TIDMCGT

To:PR Newswire

From:Capital Gearing Trust P.l.c.

LEI: 213800T2PJTPVF1UGW53

Date:13 November 2023

Capital Gearing Trust P.l.c. (the "Company")

Announcement of the Half-Year Financial Report for the six months ended 30

September 2023

Chairman's Statement

Investment Performance

At the half year to 30 September 2023, the net asset value per share (`NAV') was

4,674.9p, compared to 4,797.3p at 31 March 2023. This represents a NAV total

return of -1.3% over the past six months. This return was better than the global

aggregate bond index and the investment trust index which returned -3.8% and

-1.7% respectively in Sterling terms. Whilst it is always disappointing to

report negative returns the defensive orientation of the portfolio did provide

some protection from simultaneously weak bond and equity markets. The returns

lagged Consumer Price Index (`CPI') inflation of 2.4% in the period.

The share price ended the half year at 4,585p, a fall of 1.8%. During the period

2,218,929 shares, with an aggregate value of £102.1m, were bought back under the

Company's discount control policy (`DCP').

Discount Control Policy Update

Since 2015 the Company has operated the DCP which aims to ensure that, in normal

market conditions, the shares trade consistently close to their underlying NAV.

As announced on 31 October 2023, the Company was in the process of seeking

approval from the Northern Irish Courts to reclassify its share premium account

as a distributable reserve to continue to support the DCP. In our announcement,

we referred to this process having been subject to significant delays as a

result of various "technical and administrative issues". It is now clear that

these issues comprise a series of errors and omissions on the part of third

parties. As a result, the Board has decided to take direct control over this

process and has agreed a revised timetable to take this through to a successful

conclusion. This will start with refreshing the requisite shareholder authority

at a soon to be convened General Meeting and should result in the reserves being

created in the early part of next year. The Board is extremely frustrated by the

delay caused in the process and the fact that it was not made aware of this

until very recently. The Board intends to investigate matters further and seek

compensation for any costs incurred whilst reserving all the Company's other

rights.

Following the cancellation of the share premium account the Company will have

very significant headroom in its reserves to support the DCP for the foreseeable

future. Shareholders should be assured that the Board remains fully committed to

the DCP and any temporary modifications will be reversed as soon as the Northern

Irish Court process is concluded.

Performance Comparators

The Company does not have a formal benchmark but over the years has compared its

performance against Retail Price Index (`RPI') inflation and the MSCI UK index.

RPI inflation is no longer classified as a national statistic by the Office for

National Statistics due to methodological flaws. It has been replaced by CPI

inflation, which we will now refer to as a comparator. As a number of

shareholders have pointed out, neither our investment objective nor our

portfolio construction reflect the UK equity market, so the Company will no

longer use the MSCI UK index as a comparator but may refer to equity indices

more generally when looking at specific components of performance.

Board Update

We are pleased to welcome Ravi Anand as a non-executive Director with effect

from 1 August 2023. Ravi has already made a positive impact on our discussions

pulling on his experience of investment trusts and financial services more

generally.

Wendy Colquhoun has been appointed as Chair of the Nominations Committee to lead

our Board succession planning. Robin Archibald will retire at the 2024 AGM after

nine years on the Board. As noted in the Annual Report, to avoid two long

standing Directors departing at the same time, it has been agreed that I will

remain on the Board for a further period of one or two years beyond 2024 to

enable a further Board member to be recruited and to oversee an orderly handover

to a new Chairman.

Outlook

It seems likely that the second half of the year will continue to be

challenging, as all asset markets are buffeted by a deteriorating geopolitical

backdrop, high interest rates and lingering inflation. Against this backdrop the

Company remains defensively positioned, with a relatively constrained allocation

to equities and significant exposure to short duration high quality bonds.

However, with volatile markets come opportunities and the investment manager

will seek to exploit falling prices in the bond and equity markets when values

become compelling.

Jean Matterson

Chairman

10 November 2023

Investment Manager's Report

Investment Review

The first half of the financial year has proven challenging with a negative

return of 1.3%. The six month period was characterised by rising interest rates

in developed markets which proved a headwind to our bond portfolios and rising

investment trust discounts, particularly in the alternatives sector, which were

a challenge to our risk assets.

