TIDMBIOG

LONDON STOCK EXCHANGE ANNOUNCEMENT

The Biotech Growth Trust PLC

(the "Company")

Unaudited Half Year Results For The Six Months Ended 30 September 2023

This announcement is not the Company's Half Year Report. It is an abridged

version of the Company's full Half Year Report for the six months ended 30

September 2023. This announcement contains references to graphs and charts which

appear in the full Half Year Report, which will shortly be available on the

Company's website at www.biotechgt.com. Up to date information on the Company,

including daily NAVs, share prices and monthly fact sheets, can also be found on

the website.

The Company's Half Year Report for the six months ended 30 September 2023 has

been submitted to the Financial Conduct Authority, and will shortly be available

for inspection on the National Storage Mechanism (NSM) at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

For further information please contact: Katherine Manson, Frostrow Capital LLP,

020 3709 8734

COMPANY PERFORMANCE

KEY STATISTICS

As at As at %

30 September 31 March Change

2023 2023

Net asset value ("NAV") per share 817.9p 852.6p (4.1)

Share price 776.0p 783.0p (0.9)

Discount of share price to NAV per share^ 5.1% 8.2%

Nasdaq Biotechnology Index (sterling adjusted) 3,239.10 3,340.80 (3.0)

Gearing^ 3.1% 7.8%

Ongoing Charges^ 1.1% 1.1%

Active Share*^ 68.1% 76.6%

^Alternative Performance Measure (see Glossary)

*Source: Morningstar

CHAIRMAN'S STATEMENT

INTRODUCTION AND RESULTS

In the first six months of this financial year, the Company's NAV per share

total return^ was -4.1%, underperforming the decline of 3.0% in the NASDAQ

Biotechnology Index (the "NBI" or the "Benchmark"). The continuing difficult

economic environment, rising cost of capital and associated investor caution all

provided a challenging backdrop for a portfolio heavily weighted to small and

mid sized biotechnology stocks. It is an environment which has persisted for

some 18months and lies at the heart of the recent poor performance of our

Company relative to the Benchmark against which we measure ourselves.

The principal detractors from performance were Travere Therapeutics, uniQure and

StemiRNA. Travere Therapeutics and uniQure both announced disappointing trial

results during the period. StemiRNA, one of the Company's two remaining direct

private investments, was written down by 74% at the period end, contributing

1.3% to the decline in the Company's NAV, exceeding the total underperformance

relative to the Benchmark in the period. The reasons for this substantial

write-down are detailed in the Portfolio Manager's Review. The valuation was

produced by Kroll (an independent third-party valuation agent) and then reviewed

and agreed by both the AIFM's and the Company's Valuation Committees. The write

down was reflected in the Company's daily NAV announcements immediately upon

receipt of the updated valuation.

The Company has not made any new "crossover" investments (investments in a

company's last private funding round prior to an initial public offering

("IPO")) in the period. Investments in China represented 9.2% of the portfolio

as at the period end. The Portfolio Manager continues to believe in the high

levels of innovation found in the biotechnology sector in China, but the

difficult local macroeconomic and regulatory environments continue to deter

further investment.

In addition, the presence of gearing over the period detracted 0.3% from the

Company's NAV performance. While the Portfolio Manager usually aims to keep

gearing in the 5-10% range, given renewed interest rate pressure in the U.S.,

gearing was reduced from 7.8% to 3.1% over the period.

Despite these setbacks, there were some positive developments in the portfolio.

During the period, GSK announced their intention to acquire BELLUS Health at a

100% premium to the share price at the time, and Novartis announced their

intention to acquire Chinook Therapeutics at a 67% premium to the share price at

the time. BELLUS Health and Chinook Therapeutics were the top two contributors

during the period. Other positive contributors included Vera Therapeutics and

Ionis Pharmaceuticals which both announced positive trial results during the

period.

The Company's NAV benefited from the depreciation in sterling over the period by

1.3% against the U.S. dollar, being the currency in which the majority of the

Company's investments are denominated.

A fuller description of performance in the period is set out in the Portfolio

Manager's Review.

SHARE PRICE PERFORMANCE

The discount^ of the share price to the NAV per share narrowed over the period:

at 31 March 2023, the discount was 8.2% and at 30 September, 5.1%. This

reduction in the discount meant that the share price return^ over the six months

was -0.9% (2022: +10.7%).

DISCOUNT MANAGEMENT

The Company's shares traded at a discount to the NAV per share throughout the

period. Shareholders will be aware that the Company pursues an active discount

management policy, buying back shares when the discount of the Company's share

price to the NAV per share is higher than 6%. Accordingly, during the period the

Company bought back 2,861,502 shares at an average discount of 7.3% to the NAV

per share, at a cost of £23.1m.

At the period end there were 35,875,917 shares in issue and the share price

traded at a 5.1% discount to the NAV per share. As we have previously commented,

it remains possible for the share price discount to trade at a discount wider

than 6% for a period of days or indeed longer, particularly in volatile markets

and periods when investor risk appetites are muted. However, the Company remains

committed to protecting a 6% share price discount over the longer term. Since

the period end a further 575,440 shares have been bought back for cancellation

and at the time of writing the share price discount stands at 6.7%.

BOARD CHANGES

On 9 October we announced the appointment of Hamish Baillie to the Board,

effective 1 November. We are very pleased to have appointed a Director with such

extensive experience and expertise both in managing an investment trust and as a

non-executive director. Hamish has also been appointed to the Audit, Valuation,

Management Engagement, and Nominations Committees.

Hamish's appointment means that there will be seven directors on the Board for a

short period. Steve Bates, our Senior Independent Director, intends to retire at

the next Annual General Meeting at which point we will return to being a

sixperson Board.

PERFORMANCE FEE

Due to the ongoing underperformance against the Benchmark, there is no provision

within the Company's NAV for any performance fee payable at a future calculation

date.

As explained in more detail in the Annual Report, the performance fee is

calculated quarterly and is dependent on the long-term outperformance of the

Company. In addition, a performance fee only becomes payable if and when the

Company's cumulative outperformance gives rise to a performance fee that exceeds

the total of performance fees paid to date. This ensures that a performance fee

is not payable for any outperformance that contributes to recovery of prior

performance.

OUTLOOK

The future of the biotech sector is complex. On the one hand, current

macroeconomic conditions remain extremely challenging. Volatile equity markets,

rising interest rates and investor risk aversion all increase the cost of the

capital the sector relies on to fund investment. However, confidence can be

found in the exciting range and pace of innovation in the biotech sector. The

pace of innovation is accelerating and there is a robust pipeline of therapies

based on a wide variety of scientific and technological developments. The

challenge of the forthcoming `patent cliff' faced by larger biopharmaceutical

companies is an opportunity for the emerging biotech companies in which your

Company is invested and we expect to see a further increase in merger and

acquisition ("M&A") activity.

The Board shares the Portfolio Manager's and, no doubt, shareholders'

frustration with the length of time these catalysts are taking to materialise

but remains confident that the investment strategy will yield good returns in

the long term.

Roger Yates

Chairman

9 November 2023

^Alternative Performance Measure. See glossary.

PORTFOLIO MANAGER'S REVIEW

PERFORMANCE

The Company's NAV per share declined 4.1% during the six-month period ended 30

September 2023. This compares with a 3.0% decline in the Benchmark, the NASDAQ

Biotechnology Index (measured on a sterling adjusted basis).

Following a difficult fiscal year for the Company ending 31 March 2023,

macroeconomic factors continued to dominate biotech sector performance during

the review period. Long-term interest rates rose during the review period, which

continued to pressure shares of unprofitable emerging biotech companies. The

U.S. Federal Reserve (the "Fed") enacted two 0.25% increases in the Fed Funds

rate in May and July and opted to leave rates unchanged at its June and

September meetings, indicating a slowdown in the pace of interest rate hikes

from the aggressive pace of increases over the previous nine meetings. Even so,

10-year U.S. government yields increased from 3.47% to 4.57% during the review

period, as shown in Figure 1 on page 5 of the Half Year Report. While inflation

in the U.S. has been declining since its 9% peak in June 2022, the U.S. economy

remains strong. This has given the Fed flexibility to leave interest rates

higher for a longer duration of time in order to achieve its stated inflation

target of 2%. We continue to believe that the Fed is in the final stages of

raising interest rates and do not expect significant further rate hikes from

this point forward. However, Fed messaging that rates may stay "higher for

longer" has caused long-term interest rates to rise in the short term.

