Paypoint plc Annual Financial Report

23 Junio 2020 - 3:01AM

UK Regulatory

TIDMPAY

PayPoint plc (the "Company")

Annual Report and Financial Statements 2020

In compliance with Listing Rule 9.6.1, the Company announces that the

following documents have today been submitted to the UK Listing

Authority, and will shortly be available for inspection via the National

Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism:

-- Annual Report and Financial Statements 2020; and

-- Notice of Annual General Meeting of the Company, which will be held at

The Boulevard, 1 Shire Park, Welwyn Garden City, AL7 1EL at 12:00 noon on

Friday 24 July

In accordance with DTR 6.3.5(3) the Annual Report and Financial

Statements 2020 and the Notice of Annual General Meeting are accessible

at

https://www.globenewswire.com/Tracker?data=J-GX2r2N9zPpzHPEbr3gOfFXC18K5IXDJovu6V5x_dHgqdAVDBuFXPkLBMjzLO_lzRb9xj16BGxdJOL3NHmgHz35sbWHg02zuoVoaV0vLe98vJHCozG2xglOuXrjF9YS

www.corporate.paypoint.com.

A condensed set of PayPoint plc's financial statements and information

on important events that have occurred during the year and their impact

on the financial statements were included in the Company's preliminary

results announcement on 28 May 2020. That information together with the

information set out below which is extracted from the Annual Report and

Financial Statements constitute the requirements of DTR 6.3.5 which is

to be communicated via an RIS in unedited full text. This announcement

is not a substitute for reading the full Annual Report and Financial

Statements. To view the preliminary results announcement, visit the

Company website www.corporate.paypoint.com

For further information, please contact:

Sarah Carne

Company Secretary

PayPoint plc

LEI: 5493004YKWI8U0GDD138

Tel: +44 (0)1707 600300

Additional Information

Principal risks and uncertainties

Below are details of our principal risks, their movement during the year,

and key mitigating controls. They do not comprise all risks faced by the

Group and are not set out in order of priority.

Risk area Potential impact Mitigation strategies Change

------------------- ----------------------------------- ---------------------------------------- ----------

Credit and PayPoint processes large PayPoint has effective credit ->

operational volumes of payments creating and operational procedures and

risk significant credit risks controls in place. Retailers

and risk of fraud and error. and counterparties are subject

Significant credit exposures to ongoing credit assessments,

exist with large retailers and effective debt management

and other counterparties, processes are implemented. Settlement

and failure of a large processes and controls are continually

retailer or counterparty assessed and enhanced, and new

may result in significant systems and technology implemented.

financial loss. Effective Effective governance is in place

operational controls are with segregation of duties and

essential to settle funds approval processes enforced to

securely and timely, and protect against fraud and error.

inadequate or failed controls

may result in fraud, liquidity

risk, contractual breaches

or other financial loss.

People and Failure to attract and The Executive Board define and ->

culture develop key talent and advocate PayPoint's values, and

continue evolving our culture employee development and culture

may impact service levels are key strategic priorities.

and delivery of strategic Talent management and people

initiatives. If we do not development are well established,

develop our employees and and employment guidelines and

maintain an appropriate ethical principles are implemented

culture our business performance to assist maintaining a strong

and reputation may be damaged culture. Values and ethical principles

resulting in reduced revenue are aligned with employee objectives

and growth. and employee and retailer engagement

surveys are regularly conducted

to assess how we deliver on our

values. PayPoint is protecting

its employees through the Covid-19

pandemic by allowing employees

to work from home and offering

additional support and flexibility.

Losing key PayPoint has diversified PayPoint builds strategic relationships ->

clients and portfolios of clients and with key clients and retailers

retailers retailers however some and continually seeks to improve

are more strategically its service levels; including

important. Our business conducting retailer engagement

relies on an appropriate surveys to monitor and enhance

mix of clients and retailers our performance. Key clients

and losing a key client and retailers are on long term

or retailer, such as losing contracts, and new clients and

British Gas as an energy retailers are routinely onboarded

client in 2019, has the maintaining and diversifying

ability to adversely impact portfolios. New products and

the business model and channels are also developed to

reduce revenue. diversify revenue streams and

mitigate the impact of losing

key clients or retailers in particular

markets.

Competition The markets in which PayPoint PayPoint closely monitors consumer

and markets operates, and the competition and technological trends and

in those markets continue engages with clients and retailers

to evolve. The decline to continually improve service

in cash usage, and changes levels. The Executive Board regularly

in consumer trends and reviews markets, trading opportunities,

Government policy may impact pricing and competitor activity,

our core markets, and failure and the Board oversee and challenge

to implement effective strategic direction. PayPoint

strategies in response invests in new products, services

to changes will negatively and technology and adapts to

impact revenue. Industry consumer trends such as growing

consolidation in the UK its parcel and online payments

has increased the competitive businesses to capitalise on market

environment, and our market changes.

proposition and service

levels need to remain strong

to maximise business performance.