Despite the headwinds, corporate bonds and risk assets made positive

contributions to the portfolio. Detracting from performance were nominal

government bonds, index-linked bonds, and gold. The Company's nominal government

bonds comprise treasury bills and short duration bonds. A significant majority

of these are denominated in Sterling and generated positive returns. However,

the holdings of Japanese treasury bills (2%) and Swedish government bonds (2%)

both made negative contributions as sterling appreciated by 10.1% and 3.6%

against the Japanese Yen and Swedish Krona, respectively.

Since the start of 2021, the Yen has risen from 141 to the pound to 182.

Adjusting for relative inflation, it has depreciated by over 30%. We remain

convinced of the Yen's attraction and have a 9% weighting to the currency. This

is both on valuation grounds and portfolio composition. On all purchasing power

parity (`PPP') measures, the Yen appears to be extraordinarily cheap. The

portfolio role for the Yen is also important. Japan is the single largest

overseas holder of US government bonds. There is a concern, justified in our

view, that a change in Japanese monetary policy could result in huge sales of

treasuries and repatriation of the proceeds. Were this to happen, rising yields

on US government bonds should be accompanied by gains on the Yen.

Index-linked bonds were the other source of negative returns. The Company's

holdings of UK index-linked bonds (23% of the portfolio) made positive

contributions, helped by the very short duration. We took advantage of weakness

over the summer to lengthen duration adding to 5 year bonds on very attractive

yields. US TIPS were the chief detractor during the period as 10 year yields

rose by around 100 basis points.

Corporate bonds delivered positive returns of 1.9% over the six months. Gains

were broad based. The portfolio currently has a duration of around 2.5 years and

yields around 7% with the vast majority carrying an investment grade credit

rating. While pleased with the performance of our credit portfolio, with credit

spreads tight and a deteriorating macroeconomic environment, we are reluctant to

increase the Company's allocation to the asset class or take on additional

duration risk.

Risk assets contributed positively over the six-month period with conventional

equities returning over 5%. Our two largest holdings the SPDR Europe Energy ETF

and the iShares MSCI Japan ESG ETF returned 13.6% and 5.9% respectively. Our

property holdings contributed 6.5%, buoyed by Civitas Social Housing being

subject to a takeover bid. The only significant drag on return was our

infrastructure holdings which delivered a negative return of 11%. We have taken

the opportunity to add to our infrastructure holdings on the back of share price

weakness. They offer, based on conservative assumptions, prospective real

returns of mid-single digits: equal or higher than the long-term return on

equities with considerably lower risk. Such returns are very appetising.

With discounts so wide in the alternatives sector it is reasonable to ask

whether the stated NAVs can be relied upon. Our answer is a cautious "yes". The

evidence of solidity is mounting with asset disposals at or above book value

being announced across many trusts in multiple sectors. If the valuations can be

relied upon why are so many trusts trading at large discounts? It is simply a

question of supply, demand and the quantity theory of asset prices. Huge amounts

of capital have been raised in the alternative space in recent years. Over the

last 18months multi-asset funds have seen large redemptions and wealth managers

have switched their focus to highly tax efficient low coupon gilts. With demand

falling and the supply remaining constant, the balancing variable - price - must

take the strain, with all too painful consequences. The diagnosis reveals the

cure. With no prospect for a change in demand, supply needs to be withdrawn from

the sector. For now the only contraction comes from takeovers. It would be

preferable for the sector to help itself by selling assets and buying-back

shares or returning capital to shareholders. We see precious little evidence of

this to date and have generally been frustrated by the attitudes of boards and

management teams. We will continue to engage with boards and hope to report

greater progress to you in the full year results.

Outlook

The key feature of the last six months has been the surprising resilience of the

US economy (and, to a lesser extent, Europe and the UK). This has resulted in

the market coming to believe the Federal Reserve when they said that rates

needed to be "higher for longer". Accompanying this realisation is a growing

chorus of voices calling for a "soft landing". We remain sceptical of this

outcome: the effects of the rate hiking cycle have not fully flowed into the

economy, credit availability is falling rapidly, and the money supply is

shrinking. As Niall Ferguson recently put it "The US economy's not a plane and

it won't land gently". Nor is history on the side of the optimists, indeed the

swelling chorus may itself be a siren song. There was a huge spike in the number

of articles containing the phrase "soft landing" in both 1999/2000 and 2007/08.