When it became apparent in September that 10-year yields might continue to

increase given the "higher for longer" expectation, we reduced some of our

emerging biotech positions to manage interest rate risk. We also reduced gearing

in the portfolio to the lower end of our normal gearing range of 5-10% to

maintain flexibility to add to positions at lower prices. Having said that, we

continue to believe that the unprecedented low valuations of emerging biotech

already heavily discount the expected impact of higher rates. Eventually rates

will stabilize or even fall, and that should precipitate a recovery in small

capitalization ("cap") emerging biotech.

It is important to note that the impact of higher interest rates has affected

all unprofitable growth stocks, not just biotech. Figure 2 on page 6 of the Half

Year Report, is a graph showing a basket of unprofitable technology stocks put

together by Goldman Sachs, of which only 6% is represented by healthcare. One

can see that there has been no appreciable recovery in the share prices of

unprofitable technology companies since the drawdown that began in 2021.

The Company's positioning remains overweight small caps and underweight large

caps versus the Benchmark, as we continue to believe the small cap names are

oversold and better value than the large caps. As noted in Figure 3 on page 7 of

the Half Year Report, small and mid cap stocks have underperformed large cap

stocks by a considerable margin since 31 March 2021. We had been expecting the

small cap segment to begin outperforming and closing the performance gap, but

disappointingly, that has not occurred yet. The tables in Figure 3 show the

market cap distribution of the Company's holdings versus the Benchmark. One will

note that the extent of small cap overweighting at 30 September 2023 is less

aggressive than that at 31 March 2021. As mentioned earlier, this was simply the

result of risk reduction in September when it became clear that 10-year interest

rates were moving higher. Once interest rates have stabilized, it is likely that

we will increase small cap exposure again to capture a long-overdue small cap

recovery.

Our confidence in a small cap recovery stems from the segment's unprecedented

underperformance versus the S&P 500, record low absolute valuations, and

continued innovation in the sector.

One proxy used by investors to track small and mid cap biotech is the XBI, an

exchange traded fund ("ETF") that tracks the equal-weighted S&P Biotech Select

Industry Index. Figure 4 on page 8 of the Half Year Report shows the relative

performance of the XBI versus the S&P 500 since the XBI's inception in 2006. For

most of the past 15 years, the XBI has outperformed the S&P 500, but there have

been temporary periods when the XBI has underperformed the S&P 500, as shown by

the red circles. Following each of those periods of underperformance, the XBI

has generally recovered and outperformed the S&P 500 once again (shown by the

green arrows). As shown in Figure 4, the relative underperformance of the XBI

versus the S&P 500 that began in early 2021 has been unprecedented in its

severity and duration. Our continued view is that the XBI is overdue for a

period of outperformance versus the S&P 500, consistent with the pattern of

performance it has demonstrated previously. We were initially encouraged by the

period of relative outperformance of the XBI in the second half of 2022, but

since the beginning of 2023, the XBI has begun underperforming again due to

rising interest rates. The latest dip in small and mid cap biotech has once

again sent the XBI to record levels of underperformance versus the S&P 500. A

reversion of performance seems likely.

Our confidence in a recovery is underpinned by the absolute valuations of

emerging biotech, which are now sitting at unprecedented lows. One objective

measure of looking at valuation is to look at the ratio of a company's market

cap to net cash on the company's balance sheet. Figure 5 (on page 9 of the Half

Year Report) shows that the median ratio for the biotech industry is now at all

-time lows, below that of the dot com bust, the Global Financial Crisis, and the

Hillary Clinton drug pricing tweet in 2015. As shown in Figure 6 (on page 10 of

the Half Year Report), about 25% of the biotech universe representing over 120

companies are now trading at market caps below the net cash on their balance

sheets. Importantly, while 10-year U.S. government yields are currently above

4%, 10-year rates were also above 4% in the 2004-2007 timeframe and yet

valuations back then were not nearly as low as they are now. We believe the

impact of higher interest rates is more than reflected in current valuations and

the emerging biotech sector is extremely oversold.

Given the Company's worldwide mandate to invest in the best biotech investment

opportunities globally, the Company has held a portion of its portfolio in

China. As of 30 September 2023, China accounts for 9.2% of the portfolio. The

Chinese central government made developing an innovative domestic biotechnology

industry a priority in its 10-year plan in 2015. Since then, the government has

increased data quality standards at the National Medical Products Administration

(the Chinese equivalent of the U.S. FDA), accelerated drug review timelines to

be on par with that of U.S. and Europe, and loosened requirements for

unprofitable biotech companies to go public in China and Hong Kong. IQVIA, a

data provider, estimates that Chinese biopharmaceutical companies accounted for

15% of the worldwide drug development pipeline in 2022 versus 4% in 2012. Among

emerging biotech (excluding large pharma), IQVIA estimates China-headquartered

companies actually accounted for 20% of the global emerging biopharma pipeline

in 2022, higher than the 17% share from Europe. Excluding the write-down in

StemiRNA Therapeutics (explained later), the China portfolio outperformed our

non-China holdings during the review period. As in the U.S., our China portfolio

has been pressured over the past two years due to macro factors, including COVID

lockdowns in China, U.S./China geopolitical tensions, and a disappointing post

-COVID economic recovery. However, Chinese government commitment to developing

an innovative biotech industry remains unchanged, and large pharma companies

like AstraZeneca and Pfizer continue to invest in the country to tap into

Chinese innovation. The Hang Seng Healthcare Index is now trading at all-time

lows, so we believe a recovery in Chinese biotech is likely. Our Chinese

holdings include BeiGene, which markets a best-in-class BTK inhibitor in the

U.S. and China for leukemia and lymphoma, and Innovent Biologics, a Chinese

biotech company developing the leading domestic GLP-1 agonist in China for

obesity. We do not anticipate increasing our China exposure from current levels

at this time given the macro uncertainty in the region.

CONTRIBUTORS TO PERFORMANCE

The principal contributors to performance during the review period were BELLUS

Health, Chinook Therapeutics, Vera Therapeutics, Ionis Pharmaceuticals, and

Amgen.

· BELLUS Health is a clinical stage company developing camlipixant for the

treatment of refractory chronic cough. Inmid-April, GSK agreed to acquire the

company for $2 billion in cash, representing a 103% premium to BELLUS' share

price prior to the announcement.

· Chinook Therapeutics is a clinical-stage biopharmaceutical company focused

on discovering, developing, and commercializing precision medicines for kidney

diseases. In June, Novartis agreed to acquire the company for up to $3.5

billion, a 67% premium to Chinook's last closing price.

· Vera Therapeutics is a clinical-stage biotechnology company focused on

developing and commercializing treatments for patients with serious

immunological diseases. In July, the company reported positive Phase 2a data for

its lead asset atacicept in patients with IgA nephropathy, an autoimmune disease

in which antibodies build up in kidney tissue.

· Ionis Pharmaceuticals is a fully-integrated biotechnology company and a

leader in RNA-targeted therapies. In late September, the company announced

positive results from a Phase 3 study of olezarsen in patients with familial

chylomicronemia syndrome, a rare genetic disease that prevents the body from

breaking down fats consumed through the diet.

· Amgen is a large cap biotechnology company with a diversified pipeline of

commercial and clinical stage products in the areas of kidney disease, oncology,

cardiovascular disease, inflammation, metabolic disorders, and neuroscience. The

stock appreciated during the review period due to better-than-anticipated Q2

2023 earnings and the announcement of positive data for two clinical stage

oncology programs: tarlatamab, a first-in-class bispecific T-cell engager for

lung cancer and AMG 193, a novel PRMT5 inhibitor for solid tumors. Additionally,

Amgen is evaluating two anti-obesity drugs in clinical trials. The stock rose in

part due to investor anticipation of data from those drugs in 2024.

