TIDMPTY

RNS Number : 8018J

Parity Group PLC

16 April 2020

16 April 2020

PARITY GROUP PLC

FULL YEAR RESULTS FOR THE YEARED 31 DECEMBER 2019

Parity Group plc ("Parity" or the "Group"), the data and

technology focussed professional services business, announces its

full year results for the year ended 31 December 2019.

2019 Financial Headlines:

-- Group revenues GBP80.4m (2018: GBP86.1m)

-- Adjusted profit before tax(1) GBP115k (2018: GBP853k)

-- Loss before tax GBP1,057k (2018: profit before tax GBP358k)

-- Continued positive cash flow from operations of GBP3.4m (2018: GBP0.6m)

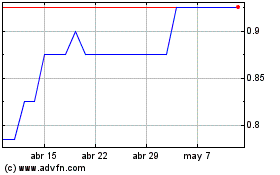

-- Net cash positive at year end GBP0.9m (2018: net debt of GBP1.1m)

1 Adjusted profit before tax is defined as profit before tax and non-recurring items

2019 Strategic and Operational Headlines:

-- Significant business restructuring delivers gross GBP3.3m of annualised cost savings

-- Cost savings higher than anticipated

-- Net annualised cost savings, after reinvestment in new team, of GBP2.0m

-- Staff numbers reduced by net 44%

-- Started shift to flexible and scalable outsourced operating model

-- Investment in new team to drive new higher margin business model

-- Focus on consultancy and higher margin recruitment

-- New heads of consultancy and resourcing delivering new opportunities

-- Dedicated Learning & Development offer within consultancy service

-- Refreshed market proposition and brand gaining good traction with clients

-- Good progress in securing government and private sector data

services work including NHS Digital and NHS Health Data Research

and consulting work supporting BooHoo.com

-- Brand relaunched with more active communications and reputation management

2020 Outlook:

Board unable to forecast with any certainty 2020 revenue and

profit before tax performance at this time in light of ongoing

Covid-19 uncertainties

-- Covid-19 impacts will, in part, be mitigated by cost savings already achieved in 2019

-- Further organisational design and process mapping work

instigated before the pandemic will deliver additional gross

annualised savings, targeted to be GBP700k, in 2020

-- In direct response to the pandemic, management have agreed a

20% reduction in salaries with all Directors and staff for the

three months starting 1 April 2020

-- Management are conducting a daily review of Covid-19 impacts

with clients and contractors to assess supply and demand in as

close to real time as possible. This review process is designed to

give the advanced warning required to be able to manage impacts on

the business and to help clients fill potential gaps in their

workforces

-- Parity remains well capitalised, with net cash at 31 December

2019, and a GBP10m existing credit facility providing a comfortable

level of headroom through asset-based lending

-- The government's VAT deferral measures will provide an

additional useful help to cash flow in the current year

-- The Board remains confident that Parity has sufficient access

to cash to enable it to trade its way through this period of global

uncertainty

John Conoley, Non-Executive Chairman of Parity Group, said:

"The significant disruption to the world economy brought on by

the Covid-19 virus will impact almost every single company. At this

point it is difficult to predict its impact on Parity. The

significant costs that have come out of the business in the last

twelve months will help us to ride out the storm.

"Parity's business is heavily weighted towards the public

sector, which accounted for approximately 70% of revenues in 2019.

We are already seeing signs that Government expenditure will be

more resilient as much of it is aligned to the provision of key

public services. However due to the ongoing uncertainty caused by

Covid-19, Parity expects there will be an impact on revenues for

the current year, the exact extent of this impact remains

impossible to quantify at this stage.

"In 2019 we made great progress in implementing our new strategy

and the transformation of our business is on track. We have moved

to a new business model, taken a significant level of cost out of

the business and invested in new talent. That we have been able to

achieve such a significant organisational change whilst still

reporting a modest adjusted profit before tax, and improving our

cash position, gives us confidence in the future of the

business."

Matthew Bayfield, Chief Executive, said:

"The Covid-19 pandemic has brought significant uncertainty to

our business however all our staff are working remotely, enabling

the business to remain fully operational. Our responsibility is to

all stakeholders in these difficult times, we are committed to

providing the best support we can to protect staff, contractors and

clients.

"The coming months will be challenging for our business, but our

people have been fantastic in the way they have reacted to the

evolving needs of our clients and contractors.

"Technology continues to transform the recruitment market and

this process has been accelerated by the pandemic. The multitude of

platforms employers use to look for candidates, the artificial

intelligence that brings speed and efficiency to the recruitment

process, and the lower costs of technology led solutions, have

brought about fundamental changes in the way our market operates.

At Parity, with our focus on data people and skills, we see great

opportunities from these market shifts, however we have needed to

restructure our business in order to take full advantage."

"To that end we began a 'digital first' transformation in our

business. This has led to a headcount reduction of over 40% with a

net annualised saving of GBP2m. We have streamlined processes that

enable us to be more agile, flexible and cost efficient at

servicing our client needs. This transformation will continue

throughout 2020."

For further information, contact:

Matthew Bayfield

CEO 020 8543

Roger Antony GFD Parity Group plc 5353

David Beck Donhead Consultants 07836 293383

Mike Coe 0207 220

Chris Savidge WH Ireland 1666

This announcement contains certain statements that are or may be

forward-looking with respect to the financial condition, results or

operations and business of Parity Group plc. By their nature

forward-looking statements involve risk and uncertainty because

they relate to events and depend on circumstances that will occur

in the future. There are a number of factors that could cause

actual results and developments to differ materially from those

expressed or implied by such forward-looking statements. These

factors include, but are not limited to (i) adverse changes to the

current outlook for the UK IT recruitment and solutions market,

(ii) adverse changes in tax laws and regulations, (iii) the risks

associated with the introduction of new products and services, (iv)

pricing and product initiatives of competitors, (v) changes in

technology or consumer demand, (vi) the termination or delay of key

contracts and (vii) volatility in financial markets.

Chairman's report

2019 - Transformation on track

Parity underwent very significant change during 2019. At the

beginning of the year we appointed our new chief executive Matthew

Bayfield and the Board asked him to address the structural changes

that were impacting our markets and undermining our ability to earn

returns for shareholders from the recruitment market. The loss of a

large framework contract in Scotland at the beginning of the year

and the end of a significant consultancy contract were both further

catalysts for change, they gave us an urgency in our pursuit of a

new business model that will deliver for all our stakeholders.

I am pleased to be able to report that we have made great

progress in implementing our new strategy and the transformation of

our business is very much on track. Whilst revenues, EBITDA and

adjusted profit before tax are all lower than in the previous year

this is in line with the Board's expectations. We have moved to a

new business model, taken a significant level of cost out of the

business and invested in new talent. That we have been able to

achieve such a significant organisational change whilst still

reporting a modest adjusted profit before tax, and improving our

cash position, gives us confidence in the future of the

business.

Strategy

Our strategy is a reflection of our client's needs. Data is a

huge challenge for businesses; the volume of data in data centre

storage is five times higher than it was five years ago and that

rate of growth is forecast to continue. For businesses, that makes

decision making more complex and the analysis of data more

difficult, and to make matters more challenging, data analytic

skills are scarce and data gurus at a premium.

That is Parity's opportunity, our strategy is to help our

clients realise the true value of their data. We can do that in

different ways; we can help them find data expertise because we

have access to a community of experts, we can teach our clients'

people to become data experts and we can take on our clients' data

services as a consultancy project, and of course we can offer them

any combination of all three of those services.

