TIDM88E

RNS Number : 2255T

88 Energy Limited

13 November 2023

This announcement contains inside information

13 November 2023

88 Energy Limited

NAMIBIAN OIL AND GAS FARM-IN AGREEMENT

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) ( 88 Energy or

the Company ) is pleased to announce the execution of a three stage

farm-in agreement ( Farm-In Agreement ) with a wholly-owned

subsidiary of Monitor Exploration Limited ( Monitor ) to earn up to

a 45% non-operated working interest in onshore Petroleum

Exploration Licence 93 ( PEL 93 ), located in the Owambo Basin,

Republic of Namibia ( Namibia ).

Farm-In Agreement Highlights

-- Farm-In Agreement provides a staged entry into PEL 93, a vast

18,500km(2) onshore acreage position comprising blocks 1717 and

1817 in the Owambo Basin, Namibia (the Licence).

-- Namibia represents one of the last frontier oil and gas

jurisdictions capable of delivering multi-billion barrel

discoveries, as evidenced by the recent Venus-1X offshore light oil

discovery .

-- Exposure to a first-class operating jurisdiction, with a highly competitive petroleum regime.

-- Farm-In Agreement provides an opportunity to earn a

significant working interest with future potential to transition to

project operator.

-- Farm-in to PEL 93 and forward work-program complementary to

88E's existing Alaskan exploration and appraisal activities.

-- Partner and operator, Monitor, has deep technical experience

with extensive in-country and regional knowledge.

-- The Licence includes an extensive lead portfolio, with ten

significant independent structural closures identified from a range

of geophysical and geochemical techniques. Considerable potential

for more leads to be identified as dataset is expanded.

-- Pathway to potential commercialisation with logical staged work-program.

-- Forward program to include acquisition of 200 line-kilometres

of low-impact 2D seismic planned for mid-2024 and potential initial

exploration well targeting the Damara play as early as H2

CY2025.

-- Farm-in Agreement remains subject to Namibian government and

other regulatory approvals, which are expected to be received by Q1

2024.

88 Energy Managing Director, Ashley Gilbert, commented:

"The execution of this farm-in agreement with Monitor provides

88 Energy and its shareholders with a fantastic opportunity to earn

a significant working interest in a very large scale, highly

prospective, under-explored acreage position on attractive and

logically staged commercial terms.

We are very pleased to be partnering with Monitor who will

provide a wealth of technical expertise and strong in-country and

regional exploration experience. Monitor has completed a systematic

historical work-program that has identified significant

large-scale, untested prospects.

While 88 Energy is continuing its focus on its existing Alaskan

North Slope assets, PEL 93 provides a logical expansion of 88

Energy's existing portfolio, with similar scale and potential that

our shareholders are accustomed to. The Licence includes an

extensive lead portfolio which will provide an increased level of

activity and value catalysts throughout the year.

We look forward to providing further detail on the project

including an upcoming activity schedule aimed at delivering an

initial program of approximately 200 line-kilometres of low-impact

2D seismic. This will minimise the environmental impact and be used

to better define potential drilling prospects for as early as the

second half of 2025."

Farm-In Agreement detail

The Farm-In Agreement is between Eighty Eight Energy (Namibia)

(Pty) Ltd ( 88EN ), a newly formed, wholly owned subsidiary of 88

Energy and private Namibian company, Monitor Oil and Gas

Exploration (Namibia) Pty Ltd ( MELN ), a wholly owned subsidiary

of Monitor. MELN currently holds a 75% working interest in the

Licence and acts as Operator of the exploration and development of

PEL 93. Private Namibian company, Legend Oil Namibia (Pty) Ltd (

Legend ) holds a 15% working interest and and Namibian government

entity National Petroleum Corporation of Namibia (Pty) Ltd ( NAMCOR

) holds a 10% working interest in the Licence.

Under the terms of the Farm-In Agreement 88 Energy, together

with the current working interest owners, will become party to a

new Joint Operating Agreement ( JoA ) in relation to the Licence

and may earn up to a 45% working interest in PEL 93 by funding its

share of agreed costs under the 2023-2024 approved work program and

budget as defined in the Farm-In Agreement ( 2024 Work Program ),

and any future work program budgets yet to be agreed. The maximum

total investment costs are anticipated to be US$18.7 million.