DETRACTORS FROM PERFORMANCE

The principal detractors from performance were Travere Therapeutics, uniQure,

StemiRNA Therapeutics, Mersana Therapeutics, and Compass Therapeutics.

· Travere Therapeutics is a commercial-stage biotechnology company focused on

rare diseases. In late September, the company's two-year Phase 3 trial showed a

numerical benefit for its drug, Filspari, versus standard of care on kidney

function but missed statistical significance by a narrow margin in patients with

IgA nephropathy.

· uniQure is a clinical-stage gene therapy company that focuses on

neurological disorders. In June, the company showed interim data from its Phase

1/2 trial of its gene therapy for Huntington's disease, a genetic disorder that

causes breakdown of nerve cells in the brain, that fell below investor

expectations.

· StemiRNA Therapeutics is a private Chinese biotech company developing mRNA

-based vaccines and therapeutics. The Company initially invested in StemiRNA in

2021 because it was developing one of the leading domestic mRNA-based COVID

vaccines in China at a time when no mRNA-based vaccines had yet been approved in

China. Given that the commercial opportunity for COVID vaccines had diminished

substantially, the company decided to abandon its COVID program and focus on its

earlier-stage programs, including a personalized cancer vaccine in Phase I. As a

result, the company's next financing round is likely to be carried out at a

substantial discount to its last round. The Company's third-party valuation

agent, Kroll, recommended an appropriate write-down to reflect this at 30

September 2023, which has been agreed by the Board and reflected in the

Company's NAV.

· Mersana Therapeutics is a clinical stage company developing antibody-drug

conjugate therapeutics. At the end of July, the company's shares declined when

it announced that its lead asset, UpRi, had failed to show a significant benefit

in late-stage ovarian cancer patients.

· Compass Therapeutics is a clinical stage oncology company developing

bispecific antibodies.

The company's lead drug is intended to restrict the supply of blood to tumors

and has the potential to treat a variety of tumor types, including bile duct

cancer and colorectal cancer. Shares declined as the company delayed clinical

data updates due to slower-than-expected patient enrollment.

BIOTECH INNOVATION REMAINS STRONG

Ultimately, the successful development of novel medicines is the principal

driver of value creation in the biotech sector, and innovation remains as strong

as ever. We firmly believe that the valuation decline we've observed in the

sector over the past two years is not reflective of the strong fundamentals of

the industry. Innovation remains robust across a wide range of therapeutic areas

and technologies, and it is the strength of this innovation that ultimately

underpins our confidence that the biotech sector will recover from its current

depressed levels.

As shown in Figure 7 on page 12 of the Half Year Report, drug approvals for the

first nine months of 2023 are occurring at an annualized rate above 50peryear,

consistent with the elevated rate of drug approvals we've seen over the past few

years.

The increase in the number of drug approvals over the past 20 years has been

driven by a favorable regulatory environment and the advent of a number of novel

drug development technologies, including oligonucleotide-based therapies, gene

therapy, and bispecific antibodies.

A snapshot of the Company's exposure to some of these next-generation drug

development technologies as at 30September 2023 is shown in Figure 8 on page 13

of the Half Year Report. Investors in the Company get exposure to a wide cross

-section of these cutting-edge technologies as they generate promising new

medicines to deliver significant clinical benefit to patients.

Here are some specific examples of companies working in each technology area:

ANTIBODY-DRUG CONJUGATES ("ADCS")

Antibody-drug conjugates are antibodies that are bound to a drug which allows

targeting of drugs to specific cells. Typically, this approach has been used to

deliver toxins to cancer cells in the body, resulting in targeted killing of

thosecells.

Examples of antibody-drug conjugates include Seagen's Padcev, a first-in-class

ADC targeting nectin-4, a protein expressed in bladder cancer; and Gilead

Sciences' Trodelvy, a first-in-class ADC targeting Trop-2, a surface antigen

found in breast and bladder cancer. Trodelvy has been shown to reduce the risk

of death for patients with certain types of advanced breast cancer by 49%.

Amgen is a large-cap biotech company with a diversified pipeline of commercial

and clinical stage products. Our investment thesis for Amgen is premised on

attractive revenue growth in the near term, an undemanding valuation, and a

deep, innovative clinical stage pipeline that is rapidly advancing. Amgen

recently closed its acquisition of Horizon Therapeutics, integrating a pipeline

of clinical and commercial stage rare disease therapies; we believe this

acquisition will accelerate revenue growth for Amgen. Among Amgen's development

pipeline is a suite of anti-obesity drugs, including AMG 133, a novel antibody

-peptide conjugate. AMG 133 consists of a GLP-1 (glucagon-like peptide-1)

receptor agonist tethered to a glucose-dependent insulinotropic polypeptide

("GIP") receptor antagonist. GLP-1 agonism has been shown to drive weight loss

by promoting satiety and decreasing gastric emptying. This is the mechanism by

which Novo Nordisk's obesity drug Wegovy promotes weight loss. GIP receptor

antagonism reduces adipogenesis, or fat cell development and accumulation, which

is synergistic with GLP-1 agonism. This dual mechanism has the potential to

differentiate from the current weight loss drugs on the market by having better

tolerability, generating more significant weight loss, and delivering longer

durability of effect, which allows for less frequent dosing. Amgen has announced

compelling Phase 1 clinical data with up to 14.5% weight loss after three

-monthly doses of AMG 133 in obese patients. Asof 30 September 2023, the Company

had a 9.3% position in Amgen, making it the largest single position in the

portfolio.

CELL THERAPY

Cell therapy involves administering modified cells to a patient to treat

disease. The cells can be harvested from the patient's own body (autologous) or

delivered from another source (allogeneic). The cells are commonly immune system

cells that have been specifically modified to target and destroy cancer cells in

the body. Examples of cell therapies include Gilead Sciences' Yescarta, an

autologous T-cell treatment for lymphoma, and Johnson & Johnson's Carvykti, an

immunotherapy for multiple myeloma in which a patient's T-cells are modified to

target B-cell maturation antigen ("BCMA"). The clinical benefit from this

approach can be dramatic, with Carvykti demonstrating a 95% response rate

(i.e.reduction of tumor burden) with an average duration of response of close to

two years.

Immatics is a promising clinical stage oncology company developing cell

therapies for solid tumors (i.e. cancers that occur in tissues or organs like

the breast or lung rather than the blood, bone marrow, or lymphatic system).

Other efforts to develop cell therapies for solid tumors have largely been

unsuccessful as they have been unable to identify targets that are specific to

tumor cells. Immatics is attempting to solve this problem by using a novel

technology to target its cell therapy to a protein, PRAME, which is specifically

expressed across several tumors and is not expressed by healthy cells. In Phase

1 clinical studies, Immatics has shown encouraging data in melanoma with over

half of patients responding to the therapy. Additional updates over the next

year will be key as investors look to understand the full potential of the

approach in melanoma and additional tumor types such as ovarian cancer, lung

cancer, and uterine cancer.

GENE THERAPY/GENE EDITING

Gene therapy involves delivering a gene into the body to resolve a genetic

defect in the patient that is causing disease. The gene is typically delivered

into the patient's cells via a modified virus or a non-viral delivery vector

such as liposome-based nanoparticles. Gene editing is an advanced form of gene

therapy whereby the patient's existing genes are modified by a drug to

ameliorate disease or increase patient function. Examples of gene therapy

include Novartis' Zolgensma, a gene therapy for spinal muscular atrophy

originally developed by biotech company AveXis, and Roche's Luxturna, a gene

therapy initially developed by biotech company Spark Therapeutics for a rare

retinal disease that leads to blindness.

