TIDMIRON

RNS Number : 7349V

Ironveld PLC

05 December 2019

5 December 2019

IRONVELD PLC

("Ironveld" or the "Company")

Final results for the year ended 30 June 2019

Ironveld plc, the owner of a High Purity Iron ("HPI"), Vanadium

and Titanium project located on the Northern Limb of the Bushveld

Complex in Limpopo Province, South Africa (the "Project") is

pleased to announce its final results for the 12 months ended 30

June 2019 ("the Period").

Operational Highlights

-- Appointed finnCap to conduct a strategic review of the Company's mining assets

-- Positively engaged in discussions with several interested parties

-- Confidentiality agreements have been entered into with

various parties, who are engaged in management discussions and have

conducted site visits

-- Discussions continue with potential partners who could fund the development of the Project

-- Completed a bulk sampling and testing programme, although

commercially viable terms could not be agreed

Financial Highlights

-- Successfully completed a placing in February 2019 to raise

GBP1.1 million with proceeds used to strengthen the Company's

balance sheet and cover our overheads

-- Focused on rationalising the cost base across both South Africa and the UK

Outlook

-- Expect either to have secured a strategic financing partner

or have concluded the strategic review early in 2020

Peter Cox, CEO said:

"This year has seen us pursue multiple routes as we look to

maximise the value of our mining assets, whether that be through

the commencement of operations or through a sale. We remain engaged

in discussions with several parties and all options remain open at

this stage.

We remain confident in a successful outcome from the strategic

review and look forward to providing updates in due course. We

thank all our shareholders for their continued support in

Ironveld."

For further information, please contact:

Ironveld plc c/o Camarco

Peter Cox, Chief Executive 020 3757 4980

finnCap (Nominated Advisor)

Christopher Raggett

Hannah Boros 020 7408 4090

Camarco

Gordon Poole / Kimberley Taylor / Thayson

Pinedo 020 3757 4980

Notes to Editors:

Ironveld (IRON.LN) is the owner of Mining Rights over

approximately 28 kilometers of outcropping Bushveld magnetite with

a SAMREC compliant ore resource of some 56 million tons of ore

grading 1,12% V2O5 68,6% Fe2O3 and 14,7% TiO2,

The Definitive Feasibility Study published in April 2014

confirms the project's viability to deliver a Vanadium slag product

for which the company has an offtake agreement as well a High

Purity Iron product which commands a premium in the market place

and Titanium slag containing commercial grades of titanium ,.

Ironveld's Board includes; Giles Clarke as Chairman, Peter Cox

as CEO, Vred von Ketelhodt as CFO and Nick Harrison as a

Non-Executive Director.

Ironveld is an AIM traded company. For further information on

Ironveld please refer to www.ironveld.com.

CHAIRMAN'S STATEMENT - STRATEGIC REPORT

During the Period, we undertook various activities focused on

realising the value of the Company's assets and maximising returns

for Ironveld's shareholders. We anticipate significant progress to

be made in the coming 3 months.

In July, we announced that finnCap had been engaged to lead a

review of the strategic alternatives for Ironveld's mining assets

(the "Strategic Review"). These assets include unfettered rights to

56.4 million tonnes of magnetite ore, which the JORC compliant

mineral resources demonstrates holds 1.4 billion pounds weight of

Vanadium - equivalent to four times annual global Vanadium demand;

27 million tons of High Purity Iron in situ; and 8.3 million tonnes

of titanium. The current resource does not include the

mineralisation on the Luge Farm prospecting right; this is near the

current JORC resource but is yet to be defined, although is

believed to have the same geology.

Post-Period end, the Company announced that as part of the

Strategic Review, it has been positively engaging with several

parties potentially interested in making an offer to purchase all

or part of Ironveld's mining assets. Confidentiality agreements

were entered into with various parties, who have held discussions

with management and have conducted site visits. The Company has

gathered expressions of interest from certain of these parties and

expects to make further progress toward firm proposals in the New

Year although it is unlikely that the Company will have been able

to sell the assets by the end of January.

Alongside the Strategic Review, the Company is in discussions

with various partners that could lead initially to a further

injection of working capital into the business and in the medium

term to the funding of the development of the Project and the

commencement of smelting operations.

During the Period, we completed a bulk sampling and testing

programme with a potential off-take partner, a specialist

subsidiary of an international steel group. However, the Board

concluded that it would not be possible to agree commercially

viable terms with this off-take partner.

The Company continues to have in place an offtake agreement for

the Project's envisaged vanadium slag product that was originally

entered into in 2016, and also remains in discussions with offtake

partners for the other products.

We would like to thank our shareholders for their ongoing

support, as we successfully completed a placing raising GBP1.1

million before expenses through a placing of 62,857,143 new

ordinary shares at a price of 1.75 pence each. The net proceeds of

the placing have been used to strengthen the Company's financial

position and cover its overheads.

We remain committed to operating responsibly, working closely

with stakeholders and local communities at grass root level to

improve the standards of living. We continue to support our Keep a

Girl in School Programme initiative working alongside our local

partners, The Imbumba Foundation and the Nelson Mandela Foundation,

to provide hygiene support to approximately 600 female students at

school in the local area.

Financial

The Group recorded a loss before tax of GBP0.6m (2018: GBP0.5m)

and had cash balances of GBP0.6m (2018: GBP0.5m) at the end of the

period. The Company does not plan to pay a dividend for the year

ended 30 June 2019.

Going concern

Following the share placing in February 2019 and the

rationalisation of the Company's cost base in both South Africa and

the UK both prior to the announcement of 30 September 2019 and

since, the Group's present financial resources and existing

facilities are considered sufficient to enable it to operate until

March 2020, by which time, the board of directors anticipates to

have either secured further financing or successfully concluded the

Strategic Review.

Outlook

Ironveld's Board is committed to delivering value to our

shareholders. The Company continues to hold discussions with a

number of parties interested in potentially making an offer to

purchase all or part of the Company's assets and expects either to

have secured a strategic financing partner or have concluded its

Strategic Review early in the New Year.

