MARKET WRAPS

Watch For:

Retail Sales for December; Import Prices for December;

Industrial Production & Capacity Utilization for December;

Business Inventories for November; Fed's Beige Book; Canada

Industrial Product and Raw Materials Price Indexes for December

Today's Top Headlines/Must Reads:

- Markets Expect Rate Cuts Soon. Central Banks Say Not So

Fast.

- What to Watch in Retail Report: Strength of Consumers Heading

Into 2024

- A Pandemic-Era Tax Break Is Unraveling, and the Lawsuits Are

Flying

Opening Call:

Stock futures fell on Wednesday as central-bank officials'

cautious comments regarding the speed of rate cuts continued to

weigh.

European Central Bank President Christine Lagarde said this

morning that interest-rate cuts were likely, but data dependent and

that there was still some uncertainty.

This came after Fed governor Christopher Waller said Tuesday

that continued declines in inflation would allow the Federal

Reserve to lower rates, but there was "no reason to move as quickly

or cut as rapidly as in the past."

Overseas Markets

Weak China data hit Asian markets, as Hang Seng fell more than

3%, while the mainland's CSI 300 index declined 2%. The data

highlighted slowing economic growth, a property-market meltdown and

population decline .

European stocks also slipped with the Stoxx 600 Index losing

over 1%, while London's FTSE 100 fell further after data showed an

unexpected rise in U.K. inflation .

Premarket Movers

U.S.-listed shares of Alibaba were down 3.2%, JD.com slumped

5.2%, and PDD Holdings fell 4.4% after gross domestic product in

China expanded 5.2% in the fourth quarter and for 2023.

Impinj said it expects fourth-quarter revenue of more than $70

million, above its prior guidance of $65.5 million to $68.5

million. Shares rose 5.9%.

Interactive Brokers reported fourth-quarter adjusted earnings of

$1.52 a share, missing analysts' estimates by 1 cent. The stock

declined 3.6%.

NIO's stock fell almost 10% in Hong Kong after rival Tesla cut

its prices in China. NIO's ADRs declined more than 6%

premarket.

Progress Software posted fourth-quarter adjusted earnings that

fell from a year earlier but topped Wall Street expectations.

Shares were up 2.9%.

Spirit Airlines fell 47% on Tuesday and was down a further 4.4%

in premarket trading after a federal judge blocked the budget

carrier's acquisition by JetBlue Airways, saying the deal would do

harm to the airline's cost-conscious fliers. JetBlue rose 1%.

Forex:

The euro fell to its lowest level against the doll ar so far in

2024 as bond markets reassessed interest-rate cut pricing, driving

Treasury yields higher, Danske Bank Research said.

"EUR/USD faced renewed pressure as markets reassessed the

aggressive pricing of rate cuts."

Danske Bank Research maintained its strategic case for a lower

EUR/USD, and in the near term, prefering to sell on any

rallies.

The euro repeatedly failed to sustain a break above $1.10

throughout 2023 and is shy of this level so far in 2024, but BNP

Paribas Markets 360 believes it has the potential to rise in the

longer term.

"Going forward, we think it's more likely than not that this

barrier [1.10] is broken through and we forecast EUR/USD to close

the year at 1.15."

Sterling rebounded after data showed U.K. annual CPI inflation

unexpectedly rose to 4.0% , dulling chances of an early

interest-rate cut.

The data prompted some to slash bets on the currency falling

below $1.26 against the dollar, Swissquote Bank said.

The U.K.'s anemic growth should limit gains in sterling against

the U.S. dollar, Swissquote added.

Energy:

Oil prices traded lower on a stronger dollar as investors scaled

back expectations of imminent interest-rate cuts following comments

from a Fed official.

"Oil markets continue to trade in a fairly rangebound manner

despite developments in the Middle East," ING said.

"Comments from a Fed official and a surge in the USD yesterday

held large parts of the commodity complex back."

Meanwhile, tensions in the Middle East were escalating amid

fresh Houthi attacks on ships transiting the Red Sea and

retaliation strikes from the U.S. and its allies.

Metals:

Metals prices were falling as the latest figures from top

consumer China weighed on market sentiment, revealing the country's

economy grew at one of its slowest rates in decades last year.

Meanwhile, the impact of shipping disruptions in the Red Sea

seems to be having only a marginal impact on commodities, but

further escalation of the conflict could be supportive for

prices.

"While the conflict at the Red Sea is not directly translating

into higher base metals prices, the indirect impacts are mounting,

possibly delaying shipments and increasing freight costs," Sucden

Financial said.

Copper

Copper prices are likely to trough around $8,000 a metric ton in

3Q , Macquarie said, who raised its expected copper-price nadir

from a previous forecast of $7,600/ton.

"We have taken a more constructive view" following supply

disruptions that suggest a smaller-than-anticipated surplus of the

metal in 2024, it said.

TODAY'S TOP HEADLINES

Maersk, Hapag-Lloyd Form Shipping Alliance

Danish shipping giant A.P. Moeller-Maersk and Germany's

Hapag-Lloyd are teaming up to form a new vessel-sharing agreement

from next year, shaking up the global lineup of shipping

alliances.

Following the end to the pandemic-fueled cargo boom, when

freight demand outstripped the supply of ships, the industry has

been left with a surplus of vessels and sharply lower freight

rates, while the recent escalation of hostilities in the Middle

East has forced shippers to divert their vessels by thousands of

miles.

BP Veteran Named as CEO, Signaling Commitment to Renewable

Shift

BP appointed Murray Auchincloss as chief executive, turning to a

company veteran to continue the oil giant's shift toward renewable

energy.

Auchincloss has run the London-based company on an interim basis

since September following the abrupt resignation of Bernard Looney

over his failure to disclose details about past relationships with

colleagues.

Tesla cuts prices in Germany after reductions in China, report

says

Tesla cut the prices of its Model Y in Germany, just a week

after cutting prices in China, according to a report.

Reuters reported that Tesla TSLA has cut one Model Y vehicle by

9% and another by 8.1%.

Europe Braces for Trade Hit as Global Commerce Slows

Europe's trade relationships are set to suffer as global

conflicts and protectionism open a chillier chapter in

international commerce, hitting growth on the continent.

Trade is now growing at a slower pace than the world economy,

marking a fundamental shift away from the trade-centric globalism

prevalent since the end of the Cold War, Boston Consulting Group

said in a report published this month. The slowdown is due to

rising protectionism, including in China, and increased disruptions

from conflict, BCG said.

How Quickly Donald Trump Could Clinch the Republican

Nomination

Florida Gov. Ron DeSantis muscled out a second-place finish in

Iowa, but he trailed Donald Trump by roughly 30 points. Polls have

shown Nikki Haley on the rise in New Hampshire, in some cases

closing the gap with Trump to single digits. But beyond that, there

is little to suggest anyone is positioned to damp the air of

inevitability around Trump's campaign. If Trump continues winning

by margins similar to his dominant performance in Iowa, he is on a

path to securing the delegates needed to clinch the nomination in a

matter of weeks.

Here's a look at how the delegate math might add up through

Super Tuesday.

Taiwan's New Leader Says He'll Stick to the Status Quo-but His

Past Makes the U.S. Nervous

TAINAN, Taiwan-More than a decade ago, some residents of this

southern Taiwanese city got a lesson in the character of the man

who is now set to be Taiwan's next president.

Lai Ching-te, then Tainan's mayor, wanted to move a section of

railway underground. Residents whose homes would have to be

demolished blocked bulldozers with their bodies and accused him of

selling them out to property developers. Political opponents called

him a dictator.

China's Population Decline Accelerates as Women Resist Pressure

to Have Babies

Births in China dropped by more than 500,000 last year to just

over 9 million in total, accelerating the decline in the country's

population as women shrugged off the government's exhortations to

reproduce.

The number of newborns has gone into free fall over the past

several years. Official figures released Wednesday showed that

China had fewer than half the number of births in 2023 than the

country did in 2016, after China abolished the one-child policy.

The latest number points to a fertility rate-the number of children

a woman has over her lifetime-that is close to 1.0, a level

considered by demographers as "ultralow."

Write to ina.kreutz@wsj.com

TODAY IN CANADA

Earnings:

Haivision Syss 4Q

Economic Calendar (ET):

0830 Nov International transactions in securities

0830 Dec Industrial product and raw materials price indexes

Stocks to Watch:

Gildan Activewear Provides Update on Former CEO; Gildan

Activewear Alleges Glenn Chamandy Failed to Disclose Investments in

Funds Managed by Shareholder Who Has Now Come Out in Support of

Reinstalling Chamandy as CEO

---

Mandalay Resources Achieves 2023 Production Guidance,/ Provides

Outlook for 2024; Consolidated Annual Production Guidance of 90,000

to 100,000 Gold Equivalent Ounces

---

Parex Resources Announces Approval of Normal Course Issuer Bid

and Automatic Shr Purchase Plan; to Buy Up to 10.2M Shares

Expected Major Events for Wednesday

07:00/UK: Dec CPI

07:00/UK: Dec UK producer prices

09:30/UK: Oct Card Spending statistics

09:30/UK: Nov UK House Price Index

12:00/US: 01/12 MBA Weekly Mortgage Applications Survey

13:30/US: Dec Import & Export Price Indexes

13:30/CAN: Nov International transactions in securities

13:30/US: Dec Advance Monthly Sales for Retail & Food

Services

13:30/CAN: Dec Industrial product and raw materials price

indexes

13:55/US: 01/13 Johnson Redbook Retail Sales Index

14:15/US: Dec Industrial Production & Capacity

Utilization

15:00/US: Nov Manufacturing & Trade: Inventories &

Sales

15:00/US: Jan NAHB Housing Market Index

19:00/US: U.S. Federal Reserve Beige Book

21:30/US: 01/12 API Weekly Statistical Bulletin

23:50/JPN: Nov Orders Received for Machinery

All times in GMT. Powered by Kantar Media and Dow Jones.

Expected Earnings for Wednesday

Alcoa Corp (AA) is expected to report $-1.04 for 4Q.

Avalon Advanced Materials Inc (AVL.T) is expected to report for

1Q.

BancFirst Corp (BANF) is expected to report $1.44 for 4Q.

Bar Harbor Bankshares (BHB) is expected to report $0.67 for

4Q.

CNB Financial Corp (Pennsylvania) (CCNE) is expected to report

$0.54 for 4Q.

Caldwell Partners International Inc (CWL.T) is expected to

report for 1Q.

Cass Information Systems (CASS) is expected to report $0.48 for

4Q.

Charles Schwab Corp (SCHW) is expected to report $0.50 for

4Q.

Citizens Financial Group (CFG) is expected to report $0.60 for

4Q.

Community Trust Bancorp (CTBI) is expected to report $1.08 for

4Q.

Discover Financial Services (DFS) is expected to report $2.51

for 4Q.

FRMO Corp (FRMO) is expected to report for 2Q.

First Community Corp. (South Carolina) (FCCO) is expected to

report $0.37 for 4Q.

First Financial Bankshares Inc (FFIN) is expected to report

$0.34 for 4Q.

Fortrea Holdings Inc (FTRE) is expected to report for 4Q.

HB Fuller Co (FUL) is expected to report $1.07 for 4Q.

Hingham Institution for Savings (HIFS) is expected to report for

4Q.

John Marshall Bancorp Inc (JMSB) is expected to report for

4Q.

Kinder Morgan Inc (KMI) is expected to report $0.31 for 4Q.

Madison Pacific Properties Inc - B Share (MPC.T) is expected to

report for 1Q.

Ocean Biomedical Inc (OCEA) is expected to report for 3Q.

Parke Bancorp Inc (PKBK) is expected to report for 4Q.

Plumas Bancorp (PLBC) is expected to report $1.23 for 4Q.

Prologis Inc (PLD) is expected to report $0.60 for 4Q.

SeaChange International Inc (SEAC) is expected to report for

3Q.

Synovus Financial (SNV) is expected to report $0.40 for 4Q.

U.S. Bancorp (USB) is expected to report $0.71 for 4Q.

Wayne Savings Bancshares Inc (WAYN) is expected to report for

4Q.

Wintrust Financial Corp (WTFC) is expected to report $2.42 for

4Q.

Powered by Kantar Media and Dow Jones.

ANALYST RATINGS ACTIONS

Acadia Realty Trust Cut to Hold From Buy by Truist

Securities

Ambrx Biopharma Cut to Neutral From Outperform by Baird

Americold Realty Trust Raised to Buy From Hold by Truist

Securities

APA Cut to Sector Perform From Sector Outperform by

Scotiabank

AvalonBay Cut to Hold From Buy by Truist Securities

Axonics Cut to Hold From Buy by Truist Securities

Bank of America Cut to Hold From Buy by Odeon Capital

BlackRock Raised to Outperform From Market Perform by TD

Cowen

Boeing Cut to Equal-Weight From Overweight by Wells Fargo

Boot Barn Holdings Cut to Hold From Buy by Williams Trading

Boston Beer Raised to Market Perform From Underperform by

Bernstein

Brinker International Cut to Underweight From Equal-Weight by

Morgan Stanley

Brinker International Raised to Buy From Hold by Gordon

Haskett

Cactus Cut to Hold From Buy by Benchmark

Carrols Restaurant Cut to Equal-Weight From Overweight by

Stephens & Co.

Celanese Cut to Underperform From Neutral by B of A

Securities

Centerspace Raised to Outperform From Sector Perform by RBC

Capital

Chevron Cut to Sector Perform From Sector Outperform by

Scotiabank

CMS Energy Raised to Outperform From Peer Perform by Wolfe

Research

Coherent Raised to Overweight From Equal-Weight by Barclays

CVR Energy Cut to Sector Underperform From Sector Perform by

Scotiabank

DocuSign Raised to Equal-Weight From Underweight by Morgan

Stanley

Dollar General Raised to Overweight From Equal-Weight by Morgan

Stanley

Domino's Pizza Raised to Buy From Hold by Gordon Haskett

Dow Raised to Buy From Neutral by B of A Securities

Driven Brands Holdings Cut to Equal-Weight From Overweight by

Morgan Stanley

DTE Energy Cut to Peer Perform From Outperform by Wolfe

Research

DuPont de Nemours Cut to Underperform From Buy by B of A

Securities

Dutch Bros Raised to Buy From Hold by Stifel

Ecolab Raised to Neutral From Underperform by B of A

Securities

Equinix Raised to Buy From Hold by Truist Securities

Equity Lifestyle Cut to Hold From Buy by Truist Securities

Federal Realty Raised to Buy From Hold by Truist Securities

Five Below Cut to Hold From Buy by Craig-Hallum

Floor & Decor Holdings Cut to Market Perform From Outperform

by Bernstein

Fluence Energy Raised to Outperform From Market Perform by BMO

Capital

FMC Corporation Cut to Underperform From Neutral by B of A

Securities

G-III Apparel Cut to Underweight From Equal-Weight by Wells

Fargo

Harpoon Therapeutics Cut to Market Perform From Outperform by TD

Cowen

Helmerich & Payne Cut to Hold From Buy by Benchmark

Hercules Capital Cut to Neutral From Buy by Compass Point

Hewlett Packard Ent Cut to Market Perform From Outperform by

Bernstein

Home Depot Raised to Overweight From Neutral by Piper

Sandler

Hyatt Hotels Cut to Neutral From Buy by Redburn Atlantic

Levi Strauss Cut to Equal-Weight From Overweight by Wells

Fargo

MasTec Cut to Neutral From Outperform by Baird

Mid-America Apartment Raised to Buy From Hold by Truist

Securities

Mid-America Apartment Raised to Sector Perform From Sector

Underperform by Scotiabank

Nabors Cut to Hold From Buy by Benchmark

NetApp Cut to Market Perform From Outperform by Raymond

James

Northrop Grumman Cut to Neutral From Outperform by Baird

NOV Cut to Hold From Buy by Benchmark

OGE Energy Cut to Neutral From Buy by Ladenburg Thalmann

Omega Healthcare Cut to Neutral From Buy by B of A

Securities

Parsons Raised to Outperform From Neutral by Baird

Patterson-UTI Cut to Hold From Buy by Benchmark

PayPal Holdings Cut to Neutral From Buy by Mizuho

ProPetro Holding Cut to Hold From Buy by Benchmark

Raytheon Technologies Cut to Neutral From Outperform by

Baird

Rent the Runway Cut to Equal-Weight From Overweight by Wells

Fargo

Revvity Cut to Neutral From Buy by UBS

Rocket Cos. Cut to Sell From Neutral by Citigroup

Sallie Mae Raised to Buy From Neutral by Citigroup

Sana Biotechnology Raised to Buy From Neutral by HC Wainwright

& Co.

SL Green Realty Cut to Hold From Buy by Truist Securities

Starbucks Cut to Hold From Buy by Gordon Haskett

Starbucks Raised to Overweight From Equal-Weight by Morgan

Stanley

Sun Communities Cut to Hold From Buy by Truist Securities

Sweetgreen Cut to Underweight From Equal-Weight by Morgan

Stanley

Tractor Supply Cut to Underweight From Equal-Weight by Morgan

Stanley

Transphorm Cut to Hold From Buy by Benchmark

Triumph Group Raised to Outperform From Neutral by Baird

Valvoline Raised to Overweight From Equal-Weight by Morgan

Stanley

Ventas Raised to Buy From Neutral by B of A Securities

Wabtec Raised to Buy From Neutral by B of A Securities

Wayfair Raised to Overweight From Equal-Weight by Morgan

Stanley

Wendy's Cut to Hold From Buy by Gordon Haskett

Western Digital Raised to Buy From Hold by Deutsche Bank

Western Digital Raised to Overweight From Equal-Weight by

Barclays

Whitestone REIT Raised to Buy From Hold by Truist Securities

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

January 17, 2024 06:29 ET (11:29 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

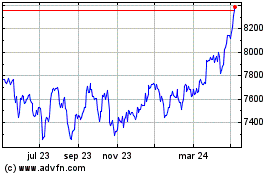

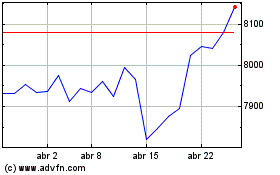

FTSE 100

Gráfica de índice

De Abr 2024 a May 2024

FTSE 100

Gráfica de índice

De May 2023 a May 2024