Three stage Farm-In Agreement schedule :

-- Stage 1: 88 Energy to pay Monitor US$3.7 million over four

instalments, in consideration for past costs of US$0.7 million as

well as a carry of up to the first US$3 million(1) of the 2024 work

program which includes a 250 line-kilometer 2D seismic acquisition

program on behalf of the Joint Venture, for a total of 20% working

interest in PEL 93:

-- 1(st) instalment: US$0.28 million in cash on signing for

partial payment of back costs;

-- 2(nd) instalment: US$1.25 million to be paid in 88 Energy

shares on signing for part payment of the 2D seismic carry(4) ;

-- 3(rd) instalment: US$1.25 million to be paid in 88 Energy

shares upon approval of the Licence working interest transfer by

the Namibian government expected within 30-60 days, as a further

payment in relation to the 2D seismic program carry; and

-- 4(th) Instalment: US$0.9 million in cash to be paid on or

before 1 June 2024 for remaining payment of back costs and 2024

work-program carry.

-- Stage 2: 88 Energy to pay to MELN up to the first US$7.5

million of the first well gross cost, estimated at US$12 million,

to receive a further 17.5% working interest , for a total of

37.5%(2) working interest.

-- Stage 3: 88 Energy has the option to fund the first US$7.5

million of the second well gross cost, estimated at US$12

million(3) , to receive a further 7.5% working interest taking 88

Energy's aggregate working interest to 45% .

-- Following the commencement of commercial production, Monitor

will also be entitled to a Gross Royalty of 2% of the revenues.

Any 88 Energy shares to be issued under the Farm-In Agreement

will be issued under the Company's placement capacity pursuant to

ASX Listing Rule 7.1.

1. Any agreed Joint Venture costs exceeding US$3M to be shared

between MELN and 88E, pro rata to their total Licence interests,

being 55% and 20%, respectively.

2. Conditional on 88E's positive assessment of the work

programme. Any agreed JV costs exceeding US$7.5M from commencement

of drill planning activities to be shared equally between MELN and

88E.

3. Combined MELN and 88E estimated cost of US$10M. Any MELN and

88E JV costs exceeding US$7.5M from commencement of drilling

planning activities to be shared pro-rata to their licence

interests, being 30% and 45% respectively, to receive a final 7.5%

of the JV for a total of 45% of the JV, providing MELUK has decided

not to exercise its right to fund its then 37.5% equity share of

the cost.

4. To be returned in cash or as an equivalent interest in MELN

in proportion to the participating interest that would have been

transferred to 88EN, net of costs, if Government approval is not

received.

Background to the Licence area

PEL 93 covers a vast 18,500 km(2) acreage position in the north

of Namibia, comprising blocks 1717 and 1817 within the Owambo

Basin. The region has been identified as one of the last remaining

under-explored onshore frontier basins and one of the World's most

prospective new exploration zones.

Recent drilling results on nearby acreage has highlighted the

potential of a new and underexplored conventional oil and gas play

in the Damara Fold belt, referred to as the Damara Play.

Historical assessment utilised a combination of techniques and

interpretation of legacy data to identify the Owambo Basin, and

specifically blocks 1717 and 1817, as having significant

exploration potential.

88 Energy has been impressed with the systematic exploration

approach undertaken by Monitor since award of PEL 93 in 2018 and is

extremely encouraged by the correlation and validation of results

to date, which has highlighted the enormous potential of the

acreage.

PEL 93 has entered the first renewal period which requires a

firm commitment to complete a (i) 200+ line-kilometre 2D seismic

program (minimum spend of US$2 million) and (ii) to drill a

contingent exploration well within a two-year period commencing

October 2023.

The current and potential future PEL 93 Joint Venture partners

and working interests are as follows:

Entity Pre Stage 1 Stage 2 Stage 3

Farm-in

(Past costs (1(st) Well) (2(nd) Well)

& 2D)

Monitor* 75.0% 55.0% 37.5% 30.0%

--------- ------------- -------------- --------------

Legend 15.0% 15.0% 15.0% 15.0%

--------- ------------- -------------- --------------

NAMCOR 10.0% 10.0% 10.0% 10.0%

--------- ------------- -------------- --------------

88 Energy - 20.0% 37.5% 45.0%

--------- ------------- -------------- --------------

*Operator

Figure 1: PEL 93 location in the Owambo Basin, Northern Republic

of Namibia.