We worry that history will repeat itself.

Markets do not share our concerns: credit spreads and equity risk premia are

low. In the full year results we wrote that the most rapid rate hiking cycle,

following on from an extended period of ultra-cheap money, might result in the

financial system breaking. So far this has not come to pass. That crises at

Credit Suisse and Silicon Valley Bank were contained does not mean that future

crises will be avoided. To give an example, at the end of Q3 Bank of America's

losses on its hold to maturity portfolio - mostly comprising agency mortgage

bonds - were $130 bn, around 58% of its tier 1 capital. Given the subsequent

moves in rates we can only assume those losses have grown. This is just one bank

and one part of its balance sheet. The scale of losses throughout the financial

system must be very large indeed.

Ordinarily a financial crisis or a recession would be bullish for long bonds.

While this may yet occur, it is by no means certain. Short dated bonds will

rally as markets anticipate rate cuts from the Federal Reserve. What happens to

longer dated bonds is less clear. If the Fed is forced to cut rates before

inflation has been brought under control, then long term interest rates may rise

as investors price higher inflation and demand additional term premium to

compensate for volatility.

Such a move might be exacerbated by concerns over debt sustainability. This year

the US budget deficit is forecast to be 7.7% of GDP - a truly staggering $2tn. A

recession would only make this figure worse. As the Federal Government rolls

over its debts (around one third over the next 12 months) it is paying real

interest rates of around 2.5%. This is higher than the trend growth rate of the

economy. The formula r - g(1) neatly encapsulates the problem. It shows that the

debt to GDP ratio would rise even if it were to run a balanced primary budget.

For the past two decades the increasing debt stock of the US has been financed

by relatively price insensitive buyers(2). The appetite of these buyers is

waning and new buyers will need to be found. The price of money may rise to

enable the market to clear. The knock-on impact to other asset classes is

unknown but fiscal dominance and crowding out must be a risk.

Eventually, these high yields are the source of their own destruction. There are

only two ways in which government borrowings can be made sustainable. Either

countries must run balanced budgets or, through financial repression, reduce the

interest rate they pay on their debts. With no political constituency for fiscal

prudence the latter becomes the only viable route.

The destination is clear, but the timing and the path taken are not. There are

only three things of which we can be reasonably certain. First, the attempt by

markets to price a bi-stable regime (comprising the present regime of rising

real yields and a future regime of financial repression) will bring volatility

to bond markets. Second, long duration nominal bonds are likely to be a poor

investment across both regimes. Third, index-linked bonds will fair much better

than their nominal cousins and thrive when the financial repression eventually

comes. For the time being, we accept our inability to forecast the future and

therefore adopt a cautious stance, positioning the portfolio to withstand and

ultimately, we hope, profit from what lies ahead.

Peter Spiller Alastair Laing Christopher Clothier

10 November 2023

(1) Where r is the real cost of debt and g the trend growth of the economy

(2) These have ranged from global FX reserve managers, yield starved Japanese

pension funds, the Federal Reserve conducting QE and - in recent years -

domestic banks trying to invest a glut of post-Covid deposits

Interim Management Report

A review of the half year and the outlook for the Company can be found in the

Chairman's Statement and the Investment Manager's Report above.

Principal Risks and Uncertainties

The principal risks and uncertainties facing the Company were explained in

detail within the Annual Report issued in May 2023.

There remain heightened uncertainties for global economies and financial

markets, with rapid changes in interest rates, higher levels of inflation,

volatility in bond and equity markets and continued heightened geopolitical

risks impacting on energy supply and costs, global trade and economic activity.

Recent conflict in the Middle East has heightened geopolitical risk and is

likely to continue to have an adverse impact on world markets.

As announced on 31 October 2023, the Company has placed temporary limits on buy

backs under its discount control policy while it awaits approval from the

Northern Irish Court to cancel the Company's share premium account and create

additional distributable reserves. While this progresses, there is heightened

risk around the premium and discount at which the shares will trade, the

continued operation of the DCP and the Company's third party service providers

responsible for monitoring the DCP and providing administration services. The

DCP is expected to be restored in full following receipt of Court approval.

