TIDMMEN

RNS Number : 9111N

Molecular Energies PLC

28 September 2023

28 September 2023

MOLECULAR ENERGIES PLC

("Molecular", "the Company" or "the Group")

Unaudited Interim Results for H1 2023

Current trading

Molecular Energies PLC (AIM:MEN), the international energy

company, announces its unaudited interim results for the six months

ended 30 June 2023.

Selected Results Summary

All numbers exclude discontinued operations H1 2023 H1 2022 F/Y

and are in US$ '000 unless stated 2022

Average daily production, boe 1,559 1,885 1,656

-------- -------- -------

Group turnover 14,674 16,183 31,547

-------- -------- -------

Adjusted EBITDA 1,686 5,282 7,063

-------- -------- -------

Profit after tax before non-cash items 693 5,280 5,638

-------- -------- -------

Group net debt of which: 42,829 29,242 39,584

-------- -------- -------

Third party debt (President Argentina)

now removed from Group 33,782 22,923 35,452

-------- -------- -------

Corporate and Financial Summary

-- Group turnover of US$14.7 million (H1 2022 US$16.2 million)

-- Adjusted EBITDA of US$1.7 million (H1 2022 US$ 5.3 million)

-- Profit after tax before non-cash items* of US$0.7 million (H1 2022 US$5.3 million)

-- Third party financial borrowings in Argentina non-recourse to

Group was US$33.8 million (H1 2022 US$22.9 million) all of which is

now removed from Group pursuant to the sale in September 2023, of

the Argentine business and assets.

-- Mark to market value of holding in Atome Energy PLC (not

taken into the Group accounts) as at 30 June 2023 of US$11.6

million (FY2022: US$11.6 million)

-- In April 2023 the shareholder loan outstanding to IYA Global

Limited was converted to an interest free long-term loan repayable

at the end of 2025. There is no other Group financial debt as at

the date hereof.

Operational Summary

-- In Paraguay, work continued in relation to preparation for

drilling of the high impact exploration well with our partner CPC,

the State Energy Company of Taiwan.

-- Green House Capital has been created with the purpose of

becoming the alternative energy division of Molecular.

Current trading and developments

-- Sale of business and assets in Argentina approved by

shareholders on 21 September 2023 (the "Sale"). The Sale has been

completed and all Argentine debt is now removed.

-- The flow of monies to the Group resulting from the Sale is

expected to commence in 2024 and to continue thereafter up to a

period of five years providing the Group with base working

capital.

-- The exploration well in Paraguay is expected to commence

drilling in October 2023 and will be subject to a separate

announcement.

-- Work on the proposed initial public offering on the AIM

market of Green House Capital is progressing well with further

updates planned in the coming weeks. A Chief Executive Officer has

now been appointed with the professional team all in place. Further

announcements are expected to be issued in October.

-- As detailed in its RNS of 21 September 2023, Molecular's

management team are evaluating alternative major energy projects to

place the Group at the forefront of the ongoing energy revolution

utilising its assets, knowhow, geographic location and reputation

on the ground. Such projects now include sustainable aviation fuel

production on a commercial scale with Aecom, the international

engineering consultancy, having been commissioned to produce a

feasibility report which will be available in Q4 2023. In the

meantime, several non-disclosure agreements have been entered into

and discussions taking place with equipment suppliers and potential

off takers.

Commenting on today's announcement, Peter Levine, Chairman

said:

"Times change and so must Molecular. By making plans to pivot to

green fuel, the Company will benefit from its and its sister

company's contacts, experience, know-how and location to create a

major future fuel business.

"In the meantime, the existing business and assets of Molecular,

now free from the large Argentine debt and all third-party

financial debt, provide a solid and worthwhile base from which to

grow."

* Adjusted EBITDA means Operating Profit before depreciation,

depletion and amortisation, adjusted for non-cash share-based

expenses and certain non-recurring items. Non-recurring items

include where relevant workovers.