About Monitor

Monitor is a private UK exploration company, established in

2018, for onshore oil and gas exploration with a focus on Namibia.

Monitor was formed by Geodynamics Worldwide ( Geodynamics ), a

specialist oil service company, and has leveraged this proprietary

relationship to select and survey the most promising acreages

positions. The management and technical team at Monitor have

considerable business experience in the sector on the African

continent, including Namibia, and will be an invaluable partner to

88 Energy in the advancement of PEL 93.

Monitor was established to take advantage of:

-- Direct access to geophysical technologies, managed and

operated by Geodynamics and its partners, that reduce the risk,

time, and cost of identifying hydrocarbons directly.

-- Sedimentary basins in Africa that are relatively

under-explored but prospective geologically and locations where

local experience exists in terms of geological and geophysical

data.

-- Countries that are prepared to offer attractive terms, are

non-restrictive or onerous on work programs, and allow the option,

as opposed to the obligation, to progress on a phased approach.

-- Scope to obtain substantial initial interests in licences,

whilst partnering with local companies to promote national

content.

Forward work plan

Monitor has utilised a range of geophysical and geochemical

techniques to assess and validate the significant potential of the

acreage since award of PEL 93 in 2018. It has identified 10

independent structural closures from airborne geophysical methods

and partly verified these using existing 2D seismic coverage.

Further, ethane concentration measured in soil samples over

interpreted structural leads validates the existence of an active

petroleum system, with passive seismic anomalies also aligning

closely to both interpreted structural leads and measured alkane

molecules (c1-c5) concentrations in soil.

Figure 2: Lead inventory showing proposed 2D seismic program.

(structural leads derived from airborne gravity data)

The forward work-program will start with a low impact 200

line-kilometre 2D seismic program focusing on confirming the

structural closures of the 10 independent leads identified. The 2D

seismic program will be conducted in mid-2024 following a period of

planning, public consultation, updating of environmental compliance

requirements and relevant approvals. Results from the 2D seismic

program will then be incorporated into existing historical

exploration data over the acreage, with results used to identify

possible exploration drilling locations.

An indicative forward work-program is shown below;

The forward work-program is subject to exploration results and

relevant Government and Joint Venture approvals.

This announcement has been authorised by the Board.

Media and Investor Relations

88 Energy Ltd

Ashley Gilbert, Managing Director

Tel: +61 8 9485 0990

Email: investor-relations@88energy.com

Fivemark Partners , Investor and Tel: +61 422 602 720

Media Relations

Michael Vaughan

EurozHartleys Ltd Tel: + 61 8 9268 2829

Dale Bryan

Cavendish Securities Plc Tel: + 44 131 220 6939

Derrick Lee / Pearl Kellie

Pursuant to the requirements of the ASX Listing Rules Chapter 5

and the AIM Rules for Companies, the technical information and

resource reporting contained in this announcement was prepared by,

or under the supervision of, Dr Stephen Staley, who is a

Non-Executive Director of the Company. Dr Staley has more than 40

years' experience in the petroleum industry, is a Fellow of the

Geological Society of London, and a qualified

Geologist/Geophysicist who has sufficient experience that is

relevant to the style and nature of the oil prospects under

consideration and to the activities discussed in this document. Dr

Staley has reviewed the information and supporting documentation

referred to in this announcement and considers the resource and

reserve estimates to be fairly represented and consents to its

release in the form and context in which it appears. His academic

qualifications and industry memberships appear on the Company's

website and both comply with the criteria for "Competence" under

clause 3.1 of the Valmin Code 2015. Terminology and standards

adopted by the Society of Petroleum Engineers "Petroleum Resources

Management System" have been applied in producing this

document.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGRQXLBFXFLZFBL

(END) Dow Jones Newswires

November 13, 2023 02:00 ET (07:00 GMT)

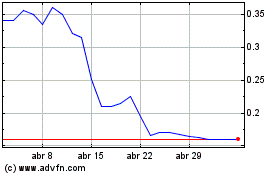

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De May 2023 a May 2024