We would like to thank all of our shareholders for their

continuing support for both the Company and the Project and we look

forward to providing further updates in the near future

Giles Clarke

Chairman

4 December 2019

IRONVELD PLC

CONSOLIDATED INCOME STATEMENT

FOR THE YEARED 30 JUNE 2019

Year Year

ended ended

2019 2018

Note GBP'000 GBP'000

Administrative expenses (629) (570)

-------- --------

Operating loss 4 (629) (570)

Investment revenues 6 6 41

Finance costs 7 (2) (7)

-------- --------

Loss before tax (625) (536)

Tax 8 - -

-------- --------

Loss for the year (625) (536)

-------- --------

Attributable to:

Owners of the Company (624) (535)

Non-controlling interests (1) (1)

-------- --------

(625) (536)

-------- --------

Loss per share - Basic and diluted 9 (0.10p) (0.10p)

-------- --------

There is no difference between the results as disclosed above

and the results on a historical cost basis. The income statement

has been prepared on the basis that all operations are continuing

operations.

IRONVELD PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

YEARED 30 JUNE 2019

Year ended Year ended

2019 2018

GBP'000 GBP'000

Loss for the period (625) (536)

Exchange differences on the translation

of foreign operations 211 (1,505)

----------- -----------

Total comprehensive income for

the year (414) (2,041)

----------- -----------

Attributable to:

Owners of the Company (448) (1,805)

Non-controlling interests 34 (236)

----------- -----------

(414) (2,041)

----------- -----------

IRONVELD PLC

CONSOLIDATED BALANCE SHEET

AS AT 30 JUNE 2019

2019 2018

Note GBP'000 GBP'000

Non-current assets

Intangible assets 11 27,423 26,218

Property, plant and equipment 12 5 4

Investments - other 13 390 386

------------ -------------

27,818 26,608

------------ -------------

Current assets

Trade and other receivables 14 156 177

Cash and cash equivalents 566 517

------------ -------------

722 694

Total assets 28,540 27,302

------------ -------------

Current liabilities

Trade and other payables 15 (610) (413)

------------ -------------

(610) (413)

------------ -------------

Net-current liabilities

Deferred tax liabilities 16 (5,243) (5,194)

------------ -------------

Total liabilities (5,853) (5,607)

------------ -------------

Net assets 22,687 21,695

------------ -------------

Equity

Share capital 18 9,774 8,903

Share premium 19 19,691 19,161

Retained earnings 19 (10,499) (10,056)

------------ -------------

Equity attributable to owners

of the Company 18,966 18,008

Non-controlling interests 22 3,721 3,687

Total equity 22,687 21,695

------------ -------------

These financial statements were approved by the Board and

authorised for issue on, 4 December 2019

Signed on behalf of the Board

P Cox Company Registration No: 04095614

Director

IRONVELD PLC

PARENT COMPANY BALANCE SHEET

AS AT 30 JUNE 2019

2019 2018

Note GBP'000 GBP'000

Non-current assets

Investments 13 24,074 23,091

-------- --------

Current assets

Trade and other receivables 14 25 36

Cash and cash equivalents 523 464

-------- --------

548 500

-------- --------

Total assets 24,622 23,591

-------- --------

Current liabilities

Trade and other payables 15 (70) (63)

-------- --------

Total liabilities (70) (63)

-------- --------

Net assets 24,552 23,528

-------- --------

Equity

Share capital 18 9,774 8,903

Share premium 19 19,691 19,161

Retained earnings 19 (4,913) (4,536)

-------- --------

Total equity (Attributable to

owners of the Company) 24,552 23,528

-------- --------

The loss for the financial year dealt with in the financial

statements of the parent Company was GBP382,000 (2018 - loss

GBP460,000).

These financial statements were approved by the Board and

authorised for issue on 4 December 2019.

Signed on behalf of the Board

P Cox Company Registration No: 04095614

Director

Company Registration No: 04095614

IRONVELD PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 JUNE 2019

Equity attributable to the owners of the Company:

Share Share Retained Total

Capital Premium Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2017 7,671 18,211 (8,282) 17,600

Exchange differences

on

Translation of foreign

operations - - (1,270) (1,270)

Issue of share capital 1,232 950 - 2,182

Credit for equity-settled

share based payments - - 31 31

Loss for the year - - (535) (535)

At 30 June 2018 8,903 19,161 (10,056) 18,008

-------- -------- --------- --------

Exchange differences

on

Translation of foreign

operations - - 176 176

Issue of share capital 871 530 - 1,401

Credit for equity settled

share based payments - - 5 5

Loss for the year - - (624) (624)

At 30 June 2019 9,774 19,691 (10,499) 18,966

-------- -------- --------- --------

IRONVELD PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (continued)

FOR THE YEARED 30 JUNE 2019

Owners of the Non-controlling Total equity

Total equity: Company interest

GBP'000 GBP'000 GBP'000

At 1 July 2017 17,600 3,923 21,523

Exchange differences

on

Translation of foreign

operations (1,207) (235) (1,505)

Issue of share capital 2,182 - 2,182

Credit for equity

settled share based

payments 31 - 31

Loss for the year (535) (1) (536)

At 30 June 2018 18,008 3,687 21,695

-------------- ---------------- -------------

Exchange differences

on

Translation of foreign

operations 176 35 211

Issue of share capital 1,401 - 1,401

Credit for equity

settled share based

payments 5 - 5

Loss for the year (624) (1) (625)

At 30 June 2019 18,966 3,721 22,687

-------------- ---------------- -------------

IRONVELD PLC

COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 JUNE 2019

Equity attributable to the equity holders of the Company:

Share Share Retained Total

Capital Premium Earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2017 7,671 18,211 (4,107) 21,775

Credit for equity

settled share based

payments - - 31 31

Issue of share

capital 1,232 950 - 2,182

Loss for the year - - (460) (460)

-------- -------- --------- --------

At 30 June 2018 8,903 19,161 (4,536) 23,528

-------- -------- --------- --------

Credit for equity

settled share based

payments - - 5 5

Issue of share

capital 871 530 - 1,401

Loss for the year - - (382) (382)

-------- -------- --------- --------

At 30 June 2019 9,774 19,691 (4,913) 24,552

-------- -------- --------- --------

IRONVELD PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEARED 30 JUNE 2019

2019 2018

Note GBP'000 GBP'000

Net cash from operating activities 20 (420) (362)

-------- --------

Investing activities

Purchases of property, plant and

equipment (4) (1)

Purchase of investments - (386)

Purchase of exploration and evaluation

assets (1,202) (1,263)

Contributions to exploration and 268 -

evaluation assets

Interest received 6 41

-------- --------

Net cash used in investing activities (932) (1,609)

-------- --------

Financing activities

Proceeds on issue of shares (net

of costs) 1,401 2,632

Repayment of borrowings - (889)

-------- --------

Net cash generated by financing

activities 1,401 1,743

-------- --------

Net (decrease)/increase in cash

and cash equivalents 49 (228)

