TIDMPIER

RNS Number : 4394N

Brighton Pier Group PLC (The)

25 September 2023

25 September 2023

The Brighton Pier Group PLC

(the "Company" or the "Group")

Unaudited interim results for the 6 months ended 25 June

2023

The Brighton Pier Group today announces its unaudited results

for the 6 months ended 25 June 2023. Total revenues for the Group

were GBP16.2 million (2022: GBP17.3 million), following a

challenging second quarter as previously announced by the Group.

The majority of this sales decline was from the Bars division which

faced tough comparable numbers, following exceptionally strong

trading from a post-pandemic surge in demand in the first half of

2022. Ongoing inflationary pressures, in particular to food,

beverage and staff costs have had a significant impact on the

Group's operating margins in the first half of 2023, resulting in

lower earnings than in the previous year.

Financial highlights

-- Total revenue in the period was GBP16.2 million (2022: GBP17.3 million).

-- Group EBITDA* was GBP1.4 million (2022: GBP3.0 million).

-- Group gross margin was 86% (2022: 87%).

-- Loss before tax (excluding highlighted items) was GBP(1.0)

million (2022: profit of GBP0.7 million).

-- Adjusted EPS was (1.7)p (2022: 0.9p).

-- Net cash flow from operations was GBP3.2 million (2022: GBP4.4 million).

-- Net debt was GBP4.7 million (25 December 2022: GBP7.1 million).

* EBITDA is detailed in Note 7 to the financial statements.

Principal developments

-- Brighton Palace Pier sales performance was up 2% versus 2022,

but down GBP(0.2) million on EBITDA at GBP0.5 million (2022: GBP0.7

million).

-- The Bars division suffered from a contraction in consumers'

disposable incomes resulting from the challenging macroeconomic

environment, with sales down across the estate.

-- The Golf division saw lower footfall across the estate in

June and higher costs but with the exception of June, trading has

been consistent, with the division generating GBP1.4 million of

EBITDA (2022: GBP1.9 million).

-- Lightwater Valley added new dinosaur-themed attractions for

2023. Admissions were down versus the prior year primarily due to

wet weather, but the park achieved a new weekend record number of

visitors during the Coronation of King Charles III in May.

Outlook

-- As reported in the 25 July 2023 trading update, the weekend train strikes, exacerbated by exceptionally poor weather in July and August, and the temporary restriction of access following a fire at a major hotel opposite the entrance to the Pier towards the end of July, resulted in sales and earnings being lower than expected.

-- These factors continued to affect trading in the 12-week

period ending 17 September 2023 resulting in total sales of GBP12.3

million, down GBP(0.3) million versus the previous year (2022:

GBP12.6 million).

-- Whilst the board has been encouraged to see improved trading

in the first 3 weeks of September, macroeconomic challenges

continue to impact the business. This, together with the weaker

than expected summer trading period, has led the Board to conclude

that operating profit for the current financial year is likely to

be below current expectations.

-- The Group's outlook in the short-to-medium term remains cautious.

Anne Ackord, Chief Executive Officer, said:

"As highlighted in our last trading update, the Group is

navigating a challenging environment, with persistent high

inflation and cautious spending by consumers negatively impacting

trading. When combined with the ongoing cost pressures, this has

resulted in the Group recording lower than expected sales and

earnings in the first half of 2023.

Trading in the 12 weeks to 17 September 2023 has been further

impacted by events outside of our control. The regular weekend

train strikes in particular have reduced visitor numbers on the

Pier by 18% versus comparable weeks in 2022. Combined with the

unseasonably wet weather and the hotel fire that disrupted sales on

the Pier for the final two weeks of July (two of the top ten

trading weeks of the year), trading has been unusually

difficult.

The Group continues to be cash generative and has a robust

balance sheet, making it well placed to weather the macroeconomic

challenges and execute its longer-term growth strategy.

I believe as a result there is significant upside opportunity

for the Group in a more typical year".