The Directors continue to work with the agents and advisers to the Company to

manage the risks, including any emerging risks the best they can.

Related Party Transactions

Details of related party transactions are contained in the Annual Report issued

in May 2023. There have been no material changes to be reported.

Going Concern

The Company's investment objective and business activities, together with the

main trends and factors likely to affect its development and performance are

monitored continuously by the Board. The Directors believe that the Company is

reasonably well placed to manage its business risks and, having reassessed the

principal risks, consider it appropriate to continue to adopt the going concern

basis of accounting in preparing the interim financial information.

Statement of Directors' Responsibilities

Each Director confirms that, to the best of their knowledge:

(i) the condensed set of financial statements has been prepared

in accordance with Financial Reporting Standard 104 (Interim Financial

Reporting);

(ii) the Half-Year Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule 4.2.7R

(indication of important events during the first six months of the financial

year and description of principal risks and uncertainties for the remaining six

months of the financial year) and includes a fair review of the information

required by Disclosure Guidance and Transparency Rule 4.2.8R (disclosure of

related party transactions and changes therein); and

(iii) the Half-Year Report, taken as a whole, is fair, balanced

and understandable and provides information necessary for shareholders to access

the Company's performance, position and strategy.

For and on behalf of the Board

Jean Matterson

Chairman

10 November 2023

Investments of the

Company

at 30 September 2023

The top ten investments

in each asset category

are listed below.

30 September 2023 31 March 2023

£'000 £'000

Index-Linked Government

Bonds

Index-Linked Bonds - 257,996 267,376

United Kingdom

Index-Linked Bonds - 177,113 248,154

United States

Index-Linked Bonds - 27,553 29,840

Japan

Index-Linked Bonds - 15,036 16,693

Canada

Index-Linked Bonds - 11,003 10,997

Sweden

Index-Linked Bonds - 4,414 4,834

Australia

Index-Linked Bonds - - 5,236

Germany

493,115 583,130

Conventional Government

Bonds

Conventional Government 104,392 95,319

Bonds - United Kingdom

Conventional Government 23,399 19,304

Bonds - Sweden

Conventional Government 22,783 34,978

Bonds - Japan

Conventional Government - 5,638

Bonds - United States

150,574 155,239

Preference Shares /

Corporate Debt

Grainger 3.375% 2028 7,824 7,484

Akelius Residential 6,252 5,123

Property 2.375% 2025

BP Capital Perpetual Bond 5,277 -

Burford Capital 6.125% 5,170 4,878

2025

Network Rail 1.75% 2027 4,715 -

Liberty Living Finance 4,648 3,179

2.625% 2024

Land Securities 1.974% 4,631 -

2026

RMS IL 2.8332% 2035 4,364 3,074

NB Private Equity 4,213 -

Partners ZDP 2024

Deutsche Pfandbriefbank 4,155 4,207

7.625% 2025

Other Preference 114,517 145,842

Shares/Corporate Debt

Investments

165,766 171,787

Funds / Equities

iShares MSCI Japan ESG 42,855 46,301

Screened UCITS ETF

SPDR MSCI Europe Energy 32,622 34,236

UCITS ETF

Lyxor STOXX Europe 600 17,707 18,670

Basic Resources UCITS ETF

North Atlantic Smaller 16,078 15,335

Companies Investment

Trust

Greencoat UK Wind 14,801 14,815

Grainger 10,887 11,327

iShares S&P 500 Energy 8,392 7,795

Sector UCITS ETF

International Public 7,023 7,558

Partnerships

GCP Infrastructure 6,053 7,618

Investments

Aker Asa 6,048 8,838

Other Fund/Equity 144,877 156,104

Investments

307,343 328,597

Gold

Wisdomtree Physical Swiss 11,250 13,048

Gold

Total investments 1,128,048 1,251,801

Cash 5,006 13,766

Total 1,133,054 1,265,567

Income

Statement

Six months

ended 30

September

2023

(unaudited)