-------- --------

Cash and cash equivalents at the

beginning o of the year 20 517 788

Effect of foreign exchange rates - (43)

-------- --------

Cash and cash equivalents at end

of year 20 566 517

-------- --------

IRONVELD PLC

COMPANY CASH FLOW STATEMENT

FOR THE YEARED 30 JUNE 2019

2019 2018

Noted GBP'000 GBP'000

Net cash from operating

activities 20 (381) (586)

-------- --------

Investing activities

Payments to acquire investments (961) (1,842)

Net cash used in investing

activities (961) (1,842)

-------- --------

Financing activities

Proceeds on issue of shares

(net of costs) 1,401 2,632

Net cash generated by financing

activities 1,401 2,632

-------- --------

Net increase in cash and

cash equivalents 59 204

-------- --------

Cash and cash equivalents

at the beginning of the

year 20 464 260

-------- --------

Cash and cash equivalents

at end of year 20 523 464

-------- --------

IRONVELD PLC

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

1. General information

Ironveld Plc is a public company incorporated in the United

Kingdom under the Companies Act 2006 whose shares are listed on the

Alternative Investment Market of the London Stock Exchange. The

address of the registered office is given on page 2. The nature of

the Group's operations and its principal activities are set out in

note 3 and in the Strategic Report on pages 3 to 4.

Adoption of new and revised Standards

In the current year, the Group has applied a number of new or

amended standard for the first time which are mandatory for

accounting periods commencing on or after 1 January 2018. None of

the standards adopted had a material impact on the financial

statements. The significant new and amended standards adopted were

as follows:-

IFRS 15 - Revenue from Contracts with Customers

IFRS 9 - Financial instruments

At the date of authorisation of these financial statements, the

following accounting standards, amendments to existing standards

and interpretations are not yet effective and have not been adopted

early by the Group.

IFRS 16 - Leases

IFRS 17 - Insurance contracts

Amendments to references to the conceptual Framework in IFRS

Standards

Annual Improvements to IFRSs 2015-2017 Cycle.

The adoption of these standards, amendments and interpretations

is not expected to have a material impact on the Group and

Company's results or equity.

.

2.1 Significant accounting policies

The financial statements are based on the following policies

which have been consistently applied:

Basis of preparation

The financial statements of the Group and Parent Company have

been prepared in accordance with International Financial Reporting

Standards (IFRSs) as adopted by the European Union and the

Companies Act 2006.

Under section 408 of the Companies Act 2006 the Parent Company

is exempt from the requirement to present its own profit and loss

account.

The financial statements have been prepared on the historical

cost basis. The financial statements are presented in pounds

sterling because that is considered to be the currency of the

primary economic environment.

The principal accounting policies are set out below:

Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and all entities controlled by the

Company (its subsidiaries) made up to the year end. Control is

achieved where the Company has power to govern the financial and

operating policies of an investee entity so as to obtain benefits

from its activities.

Subsidiaries are consolidated from the date of their

acquisition, being the date on which the Company obtains control

and ceases when the Company loses control of the subsidiary. Profit

or loss and each component of other comprehensive income are

attributed to the owners of the Company and to the non-controlling

interests. Total comprehensive income of the subsidiaries is

attributed to the owners of the Company and to the non-controlling

interests even if this results in the non-controlling interests

having a deficit balance.

Non-controlling interests in subsidiaries are identified

separately from the Group's equity therein. Those interests of

non-controlling shareholders are initially measured at their

proportionate share of the fair value of the acquiree's

identifiable net assets. Subsequent to acquisition, the carrying

value of the non-controlling interests is the amount of initial

recognition plus the non-controlling interests' share of the

subsequent changes in equity.

Changes in the Group's interests in subsidiaries that do not

result in a loss of control are accounted for as equity

transactions. The carrying amount of the Group's interests and the

non-controlling interests are adjusted to reflect the changes in

their relative interests in the subsidiaries. Any difference

between the amount by which the non-controlling interests are

adjusted and the fair value of the consideration paid or received

is recognised directly in equity and attributed to the owners of

the Company.

Business combinations

Acquisitions of subsidiaries are accounted for using acquisition

accounting. The consideration for each acquisition is measured at

the fair value of assets given, liabilities incurred or assumed and

equity instruments issued by the Group in exchange for control in

the acquiree. Acquisition-related costs are recognised in the

income statement as incurred.

Exploration and evaluation

Costs incurred prior to acquiring the rights to explore are

charged directly to the income statement.

Licence acquisition costs and all other costs incurred after the

rights to explore an area have been obtained, such as the direct

costs of exploration and appraisal (including geological, drilling,

trenching, sampling, technical feasibility and commercial viability

activities) are accumulated and capitalised as intangible

exploration and evaluation ("E&E") assets, pending

determination. Amounts charged to project partners in respect of

costs previously capitalised are deducted as contributions received

in determining the accumulated cost of E&E assets.

E&E assets are not amortised prior to the conclusion of the

appraisal activities. At completion of appraisal activities, if

financial and technical feasibility is demonstrated and commercial

reserves are discovered then, following development sanctions, the

carrying value of the relevant E&E asset will be reclassified

as a development and production asset in intangible assets after

the carrying value has been assessed for impairment and, where

appropriate adjusted. If after completion of the appraisal of the

area it is not possible to determine technical and commercial

feasibility or if the legal rights have expired or if the Group

decide to not continue activities in the area, then the cost of

unsuccessful exploration and evaluation are written off to the

income statement in the relevant period.

The Group's definition of commercial reserves for such purposes

is proved and probable reserves on an entitlement basis. Proved and

probable reserves are the estimated quantities of minerals which

geological, geophysical and engineering data demonstrate with a

specified degree of certainty to be recoverable in future years

from the known reserves and which are considered to be commercially

producible.

Such reserves are considered commercially producible if

management has the intention of developing and producing them and

such intention is based upon:

- a reasonable expectation that there is a market for

substantially all of the expected production;

- a reasonable assessment of the future economics of such

production;

- evidence that the necessary production, transmission and

transportation facilities are available or can be made available;

and

- agreement of appropriate funding; and

- the making of the final investment decision.

On an annual basis a review for impairment indicators is

performed. If an indicator of impairment exists an impairment

review is performed. The recoverable amount is then considered to

be the higher of the fair value less costs of sale or its value in

use. Any identified impairment is written off to the income

statement in the period identified.

Development and production assets

Development and production assets, classified within property,

plant and equipment, are accumulated generally on a field basis and

represents the cost of developing the commercial reserves

discovered and bringing them into production, together with the

E&E expenditure incurred in finding the commercial reserves

transferred from intangible assets.

