TIDMWJG

RNS Number : 4426E

Watkin Jones plc

06 November 2020

For immediate release 6 November 2020

Watkin Jones plc

('Watkin Jones' or the 'Group')

FY-2020 Trading Update

'Active second half drives future confidence across the

business'

Watkin Jones plc (AIM:WJG), the UK's leading developer and

manager of residential for rent with a focus on the build to rent

('BtR') and purpose built student accommodation ('PBSA') sectors,

is pleased to provide a trading update for the year ended 30

September 2020 (the 'year' or '2020').

Highlights

-- Resilient operational and financial performance, with seven

developments successfully delivered despite lockdown

restrictions

-- Nine new development sites secured in the second half of the

year, with three more expected to be secured shortly, significantly

strengthening our BtR and PBSA pipelines

-- Increased activity in the institutional forward sale market

demonstrates confidence in the long term demand for BtR and PBSA.

Two PBSA developments forward sold subsequent to the year end

-- Strong second half recovery with adjusted operating profit

for 2020 expected to be in the range GBP48.0 million to GBP50.0

million, with revenues of circa GBP350.0 million

-- Repayment of all COVID-19 financial assistance received from

the government this year, totalling GBP0.8 million, in view of the

recovery in performance

-- Intention to pay a full year dividend for 2020 in line with

our policy of 2.0x cover, reflecting our strong cash position,

subject to there being no material deterioration in market

conditions

Commenting on the year, Richard Simpson, CEO of Watkin Jones,

said: "I am really encouraged by our ability to adapt and overcome

the numerous challenges presented by the ongoing pandemic, not

least for our customers for whom we continue to work tirelessly to

ensure that their needs are being attended to. All of this simply

would not have been possible without the enormous commitment and

resilience of both our people and our suppliers and I would

personally like to extend my sincere thanks to them for their

continued hard work.

"As a result of their actions, we have had a strong second half

to the year. We have successfully completed seven schemes and made

excellent progress in growing our development pipeline, which will

deliver returns in the future. We have also started to see growing

evidence that institutional investors are beginning to recover

their appetite for forward funding developments in both BtR and

PBSA, and this is confirmed by our news today that we have forward

sold two PBSA developments to Student Roost (owned by Brookfield)

for GBP48.8 million.

"We are mindful of the continued disruption and hardship from

the COVID-19 pandemic, and so, along with ensuring the well-being

of our employees, customers and partners, we have repaid all

government financial assistance that we received this year. The

underlying market dynamics for residential for rent, both student

and build to rent, remain strong. As we enter our 2021 financial

year, the business has gained real momentum and, with our

resilient, diverse and capital light business model, we believe

that we are well placed to navigate the challenges and are

confident in the future. Whilst the duration of the latest lockdown

measures introduced remains uncertain, we do not currently

anticipate any significant impact on our operations."

Operations

Through the pandemic, our first priority has been ensuring the

wellbeing of all our employees, tenants and partners. We have

significantly increased the support we provide to employees and the

students who live with us and this has contributed to COVID-secure

accreditation from the British Safety Council for both our

workplaces and for the buildings we manage.

We were able to swiftly remobilise construction activities, with

appropriate health and safety practices in place, when government

restrictions began to ease. We completed six PBSA schemes (2,256

beds) and one BtR scheme for 159 apartments. As previously

announced, only one PBSA scheme has been delayed beyond the start

of the new term, and work continues alongside the purchaser and

university to minimise the impact on students.

Our accommodation management business, Fresh Property Group

('FPG'), mobilised nine new PBSA schemes in the year (3,593 beds),

ready for occupation and management from the start of the 2020/21

academic year, and won mandates for the future management of 1,414

PBSA beds and BtR apartments. At the start of 2021, FPG had 20,179

PBSA beds and BtR apartments under management across 66

schemes.

Our house building division saw a strong pick up in sales

following the relaxation of lockdown measures and introduction of

the temporary stamp duty relief. The division completed 95 sales in

2020 and is well positioned with 25 homes exchanged or reserved

going into 2021.

Financial performance

We expect 2020 adjusted operating profit to be in the range

GBP48.0 million to GBP50.0 million from revenues of circa GBP350.0

million. We have also incurred certain non-underlying costs in the

year associated with the COVID-19 disruption of approximately

GBP6.0 million and the previously announced provision for cladding

replacement costs, now expected to be approximately GBP15.0

million.

The current COVID-19 disruption to the student letting market

does not cause any significant exposure to us in respect of the fee

revenue earned by FPG on its contracted portfolio of assets under

management. However, as previously announced, we do hold six legacy

leased PBSA assets. The lower level of student occupancy for the

2020/21 academic year is currently expected to result in a

reduction of revenue for us in 2021 of approximately GBP5.0

million. This will result in an impairment in the carrying value of

our right of use assets, the cost of which is expected to be GBP1.9

million and is included in the non-underlying COVID-19 costs

referred to above.

