Barclays Agrees to Pay $6.3 Million in Asian Hiring Case

27 Septiembre 2019 - 4:46PM

Noticias Dow Jones

By Kristin Broughton

Barclays PLC has agreed to pay $6.3 million to settle charges

from the U.S. securities regulator it violated bribery laws by

hiring the children and relatives of high-ranking decision makers

to win business.

The case involves the London bank's hiring practices in Asia.

From at least April 2009 through August 2013, Barclays hired 117

people who had connections to its clients in the region, the

Securities and Exchange Commission said Friday.

Many candidates were hired through an unofficial internship

program for job candidates who, based on their connections, could

help the bank win deals, according to the securities regulator.

Barclays violated the Foreign Corrupt Practices Act by using

employment at the bank to influence deal making, and failed to

maintain a system of internal controls around hiring, the SEC said.

Additionally, employees at the company falsified records to conceal

the identities of job candidates, the securities regulator

said.

A spokesman for Barclays declined to comment.

Barclays is one of several global banks coming under scrutiny in

the U.S. for hiring the friends and family of senior executives and

government officials.

Among the several examples cited by the SEC, Barclays in 2009

hired the son of an executive at a South Korean state-owned company

that bankers were pursuing for business. Soon after, the bank

secured a deal to act as joint lead manager on a $1 billion bond

issuance for the company that generated $971,000 in fees.

Similarly, in March 2013, bankers in Barclays's Asia-Pacific

division hired the nephew of the chief executive of one of its key

business clients. Two months later, Barclays recorded $2.6 million

in revenue from the CEO's company.

Barclays voluntarily reported the conduct and took remedial

actions, including terminating executives involved in the

misconduct, before the government investigation, according to the

SEC. The bank didn't admit or deny wrongdoing as part of the

agreement.

The Justice Department also opened a probe into Barclays's

hiring practices in Asia, which the bank announced in March 2016. A

spokesman for the agency declined to comment on the status of that

investigation.

Write to Kristin Broughton at Kristin.Broughton@wsj.com

(END) Dow Jones Newswires

September 27, 2019 17:31 ET (21:31 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

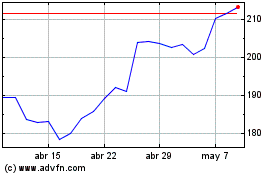

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024