Depreciation of producing assets

The net book values of producing assets are depreciated

generally on the field basis using the unit or production method by

reference to the ratio of production in the period and the related

commercial reserves of the field, taking into account the future

development expenditure necessary to bring those reserves to

production.

Research and development

Research expenditure is recognised as an expense in the period

in which it is incurred.

An internally-generated asset arising from any development is

recognised only if all of the following conditions are met:

- an asset is created that can be identified;

- it is probable that the asset created will generate future economic benefits; and

- the development cost of the asset can be measured reliably.

Non-current assets held for sale

Non-current assets (and disposal groups) classified as held for

sale are measured at the lower of carrying amount and the fair

value less costs to sell.

Non-current assets and disposal groups are classified as held

for sale if their carrying amount will be recovered through a sale

transaction rather than through continuing use. This condition is

regarded as met only when the sale is highly probable and the asset

(or disposal group) is available for immediate sale in its present

condition. Management must be committed to the sale which should be

expected to qualify for recognition as a completed sale within one

year from the date of classification.

When the Group is committed to a sale plan involving loss of

control of a subsidiary, all of the asset and liabilities of that

subsidiary are classified as held for sale when the criteria

described above are met, regardless of whether the Group will

retain a non-controlling interest in its former subsidiary after

sale.

Revenue

Revenue is measured at the fair value of the consideration

received or receivable for goods and services provided in the

normal course of business, net of discounts and value added tax.

The Group reported no revenue for the year.

Taxation

The tax expense represents the sum of the tax payable and

deferred tax.

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amount of assets and liabilities

in the financial statements and the corresponding tax base used in

the calculation of the taxable profit and is accounted for using

the balance sheet liability method. Deferred tax liabilities are

generally recognised on all appropriate taxable temporary

differences and deferred tax assets are recognised to the extent

that it is probable that taxable profits will be available against

which the deductible timing differences can be utilised. The

carrying amount of deferred tax assets is reviewed at each balance

sheet date.

Deferred tax is calculated at the tax rates that are expected to

be applicable in the period when the liability or asset is realised

and is based on tax laws and rates substantially enacted at the

balance sheet date. Deferred tax is charged in the income statement

except where it relates to items charged/credited in other

comprehensive income, in which case the tax is also dealt with in

other comprehensive income.

Leases

Rentals payable under operating leases are charged to the income

statement on a straight line basis over the lease term.

Property, plant and equipment

Tangible fixed assets are stated at cost less depreciation.

Depreciation is provided at rates calculated to write off the cost

less the estimated residual value of each asset over its expected

useful life, as follows:

Plant and machinery 10% - 25% straight line basis or reducing

balance basis

Foreign currencies

The individual financial statements of each group company are

presented in the currency of the primary economic environment in

which it operates (its functional currency). For the purposes of

the consolidated financial statements, the results and financial

position of each group company are expressed in pounds sterling,

which is the functional currency of the Company, and the

presentation currency for the consolidated financial

statements.

In preparing the financial statements of the individual

companies, transactions in currencies other than the entity's

functional currency are recognised at the rates of exchange

prevailing on the dates of the transactions. At each balance sheet

date, monetary assets and liabilities that are denominated in

foreign currencies are retranslated at the rates prevailing at that

date. Non-monetary items carried at fair value that are denominated

in foreign currencies are translated at the rates prevailing at the

date the fair value was determined. Non-monetary items that are

measured in terms of historical cost in a foreign currency are not

retranslated. Exchange differences are recognised in the income

statement in the period in which they arise.

When presenting the consolidated financial statements, the

assets and liabilities of the Group's foreign operations are

translated at the exchange rates prevailing at the balance sheet

date. Income and expense items are translated at average exchange

rates for the period, unless exchange rates have fluctuated

significantly in which case the rates at the date of the

transactions are used. Exchange differences arising are recognised

in other comprehensive income and accumulated in equity (attributed

to non-controlling interests where appropriate).

Goodwill and fair value adjustments arising on the acquisition

of a foreign entity are treated as assets and liabilities of the

foreign entity and translated using the closing rate.

Financial instruments

Financial assets and financial liabilities are recognised in the

Group's balance sheet when the Group becomes a party to the

contractual provisions of the instrument.

Other receivables

Other receivables are measured at initial recognition at fair

value, and are subsequently measured at amortised cost using the

effective interest rate method except for short-term receivables

when recognition of interest would be immaterial. Appropriate

allowances for the estimated irrecoverable amounts are recognised

in the income statement when there is objective evidence that the

asset is impaired.

Cash and cash equivalents

Cash and cash equivalents comprise cash on hand and demand

deposits, and other short term highly liquid investments that are

readily convertible to a known amount of cash and are subject to an

insignificant risk of change in value

Financial liability and equity

Interest bearing bank loans and overdrafts are recorded at the

proceeds received, net of direct issue costs. Finance charges,

including premiums payable on settlement or redemption and direct

issue costs, are accounted for on an accrual basis in the income

statement using the effective interest rate method and are added to

the carrying amount of the instrument to the extent that they are

not settled in the period in which they arise.

The Group classifies financial instruments, or their component

parts, on initial recognition as a financial asset, financial

liability or an equity instrument in accordance with the substance

of the contractual arrangement. Financial instruments are initially

recognised at fair value and are subsequently amortised using the

effective interest method. Fair value is estimated from available

market data and reference to other instruments considered to be

substantially the same.

Trade and other payables

Trade payables and other financial liabilities are initially

measured at fair value, and are subsequently measured at amortised

cost, using the effective interest rate method.

The Group's activities expose it primarily to the financial

risks of changes in interest rates on borrowings.

Investments

Investments in subsidiaries are stated at cost less any

provision for the permanent diminution in value.

Share-based payments

The Group issues equity-settled share-based payments to certain

employees and other parties. Equity settled share-based payments

are measured at fair value at the date of grant. In respect of

employee related share based payments, the fair value determined at

the grant date is expensed on a straight-line basis over the

vesting period, based on the Group's estimate of shares that will

eventually vest. In respect of other share based payments, the fair

value is determined at the date of grant and recognised when the

associated goods or services are received.

Operating segments

The Group considers itself to have one operating segment in the

year and further information is provided in note 3.

Going concern

The Directors have, at the time of approving the financial

statements, a reasonable expectation that the Company and the Group

will have adequate resources to continue in operating existence for

the foreseeable future. Thus they continue to adopt the going

concern basis of accounting in preparing the financial statements.