The resilience of the business is reflected in our continued

strong cash generation. We expect to report a 2020 year-end gross

cash balance of circa GBP130.0 million and a net cash balance of

GBP90.0 million, after deducting site specific loans of GBP40.0

million.

Forward sale markets

Activity in the institutional forward sale markets started to

recover in the latter part of 2020 and we are pleased to report

that post the year end we forward sold two PBSA sites (659 beds),

in York and Bristol, to Student Roost (owned by Brookfield) for

delivery in 2022. The consideration payable to Watkin Jones for the

development works over the next two years, net of client funding

costs, is GBP48.8 million. We are in negotiation on further

potential sales from both our BtR and PBSA pipelines and we

continue to achieve margins in line with previously guided

levels.

Development pipeline

The development pipeline of BtR and PBSA sites continued to

build in the second half of 2020, with nine development sites

secured and a further three expected to be secured imminently.

These development sites are well located in London, Edinburgh,

Manchester, Birmingham, Bristol, Glasgow, York, Guildford and

Leicester.

We also secured planning permissions for 296 BtR apartments and

992 PBSA beds across five sites.

Our delivery pipeline now comprises over 4,350 BtR apartments

and 8,450 PBSA beds as follows:

Delivery Pipeline BtR PBSA

(Apartments) (Beds)

Total 2021 2022+ Total 2021 2022+

pipeline pipeline

Total pipeline 4,357 857 3,500 8,456 3,192 5,264

Forward sold 928 857 71 3,648 2,730 918

Forward sales in negotiation 422 - 422 1,214 462 752

Sites secured 2,760 - 2,760 3,024 - 3,024

Site acquisitions

in legals 247 - 247 570 - 570

We are well placed to capitalise on opportunities presented

during this period of disruption and we will continue to add to our

development pipeline over the coming months, whilst being careful

to protect our liquidity position against the potential for further

interruption to the forward sale markets and to building

activities.

Note: References to 2020, 2021 and 2022 are to our financial

years ended 30(th) September.

Notice of Final Results

We will make a further announcement in due course regarding the

specific timing of our Final Results.

- Ends -

The information contained within this announcement is deemed by

the Group to constitute inside information as stipulated under the

Market Abuse Regulation. Upon the publication of this announcement

via Regulatory Information Service, this inside information is now

considered to be in the public domain.

For further information:

Watkin Jones plc

Richard Simpson, Chief Executive Tel: +44 (0) 1248 362 516

Officer

Phil Byrom, Chief Financial Officer www.watkinjonesplc.com

Peel Hunt LLP (Nominated Adviser & Joint Tel: +44 (0) 20 7418

Corporate Broker) 8900

Mike Bell / Ed Allsopp www.peelhunt.com

Jefferies Hoare Govett (Joint Corporate Tel: +44 (0) 20 7029

Broker) 8000

Max Jones / Will Soutar www.jefferies.com

Media enquiries:

Buchanan

Henry Harrison-Topham / Richard Oldworth Tel: +44 (0) 20 7466 5000

Jamie Hooper / Steph Watson

watkinjones@buchanan.uk.com www.buchanan.uk.com

Notes to Editors

Watkin Jones is the UK's leading developer and manager of

residential for rent, with a focus on the Build to Rent and student

accommodation sectors. The Group has strong relationships with

institutional investors, and a reputation for successful,

on-time-delivery of high quality developments. Since 1999, Watkin

Jones has delivered 41,000 student beds across 123 sites, making it

a key player and leader in the UK purpose-built student

accommodation market. In addition, the Fresh Property Group, the

Group's specialist accommodation management company, manages nearly

18,000 student beds and Build to Rent apartments on behalf of its

institutional clients. Watkin Jones has also been responsible for

over 80 residential developments, ranging from starter homes to

executive housing and apartments. The Group is increasingly

expanding its operations into the Build to Rent sector.

The Group's competitive advantage lies in its experienced

management team and business model, which enables it to offer an

end-to-end solution for investors, delivered entirely in-house with

minimal reliance on third parties, across the entire life cycle of

an asset.

Watkin Jones was admitted to trading on AIM in March 2016 with

the ticker WJG.L. For additional information please visit

www.watkinjonesplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUPGRPGUPUGMA

(END) Dow Jones Newswires

November 06, 2020 13:40 ET (18:40 GMT)

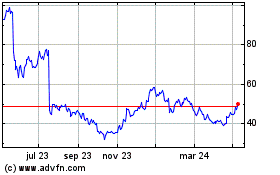

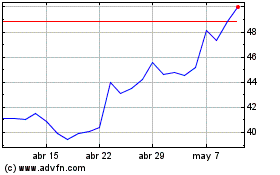

Watkin Jones (LSE:WJG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Watkin Jones (LSE:WJG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024