TIDMWTAN

RNS Number : 6040O

Witan Investment Trust PLC

02 June 2020

Witan Investment Trust plc

2 June 2020

Witan's performance in 2020

Towards the end of 2019, investors began to factor in a 2020

revival in global cyclical prospects and, following the clear-cut

General Election outcome, an improvement in the UK market's

performance. These expectations were turned on their head by the

spreading COVID-19 epidemic in February, which caused a dramatic

fall in global equity markets. Our portfolio fell steeply in this

changed environment, so 2020 has been a disappointing time for our

shareholders, with our -17% total return to the end of May trailing

that of our benchmark (which has fallen 5%). Although our recent

investor updates and factsheets have referred to some of the

contributory causes, this report gives additional details of what

has driven this very poor performance and what we have, and have

not, done in response.

In broad terms, our 12% underperformance has been due mainly to

the underperformance of our underlying portfolio (9%), exacerbated

by being geared into a market fall (2%), with an additional 1%

being the cost of the early repayment of our 2025 6.125% Secured

Bonds.

Portfolio performance

Turning first to the portfolio, the causes of underperformance

have been various. We adopted a new and simpler benchmark from the

start of 2020, with a lower UK content (19%, down from 30%) and a

higher weighting in the US (46%, up from 25%). As a legacy from our

previous benchmark, our portfolio was heavily represented in the UK

and Europe and underrepresented in the US. In view of the reduced

political uncertainty in the UK and improving expectations for

economic growth outside the US, we decided, wrongly as it turned

out, to move only gradually to align our manager allocations to

reflect the more global structure of the new benchmark. This proved

costly, with the UK (-19% to the end of May) and Europe (-7%)

performing much worse than the US (+2%), which was boosted by its

high weighting in technology stocks, whose prospects were enhanced

by increased internet use during the COVID-19 lockdown.

Aside from this, our global managers, in the round, were

themselves underweight in the US, preferring the valuations on

offer elsewhere. Our managers had reduced their technology exposure

before 2020 on stock-specific and valuation grounds and were more

highly weighted in the stocks that had been expected to benefit

from 2020 being a better year for economic growth. These

expectations, as referred to earlier, were confounded by the

lockdown measures adopted to contain the COVID-19 epidemic.

Although technology stocks have understandably performed strongly

recently, it seems reasonable to expect a broader base of sectors

to participate in the stock market's recovery once the economies

that they depend on show clearer signs of pulling out of the recent

dive in activity.

Two of our global managers (Lansdowne and Pzena) were

particularly hard hit, having portfolios with significant cyclical

exposure. Our two UK managers (Artemis and Heronbridge) also

suffered from their exposure to domestic stocks and the poor

performance of the UK market. The portfolio of direct holdings in

investment companies was affected by specific concerns about a

minority of holdings allied to a general widening of investment

company discounts. Good relative performance by our other two

global managers (Lindsell Train and Veritas) and by GQG Partners in

Emerging markets was insufficient to offset the drag from the rest

of the portfolio, hence the lamentable overall portfolio

result.

Gearing

The reason we were geared in January, ahead of the COVID-19

crisis, was a belief that our managers had in aggregate a lowly

valued portfolio that stood to benefit from economic conditions

that (at the time) were widely expected to improve. When COVID-19

spread beyond China expectations changed dramatically, which turned

our gearing from a potential benefit to a burden on performance. We

reduced gearing from mid-February onwards but not as rapidly as,

with the benefit of hindsight, we should have. Being geared into

the rapid market fall cost us around 3% in performance, while being

geared into the subsequent market recovery has recouped 1% of

this.

We have used a lower average level of gearing since the crisis,

reflecting the less predictable economic outlook. As previously

announced, we decided to repay our 2025 6.125% Secured Bonds early,

in order to reduce interest charges and take advantage of the

greater flexibility offered by short term borrowings. The cost of

the early redemption was GBP23m (which equated to just over 1% of

our end 2019 NAV). Most of this will be recouped in the years to

2025 by the lower rates of interest (which are expected to persist)

for short-term borrowing and the ability to repay borrowings when

not used.

