TIDMBT.A

RNS Number : 1140S

BT Group PLC

02 November 2023

Results for the half year to 30 September 2023

BT Group plc

2 November 2023

Philip Jansen, Chief Executive, commenting on the results, said

"These results show that BT Group is delivering and on target:

we're rapidly building and connecting customers to our next generation

networks, we're simplifying our products and services, and we're

now seeing predictable and consistent revenue and EBITDA growth.

"We've strengthened our competitive position with the launch of

both New EE and our renewed strategy in Business, and Openreach

has now built full fibre broadband to more than a third of the

UK's homes and businesses with a growing connection rate. Our transformation

programme has now delivered GBP2.5bn in annualised savings, well

on track to meet our GBP3bn savings target by FY25.

"Our delivery in the first half means we are confirming our financial

outlook for FY24 with normalised free cash flow now expected towards

the top end of the guidance range, and we are declaring an interim

dividend of 2.31 pence per share. BT Group has a bright future

and I'm pleased to be handing the baton to Allison Kirkby early

in the new year. She knows the sector, she knows the company and

she's the right person to lead BT Group from this position of operational

strength."

Continued strong execution of our strategy

-- FTTP build rate accelerated to 66k per week delivering a

record of 860k premises passed in the quarter, FTTP footprint is

now expanded to 12m premises with a further 6m where initial build

is underway

-- Strong customer demand in Openreach for FTTP with net adds of

364k in Q2, bringing take-up rate to 33%

-- Openreach broadband ARPU grew by 10% year-on-year due to

price rises and increased volumes of FTTP; Openreach broadband line

losses of 255k in H1, a 1% decline in the broadband base; whilst we

continue to target a decline of around 400k in FY24, softer market

conditions increase the risk that losses will be above this

level

-- Consumer broadband ARPU for the year to date increased 4%

year-on-year and Consumer postpaid mobile ARPU for the year to date

increased 9% year-on-year; churn for the year to date remains

stable for both broadband and postpaid mobile at 1.1% and 1.0%

respectively

-- In October 'New EE' was launched with a modern digital

platform and a set of converged products and services

-- Retail FTTP base grew year-on-year by 48% to 2.2m of which

Consumer 2.1m and Business 0.1m; 5G base 9.9m, up 42%

year-on-year

-- Cost transformation on track with gross annualised cost

savings of GBP2.5bn since April 2020 against our GBP3bn target,

with a cost to achieve of GBP1.3bn against a target of GBP1.6bn

-- Continued focus on creating standout customer experiences

with BT Group NPS of 22.7, up 1.8pts year-on-year

Adjusted(1) Revenue and EBITDA growth:

-- Reported revenue GBP10.4bn, in line with the prior year;

adjusted(1) revenue GBP10.4bn, up 3% on a pro forma(2) basis due to

increased fibre-enabled product sales, inflation-linked pricing and

improved lower margin trading in Business partially offset by

legacy product declines

-- Adjusted(1) EBITDA GBP4.1bn, up 6%; and up 4% on a pro

forma(2) basis with revenue flow through and strong cost control

more than offsetting cost inflation and one-off items in the prior

year; Business EBITDA decline due to increased input costs and

legacy high-margin managed contract declines

-- Reported profit before tax GBP1.1bn, up 29% largely due to

factors driving adjusted(1) EBITDA growth

-- Reported capital expenditure ('capex') GBP2.3bn, down 11%

with lower fixed network spend driven by lower FTTP build unit

costs; cash capex of GBP2.5bn also down 11%

-- Net cash inflow from operating activities GBP2.3bn;

normalised free cash flow(1) GBP0.5bn, up GBP0.4bn primarily due to

GBP0.2bn increase in adjusted EBITDA(1) and GBP0.3bn decrease in

cash capital expenditure partly offset by GBP(0.1)bn net working

capital outflow; net working capital movements includes GBP359m

from the sale of cash flows of contract assets relating to mobile

handsets as well as GBP(220)m from lower utilisation of a supply

chain financing programme

-- Net debt GBP19.7bn, (31 March 2023: GBP18.9bn), increasing

mainly due to pension scheme contributions with net free cash flow

for the first half of FY24 substantially offsetting the payment for

the final dividend of FY23

-- Gross IAS 19 deficit of GBP3.9bn, up from GBP3.1bn at 31

March 2023 mainly due to the increase in real interest rates and

narrowing of credit spreads over H1, partly offset by deficit

contributions

-- Interim dividend for FY24 of 2.31 pence per share (pps) in

line with our policy of paying 30% of prior year's full year

dividend

-- FY24 Outlook: Adjusted(1) revenue and EBITDA growth on a pro

forma basis; capital expenditure excluding spectrum of around

GBP5.0bn; normalised free cash flow towards the top end of

GBP1.0bn-GBP1.2bn range.