Board and people

Matthew Bayfield joined the board as Chief Executive in February

2019 and had an immediate impact on the business. He and Roger

Antony, our CFO, have been responsible for the implementation of

the new strategy which has seen us move a number of people out of

the business and recruit others with the skills we require to

develop new services and take them to market. It is never an easy

task to make such significant people changes, we have tried very

hard to ensure that we have treated all concerned with respect and

fairness. We have welcomed some new and very talented people to the

business, and we have changed the way we incentivise people to

align management and shareholder's interests, moving to a profit

based incentive plan.

The Board wishes to record its thanks to all of the staff who

have contributed to the transformation of our business, much hard

work has gone into ensuring we remain focused on delivering for

existing clients and identifying potential new clients. We are

fortunate to have an enthusiastic and talented team.

Results

Revenue across the Group was 6.6% lower at GBP80.4 million,

largely as a result of lower recruitment revenues as our large

contract with the Scottish Government, which was not renewed in

early 2019, began to wind down. The Group continues to be cash

generative and helped by a reduction in working capital we

generated GBP3.4m in cash from operations taking us to a net cash

positive position of GBP0.9m at the year end. Adjusted profit

before tax of GBP115k was in line with our expectations. After

non-recurring items of GBP1.2m before tax, we recorded a loss

before tax for the year of GBP1.1m (2018: profit before tax of

GBP0.4m). Going forward we will look to build revenues in higher

margin service lines such as consultancy and learning and

development and also change the nature of our recruitment offer to

higher margin work.

Financing and dividend

In May we renewed our banking arrangements with PNC for a

further two years at more competitive rates, resulting in a GBP10m

facility at 2.00% above base. The exceptional cash performance at

the end of 2019 left us with GBP0.9m of net cash at the year end.

An improved cash position will give us further flexibility when

reviewing our facility, which has a minimum period to May 2021. The

Board is not proposing a dividend at this time but will keep this

policy under review.

Current trading and outlook

The significant disruption to the world economy brought on by

the Covid-19 virus will impact almost every single company. At this

point it is difficult to predict its impact on Parity. The

significant costs that have come out of the business in the last

twelve months will help us to ride out the storm.

Parity's business is heavily weighted towards the public sector,

which accounted for approximately 70% of revenues in 2019. We are

already seeing signs that Government expenditure will be more

resilient as much of it is aligned to the provision of key public

services.

However in light of the ongoing Covid-19 the Board is unable to

forecast with any certainty 2020 revenue and profit before tax

performance at this time. We anticipate that Covid-19 impacts will,

in part, be mitigated by cost savings already achieved in 2019 and

further organisational design and process mapping work instigated

before the pandemic will deliver additional savings in 2020.

In direct response to the pandemic, management have agreed a 20%

reduction in salaries with all Directors and staff for the three

months starting 1 April 2020. Management are conducting a daily

review of Covid-19 impacts with clients and contractors to assess

supply and demand in as close to real time as possible. This review

process is designed to give the advanced warning required to be

able to manage impacts on the business and to help clients fill

potential gaps in their workforces.

Parity remains well capitalised, with net cash at 31 December

2019, and a GBP10m existing credit facility providing a comfortable

level of headroom through asset-based lending. The government's VAT

deferral measures will provide an additional useful help to cash

flow in the current year. The Board remains confident that Parity

has sufficient access to cash to enable it to trade its way through

this period of global uncertainty.

Chief Executive's statement

A restructured business, focussed on growth

2019 saw comprehensive changes to our business as we implemented

the strategic plan set out a year ago.

Technology continues to transform the recruitment market and

recently this process has been accelerated by the Covid-19

pandemic. The multitude of platforms that employers use to look for

candidates, the artificial intelligence that brings speed and

efficiency to the recruitment process, and the lower costs of

technology led solutions, have brought about fundamental changes in

the way our market operates. At Parity, with our focus on data

people and skills, we continue to see great opportunities from

these market shifts, however we have needed to restructure our

business in order to take full advantage.

To that end we began a 'digital first' transformation in our

business. This has led to a headcount reduction of over 40% with a

net annualised saving of over GBP2m. We have streamlined processes

that enable us to be more agile, flexible and cost efficient at

servicing our client needs. This transformation will continue

throughout 2020.

At the beginning of 2019 we set out to refocus our business on

sustainable, higher margin revenues. We said we would:

-- refresh our senior management with new skills in consulting,

learning and development and marketing;

-- implement a new single operating model;

-- refresh the Parity brand and upgrade our web presence;

-- review the role of technology in recruitment services and

investigate how AI can help us keep ahead of market changes;

-- create a new business function; and

-- set out to reduce our overheads both to be able to afford the

investment required and to improve the company's net margins and

cash position.

Progress on many fronts

Stronger financially

In 2019 we reduced our operating costs by a gross GBP3.3

million. These savings were significantly ahead of what we

initially set out to achieve as our restructuring went further and

deeper into the organisation. Staff numbers reduced by a net 44% as

we rightsized our recruitment team and made savings in central

management. After reinvesting a total of GBP1.3m, our net

annualised cost savings in 2019 were GBP2.0m.

The cost of achieving these savings was a restructuring charge

of GBP1.2m in the full year, we will see a return on the cost of

these net savings in less than 8 months. We were also able to

implement these cost savings whilst making a significant further

improvement to our net cash position. Helped by a reduction in

working capital, we generated GBP3.4m of cash from operations

during the year and were net cash positive at the year end. The

business is now less constrained by debt, this enables us to plan

for the future with greater confidence.

A refreshed and strengthened management team

The restructuring of our operating costs has allowed us to

invest in building a stronger senior team. Of the total GBP1.3m of

cost savings reinvested, GBP1.0m was in new hires.

In April we appointed Antonio Acuña MBE to head our consultancy

offer. Antonio had worked in the public sector for over 15 years,

with a foundation in digital transformation, lean processes and

efficiencies, he mainly focused on difficult, large projects. Since

joining Parity he has led our renewed focus on providing clients

with data consultancy and execution using Parity data experts.

Antonio and his team have had success within both the government

and the private sectors.

We have created a Learning & Development Practice within our

consultancy service, reporting to Antonio. The team based in

Manchester and Edinburgh offer organisations support in developing

their own talented people and getting the best from their

workforce.

Lee-Ann Falconer joined as Head of Resourcing earlier this year

with a wealth of experience within resourcing, recruitment and

leadership across a number of sectors. Based in Edinburgh, Lee-Ann

is helping us to focus our recruitment business on higher margin

briefs, specialising in real data experts who we can identify from

our growing community.

Shaun O'Hara has been our new people Director since May, he is

passionate about making Parity a great place to work for existing

and future employees, believing that the best way to ensure

incredible service and delivery for clients is to help nurture a

motivated and aligned team.

We have outsourced our marketing function and are working with a

firm of specialist marketeers who are helping with lead generation,

content and marketing plans. This is part of our overall strategy

to move from a fixed to flexible cost base that is scalable and

aligned to market performance.

A new business model and refreshed brand

Parity sets out to be the 'trusted partner of data driven

transformation' for our clients. We have designed and implemented a

new business model that allows us to deliver on that purpose. We

provide solutions across three areas;

-- Data Solutions. We help our clients architect and develop

their data strategy, designing and delivering data solutions that

drive confident commercial decision making.