Revenue Capital Total

£'000 £'000 £'000

Net losses - (27,390) (27,390)

on

investments

Net currency - (82) (82)

losses

Investment 13,627 - 13,627

income (note

2)

Other income 160 - 160

Gross return 13,787 (27,472) (13,685)

Investment (2,188) - (2,188)

management

fee

Other (538) - (538)

expenses

Net return 11,061 (27,472) (16,411)

before tax

Tax charge (1,818) - (1,818)

on net

return

Net return 9,243 (27,472) (18,229)

attributable

to equity

shareholders

Net return 36.47p (108.40)p (71.93)p

per

Ordinary

Share (note

3)

Income Statement

Six months

ended 30

September

2022

(unaudited)

Revenue Capital Total

£'000 £'000 £'000

Net losses on - (59,969) (59,969)

investments

Net currency gains - 131 131

Investment income (note 12,711 - 12,711

2)

Other income - - -

Gross return 12,711 (59,838) (47,127)

Investment management (2,247) - (2,247)

fee

Other expenses (482) - (482)

Net return before tax 9,982 (59,838) (49,856)

Tax charge on net (656) - (656)

return

Net return attributable 9,326 (59,838) (50,512)

to equity shareholders

Net return per 39.75p (255.07)p (215.32)p

Ordinary Share (note 3)

Income

Statement

Year

ended 31

March

2023

(audited)

Revenue Capital Total

£'000 £'000 £'000

Net losses on - (68,449) (68,449)

investments

Net currency - (547) (547)

losses

Investment 24,846 - 24,846

income (note

2)

Other income 93 - 93

Gross return 24,939 (68,996) (44,057)

Investment (4,620) - (4,620)

management

fee

Other (974) - (974)

expenses

Net return 19,345 (68,996) (49,651)

before tax

Tax charge on (1,739) - (1,739)

net return

Net return 17,606 (68,996) (51,390)

attributable

to equity

shareholders

Net return 70.67p (276.96)p (206.29)p

per

Ordinary

Share (note

3)

The total

column of

this

statement

represents

the Income

Statement of

the Company.

The Revenue

return and

Capital

return

columns are

supplementary

to this and

are prepared

under

guidance

issued by the

Association

of Investment

Companies.

All revenue

and capital

items in the

above

statement

derive from

continuing

operations.

There are no

gains or

losses other

than those

recognised in

the Income

Statement.

Statement of

Changes in

Equity

(unaudited)

for the six

months

ended 30

September

2023

Called Share Capital Unrealised Realised Revenue

Total

-up premium re reserve*

share account -demption capital capital

capital

reserve reserve*

reserve

£'000 £'000 £'000 £'000 £'000 £'000

£'000

Opening 6,645 1,101,753 16 (7,973) 140,426 18,852

1,259,719

balance at 1

April 2023

Net return - - - (24,365) (3,107) 9,243

(18,229)

attributable

to equity

shareholders

and total

comprehensive

income for

the period

Shares bought - - - - (102,065) -

(102,065)

back

(note 6)

Dividends - - - - - (15,577)

(15,577)

paid (note 4)

Total - - - - (102,065) (15,577)

(117,642)

transactions

with

owners

recognised

directly in

equity

Closing 6,645 1,101,753 16 (32,338) 35,254 12,518

1,123,848

balance at 30

September

2023

for the six months ended 30 September 2022

Called Share Capital Unrealised Realised Revenue

Total

-up premium re reserve*

share account -demption capital capital

capital

reserve reserve*

reserve

£'000 £'000 £'000 £'000 £'000 £'000

£'000

Opening 5,223 816,009 16 57,222 159,561 11,804

1,049,835

balance at 1

April 2022

Net return - - - (72,894) 13,056 9,326

(50,512)

attributable

to equity

shareholders

and total

comprehensive

income for

the period

New shares 1,198 242,390 - - - -

243,588

issued (note

6)

Dividends - - - - - (10,558)

(10,558)

paid (note 4)

Total 1,198 242,390 - - - (10,558)

233,030

transactions

with

owners

recognised

directly in

equity

Closing 6,421 1,058,399 16 (15,672) 172,617 10,572

1,232,353

balance at 30

September

2022

*These reserves are regarded as being available for distribution.