BioMarin Pharmaceutical is a pioneer in the development and commercialization of

therapies for the treatment of rare diseases. It has a diversified and growing

base business of ultra-orphan enzyme replacement therapies annualizing at more

than $2 billion a year globally, with a high barrier of entry generating

positive cash-flow. The company has recently launched two potentially

blockbuster therapies, Voxzogo and Roctavian, that are sold through its existing

global commercial infrastructure, providing significant operating leverage.

Voxzogo, launched in late 2021, is the first treatment approved for

achondroplasia, a form of dwarfism caused by impaired bone growth, and

represents BioMarin's strongest global launch to date. Roctavian was approved

earlier this year in the United States as the first-ever gene therapy treatment

for hemophilia A. We believe there is meaningful patient demand for improved

control of hemophilia A beyond just eliminating bleeds, including improved

quality of life and better long-term patient outcomes.

Hemophilia A is a lifelong, genetic condition caused by a mutation in the gene

responsible for producing a protein called Factor VIII ("FVIII"), which is

necessary for blood clotting. Hemophilia A patients are severely deficient in

this clotting protein, making them susceptible to painful and potentially life

-threatening bleeds. Treatment options for hemophilia Arequire infusions three

times a week of recombinant FVIII or less frequent injections of another

medication known as Hemlibra. While these medicines limit the bleeding events

that hemophiliacs have, bleeding events can still occur spontaneously or upon

minor injury. The bleeding risk creates many lifestyle restrictions for patients

who suffer from the disease. Roctavian is the first-ever gene therapy approved

in the United States and Europe for the treatment of hemophilia A. While not a

cure, Roctavian is a one-time treatment that eliminates the need for frequent

FVIII replacement therapy because the gene therapy allows the body to produce

its own, natural FVIII. Studies have shown Roctavian can reduce the number of

annual bleeds in hemophilia patients by about 50%. The therapy is new, so its

ultimate duration of effect is currently not known, but the vast majority of

patients still have benefit three years post treatment and beyond. BioMarin

estimates 13,000 patients worldwide are eligible to receive Roctavian for its

initial labeled indication. At an estimated net one-time price of $1.9 million

per patient, Roctavian can significantly enhance BioMarin's near-term growth

profile.

OLIGONUCLEOTIDE THERAPIES

Oligonucleotides are short strands of DNA or RNA that can be administered to

patients to allow them to express a new protein or to block expression of a

patients' genes for therapeutic effect. Such therapies come in a variety of

forms. Antisense oligonucleotides are single-strand RNA molecules that can block

gene expression, modify how genes are spliced, or repair faulty gene expression

in order to create functional protein. Small interfering RNA therapeutics are

short double-stranded non-coding duplexes that can silence gene expression by

targeting specific messenger RNA ("mRNA") sequences for degradation, preventing

their translation into protein. Finally, mRNA therapeutics are synthetic protein

-coding mRNA sequences engineered and delivered to transiently express target

proteins. Moderna and Pfizer's COVID vaccines work by delivering mRNA encoding

virus protein to a person's cells, allowing those cells to express viral protein

so that the immune system can create antibodies against them.

Ionis Pharmaceuticals is a leader in RNA-targeted therapeutics, with a focus on

neuroscience, rare diseases, and cardiometabolic disorders. Its antisense

platform works by binding and destroying mRNA in a highly specific manner, such

that the amount of disease-causing protein is significantly decreased. The

technology can also be used to treat disease by increasing protein production;

this led to the development of one of the most successful medicines on the

market today, Spinraza, for spinal muscular atrophy. The company has made

tremendous progress in the last 12months on both wholly-owned and partnered

programs, creating significant value for shareholders. In November 2022, Ionis

reported positive Phase 2 data from an extension study of its drug donidalorsen

in patients with hereditary angioedema ("HAE"), a rare genetic disorder

characterized by recurrent episodes of rapid swelling of tissues in the hands,

feet, limbs, face, intestinal tract, and airway. In some cases, these attacks

can be life-threatening. Ionis' drug showed a 95%+ reduction in frequency of

attacks in the monthly dosing arm of the trial, an unprecedented result that

suggests it could become the new standard of care in HAE. In April 2023, Ionis,

together with partner Biogen, announced the approval of Qalsody (tofersen),

marking a major scientific advance in the treatment of superoxide dismutase 1

(SOD1)-amyotrophic lateral sclerosis ("ALS"). In September 2023, the company

announced positive Phase 3 data for its drug, olezarsen, for familial

chylomicronemia syndrome. Impressively, the drug eradicated acute pancreatitis

events, marking another important medical breakthrough. Finally, following a

very successful Phase 3 study in transthyretin polyneuropathy, we expect

eplontersen (developed with partner AstraZeneca) to be approved in late December

2023.

MULTI-SPECIFIC ANTIBODIES/T-CELL ENGAGERS

Antibody-based drugs have traditionally only bound to one protein target.

Bispecific drugs have now been engineered to bind two different targets

simultaneously. One type of bispecific antibody is a T-cell engager, which is an

antibody that binds a T-cell in the body and a protein on a cancer cell

simultaneously in order to allow the T-cell to kill the cancer cell. Examples of

T-cell engagers include Amgen's Blincyto, a bispecific T-cell engager for

leukemia, and Roche's Lunsumio, a T-cell engager for lymphoma that targets CD20

on B-cells and CD3 expressed on T-cells.

Janux Therapeutics is a next generation immuno-oncology company developing drugs

that recruit T cells to kill cancer cells. T-cell engager therapies have

traditionally been associated with toxicity due to non-specific activation of

the immune system. To solve this problem, Janux has developed its T-cell

engagers with masking technology such that the drugs are only active when they

are present in tumors. In July 2023, Janux released first-in-human data from its

masked T-cell engager program in prostate cancer demonstrating encouraging

signals of efficacy with a reasonable safety profile. We look forward to

potentially value-inflecting data updates from this prostate cancer program and

another program in lung cancer in 2024.

FINANCING ENVIRONMENT PRESENTS OPPORTUNITIES

Given the decline in biotech valuations, IPO activity in the sector remains

relatively muted, though we have seen a slight uptick in activity over the past

couple of quarters as can be seen in Figure 9 on page 17 of the Half Year

Report. The few companies undertaking an IPO are typically depending heavily on

existing investors to make up a significant portion of the order book. We will

remain selective in reviewing those opportunities.

Given the diminished IPO activity, we did not make any new crossover investments

during the review period.

The follow-on offering market for biotech companies remains steady, as shown in

Figure 10 on page 18 of the Half Year Report. Quality companies with strong

assets have not had any problems raising money and many offerings have been

multiple times oversubscribed. Earlier-stage companies have had more difficulty

raising money in the current interest rate environment, and many of them have

resorted to sharing non-public clinical data confidentially with a select group

of investors to entice them to participate in a financing. Given OrbiMed's

stature in the healthcare investing space, we are among a select group of

investors that are regularly informed about those confidential equity

placements. We believe this deal flow provides a source of investment

opportunities not available to other investors. In some cases, warrant coverage

and other preferential deal terms can be extracted from companies desperate for

cash to support their operations. We will be selective in pursuing these

financing opportunities to maximize Company returns.

M&A ACTIVITY REMAINS ROBUST

We believe M&A activity will remain an important source of investment

performance in the near term for two reasons: 1)the unprecedented low valuations

of emerging biotech companies make acquisitions less expensive for larger

companies; and 2) there is a significant need for large pharmaceutical companies

to acquire innovative biotech companies given the expected loss of exclusivity

of approximately $250 bn of branded drug sales in the 2025-2030 timeframe. Areas

of therapeutic interest in large pharmaceutical companies include inflammation &

immunology, neuroscience, and cardiovascular disease, and we believe they are

particularly interested in acquiring later-stage or commercial assets that will

be able to deliver revenue in the second half of the decade.

The tables in Figure 11 on page 19 of the Half Year Report list some selected

transactions that have been announced recently, many of which were done at

triple digit premiums. The red stars indicate transactions in which the Company

held the target at the time of the acquisition announcement. The Company has

directly benefited from M&A activity in the sector, and we expect to continue to

do so. There are a number of holdings in the portfolio that we believe are

likely M&A candidates.

