TIDMINSE

RNS Number : 3042I

Inspired Energy PLC

11 December 2020

11 December 2020

Inspired Energy plc

("Inspired Energy" or the "Group")

Disposal of SME Division and Trading Update

Inspired Energy (AIM: INSE), the leading consultant for energy

procurement, utility cost optimisation and legislative compliance

in the UK and Ireland, announces that it has completed the disposal

of the Group's SME division, consisting of subsidiaries, Energisave

Online Limited, KwH Consulting Limited and Simply Business Energy

Limited, ("SME Division") to its management team (the "Buyer"), by

way of a management buyout ("MBO"), for a total consideration of up

to GBP10.5 million, calculated on a cash free debt free basis (the

"Disposal"). The Group also announces a trading update noting the

effect on Q4 due to the ongoing COVID-19 related lockdown.

The Disposal has been undertaken to enable the Group to focus

exclusively on its strategy of providing expert assurance and

utility cost optimisation services to Corporate Energy Consumers,

helping them manage energy costs effectively and delivering their

Net Zero Carbon and ESG objectives.

SME DIVISION

-- The SME Division provides price comparison and contract

arrangement services for SME consumers, which the Board considers

to be a non-core activity, contributing 7% of Group revenues during

H1 2020.

-- For the year ending 31 December 2019, the SME Division

generated revenues of GBP5.6m and adjusted EBITDA of GBP1.9m, with

net assets of GBP7.9m.

-- During 2020, the financial performance of the Group's SME

Division has been significantly impacted by the on-going pandemic,

with the SME Division experiencing a reduction in demand for energy

supplier switching services.

-- For the six-month period ending 30 June 2020, the SME

Division generated revenues of GBP1.9m (H1 2019: GBP2.88m) and

adjusted EBITDA of GBP0.5m (H1 2019: GBP0.97), after utilising the

benefit of the Government Coronavirus Job Retention Scheme ("CJRS")

extensively.

-- The downturn in performance continued during H2 2020, with

the SME Division being loss making in the period, despite the

ongoing utilisation of the CJRS.

KEY TERMS

-- Aggregate consideration of up to GBP10.5 million, is payable

to Inspired Energy on the collection and run off of the SME

Division's accrued income balance, the majority of which is

expected to be recovered within three years of completion.

-- The Buyer and Inspired Energy have entered into a

transitional services agreement ("TSA") for a period of 36 months

from completion.

-- Working capital facility ("Facility") provided from Inspired

Energy to the Buyer, of which GBP250,000 will be drawn at

completion, with up to a further GBP500,000 available to be drawn

in tranches across the six months from completion, subject to

compliance with the terms of the facility.

-- The Facility carries an interest rate of 5% per annum above

Bank of England base rate, with quarterly repayments commencing

from month 18, with the Facility repaid in full three years from

completion. The provision of the Facility has the benefit of

ensuring efficiency in the transaction process, as well as

facilitating the grant of security in favour of Inspired

Energy.

-- To maintain full market coverage, where the Group has a need

to provide price comparison services to SME consumers, following

the MBO the Buyer will become a supplier to the Group to enable a

continuation of that service provision.

TRADING UPDATE

As set out the time of the interim results, announced on 9

September 2020, the Group reported that the SME division was

materially impacted by COVID-19. The latest lockdown has continued

to impact the performance of the SME Division, which has been loss

making since Q2 as a result of the significant reduction in SME

customer energy switching activity and consumption. Following the

Disposal, the SME division will be reported as a discontinued

operation in the Group's full year result. The anticipated recovery

for the SME Division in the latter part of the period did not

materialise as a result of the impacts of the continued lockdown,

and as a consequence underlying EBITDA contribution from the SME

Division is now anticipated to be c.GBP1.2m below current

expectations for FY2020.

Within the Group's continuing operations of the Corporate

Division, trading in the core Corporate Assurance Service business

remains robust and ahead of management expectations for the full

year, despite the disruption in Q4. The average energy consumption

reduction by customers for the April to December period is expected

to be c.18%, well ahead of the 25% reduction modelled in the

Board's COVID downside case.