(1) See Glossary on page 3 .

(2) See 'Prior period comparatives' section on page 2 for

background on pro forma comparatives.

Half year to 30 September 2023 2022 Change

---------------------- -----------------------

Reported measures GBPm GBPm %

Revenue 10,407 10,366 -

Profit before tax 1,076 831 29

Profit after tax 844 893 (5)

Basic earnings per share 8.6p 9.1p (5)

Net cash inflow from operating

activities 2,324 2,911 (20)

Interim dividend 2.31p 2.31p -

Capital expenditure 2,321 2,613 (11)

------------------------------- ---------------------- ----------------------- -------------------------

Adjusted measures

Adjusted(1) Revenue 10,414 10,368 -

Adjusted(1) EBITDA 4,094 3,873 6

Pro forma(2) Revenue 10,414 10,130 3

Pro forma(2) EBITDA 4,094 3,944 4

Adjusted(1) basic earnings per

share 10.3p 10.0p 3

Normalised free cash flow(1) 456 64 613

Net debt(1,3) 19,689 19,042 GBP647m

------------------------------- ---------------------- ----------------------- -------------------------

Customer-facing unit updates

Adjusted(1) revenue Adjusted(1) EBITDA Normalised free

cash flow(1)

--------------------------------- -------------------------------

2022 2022 2022

Half year Pro forma(2) Pro forma(2) Pro forma(2)

to 30 September 2023 re-presented(2) Change 2023 re-presented(2) Change 2023 re-presented(2) Change

-----------------

GBPm GBPm % GBPm GBPm% GBPm GBPm %

----------------- ------- ---------------- ------ ----- ---------------- ----- ----- ---------------- ------

Consumer 4,903 4,754 3 1,347 1,2964 798 499 60

Business 4,100 4,041 1 806 903 (11) (65) 12 (642)

Openreach 3,053 2,836 8 1,936 1,735 12 152 59 158

Other 8 14 (43) 5 10 (50) (429) (506) 15

Intra-group

items (1,650) (1,515) (9) - -- - -

----------------- ------- ---------------- ------ ----- ---------------- ----- ----- ---------------- ------

Total 10,414 10,130 3 4,094 3,9444 456 64 613

----------------- ------- ---------------- ------ ----- ---------------- ----- ----- ---------------- ------

2022 2022 2022

Second quarter Pro forma(2) Pro forma(2) Pro forma(2)

to 30 September 2023 re-presented(2) Change 2023 re-presented(2) Change 2023 re-presented(2) Change

-----------------

GBPm GBPm % GBPm GBPm% GBPm GBPm %

----------------- ----- ---------------- ------ ----- ---------------- ----- ---- ---------------- ------

Consumer 2,480 2,406 3 674 6642

Business 2,073 2,074 - 420 469 (10)

Openreach 1,527 1,419 8 971 872 11

Other 3 7 (57) (4) (6) 33

Intra-group

items (833) (755) (10) - --

----------------- ----- ---------------- ------ ----- ---------------- ----- ---- ---------------- ------

Total 5,250 5,151 2 2,061 1,9993 687 269 155

----------------- ----- ---------------- ------ ----- ---------------- ----- ---- ---------------- ------

(1) See Glossary on page 3 .

(2) See 'Prior period comparatives' section below for more

information on pro forma and re-presented measures.

(3) Net debt was GBP18,859m at 31 March 2023.

Prior period comparatives

Throughout this release, comparative financial information for

the half year to 30 September 2022 ('FY23') has been re-presented

to reflect the merger of our Global and Enterprise business units

to form Business; and the change in the methodology used to

allocate shared Network, Digital and support function costs across

our units, which improves the relevance of our financial reporting

by better allocating internal costs to the drivers behind those

costs. These adjustments are made pursuant to IFRS accounting

requirements, for more information see note 1 to the condensed

consolidated financial statements on page 15 .

In addition, the group and operating review sections of this

release present comparative financial information for the Consumer

customer-facing unit and BT Group overall on an unaudited 'pro

forma' basis. This reflects adjustments that estimate the impact as

if trading in relation to BT Sport has been equity accounted in

FY23, akin to the Sports JV being in place historically. Analysis

on a pro forma basis enables comparison of results on a

like-for-like basis.

