TIDM88E

RNS Number : 0479V

88 Energy Limited

29 November 2023

This announcement contains inside information

29 November 2023

88 Energy Limited

SUCCESSFUL PLACEMENT TO RAISE A$9.9M

Highlights

-- Successful oversubscribed share placement to raise A$9.9

million (before costs) to domestic and international institutional

and sophisticated investors

-- Issue price of A$0.0045 per share (GBP0.0023 per share),

including 1 option/warrant for every 3 placement shares issued

-- Company is now fully funded for the upcoming Hickory-1 flow

test program, including contingencies to cover financial exposure

relating to the financial position of the Project Phoenix Joint

Venture partner

-- Funds from the placement will also be directed towards

initial exploration activities in Namibia

-- 88 Energy is now focused on delivering the successful flow

testing of multiple reservoirs at the Hickory-1 well in Q1 2024

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) ( 88 Energy or

the Company ) is pleased to advise that it has successfully

completed a bookbuild to domestic and international institutional

and sophisticated investors to raise A$9.9 million (approx. GBP5.16

million) before costs (the Placement ). The Placement will involve

the issue of 2,200,000,005 new fully paid ordinary shares in the

Company (the New Ordinary Shares ) at an issue price of A$0.0045

(GBP0.0023) per New Ordinary Share) (the Issue Price ).

In addition, the Company will issue options on a 1 for 3 basis

for shares subscribed for in the Placement to ASX investors (

Options ) with the Company intending on listing the Options on the

ASX, subject to certain conditions. The Options are exercisable at

A$0.0075 per share and expire three years from the date of issue.

Investors participating in the Placement in the UK will receive 1

warrant for every 3 shares subscribed for ( Warrants ), with an

exercise price of GBP0.0039. The Warrants are unlisted and can be

exercised at any time before 15 December 2026.

The net proceeds of the Placement, together with the Company's

existing cash reserves (A$9.4 million as at 31 October 2023,

unaudited), will be used to fund:

-- upcoming flow testing operations at the Project Phoenix

Hickory-1 well (North Slope, Alaska; 88E existing 75% net working

interest);

-- initial farm-in exploration activities at the Company's

recently acquired Owambo Basin acreage in Namibia; and

-- contingencies and additional working capital.

The Hickory-1 flow test planning and permitting remains on track

for program operations during Q1 2024. Following declaration of a

maiden 2C Contingent Resource estimate for the BFF reservoir of 157

MMBOE(1,3) , the program is set to focus on flow testing the

shallower SMD-B and SFS reservoirs. The SMD-B and SFS reservoirs

have been successfully flow tested by Pantheon Resources in the

northern adjacent acreage and are targeting a multi-million barrel

net mean prospective resource(1,2) .

The Placement enables 88 Energy to undertake the Hickory-1 flow

test despite the potential failure of its Project Phoenix JV

partner, Burgundy Xploration, LLC ( Burgundy ), to meet ongoing

obligations and cure its payment defaults by the requisite deadline

of 30 November 2023 (refer 88 Energy ASX release dated 31 October

2023). Burgundy has informed the Company that it is continuing to

finalise its fund raising program and will work with 88 Energy to

cure the default, however at this time 88 Energy has made the

decision to complete the Placement to secure funding arrangements

for the flow test in the absence of certainty of Burgundy's ability

to finance its share of the Hickory-1 activities. 88 Energy

maintains its rights under the Joint Operating Agreement, including

exercising the option to require Burgundy to relinquish its working

interests in the Project and Joint Venture.

88 Energy Managing Director and CEO, Ashley Gilbert,

commented:

"We are now fully funded to undertake Hickory-1 flow test

operations during the upcoming winter operational season in Alaska.

Burgundy's failure to rectify its payment default to date is

disappointing and has necessitated the raising of additional funds.

However, if not cured their default will enable us to exercise

remedies under the JOA which may include the potential for 88

Energy to move to a 100% working interest in some or all of the

leases within Projects Phoenix and Icewine West covered under the

default.

We are also excited about commencing initial exploration

activity on our Namibian farm-in acreage. The Owambo Basin delivers

large-scale hydrocarbon exploration potential across a highly

prospective and underexplored acreage position."

Placement details

The issue of the 2,200,000,005 New Ordinary Shares and a total

of 733,333,332 associated Options/Warrants fall within the

Company's placement capacity pursuant to ASX Listing Rules 7.1 and

7.1A and is not subject to shareholder approval:

-- 916,622,618 New Ordinary Shares and a total of 733,333,332

Options/Warrants will be issued under the Company's available

placement capacity pursuant to Listing Rule 7.1; and

-- 1,283,377,387 New Ordinary Shares will be issued under the

Company's available placement capacity pursuant to Listing Rule

7.1A.

The New Ordinary Shares will rank pari passu with the existing

ordinary shares in the Company, with settlement on ASX scheduled

for 7 December 2023. Application has been made for the New Ordinary

Shares to be admitted to trading on AIM (Admission), with Admission

expected to occur at 8.00am on 8 December 2023.