Further details are provided in the note 2.2 and in the Strategic

Report on pages 3 to 4. The financial statements therefore do not

include the adjustments that would result if the Group and Company

were unable to continue as a going concern.

2.2 Critical accounting estimates and judgements

The Group makes estimates and assumptions regarding the future.

Estimates and judgements are continually evaluated based on

historical experience and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances. In the future, actual experience may differ from

these estimates and assumptions. The estimates and assumptions that

have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next

financial year are discussed below.

Non-current assets held for sale

As announced by the Company in August 2019, the company entered

into confidentiality agreements with several parties interested in

potentially making an offer to purchase all or part of the

Company's assets. At the date of these financial statements these

discussions are ongoing. As a sale of the underlying assets or

subsidiary companies did not meet the criteria of International

Financial Reporting Standard 5 at the balance sheet date, then no

re-classification as Assets held for resale is judged

appropriate

Fair value of acquisition

On acquisition of a subsidiary, the Company is required to

estimate the fair value of the assets and liabilities acquired and

the consideration paid. The estimate in respect of exploration and

evaluation assets is affected by many factors including the future

viability of commercial reserves which have been based on the

judgement of directors supported by third party technical

reports.

Going concern

In July 2019, the Company announced that it had commenced a

review of the strategic alternatives for the Company's mining

assets (the "Strategic Review"). Subsequently, in September 2019,

the company announced that it had engaged positively with several

parties interested in potentially making an offer to purchase all

or part of the Company's mining assets. The parties, with whom

Ironveld entered into confidentiality agreements, have held

discussions with management and conducted visits to the Company's

site.

Whilst the Company expects to advance these discussions,

alongside the Strategic Review the Company has been in discussions

with various partners and investors that could lead to the funding

of the development of the Project and the commencement of smelting

operations and, additionally has moved to rationalise its cost base

in both South Africa and the UK.

However, further to the announcement of 19 February 2019, the

Groups present financial resources and facilities are only

considered sufficient to enable it to operate at present levels

until March 2020, by which time, the board of Directors anticipates

to have either secured further financing or successfully concluded

the Strategic Review.

Therefore, whilst the existing resources are not sufficient to

develop the mining asset, the Directors have a reasonable

expectation that the Group will be able to obtain adequate

resources to continue in operational existence for the foreseeable

future, being twelve months from the date of the approval of the

financial statements. The Group is committed to developing its

Strategic Review and is actively engaged with interested parties.

For this reason, the Board continues to adopt the going concern

basis in the preparation of these financial statements.

Exploration and evaluation assets

The Group has adopted a policy of capitalising the costs of

exploration and evaluation and carrying the amount without

impairment assessment until impairment indicators exist (as

permitted by IFRS 6). The directors consider that the Group remains

in the exploration and evaluation phase and therefore, under IFRS

6, the directors have to make judgements as to whether any

indicators of impairment exist and the future activities of the

Group. No such indicators of impairment were identified and

therefore no impairment review has been carried out.

Deferred tax assets

The directors must judge whether the future profitability of the

Group is likely in making the decision whether or not to recognise

a deferred tax asset in respect of taxation losses. No deferred tax

assets have been recognised in the year.

Useful lives of property, plant and equipment

Property, plant and equipment are amortised or depreciated over

their useful lives. Useful lives are based on the management's

estimates of the period that the assets will generate revenue,

which are based on judgement and experience and periodically

reviewed for continued appropriateness. Changes to estimates can

result in significant variations in the carrying value and amounts

charged to the consolidated income statement in specific

periods.

3. Business and geographical segments

Information reported to the Group Directors for the purposes of

resource allocation and assessment of segment performance is

focused on the activity of each segment and its geographical

location. The directors consider that there is only one business

segment, which is the activity of prospecting, exploration and

mining based in South Africa.

4. Operating loss

Year Year

Operating loss for the year is shown after ended ended

charging:

2019 2018

GBP'000 GBP'000

Depreciation on tangible assets 3 2

Lease payments under operating

leases 53 43

-------- --------

Auditors remuneration

Fees payable to the auditors for the audit

of the Company's accounts 37 35

Fees payable to the Company's auditors and its associates

for other services:-

The audit of the Company's subsidiaries 14 13

Tax compliance services 7 13

Other assurance services 12 33

Other non-audit services 3 -

--- ---

5. Staff costs

Year Year

ended ended

2019 2018

GBP'000 GBP'000

Wages and salaries 438 423

Social security costs 15 19

Share based payments 5 31

Directors other fees 382 399

-------- --------

840 872

-------- --------

The average monthly number of employees, including 2019 2018

Directors, during the period was as follows:

Number Number

Administration and management 20 15

------- -------

Directors remuneration and other

fees 517 534

---- ----

The aggregate remuneration paid to the highest

paid Director was 251 261

---- ----

Further details of the Directors' remuneration are given in the

Directors' Remuneration Report on pages 9 and 10.

Company

Year Year

ended ended

2019 2018

GBP'000 GBP'000

Wages and salaries - directors 135 135

Social security costs 12 18

147 153

-------- --------

The average monthly number of employees, including 2019 2018

Directors, during the period was as follows:

Number Number

Directors 5 5

------- -------

6. Investment revenues

Year Year

ended ended

2019 2018

GBP'000 GBP'000

Interest on financial deposits 6 41

-------- --------

7. Finance costs

Year Year

ended ended

2019 2018

GBP'000 GBP'000

Loan interest and similar charges 2 7

-------- --------

8. Tax

Year Year

ended

ended

2019 2018

GBP'000 GBP'000

a) Tax charge for the period

Corporation tax:

Current period - -

Deferred tax (note 16) - -

-------- --------

- -

-------- --------

b) Factors affecting the tax charge for

the period

Loss on ordinary activities for the period

before taxation (625) (535)

-------- --------

Loss on ordinary activities for the period

before taxation multiplied by effective

rate of corporation tax in the UK of 19%

(2018 - 19%) (119) (102)

Non- deductible expenses - -

Unused tax losses not recognised 119 102

-------- --------

Tax expense for the period - -

-------- --------

c) Factors that may affect future tax charges - The Group has

estimated unutilised tax losses amounting to GBP4,235,000 (2018 -

GBP3,850,000) the values of which are not recognised in the balance

sheet. The losses represent a potential deferred taxation asset of

GBP831,000 (2018 - GBP760,000) which would be recoverable should

the Group make sufficient suitable taxable profits in the

future.

In addition, the Group has pooled exploration costs incurred of

GBP8,082,000 (2018 - GBP7.610,000) which are expected to be

deductible against future trading profits of the Group.