All Company announcements and news are available at

www.brightonpiergroup.com

Enquiries:

The Brighton Pier Group PLC Tel: 020 7376 6300

Luke Johnson, Chairman Tel: 020 7016 0700

Anne Ackord, Chief Executive Officer Tel: 01273 609 361

John Smith, Chief Financial Officer Tel: 020 7376 6300

Cavendish Securities plc (Nominated Adviser

and Broker)

Stephen Keys (Corporate Finance) Tel: 020 7 397

8926

Callum Davidson (Corporate Finance) Tel: 020 7397 8923

Michael Johnson (Sales) Tel: 020 7397 1933

Novella (Financial PR) Tel: 020 3151 7008

Tim Robertson

Claire de Groot

Safia Colebrook

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

About The Brighton Pier Group PLC

The Brighton Pier Group PLC is a UK entertainment business

spread across four divisions:

-- Brighton Palace Pier offers a wide range of attractions

including two arcades (with over 300 machines) and eighteen funfair

rides, together with a variety of on-site hospitality and catering

facilities. According to Visit Britain, it was the most popular

free outdoor attraction in England with over 4.6 million visitors

in 2022 .

-- The Golf division ( which trades as Paradise Island Adventure

Golf) operates eight indoor mini-golf sites at high footfall retail

and leisure centres.

-- The Bars division trades under a variety of concepts

including Embargo República, Lola Lo, Le Fez, Lowlander and

Coalition. The Group's bars target a customer base of students'

midweek and stylish over-21s and professionals at the weekend.

-- Lightwater Valley Family Adventure Park, a leading North

Yorkshire attraction, is focused on family days out. Set within 175

acres of landscaped parkland, the park operates a variety of

attractions including rides, amusements, crazy golf, children's

outdoor and indoor play, entertainment shows, together with

numerous food, drink and retail outlets.

Business Review

Introduction

The Group's strategy remains focused on capitalising on the

potential of its diversified portfolio of leisure and family

entertainment assets in the UK. However, the Group is navigating a

uniquely challenging trading environment, with persistently high

inflation leading to a decline in consumer confidence and

discretionary spend. This, combined with significant ongoing cost

increases, has led to lower sales and earnings in the 6 months

ended 25 June 2023 (2022: 6 months ended 26 June 2022).

Operational review

The first 13-week period to the end of March 2023 saw the Group

trading in line with expectations. A comparatively mild winter

resulted in strong initial demand at the Pier, but this was offset

by the wettest March in over 40 years. The high-margin Golf

division continued to perform well during this period. The Bars

division saw some softness in trading but was behind 2022 primarily

due to exceptional trading following the surge in demand seen

post-pandemic. Lightwater Valley was closed during this time.

In the latter 13-week period, which typically represents

approximately 60% of sales in the 6 month period, trading suffered

across the Group as previously announced, with continued wet

weather in April leading to lower admissions on the Pier and at

Lightwater Valley across the key Easter period. Rail disruption

also affected footfall to the Pier and some Bars sites.

Cost increases during this period were particularly severe, with

significant increases to food prices contributing to lower gross

margins at the Pier and Lightwater Valley, which were both down 3%

versus 2022. Wage increases, meanwhile, resulted in lower operating

margins across the Group.

Financial review and KPIs

Total Group revenue for the period was GBP16.2 million (2022:

GBP17.3 million).

Revenue split by division :

-- Pier division GBP7.5 million (2022: GBP7.3 million)

-- Golf division GBP3.2 million (2022: GBP3.4 million)

-- Bars division GBP4.1 million (2022: GBP5.1 million)

-- Lightwater Valley GBP1.4 million (2022: GBP1.5 million)

Total Group EBITDA for the period was GBP1.4 million (2022:

GBP3.0 million).

