Paypoint plc Paypoint Plc: Trading Update For The Three Months Ended 31 December 2019 23 January 2020

23 Enero 2020 - 1:00AM

UK Regulatory

TIDMPAY

PayPoint plc

Trading update for the three months ended 31 December 2019(1)

23 January 2020

Highlights:

-- Underlying2 group net revenue increased by GBP1.3 million (4.2%) to

GBP32.7 million (GBP31.4 million).

-- Service fee grew strongly by 32.8% to GBP3.5 million (GBP2.6 million)

driven by the roll out of PayPoint One to 16,223 sites at 31 December

2019 (15,088 at 30 September 2019) and a 3.3% improvement in the average

weekly service fee3.

-- UK parcel volumes increased by 12.6% to 7.6 million, reflecting a solid

performance over the peak period and the benefit of new parcel

partnerships.

-- UK bill payments net revenue increased by 2.2%, driven by strong growth

in MultiPay and improvement in net revenue per transaction offsetting a

1.1% decline in transactions.

-- Romania net revenue increased by 0.4%, increasing by 4.7% after adjusting

for a one-off payment of marketing support received in the prior year,

due to increased transactions and price increases. Good control of costs

also drove improved margins.

Nick Wiles, PayPoint's Executive Chairman, commented:

"Overall our results for the quarter reflect resilience in our bill

payments business, growth in our parcels activities during the important

peak parcels period and continued progress in the rollout of PayPoint

One and our retail services activities. Romania has performed well with

a steady increase in transactions and good control of costs."

Current trading and outlook

The warmer weather over the period of the festive season and the first

three weeks of January continues to affect energy transactions within UK

bill payments and parcel volume growth remains towards the lower end of

our expectations as the four new parcel partners become established

within our network. Retail services, excluding parcels, are performing

in line with our expectations and are expected to carry on growing well.

Actions to deliver cost efficiencies and enhance customer service

delivery are effective and ongoing.

Overall, the board remains confident that there will be a progression in

profit before tax and exceptional items for the year ending 31 March

2020, albeit it is now likely to be at a more modest rate than

previously expected.

Performance for the third quarter ending 31 December 2019

Underlying(2) group net revenue increased by GBP1.3 million from GBP31.4

million to GBP32.7 million driven by an increase in service fees,

through the ongoing roll out of PayPoint One, and a robust performance

in bill payments in the UK and Romania.

Progress during the period against our strategic priorities is set out

below:

-- Embed PayPoint at the heart of convenience retail

-- Retail services net revenue grew by 9.5%4 driven by the continued

strong performance of the PayPoint One rollout and the increased

parcel volumes delivered from our new parcel partners, which have

been successfully integrated into the network. We remain on track

to reach our upgraded year-end target of 16,500 PayPoint One sites

with 16,223 sites installed at 31 December 2019, an increase of

3,342 since the start of the financial year.

-- Service fee net revenue increased by 32.8% to GBP3.5 million and

PayPoint One's average weekly service fee per site increased by

GBP0.49, 3.3%, to GBP15.38 (GBP14.89)3. EPoS Pro terminals grew by

209 to 854 from 645 at 31 March 2019.

-- Card payment transactions grew by 17.9% to 34.0 million, card

payment rebate revenue increased by 5.0% as lower average

transaction values partially offset the volume growth. Our card

payments service was in 9,820 sites at 31 December 2019, broadly

unchanged from 30 September 2019.

-- ATM net revenue decreased by 1.3% to GBP3.0 million due to a 2.3%

reduction in transactions to 10.3 million. The LINK interchange reduction

of 5% was offset by enhanced premiums and the revenue benefit being

realised from the rollout to the leisure centres of a significant new

client.

-- Our retail network reduced to 27,832 (30 September 2019: 28,366) sites in

the UK as expected and as a result of our legacy terminal sunset program.

-- Become the definitive parcel point solution

-- Parcel volumes grew by 12.6%, reflecting the increased volumes

from our new partners Amazon, DHL, ebay, FedEx. In December parcel

volumes increased by 15%. Although this performance was towards

the lower end of our expectations it compared very well to the

overall market growth of 2.6% in on-line sales over the festive

period5.

-- Operationally the parcels business delivered a robust performance

during the peak parcel period, with service levels maintained as

we embedded the four new parcel partners into our parcels network

and successfully managed the higher level of parcel volumes.