STRATEGY AND OUTLOOK

While the persistent interest rate headwinds have been disappointing, we remain

convinced that smaller emerging biotech will recover from its unprecedented low

valuations and continue to believe overweighting that segment of the industry

makes sense in the portfolio. Having said that, we did choose to reduce our

small cap exposure and gearing during the month of September to increase our

flexibility to add to names at lower prices. Our target gearing remains 5-10%

but may fluctuate tactically based on the opportunity set we see at a given

time.

Turnover of the portfolio remains relatively high and annualized at 90.4% as at

the half year end. This is because the smaller emerging biotech names can be

quite volatile and move dramatically in response to various catalysts, whether

it be a clinical trial result or an FDA regulatory decision. A 100% increase in

share price or an 80% decline in share price on a single day are not uncommon

for a stock when an important clinical trial result is announced. While much of

this risk is idiosyncratic and can be minimized with diversification, we feel it

is important to be nimble to navigate the catalyst path prudently for those

stocks. We are constantly monitoring the risk/reward of any given position and

will regularly modify the size of each position as appropriate, being mindful of

valuation and downside risk. We aim to size our positions so that we don't lose

more than 100 bps of performance on any single binary event. Our goal is to keep

the portfolio populated with fresh ideas that have the best chances of

delivering a positive investment return, so we generally reduce positions once

we believe they are fully valued.

What could catalyze a recovery in emerging biotech?

1) A pause in Fed hikes and rate reductions. Rising interest rates have been by

far the greatest headwind to overall performance.

Fortunately, the Fed has already signaled that it is slowing down rate hikes

since inflation has dropped, and it is quite possible that the Fed has

completely finished raising rates. Current market expectations suggest a

reduction in rates is possible in the second half of 2024. Clearly such a

reduction would be a tremendous tailwind for the sector that could catalyze a

recovery.

2) M&A activity. As we've seen thus far, M&A activity can generate idiosyncratic

returns for the portfolio. Increased M&A activity could spur a broader sector re

-rating upwards.

3) Major new product launches or dramatic clinical results addressing large

markets. Generalist investors who invested in biotech during the COVID pandemic

have largely exited the sector. In order to attract their interest again,

groundbreaking clinical trial results for therapies addressing large markets or

successful launches of products with multi-billion dollar potential would be

helpful. Generalist investor interest, for example, has helped propel the share

prices of the large pharmaceutical companies Eli Lilly and Novo Nordisk, the

marketers of the GLP-1 based obesity agents, given the large addressable market

opportunity. We think a similar dynamic could occur as more biotech drugs are

developed for large indications like Alzheimer's, heart disease, and autoimmune

disorders.

As we've stated before, we have never seen such a large disconnect between

biotech company valuations and the fundamental innovation occurring in the

industry. We continue to believe this is a compelling entry point for investors

seeking to gain exposure to a highly innovative sector developing important

medicines for the benefit of patients worldwide.

Geoff Hsu and Josh Golomb

OrbiMed Capital LLC, Portfolio Manager

9 November 2023

INVESTMENT PORTFOLIO

INVESTMENTS HELD AS AT 30 SEPTEMBER 2023

Country/ Fair value % of

Security Region# £'000 investments

Amgen United States 28,030 9.3

Biogen United States 21,272 7.0

BioMarin Pharmaceutical United States 17,978 6.0

Argenx Netherlands 17,526 5.8

lonis Pharmaceuticals United States 17,307 5.7

XtalPi* China 12,867 4.3

United Therapeutics United States 10,900 3.6

Vera Therapeutics United States 9,750 3.2

Regeneron Pharmaceuticals United States 9,099 3.0

Xenon Pharmaceuticals Canada 7,931 2.6

Ten largest investments 152,660 50.5

Seagen United States 7,406 2.5

Sarepta Therapeutics United States 7,167 2.4

Vaxcyte United States 7,006 2.3

Keros Therapeutics United States 6,411 2.1

lnnovent Biologics China 6,390 2.1

Vertex Pharmaceuticals United States 6,382 2.1

Horizon Therapeutics United States 6,179 2.0

Gilead Sciences United States 6,141 2.0

Mirati Therapeutics United States 6,064 2.0

Aerovate Therapeutics United States 6,024 2.0

Twenty largest investments 217,830 72.0

Rhythm Pharmaceuticals United States 5,915 2.0

RAPT Therapeutics United States 5,804 1.9

Compass Therapeutics United States 5,735 1.9

Neumora Therapeutics United States 5,192 1.7

lmmatics Germany 4,917 1.6

Janux Therapeutics United States 4,341 1.4

Syndax Pharmaceuticals United States 4,078 1.4

Apellis Pharmaceuticals United States 3,870 1.3

ALX Oncology Holdings United States 3,579 1.2

Scholar Rock Holding United States 3,522 1.2

Thirty largest investments 264,783 87.6

uniQure Netherlands 3,401 1.1

KeyMed Biosciences China 3,247 1.1

Madrigal Pharmaceuticals United States 2,610 0.9

Arrowhead Pharmaceuticals United States 2,548 0.8

Crinetics Pharmaceuticals United States 2,541 0.8

MoonLake lmmunotherapeutics United States 2,333 0.8

Karuna Therapeutics United States 1,940 0.6

Akero Therapeutics United States 1,906 0.6

Kezar Life Sciences United States 1,863 0.6

Gracell Biotechnologies China 1,778 0.6

Forty largest investments 288,950 95.5

#Primary listing.

*Unquoted investment.

?Partnership interest.

Country/ Fair value % of

Security Region# £'000 investments

OrbiMed Asia Asia 1,582 0.5

Partners*?

YS Biopharma China 1,510 0.5

Ventyx Biosciences United States 1,473 0.5

StemiRNA Therapeutics* China 1,338 0.4

Wuxi Biologics Cayman China 1,308 0.4

Edgewise Therapeutics United States 1,247 0.4

Essa Pharma Canada 1,109 0.4

Morphic Holding United States 1,050 0.4

Prelude Therapeutics United States 874 0.3

Heron Therapeutics United States 677 0.2

Fifty largest 301,118 99.5

investments

Suzhou Basecare China 627 0.2

Medical

Enliven Therapeutics United States 522 0.2

Repare Therapeutics Canada 487 0.2

BioAtla United States 389 0.1

Xencor United States 316 0.1

Awakn Life Sciences Canada 309 0.1

Galecto Denmark 34 0.0

Awakn Life Sciences Canada - -

warrants 18/03/2024

Total equities 303,802 100.4

OTC equity swaps -

Financed

BeiGene China 4,981 1.6

Less: Gross exposure (6,305) (2.0)

on financed swaps

Total OTC equity swaps (1,324) (0.4)

Total investments 302,478 100.0

including OTC equity

swaps

All of the above investments are equities unless otherwise stated.

#Primary listing.

*Unquoted investment.

?Partnership interest.

PORTFOLIO BREAKDOWN

Investments Fair value % of

£'000 investments

Quoted

Equities 288,015 95.2

288,015 95.2

Unquoted

Equities 14,205 4.7

Partnership interest 1,582 0.5

15,787 5.2

Derivatives

OTC equity swaps (1,324) (0.4)

Total investments 302,478 100.0

CONDENSED INCOME STATEMENT

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 30

September September

2023 2022

Revenue Capital Total Revenue Capital Total

Notes £'000 £'000 £'000 £'000 £'000 £'000

Investment income 2 638 - 638 299 - 299

(Losses)/gains on - (11,070) (11,070) 44,507 44,507

investments held

at fair value

through profit or

loss

Exchange losses - (881) (881) (5,293) (5,293)

on currency

balances

AIFM, portfolio 3 (73) (1,383) (1,456) (91) (1,731) (1,822)

management and

performance fees

Other expenses (350) (10) (360) (371) (18) (389)

Return/(loss) 215 (13,344) (13,129) (163) 37,465 37,302

before finance

costs

and taxation

Finance costs (26) (498) (524) (14) (258) (272)

Return/(loss) 189 (13,842) (13,653) (177) 37,207 37,030

before taxation

Taxation (83) - (83) (39) - (39)

Return/(loss) for 106 (13,842) (13,736) (216) 37,207 36,991

the period

Basic and diluted 4 0.3p (37.0)p (36.7)p (0.5)p 91.2p 90.7p

earnings/(loss)

per share

The Company does not have any income or expenses which are not included in the

profit or loss for the period. Accordingly the "return/(loss) for the period" is

also the "Total Comprehensive Income for the period", as defined in IAS 1

(revised) and no separate Statement of Other Comprehensive Income has been

presented.