EBITDA split by division :

-- Pier division GBP0.5 million (2022: GBP0.7 million)

-- Golf division GBP1.4 million (2022: GBP1.9 million)

-- Bars division GBP0.4 million (2022: GBP1.1 million)

-- Lightwater Valley GBP(0.3) million (2022: GBP(0.1)

million)

-- Group overhead costs GBP(0.6) million (2022: GBP(0.6)

million)

Group gross margin for the period was 86% (2022: 87%).

Highlighted items totalling GBP3.0 million of charges (2022:

GBPnil) were recognised during the period. These charges

reflect:

-- GBP1.1 million - impairment of goodwill in Lightwater Valley; and

-- GBP1.9 million - impairment charges to property, plant and

equipment and right-of-use assets in the Bars division.

Group loss on ordinary activities before tax (excluding

highlighted items) was GBP(1.0) million (2022: profit of GBP0.7

million).

Group loss on ordinary activities after tax was GBP(3.6) million

(2022: profit of GBP0.4 million).

In summary, for the 6 month period ended 25 June 2023:

-- Revenue: GBP16.2 million (2022: GBP17.3 million)

-- Operating (loss)/profit: GBP(3.2) million (2022: GBP1.3

million)

-- Group EBITDA: GBP1.4 million (2022: GBP3.0 million)

-- Operating (loss)/profit excluding highlighted items*:

GBP(0.3) million (2022: GBP1.3 million)

-- (Loss)/profit before tax excluding highlighted items*:

GBP(1.0) million (2022: GBP0.7 million)

-- (Loss)/profit before tax: GBP(3.9) million (2022: GBP0.7

million)

-- (Loss)/profit for the period: GBP(3.6) million (2022: GBP0.4

million)

-- Net debt at the end of the period: GBP4.7 million (25 Dec

2022: GBP7.1 million)

-- Basic (losses)/earnings per share excluding highlighted items*: (1.7)p

(2022: 0.9p)

-- Basic (losses)/earnings per share: (9.6)p (2022: 1.1p)

-- Diluted (losses)/earnings per share excluding highlighted items*: (1.7)p

(2022: 0.9p)

-- Diluted (losses)/earnings per share: (9.6)p (2022: 1.1p)

* Highlighted items are detailed in Note 4 to the financial

statements.

Cash flow and balance sheet

The Group generated net cash flow from operations of GBP3.2

million (2022: GBP4.4 million), after interest and tax payments ,

all of which was available for investment or the repayment of

debt.

Capital expenditure in the period totalled GBP0.4 million (2022:

GBP0.6 million) across the Group .

During the period, the Group made net debt repayments of GBP0.4

million (2022: GBP2.8 million ), which includes the final repayment

of the Group's Coronavirus Business Interruption Loans (totalling

GBP5.0 million).

Total bank debt at the end of the period was GBP10.9 million (25

December 2022: GBP11.3 million). With the Group's Coronavirus

Business Interruption Loans now fully repaid, remaining debt

relates to the term loan .

At the period end, cash and cash equivalents were GBP6.2 million

(25 December 2022: GBP4.2 million).

Consequently, net debt at the period end stood at GBP4.7 million

(25 December 2022: GBP7.1 million). The Directors continue to take

a cautious approach to net debt levels for the Group.

The Group currently has an undrawn revolving credit facility of

GBP1.0 million, giving total cash availability to the Group of GBP

7.2 million as at the period end .

Details of the Group's banking covenants can be found on page 90

of the December 2022 Annual Report.

Trading for the 12 weeks to the 17 September 2023

Total sales for the 12-week period to 17 September 2023 were

GBP12.3 million, down GBP(0.3) million versus the previous year

(2022: GBP12.6 million). This shortfall was primarily due to a

significant reduction in footfall to the Pier, which saw visitor

numbers decrease by 18% compared to 2022.

Total sales for the Pier were GBP6.0 million, down GBP(0.5)

million versus 2022 (2022: GBP6.5 million), due to a combination of

one-off factors previously noted.