-- People Solutions. We understand the people who understand

data. With the most experienced community of talent in the market,

we can help our clients build a team of data experts and leaders to

transform their businesses.

-- Development Solutions. We can help our clients become data

driven organisations. Through training, shaping and developing

their existing teams' skills and behaviours to deliver high

performance even within complex data environments.

Our organisation is designed to find the right solution or

combination of solutions matched to each client's needs. A single

account management function allows us to be solution agnostic and

always put the client first.

Parity has more than forty-five years history of trusted

relationships with our clients and a name that is well known in its

market. However, the Parity brand had not been refreshed for many

years and was failing to convey our values. Starting with last

year's annual report and accounts we rolled out our new branding,

including a new web site, marketing literature and social media

feeds.

Artificial Intelligence (AI) in our market place

In 2019 we undertook to review the role of technology in

recruitment services and to investigate how AI can help us keep

ahead of market changes. We have already seen the impact of web and

app based recruitment tools and the structural changes they have

prompted. Less well recognised is the impact of the vast quantities

of data that is recorded and stored about individuals and the role

AI has to play in the intelligent analysis of that data to assist

recruiters.

In November we announced a strategic partnership with Integumen

which we believe will help accelerate Parity's transformation from

a predominantly commoditised recruitment business to a data

consultancy service provider of intelligent data management

systems, extracting value using analytics, with a focus on return

on investment for our clients. Integumen's proprietary software

includes full GDPR compliance with secure cloud data migration from

existing legacy systems to a digital workplace through the military

grade encryption "Drive4Growth" AI platform powered by Integumen's

Rinodrive.

Rinodrive delivers big data, AI functionality and world class

infrastructure to large companies with big data problems. These

include financial services, education and life science companies. A

fully integrated set of software tools that can ingest data, in any

volume, from any source in any format, interact with it, learn from

it and enrich it to unlock insights and discoveries. This data

management solution was developed by scientists and engineers with

experience in software, sensors, AI, optofluidic research, fintech,

green-tech, travel and healthcare. It was designed to allow

interaction, in a cyber-secure environment, with commercially

sensitive data, and to share insights across multi-disciplinary

teams, generating different data formats, from multiple sources,

located in different countries.

At Parity we will continue to be at the forefront of

technological advances and are excited by the opportunity to work

with Integumen to bring the benefits of AI to our clients. This is

another example of how we have sought to modernise our business and

move it to higher value solutions for our clients.

Building a higher margin business

At the heart of our strategy is our determination to increase

our gross profit margin in order to improve total shareholder

returns. The structural shifts in the recruitment market described

above have meant that our already low margin recruitment business

was not going to remain sustainable without significant changes.

The Board, in setting out a new strategic direction for the

Company, was conscious that at no time in our recent past have we

achieved a net profit margin of even 2%. With continued and

sustained gross margin pressure in recruitment, this record was not

likely to change unless we embraced some fundamental changes to our

business model and strategy.

Our new business model is designed to substantially change our

financial model. Revenues will be lower as we reduce our exposure

to relatively high volume but low margin recruitment revenues.

Margins on the other hand will improve as we focus on higher value

recruitment specialising in data skilled people and build our data

consultancy and learning & development service lines, both of

which attract significantly higher gross margins.

As is evident from the 2019 results it will take time for the

changes we have made to our business to impact our financial

performance. The year under review saw revenues fall by only 6.6%

as we continued to service legacy low margin contracts, notably

with the Scottish government, and our gross margins have also been

held back by these legacy contracts.

Conclusion

A new business model, a new team and a new sense of purpose have

all been achieved in 2019. I am pleased to be able to report that

our transformation is on track. In terms of cost savings we are

ahead of plan and we have been encouraged by our clients' support

for our new offer.

The Covid-19 pandemic has brought significant uncertainty to our

business, however all our staff are working remotely, enabling the

business to remain fully operational. Our responsibility is to all

stakeholders in these difficult times and we are committed to

providing the best support we can to protect staff, contractors and

clients.

The coming months will be challenging for our business, but our

people have been fantastic in the way they have reacted to the

evolving needs of our clients and contractors.

Operational and Financial Review

-- Strategic decision to move away from lower margin recruitment work

-- Transformation impacts profits during the year; but

encouraging wins including first Consultancy retainer

-- Swings from net debt to net cash, bolstered by exceptional cash collections in December 2019

2019 2018

GBP000's GBP000's

------------------------------- ---------- ----------

Key Financials

Revenue 80,409 86,112

Adjusted profit before tax(1) 115 853

Net cash/(debt) 899 (1,090)

------------------------------- ---------- ----------

1 Adjusted profit before tax is defined as profit before tax and non-recurring items

As indicated in last year's Annual Report and Accounts, Group

revenues were impacted during the year by the non-renewal of a

large framework agreement with the Scottish Government for the

supply of temporary workers. Revenues derived from the framework

are subject to a gradual run down over a two year period which

commenced in March 2019. During the year the Group embarked upon a

transformation programme to move away from a dependence on low

margin recruitment work, which has also impacted revenues.

Adjusted profit before tax fell to GBP0.1m from GBP0.9m as a

result of lower contract recruitment revenues and also due to 2018

including revenues from the MoD MCOCS consultancy project. The

Group has taken action on overheads during the year, primarily

people costs, achieving an annualised net cost out of GBP2.0m. The

majority of the cost actions were taken in Q2 2019 and Q3 2019 with

only a partial impact to the 2019 results.

Non-recurring items relate to restructuring costs incurred as

part of the transformation in relation to the new strategy, and

totalled GBP1.2m before tax. Loss before tax after deducting

non-recurring items was GBP1.1m (2018: profit before tax of

GBP0.4m). Net cash generated from operations was GBP3.4m reflecting

exceptional collections in December 2019, and swinging the Group

into a cash positive position of GBP0.9m at year end (2018 year

end: net debt of GBP1.1m).

Segmental performance

2019 2018 Incr./(Decr.)

GBP000's GBP000's %

----------------------------- ---------- ---------- --------------

Revenue

Recruitment 73,548 77,616 (5.2%)

Consultancy 6,861 8,496 (19.2%)

Group revenue 80,409 86,112 (6.6%)

----------------------------- ---------- ---------- --------------

External contribution

Recruitment 6,755 7,681 (12.1%)

Consultancy 1,347 1,996 (32.5%)

----------------------------- ---------- ---------- --------------

Total external contribution 8,102 9,677 (16.3%)

----------------------------- ---------- ---------- --------------

Reconciliation of external contribution to operating profit

2019 2018

GBP'000 GBP'000

--------------------------------------- --------------- ---------------

External contribution 8,102 9,677

Selling & administrative expenses (6,687) (8,136)

Share-based payment charges (162) (129)

Depreciation and amortisation (806) (194)

Operating profit before non-recurring

items 447 1,218

Non-recurring items (1,172) (495)

Operating (loss)/profit (725) 723

--------------------------------------- --------------- ---------------

External contribution is reconciled to the income statement as

part of segmental information presented in note 2.

Recruitment

The decline in year on year revenues was primarily driven by the

loss of the Scottish Government framework for the supply of

contract workers. Following the announcement of the decision in

March 2019, the number of contractors on billing through the

framework was subject to gradual run down over a two year period

ending 2021. As a consequence, the total average number of

contractors for the Group during the year was 871 (2018: 972) with

the closing volume of contractors at 31 December being 648 (31

December 2018: 995).