The "Total" column of this statement is the Company's Income Statement, prepared

in accordance with UK-adopted International Accounting Standards and with the

requirements of the Companies Act 2006 as applicable to companies reporting

under those standards. The "Revenue" and "Capital" columns are supplementary to

this and are prepared under guidance published by the Association of the

Investment Companies.

All items in the above statement are from continuing operations.

CONDENSED STATEMENT OF CHANGES IN EQUITY

(UNAUDITED) SIX MONTHSED 30 SEPTEMBER 2023

Ordinary Share Capital

Share premium redemption Capital Revenue

capital account reserve reserve reserve Total

£'000 £'000 £'000 £'000 £'000 £'000

At 31 March 2023 9,684 79,951 13,746 227,968 (1,058) 330,291

Net (loss)/profit - - - (13,842) 106 (13,736)

for the period

Repurchase of own (715) - 715 (23,138) - (23,138)

shares for

cancellation

At 30 September 2023 8,969 79,951 14,461 190,988 (952) 293,417

(UNAUDITED) SIX MONTHSED 30 SEPTEMBER 2022

Ordinary Share Capital

Share premium redemption Capital Revenue

capital account reserve reserve reserve Total

£'000 £'000 £'000 £'000 £'000 £'000

At 31 March 2022 10,289 79,951 13,141 291,231 (404) 394,208

Net profit/(loss) - - - 37,207 (216) 36,991

for the period

Repurchase of own (269) - 269 (10,465) - (10,465)

shares for

cancellation

At 30 September 2022 10,020 79,951 13,410 317,973 (620) 420,734

CONDENSED STATEMENT OF FINANCIAL POSITION

AS AT 30 SEPTEMBER 2023

(Unaudited) (Audited)

30 September 31 March

2023 2023

Notes £'000 £'000

Non current assets

Investments held at fair 303,802 357,229

value through profit or

loss

Current assets

Other receivables 1,276 508

Cash and cash equivalents 3,133 2,772

4,409 3,280

Total assets 308,211 360,509

Current liabilities

Other payables 2,033 8,846

Loan 11,437 20,170

Derivative - OTC equity 1,324 1,202

swaps

14,794 30,218

Net assets 293,417 330,291

Equity attributable to

equity holders

Ordinary share capital 8,969 9,684

Share premium account 79,951 79,951

Capital redemption reserve 14,461 13,746

Capital reserve 190,988 227,968

Revenue reserve (952) (1,058)

Total equity 293,417 330,291

Net asset value per share 5 817.9p 852.6p

CONDENSED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

(Unaudited) (Unaudited)

Six months ended Six months ended

30 September 2023 30 September 2022

£'000 £'000

Operating activities

(Loss)/profit before taxation* (13,653) 37,030

Finance costs 524 272

Losses/(gains) on investments held 10,527 (45,419)

at fair value through profit & loss

Transaction costs** - 912

Foreign exchange losses 881 5,293

Decrease in other receivables 9 24

(Decrease)/increase in other (77) 114

payables

Taxation paid (83) (39)

Net cash outflow from operating (1,872) (1,813)

activities

Investing activities

Purchases of investments (116,198) (254,895)

Sales of investments 152,237 278,800

Transaction costs - (912)

Net cash inflow from investing 36,039 22,993

activities

Financing activities

Repurchase of own shares for (23,668) (9,334)

cancellation

Net repayment of the loan facility (9,614) (11,574)

Finance costs - interest paid (524) (272)

Net cash outflow from financing (33,806) (21,180)

activities

Net increase in cash and cash 361 -

equivalents

Cash and cash equivalents at start 2,772 -

of period

Cash and cash equivalents at end of 3,133 -

period?

* Includes dividends earned during the period of £557,000 (six

months ended 30 September 2022: £299,000).

** In the current period, transaction costs are included within

"loss before taxation", hence it is zero compared to the prior period.

?Collateral cash held at Goldman Sachs (2022: £nil).

CHANGES IN LIABILITIES ARISING FROM FINANCING ACTIVITIES

(Unaudited) (Unaudited)

Six months ended Six months ended

30 September 2023 30 September 2022

£'000 £'000

Balance as at start of period 20,170 31,741

Net repayment of the loan facility (9,614) (11,574)

Foreign exchange losses 881 5,293

Loan balance 11,437 25,460

NOTES TO THE FINANCIAL STATEMENTS

1.A) GENERAL INFORMATION

The Biotech Growth Trust PLC is a company incorporated and registered in England

and Wales. The Company operates as an investment company within the meaning of

Section 833 of the Companies Act 2006 and has made a successful application

under Regulation 5 of the Investment Trust (Approved Company) (Tax) Regulations

2011 for investment trust status to apply to all accounting periods commencing

on or after 1 April 2012.

1.B) BASIS OF PREPARATION

The Company's condensed financial statements for the six months ended 30

September 2023 have been prepared in accordance with IAS 34 "Interim Financial

Reporting". They do not include all the financial information required for the

full annual financial statements and have been prepared using accounting

policies adopted in the audited financial statements for the year ended 31 March

2023.

Those financial statements have been prepared in accordance with International

Financial Reporting Standards ("IFRS").

The Directors have sought to prepare the financial statements in compliance with

presentational guidance set out in the Statement of Recommended Practice (the

"SORP") for Investment Trust Companies and Venture Capital Trusts produced by

the Association of Investment Companies ("AIC"), dated July 2022.

The Company's financial statements are presented in sterling and all values are

rounded to the nearest thousand pounds (£'000) except when otherwise indicated.

The financial statements have not been audited by the Company's auditors.

1.C) SEGMENTAL REPORTING

IFRS 8 requires entities to define operating segments and segment performance in

the financial statements based on information used by the Board of Directors.

The Directors are of the opinion that the Company is engaged in a single segment

of business, being investment business.

1.D) GOING CONCERN

The Directors believe that it is appropriate to adopt the going concern basis in

preparing the financial statements as the assets of the Company consist mainly

of securities that are readily realisable and, accordingly, the Company has

adequate financial resources to continue in operational existence for at least

12 months from the date of the approval of the financial statements. The next

continuation vote of the Company will be held at the Annual General Meeting in

2025 and further opportunities to vote on the continuation of the Company will

be given to shareholders every five years thereafter.

2. INCOME

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 September 30 September

2023 2022

£'000 £'000

Investment income

Overseas dividend income 557 299

Other income - bank interest 81 -

Total income 638 299

3. AIFM, PORTFOLIO MANAGEMENT AND PERFORMANCE FEES

Total Total

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 30

September September

Revenue Capital 2023 Revenue Capital 2022

£'000 £'000 £'000 £'000 £'000 £'000

AIFM fee 22 421 443 27 524 551

Portfolio 51 962 1,013 64 1,207 1,271

management

fee -

OrbiMed

Capital

LLC

Performance - - - - - -

fee

73 1,383 1,456 91 1,731 1,822

As at 30 September 2023, no performance fees were accrued or payable (30

September 2022: Nil).

For further details on the performance fee arrangements see pages 48 and 49 of

the Company's 2023 Annual Report.