9. (Loss)/earnings per share

2019 2018

GBP'000 GBP'000

Loss attributable to the owners

of the Company (625) (535)

-------- --------

Loss per share - Basic and diluted

Continuing operations (0.10p) (0.10p)

---------- --------

The calculation of basic earnings per share is based on

602,7502,339 (2018 - 529,515,251) ordinary shares, being the

weighted average number of ordinary shares in issue during the

year. Where the Group reports a loss for the current period, then

in accordance with IAS 33, the share options are not considered

dilutive. Details of such instruments which could potentially

dilute basic earnings per share in the future are included in note

18.

10. Loss attributable to owners of the parent Company

As permitted by Section 408 of the Companies Act 2006, the

profit and loss account of the parent Company is not presented as

part of these accounts. The parent Company's loss for the financial

year amounted to GBP382,000 (2018 - GBP460,000).

11. Intangible assets

Exploration

and

evaluation

assets

GBP'000

Group

Cost:

At 1 July 2017 26,750

Additions 1,320

Exchange differences (1,852)

------------

At 30 June 2018 26,218

------------

Additions 1,225

Contributions received (268)

Exchange differences 248

------------

At 30 June 2019 27,423

------------

Amortisation:

At 1 July 2017, 30 June 2018 -

and 30 June 2019

------------

Net book value at 30 June 2019 27,423

------------

Net book value at 30 June 2018 26,218

------------

The Group's exploration and evaluation assets all relate to

South Africa.

In respect of the exploration and evaluation assets which remain

in the appraisal phase, the Group has performed a review for

impairment indicators, as required by IFRS 6 and in the absence of

such indicators no impairment review was carried out. During the

period contributions of GBP268,000 (2018 - GBPNil) were received

from the project partner in respect of the mineral ore testing.

12. Property plant and equipment

Plant

and

machinery

GBP'000

Group

Cost:

At 1 July 2018 37

Additions 4

At 30 June 2019 41

Depreciation:

At 1 July 2018 33

Charge for the period 3

At 30 June 2019 36

-----------

Net book value at 30 June 2019 5

-----------

Net book value at 30 June 2018 4

-----------

Plant

and

machinery

Cost: GBP'000

At 1 July 2018 39

Additions 1

Exchange (3)

At 30 June 2019 37

Depreciation:

At 1 July 2018 34

Charge for the period 2

Exchange differences (3)

--------------

At 30 June 2019 33

--------------

Net book value at 30 June 2019 4

--------------

Net book value at 30 June 2018 5

--------------

All non-current assets in 2019 and 2018 were located in South

Africa.

13. Investments

Group - Other investment

2019 2018

GBP'000 GBP'000

Loans to other entities 390 386

-------- --------

The investment represents the Rand 7million refundable deposit

to Siyanda Smelting and Refining Proprietary Limited which the

Group has paid in exchange for a period of exclusivity to conclude

a potential acquisition of the company. The deposit is interest

free and becomes refundable should the acquisition not proceed.

Company - Subsidiary undertakings

Loans Equity Total

GBP'000 GBP'000 GBP'000

Cost:

As at 1 July 2017 861 20,352 21,213

Transfers 54 (54) -

Additions 1,847 31 1,878

---------- -------- --------

At 30 June 2018 2,762 20,329 23,091

---------- -------- --------

Additions 978 5 983

---------- -------- --------

At 30 June 2019 3,740 20,334 24,074

---------- -------- --------

Net book value 30

June 2019 3,740 20,334 24,074

---------- -------- --------

Net book value 30

June 2018 2,762 20,329 23,091

---------- -------- --------

The loans represent loans to Ironveld Holdings (Propriety)

Limited of GBP3,645,000 which incur interest at a rate not

exceeding the base lending rate applicable in England and Wales.

Under the initial terms of the loan, GBP2,500,000 is repayable 31

December 2019 with the remainder due 31 December 2020. Also

included in loans are working capital loans to Ironveld Mauritius

Limited of GBP95,000 which are interest free.

The Company has investments in the following principal

subsidiaries. To avoid a statement of excessive length, details of

the investments which are not significant have been omitted:

Name of company Shares Proportion Nature of business

of voting

rights

held

Ironveld Mauritius Ordinary *100% Holding Company

Limited

Ironveld Holdings Ordinary 100% Holdings Company

(Pty) Limited

Ironveld Mining (Pty) Ordinary 100% Mining and exploration

Limited

Ironveld Middelburg (Pty) Ordinary 100% Ore processing and

Limited smelting

Ironveld Smelting Ordinary 74% Ore processing and

(Pty) Limited smelting

HW Iron (Pty) Limited Ordinary 68% Prospecting and mining

Lapon Mining (Pty) Ordinary 74% Prospecting and mining

Limited

Luge Prospecting and Ordinary 74% Prospecting and mining

Mining (Pty) Limited

* Held directly by Ironveld Plc all other holdings are

indirect.

All subsidiary undertakings are incorporated in South Africa,

other than Ironveld Mauritius Limited, which is incorporated in

Mauritius.

Further details of non-wholly owned subsidiaries of the Group

are provided in note 22.

14. Trade and other receivables

Group Company

2019 2018 2019 2018

GBP'000 GBP'000 GBP'000 GBP'000

Other receivables 138 158 11 21

Prepayments and accrued income 18 19 14 15

-------- ---------- -------- --------

156 177 25 36

-------- ---------- -------- --------

Credit risk

The Group's principal financial assets are bank balances, cash

balances, and other receivables. The Group's credit risk is

primarily attributable to its other receivables of which GBP109,000

(2018 - GBP104,000) is due from a third party financial institution

and further information is provided in note 17. The remaining

receivable relates to recoverable VAT. The amounts presented in the

balance sheet are net of allowances for doubtful receivables.

15. Trade and other payables

Group Company

2019 2018 2019 2018

GBP'000 GBP'000 GBP'000 GBP'000

Trade payables 8 39 8 6

Taxation and social security

costs 18 15 14 14

Other payables 10 5 5 5

Accruals and deferred

income 574 354 43 38

-------- ---------- -------- --------

610 413 70 63

Due within 12 months (610) (413) (70) (63)

-------- ---------- -------- --------

Due after more than 12 - - - -

months

-------- ---------- -------- --------

16. Deferred tax

Group

2019 2018

GBP'000 GBP'000

Balance at 1 July 5,194 5,580

Exchange differences 49 (386)

-------- -------------

Balance at 30 June 5,243 5,194

-------- -------------

The deferred tax liability is made

up as follows:

Group

2019 2018

GBP'000 GBP'000

Fair value adjustments

5,243 5,194

-------- -------------

17. Financial instruments

The Group's policies as regards derivatives and financial

instruments are set out in the accounting policies in note 2. The

Group does not trade in financial instruments.

