TIDMBOKU

RNS Number : 3006Q

Boku Inc

18 June 2020

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, SINGAPORE, THE REPUBLIC OF

SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS NOT AN OFFER OF SECURITIES FOR SALE IN THE

UNITED STATES. THE SECURITIES DISCUSSED HEREIN HAVE NOT BEEN AND

WILL NOT BE REGISTERED UNDER THE US SECURITIES ACT OF 1933, AS AMED

(THE "US SECURITIES ACT") AND MAY NOT BE OFFERED, SOLD, RESOLD,

PLEDGED, DELIVERED, DISTRIBUTED OR OTHERWISE TRANSFERRED, DIRECTLY

OR INDIRECTLY IN OR INTO THE UNITED STATES OR TO PERSONS ELSEWHERE

WHO ARE "US PERSONS" WITHIN THE MEANING OF THAT TERM AS IT IS USED

IN REGULATION S OF THE US SECURITIES ACT ("US PERSONS") except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the US Securities Act, and in

compliance with any applicable securities laws of any state or

other jurisdiction of the United States. Any securities that may be

offered outside of the United States to non-US Persons will be

subject to the conditions listed under Section 903(b)(3), or

Category 3, of Regulation S. Such securities will also be

"restricted securities" as defined in Rule 144 under the US

Securities Act. The securities have not been approved or

disapproved by the US Securities and Exchange Commission, any state

securities commission in the United States or any US regulatory

authority, nor have any of the foregoing authorities passed upon or

endorsed the merits of any proposed offering of the securities, or

the accuracy or adequacy of this DOCUMENT. Any representation to

the contrary is a criminal offence in the United States. There will

be no public offering of the securities in the United States.

Hedging transactions in securities may not be conducted unless in

compliance with the US Securities Act.

NO PUBLIC OFFERING OF THE SECURITIES DISCUSSED HEREIN IS BEING

MADE IN THE UNITED STATES AND THE INFORMATION CONTAINED HEREIN DOES

NOT CONSTITUTE AN OFFERING OF SECURITIES FOR SALE IN THE UNITED

STATES, AUSTRALIA, CANADA, JAPAN, SINGAPORE OR THE REPUBLIC OF

SOUTH AFRICA.

FURTHER, THIS ANNOUNCEMENT IS MADE FOR INFORMATION PURPOSES ONLY

AND DOES NOT CONSTITUTE AN OFFER TO SELL OR ISSUE OR SOLICITATION

TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE SECURITIES IN BOKU, INC.

IN ANY JURISDICTION IN WHICH ANY SUCH OFFER OR SOLICITATION WOULD

BE UNLAWFUL.

18 June 2020

Boku, Inc.

("Boku" or the "Company" and, together with its subsidiaries,

the "Group")

Result of unconditional Placing

Boku (AIM:BOKU), a leading global mobile payment and mobile

identity company, is pleased to announce the successful completion

of the proposed placing announced yesterday (the "Placing") in

connection with Boku's conditional agreement to acquire the entire

issued and to be issued share capital of Fortumo Holdings, Inc. and

its subsidiaries.

A total of 23,600,000 new common shares of $0.0001 each in the

capital of the Company ("Common Shares") (the "Placing Shares")

have been placed by Peel Hunt LLP (the "Sole Bookrunner") by way of

a placing at a price of 85 pence per share (the "Placing Price"),

representing a 7.1% discount to the closing price on 17 June 2020,

with new and existing investors, raising gross proceeds of GBP20.1

million ($25.2 million).

The Placing Shares will represent approximately 8.4% of the

enlarged issued share capital of the Company (immediately following

completion of the Placing).

Application has been made to the London Stock Exchange for the

Placing Shares to be admitted to trading on AIM. It is expected

that admission to AIM will become effective and that dealings on

AIM will commence in the Placing Shares at 8.00 a.m. on or around

22 June 2020.

Total Voting Rights

In accordance with Rule 5.6.1 of the Financial Conduct

Authority's Disclosure Guidance and Transparency Rules, following

the Placing, the total number of Common Shares in issue is

281,382,648. There are no shares held in treasury.

Therefore, the total number of voting rights in Boku is

281,382,648.

The above figure of 281,382,648 Common Shares may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the Disclosure

Guidance and Transparency Rules. Unless otherwise stated, defined

terms used in this announcement will have the meaning set out in

the Launch Announcement published yesterday.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 ("MAR"). Upon the

publication of this announcement, this inside information is now

considered to be in the public domain. For the purposes of MAR and

Article 2 of Commission Implementing Regulation (EU) 2016/1055,

this announcement is being made on behalf of Boku by Jon Prideaux

(Chief Executive Officer) and Keith Butcher (Chief Financial

Officer).

For further information, please contact:

Boku, Inc.

Jon Prideaux, Chief Executive Officer 020 3934

Keith Butcher, Chief Financial Officer 6630

Peel Hunt LLP (Nominated Adviser, Broker,

and Sole Bookrunner)

Corporate - Edward Knight / Nick Prowting

/ Christopher Golden 020 7418

ECM - Sohail Akbar 8900

IFC Advisory Limited (Financial PR & IR)

Tim Metcalfe / Graham Herring / Florence 020 3934

Chandler 6630

Important notices

This announcement has been prepared in accordance with English

law, the AIM Rules and the Disclosure Guidance and Transparency

Rules and information disclosed may not be the same as that which

would have been prepared in accordance with the laws of

jurisdictions outside England.

