TIDMPFP

RNS Number : 5790N

Pathfinder Minerals Plc

26 September 2023

The information contained within this announcement was deemed by

the Company to constitute inside information as stipulated under

the UK Market Abuse Regulation

26 September 2023

Pathfinder Minerals plc

("Pathfinder" or the "Company")

Half-Year Results

Pathfinder (AIM: PFP), an AIM Rule 15 cash shell, today

announces its unaudited interim results for the six months ended 30

June 2023 (the "Reporting Period"). These results will shortly be

made available on the Company's website at

www.pathfinderminerals.com .

Paul Barrett, Executive Director of the Company, commented:

"Whilst the Reporting Period pre-dates the successful completion

of the Disposal of IMM to AAG, that event marked a step change in

the Company's strategy going forward and an improvement in its

fortunes. The Board, comprising two entrepreneurial exploration

geologists, is now well placed to identify and secure one or more

projects for the Company's next phase of growth. I am very pleased

to be part of this process and I look forward to reporting progress

in due course.

Following the receipt of funds in respect of the Disposal of

IMM, we have a strengthened balance sheet and an exciting

opportunity to bring in new ventures to create a platform for

strong shareholder value growth in the near to medium term ."

Enquiries:

Pathfinder Minerals Plc

Paul Barrett, Executive Director

Tel. +44 (0)20 3143 6748

Allenby Capital Limited (Nominated Adviser and Broker)

John Depasquale / Vivek Bhardwaj (Corporate Finance)

Stefano Aquilino / Joscelin Pinnington (Sales & Corporate

Broking)

Tel. +44 (0)20 3328 5656

Vigo Consulting (Public Relations)

Ben Simons / Kate Kilgallen

Tel. +44 (0)20 7390 0234

Email. pathfinderminerals@vigoconsulting.com

EXECUTIVE DIRECTOR'S STATEMENT

Introduction

The Company's primary activity during the Reporting Period was

the negotiation of a sale of the Company's wholly owned subsidiary,

IM Minerals Limited ("IMM") (the "Disposal") and the administrative

processes necessary to enable the Disposal to complete. IMM holds

the rights to bring a claim against the Government of Mozambique

for the expropriation of Mining Concession 4623C (the "Claim").

Successful disposal of IM Minerals Limited

Following the Disposal, which completed after the period end, on

18 August 2023 ("Completion"), Pathfinder received an initial

consideration of GBP1.0 million. The purchaser, Acumen Advisory

Group LLC ("AAG") has undertaken to commence legal proceedings

against the Government of Mozambique in respect of the Claim within

three months of Completion. AAG has confirmed, among other things,

that it has secured at least US$15 million to fund the Claim and

that it will use its best endeavours to settle and/or finalise the

Claim within five years.

In the event of a successful outcome of the Claim, Pathfinder

will receive a contingent payment to be made by AAG of the greater

sum of US$30 million or 25% of the aggregate amount (including all

deferred or conditional payments) payable on settlement or

determination of the Claim less all reasonable costs and expenses

properly incurred in respect of the Claim ("Contingent Payment").

As reported in the Company's announcement dated 10 December 2021,

the valuation ranges prepared by Versant Partners LLC reflect a

minimum of US$110 million for an ex-ante damages award, through to

US$1,500 million for an ex-post damages award.

To ensure that shareholders on the Pathfinder register around

the time of Completion ("Eligible Shareholders") may in due course

be compensated for the expropriation of Mining Concession 4623C,

the Company intends to enter into a deed of assignment with a

Special Purpose wholly owned subsidiary of the Company ("SPV") into

which any Contingent Payment will be paid and then distributed to

shareholders of the SPV. Eligible Shareholders are those who were

on the Company's register as at 6:00pm on the record date of 5

September 2023.

AIM Rule 15

Having successfully completed the Disposal, the Company has

ceased to own, control, or conduct all or substantially all its

previous trading business, activities or assets and on 18 August

2023 became an AIM Rule 15 cash shell pursuant to the AIM Rules for

Companies ("AIM Rules"). As such, the Company is required to make

an acquisition or acquisitions which constitute a reverse takeover

under AIM Rule 14 ("Reverse Takeover") or be re-admitted to trading

on AIM as an investing company (which requires, inter alia, the

raising of at least GBP6.0 million) under the AIM Rules, on or

before the date falling six months from 18 August 2023.

If the Company does not complete a Reverse Takeover in

accordance with AIM Rule 14, or otherwise if re-admitted to trading

on AIM as an investing company fails to implement its investing

policy to the satisfaction of the London Stock Exchange within

twelve months of becoming an investing company, the London Stock

Exchange will suspend trading in the Company's AIM securities

pursuant to AIM Rule 40.

In light of the Company's current position, the Board is

evaluating opportunities in the sectors that it considers

appropriate, seeking to identify one or more projects or assets

that the Company can acquire, which would constitute a Reverse

Takeover pursuant to AIM Rule 14.

Any Reverse Takeover transaction will require the publication of

an AIM Rules compliant admission document and will be subject to

shareholder approval at a general meeting of the Company, to be

convened at the appropriate time.

Financial results and current financial position

The unaudited interim financial statements of Pathfinder for the

six months ended 30 June 2023 follow later in this report.

The Income Statement for the period ended 30 June 2023 reflects

a loss of GBP 235 k (H1 2022: loss of GBP185k). The Group's

Statement of Financial Position shows total assets as at 30 June

2023 of GBP167k (31 December 2022: GBP 59 k). The assets were held

largely in the form of cash deposits of GBP146k (31 December 2022:

GBP46k).

The cash position as at the date of this report, following the

receipt of the Disposal funds and settlement of several costs that

were contingent on completion of the Disposal, including legal and

advisory fees and termination costs, is GBP567k.

Board Changes

Ahead of Pathfinder's Annual General Meeting on 22 June 2023,

Peter Taylor resigned as a director of the Company but remained as

an employee of the Company in the role of non-Board Chief Executive

Officer until Completion.

After the period end on 16 August 2023, shortly prior to

Completion, Dennis Edmonds, Non-Executive Chairman, resigned from

the Board, and I joined the Board as Executive Director to lead the

Company's search for new opportunities following Completion.

The current Board is comprised of Mark Gasson and me. Between

us, we have many years of natural resource sector experience, and

we believe that this places Pathfinder in a strong position to

follow up on and progress suitable Reverse Takeover candidates

which includes, but are not limited to, potential resource

opportunities, which may be presented to the Company.

Outlook

The Disposal finally positioned Pathfinder to realise value from

the Claim, predominantly in the form of the substantial Contingent

Payment in the event of success, without incurring further costs

associated with bringing the Claim. It follows a long and costly

process after the unsatisfactory events that occurred in 2011, the

responsibility for which ultimately lies with the Government of

Mozambique. I hope in due course the Eligible Shareholders will be

compensated through the Contingent Payment. Following the receipt

of funds in respect of the Disposal, we have now begun a new

chapter for Pathfinder as an AIM Rule 15 cash shell with a

strengthened balance sheet and an exciting opportunity to bring in

new ventures.

Paul Barrett

Executive Director

26 September 2023

Unaudited Consolidated Statement of Comprehensive Income

For the 6 months ended 30 June 2023

-----------------------------------------------------------------------------------

6 months 6 months Year ended

ended ended 31 December

30 June 30 June 2022 2022

2023 Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

CONTINUING OPERATIONS

Revenue - - -

Administrative expenses (235) (185) (376)

---------------------------------- ---------------- -------------- -------------

OPERATING LOSS (235) (185) (376)

Net finance charges (8) - -

--------------------------------- ---------------- -------------- -------------

LOSS BEFORE INCOME TAX (243) (185) (376)

Income tax - - -

LOSS FOR THE PERIOD (243) (185) (376)

---------------------------------- ---------------- -------------- -------------

Total comprehensive loss for

the period attributable to

equity holders of the parent (243) (185) (376)

---------------------------------- ---------------- -------------- -------------

Loss per share from continuing

operations in pence per share:

Basic and diluted (0.04) (0.03) (0.07)

Unaudited Consolidated Statement of Financial Position

For the 6 months ended 30 June 2023

----------------------------------------------------------------------------------------

6 months 6 months Year ended

ended ended 31 December

30 June 30 June 2022 2022

2023 Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

NON-CURRENT ASSETS

Investments - - -

CURRENT ASSETS

Trade and other receivables 21 20 13

Cash and cash equivalents 146 146 46

TOTAL ASSETS 167 166 59

----------------------------------- ---------------- -------------- -------------

EQUITY AND LIABILITIES

Capital and reserves attributable

to equity

holders of the Company:

Share capital 2 18,817 18,717 18,717

Share premium 14,614 14,239 14,239

Share based payment reserve 157 162 162

Warrant reserve 82 107 104

Accumulated deficit (33,567) (33,169) (33,357)

TOTAL EQUITY 103 56 135

----------------------------------- ---------------- -------------- -------------

CURRENT LIABILITIES

Trade and other payables 3 64 110 114

Borrowings - - 80

NON-CURRENT LIABILITIES - - -

TOTAL LIABILITIES 64 110 194

----------------------------------- ---------------- -------------- -------------

TOTAL EQUITY AND LIABILITIES 167 166 59

----------------------------------- ---------------- -------------- -------------

Unaudited Consolidated Statement of Changes in Equity

For the 6 months ended 30 June 2023

------------------------------------------------------------------------------------------------

Called Share Share based Warrant Accumulated Total

up share premium payment reserve deficit equity

capital reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31

December 2021 18,716 14,234 199 255 (33,169) 235

------------------------ ---------- --------- ------------ --------- ------------ --------

Loss for the

period - - - - (185) (185)

Issue of share

capital 1 5 - - - 6

Cost of issue - - - - - -

Share based payments - - (37) (148) 185 -

------------------------ ---------- --------- ------------ --------- ------------ --------

Balance at 30

June 2022 - Unaudited 18,717 14,239 162 107 (33,169) 56

Loss for the

period - - - - (191) (191)

Issue of share - - - - - -

capital

Cost of share - - - - - -

issue

Share based payments - - - (3) 3 -

------------------------ ---------- --------- ------------ --------- ------------ --------

Balance at 31

December 2022

- Audited 18,717 14,239 162 104 (33,357) (135)

Loss for the

period - - - - (243) (243)

Issue of share

capital 100 400 - - - 500

Cost of share

issue - (25) - - - (25)

Share warrants

- lapsed - - (22) 22 -

Share based

payments - repriced - - 6 - - 6

Share based

payments - lapsed - - (11) - 11 -

------------------------ ---------- --------- ------------ --------- ------------ --------

Balance at 30

June 2023 - Unaudited 18,817 14,614 157 82 (33,567) 103

------------------------ ---------- --------- ------------ --------- ------------ --------

Unaudited Consolidated Statement of Cash Flows

For the 6 months ended 30 June 2023

-------------------------------------------------------------------------------

6 months 6 months Year ended

ended 30 ended 31 December

June 2023 30 June 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Operating loss (243) (185) (376)

Adjustments for:

Share-based payments 6 - -

Finance income (1) - -

Finance expense 9 - -

---------------------------------- ----------- -------------- -------------

Net cash flow from operating

activities before changes

in working capital (229) (185) (376)

Changes in working capital:

(Increase)/decrease in trade

and other receivables (8) (39) 6

Decrease in trade and other

payables (50) (2) (35)

----------------------------------- ----------- -------------- -------------

Net cash flow used in operating

activities (287) (226) (405)

Cash flow from financing

activities

Proceeds arising as a result

of the issue of ordinary shares 500 6 6

Costs related to issue of (25) - -

ordinary share capital

Proceeds of borrowings - - 80

Repayment of borrowings (80) - -

Finance expense (9)

----------------------------------- ----------- -------------- -------------

Net cash flow from financing

activities 386 6 86

Net increase/(decrease) in

cash and cash equivalents

in the period 99 (220) (319)

Cash and cash equivalents

at beginning of the period 46 365 365

Cash and cash equivalents

at end of the period 146 145 46

----------- -------------- -------------

1. ACCOU N TING P O LICIES

B asis of preparation

These unaudited consolidated interim financial statements

("interim financial statements") for the six months ended 30 June

2023 have been prepared in accordance with the requirements of the

AIM Rules for Companies (the "AIM Rules"). As permitted, the Group

has chosen not to adopt IAS 34 'Interim Financial Statements' in

preparing this interim financial information. The interim financial

statements should be read in conjunction with the annual financial

statements for the year ended 31 December 2022, which have been

prepared in accordance with international accounting standards in

accordance with the requirements of the Companies Act 2006

applicable to Companies reporting under IFRS.

The interim financial statements of Pathfinder Minerals plc are

unaudited financial statements for the six months ended 30 June

2023. These include unaudited comparatives for the six-month ended

30 June 2022 together with audited comparatives for the year to 31

December 2022. The unaudited financial statements do not constitute

statutory accounts, as defined under section 244 of the Companies

Act 2006. The financial statements have been prepared under the

historical cost convention. The functional and presentational

currency of the Company is Pound Sterling.

The accounting policies applied in preparing these financial

statements are consistent with those applied in the previous annual

financial statements for the year ended 31 December 2022.

Going concern

Following the Disposal and with it, the Company's rights to the

Claim, the Company has ceased to own, control, or conduct all or

substantially all its previous trading business, activities and

assets and, on 18 August 2023, became an AIM Rule 15 cash

shell.

As such, the Company is required to make an acquisition or

acquisitions which constitute a reverse takeover under AIM Rule 14

("Reverse Takeover") or be re-admitted to trading on AIM as an

investing company (which requires, inter alia, the raising of at

least GBP6.0 million) under the AIM Rules, on or before the date

falling six months from 18 August 2023.

If the Company does not complete a Reverse Takeover in

accordance with AIM Rule 14, or otherwise if re-admitted to trading

on AIM as an investing company fails to implement its investing

policy to the satisfaction of the London Stock Exchange within

twelve months of becoming an investing company, the London Stock

Exchange will suspend trading in the Company's AIM securities

pursuant to AIM Rule 40.

Accordingly, the Company will evaluate opportunities in the

sectors the directors consider appropriate, seeking to identify one

or more projects or assets which the Company can acquire, which

would constitute a Reverse Takeover under AIM Rule 14.

Following the Board changes in August 2023, the monthly cost of

maintaining the Company has reduced.

The directors have considered a number of alternative scenarios

which include the identification of a Reverse Takeover target.

Whilst the cash resources of the Company are currently expected to

be sufficient to cover the costs of a Reverse Takeover, this is

unlikely to remain the case if there is a significant delay in

identifying or completing the acquisition of, an appropriate

target.

As the successful completion of any Reverse Takeover target

cannot be assured at this time, the directors have concluded that a

material uncertainty exists as to the Company's ability to continue

as a going concern beyond the AIM Rule 15 timetable. This

uncertainty arises primarily because should the Company's shares be

suspended from trading on AIM or its listing is cancelled, the

Company's ability to raise finance would be significantly

impaired.

Notwithstanding the above, as at the date of approval of the

financial statements, the base case cash flow forecast indicated

that no additional cash resources will be required over the course

of the next 12 months. The directors therefore consider the Group

and the Company to be a going concern and have therefore prepared

these financial statements on the going concern basis.

2. SHARE CAPITAL

Called up, allotted, issued and fully paid share capital

No. Ordinary Deferred Allotment Share Share

shares of shares price Capital Premium

0.1p each of 9.9p (GBPs) GBP'000 GBP'000

each

------------------------- ------------- ------------ ---------- --------- ---------

Total as at 31 December

2022 532,494,834 183,688,116 n/a 18,717 14,239

------------------------- ------------- ------------ ---------- --------- ---------

1 February 2023 100,000,000 - 0.005 100 400

1 February 2023 - - - - (25)

Total as at 30 June

2023 632,494,834 183,688,116 n/a 18,818 14,614

------------------------- ------------- ------------ ---------- --------- ---------

Share options in issue

Exercise At 1 January At 30 June

Price Grant Date Expiry Date 2023 Lapsed 2023

--------- ------------- -------------- ------------- ------------- -----------

0.75p(1) 11 May 2023 30 June 2025 10,000,000 - 10,000,000

30 August

0.75p(2) 2023 30 June 2025 6,000,000 - 6,000,000

20 September

n/a n/a 2023 18,750,000 - 18,750,000

n/a n/a 16 March 2023 6,000,000 (6,000,000) -

n/a n/a 31 March 2023 6,000,000 (6,000,000) -

0.75p(3) 8 June 2023 30 June 2025 6,000,000 - 6,000,000

0.75p(4) 22 June 2023 30 June 2025 3,000,000 - 3,000,000

3 October

0.75p(5) 2023 30 June 2025 5,000,000 - 5,000,000

--------- ------------- -------------- ------------- ------------- -----------

60,750,000 (12,000,000) 48,750,000

--------- ------------- -------------- ------------- ------------- -----------

On 27 April 2023, the directors extended the expiry date and

amended the exercise price of certain of the subsisting share

options as follows:

Previous Revised Original Revised

expiry expiry exercise exercise

date date price price

-------------------- ------------------------- ------------------------ ------------------------- -------------------------

11 May 30 June

(1) 2023 2025 1.25p 0.75p

30

August 30 June

(2) 2023 2025 1.25p 0.75p

3

October 30 June

(3) 2023 2025 1.25p 0.75p

8 June 30 June

(4) 2023 2025 1.25p 0.75p

22 June 30 June

(5) 2023 2025 1.25p 0.75p

Share warrants in issue

Share Warrants

Exercise Expiry / At 1 January At 30 June

Price Date 2023 Lapsed 2023

--------------- -------------- ------------- ------------- -----------

0.50p 31 May 2023 11,666,668 (11,666,668) -

1.50p 31 May 2023 3,076,923 (3,076,923) -

0.60p 29 April 2024 3,500,000 - 3,500,000

--------------- -------------- ------------- ------------- -----------

18,243,591 - 3,500,000

--------------- -------------- ------------- ------------- -----------

3. TRADE AND OTHER PAYABLES

6 months ended 6 months ended Year ended

30 June 2023 30 June 2022 31 December

Unaudited Unaudited 2022

GBP'000 GBP'000 GBP'000

Trade creditors 1 5 4

Social security and

other taxes 21 64 43

Other creditors 42 41 42

Accruals and deferred

income - - 25

----------------------- --------------- --------------- -------------

64 110 114

4. SALE OF INVESTMENT

Although shareholders had approved the Disposal in May 2023, the

transaction was renegotiated before being reapproved by

shareholders and the Disposal was completed in August 2023. As at

30 June 2023, in view of the uncertainty around whether the

Disposal would complete, neither the funds received in the

transaction of GBP1,000,000 nor the associated costs of GBP371,088,

including legal and advisory fees contingent on completion, have

been reflected in these financial statements. Following the

settlement of these costs, the Company's cash position as of the

date of this report is GBP567k.

A further GBP100,000 will become payable at the earlier of the

Company's next fundraising or 1 February 2024. An additional

success fee relating to the Claim, of 2.5% of the gross value of

the proceeds arising, will become payable to a third-party in

connection with their introducer fee.

5. EVENTS AFTER THE REPORTING DATE

Completion of the sale of IM Minerals Limited

Following the end of the reporting period, the aforementioned

transaction concerning the disposal of IM Minerals Limited was

necessarily renegotiated and approved by shareholders and the

disposal completed on 18 August 2023, resulting in the receipt of

GBP1.0 million. Full details of the disposal, which would entitle

the Company to receive the greater of US$30 million or 25% of any

damages award in respect of the Claim, are set out in the Company's

Notice of General Meeting dated 31 July 2023.

The Company set a record date of 6pm on 5 September 2023;

whereby shareholders on the Company's register of members as at

that date would be entitled to receive Bonus Preference Shares

which would entitle the holders thereof, to the net proceeds

received in respect of the Claim. Initial details relating to this

was announced by the Company on 16 August 2023 and 1 September

2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDCXGDDGXU

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

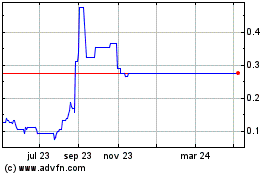

Pathfinder Minerals (LSE:PFP)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Pathfinder Minerals (LSE:PFP)

Gráfica de Acción Histórica

De May 2023 a May 2024