Innovation Failure to innovate and PayPoint is committed to innovation ->

and implementation implement new products, and investing in new technology

services and technology and products to support its continued

would impede business performance growth. Products and services

and our ability to achieve are continually reviewed and developed

strategic goals. Our business to enhance our proposition and

relies on continued product service levels, consistent with

enhancements and failing customer needs and expectations.

to improve products due Various improvement programmes

to poor design, build or are underway and effective change

rollout would ultimately management processes are deployed

reduce revenue. Continued by dedicated project teams. The

system infrastructure improvements Executive Board oversees all major

are essential in maintaining projects to ensure governance

resilient and effective and implementation are effective.

services, and ineffective

infrastructure upgrades

may impact future performance.

Key partners PayPoint has a diverse PayPoint has effective partner

and suppliers range of suppliers and and supplier selection processes

partners, however some and long-term contacts are implemented

suppliers and partners for strategic partners and suppliers.

are more strategically We aim to develop strong relationships

important and not so easily with key partners and suppliers,

substituted. If supply and single points of failure are

of goods or services is avoided where practicable, with

disrupted or relationships alternative suppliers and partners

cease before alternative contracted and continuity plans

arrangements can be implemented, implemented. Impact assessments

PayPoint may experience are conducted for critical dependencies

difficulty maintaining and mitigation measures implemented.

service levels potentially

resulting in revenue loss,

reputational damage or

penalties. Uncertainties

around the Covid-19 pandemic

may significantly impact

PayPoint's partners and

suppliers, increasing the

trend of risk.

Business Service delivery interruption Comprehensive continuity plans

interruption caused by system failure, have been implemented to mitigate

loss of premises, or other risk of disruption from Covid-19.

disruption may impede performance Systems are continually upgraded

and harm our reputation. and resilience built into systems

Clients, retailers and and processes. Effective change

consumers rely on resilient management processes are deployed

systems and continued service minimising risk of disruption,

delivery, and failure to and systems are regularly tested

promptly recover services and continually monitored for

may result in revenue loss, outages. PayPoint has a Major

contractual breaches, penalties Incident Response Plan and business

and increased costs. Uncertainties continuity and disaster recovery

around the Covid-19 pandemic plans are implemented and regularly

and the significantly changes tested. Third party data centres

in working practices may are used with failover capabilities,

impact PayPoint's service and business continuity premises

delivery, increasing the and work from home arrangements

trend of risk. are implemented.

Legal and PayPoint is required to PayPoint's Legal team work closely ->

regulatory comply with numerous legal with management to advise on regulatory

and regulatory requirements, matters and adopt strategies to

and breaches of these obligations ensure regulatory adherence. Legal

may result in costly corrective teams are engaged on key contracts

actions, reputational damage and legal matters, and Compliance

and prosecution. Regulatory teams oversee compliance programmes,

landscapes continue to monitoring and reporting. Emerging

evolve, and changes in regulations are incorporated into

regulations and license strategic planning, and we engage

requirements may adversely with regulators to ensure we have

impact our business. PayPoint appropriate frameworks to support

is subject to numerous new products and markets. External

contractual requirements counsel is engaged where required.

and failure to meet obligations

may result in penalties

and financial loss.

Cybersecurity Cyberattacks on PayPoint's PayPoint has a robust IT security

and data systems and networks may framework and deploys industry

protection significantly impact service standard security systems with

delivery and data protection cyber intelligence capabilities.

causing harm to PayPoint, Systems are constantly monitored

our clients, retailer partners for attacks with teams in place

and other stakeholders. to respond to incidents, and cybersecurity

Although PayPoint continues response plans are regularly tested.

to upgrade and enhance Home working tools, security alert

its cybersecurity capabilities, process and employee cyber awareness

attacks are a constant were enhanced in response to specific

threat, with increased Covid-19 threats. We engage with

ransomware attacks on businesses law enforcement and partners on

over the last 12 months. cybercrime, and proactively manage

Covid-19 has heightened compliance with data privacy requirements.

cyber risk with significant Additionally, PayPoint's Audit

reliance on home working Committee has a Cyber Security

tools and criminals exploiting and IT sub-committee which oversees

vulnerabilities. Failure cybersecurity capability.

to comply with service

delivery, contractual requirements

or data privacy requirements

may result in significant

fines and reputational

damage.