Conversely, the poor weather resulted in stronger trading in the

Golf division, where sites are located inside larger shopping

centres. Total sales of GBP1.7 million were GBP0.2 million higher

than the previous year (2022: GBP1.5 million).

Lightwater Valley traded ahead of 2022, with total sales of

GBP2.7 million, up GBP0.3 million (2022: GBP2.4 million). This was

due to increased visitor numbers to the park, which were 24% up on

last year principally due to warm weather in September and several

different promotional offers that were made available to guests. As

a result of these offers, overall spend per head was lower than in

2022.

The Bars division continues to be impacted by the headwinds in

the UK economy. Its younger demographic has been more severely

affected by price inflation, resulting in lower spends and

reduction in numbers of visits. Total sales were GBP1.9 million,

down GBP(0.3) million versus last year (2022: GBP2.2million).

Outlook and strategy

While current economic conditions continue to create an

uncertain trading environment, the disappointing trading seen over

the key summer months has largely been the result of circumstances

beyond the Group's control, and while the outlook for the

short-to-medium term must remain one of caution, there are

nonetheless encouraging signs.

Trading in the Golf division remains robust and, going forwards,

is expected to continue to hold up well.

Lightwater Valley is still trading below the exceptional summer

seen following acquisition of the park by the Group in June 2021.

However, visitor numbers in summer 2023 were above the prior year

equivalent. The Group will begin to implement improvement processes

to further increase revenues per visitor, particularly in relation

to food, beverage and retail. This will be combined with structural

changes that will enable the cost base to be optimised in advance

of the next peak trading period in summer 2024. The project to

install circa twenty pod-type units for rental is still in the

early stages but is expected to start once the planning variations

are approved.

Similarly, spend per head at the Pier was ahead of last year and

prior to the issues experienced across the summer months, sales

were tracking ahead of 2022. The Pier retains its iconic status,

attracting millions of visitors every year, and the Group urges

those involved in the rail strikes to agree a resolution so that

the ongoing disruption does not continue into 2024.

In the Bars division, the combination of decline in consumer

discretionary income, coupled with ongoing train strikes targeted

at Friday and Saturday trading sessions, is likely to continue to

bear down on sales and profits over the remainder of the current

financial year and potentially into 2024.

Inflationary cost pressures are expected to continue to present

challenges across the Group. Where price rises cannot be fully

passed on, the Group will instead implement cost-saving initiatives

in order to preserve future cash flows and earnings.

Poor weather over the summer disproportionately impacts the

Group's trading performance. The diverse experiences offered by the

Group's four operating divisions continue to prove attractive to

our customers, and the Board believes that the strength of these

different offerings will drive the business forwards over the

longer term.

INTERIM CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

for the 6 month period ended 25 June 2023

Unaudited Unaudited Audited

6 months ended 6 months ended 18 months ended

25 June 26 June 25 December

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

Revenue 16,204 17,332 58,905

Cost of sales (2,340) (2,238) (7,748)

Gross profit 13,864 15,094 51,157

Operating expenses - excluding highlighted items (14,143) (13,912) (42,373)

Highlighted items 4 (2,958) 44 451

-------------------------------------------------------- ------ --------------- --------------- ----------------

Total operating expenses (17,101) (13,868) (41,922)

Other operating income 21 90 197

Operating (loss)/profit - excluding highlighted items (258) 1,272 8,981

Highlighted items 4 (2,958) 44 451

-------------------------------------------------------- ------ --------------- --------------- ----------------

Operating (loss)/profit (3,216) 1,316 9,432

Finance income 68 - 24

Finance cost (782) (615) (1,817)

(Loss)/profit before tax - excluding highlighted items (972) 657 7,188

Highlighted items 4 (2,958) 44 451

-------------------------------------------------------- ------ --------------- --------------- ----------------

(Loss)/profit on ordinary activities before taxation (3,930) 701 7,639

Tax credit/(charge) on ordinary activities 5 333 (281) (1,266)

(Loss)/profit for the period (3,597) 420 6,373

(Losses)/earnings per share - Basic 6 (9.6) 1.1 17.1

Adjusted (losses)/earnings per share - Basic* 6 (1.7) 0.9 16.4

(Losses)/earnings per share - Diluted 6 (9.6) 1.1 16.9

Adjusted (losses)/earnings per share - Diluted* 6 (1.7) 0.9 16.2

* Adjusted basic and diluted earnings per share are calculated based on the profit for the

period adjusted for highlighted items.