4. BASIC AND DILUTED EARNINGS/(LOSS) PER SHARE

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 September 30 September

2023 2022

£'000 £'000

The earnings/(loss) per share is

based on the following figures:

Net revenue return/(loss) 106 (216)

Net capital (loss)/return (13,842) 37,207

Net total (loss)/return (13,736) 36,991

Weighted average number of 37,411,567 40,781,100

shares in issue during the

period

Pence Pence

Revenue earnings/(loss) per 0.3 (0.5)

share

Capital (loss)/earnings per (37.0) 91.2

share

Total (loss)/earnings per share (36.7) 90.7

5. NET ASSET VALUE PER SHARE

The net asset value per share is based on the net assets attributable to equity

shareholders of £293,417,000 (31 March 2023: £330,291,000) and on 35,875,917

shares (31 March 2023: 38,737,419) being the number of shares in issue at the

period end.

6. TRANSACTION COSTS

Purchase and sale transaction costs for the six months ended 30 September 2023

amounted to £543,000 (six months ended 30 September 2022: £912,000); broken down

as follows: purchase transactions for the six months ended 30September 2023

amounted to £124,000 (six months ended 30 September 2022: £411,000). Sale

transactions amounted to £419,000 (six months ended 30 September 2022:

£501,000). These costs comprise mainly commission.

7. INVESTMENTS

IFRS 13 requires the Company to classify fair value measurements using the fair

value hierarchy that reflects the significance of the inputs used in making the

measurements. The fair value hierarchy consists of the following threelevels:

· Level 1 - quoted prices (unadjusted) in active markets for identical assets

or liabilities;

· Level 2 - inputs other than quoted prices included with Level 1 that are

observable for the asset or liability, either directly (i.e. as prices) or

indirectly (i.e. derived from prices); and

· Level 3 - inputs for the asset or liability that are not based on observable

market data (unobservable inputs).

At 30 September 2023 the investments in OrbiMed Asia Partners LP Fund (the LP

Fund), XtalPi, and StemiRNA have been classified as Level 3 (see Level 3

reconciliation below).

The LP Fund is valued quarterly by OrbiMed Advisors LLC and is audited annually

by KPMG LLP. As the 30 September 2023 valuation is not yet available, the LP

Fund has been valued at its net asset value as at 30 June 2023. It is believed

that the value of the LP Fund as at 30 September 2023 will not be materially

different. If the value of the LP Fund were to increase or decrease by 10%,

while other variables had remained constant, the return and net assets

attributable to shareholders for the period ended 30 September 2023 would have

increased or decreased by £158,000 or 0.44ppershare (year ended 31 March 2023:

£216,000 or 0.56p per share).

The following investments have been valued by the Board following

recommendations made by the Valuation Committee which has reviewed in detail

both the valuations and the methodologies provided by Kroll, an independent

valuer.

StemiRNA and XtalPi have been valued using the probability-weighted expected

returns methodology and are classified as Level 3. If the value of these

investments were to increase or decrease by 10%, while all other variables

remain constant, the return attributable to shareholders for the period ended 30

September 2023 would have increased or decreased by £1,421,000 or 3.96p per

share (year ended 31 March 2023: £1,786,000 or 4.61p per share).

The table overleaf sets out fair value measurements of financial assets in

accordance with the IFRS13 fair value hierarchy system:

(UNAUDITED) SIX MONTHSED 30 SEPTEMBER 2023

Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Equity investments 288,015 - 14,205 302,220

Derivatives: equity swap - (1,324) - (1,324)

Partnership interest in LP Fund - - 1,582 1,582

Total 288,015 (1,324) 15,787 302,478

(AUDITED) YEARED 31 MARCH 2023

Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Equity investments 336,962 - 18,103 355,065

Derivatives: equity swap - (1,202) - (1,202)

Partnership interest in LP Fund - - 2,164 2,164

Total 336,962 (1,202) 20,267 356,027

LEVEL 3 RECONCILIATION

Please see below a reconciliation disclosing the changes during the six months

for the financial assets and liabilities, designated at fair value through

profit or loss, classified as being Level 3.

(Unaudited)

Six months (Audited)

ended Year ended

30 September 31 March

2023 2023

£'000 £'000

Assets as at beginning of 20,267 33,927

period

Purchase of unquoted - -

investments

Sale of unquoted investments - -

Net movement in investment (4,480) (3,773)

holding gains during the

period/year

Transfer from level 3 to level - (9,887)

1

Assets as at 30 September/31 15,787 20,267

March

8. PRINCIPAL RISKS PROFILE

The principal risks the Company faces from its financial instruments are:

i) market price risk, including currency risk, interest rate risk

and other price risk;

ii) liquidity risk; and

iii) credit risk.

Market price risk - This is the risk that the fair value or future cash flows of

a financial instrument held by the Company may fluctuate because of changes in

market prices. This market risk comprises three elements - currency risk,

interest rate risk and other price risk.

Liquidity risk - This is the risk that the Company will encounter difficulty in

meeting obligations associated with financial liabilities.

Credit risk - This is the risk that the counterparty to a transaction fails to

discharge its obligations under that transaction, which could result in the

Company suffering a loss.

Details of the Company's management of these risks can be found in note 14 in

the Company's 2023 Annual Report.

There have been no changes to the management of or the exposure to these risks

since the date of the Annual Report.

9. RELATED PARTY TRANSACTIONS

There have been no changes to the related party arrangements or transactions as

reported in the Annual Report for the year ended 31 March 2023.

10. CREDIT RISK

J.P. Morgan Securities LLC ("J.P. Morgan") may take assets with a value of up to

140% of the Company's loan facility as collateral. Such assets held by J.P.

Morgan are available for rehypothecation*.

As at 30 September 2023, the maximum value of assets available for

rehypothecation was £16 million being 140% of the loan balance (£11.4 million).

*See Glossary.

11. COMPARATIVE INFORMATION

The financial information contained in this half year report does not constitute

statutory accounts as defined in sections 434 to 436 of the Companies Act 2006.

The financial information for the six months ended 30 September 2023 and 2022

has not been audited by the Company's auditor.

The information for the year ended 31 March 2023 has been extracted from the

latest published audited financial statements. The audited financial statements

for the year ended 31 March 2023 have been filed with the Registrar of the

Companies. The report of the Company's auditor on those accounts was

unqualified, did not include a reference to any matters to which the Company's

auditor drew attention by way of emphasis without qualifying the report and did

not contain statements under section 498(2) or 498(3) of the Companies Act 2006.

INTERIM MANAGEMENT REPORT

PRINCIPAL RISKS AND UNCERTAINTIES

A review of the half year, including reference to the risks and uncertainties

that existed during the period and the outlook for the Company can be found in

the Chairman's Statement and in the Portfolio Manager's Review. The principal

risks faced by the Company fall into the following broad categories: market

risk; portfolio performance; share price performance; cyber risk; key person

risk; valuation risk; climate change; counterparty risk; and operational

disruption. Information on each of these areas is given in the Strategic

Report/Business Review within the Annual Report for the year ended 31 March

2023. The Company's principal risks and uncertainties have not changed

materially since the date of that report and are not expected to change

materially for the remaining six months of the Company's financial year.

The Board, the AIFM and the Portfolio Manager discuss and identify emerging

risks as part of the risk identification process and have considered that

demographic trends in China and Europe, including the effects of an ageing

workforce, may have an impact on global markets and that threats to research

funding and the effects of increased costs in the biotech sector may affect the

Company's investee companies.

RELATED PARTY TRANSACTIONS

During the first six months of the current financial year, no transactions with

related parties have taken place which have materially affected the financial

position or the performance of the Company.

GOING CONCERN

The Directors believe, having considered the Company's investment objective,

risk management policies, capital management policies and procedures, the nature

of the portfolio and expenditure projections, that the Company has adequate

resources, an appropriate financial structure and suitable management

arrangements in place to continue in operational existence for the foreseeable

future and, more specifically, that there are no material uncertainties relating

to the Company that would prevent its ability to continue in such operational

existence for at least twelve months from the date of the approval of this half

yearly financial report. For these reasons, they consider there is reasonable

evidence to continue to adopt the going concern basis in preparing the financial

statements.