The Additional Information on page 29 presents a bridge between

financial information for the half year to 30 September 2022 as

published on 3 November 2022, and the comparatives presented in

this release. For further information see bt.com/about for separate

publications covering the formation of Business and cost allocation

changes, (published 27 June 2023), and the pro forma adjustments

(published 18 October 2022).

Glossary

Adjusted Adjusted measures (including adjusted revenue, adjusted

operating costs, adjusted operating profit, and adjusted

basic earnings per share) are before specific items.

Adjusted results are consistent with the way that

financial performance is measured by management and

assist in providing an additional analysis of the

reporting trading results of the group.

Adjusted EBITDA Earnings before interest, tax, depreciation and amortisation,

before specific items, share of post tax profits/losses

of associates and joint ventures and net finance expense.

Free cash flow Net cash inflow from operating activities after net

capital expenditure.

Capital expenditure Additions to property, plant and equipment and intangible

assets in the period.

Normalised Free cash flow (net cash inflow from operating activities

free cash flow after net capital expenditure) after net interest

paid, payment of lease liabilities, net cash flows

from the sale of cash flows related to contract assets,

monies received as prepayment for the sale of redundant

copper, dividends received from non-current assets

investments, associates and joint ventures, and net

purchase or disposal of non-current asset investments,

before pension deficit payments (including their cash

tax benefit), payments relating to spectrum, and specific

items. It excludes cash flows that are determined

at a corporate level independently of ongoing trading

operations such as dividends paid, share buybacks,

acquisitions and disposals, repayment and raising

of debt, cash flows relating to loans with joint ventures,

and cash flows relating to the Building Digital UK

demand deposit account which have already been accounted

for within normalised free cash flow. For non-tax

related items the adjustments are made on a pre-tax

basis.

Net debt Loans and other borrowings and lease liabilities (both

current and non-current), less current asset investments

and cash and cash equivalents, including items which

have been classified as held for sale on the balance

sheet. Amounts due to joint ventures, loans and borrowings

recognised in relation to monies received from the

sale of cash flows of contract assets and as prepayment

for the forward sale of redundant copper are excluded.

Currency denominated balances within net debt are

translated into sterling at swapped rates where hedged.

Fair value adjustments and accrued interest applied

to reflect the effective interest method are removed.

Service revenue Earned from services delivered using our fixed and

mobile network connectivity, including but not limited

to, broadband, calls, line rental, TV, residential

sport subscriptions, mobile data connectivity, incoming

& outgoing mobile calls and roaming by customers of

overseas networks.

Re-presented FY23 comparatives throughout this release have been

re-presented to reflect:

(i) the merger of our Global and Enterprise business

units to form Business; and

(ii) the change in our methodology used to allocate

shared Network, Digital and support function costs

across our units.

Refer to the 'Prior period comparatives' section on

page 2 and note 1 to the condensed consolidated financial

statements on page 15 for more details, and to Additional

Information on page 29 for a bridge between previously

published FY23 financial information and re-presented

numbers.

Pro forma Unaudited pro forma results estimate the impact on

the group as if trading in relation to BT Sport has

been equity accounted in FY23, akin to the Sports

JV being in place historically.

Refer to the 'Prior period comparatives' section on

page 2 for more information and to Additional Information

on page 29 for a bridge between previously published

financial information (re-presented as noted above)

and pro forma numbers.

Specific items Items that in management's judgement need to be disclosed

separately by virtue of their size, nature or incidence.

In the current period these relate to changes to our

assessment of our provision for historic regulatory

matters, restructuring charges, divestment-related

items and net interest expense on pensions.

------------------- -------------------------------------------------------------

We assess the performance of the group using a variety of

alternative performance measures. Reconciliations from the most

directly comparable IFRS measures are in Additional Information on

pages 29 to 31.

Click on, or paste the following link into your web browser, to

view the associated PDF document.

http://www.rns-pdf.londonstockexchange.com/rns/1140S_1-2023-11-1.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UPGUUGUPWPUG

(END) Dow Jones Newswires

November 02, 2023 03:00 ET (07:00 GMT)

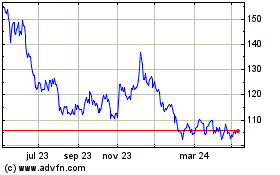

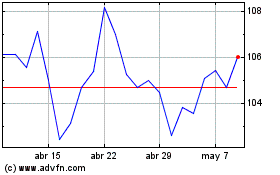

Bt (LSE:BT.A)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Bt (LSE:BT.A)

Gráfica de Acción Histórica

De May 2023 a May 2024