Statement of Financial Position (unaudited)

at 30 September 2023

(unaudited) (unaudited) (audited)

30 30 September 2022 31 March

September

2023 2023

£'000 £'000 £'000

Fixed assets

Investments held at fair 1,128,048 1,211,490 1,251,801

value through profit or

loss

Current assets

Debtors 4,276 8,045 7,892

Cash at bank and in hand 5,006 42,578 13,766

9,282 50,623 21,658

Creditors: amounts falling (13,482) (29,760) (13,740)

due within one year

Net current (4,200) 20,863 7,918

(liabilities)/assets

Total assets less current 1,123,848 1,232,353 1,259,719

liabilities

Capital and reserves

Called-up share capital 6,645 6,421 6,645

Share premium account 1,101,753 1,058,399 1,101,753

Capital redemption reserve 16 16 16

Capital reserve 2,916 156,945 132,453

Revenue reserve 12,518 10,572 18,852

Total equity shareholders' 1,123,848 1,232,353 1,259,719

funds

Net asset value per 4,674.9p 4,798.4p 4,797.3p

Ordinary Share

The Half-Year Financial Report for the six months ended 30 September 2023 was

approved by the Board of Directors on 10 November 2023 and signed on its behalf

by:

Jean Matterson

Chairman

10 November 2023

Cash Flow Statement (unaudited)

for the six months ended 30 September 2023

(unaudited) (unaudited) (audited)

6 months ended 6 months ended Year

30 September 2023 30 September 2022 ended

31 March

2023

£'000 £'000 £'000

Net cash 5,821 7,767 16,499

inflow from

operating

activities

(note 5)

Payments to

(1,037,482)

acquire (339,122) (522,583)

investments

Receipts 440,413 264,802 713,875

from sale

of

investments

Net cash 101,291 (257,781) (323,607)

inflow/(outf

l

ow)

from

investing

activities

Equity (15,577) (10,558) (10,558)

dividends

paid

Repurchase (100,185) - (15,315)

of Ordinary

shares

Proceeds - 253,075 297,172

from the

issue

of Ordinary

shares

Cost of - (536) (1,036)

shares

issues

Cost of (110) - -

share

buybacks

Net cash (115,872) 241,981 270,263

(outflow)/in

f

low

from

financing

activities

Decrease in (8,760) (8,033) (36,845)

cash and

cash

equivalents

Cash and 13,766 50,611 50,611

cash

equivalents

at start of

period

Cash and 5,006 42,578 13,766

cash

equivalents

at end of

period

Notes to the Financial Statements

1Basis of preparation

The condensed Financial Statements for the six months to 30 September 2023

comprise the Income Statement, the Statement of Changes in Equity, the Statement

of Financial Position and the Cash Flow Statement, together with the notes set

out below. They have been prepared in accordance with FRS 104 `Interim Financial

Reporting', the AIC's Statement of Recommended Practice issued in 2022 ("SORP"),

UK Generally Accepted Accounting Principles ("UK GAAP") and using the same

accounting policies as set out in the Company's Annual Report and Accounts at 31

March 2023.

2Investment income

(unaudited) (unaudited) (audited)

6 months 6 months Year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

£'000 £'000 £'000

Income from investments

Interest from UK bonds 5,116 2,570 6,049

Income from UK equity and 4,740 6,375 11,057

non-equity investments

Interest from overseas 3,474 1,505 4,973

bonds

Income from overseas equity 297 2,261 2,767

and non-equity investments

Total income 13,627 12,711 24,846

3Net return per Ordinary share

The calculation of return per Ordinary share is based on results after tax

divided by the weighted average number of shares in issue during the period,

excluding shares held in treasury, of 25,344,195 (30 September 2022: 23,459,021,

31 March 2023: 24,912,016).

The revenue, capital and total return per Ordinary share is shown in the Income

Statement.