Capital risk management

The Group manages its capital to ensure that they will be able

to continue as a going concern whilst maximising the return to

stakeholders through the optimisation of the debt and equity

balance. The Group's overall strategy remains unchanged from

2018.

The capital structure of the Group consists of debt, which

includes the borrowings disclosed in note 16, cash and cash

equivalents and equity attributable to equity holders of the parent

Company.

The Group is not subject to any externally imposed capital

requirements.

Interest rate risk profile

The Group has no significant exposure to interest rate risk as

the group has no external interest bearing borrowings and no

significant interest income. The Group's exposures to interest

rates on financial assets and financial liabilities are detailed in

the liquidity risk management section of this note.

Credit risk management

Credit risk refers to the risk that a counterparty will default

on its contractual obligations resulting in financial loss to the

Company. The Group has adopted a policy of only dealing with

creditworthy counterparties as a means of mitigating the risk of

financial loss from defaults. The Group's exposure and the credit

ratings of its counterparties are continuously monitored and the

aggregate value of the transactions concluded is spread where

possible.

Liquidity Risk Management

Ultimate responsibility for liquidity risk management rests with

the Board of Directors, which has established an appropriate

liquidity risk management framework for the management of the

Group's short, medium and long term funding and liquidity

management requirements. The Group manages liquidity risk by

assessing required reserves and banking facilities by continuously

monitoring forecast and actual cash flows, and by matching the

maturity profiles of financial assets and liabilities. Details of

additional undrawn bank facilities that the Group has at its

disposal to manage liquidity are set out below.

Financial facilities

The Group did not have any secured bank loan or overdraft

facilities during the current or comparative period.

Financial assets

The Group has no financial assets, other than short-term

receivables and cash deposits of GBP566,000 (2018 - GBP517,000).

The cash deposits attract variable rates of interest. At the year

end the effective rate was 0.7% (2018 - 0.5%). The cash deposits

held were as follows:-

2019 2018

GBP'000 GBP'000

Sterling - United Kingdom

banks 518 429

USD - United Kingdom banks 2 7

South African Rand - United Kingdom banks 5 29

South African Rand - South African banks 41 52

-------- --------

566 517

-------- --------

Financial liabilities

The Group had no interest bearing financial liabilities.

Currency exposures

The Group undertakes transactions denominated in foreign

currencies and is consequently exposed to fluctuations in exchange

rates.

The carrying amounts of the Group's foreign currency denominated

monetary assets and monetary liabilities were as follows:-

As at 30 June 2019 Assets Liabilities

GBP'000 GBP'000

British Pound Sterling (GBP) 528 70

USD ($) 2 13

South African Rand (R) 564 41

-------- --------------

1,094 610

-------- --------------

As at 30 June 2018 Assets Liabilities

GBP'000 GBP'000

British Pound Sterling (GBP) 449 63

USD ($) 7 7

South African Rand (R) 605 343

-------- --------------

1,061 413

-------- --------------

Financial commitments and guarantee

Rehabilitation guarantees of GBP1,340,000 (R 24,278,412) have

been issued to the Department of Mineral Resources for three

subsidiaries, HW Iron Proprietary Limited, Lapon Mining Proprietary

Limited and Luge Prospecting and Mining Company Proprietary Limited

in order to comply with Section 41 of the Mineral and Petroleum

Resources Development Act, 2002 (Act 28 of 2002). Under this

agreement the Group will pay deposits to a third party financial

institution to be held pending discharge of any potential claim on

this guarantee. At 30 June 2019 GBP109,000 (R 1,962,000) (2018 -

GBP104,000 (R 1,879,000)) had been deposited in respect of this

agreement and is included in other receivables. This represents a

concentration of credit risk and the Group is exposed to currency

risk on these amounts. As the project has not yet commenced then no

liability is considered to have arisen under this guarantee at the

reporting date.

18. Share capital

Group and Company

2019 2018

GBP'000 GBP'000

Allotted, called up and fully

paid

654,990,841 (2018 - 567,891,279) ordinary

shares of 1p each 6,550 5,679

322,447,158 (2018 - 322,447,158) deferred

shares of 1p each 3,224 3,224

-------- --------

9,774 8,903

-------- --------

On 3 December 2018, the Company issued 24,242,420 ordinary

shares of 1.65p each raising GBP400,000 before expenses.

On 28 February 2019, the Company issued 62,857,143 ordinary

shares of 1.75p each raising GBP1,100,000 before expenses.

Unlike ordinary shares, the deferred shares have no voting

rights, no dividend rights and on a return of capital or winding up

are entitled to a return of amounts credited as paid. The deferred

shares are not transferrable and beneficial interests in the

deferred shares can be transferred to such persons as the Directors

may determine as custodian for no consideration without sanction of

the holder. For this reason the deferred shares are excluded from

any Earnings per share calculations.

Share options

The Company has a share option scheme for certain employees and

former employees of the Group. The share options in issue during

the period were as follows:

Exercise As at 1 July Granted Exercised Lapsed As at

Price 2018 in year in year / Cancelled 30 June

Date Granted 2019

GBP'000 GBP'000 No No No

21 May 2010 10p 1,600,000 - - - 1,600,000

16 August

2012 1p 5,949,558 - - - 5,949,558

14 November

2012 1p 6,663,505 - - - 6,663,505

16 April

2013 1p 1,033,334 - - - 1,033,334

7 November

2013 1p 2,086,667 - - - 2,086,667

1 May 2014 1p 200,000 - - - 200,000

1 October

2015 1p 2,500,000 - - - 2,500,000

27 January

2016 1p 445,545 - - - 445,545

------------- ----------- -------------- ------------- ----------

The exercise period of the options

is as follows:

Date granted Expiry date Exercise period

21 May 2010 21 May 2020 To May 2020

16 August 16 August 2022 The options are exercisable 1/3 on the

2012 first anniversary of the grant, 1/3 on

the second anniversary of the grant and

the final 1/3 on third anniversary of

the grant

14 November 14 November 2022

2012

16 April 16 April 2023

2013

7 November 7 November 2023

2013

1 May 2014 1 May 2024

1 October 1 October 2025

2015

27 January 27 January 2026

2016

Of the options granted on 1 October 2015, 1,000,000 are

exercisable following first commercial production from the proposed

15 MW smelter.

The Group recognised a share based payment expense of GBP5,000

(2018 - GBP31,000) in the period. No options were granted in the

year

19. Reserves

Share premium Retained earnings

Group account

GBP'000 GBP'000

At 1 July 2018 19,161 (10,056)

Loss for the year - (624)

Exchange difference on translation

of foreign operations - 176

Issue of share capital 530 -

Credit for equity settled share based

payments - 5

------------------- -------------------

At 30 June 2019 19,691 (10,499)

---------------- ------------------

Retained earnings is made up of cumulative profits and losses to

date, share based payments, adjustments arising from changes in

non-controlling interests and exchange differences on translation

of foreign operations.

