TIDMATM

RNS Number : 5203T

Andrada Mining Limited

15 November 2023

15 November 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in

the United Kingdom pursuant to the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information will be in the

public domain.

Andrada Mining Limited

("Andrada" or the "Company")

Renewal of the THAISARCO and AFRIMET off-take agreements

Andrada Mining Limited (AIM: ATM, OTCQB: ATMTF), an African

technology metals mining company with a portfolio of production and

exploration assets in Namibia, is pleased to confirm the renewal of

off-take agreements with the Thailand Smelting and Refining Co.

Limited ("Thaisarco") and AfriMet Resources AG ("AfriMet") for tin

concentrate and tantalum concentrate, respectively.

Highlights

-- Renewal of the Thaisarco off-take agreement for a further

three years commencing 1 December 2023 for a minimum supply of 90

metric tonnes ("mt") per month and up to 100% of the expanded

production.

-- Renewal of the AfriMet off-take agreement for plant

production period of 12 months commencing 1 January 2024 with an

option to receive advance payment.

Anth ony Viljoen, Chief Executive Officer, commented:

"Our relationship with Thaisarco has been extremely successful

and we are happy to be renewing the off-take agreement for another

three years. The agreement secures off-take of our tin production,

allowing management to focus on achieving the Orion royalty

tonnage. Importantly, we are proud of the major milestones we have

achieved at Uis Mine to date, including the successful expansion of

the processing plant and the on-going continuous improvement

programme to enhance efficiencies and profitability.

"The renewal of the tantalum off-take agreement secures all the

Company's tantalum production and, despite the small tantalum

concentrate volumes, the additional revenue will incrementally

improve profitability. Producing tantalum adds the second

technology-metal to Andrada's portfolio of products and is a

positive step towards participating in the green transition."

Andrew Davies, Managing Director of Thaisarco commented:

"We are pleased to have renewed the offtake agreement with

Andrada, following a mutually beneficial initial contract. As a

major smelter, we are well - positioned to absorb Andrada's planned

increase in production. Our partnership with Anthony and his team

has been extremely successful, and we look forward to continuing to

support the Company's growth story."

Hadley Natus, Chief Executive Officer of AfriMet commented:

"The renewal of the tantalum o take agreement with Andrada is a

positive step in strengthening our relationship. While the initial

contract was not activated, we remain confident in our partnership

and look forward to working with Andrada to supply the specialist

tantalum market."

TIN concentrate OFF-TAKE AGREEMENT: thaisarco

Thaisarco was established in 1963 and is recognised globally as

an industry leader in the manufacture of tin, tin alloys, and

tin-related products. The renewed contract with Thaisarco is for

three years from 1 December 2023 to 30 November 2026. Thaisarco has

the capacity to absorb the planned increase of tin production in

line with the Orion royalty agreement. (See announcement dated 15

August 2023).

The Company will supply up to 100% of its production with a

minimum of 90mt per month, with prices linked to the London Metal

Exchange pricing (after deducting treatment and impurity

charges).

Tantalum concentrate off-take AGREEMENT: aFRImet

AfriMet is a strategic African commodity trading company and 100

percent- owned subsidiary of the Zug (Switzerland) based ferrous

and non-ferrous commodity merchant, VanoMet AG. AfriMet is a leader

in the trading of tin, tantalum, and tungsten. The o take agreement

is for a period of 12 months, commencing 1 January 2024, and will

absorb all the production from the recently commissioned tantalum

circuit at Uis Mine. .The pricing will be linked to Argus Metals

and Asian Metals tantalum prices. Andrada also has the right to

elect to receive an advance payment, to the value of 50% of the

cargo, 30 days prior to the expected delivery date.

Andrada's operations are being continually improved and

optimised to ensure the efficient production of both tin and

tantalum to meet the off-take agreements.

CONTACT

Andrada Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO investorrelations@andradamining.com

Sakhile Ndlovu, Investor Relations

Nominated Adviser

WH Ireland Limited

Katy Mitchell +44 (0) 207 220 1666

Corporate Adviser and Joint

Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Matt Hasson +44 (0) 20 7907 8500

Stifel Nicolaus Europe Limited

Ashton Clanfield

Calum Stewart

Varun Talwar +44 (0) 20 7710 7600

Tavistock Financial PR (United +44 (0) 207 920 3150

Kingdom) andrada@tavistock.co.uk

Jos Simson

Catherine Drummond

Adam Baynes

About Andrada Mining Limited

Andrada Mining Limited, is a London-listed technology metals

mining company with a vision to create a portfolio of globally

significant, conflict-free, production and exploration assets. The

Company's flagship asset is the Uis Mine in Namibia, formerly the

world's largest hard-rock open cast tin mine.

An exploration drilling programme is currently underway at Uis

with the aim of expanding the tin resource over the fourteen

additional, historically mined pegmatites, all of which occur

within a 5 km radius of the current processing plant. The Company

has set a mineral resource target of 200 Mt to be delineated within

the next 5 years. The existing mine, together with its substantial

mineral resource potential, allows the Company to consider

economies of scale.

Andrada is managed by a board of directors with considerable

industry knowledge and a management team with extensive commercial

and technical skills. Furthermore, the Company is committed to the

sustainable development of its operations as demonstrated by the

way the leadership team places emphasis on creating value for the

wider community, investors, and other key stakeholders. Andrada has

established an environmental, social and governance (ESG) system

that has been implemented at all levels of the Company and aligns

with international standards.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBABFTMTBBMIJ

(END) Dow Jones Newswires

November 15, 2023 02:00 ET (07:00 GMT)

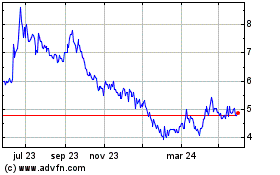

Andrada Mining (LSE:ATM)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

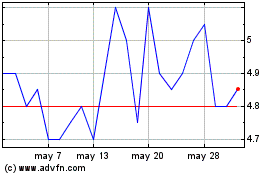

Andrada Mining (LSE:ATM)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024