

The company stood by its 2018 earnings projection of $1 to $1.07

a share; it has said it was likely to meet the lower end of that

range. Analysts currently forecast just 95 cents a share for the

year. The estimate was originally given in November when the

company revised its long-held target of $2 a share in earnings for

2018.

GE now expects adjusted free cash flow of about $6 billion for

2018, down from a previous projection of $6 billion to $7 billion.

The company still expects to end the year with at least $15 billion

in cash.

GE cut its dividend in November for only the second time since

the Great Depression and investors are focused on its ability to

generate cash from its operations. In the latest quarter, it had

adjusted free cash flow of $258 million from its industrial

operations, a jump from last quarter's negative free cash flow of

$1.7 billion but down from $369 million a year ago.

Revenue in the Power unit fell 19% in the second quarter on a

26% drop in orders. The segment's profit declined 58% in the

period. GE said it is still working on shrinking the physical size

of the business and cutting costs, while focusing on servicing its

existing customers.

Profits and sales rose in GE's other two core units, aviation

and health care.

In the Aviation business, which manufactures and services jet

engines, sales rose 13% in the quarter and profit grew 7%. Orders

at the division jumped 29% as demand for its next generation jet

engines remained strong. GE also booked more than $22 billion in

new orders this week at the Farnborough air show in England, it

said.

At Healthcare, profit rose 12% to $926 million as revenue grew

6% to about $5 billion.

Profit at GE Capital, the company's financial-services division,

dropped 20% to $207 million in the quarter, while revenue fell 1%

to $2.4 billion.

GE continues to contemplate shrinking both the size and risk in

the unit. The business has been a source of negative surprises for

investors and Mr. Flannery is looking for options to neutralize or

exit parts or all of the business, people familiar with the matter

say.

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

July 20, 2018 07:58 ET (11:58 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

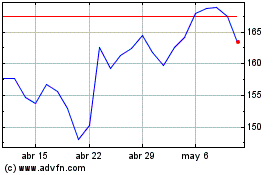

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

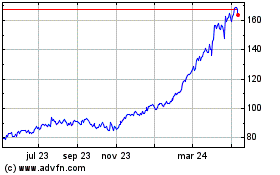

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024