RiverFort Global Opportunities PLC Q1 Update - to 31 March 2019 (8674E)

09 Julio 2019 - 3:31AM

UK Regulatory

TIDMRGO

RNS Number : 8674E

RiverFort Global Opportunities PLC

09 July 2019

9 July 2019

RiverFort Global Opportunities plc

("RGO" or the "Company")

Quarterly update to 31 March 2019

RiverFort Global Opportunities plc is pleased to provide a

quarterly update to 31 March 2019.

Highlights

-- Over GBP4.6 million invested in RiverFort-arranged opportunities as at the period end

-- Total investment income generated of GBP483,000 in the quarter

-- Net asset value up by around 5% over the quarter

-- The Company is continuing to build on the progress made in 2018

-- Significant cash balance available for further investment

-- Additional investments made during the period in companies

including Jubilee Metals Group plc

Chairman's review

The progress made for 2018 has continued apace into the first

quarter of this year, with the majority of the GBP483,000 of total

investment income for the quarter being generated from

RiverFort-arranged opportunities. Overall, after administration and

other costs, Q1 2019 represented a profitable quarter for the

Company.

The analysis of income for the period is set out below:

Q1 2019 Year to 31

December 2018

GBP GBP

-------- ---------------

Investment income 283 513

-------- ---------------

Net income from financial instruments

at FVTPL 200 (929)

-------- ---------------

Total investment income 483 (416)

-------- ---------------

The improved level of total investment income in Q1 2019 was

principally driven by the returns made from the Company's Q1

investments. In particular, the Company announced an investment of

GBP1.2 million in Jubilee Metals Group plc during this period, its

largest investment to date.

The key unaudited performance indicators are set out below:

Performance indicator 31 March 2019 31 December Change

2018

------------------------------------- ---------------- ------------ ---------

Investment income GBP283,000 GBP513,000

------------------------------------- ---------------- ------------ ---------

Net asset value GBP7,575,442 GBP7,254,727 +4.4%

Net asset value - fully diluted per

share 0.112p 0.107p +4.4%

Closing share price 0.085p 0.090p -5.5%

Net asset value premium to the share

price 31% 19%

Market capitalisation GBP5,770,935 GBP6,110,000 -5.5%

------------------------------------- ---------------- ------------ ---------

The Company's principal investment portfolio categories are

summarised below:

Category Cost or valuation at 31

March 2019

Debt and equity- linked debt

investments 4,643,751

------------------------

Equity investments 719,391

------------------------

Other 200,000

------------------------

Cash resources 2,048,437

------------------------

Total 7,611,579

------------------------

The Company's net asset value has increased by around 5% during

the quarter and the Company has continued to build its investment

portfolio of RiverFort-arranged investments. Also, during this

quarter, the Company's equity portfolio has grown slightly due to

the further investment made in Pires Investments plc as part of

that company's recent fund raising.

Further details about the Company's investment portfolio are set

out on the Company's website at

www.riverfortglobalopportunities.com.

The Company is continuing to see a number of interesting

investment opportunities where it can deploy its investment funds

in order to make attractive returns.

Philip Haydn-Slater

Non-Executive Chairman

9 July 2019

For more information, please contact:

RiverFort Global Opportunities plc: +44 (0) 20 3984 9191

Philip Haydn-Slater, Non-Executive Chairman

Nicholas Lee, Investment Director

Nominated Adviser:

Beaumont Cornish +44 (0) 20 7628 3396

Roland Cornish/Felicity Geidt

Joint Broker: +44 (0) 20 7601 6100

Shard Partners LLP

Damon Heath/Erik Woolgar

Joint Broker: +44 (0) 20 7562 3351

Peterhouse Capital Limited

Lucy Williams

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDRPMBTMBMMTRL

(END) Dow Jones Newswires

July 09, 2019 04:31 ET (08:31 GMT)

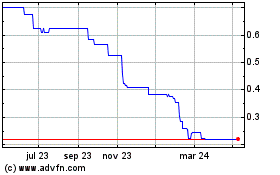

Riverfort Global Opportu... (LSE:RGO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

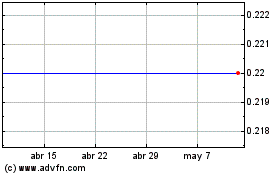

Riverfort Global Opportu... (LSE:RGO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024