- Organic revenue growth1 of 6.9% over Q1 2024, reaching

€76.9m revenue

- Annual Recurring Revenue (ARR) at €227.8m, up 8.4% compared

with end-March 2023

- Buoyant Subscription activity with organic growth of over

30% for the quarter

- Sopra Banking Software acquisition project well on

track

Regulatory News:

Axway (Euronext: AXW.PA) made a solid start to 2024 thanks to

sustained sales activity, driven in particular by the Americas and

Rest of Europe regions, which recorded important revenue growth. As

large companies continue to accelerate their move to cloud

infrastructures, Axway is benefiting from its optimized

organization by regions and main products to accelerate new

customer acquisition. Over the period, thanks to 3 large deals, the

value of new customer bookings more than doubled compared with

2023. This trend was accompanied by quarterly organic revenue

growth of 6.9%, underpinned by the go-live of contracts signed in

the second half of 2023.

In terms of the main product lines, several major developments

took place since the beginning of the year:

- In the MFT and B2B markets, Axway is capitalizing on its

historical expertise and strong leading positions to fuel new

customers signings. In addition to the security and reliability of

products, decision-makers are looking to Axway's Managed Cloud

infrastructures to help them get up and running quickly. Both

product lines, which have very large installed bases worldwide, are

also seeing major customers accelerate their migration to the

cloud, with strong demands for containerization of their

applications.

- The Amplify API Management offering got off to a successful

sales start in 2024, supported by growth in key customer usage and

the gain of several new logos. Signings and pipeline were

particularly boosted by the new Amplify Marketplace offering

success, which addresses the aggregation, security and consumption

management of all APIs for the largest enterprises.

- The Axway Financial Accounting Hub (AFAH) offering, recently

reinforced with new functionalities from the acquisition of Cycom

Finances, has been boosted by strategic partnerships, including the

one signed with KPMG France at the end of 2023, which are beginning

to bear fruit and feed business pipeline growth. Axway's value

proposition of offering consistency, agility and auditability to

the company's main financial departments through a single hub is

very positively perceived, making Axway a preferred partner for

customers rationalizing their existing configurations or

implementing new projects accelerated by the involvement of

business teams.

Patrick Donovan, Axway's Chief Executive Officer, said:

“I am delighted to see that the Axway team has launched 2024 on

a promising note, building upon the momentum of our recent years'

achievements. As we progress, it is imperative for Axway to

maintain unwavering focus on delivering value and results to its

customers. To do so, we'll need the energy and enthusiasm I've seen

in all the events that have kicked off our year. This was once

again the case a few days ago when I attended our annual North

American Summit, which was a great success thanks to the strong

engagement of each participating Customers, Partners and

Collaborators. As Axway enters a new chapter, building a reference

player in the world of enterprise software solutions through

renowned products and brands, offering crucial business benefits to

our customers will remain our steadfast commitment. This is the

cornerstone of our day-to-day activities, and we look forward to

welcoming Sopra Banking Software teams to share this mission. The

consistency of this strategic approach is reflected in the strength

of our portfolio of market-leading products. Exciting times lie

ahead as we steer Axway towards the next stage of its development,

and we'll be sure to keep everyone informed of our ongoing

progress.”

Comments on Q1 2024 activity

Axway Software: Consolidated revenue 1st Quarter

2024 (€m) Q1 2024 Q1 2023Restated* Q1

2023Reported TotalGrowth OrganicGrowth

Revenue

76.9

71.9

71.8

7.1%

6.9%

* Revenue at 2024 scope and exchange rates

Axway's revenue amounted to €76.9m in Q1 2024, representing

organic growth of 6.9% and total growth of 7.1%. Within the Q1 2023

restated figures, currency fluctuations had a negative impact of

€0.3m due to the slight depreciation of the US dollar against the

euro while changes in the consolidation scope, resulting from the

2023 acquisitions, had a positive impact of €0.4m.