The loss of the Scottish Government framework reflects margin

challenges in the commoditised UK recruitment market. The Group

sought to address this issue in two ways. Firstly, by focussing on

offering greater value to our clients, with solutions to their

specific data challenges, and thereby attracting higher margins.

Secondly, management took action to right-size its operations, with

particular focus on costs associated with delivery to the Scottish

Government framework.

During the year the Group also made the commercial decision to

discontinue two small teams of permanent candidate recruiters. The

Group continued to supply contract recruitment through several

established frameworks in the public sector and to its clients such

as Primark in the private sector.

Consultancy

Whilst financial results were down year on year, the 2018

financial year benefitted from 8 months' work at the MOD, on the

relatively higher margin MCOCS project. During the year, the Group

continued consultancy delivery to both the Department of Education

and BAT, with contract renewals at both clients extending into

2020.

The Group appointed Antonio Acuna as Head of the Consulting

Practice during the year to help accelerate the data strategy.

Under Antonio's leadership the Group won higher margin data

consultancy work with large organisations in both the public and

private sectors. The revenues from the new work tend to be

accretive, providing optimism for the longer term, with one large

client in the private sector signing up to a retainer fee during

the year.

Selling and Administrative Costs

During the year, the Group took action to right size the Group

in relation to the new strategy, and following the loss of the

Scottish Government Framework. As a result, the Group achieved an

annualised net cost out of GBP2.0m. The savings were predominately

in relation to people costs with a 44% reduction in headcount over

the course of the year.

Depreciation and Amortisation

In accordance with IFRS 16, the 2019 results are presented with

lease assets and liabilities recognised in the Group's Statement of

Financial Position, where the Group is the lessee. Consequently,

depreciation and amortisation include GBP0.7m of expenses that were

classified as operating expenses in 2018.

Non-recurring items

Non-recurring items of GBP1.2m (2018: GBP0.5m) before tax were

incurred during the year, primarily as a result of restructuring

the Group, following the appointment of a new CEO, and a change in

strategy, and are analysed in note 5.

Taxation

The tax charge on profit before tax was GBP0.03m (2018: tax

credit of GBP0.06m) mainly representing a deferred tax adjustment

in respect of prior periods. The Group did not provide for

corporation tax payable in 2019 due to the utilisation of Group

relief and the availability of carried forward deductible timing

differences and tax losses.

Discontinued operations

There were no discontinued operations during the year. In 2018

the Group disposed of the non-core Inition subsidiary in April 2018

for consideration of GBP0.2m and recorded a loss on disposal of

GBP0.3m.

Earnings per share and dividend

The basic loss per share from continuing operations was 1.05

pence (2018: earnings of 0.41 pence per share). The Group's results

were impacted by significant restructuring costs.

The Board does not propose a dividend for 2019 (2018: nil) but

will keep the position under review.

Statement of Financial Position

Trade and other receivables

Trade and other receivables decreased significantly during the

year to GBP6.7m (2018: GBP12.0m). This is mainly due to the

exceptional level of cash collections experienced in December 2019

with Group debtor days, calculated on billings on a countback

basis, at an all-time low of 12 days (2018: 18 days). We benefitted

from a number of clients paying ahead of terms before the financial

year end and therefore do not expect debtor days to hold at these

unprecedented levels. To a lesser extent, the decrease was also due

to the fall in the contractor volumes over the year and the

associated release of working capital.

Trade and other payables

Trade and other payables decreased during the year to GBP6.0m

(2018: GBP8.3m) mainly as a result in the reduction in contractor

volumes. At the year end, creditor days were 24 days (2018: 28

days).

Loans and borrowings

Loans and borrowings represent the Group's debt under the

asset-based lending facility. This is a working capital facility

and is consequently linked to the same cycle as the trade

receivables. The asset-based lending facility with PNC Business

Credit ("PNC"), a leading secured finance lender, has been in place

since 2010 and was renewed in May 2019 on improved terms. Following

the renewal, the facility allows for borrowing of up to GBP10m

depending on the availability of appropriate assets as security,

with borrowings at a discount rate of 2.0% above base (previously

2.35% above base). The current facility is subject to a minimum

period of two years after which the facility becomes evergreen.

Cash flow and net debt

The Group generated positive net cash flows from operating

activities of GBP3.4m (2018: GBP0.6m), driven by the positive

working capital swing (see paragraph headed "Trade and Other

Receivables" above) with a reduction in debtor days to 12 (2018: 18

days). The GBP3.4m cash generated was after outflows of GBP0.7m in

respect of non-recurring items.

As a result of the positive cash flow, the Group swung to a net

cash positive position of GBP0.9m (2018: net debt of GBP1.1m).

Defined Benefit Pension Deficit

At the year end the deficit had improved to GBP0.9m (2018:

GBP1.9m). Whilst the scheme liabilities increased during the year

as a result of lower long term bond rates, the scheme investments

increased by a greater amount, reflecting stronger global equity

markets.

During the year the triennial actuarial review as at 5 April

2018 was completed. The outcome of the review was such that the

Group agreed to pay contributions of GBP0.3m per annum for five

years, with contributions being assessed at the next actuarial

review, scheduled as at 5 April 2020.

Consolidated Income Statement for the year ended 31 December

2019

Non-recurring Non-recurring

items items

Before (note Before (note

non- 5) non- 5)

recurring 2019 recurring 2018

items GBP'000 Total items GBP'000 Total

Notes 2019 2019 2018 2018

GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------------ -------------- ----------- ------------ -------------- -----------

Continuing

operations

Revenue 3 80,409 - 80,409 86,112 - 86,112

Employee benefit

costs 4 (4,876) (867) (5,743) (5,976) (299) (6,275)

Depreciation,

amortisation

and impairment 4 (806) (142) (948) (194) - (194)

All other

operating

expenses 4 (74,280) (163) (74,443) (78,724) (196) (78,920)

----------------- ----- ------------ -------------- ----------- ------------ -------------- -----------

Total operating

expenses (79,962) (1,172) (81,134) (84,894) (495) (85,389)

----------------- ----- ------------ -------------- ----------- ------------ -------------- -----------

Operating

profit/(loss) 447 (1,172) (725) 1,218 (495) 723

Finance costs 7 (332) - (332) (365) - (365)

----------------- ----- ------------ -------------- ----------- ------------ -------------- -----------

Profit/(loss)

before

tax 115 (1,172) (1,057) 853 (495) 358

Tax

(charge)/credit 9 (149) 124 (25) (16) 79 63

----------------- ----- ------------ -------------- ----------- ------------ -------------- -----------

(Loss)/profit

for

the year from

continuing

operations (34) (1,048) (1,082) 837 (416) 421

----------------- ----- ------------ -------------- ----------- ------------ -------------- -----------

Discontinued

operations

Loss from

discontinued

operations

after

tax 8 - - - (381) - (381)

----------------- ----- ------------ -------------- ----------- ------------ -------------- -----------

(Loss)/profit

for

the year

attributable

to owners of

the

parent (34) (1,048) (1,082) 456 (416) 40

----------------- ----- ------------ -------------- ----------- ------------ -------------- -----------

(Loss)/earnings per share - Continuing operations

Basic 10 (1.05p) 0.41p

Diluted 10 (1.05p) 0.41p

(Loss)/earnings per share - Continuing and discontinued

operations

Basic 10 (1.05p) 0.04p

Diluted 10 (1.05p) 0.04p

----------------- ----- ------------ -------------- ----------- ------------ -------------- -----------