2023 basic weighted average number of shares in issue was 37.29m (2022: 37.29m).

2023 diluted weighted average number of shares in issue was 37.57m (2022: 37.29m).

No other comprehensive income was earned during the period (2022: GBPnil).

INTERIM CONDENSED CONSOLIDATED BALANCE SHEET

At At At

25 June 26 June 25 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 8,480 11,004 9,545

Property, plant & equipment 27,464 28,608 28,139

Right-of-use assets 22,878 24,153 25,223

Other receivables due in more than

one year - 206 -

58,822 63,971 62,907

-------- -------- ------------

Current assets

Inventories 1,046 931 815

Trade and other receivables 3,288 1,967 1,835

Deferred tax assets 333 - -

Cash and cash equivalents 6,191 7,654 4,208

10,858 10,552 6,858

-------- -------- ------------

TOTAL ASSETS 69,680 74,523 69,765

======== ======== ============

EQUITY

Issued share capital 9,322 9,322 9,322

Share premium 15,993 15,993 15,993

Merger reserve (1,111) (1,111) (1,111)

Other reserve 452 452 452

Retained (deficit)/earnings (2,700) 275 897

Equity attributable to equity

shareholders of the parent 21,956 24,931 25,553

-------- -------- ------------

TOTAL EQUITY 21,956 24,931 25,553

-------- -------- ------------

LIABILITIES

Current liabilities

Trade and other payables 8,189 8,928 3,833

Other financial liabilities 485 1,371 11,327

Lease liabilities 2,154 1,842 1,808

Income tax payable 987 1,297 987

Provisions 119 - 119

11,934 13,438 18,074

-------- -------- ------------

Non-current liabilities

Other financial liabilities 10,400 11,271 -

Lease liabilities 24,617 24,359 25,365

Deferred tax liability 512 524 512

Other payables 261 - 261

35,790 36,154 26,138

-------- -------- ------------

TOTAL LIABILITIES 47,724 49,592 44,212

-------- -------- ------------

TOTAL EQUITY AND LIABILITIES 69,680 74,523 69,765

======== ======== ============

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Unaudited Unaudited Audited

6 months to 6 months to 18 months to

25 June 26 June 25 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Operating activities

(Loss)/profit before tax (3,930) 701 7,639

Net finance costs 714 615 1,793

Amortisation of intangible assets 31 35 126

Depreciation of property, plant and equipment 750 751 2,372

Depreciation of right-of-use assets 866 897 2,453

Gain on derecognition of lease liabilities due to disposal - - (688)

Gain on derecognition of lease liabilities due to waivers &

concessions - (145) (402)

Charge on recognition of in-substance fixed rent - 264 268

Impairment charge - goodwill 1,070 643 985

Impairment charge/(credit) - property, plant and equipment 303 (424) (424)

Impairment charge/(credit) - right-of-use assets 1,585 (489) (489)

(Decrease)/increase in provisions - (258) 119

Increase in inventories (231) (219) (84)

Increase/(decrease) in trade and other receivables (1,453) (714) 2,381

Increase/(decrease) in trade and other payables 4,229 3,361 (3,539)

Interest paid on borrowings (411) (247) (712)

Interest paid on lease liabilities (371) (368) (1,105)

Interest received 68 - 24

Income tax paid - (34) (32)

Net cash inflow from operating activities 3,220 4,369 10,685

------------ ------------ -------------

Investing activities

Purchase of property, plant and equipment and intangible assets (415) (582) (1,296)