* Profit after tax before non-cash items which comprise

depletion, depreciation, amortisation, impairment, non-operating

gains/losses and deferred tax.

Notes to Editors

Molecular Energies PLC is an AIM listed company at the forefront

of energy development and has interests across the energy spectrum,

from an oil and gas project to the green and alternative energy

sector.

The Company currently has an oil exploration asset in Paraguay.

The Company has two separate subdivisions which are focused on

early-stage opportunities in the green and/or alternative energy

sub-sector.

Activities in the green and alternative energy space are being

carried out direct through Molecular and under the Green House

Capital brand and through AIM listed Atome Energy PLC, a green

hydrogen, ammonia, and fertiliser company operating in Paraguay,

Costa Rica and Iceland, in which Molecular currently has 20.5%.

With a strong strategic and institutional base of support, no

third-party financial debt and a Chairman whose interests as the

largest shareholder are aligned to those of its shareholders,

Molecular gives UK investors access to an energy growth story

combined with world class standards of corporate governance,

environmental and social responsibility.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR"). The person who arranged for the release of this

announcement on behalf of the Company was Robert Shepherd, Finance

Director.

Contact:

Molecular Energies PLC

Peter Levine, Chairman +44 (0)20 7016 7950

Rob Shepherd, Group FD info@molecularenergiesplc.com

Cavendish Corporate Finance Limited

(Nominated Adviser and Broker)

Simon Hicks, George Dollemore +44 (0)20 7220 0500

Tavistock (Financial PR & IR)

Simon Hudson, Nick Elwes, Charles

Baister +44 (0)20 7920 3150

Glossary of terms

Boe(pd) Barrels of oil equivalent (per day)

Bopd Barrels of oil per day

DDA Depletion, depreciation and. amortisation

EV Enterprise value meaning market capitalisation plus debt

MMbbls Million barrels of oil

MMboe Million barrels of oil equivalent

MMBtu Million British Thermal Units (gas)

M(3) /d Cubic metres of production of gas or oil per day (as the case may be)

Condensed Consolidated Statement of Comprehensive Income

Six months ended 30 June 2023

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2023 2022 2022

(Note

(Unaudited) (Unaudited) 2)

US$000 US$000 US$000

Continuing Operations

Revenue 14,674 16,183 31,547

Cost of sales

Depletion, depreciation & amortisation (3,415) (4,273) (7,296)

Other cost of sales (10,643) (10,294) (20,174)

------------ ------------ ---------

Total cost of sales 3 (14,058) (14,567) (27,470)

------------ ------------ ---------

Gross profit/(loss) 616 1,616 4,077

Administrative expenses (2,678) (1,380) (4,070)

Operating gain/(loss) - 500 -

Operating profit / (loss) before

impairment charge

------------ ------------ ---------

and non-operating gains / (losses) (2,062) 736 7

Impairment intangible asset in

Paraguay - - (8,583)

Loss in associate undertaking - (25) (25)

Gain on disposal of USA business 5 1,411 - -

Other non-operating gains /(losses) 5 1,280 351 1,269

Profit/(loss) after impairment

and non-operating

------------ ------------ ---------

gains and (losses) 629 1,062 (7,332)

Finance income 6 2,255 3,259 4,907

Finance costs 6 (2,877) (3,029) (6,617)

------------ ------------ ---------

Profit / (loss) before tax from

continuing operations 7 1,292 (9,042)

Income tax (charge)/credit

Current tax income tax (charge)/credit (81) - (59)

Deferred tax being a provision

for future taxes 156 2,030 2,033

Total income tax (charge)/credit 75 2,030 1,974

Profit/(loss) for the period from

continuing operations 82 3,322 (7,068)

Profit/(loss) for the period from

discontinued operations 7 (156) 245 (3,430)

Share of loss attributable to non-controlling

interest 282 - -

Profit/(loss) for the period attributable

to equity holders 208 3,567 (10,498)