Axway Software: Revenue by business line 1st

Quarter 2024 (€m) Q1 2024 Q1 2023Restated* Q1

2023Reported TotalGrowth OrganicGrowth

Subscription

49.4

37.9

37.8

30.9%

30.3%

of which Axway Managed

12.4

11.0

10.7

15.3%

12.5%

of which Customer Managed

37.0

26.9

27.0

37.1%

37.6%

Maintenance

17.1

22.3

22.5

-23.8%

-23.4%

Subtotal - Renewable Contracts

66.5

60.3

60.2

10.5%

10.4%

License

1.4

2.1

2.1

-36.3%

-35.8%

Services

9.0

9.5

9.5

-5.2%

-5.5%

Axway Software

76.9

71.9

71.8

7.1%

6.9%

* Revenue at 2024 scope and exchange rates

The Subscription activity posted quarterly revenue of

€49.4m, with strong organic growth of 30.3%. Revenue was boosted by

the signing or renewal of several major Customer Managed deals,

giving rise to immediate recognition of around half their total

value. Upfront revenue from new or renewed Customer Managed

contracts represented €24.7m in Q1 2024. At the same time, Axway

Managed offerings continued to gain ground, accounting for 45% of

new contracts signed during the period, with booking growth of

almost 65%. The annual value of new subscription contracts signed

(ACV) during the quarter reached €7.8m.

Maintenance generated €17.1m in revenue during Q1 2024,

representing 22% of Axway's total revenue. The activity experienced

an organic decline of 23.4%. With a high renewal rate of around 91%

over the quarter, the decline in revenue, in line with forecasts,

was due to the continuous migration of customers to

subscription-based contracts.

At the end of March 2024, Axway's ARR (Annual Recurring Revenue)

stood at €227.8m, increasing by 8.4% on a like-for-like basis

compared with €210.2m at the end of March 2023. In Q1 2024, revenue

from renewable contracts represented 86% of total revenue.

License revenue was €1.4m in the first 3 months of the

year, representing less than 2% of Axway's total revenue. Activity

was down 35.8% compared with Q1 2023.

Stabilized at around 12% of Axway's total revenue, the

Services activity experienced a slight organic decline, with

revenue of €9.0m (-5.5%) over the period. On a full-year basis,

revenue should be stable compared with 2023.

Axway Software: Revenue by geographic area 1st

Quarter 2024 (€m) Q1 2024 Q1 2023Restated* Q1

2023Reported TotalGrowth OrganicGrowth France

23.9

24.8

24.7

-3.2%

-3.5%

Rest of Europe

17.4

13.8

13.5

29.5%

25.9%

Americas

32.1

30.6

30.9

4.2%

5.2%

Asia/Pacific

3.4

2.7

2.8

21.5%

25.1%

Axway Software

76.9

71.9

71.8

7.1%

6.9%

* Revenue at 2024 scope and exchange rates

In France, Axway reported first-quarter revenue of

€23.9m, down 3.5% organically on the very high comparison basis

achieved in early 2023. Despite the signing of large deals at the

end of the quarter, the exceptional performance recorded in Q1 2023

prevented business from growing. Nevertheless, the strong pipeline

enables Axway to anticipate full-year growth in the country.

In the Rest of Europe, Axway maintained its growth

trajectory with revenue of €17.4m, up 25.9% on the previous year.

Activity was supported by solid performances in Germany and

Benelux, driven by MFT and B2B offerings.

In the Americas (USA and Latin America), revenue reached

€32.1m in Q1 2024, or 42% of total revenue. With organic growth of

5.2% and total growth of 4.2%, Axway's business benefited from

improved sales momentum across the continent. In both the United

States and Brazil, Axway's MFT and Amplify (APIM) offerings met

with great success, winning new customers.

In Asia/Pacific, revenue for the quarter came to €3.4m

representing strong organic growth (25.1%), driven by earnings from

Axway Managed contracts signed in 2023.

Update on Sopra Banking Software acquisition project

On February 21, 2024, Axway announced that it had entered into

exclusive discussions with Sopra Steria regarding the acquisition

of a significant part of the activities of Sopra Banking Software.

Axway would acquire the concerned Sopra Banking Software activities

for an enterprise value of around €330m by combining a capital

increase of around €130m with preferential subscription rights2,

with new credit facilities.

At this stage, all steps described in the project announcement

are in motion and well underway. Assuming parties involved secure

the necessary approvals and clearances, and complete the different

requirements, Axway reaffirms its objective of finalizing the

acquisition of Sopra Banking Software by the end of Q2 2024, or at

the latest during Q3 2024.

Financial position at March 31, 2024

At March 31, 2024, Axway had cash of €23.7m and net debt of

€60.4m.

Axway’s bank lines, in place through 2027, provide financing of

up to €125.0m. Axway highlights that, if necessary, it has access

to additional financing capacity under its existing revolving

credit facility. However, in the context of the proposed

acquisition of Sopra Banking Software, Axway's credit facility will

be reviewed in the light of the debt mechanisms chosen to help

finance the deal.

