Barclays Activist Concedes Defeat in Bid for Board Seat -- Update

02 Mayo 2019 - 8:40AM

Noticias Dow Jones

By Margot Patrick

Activist Edward Bramson conceded defeat Thursday in his effort

to win a seat on the Barclays PLC board and force a move away from

investment banking. But he said his firm could take fresh action if

the British lender doesn't deliver better results this year.

Mr. Bramson's Sherborne Investors has waged a campaign to push

Barclays to reassess its strategy combining retail, business and

investment banking, and to consider scaling back the investment

bank. Barclays Chief Executive Jes Staley and the board dismissed

that request as unnecessary.

Mr. Staley's vision for Barclays is for a compact version of

JPMorgan Chase & Co.--the bank where he spent more than 30

years of his career. He said recently that he had no plans to

change course, saying the bank was making progress in the corporate

and investment bank and would stick to the strategy it set out

three years ago.

In comments before a scheduled shareholder vote Thursday, Mr.

Bramson said he expected a heavy vote against him after talking to

big Barclays shareholders in recent weeks. He said those

shareholders told him they had been asked by new chairman Nigel

Higgins to hold off on any action.

Mr. Bramson said Sherborne considers it fair to give Mr.

Higgins, who officially starts in the chairman role Thursday, a

chance to fix the bank.

However, he cautioned that Sherborne would expect to see

results. "Some of the numbers that we see are not encouraging. So

we'll wait a quarter or two and see what happens," Mr. Bramson

said.

After more than a year of discussions with Barclays, Mr. Bramson

said his next move wouldn't be to keep talking to the bank's board

and executives, because "nothing happens."

"We'd have to do something other than talk. What that is, I

think it would be premature to say," the activist said.

Barclays chairman John McFarlane, whose role ended after

Thursday's board meeting, had urged shareholders attending the

meeting to vote against Mr. Bramson. Mr. Staley told attendees the

bank has the right strategy and is "finally approaching a position

to reward your patience."

The bank's share of global investment-banking revenue has risen

slightly but returns on capital for the unit are below target and

the stock price has declined.

Mr. Bramson said his effort to get on the board was positive

because it triggered "a public recognition that the strategy isn't

working."

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

May 02, 2019 09:25 ET (13:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

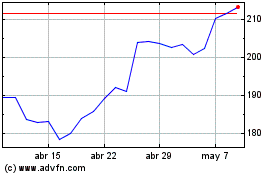

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

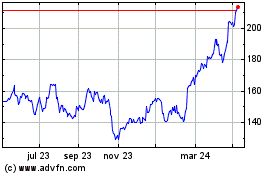

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024