DIRECTORS' RESPONSIBILITIES

The Board of Directors confirms that, to the best of its knowledge:

(i) the condensed set of financial statements contained within the

Half Year Report have been prepared in accordance with applicable International

Accounting Standards ("IAS") 34; and

(ii) the interim management report includes a true and fair review of

the information required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules, being

an indication of important events that have occurred during the first six months

of the financial year and their impact on the condensed set of financial

statements; and a description of the principal risks and uncertainties for the

remaining six months of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules, being

related party transactions that have taken place in the first six months of the

current financial year and that have materially affected the financial position

or performance of the entity during that period; and any changes in the related

party transactions described in the last annual report that could do so.

The Half Year Report has not been audited by the Company's auditors.

This Half Year Report contains certain forward-looking statements. These

statements are made by the Directors in good faith based on the information

available to them up to the date of this report and such statements should be

treated with caution due to the inherent uncertainties, including both economic

and business risk factors, underlying any such forward-looking information.

For and on behalf of the Board

Roger Yates

Chairman

9 November 2023

GLOSSARY OF TERMS AND ALTERNATIVE PERFORMANCE MEASURES

AIC

Association of Investment Companies.

ALTERNATIVE INVESTMENT FUND MANAGERS DIRECTIVE ("AIFMD")

Agreed by the European Parliament and the Council of the European Union and

transposed into UK legislation, the AIFMD classifies certain investment

vehicles, including investment companies, as Alternative Investment Funds

("AIFs") and requires them to appoint an Alternative Investment Fund Manager

("AIFM") and depositary to manage and oversee the operations of the investment

vehicle. The Board of the Company retains responsibility for strategy,

operations and compliance and the Directors retain a fiduciary duty to

shareholders.

ALTERNATIVE PERFORMANCE MEASURE ("APM")

An APM is a numerical measure of the Company's current, historical or future

financial performance, financial position or cash flows, other than a financial

measure defined or specified in the applicable financial framework. In selecting

these APMs, the Directors considered the key objectives and expectations of

typical investors in an investment trust such as the Company. Definitions of the

terms used and the basis of calculation are set out in this Glossary and the

APMs are indicated with a caret (^).

ACTIVE SHARE^

Active Share is expressed as a percentage and shows the extent to which a fund's

holdings and their weightings differ from those of the fund's benchmark index. A

fund that closely tracks its index might have a low Active Share of less than

20% and be considered passive, while a fund with an Active Share of 60% or

higher is generally considered to be actively managed.

CROSSOVER INVESTMENTS

Investments in a company's last private round prior to an initial public

offering ("IPO").

DISCOUNT OR PREMIUM^

A description of the difference between the share price and the net asset value

per share. The size of the discount or premium is calculated by subtracting the

share price from the net asset value per share and is usually expressed as a

percentage (%) of the net asset value per share. If the share price is higher

than the net asset value per share the result is a premium. If the share price

is lower than the net asset value per share, the shares are trading at a

discount.

As at As at

30 September 31 March

2023 2023

pence pence

Share price 776.0 783.0

Net asset value per share (see 817.9 852.6

note 5 for further information)

Discount of share price to net 5.1% 8.2%

asset value per share

DRAWDOWN

A measure of downside volatility, a drawdown refers to how much an investment or

sector is down from the peak before it recovers back to the peak.

GEARING^

Gearing represents prior charges, adjusted for net current assets/liabilities,

expressed as a percentage of net assets. Prior charges includes all loans for

investment purposes.

As at As at

30 September 31 March

2023 2023

£'000 £'000

Loan facility (11,437) (20,170)

Net current assets/(liabilities) 2,376 (5,566)

(excluding loan and derivatives)

(9,061) (25,736)

Net assets 293,417 330,291

Gearing 3.1% 7.8%

GICS

Global Industry Classification Standards. GICS is an industry analysis framework

that helps investors understand the key business activities for companies around

the world. MSCI and S&P Dow Jones Indices developed this classification standard

to provide investors with consistent and exhaustive industry definitions.

NET ASSET VALUE ("NAV")

The value of the Company's assets, principally investments made in other

companies and cash being held, minus any liabilities. The NAV is also described

as `shareholders' funds'. The NAV is often expressed in pence per share after

being divided by the number of shares which are in issue at the relevant date.

The NAV per share is unlikely to be the same as the share price which is the

price at which the Company's shares can be bought or sold by an investor. The

share price is determined by the relationship between the demand and supply of

the shares in the secondary market.

NAV PER SHARE TOTAL RETURN^

The NAV per share total return for the period ended 30 September 2023 is

calculated by taking the percentage movement from the NAV per share as at 31

March 2023 of 852.6p (31 March 2022: 957.8p) to the NAV at 30 September 2023 of

817.9p (30 September 2022: 1,049.7p). The Company has not paid any dividends to

shareholders during the period.

ONGOING CHARGES^

Ongoing charges are calculated by taking the Company's annualised operating

expenses expressed as a proportion of the average daily net asset value of the

Company over the year.

The costs of buying and selling investments are excluded, as are interest costs,

taxation, performance fees, cost of buying back or issuing ordinary shares and

other non-recurring costs.

As at As at

30 September 31 March

2023 2023

£'000 £'000

AIFM and portfolio management fees* 2,862 3,531

Operating expenses* 688 692

Total expenses* 3,550 4,223

Average daily net assets for the period/year 325,833 394,525

Ongoing charges 1.1% 1.1%

*Estimated expenses for the year ending 31 March 2024 based on assets as at 30

September 2023.

OTHER COST RATIOS

Total ongoing costs as disclosed in the Company's latest Key Information

Document (KID) is 1.30%. This represents the impact of the costs that are

incurred each year for the running of the Company including the impact of the

finance costs (0.2%).

OTC EQUITY SWAPS

Over-the-Counter ("OTC") refers to the process of how securities are traded via

a broker - dealer network, as opposed to a centralised exchange.

An equity swap is an agreement where one party (counterparty) transfers the

total return of an underlying equity position to the other party (swap holder)

in exchange for a payment of the principal, and interest for financed swaps, at

a set date. Total return includes dividend income and gains or losses from

market movements. The exposure of the holder is the market value of the

underlying equity position.

There are two main types of equity swaps:

· Funded - where payment is made on acquisition. They are equivalent to

holding the underlying equity position with the exception of additional

counterparty risk and not possessing voting rights in the underlying investment;

and

· Financed - where payment is made on maturity. As there is no initial outlay,

financed swaps increase exposure by the value of the underlying equity position

with no initial increase in the investments' value - there is therefore embedded

leverage within a financed swap due to the deferral of payment to maturity.

QUANTITATIVE TIGHTENING

Quantitative tightening is when the Federal Reserve reduces its balance sheet by

selling its Treasury bonds or allowing them to mature, removing liquidity from

the financial markets. It is the opposite of quantitative easing.

REHYPOTHECATION

Rehypothecation is the practice by banks and brokers of using collateral posted

as security for loans as regulated by the U.S. Securities Exchange Commission.

SHARE PRICE TOTAL RETURN^

The share price total return for the period ended 30 September 2023 is

calculated by taking the percentage movement from the share price as at 31 March

2023 of 783.0p (31 March 2022: 898.0p) to the share price as at 30 September

2023 of 776.0p (30 September 2022: 994.0p). The Company has not paid any

dividends to shareholders during the period.

^Alternative Performance Measure

9 November 2023

Frostrow Capital LLP

Company Secretary

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

November 09, 2023 02:00 ET (07:00 GMT)

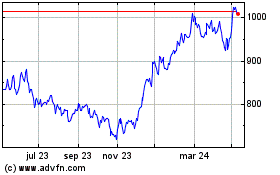

Biotech Growth (LSE:BIOG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

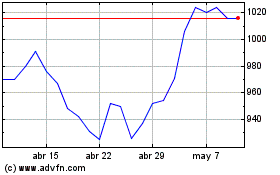

Biotech Growth (LSE:BIOG)

Gráfica de Acción Histórica

De May 2023 a May 2024