Persons (including without limitation, nominees and trustees)

who have a contractual right or other legal obligations to forward

a copy of this Announcement should seek appropriate advice before

taking any action.

This Announcement has been issued by, and is the sole

responsibility of, the Company. No representation or warranty,

express or implied, is or will be made by Peel Hunt or by any of

its affiliates or agents as to or in relation to, the accuracy or

completeness of this Announcement or any other written or oral

information made available to any interested person or its

advisers, and any liability therefore is expressly disclaimed. None

of the information in this Announcement has been independently

verified or approved by Peel Hunt or any of its partners,

directors, officers, employees, advisers, consultants or

affiliates. Save for any responsibilities or liabilities, if any,

imposed on Peel Hunt by the Financial Services and Markets Act 2000

("FSMA") or by the regulatory regime established under it, no

responsibility or liability is accepted by either Peel Hunt or any

of its partners, directors, officers, employees, advisers,

consultants or affiliates for any errors, omissions or inaccuracies

in such information or opinions or for any loss, cost or damage

suffered or incurred howsoever arising, directly or indirectly,

from any use of this Announcement or its contents or otherwise in

connection with this Announcement or from any acts or omissions of

the Company in relation to the Placing.

The distribution of this announcement in jurisdictions outside

the United Kingdom may be restricted by law and therefore persons

into whose possession this announcement comes should inform

themselves about, and observe such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities law of any such jurisdiction.

This announcement is not for release, publication, distribution,

directly or indirectly, in or into the United States (including its

territories and possessions and any state or other jurisdiction of

the United States). This announcement does not constitute or form a

part of any offer to sell or solicitation to purchase or subscribe

for securities in the United States or in any other jurisdictions.

The securities referred to in this announcement have not been, and

will not be, registered under the United States Securities Act of

1933, as amended (the "US Securities Act") and may not be offered,

sold, resold, pledged, distributed, transferred or delivered,

directly or indirectly, in or into the United States or to persons

elsewhere who are "US persons" within the meaning of that term as

it is used in Regulation S promulgated under the US Securities Act

("US Persons") except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the US

Securities Act and in compliance with any applicable securities

laws of any state or other jurisdiction of the United States. Any

securities that may be offered outside of the United States to

non-US Persons will be subject to the conditions listed under

Section 903(b)(3), or Category 3, of Regulation S. Such securities

will also be "restricted securities" as defined in Rule 144

promulgated under the US Securities Act. The securities have not

been approved or disapproved by the US Securities and Exchange

Commission, any state securities commission in the United States or

any US regulatory authority, nor have any of the foregoing

authorities passed upon or endorsed the merits of any proposed

offering of the securities, or the accuracy or adequacy of this

document. Any representation to the contrary is a criminal offence

in the United States. There will be no public offer of securities

in the United States. Hedging transactions in securities may not be

conducted unless in compliance with the US Securities Act.

Cautionary Statements

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"envisages", "plans", "anticipates", "targets", "aims",

"continues", "expects", "intends", "hopes", "may", "will", "would",

"could" or "should" or, in each case, their negative or other

variations or comparable terminology. These forward-looking

statements include matters that are not facts. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances. A number of factors

could cause actual results and developments to differ materially

from those expressed or implied by the forward-looking statements,

including, without limitation: a condition to the Placing not being

satisfied, expected cost savings not being realised, changing

demands of consumers, changing business or other market conditions,

and general economic conditions. These and other factors could

adversely affect the outcome and financial effects of the plans and

events described in this announcement. Forward-looking statements

contained in this announcement based on past trends or activities

should not be taken as a representation that such trends or

activities will continue in the future. Subject to any requirement

under the AIM Rules, the Disclosure Guidance and Transparency Rules

or other applicable legislation or regulation, Boku does not

undertake any obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. Investors should not place undue reliance on

forward-looking statements, which speak only as of the date of this

announcement.

This Announcement does not identify or suggest, or purport to

identify or suggest, the risks (direct or indirect) that may be

associated with an investment in the Placing Shares. Any investment

decisions to buy Placing Shares in the Placing must be made solely

on the basis of publicly available information, which has not been

independently verified by Peel Hunt.

The Placing Shares to be issued pursuant to the Placing will not

be admitted to trading on any stock exchange other than AIM, a

market operated by the London Stock Exchange plc.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into or forms part of this Announcement.

Peel Hunt

Peel Hunt , which is authorised and regulated in the United

Kingdom by the Financial Conduct Authority ("FCA"), is appointed as

Boku's nominated adviser and Bookrunner only and is therefore

acting only for Boku in connection with the matters described in

this announcement and is not acting for or advising any other

person, or treating any other person as its client, in relation

thereto and will not be responsible for providing the regulatory

protection afforded to clients of Peel Hunt or advice to any other

person in relation to the matters contained herein. Neither Peel

Hunt nor any of its directors, officers, employees, advisers or

agents accepts any responsibility or liability whatsoever for this

announcement, its contents or otherwise in connection with it or

any other information relating to Boku, whether written, oral or in

a visual or electronic format.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROIBDLLFBQLEBBX

(END) Dow Jones Newswires

June 18, 2020 02:00 ET (06:00 GMT)

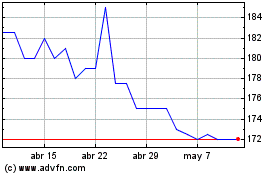

Boku (LSE:BOKU)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Boku (LSE:BOKU)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024