Share Retained

premium earnings

Company account

GBP'000 GBP'000

At 1 July 2018 19,161 (4,536)

Loss for the period - (382)

Issue of share capital 530 -

Credit for equity settled share based payments - 5

--------- ----------

At 30 June 2019 19,691 (4,913)

--------- ----------

The balance classified as share premium is the premium on the

issue of the Group's equity share capital, comprising 1p ordinary

shares and 1p deferred shares less any costs of issuing the

shares.

20. Cash generated from operations

Group 2019 2018

GBP'000 GBP'000

Operating loss (629) (570)

Depreciation on property

plant and equipment 3 2

-------- --------

Operating cash flows before movements

in working capital (626) (568)

Movement in receivables 22 138

Movement in payables 185 75

-------- --------

Cash used in operations (419) (355)

Interest paid (1) (7)

-------- --------

Net cash used in operations (420) (362)

-------- --------

Cash and cash equivalents 2019 2018

GBP'000 GBP'000

Cash and bank balances 566 517

-------- --------

Company 2019 2018

GBP'000 GBP'000

Operating loss (404) (467)

-------- --------

Operating cash flows before movements in working

capital (404) (467)

Movement in receivables 13 21

Movement in payables 10 (140)

Net cash used in operations (381) (586)

-------- --------

Cash and cash equivalents 2019 2018

GBP'000 GBP'000

Cash and bank balances 523 464

-------- --------

21. Related party transactions

Group

During the year the Group incurred GBP251,000 (2018 -

GBP261,000) for consultancy services to Goldline Global Consulting

(Pty) Limited, a company in which P Cox is materially interested.

At 30 June 2019, GBP365,000 remained unpaid in accruals.

During the year the Group incurred GBP131,000 (2018 -

GBP138,000) for consultancy services to Novem Consulting, a private

company in which V Von Ketelhodt is materially interested. At 30

June 2019, GBP145,000 remained unpaid in accruals.

Group and Company

The key management personnel of the Group are the directors.

Directors' remuneration is disclosed in Note 5.

During the year the Company paid GBP48,000 (2018 - GBP48,000)

for accounting services to Westleigh Investments Limited, a company

in which G Clarke and N Harrison are materially interested.

During the year the Company paid GBP20,000 (2018 - GBP20,000)

for consultancy services to Merlin Partnership LLP, a company in

which G Clarke is materially interested.

22. Non-controlling interest

2019 2018

GBP'000 GBP'000

At 1 July 3,687 3,923

Exchange adjustments 35 (235)

Share of loss for

the period (1) (1)

-------- --------

At 30 June 3,721 3,687

-------- --------

The table below shows details of non-wholly owned subsidiaries

of the Group that have material non-controlling interests:

Proportion Profit/(loss) Accumulated non-controlling

of voting allocated to interests

rights and non-controlling

shares held interests

2019 - (2018) 2019 2018 2019 2018

GBP'000 GBP'000 GBP'000 GBP'000

HW Iron (Pty) Limited 32% (32%) - - 1,184 1,173

Lapon Mining (Pty)

Limited 26% (26%) - - 2,540 2,517

Other non-controlling

interests (1) (1) (3) (3)

--------- -------- -------------- --------------

(1) (1) 3,721 3,687

--------- -------- -------------- --------------

Summarised financial information in respect of each of the

Group's subsidiaries that have material non-controlling interests

is set out below. The summarised financial information below

represents amounts before intragroup eliminations. The accounts of

the subsidiaries have been translated from their presentational

currency of South African Rand (R) using the R : GBP exchange rate

prevailing at 30 June 2019 of 17.9497 (2018 - 18.1197).

HW Iron (Proprietary) Limited

2019 2018

GBP'000 GBP'000

Non-current assets 7,261 7,007

Current liabilities (2,122) (1,916)

Non-current liabilities (1,441) (1,427)

-------- --------

3,698 3,664

Equity attributable to owners of the

Company 2,514 2,491

Non-controlling

interest 1,184 1,173

-------- --------

Revenue - -

Expenses - (1)

-------- --------

Loss for the year - (1)

-------- --------

Attributable to the owners

of the Company - (1)

Attributable to non-controlling

interests - -

-------- --------

Net cash inflow from operating

activities - 230

Net cash outflow from investing

activities (188) (265)

Net cash inflow from financing

activities 188 35

-------- --------

Net cash inflow - -

Net cash flow - Attributable to non-controlling

interests - -

-------- --------

Lapon Mining (Proprietary) Limited

2019 2018

GBP'000 GBP'000

Non-current assets 15,300 14,976

Current liabilities (1,728) (1,530)

Non-current liabilities (3,802) (3,766)

-------- --------

9,770 9,680

Equity attributable to owners of the Company 7,230 7,163

Non-controlling

interest 2,540 2,517

-------- --------

Revenue - -

Expenses (1) (1)

-------- --------

Loss for the year (1) (1)

-------- --------

Attributable to the owners

of the Company (1) (1)

Attributable to non-controlling

interests - -

-------- --------

Net cash inflow from operating

activities (1) (1)

Net cash outflow from investing

activities (183) (241)

Net cash inflow from financing

activities 184 242

-------- --------

Net cash inflow - -

Net cash flow - Attributable to the non-controlling

interests - -

-------- --------

23. Financial commitments

At the year end the Group had financial commitments under

operating leases of GBPNil.

24. Control

The Directors consider that there is no overall controlling

party.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR DMMGZZDRGLZZ

(END) Dow Jones Newswires

December 05, 2019 02:00 ET (07:00 GMT)

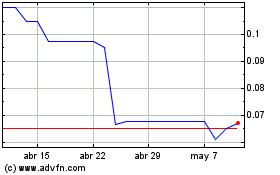

Ironveld (LSE:IRON)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Ironveld (LSE:IRON)

Gráfica de Acción Histórica

De May 2023 a May 2024