Consolidated Statement of Comprehensive Income for the year

ended 31 December 2019

2019 2018

Notes GBP'000 GBP'000

------------------------------------------------------- -------- --------- ---------

(Loss)/profit for the year (1,082) 40

Other comprehensive income

Items that may be reclassified to profit or

loss

Exchange differences on translation of foreign

operations - (3)

Items that will never be reclassified to profit

or loss

Remeasurement of defined benefit pension scheme 931 (1,005)

Deferred taxation on remeasurement of defined

pension scheme 12 (158) 171

Other comprehensive income/(expense) for the

year after tax 773 (837)

------------------------------------------------------- -------- --------- ---------

Total comprehensive expense for the year attributable

to owners of the parent (309) (797)

------------------------------------------------------- -------- --------- ---------

Consolidated Statement of Changes in Equity for the year ended

31 December 2019

Share Capital

Share premium redemption Other Retained

capital reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- ---------- ------------ ---------- ---------- ---------

At 31 December 2018 2,053 33,244 14,319 34,560 (77,612) 6,564

Adoption of IFRS 16 (note

1) - - - - 6 6

---------------------------- --------- ---------- ------------ ---------- ---------- ---------

Revised at 1 January

2019 2,053 33,244 14,319 34,560 (77,606) 6,570

---------------------------- --------- ---------- ------------ ---------- ---------- ---------

Share options - value

of employee services - - - - 162 162

---------------------------- --------- ---------- ------------ ---------- ---------- ---------

Transactions with owners - - - - 162 162

---------------------------- --------- ---------- ------------ ---------- ---------- ---------

Loss for the year - - - - (1,082) (1,082)

Remeasurement of defined

benefit pension scheme - - - - 931 931

Deferred taxation on

remeasurement of defined

pension scheme taken

directly to equity - - - - (158) (158)

At 31 December 2019 2,053 33,244 14,319 34,560 (77,753) 6,423

---------------------------- --------- ---------- ------------ ---------- ---------- ---------

Share Capital

Share premium redemption Other Retained

capital reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- ---------- ------------ ---------- ---------- ---------

At 1 January 2018 2,043 33,211 14,319 44,160 (86,544) 7,189

---------------------------- --------- ---------- ------------ ---------- ---------- ---------

Issue of new ordinary

shares 10 33 - - - 43

Share options - value

of employee services - - - - 129 129

Transactions with owners 10 33 - - 129 172

---------------------------- --------- ---------- ------------ ---------- ---------- ---------

Profit for the year - - - - 40 40

Exchange differences

on translation of foreign

operations - - - - (3) (3)

Remeasurement of defined

benefit pension scheme - - - - (1,005) (1,005)

Deferred taxation on

remeasurement of defined

pension scheme taken

directly to equity - - - - 171 171

Reallocation of impairment

charge - - - (9,600) 9,600 -

At 31 December 2018 2,053 33,244 14,319 34,560 (77,612) 6,564

---------------------------- --------- ---------- ------------ ---------- ---------- ---------

Consolidated Statement of Financial Position as at 31 December

2019

2019 2018

Notes GBP'000 GBP'000

------------------------------- -------- --------- ---------

Assets

Non-current assets

Goodwill 11 4,594 4,594

Other intangible assets 32 86

Property, plant and equipment 43 69

Right-of-use assets 395 -

Deferred tax assets 12 970 1,153

Total non-current assets 6,034 5,902

------------------------------- -------- --------- ---------

Current assets

Trade and other receivables 6,739 12,018

Cash and cash equivalents 4,116 5,829

Total current assets 10,855 17,847

------------------------------- -------- --------- ---------

Total assets 16,889 23,749

------------------------------- -------- --------- ---------

Liabilities

Current liabilities

Loans and borrowings (2,719) (6,919)

Lease liabilities (325) -

Trade and other payables (6,012) (8,261)

Provisions (324) (43)

Total current liabilities (9,380) (15,223)

------------------------------- -------- --------- ---------

Non-current liabilities

Lease liabilities (173) -

Provisions (21) (20)

Retirement benefit liability (892) (1,942)

Total non-current liabilities (1,086) (1,962)

------------------------------- -------- ---------

Total liabilities (10,466) (17,185)

------------------------------- -------- --------- ---------

Net assets 6,423 6,564

------------------------------- -------- --------- ---------

Shareholders' equity

Called up share capital 2,053 2,053

Share premium reserve 33,244 33,244

Capital redemption reserve 14,319 14,319

Other reserves 34,560 34,560

Retained earnings (77,753) (77,612)

------------------------------- -------- ---------

Total shareholders' equity 6,423 6,564

------------------------------- -------- --------- ---------

Consolidated Statement of Cash Flows for the year ended 31

December 2019

2019 2018

Notes GBP'000 GBP'000

----------------------------------------------- ------ ---------- ---------

Operating activities

(Loss)/profit for the year (1,082) 40

Adjustments for:

Net finance expense 7 332 365

Share-based payment expense 162 129

Income tax charge/(credit) 9 25 (236)

Amortisation of intangible assets 52 165

Depreciation of property, plant and equipment 56 53

Depreciation and impairment of right-of-use 840 -

assets

Loss on write down of assets 16 -

Loss on disposal of subsidiary - 306

401 822

Working capital movements

Decrease in trade and other receivables 5,233 204

(Decrease)/increase in trade and other

payables (2,249) (141)

Increase in provisions 282 45

Payments to retirement benefit plan (249) (326)

----------------------------------------------- ------ ---------- ---------

Net cash flows from/(used in) operating

activities 3,418 604

----------------------------------------------- ------ ---------- ---------

Investing activities

Purchase of intangible assets - (14)

Purchase of property, plant and equipment (44) (35)

Net proceeds from disposal of subsidiary - 114

----------------------------------------------- ------ ---------- ---------

Net cash flows (used in)/from investing

activities (44) 65

----------------------------------------------- ------ ---------- ---------

Financing activities

Issue of ordinary shares - 43

(Repayment)/drawdown of finance facility (4,192) 330

Principal repayment of lease liabilities (764) -

Interest paid 7 (131) (181)

----------------------------------------------- ------ ---------- ---------

Net cash flows (used in)/from financing

activities (5,087) 192

----------------------------------------------- ------ ---------- ---------

Net (decrease)/increase in cash and cash

equivalents (1,713) 861

----------------------------------------------- ------ ---------- ---------

Cash and cash equivalents at the beginning

of the year 5,829 4,968

----------------------------------------------- ------ ---------- ---------

Cash and cash equivalents at the end of

the year 4,116 5,829

----------------------------------------------- ------ ---------- ---------

Notes to the audited preliminary results

1 Accounting policies

Basis of preparation

Parity Group plc (the "Company") is a company incorporated and

domiciled in the UK.

The financial information set out in these audited preliminary

results constitutes the Group's audited consolidated accounts for

2019 and 2018. The notes in these audited preliminary results have

been extracted from the Group's audited consolidated accounts for

the year ended 31 December 2019.

The financial information set out in these audited preliminary

results has been prepared in accordance with International

Financial Reporting Standards as adopted by the EU ("Adopted

IFRSs"). The policies have been consistently applied to all the

years presented unless otherwise stated.