The Group's Optimisation Services businesses, which are project

based and typically require access to customer sites, had been

disrupted from April to September as a result of pandemic

restrictions and some project deferrals. Whilst in October, the

Optimisation Services businesses did experience a partial recovery,

as expected, the lockdowns during November have again restricted

site access and caused the deferral of some additional projects

into FY2021. As a result of the short term disruption within

Optimisation Services, in part offset by the continued resilient

performance in Assurance Services, the Board now expects the

Corporate division and consequently the Group's continuing

operations to also report FY2020 underlying EBITDA approximately

c.GBP1.2m below current expectations. Given the impact to

Optimisation Services revenues are primarily deferrals in project

delivery, the Board reiterates FY2021 EBITDA guidance for the Group

(being the continuing operations, adjusted for the divested SME

Division).

A further trading update will be announced in January 2021.

Related Party Transaction

Andrew Nuttall is the Managing Director of the SME Division and

as a result the Disposal is classed as a related party transaction

under Rule 13 of the AIM Rules for Companies. The directors of

Inspired Energy, all of whom are deemed to be independent for the

purposes of the transaction, having consulted with the Group's

nominated adviser, Shore Capital & Corporate Limited, consider

the terms of the Disposal, the Facility and the TSA to be fair and

reasonable insofar as shareholders are concerned.

Commenting on the transaction, Mark Dickinson, CEO of Inspired

said: "The disposal of the SME Division represents an important

milestone in the strategic direction of Inspired Energy. Unlike the

Corporate Division, where Assurance Services have performed better

than our COVID Sensitised model, and Optimisation Services where

FY2020 performance is impacted by deferrals to project delivery,

but is expected to recover in FY2021, the SME Division has proved

less resilient to the pandemic. This transaction allows the Group

to focus solely on our core service offering to Corporate Energy

Consumers with a business that is more resilient to the COVID

pandemic in FY2021.

"Having taken the decision to divest the SME Division we are

delighted to have agreed the sale with Andrew Nuttall, who has

driven the performance of the division since formation. The Board

believes a sale of the SME Division by MBO is the optimal route as

it enables the Group to realise value, maintain continuity of

service delivery to the customer base and enable Inspired Energy to

maintain full market coverage. We wish the team every success for

the future.

"Whilst the financial performance of the Group for FY2020 is

disappointing, it is a consequence of factors outside of the

Group's control. The Board is pleased with the continued

outperformance of the Group's core Corporate Assurance Service

lines and believes that Optimisation Services will regain strong

momentum once restrictions on movement are lifted. The Board

continues to believe there is a strong and growing demand for

optimisation services as ESG becomes a higher priority for

Corporates."

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014) (" MAR ") prior to its release as part

of this announcement and is disclosed in accordance with the

Company's obligations under Article 17 of those Regulations.

Enquiries:

Inspired Energy plc

Mark Dickinson, (Chief Executive Officer) +44 (0) 1772 689250

Paul Connor, (Chief Financial Officer) www.inspiredenergy.co.uk

Shore Capital (Nomad Adviser and Joint

Broker)

Advisory

Edward Mansfield / James Thomas / Michael

McGloin

Broking

Malachy McEntyre +44 (0) 20 7408 4090

Peel Hunt LLP (Joint Broker)

Mike Bell/Ed Allsopp +44 (0) 20 7886 2500

Alma PR +44 (0) 20 7193 7463

Justine James / Josh Royston / David +44 (0) 7525 324431

Ison / Molly Gretton inspired@almapr.co.uk

Notes to editors

Inspired Energy plc is the leading consultant for energy

procurement, utility cost optimisation and legislative compliance

in the UK and Ireland . Inspired Energy provides services to over

2,400 UK corporate business consumers, which represent c.6.7% of

the UK's expenditure on electricity and over 400 in the ROI.

Inspired Energy is ranked as the UK's number one advisor in the

most recent independent Cornwall Insight Report, which was achieved

by addressing client needs and using that insight to shape the

business strategy in addition to the acquisition and investment

activity.

The Company provides expert assurance and optimisation services

to Corporate Energy Consumers to help them manage energy costs

effectively and deliver their Net Zero Carbon and ESG objectives.

In November 2020, the Company received the London Stock Exchange's

Green Economy Mark in recognition of its environmental and

strategic advice, service and support to customers.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKKKBNKBDBCBD

(END) Dow Jones Newswires

December 11, 2020 02:00 ET (07:00 GMT)

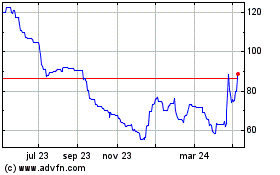

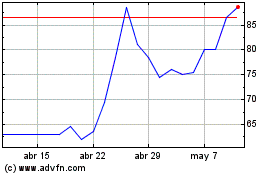

Inspired (LSE:INSE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Inspired (LSE:INSE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024