-- Sustain leadership in 'pay-as-you go' and grow digital bill payments

UK

-- Bill payment net revenue increased by 2.2% driven by an increase in net

revenue per transaction, which more than offset a 1.1% decline in

transactions.

-- MultiPay continued to grow strongly with transactions up by 17.6% to 9.4

million and net revenue increasing by 28.6%.

-- eMoney transactions increased by 18.8% driven by continued growth from

existing clients which led to a 24.8% increase in eMoney net revenue.

Overall, UK top-up and eMoney transactions reduced by 11.4% due to the

further declines in the prepaid mobile sector which resulted in a 3.0%

decrease in net revenue.

-- Eight new clients were contracted in the period and six clients renewed

contracts including an exclusive agreement with Monzo.

Romania

-- Transactions increased by 3.6% from the same period last year to reach

29.2 million. Overall sites increased to 19,526 at 31 December 2019 from

18,466 at 31 March 2019 and card payment sites increased to 1,452 sites

at 31 December 2019 from 1,300 for the same period.

-- Net revenue increased by 0.4%, increasing by 4.7% after adjusting for a

one-off payment of marketing support received in the prior year. This

revenue growth was achieved through the growth in transactions and price

increases. Good control of costs also drove improved margins.

-- Six new clients were contracted in the period.

Balance sheet as at 31 December 2019

The Group had net cash of GBP29.8 million (31 March 2019: GBP37.5

million) including the balance held in respect of short term client

settlement obligations of GBP43.1 million (31 March 2019: GBP34.0

million).

Dividends

The group has previously declared an interim dividend of 23.6 pence per

share and an additional interim dividend of 18.4 pence per share. The

first instalments of the interim ordinary dividend of 11.8p per share

and the additional dividend of 9.2p per share were paid on 30 December

2019.The second instalments of the same amounts will be paid on 9 March

2020.

Enquiries

PayPoint plc Finsbury (Tel: 0207 251 3801)

Nick Wiles, Executive Chairman (Tel: 01707 600 317)

Rollo Head

Rachel Kentleton, Finance Director (Tel: 07843 074 906)

Andy Parnis

ABOUT PAYPOINT

In thousands of retail locations, at home and on the move, we make life

more convenient for everyone.

For retailers, we offer innovative and time-saving technology that

empowers convenience retailers in the UK and Romania to achieve higher

footfall and increased spend so they can grow their businesses

profitably. Our innovative retail services platform, PayPoint One, is

now live in over 16,000 stores in the UK and offers everything a modern

convenience store needs, from parcels and contactless card payments to

EPoS and bill payment services. Our technology helps retailers to serve

customers quickly, improve business efficiency and stay connected to

their stores from anywhere.

We help millions of people to control their household finances, make

essential payments and access in-store services, like parcel collections

and drop-offs. Our UK network of almost 28,000 stores is bigger than all

banks, supermarkets and Post Offices together, putting us at the heart

of communities nationwide.

For clients of all sizes we provide cutting-edge payments technologies

without the need for capital investment. Our seamlessly integrated

multichannel payments solution, MultiPay, is a one-stop shop for

customer payments. PayPoint helps c500 consumer service providers to

save time and money while making it easier for their customers to pay --

via any channel and on any device.

(1) PayPoint's auditors have not been requested to review the

performance.

(2) Underlying net revenue excludes the GBP0.2 million impact from the

Yodel renegotiation.

(3) Average weekly service fee increased to GBP15.38 compared to

GBP14.89 at 31 December 2018.

(4) Includes underlying parcel net revenue growth of 25.3%.

(5) https://brc.org.uk/news/2019/worst-year-on-record-for-retail/.

Online sales increased 2.6% over the combined period months of November

and December compared to the same period in the prior year.

Attachment

-- Trading update Q3 2019

https://ml-eu.globenewswire.com/Resource/Download/183ae4b5-ab44-4f61-b298-8a583077137a

(END) Dow Jones Newswires

January 23, 2020 02:00 ET (07:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

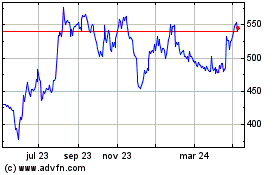

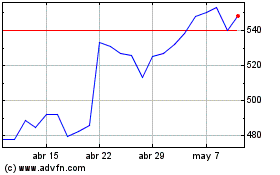

Paypoint (LSE:PAY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Paypoint (LSE:PAY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024