Other comprehensive income

- Items that may be reclassified

subsequently to profit or loss

Exchange differences on translating

non-US Dollar operations (35) - -

Total comprehensive profit/(loss)

for the period

attributable to the equity holders

of the Parent Company 173 3,567 (10,498)

============ ============ =========

Basic earnings/ (loss) per share US cents US cents US cents

Earnings/ (loss) per share from

continuing operations 8 3.5 32.3 (68.7)

Earnings / (loss) per share from

discontinued operations 8 (1.5) 2.4 (33.3)

2.0 34.7 (102.0)

============ ============ =========

Diluted earnings/ (loss) per share

Earnings/ (loss) per share from

continuing operations 8 3.5 31.8 (68.7)

Earnings / (loss) per share from

discontinued operations 8 (1.5) 2.3 (33.3)

2.0 34.1 (102.0)

============ ============ =========

Condensed Consolidated Statement of Financial Position

As at 30 June 2023

30 June 30 June 31 Dec

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

ASSETS Note

Non-current assets

Intangible exploration and

evaluation assets 9 45,721 54,304 45,721

Goodwill 705 705 705

Property, plant and equipment 9 72,758 74,071 71,937

------------ ------------ ----------

119,184 129,080 118,363

Deferred tax - 356 45

Other non-current assets - 103 103

119,184 129,539 118,511

------------ ------------ ----------

Current assets

Trade and other receivables 10 15,591 7,350 11,710

Cash and cash equivalents 3,093 4,970 7,941

18,684 12,320 19,651

------------ ------------ ----------

TOTAL ASSETS 137,868 141,859 138,162

============ ============ ==========

LIABILITIES

Current liabilities

Trade and other payables 11 23,316 22,891 20,708

Borrowings 12 19,897 12,521 18,391

43,213 35,412 39,099

------------ ------------ ----------

Non-current liabilities

Trade and other payables 11 3,144 4,059 3,362

Long-term provisions 7,038 7,963 7,854

Borrowings 12 26,025 21,691 29,134

Deferred tax 94 253 250

36,301 33,966 40,600

------------ ------------ ----------

TOTAL LIABILITIES 79,514 69,378 79,699

============ ============ ==========

EQUITY

Share capital 36,180 36,179 36,179

Share premium 289 48 48

Translation reserve (50,270) (50,240) (50,235)

Profit and loss account 64,855 78,712 64,647

Other reserve 7,582 7,782 7,824

58,636 72,481 58,463

Non-controlling interest (282) - -

TOTAL EQUITY 58,354 72,481 58,463

============ ============ ==========

TOTAL EQUITY AND LIABILITIES 137,868 141,859 138,162

============ ============ ==========

Condensed Consolidated Statement of Changes in Equity

Share Profit Other Total Non-controlling Total

capital and loss reserves interest Equity

& share account

premium

US$000 US$000 US$000 US$000 US$000 US$000

Balance at 1 January

2022 36,227 75,145 (42,531) 68,841 - 68,841

--------- ---------- ---------- --------- ---------------- ---------

Share-based payments - - 73 73 - 73

Transactions with

owners - - 73 73 - 73

Loss for the period - 3,567 - 3,567 - 3,567

Total comprehensive

income/(loss) - 3,567 - 3,567 - 3,567

Balance at 30

June 2022 36,227 78,712 (42,458) 72,481 - 72,481

Share-based payments - - 42 42 - 42

Transactions with

owners - - 42 42 - 42

Profit for the

period - (14,065) - (14,065) - (14,065)

Exchange differences

on

translation - - 5 5 - 5

Total comprehensive

income/(loss) - (14,065) 5 (14,060) - (14,060)

Balance at 1 January

2023 36,227 64,647 (42,411) 58,463 - 58,463

Exercise of options 242 - (242) - - -

Transactions with

owners 242 - (242) - - -

Loss for the period - 208 - 208 (282) (74)

Exchange differences

on

translation - - (35) (35) - (35)

Total comprehensive

income/(loss) - 208 (35) 173 (282) (109)

Balance at 30

June 2023 36,469 64,855 (42,688) 58,636 (282) 58,354

========= ========== ========== ========= ================ =========

Condensed Consolidated Statement of Cash Flows

Six months ended 30 June 2023

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2023 2022 2022

(Note

(Unaudited) (Unaudited) 2)

US$000 US$000 US$000

Cash flows from continuing operations

- (Note 13)

Cash generated/(consumed) by operations (368) 8,283 11,637

Interest received 218 83 244

Taxes paid (59) - -

Cash generated/(consumed) by discontinued

operations (40) 356 (271)

(249) 8,722 11,610

------------ ------------ ---------

Cash flows from investing activities

Expenditure on exploration and evaluation

assets - - -

Expenditure on development and production

assets

(excluding increase in provision for

decommissioning) (4,432) (9,911) (21,832)

Insurance proceeds - - 1,289

Recovery of previously impaired costs - - 748

Acquisition & licence extension in Argentina 1,280 - -

Net cash used in investing activities

in discontinued operations - (110) (450)

(3,152) (10,021) (20,245)

------------ ------------ ---------

Cash flows from financing activities

Proceeds from issue of shares (net of

expenses) - - -

Loan drawdown 11,471 8,120 40,345

Repayment of borrowings (12,784) (3,018) (21,747)

Payment of loan interest and fees (1,092) (1,539) (4,366)

Repayment of obligations under leases (424) (640) (947)

Net cash used in financing activities

in discontinued operations (37) (63) (120)

(2,866) 2,860 13,165

------------ ------------ ---------

Net increase/(decrease) in cash and

cash equivalents (6,267) 1,561 4,530

Opening cash and cash equivalents at

beginning of year 7,941 2,014 2,014

Exchange (losses)/gains on cash and

cash equivalents 1,419 1,395 1,397

Closing cash and cash equivalents 3,093 4,970 7,941

============ ============ =========

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2023

1 Nature of operations and general information

Molecular Energies PLC and its subsidiaries' (together," the

Group") principal activities are the exploration for and the

evaluation and emerging new energy projects.

Molecular Energies PLC is the Group's ultimate parent company.

It is incorporated and domiciled in England. Following the sale of

business and assets in Argentina approved by shareholders on 21

September 2023, the Group has onshore exploration assets in

Paraguay and interests in emerging alternative energy projects. The

address of Molecular Energies PLC's registered office is Carrwood

Park, Selby Road, Leeds, LS15 4LG. Molecular Energies PLC's shares

are listed on the AIM of the London Stock Exchange.

These condensed consolidated interim financial statements (the

interim financial statements) have been approved for issue by the

Board of Directors on 27 September 2023. The financial information

for the year ended 31 December 2022 set out in this interim report

does not constitute statutory accounts as defined in Section 434 of

the Companies Act 2006. The financial information for the six

months ended 30 June 2023 and 30 June 2022 was neither audited nor

reviewed by the auditor. The Group's statutory financial statements

for the year ended 31 December 2022 have been filed with the

Registrar of Companies. The auditor's report on those financial

statements was unqualified and did not draw attention to any

matters by way of emphasis and did not contain a statement under

section 498(2) or (3) of the Companies Act 2006

2 Basis of preparation

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2022, which

have been prepared under UK adopted international accounting

standards ("IFRS").

These financial statements have been prepared under the

historical cost convention. The accounting policies adopted in the

2023 interim financial statements are the same as those adopted in

the 2022 Annual report and accounts.

The 31 December 2022 audited results have been re-presented to

disclose the operations discontinued in 2023, in accordance with

IFRS 5.

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2023 - continued

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2023 2022 2022

(Note

(Unaudited) (Unaudited) 2)

US$000 US$000 US$000

3 Cost of

Sales

Depreciation 3,415 4,273 7,296

Release of abandonment provision - - (711)

Royalties & production taxes 2,364 3,161 4,968

Well operating costs 8,279 7,133 15,917

14,058 14,567 27,470

============ ============ ========

4 Adjusted

EBITDA

Adjusted EBITDA 1,686 5,282 7,063

Non-recurring items (290) (159) (252)

EBITDA excluding share options 1,396 5,123 6,811

Release of abandonment provision - - 711

Depreciation, depletion

& amortisation (3,458) (4,314) (7,400)

Share based payment expense - (73) (115)

Operating profit / (loss) (2,062) 736 7

------------ ------------ --------

5 Non-operating (gains) / losses

Recovery of impaired costs - - (748)

Gain on insurance proceeds (1,280) - (115)

Arising on lease modifications - 4 (51)

Other (gains) / losses - (355) (355)

Gain on USA disposal (1,411) - -

(2,691) (351) (1,269)

======== ====== ========

6 Finance income & costs

Interest income 218 83 244

Exchange gains 2,037 3,176 4,663

Finance income 2,255 3,259 4,907

======== ====== ========

Interest & similar charges 2,877 3,029 6,617

Exchange losses - - -

Finance costs 2,877 3,029 6,617

======== ====== ========

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2023 - continued

7 Discontinued Operations 6 months 6 months Year to

to 30 to 30

June June 31 Dec

2023 2022 2022

(Note

(Unaudited) (Unaudited) 2)

US$000 US$000 US$000

Discontinued Operations

Revenue 346 1,449 1,686

Cost of sales (414) (833) (2,874)

Gross profit/(loss) (68) 616 (1,188)

Administrative expenses (30) (361) (473)

Operating profit / (loss) before

impairment charge

------------ ------------ --------

and non-operating gains / (losses) (98) 255 (1,661)

Impairment charge - - (1,433)

Non-operating gains /(losses) - - 1

Profit/(loss) after impairment and

non-operating

------------ ------------ --------

gains and (losses) (98) 255 (3,093)

Finance income - - -

Finance costs (13) (16) (32)

Profit / (loss) before tax (111) 239 (3,125)

Income tax (charge)/credit

Current tax income tax (charge)/credit - - -

Deferred tax being a provision for

future taxes (45) 6 (305)

Total income tax (charge)/credit (45) 6 (305)

Profit/(loss) for the period from

discontinued operations (156) 245 (3,430)

============ ============ ========

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2023 - continued

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2023 2022 2022

(Note

(Unaudited) (Unaudited) 2)

US$000 US$000 US$000

8 Earnings / (loss) per share

Net profit / (loss) for

the period attributable

to the equity holders of

the

Parent Company from continuing

operations 364 3,322 (7,068)

============ ============ =========

Net profit / (loss) for

the period from

discontinued operations (156) 245 (3,430)

============ ============ =========

Number Number Number

'000 '000 '000

Weighted average number

of shares in issue 10,355 10,290 10,290

============ ============ =========

Earnings /(loss) per share

from continuing operation US cents US cents US cents

Basic 3.5 32.3 (68.7)

Diluted 3.5 31.8 (68.7)

============ ============ =========

Earnings /(loss) per share

from discontinued operations US cents US cents US cents

Basic (1.5) 2.4 (33.3)

Diluted (1.5) 2.3 (33.3)

============ ============ =========

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2022 - continued

9 Non-current assets

Property

Plant

E&E and Total

Assets Equipment

US$000 US$000 US$000

Cost

At 1 January 2022 146,725 163,197 309,922

Additions - 18,961 18,961

Acqusition in USA - - -

Right of use assets (IFRS16) - 377 377

At 30 June 2022 146,725 182,535 329,260

Additions - 5,359 5,359

Acquisition of well in USA - 600 600

Damaged by fire - (1,249) (1,249)

Disposals of Right of Use Assets (IFRS!^) - (1,404) (1,404)

At 1 January 2023 146,725 185,841 332,566

Additions - 4,547 4,547

Disposal of USA - (12,514) (12,514)

Right of use assets (IFRS16) - - -

At 30 June 2023 146,725 177,874 324,599

======== ========== =========

Depreciation/Impairment

At 1 January 2022 92,421 104,049 196,470

Charge for the period - 4,415 4,415

-------- ---------- ---------

At 30 June 2022 92,421 108,464 200,885

Impaired 8,583 1,433 10,016

Disposals - (293) (293)

Damaged by fire - (75) (75)

Charge for the period - 4,375 4,375

-------- ---------- ---------

At 1 January 2023 101,004 113,904 214,908

Disposal of USA - (12,304) (12,304)

Charge for the period - 3,516 3,516

At 30 June 2023 101,004 105,116 206,120

======== ========== =========

Net Book Value 30 June 2023 45,721 72,758 118,479

======== ========== =========

Net Book Value 30 June 2022 54,304 74,071 128,375

======== ========== =========

Net Book Value 31 December 2022 45,721 71,937 117,658

======== ========== =========

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2023 - continued

30 June 30 June 31 Dec

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

10 Trade and other receivables

Trade and other receivables 7,522 6,092 8,805

Prepayments 8,069 1,258 2,905

15,591 7,350 11,710

============ ============ ==========

11. Trade and other payables

Current

Trade and other payables 8,903 9,176 7,707

Drilling, workover and operation

accruals 13,359 12,519 12,317

Current portion of leases 1,054 1,196 684

23,316 22,891 20,708

============ ============ ==========

Non-current

Non-current trade and other

payables 2,719 2,409 2,569

Non-current portion of leases 425 1,650 793

3,144 4,059 3,362

============ ============ ==========

Total carrying value 26,460 26,950 24,070

============ ============ ==========

12 Borrowings

Current

Bank loan 951 1,680 1,183

Promissory notes & bonds 18,946 10,841 17,208

19,897 12,521 18,391

Non-Current

IYA Loan 12,140 11,289 12,073

Bank loan 2,009 2,342 1,072

Promissory notes & bonds 11,876 8,060 15,989

26,025 21,691 29,134

------------ ------------ ----------

Total carrying value of

borrowings 45,922 34,212 47,525

============ ============ ==========

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2023 - continued

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2023 2022 2022

(Note

(Unaudited) (Unaudited) 2)

US$000 US$000 US$000

Profit/(loss) from operations before

taxation 7 1,292 (9,042)

Interest on bank deposits (218) (83) (244)

Interest payable and loan

fees 2,877 3,029 6,617

Depreciation and impairment

of property,

plant and equipment 3,458 4,314 7,400

Release of abandonment provision - - (711)

Impairment charge - - 8,583

Loss on associate investment - 25 25

Gain on non-operating transaction (1,280) (351) (1,269)

Gain on disposal of USA

business (1,411) - -

Share-based payments - 73 115

Foreign exchange difference (2,037) (3,176) (4,663)

Operating cash flows before movements

in working capital 1,396 5,123 6,811

(Increase)/decrease in receivables (4,565) 1,638 (3,137)

(Increase)/decrease in inventory - 1,687 1,691

(Decrease)/increase in payables 2,801 (165) 6,272

Net cash generated by/(used in)

operating

activities (368) 8,283 11,637

============ ============ ========

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2023 - continued

14 Atome

Energy plc

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

Selected key financial extracts US$000 US$000 US$000

Group Statement of Comprehensive Income

Gain / (loss) on Atome associate

investment - (25) (25)

- (25) (25)

============ ============ ==========

Company Profit & Loss Statement

Gain arising on mark to

market of investment 49 580 1,414

49 580 1,414

============ ============ ==========

Company Statement of Financial position

Investment in Atome Energy

plc at market value 11,638 10,755 11,589

============ ============ ==========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCGDCISDDGXR

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

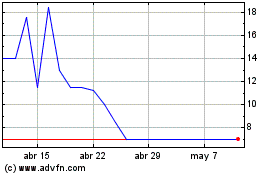

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De May 2023 a May 2024