The financial statements have been prepared on a going concern

basis. The Directors have reviewed the Group's cash flow forecasts

for the period to 31 December 2021, taking account of reasonably

possible changes in trading performance, including potential

downsides from the impact of Covid-19. Downside sensitivities have

included reduced levels of new business, lower contractor

extensions and reduced contractor utilisation in the event that

some contractors are unable to work or have their contracts

terminated. In these scenarios, the Directors do not anticipate

issues with the Group's financing requirements. The Group is

currently well capitalised with its financing facility providing a

comfortable level of headroom. Measures have already been taken to

protect the Group from a downturn in revenues and there are further

mitigating actions which would be taken if required. Nevertheless,

the Directors acknowledge the significant uncertainty caused by the

Covid-19 pandemic and are closely monitoring the outlook for the

Group. The Directors cannot be certain as to the severity and

duration of these impacts and therefore there is a material

uncertainty which may cast significant doubt on the Group's and

parent company's going concern.

IFRS 16 'Leases'

The Group adopted IFRS 16 from 1 January 2019, replacing IAS 17

'Leases' and related interpretations. This represents a change in

accounting for lease arrangements in which the Group acts as lessee

whereby operating leases previously treated solely through profit

and loss are to be recorded in the statement of financial position

in the form of a right-of-use asset and a lease liability, subject

to exemptions for low-value leases. The nature of the costs changes

from operating expenses to predominantly depreciation with an

interest expense on the lease liability. The Group has been mainly

impacted by IFRS 16 on its leases for office premises.

In accordance with the transition provisions of IFRS 16,

comparative information has not been restated, with the cumulative

effect of initially applying the standard recognised as an

adjustment to opening retained earnings at 1 January 2019. Lease

liabilities previously assessed as operating leases have been

measured on 1 January 2019 at the present value of the remaining

lease payments, discounted using the Group's incremental borrowing

rate at that date of 3.10%. Associated right-of-use assets have

been measured at amounts equal to the lease liabilities, adjusted

for any prepaid or accrued lease payments.

The Group has applied practical expedients permitted by IFRS 16

as follows:

-- Relying on previous assessments on whether leases are onerous

as an alternative to performing an impairment review. There were no

onerous leases at 1 January 2019

-- Excluding initial direct costs from the measurement of

right-of-use assets at the date of initial application

Application resulted in the recognition of total lease

liabilities of GBP1,057,000 and right-of-use assets of

GBP1,063,000, resulting in an increase to retained earnings of

GBP6,000.

2 Segmental information

Factors that management used to identify the Group's reporting

segments

In accordance with IFRS 8 'Operating Segments' the Group's

management structure, and the reporting of financial information to

the Chief Operating Decision Maker (the Group Board), have been

used as the basis to define reporting segments.

Description of the types of services from which each reportable

segment derives its revenues

During the period, the Group initiated a strategic

reorganisation such that reporting of financial information to the

Chief Operating Decision Maker (the Group Board) by operating

segments changed. In 2019 the Group derived revenue from two

operating segments, being Recruitment (previously Parity

Professionals) and Consultancy (previously Parity Consultancy

Services). These service lines are supported by a single sales,

marketing and back office function. Accordingly, internal overheads

are not allocated to service lines. In accordance with IFRS 8

'Operating Segments', segmental information from prior periods has

been restated.

The Group's operating segments are defined as follows:

-- Recruitment - targeted recruitment of temporary and permanent

professionals to support IT and business change programmes.

Recruitment provides 91% (2018: 90%) of the continuing Group's

revenues.

-- Consultancy - business and IT consultancy services focusing

on the provision of data solutions and delivery of IT projects.

Consultancy provides 9% (2018: 10%) of the continuing Group's

revenues.

The internal financial information prepared for the Group Board

includes external contribution at a segmental level, and the Group

Board allocates resources on the basis of this information.

Segment external contribution, defined as gross revenue less

contractor and sub-contracted direct costs, profit before tax, and

assets and liabilities are internally reported at a Group

level.

Selling and administrative expenses include sales and delivery

costs plus central costs and salaries of Directors and support

staff. These are not allocated to reporting segments for internal

reporting purposes.

Measurement of operating segment contribution

The accounting policies of the operating segments are the same

as those described in the summary of significant accounting

policies.

The Group evaluates performance on the basis of results before

tax and non-recurring items, such as restructuring costs.

Inter-segment sales are priced on the same basis as sales to

external customers, with a discount applied to encourage the use of

Group resources at a rate acceptable to the tax authorities.

Inter-segment revenue in the year is a result of Recruitment

selling IT recruitment services to Consultancy. These amounts are

eliminated in the segmental reporting below.

Recruitment Consultancy Total

2019 2019 2019

GBP'000 GBP'000 GBP'000

Gross revenue from external customers 73,548 6,861 80,409

Contractor costs (66,793) - (66,793)

--------------------------------------- -------------- -------------- ---------

Net revenue 6,755 6,861 13,616

Sub-contracted direct costs - (5,514) (5,514)

--------------------------------------- -------------- -------------- ---------

External contribution 6,755 1,347 8,102

--------------------------------------- -------------- -------------- ---------

Selling and administrative expenses (6,687)

Depreciation and amortisation (806)

Share-based payment (162)

Operating profit before non-recurring

items 447

Finance costs (332)

--------------------------------------- -------------- -------------- ---------

Adjusted profit before tax 115

Non-recurring items (1,172)

--------------------------------------- -------------- -------------- ---------

Loss before tax (1,057)

--------------------------------------- -------------- -------------- ---------

Recruitment Consultancy Total

2018 2018 2018

(Restated) (Restated) (Restated)

Continuing operations GBP'000 GBP'000 GBP'000

Gross revenue from external customers 77,616 8,496 86,112

Contractor costs (69,935) - (69,935)

--------------------------------------- ------------ ------------ ------------

Net revenue 7,681 8,496 16,177

Sub-contracted direct costs - (6,500) (6,500)

--------------------------------------- ------------ ------------ ------------

External contribution 7,681 1,996 9,677

--------------------------------------- ------------ ------------ ------------

Selling and administrative expenses (8,136)

Depreciation and amortisation (194)

Share-based payment (129)

Operating profit before non-recurring

items 1,218

Finance costs (365)

--------------------------------------- ------------ ------------ ------------

Adjusted profit before tax 853

Non-recurring items (495)

--------------------------------------- ------------ ------------ ------------

Profit before tax 358

--------------------------------------- ------------ ------------ ------------

All segment assets and liabilities are based in the UK.

3 Revenue

All of the Group's revenue derives from contracts with

customers. Trade receivables, amounts recoverable on contracts and

accrued income arise from contracts with customers. Changes to the

Group's contract assets are attributable solely to the satisfaction

of performance obligations.

The Group's revenue from external customers disaggregated by

pattern of revenue recognition is as follows:

Recruitment Consultancy Recruitment Consultancy

2019 2019 2018 2018

Continuing operations GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ------------ ------------ ------------ ------------

Services transferred over

time 73,162 6,861 76,978 8,496

Services transferred at a

point in time 386 - 638 -

--------------------------------- ------------ ------------ ------------ ------------

Revenue from external customers 73,548 6,861 77,616 8,496

--------------------------------- ------------ ------------ ------------ ------------

The Group's revenue from external customers disaggregated by

primary geographical market is as follows:

Recruitment Consultancy Recruitment Consultancy

2019 2019 2018 2018

Continuing operations GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ------------ ------------ ------------ ------------

UK 71,143 6,861 76,033 8,496

Rest of EU 2,405 - 1,583 -

--------------------------------- ------------ ------------ ------------ ------------

Revenue from external customers 73,548 6,861 77,616 8,496

--------------------------------- ------------ ------------ ------------ ------------

72% (2018: 72%) or GBP53.2m (2018: GBP56.0m) of Recruitment

revenue from external customers was generated in the public sector.