4Dividends paid

(unaudited) (unaudited) (audited)

6 months ended 6 months ended Year

30 September 30 September ended

2023 2022 31 March

2023

£'000 £'000 £'000

2022 - 10,558 10,558

dividend

paid 15

July

2022

(46.0p

per

share)

2023 15,577 - -

dividend

paid 10

July

2023

(60.0p

per

share)

5Reconciliation of net return on ordinary activities before tax to net cash

inflow from operating activities

(unaudited) (unaudited) (audited)

6 months 6 months Year

ended ended ended

30 30 31 March

September September

2023

2023 2022

£'000 £'000 £'000

Net return (16,411) (49,856) (49,651)

before tax

Adjustments

for:

Capital 27,472 59,838 68,996

return

before tax

Decrease/(inc 16 28 (5)

rease) in

prepayments

Increase in 16 102 39

accruals and

deferred

income

Overseas (29) (59) (115)

withholding

tax paid

Decrease/(inc 3 (10) (10)

rease) in

recoverable

tax

UK (1,006) (243) (874)

Corporation

tax paid

(Increase)/de (326) (307) 186

crease in

dividends

receivable

Increase in (3,832) (1,857) (1,520)

accrued

interest

Realised (82) 131 (547)

(losses)/gain

s on foreign

currency

transactions

Net cash 5,821 7,767 16,499

inflow from

operating

activities

6Ordinary Shares

During the period, the Company bought back 2,218,929 Ordinary shares (six months

to 30 September 2022: nil and year to 31 March 2023: 321,500) for a cash

consideration totalling £102,065,000 (six months to 30 September 2022: nil and

year to 31 March 2023: £15,334,000).

During the period, the Company issued no new Ordinary shares and no Ordinary

shares were issued from treasury (six months to 30 September 2022: 4,790,460 new

Ordinary shares issued for proceeds totalling £243,588,000 and no Ordinary

shares were issued from treasury, year to 31 March 2023: 5,688,288 new Ordinary

shares issued for proceeds totalling £287,166,000 and no Ordinary shares were

issued from treasury).

At 30 September 2023, there were 26,580,263 Ordinary shares in issue (30

September 2022: 25,682,435 and 31 March 2023: 26,580,263). At 30 September 2023

2,540,429 Ordinary shares were held in treasury (30 September 2022: nil and 31

March 2023: 321,500).

7Fair value of financial assets and liabilities

Financial Reporting Standard 102 requires an entity to classify fair value

measurements using a fair value hierarchy that reflects the significance of the

inputs used in making the measurements. The fair value hierarchy has the

following levels:

Level 1: valued using unadjusted quoted prices in active markets for identical

assets;

Level 2: valued using observable inputs other than quoted prices included within

Level 1; and

Level 3: valued using inputs that are unobservable and are valued by the

Directors using International Private Equity and Venture Capital Valuation

(`IPEV') guidelines, such as earnings multiples, recent transactions and net

assets, which equate to their fair values.

The financial assets and liabilities measured at fair value in the Statement of

Financial Position are grouped into the fair value hierarchy at 30 September

2023 as follows:

Financial assets at fair Level 1 Level 2 Level 3 2023

value through profit or

loss £000 £000 £000 Total

£000

Quoted securities 1,127,386 - - 1,127,386

Delisted equities - - 662 662

Net fair value 1,127,386 - 662 1,128,048

8General information

The financial information contained in this Half-Year Report does not constitute

statutory accounts as defined in section 434 of the Companies Act 2006. The

financial information for the half-years ended 30 September 2023 and 30

September 2022 have not been audited. The abridged financial information for the

year ended 31 March 2023 has been extracted from the Company's statutory

accounts for that period, which have been filed with the Registrar of Companies.

The report of the Auditors on those accounts was unqualified and did not contain

a statement under either section 498(2) or section 498(3) of the Companies Act

2006.

Enquiries:

Juniper Partners Limited

Company Secretary

Email: company.secretary@capitalgearingtrust.com

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

November 13, 2023 02:00 ET (07:00 GMT)

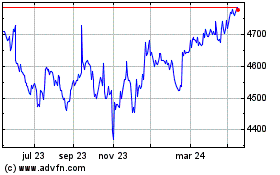

Capital Gearing (LSE:CGT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

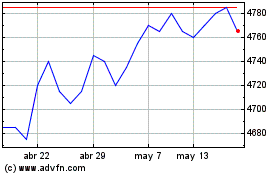

Capital Gearing (LSE:CGT)

Gráfica de Acción Histórica

De May 2023 a May 2024