Our current level of gearing (7.9% at the end of May) will be

subject to adjustment according to our confidence in the economic

outlook and the value on offer in global stock markets. The

selective use of gearing has been a significant source of added

value for Witan over the years, notwithstanding occasions such as

early 2020 when it has amplified losses.

Our response

Just as it is important not to become complacent when

investments do well, one should avoid reacting to misfortune by

automatically selling what you wish you had sold earlier.

Nevertheless, after this period of unusually poor performance, the

Board has carefully examined the drivers of Witan's performance in

2020 and considered what changes arising from the COVID-19 lockdown

may be transitory and which may be permanent. A number of changes

have been made.

The manager structure has changed to reflect the more global

nature of our benchmark, with reduced use of regional managers and

a greater proportion of the portfolio in global mandates. As at the

end of May, we are still underweight in the US (with 38%) and

overweight in the UK (with 27%) but this is principally driven by

stock-specific decisions by our external managers.

We terminated the two Europe ex-UK mandates, in favour of making

greater use of unconstrained global managers able to choose between

European stocks and those in other regions. We have sold the global

systematic value portfolio managed by Pzena, with the majority of

the proceeds being held in a US equity index ETF, pending the

conclusion of a search for an additional more stylistically neutral

global manager.

The discounts of investment trusts, including our own, have been

unusually volatile in recent months. We have stepped up our level

of share buybacks, particularly during periods of wide discounts

such as March and May. This is accretive to NAV as well as

contributing to our objective of a sustained low discount or a

premium, which is in shareholders' interests.

There have been widely-publicised cuts in dividends by many

companies, including those held within Witan's portfolio. Growth in

our portfolio's income over time is a confirmation of its cash

generation and the progress made by the individual businesses,

although clearly the circumstances in 2020 are exceptional.

Although we are total return investors we recognise the importance

of income to many of our investors. Witan's revenue reserves at the

end of 2019 were equivalent to over 1.5 times the annual dividend

and the Company has announced that is prepared to draw on these

reserves if necessary in order to extend its record of 45

consecutive years of dividend rises.

Conclusion

Shareholders could be forgiven for thinking that Witan and its

managers had been afflicted with a reverse Midas touch - everything

we touch having seemingly turned to lead earlier in the year. The

impact is all the greater coming after a strong year in 2019. I

apologise to our shareholders for the poor performance experienced

so far this year. Rest assured that the Board and everyone at Witan

take the delivery of value for shareholders very seriously and this

year's setback is felt keenly, not least because we are

shareholders ourselves.

Witan's business model has delivered good returns for

shareholders in most years over the past decade and the Board is

confident that, following a poor showing during this especially

turbulent time, our managers will return to form, enhanced by the

changes made and the broader range of opportunities offered by the

benchmark adopted at the turn of the year.

Andrew Bell

Chief Executive, Witan Investment Trust plc

- ENDS -

For further information please contact:

Andrew Bell, Chief Executive

Witan Investment Trust plc

Tel: 020 7227 9770

Andrew.Bell@witan.co.uk

James Hart, Investment Director

Witan Investment Trust plc

Tel: 020 7227 9770

James.Hart@witan.co.uk

Alexis Barling, Director of Marketing

Witan Investment Trust plc

Tel: 020 7227 9770

Alexis.Barling@witan.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

STRKKDBQCBKDDAK

(END) Dow Jones Newswires

June 02, 2020 02:00 ET (06:00 GMT)

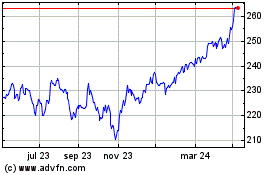

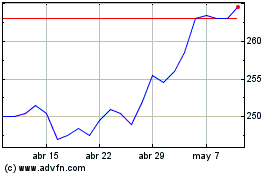

Witan Investment (LSE:WTAN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Witan Investment (LSE:WTAN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024