80% (2018: 83%) or GBP5.5m (2018: GBP7.0m) of Consultancy revenue

was generated in the public sector.

The largest single customer in Recruitment contributed revenue

of 19% or GBP14.6m and was in the public sector (2018: 14% or

GBP11.7m and in the public sector). The largest single customer in

Consultancy contributed revenue of 70% or GBP4.8m and was in the

public sector (2018: 64% or GBP5.4m and in the public sector).

4 Operating expenses

2019 2018

Continuing operations GBP'000 GBP'000

------------------------------------------------------------------------- ---- ---- --------- ---------

Employee benefit costs

- wages and salaries 5,008 5,478

- social security costs 576 623

- other pension costs 159 174

------------------------------------------------------------------------------------- --------- ---------

5,743 6,275

----------------------------------------------------------------------------------- --------- ---------

Depreciation, amortisation and impairment

Amortisation of intangible assets

- software 52 155

Depreciation of leased property,

plant and equipment 7 11

Depreciation of owned property,

plant and equipment 49 28

Depreciation of right-of-use assets 698 -

Impairment of right-of-use assets 142 -

------------------------------------------------------------------------------------- --------- ---------

948 194

----------------------------------------------------------------------------------- --------- ---------

All other operating expenses

Contractor costs 72,031 76,067

Sub-contracted direct costs 271 363

Operating lease rentals - plant

and machinery - 8

- land and buildings - 661

Other occupancy costs 170 156

IT costs 317 326

Net exchange loss/(gain) 13 (6)

Equity settled share-based payment

charge 162 129

Other operating costs 1,479 1,216

------------------------------------------------------------------------------------- --------- ---------

74,443 78,920

----------------------------------------------------------------------------------- --------- ---------

Total operating expenses 81,134 85,389

------------------------------------------------------------------------------------- --------- ---------

During the year the Group obtained the following services from

the Group's auditors:

Grant Thornton

UK LLP

2019 2018

GBP'000 GBP'000

-------------------------------------------- --------- ---------

Audit of the Group, Company and subsidiary

financial statements 65 65

Tax compliance 16 14

Other services 16 14

-------------------------------------------- --------- ---------

Total fees 81 79

-------------------------------------------- --------- ---------

All other services have been performed in the UK.

5 Non-recurring items

2019 2018

Continuing operations GBP'000 GBP'000

--------------------------------------- --------- ---------

Restructuring

* Costs related to employees 940 318

230 -

* Costs related to premises

* Other costs 68 122

Legal costs - 35

Past service cost for defined benefit

pension scheme - 20

Receipt from previously impaired (66) -

receivable

1,172 495

--------------------------------------- --------- ---------

Non-recurring items during 2019 included:

-- Costs related to the restructuring of the Group, following

its new strategic direction under a new CEO and in reaction to the

loss of a significant contract within the tightening recruitment

market. Costs include employee termination payments and fees for

professional services

-- Impairment of right-of-use assets and provisions for other

property costs following the decision to vacate two office premises

ahead of their planned lease end dates in order to secure office

space at premises more appropriate for the restructured

business

-- Receipt of a cash amount in respect of a previously impaired

receivable, related to the Inition business that was sold in

2018

Non-recurring items during 2018 included:

-- Costs related to restructuring of Parity Consultancy Services

to align to the Group's strategy of focusing on the data

consultancy market. Costs include employee termination payments,

fees for professional services and costs of changes in management

structure

-- Legal costs for professional services fees in respect of

one-off cases with no significant further related costs

anticipated

-- Past service cost for the Group's defined benefit pension

scheme in respect of GMP equalisation

The restructurings that took place in 2018 and 2019 are distinct

events. In 2018, restructuring focused solely on the realignment of

Parity Consultancy Services, however the restructuring in 2019 was

a separate and more significant Group-wide exercise, based on

following the Group's new strategic direction and the right-sizing

of the business required following the loss of a significant

contract.

6 Average staff numbers

2019 2018

Number Number

----------------------------------------- -------- --------

Continuing operations

Recruitment - United Kingdom(1) 60 86

Consultancy - United Kingdom, including

corporate office(2) 16 23

76 109

----------------------------------------- -------- --------

Discontinued operations

Consultancy(3) - 15

------------------------------------------ -------- --------

(1) Includes 18 (2018: 20) employees providing shared services

across the Group

(2) Includes 4 (2018: 4) employees of the Company

(3) 2018 average for 4 months

At 31 December 2019, the Group had 57 continuing employees

(2018: 101).

7 Finance costs

2019 2018

GBP'000 GBP'000

--------------------------------------- --------- ---------

Finance costs

Interest expense on financial

liabilities 131 181

Interest expense on lease liabilities 24 -

Net finance costs in respect

of post-retirement benefits 177 184

----------------------------------------- --------- ---------

332 365

--------------------------------------- --------- ---------

The interest expense on financial liabilities represents

interest paid on the Group's asset-based financing facilities. A 1%

increase in the base rate would have increased annual borrowing

costs by approximately GBP26,000 (2018: GBP37,000).

8 Discontinued operations

In April 2018 the Group sold Inition Limited following the

strategic decision made to place greater focus on the Group's core

business. As such, Inition Limited's operating result for the

comparative year, including the loss on disposal and the impairment

of goodwill associated with the Inition cash generating unit, is

presented as discontinued.

9 Taxation

2019 2018

GBP'000 GBP'000

------------------------------------------ ---- ---- --------- ---------

Current tax

Current tax on profit for the year - -

Total current tax expense - -

------------------------------------------ ---- ---- --------- ---------

Deferred tax

Accelerated capital allowances (12) 15

Origination and reversal of other

temporary differences (20) 72

Adjustments in respect of prior periods 57 (150)

------------------------------------------------------ --------- ---------

Total deferred tax charge/(credit) 25 (63)

------------------------------------------------------ --------- ---------

Tax charge/(credit) on continuing

operations 25 (63)

------------------------------------------------------ --------- ---------

The tax credit on continuing operations in 2018 excludes the tax

credit from discontinued operations of GBP173,000, comprising a

current tax credit of GBP173,000 and a deferred tax expense of

GBPnil. This has been included in loss from discontinued operations

after tax.

The adjustment in respect of prior periods of GBP57,000 (2018:

credit of GBP150,000) largely relates to decisions to claim or

disclaim capital allowances.

There is no current tax payable by the Group for 2019 (2018:

GBPnil).

The Group's profits for this accounting period are subject to

tax at a rate of 19% (2018: 19%). A reduction to 17% effective 1

April 2020 was substantively enacted on 15 September 2016. As such,

the tax rate of 17% (2018: 17%) has been applied in calculating the

UK deferred tax position of the Group.