Following the issue of the New Ordinary Shares, the Company will

have 24,318,655,048 ordinary shares on issue, all of which have

voting rights. The figure of 24,318,655,048 ordinary shares may be

used by shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or change their interest in, the Company.

The Issue Price represents a 18.2% discount to the closing price

of A$0.0055 on 27 November 2023 and a 23.6% discount to the ASX

VWAP for the ten trading days prior to 28 November 2023.

The attaching Options will be exercisable at A$0.0075, each with

an expiry date three years from issue.

The Company intends to apply for quotation of the Options on the

ASX (but not on AIM), subject to meeting ASX minimum listing

requirements.

Instead of attaching Options, investors in the UK Placement will

be granted Warrants on materially the same terms as the Options.

The warrants will be unlisted and have a Sterling exercise price of

GBP GBP0.0039 and expiry on 15 December 2026 .

Euroz Hartleys Limited acted as Sole Lead Manager and Bookrunner

to the Placement. Cavendish Capital Markets Ltd acted as Nominated

Adviser and Sole Broker to the Placement in the United Kingdom.

Inyati Capital Pty Ltd acted as Co-Manager to the Placement.

Commission for the Placement was 6% (plus GST) of total funds

raised across Euroz Hartleys Limited, Inyati Capital Pty Ltd and

Cavendish Capital Market Ltd. In addition and subject to

shareholder approval, the Company will issue a total of 75,000,000

Options or Warrants (collectively) to the managers of the Placement

(on the same terms as the ASX Options and UK Warrants).

JV partner update

As previously reported, the Company's 100%-owned subsidiary

Accumulate Energy Alaska, Inc (88E-Accumulate) entered into a

standstill and option agreement with its Project Phoenix JV

partner, Burgundy. The agreement provided Burgundy additional time

to raise funds to pay its outstanding cash calls by 31 October

2023.

On 31 October 2023, 88E-Accumulate issued Burgundy with a

default notice under the JOA in respect of its outstanding cash

calls for the 2023 work program and budget including acreage lease

payments and share of costs associated with the Hickory-1 well that

was completed in Q1 CY2023 (Cash Calls). Burgundy could cure its

payment defaults under the JOA if 88E-Accumulate received payment

in full of the cash call amount totalling US$3.4 million within 30

days.

Whilst Burgundy continues to support the progression of the

upcoming Hickory-1 flow test program, it has failed to make this

payment by the requisite default notice deadline of 30 November

2023 .

As a result, 88E-Accumulate now intends to exercise some or all

of the remedies available under the JOA. Remedies include

88E-Accumulate having the right to require that Burgundy completely

withdraw from the JOA and assign all of its participating interest

in the relevant leases to 88E-Accumulate. This may result in 88

Energy holding a 100% working interest in some or all of the leases

covered under the default within Project Phoenix and Project

Icewine West. Any additional working interest secured under the

default process could create greater flexibility around any

possible future farm-out arrangement.

88 Energy remains committed to the upcoming Hickory-1 flow test

program and has undertaken the Placement to ensure it is

sufficiently funded to proceed with the program.

Pursuant to the requirements of the ASX Listing Rules Chapter 5

and the AIM Rules for Companies, the technical information and

resource reporting contained in this announcement was prepared by,

or under the supervision of, Dr Stephen Staley, who is a

Non-Executive Director of the Company. Dr Staley has more than 40

years' experience in the petroleum industry, is a Fellow of the

Geological Society of London, and a qualified

Geologist/Geophysicist who has sufficient experience that is

relevant to the style and nature of the oil prospects under

consideration and to the activities discussed in this document.

Dr Staley has reviewed the information and supporting

documentation referred to in this announcement and considers the

resource and reserve estimates to be fairly represented and

consents to its release in the form and context in which it

appears. His academic qualifications and industry memberships

appear on the Company's website and both comply with the criteria

for "Competence" under clause 3.1 of the Valmin Code 2015.

Terminology and standards adopted by the Society of Petroleum

Engineers "Petroleum Resources Management System" have been applied

in producing this document.

This announcement has been authorised by the Board.

Media and Investor Relations:

88 Energy Ltd

Ashley Gilbert, Managing Director

Tel: +61 (0)8 9485 0990

Email: investor-relations@88energy.com

Fivemark Partners, Investor and Media Relations

Michael Vaughan Tel: +61 (0)422 602 720

EurozHartleys Ltd

Dale Bryan Tel: +61 (0)8 9268 2829

Cavendish Capital Markets

Limited

Derrick Lee Tel: +44 (0)131 220 6939 / +44

(0)20 7397 8900

Pearl Kellie

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFEASMUEDSEIF

(END) Dow Jones Newswires

November 29, 2023 02:03 ET (07:03 GMT)

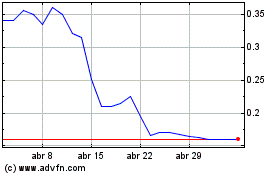

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De May 2023 a May 2024