2024 Targets

For 2024, Axway anticipates organic growth of between 1% and 3%,

and a profit on operating activity of around 20% of revenue.

Financial Calendar

Thursday, May 16, 2024, 2:30 p.m. (UTC+2): Annual Shareholders'

Meeting Tuesday, July 23, 2024, after market closing: Publication

of 2024 Half-Year Results Tuesday, July 23, 2024, 6:30 p.m.

(UTC+2): 2024 Half-Year Results Virtual Analyst Conference

Thursday, October 24, 2024, before market opening: Publication of

Q3 2024 Revenue

Glossary and Alternative Performance Measures

ACV: Annual Contract Value – Annual

contract value of a subscription agreement.

ARR: Annual Recurring Revenue –

Expected annual billing amounts from all active maintenance and

subscription agreements.

Employee Engagement Score:

Measurement of employee engagement through an independent annual

survey.

Growth at constant exchange rates:

Growth in revenue between the period under review and the prior

period restated for exchange rate impacts.

NPS: Net Promoter Score – Customer

satisfaction and recommendation indicator for a company.

Organic growth: Growth in revenue

between the period under review and the prior period, restated for

consolidation scope and exchange rate impacts.

Profit on operating activities:

Profit from recurring operations adjusted for the non-cash

share-based payment expense, as well as the amortization of

allocated intangible assets.

Restated revenue: Revenue for the

prior year, adjusted for the consolidation scope and exchange rates

of the current year.

TCV: Total Contract Value – Full

contracted value of a subscription agreement over the contract

term.

Disclaimer

This press release contains forward-looking statements that may

be subject to various risks and uncertainties concerning Axway’s

growth and profitability, notably in the event of future

acquisitions. Axway highlights that signature of contracts, which

represent investments for customers, are more significant in the

second half of the year and may therefore have a more or less

favorable impact on full-year performance. In addition, Axway notes

that potential acquisition(s) could also impact this financial

data. Furthermore, activity during the year and/or actual results

may differ from those described in this document as a result of a

number of risks and uncertainties set out in the 2023 Universal

Registration Document filed with the French Financial Markets

Authority (Autorité des Marchés Financiers, AMF) on March 25, 2024.

The distribution of this document in certain countries may be

subject to prevailing laws and regulations. Natural persons present

in these countries and in which this document is disseminated,

published, or distributed, should obtain information about such

restrictions, and comply with them.

About Axway

Axway enables enterprises to securely open everything by

integrating and moving data across a complex world of new and old

technologies. Axway’s API-driven B2B integration and MFT software,

refined over 20 years, complements Axway Amplify, an open API

management platform that makes APIs easier to discover and reuse

across multiple teams, vendors, and cloud environments. Axway has

helped over 11,000 businesses unlock the full value of their

existing digital ecosystems to create brilliant experiences,

innovate new services, and reach new markets. Learn more at

axway.com

Appendices (1/1)

Axway Software: Impact on revenue of changes in scope and

exchange rates 1st Quarter 2024 (€m) Q1

2024 Q1 2023 Growth Revenue

76.9

71.8

7.1%

Changes in exchange rates

-0.3

Revenue at constant exchange rates

76.9

71.5

7.6%

Changes in scope +0.4

Revenue at constant scope and exchange

rates

76.9

71.9

7.0%

Axway Software: Changes in exchange rates

1st Quarter 2024For 1€ Average rateQ1 2024

Average rateQ1 2023 Change US Dollar

1.086

1.073

- 1.2%

1 See Glossary and Alternative Performance Measures 2 The

subscription price per new Axway share will be determined at the

time of launch of the rights issue, according to standard market

practice, and will include a customary discount to the Theoretical

Ex-Rights Price (TERP). Taking into account the discount to TERP,

the subscription price will be not higher than 26.5€.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240424934013/en/

Investor Relations: Arthur Carli – +33 (0)1 47 17 24 65 –

acarli@axway.com

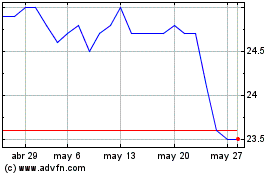

Axway Software (EU:AXW)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Axway Software (EU:AXW)

Gráfica de Acción Histórica

De May 2023 a May 2024