The reasons for the difference between the actual tax credit for

the year and the standard rate of corporation tax in the UK applied

to profit for the year are as follows:

2019 2018

GBP'000 GBP'000

(Loss)/profit before tax from continuing

operations (1,057) 358

---------------------------------------------------------- -------- -------

Expected tax (credit)/charge based on the

standard rate of UK

corporation tax of 19% (2018: 19%) (201) 68

Expenses not allowable for tax purposes 69 29

Adjustments in respect of prior periods 57 (150)

Tax losses not recognised 91 -

Other 9 (10)

---------------------------------------------------------- -------- -------

Tax charge/(credit) on continuing operations 25 (63)

---------------------------------------------------------- -------- -------

Tax on each component of other comprehensive income is as

follows:

2019 2018

Before After Before After

tax Tax tax tax Tax tax

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- --------- ---------- --------- --------- ---------- ---------

Exchange differences on translation

of foreign operations - - - (3) - (3)

Remeasurement of defined benefit

pension scheme 931 (158) 773 (1,005) 171 (834)

------------------------------------- --------- ---------- --------- --------- ---------- ---------

931 (158) 773 (1,008) 171 (837)

------------------------------------- --------- ---------- --------- --------- ---------- ---------

10 Earnings per ordinary share

Basic earnings per share is calculated by dividing the basic

earnings for the year by the weighted average number of fully paid

ordinary shares in issue during the year.

Diluted earnings per share is calculated on the same basis as

the basic earnings per share with a further adjustment to the

weighted average number of fully paid ordinary shares to reflect

the effect of all dilutive potential ordinary shares.

Weighted Weighted

average average

number number Earnings/

of Loss of (loss)

Loss Earnings/

shares per share (loss) shares per share

2019 2019 2019 2018 2018 2018

GBP'000 '000 Pence GBP'000 '000 Pence

---------------------------- ---------- --------- ------------ ----------- --------- ------------

Continuing operations

Basic (1,082) 102,624 (1.05) 421 102,464 0.41

Effect of dilutive options - - - - 1,126 -

Diluted (1,082) 102,624 (1.05) 421 103,590 0.41

Discontinued operations

Basic - - - (381) 102,464 (0.37)

Effect of dilutive options - - - - - -

Diluted - - - (381) 102,464 (0.37)

Continuing and discontinued

operations

Basic (1,082) 102,624 (1.05) 40 102,464 0.04

Effect of dilutive options - - - - 1,126 -

Diluted (1,082) 102,624 (1.05) 40 103,590 0.04

---------------------------- ---------- --------- ------------ ----------- --------- ------------

As at 31 December 2019 the number of ordinary shares in issue

was 102,624,020 (2018: 102,624,020).

11 Goodwill

The carrying amount of goodwill is allocated to the Group's two

separate continuing cash generating units (CGUs), being Recruitment

and Consultancy.

Carrying amounts are as follows:

Recruitment Consultancy Total

GBP'000 GBP'000 GBP'000

------------------------------- ------------ ------------ ---------

Carrying value

Balance at 1 January 2018 and

31 December 2018 2,642 1,952 4,594

------------------------------- ------------ ------------ ---------

Balance at 1 January 2019 and

31 December 2019 2,642 1,952 4,594

------------------------------- ------------ ------------ ---------

Goodwill was tested for impairment in accordance with IAS 36 at

the year end and no impairment charge was recognised. Impairment

calculations include the effect of changes following the

application of IFRS 16.

The recoverable amounts of the CGUs are based on value in use

calculations using the pre-tax cash flows based on budgets approved

by management for 2020. Years from 2021 to 2023 are based on the

budget for 2020 projected forward at expected growth rates. Years

from 2024 onward assume no further growth. This approach is

considered prudent based on current expectations of the 2020

long-term growth rate.

Major assumptions are as follows:

Recruitment Consultancy

% %

2019

Discount rate 13.0 12.5

Forecast revenue growth (years 1

to 4) 2.0 10.0

Operating margin 2020 2.4 8.5

Operating margin 2021 onward 2.5-2.8 8.9-9.9

2018

Discount rate 13.0 11.5

Forecast revenue growth (years 1

to 4) 2.0 10.0

Operating margin 2019 1.9 6.1

Operating margin 2020 onward 2.0-2.3 7.8-10.5

Discount rates are based on the Group's weighted average cost of

capital adjusted for the specific risks of each cash generating

unit.

Forecast revenue growth is expressed as the compound growth rate

over the next 4 years from 2020 to 2023. Growth for the Recruitment

CGU is based upon the long-term growth rate for the UK economy.

Growth for the Consultancy CGU is assumed to be higher than the

long-term growth rate due to the following factors:

-- The CGU is the focal point of the Group's strategy and growth plans;

-- The CGU is relatively small so higher rates of growth are achievable from a smaller base;

-- The business has invested in new senior hires and new

marketing and branding to focus on consultancy opportunities;

and

-- New client wins in 2019 and contract extensions help to underwrite the growth forecasts.

For all CGUs the rates are based on past experience of growth in

revenues and future expectations of economic conditions. Operating

margins are based on past experience.

A 10% change in any of the underlying assumptions used in the

discounted cash flow forecasts would not lead to the carrying value

of goodwill being in excess of their recoverable amounts.

12 Deferred taxation

2019 2018

GBP'000 GBP'000

------------------------------------------------- -------- --------

At 1 January 1,153 919

Recognised in other comprehensive income

Remeasurement of defined benefit pension scheme (158) 171

Recognised in the income statement

Adjustments in relation to prior periods (57) 150

Capital allowances in excess of depreciation 12 (15)

Other short-term timing differences 20 (72)

At 31 December 970 1,153

------------------------------------------------- -------- --------

The deferred tax asset of GBP970,000 (2018: GBP1,153,000)

comprises:

2019 2018

GBP'000 GBP'000

---------------------------------------------- --------- ---------

Depreciation in excess of capital allowances 775 820

Other short-term timing differences 43 3

Retirement benefit liability 152 330

---------------------------------------------- --------- ---------

970 1,153

---------------------------------------------- --------- ---------

A deferred tax asset for deductible temporary differences is not

recognised unless it is more likely than not that there will be

taxable profits in the foreseeable future against which the

deferred tax asset can be utilised. At the balance sheet date, the

Directors assessed the probability of future taxable profits being

available against which Parity Consultancy Services Limited could

recognise a deferred tax asset for previously unrecognised

deductible temporary differences. The review concluded that it is

probable that future taxable profits will be available. As such,

the Directors have recognised a deferred tax asset for all

deductible temporary differences available to Parity Consultancy

Services Limited.

A deferred tax asset for unused tax losses carried forward is

normally recognised on the same basis as for deductible temporary

differences. However, the existence of the unused tax losses is

itself strong evidence that future taxable profit may not be

available. Therefore, when an entity has a history of recent

losses, the entity recognises a deferred tax asset arising from

unused tax losses only to the extent that there is convincing

evidence that sufficient taxable profit will be available against

which the unused tax losses can be utilised. At the balance sheet

date, the Directors considered recognising a deferred tax asset for

previously unrecognised unused tax losses carried forward by Parity

Consultancy Services Limited. The review concluded that given the

company's history of relatively recent tax losses and the

additional requirement of providing convincing evidence that

sufficient taxable profit will be available, a prudent approach

would be taken and deferred tax would remain unrecognised for tax

losses carried forward by the company.

The Directors believe that the deferred tax asset recognised is

recoverable based on the future earning potential of the Group and

the individual subsidiaries. The forecasts for Parity Professionals

Limited comfortably support the unwinding of the deferred tax asset

held by this company of GBP378,000 (2018: GBP404,000) and the

forecasts for Parity Consultancy Services Limited comfortably

support the unwinding of the deferred tax asset held by this

company of GBP592,000 (2018: GBP749,000).

The deferred tax assets at 31 December 2019 and 2018 have been

calculated on the rate of 17% substantively enacted at the balance

sheet date.

The movements in deferred tax assets during the period are shown

below: