Swiss Franc Firms In Cautious Trade

22 Marzo 2024 - 6:05AM

RTTF2

The Swiss franc moved up against its major counterparts in the

New York session on Friday, as U.S. stocks dropped amid profit

taking.

Lingering uncertainty about the outlook for interest rates

weighed on the markets following the Federal Reserve's monetary

policy announcement earlier in the week.

While the Fed maintained its forecast for three interest rate

cuts this year, the timing of the first rate cut remains

undetermined.

The chances of a quarter point rate cut in June have rebounded

to 65.9 percent, according to CME Group's FedWatch Tool, but there

is still a 27.8 percent chance the Fed will leave rates unchanged

at the meeting.

Investors digested unexpected dovish moves from certain central

banks, notably the Swiss National Bank.

The franc edged up to 0.9709 against the euro and 1.1314 against

the pound, off its early lows of 0.9757 and 1.1380, respectively.

The currency is likely to locate resistance around 0.95 against the

euro and 1.11 against the pound.

The franc rebounded to 168.58 against the yen and 0.8969 against

the greenback, from an early 3-day low of 167.97 and more than a

4-month low of 0.9020, respectively. Next key resistance for the

currency may be located around 170.00 against the yen and 0.88

against the greenback.

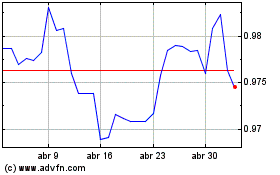

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

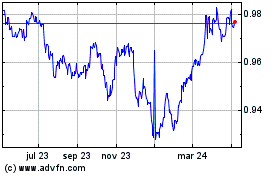

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024