Euro Appreciates After Hawkish ECB Remarks

21 Junio 2022 - 2:28AM

RTTF2

The euro spiked up against its major counterparts in the

European session on Tuesday, following comments from European

Central Bank Chief Economist Philip Lane that a bigger 50 basis

point hike is possible at the meeting in September.

The ECB would not revisit its decision to raise interest rates

by 25 basis points at its meeting next month, Lane said on

Monday.

The exit from negative rates would be done in two stages, first

by lifting the negative 0.5 percent deposit rate to minus 0.25

percent in July and by a possibly larger amount in September, Lane

told.

"With inflation rising sharply, there has been good reason to

expedite the normalisation of monetary policy," ECB Governing

Council member Olli Rehn said.

ECB President Christine Lagarde told the European lawmakers on

Monday that the decision to develop a crisis tool underscored a

previous commitment to keep inflation under control.

German bond yields rose, with the yield on the 10-year German

bund reaching 1.75 percent.

The euro climbed to 1.3669 against the loonie, from a 4-day low

of 1.3613 it touched at 2 am ET. If the euro rises further, 1.38 is

likely seen as its next resistance level.

The euro advanced to a 5-day high of 1.0582 against the

greenback and a 4-day high of 1.0215 against the franc, coming off

from its prior lows of 1.0506 and 1.0163, respectively. The next

possible resistance for the euro is seen around 1.08 against the

greenback and 1.05 against the franc.

Reversing from its early lows of 1.5079 against the aussie and

1.6578 against the kiwi, the euro moved up to a 6-day high of

1.5170 and a 4-day high of 1.6651, respectively. The euro is likely

to find resistance around 1.53 against the aussie and 1.72 against

the kiwi.

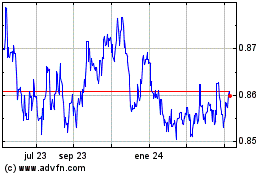

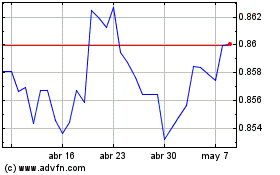

Against the pound, the single currency was up at 0.8597. Next

key resistance for the euro is likely seen around the 0.88

level.

The euro firmed to its highest level since June 9 against the

yen, at 143.21. The euro is seen finding resistance around the

145.00 level.

Looking ahead, Canada new housing price index for May and retail

sales for April and U.S. existing home sales for May will be

featured in the New York session.

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Abr 2023 a Abr 2024