Covid-19

The global Covid-19 pandemic continues to significantly impact

individuals, businesses, markets and economies, and the unprecedented

period of uncertainty presents significant risk to PayPoint across all

business areas. Whilst the majority of PayPoint retailer partners have

remained open during the pandemic to provide vital services to

communities, transaction volumes for some products have been impacted

and may continue to be impacted. Although PayPoint has taken affirmative

action to mitigate numerous risks arising from the pandemic, there

remains a high degree of uncertainty over future events and the

consequences for PayPoint. The table below details the strategic,

financial, operational and cybersecurity risks resulting from Covid-19

and the strategies to mitigate risk.

Potential impact Mitigation strategies

------------------------------------------ -------------------------------------------

Strategic risk PayPoint continually diversifies

Cash usage has significantly declined its product range to reflect market

during the Covid-19 lockdown reducing changes and our card payment revenue

PayPoint's revenue for ATMs and other significantly increased during the

cash-based products. It is anticipated Covid-19

Covid-19 will accelerate a structural lockdown. Our online MultiPay platform

decline in cash usage which will continues to grow in significance,

impact our business model and revenue. with the recent introduction of innovative

Covid-19 may also result in other new features including PayByLink.

market changes which could potentially The acquisition in April 2020 of

impact PayPoint. the 50% of shares in Collect+ PayPoint

did not previously own has significantly

strengthened our parcels proposition

in order to take advantage of the

growth in online sales.

------------------------------------------

Financial risk To maintain liquidity through a sustained

During the Covid-19 lockdown PayPoint period of disruption, the GBP70 million

has experienced reduced revenues revolving credit facility was fully

which is expected to continue until drawn down and additional dividend

an effective Covid-19 vaccine is payments and employee bonuses cancelled.

available. Reduced revenue heightens Government Covid-19 support schemes

PayPoint's liquidity risk, and the are closely monitored, and a review

deterioration in economic conditions of short-term cost reduction and

also heightens credit risk. deferment measures is being conducted

across the business. There is also

increased focus on settlement process

to ensure

heightened credit risk is appropriately

mitigated.

------------------------------------------

Operational risk IT and operational processes have

Covid-19 has heightened the risk been enhanced to ensure effective

of supplier failure, potentially service delivery and robust control.

impacting PayPoint's service delivery. PayPoint is working closely with

The sales pipeline and new initiatives suppliers to ensure continued service

have also been impacted with prospects delivery with contingencies being

delaying new ventures and other sales assessed for areas at risk. Most

initiatives also temporarily postponed. employees are working from home and

Additionally, increased working from safety measures have been implemented

home has impacted the robustness to ensure the safety of employees

of settlement processes and employee working in the office.

welfare remains a heightened risk.

------------------------------------------

Cybersecurity risk PayPoint has effective cybersecurity

Covid-19 has increased cyber threats controls and has increased focus

from cybercriminals and other malicious on addressing security alerts as

groups who are targeting individuals, soon as they arise. Security education

businesses and organisations by deploying has been increased with more frequent

Covid-19 related scams and phishing emails sent to employees highlighting

emails. Significant working from increased security dangers. The IT

home has also heightened cybersecurity change portfolio has also been reviewed

risks. with higher risk projects temporarily

postponed.

------------------------------------------

Directors' Responsibility Statement

The 2020 Annual Report contains the following statements regarding

responsibility for the financial statements in compliance with DTR

4.1.12. Responsibility is for the full Annual Report and Financial

Statements 2020 and not the condensed statements required to be set out

in the Annual Financial Report announcement.

The directors are responsible for the maintenance and integrity of the

Company's website. Legislation in the UK governing the preparation and

dissemination of financial statements may differ from legislation in

other jurisdictions. Each of the directors, whose names and functions

are listed on pages 46 and 47 of the Annual Report, confirm that, to the

best of their knowledge:

-- The Group financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view of the

assets, liabilities, financial position and profit or loss of the Company

and the undertakings included in the consolidation taken as a whole.

-- The Management Report includes a fair review of the development and

performance of the business and the position of the Company and the

undertakings included in the consolidation taken as a whole, together

with a description of the principal risks and uncertainties that they

face.

-- The Annual Report, taken as a whole, is fair, balanced and understandable,

and provides the necessary information for shareholders to assess the

Group's performance, business model and strategy.

END

(END) Dow Jones Newswires

June 23, 2020 04:01 ET (08:01 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

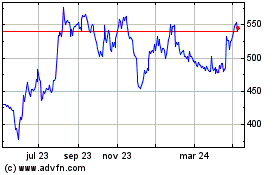

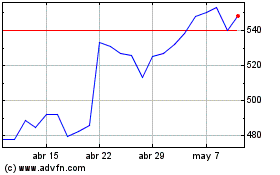

Paypoint (LSE:PAY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Paypoint (LSE:PAY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024