Bitcoin Flashes Buy Signal After Price Closed 2nd Green Month Candle In A Row

02 Noviembre 2024 - 3:00PM

NEWSBTC

The Bitcoin price enjoyed its second consecutive green candle in

October after closing the month with a 10% price gain. Crypto

analyst TradingShot revealed why this development was a positive

going forward and is a good buy signal for those looking to invest

in the flagship crypto. Related Reading: Ethereum Claims

Address Dominance With 43% Lead—Will It Keep Rising? Bitcoin

Triggers Buy Signal After Price Hit Second Green Month Candle

TradingShot mentioned in a TradingView post that it is always a

good signal to buy whenever the Bitcoin price closes two

consecutive green monthly candles. He made this assertion based on

the multi-year chart, which he also claimed shows that the market

continues to rally whenever Bitcoin records these two straight

green candles. The crypto analyst revealed that the Bitcoin

price recorded three straight green candle occasions and a clear

accumulation phase in the 2021 bull run. Meanwhile, in the 2017

bull run, the Bitcoin price recorded numerous straight green candle

occasions. This market cycle looks to be replicating the 2021 bull

run pattern, as BTC recorded three straight monthly green candles

between January and March earlier this year before it recorded an

accumulation phase. Therefore, as TradingShot explained, this

is likely a good buying opportunity since the Bitcoin price could

record a third straight monthly green candle in November. Another

reason why Bitcoin would likely experience a monthly green candle

in November is because the flagship crypto has enjoyed monthly

positive returns most of the time it closed October in the

green. The Bitcoin price outlook for November also looks

bullish because of the upcoming US elections. The aftermath of the

elections is expected to bring certainty to the market, which could

cause Bitcoin to rally. Economist Alex Krüger predicted that the

BTC could rally quickly to $90,000 if Donald Trump wins. Meanwhile,

he mentioned that there is a chance that the flagship crypto could

drop to as low as $65,000. Price Needs To Stay Above $69,000

In The Meantime In an X post, popular analyst Justin Bennett

mentioned that the drop in Bitcoin’s price below $70,000 isn’t a

good look, but the Bulls’ last line of defense is $69,000. He

remarked that the $65,000 lows are next if that price level fails

to hold on the high time frames. Justin Bennett added that he

doubts that the equal highs from March and October near $73,700

will go unchallenged. However, before that happens, he suggested

that the Bitcoin price could retest the lows at around

$65,000. Crypto analyst Ali Martinez has also revealed that

the Bitcoin price needs to hold above $69,000 to reach a new

all-time high (ATH). He predicted that BTC could rally to $78,000

if the $69,000 level holds. Related Reading: Bitcoin Breaks

$73,000, Yet Google Searches Stay Stagnant—Is Hype Fading? At the

time of writing, the BTC price is trading at around $69,700, up

almost 1% in the last 24 hours, according to data from

CoinMarketCap. Featured image from Forbes, chart from

TradingView

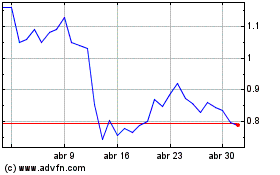

Mina (COIN:MINAUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

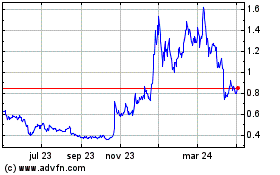

Mina (COIN:MINAUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024