Proceeds from disposal of property, plant and equipment 95 - 18

Payment of deferred consideration to former Lightwater Valley

Attractions Limited shareholders - - (1,000)

Net cash outflow used in investing activities (320) (582) (2,278)

------------ ------------ -------------

Financing activities

Repayment of borrowings (442) (2,805) (9,063)

Principal paid on lease liabilities (475) (584) (2,216)

Net cash outflow used in financing activities (917) (3,389) (11,279)

------------ ------------ -------------

Net increase/(decrease) in cash and cash equivalents 1,983 398 (2,872)

Cash and cash equivalents at beginning of period 4,208 7,256 7,080

Cash and cash equivalents at end of period 6,191 7,654 4,208

============ ============ =============

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

Issued Share Other Merger Retained Total

share premium reserves reserve earnings/ shareholders'

Unaudited capital (deficit) equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- --------- --------- ---------- --------- ----------- ---------------

At 25 December

2022 9,322 15,993 452 (1,111) 897 25,553

----------------- --------- --------- ---------- --------- ----------- ---------------

Loss for the

period - - - - (3,597) (3,597)

At 25 June

2023 9,322 15,993 452 (1,111) (2,700) 21,956

----------------- --------- --------- ---------- --------- ----------- ---------------

Issued Share Other Merger Retained Total

share premium reserves reserve (deficit)/ shareholders'

Unaudited capital earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- --------- --------- ---------- --------- ------------ ---------------

At 26 December

2021 9,322 15,993 452 (1,111) (145) 24,511

----------------- --------- --------- ---------- --------- ------------ ---------------

Profit for

the period - - - - 420 420

At 26 June

2022 9,322 15,993 452 (1,111) 275 24,931

----------------- --------- --------- ---------- --------- ------------ ---------------

Issued Share Other Merger Retained Total

share premium reserves reserve (deficit)/ shareholders'

Audited capital earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- --------- --------- ---------- --------- ------------ ---------------

At 27 June

2021 9,322 15,993 452 (1,111) (5,476) 19,180

----------------- --------- --------- ---------- --------- ------------ ---------------

Profit for

the period - - - - 6,373 6,373

At 25 December

2022 9,322 15,993 452 (1,111) 897 25,553

----------------- --------- --------- ---------- --------- ------------ ---------------

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

1. GENERAL INFORMATION

The Brighton Pier Group PLC (registered number 08687172) is a

public limited company incorporated and domiciled in England and

Wales. The Company's ordinary shares are traded on AIM. Its

registered address is 36 Drury Lane, London, WC2B 5RR. The Company

is the immediate and ultimate parent of the "Group".

The Brighton Pier Group PLC owns and operates Brighton Palace

Pier, one of the leading tourist attractions in the UK. The Group

is also a leading operator of eight premium bars nationwide, eight

indoor mini- golf sites and Lightwater Valley Family Adventure Park

in North Yorkshire.

The principal accounting policies adopted by the Group are set

out in Note 2.

2. ACCOUNTING POLICIES

The financial information for the 6 month periods ended 25 June

2023 and 26 June 2022 does not constitute statutory accounts for

the purposes of section 435 of the Companies Act 2006. The

financial information for the 6 month period ended 25 June 2023 has

not been audited. The Group's latest audited statutory financial

statements were for the 18 month period ended 25 December 2022 and

these have been filed with the Registrar of Companies.

Information that has been extracted from the 25 December 2022

accounts is from the audited accounts included in the annual

report, published in May 2023, on which the auditor gave an

unmodified opinion and did not include a statement under section

498 (2) or (3) of the Companies Act 2006. A copy of these accounts

can be found on the Group's website, www.brightonpiergroup.com

.

The interim condensed consolidated financial statements for the

6 months ended 25 June 2023 have been prepared in accordance with

the AIM Rules issued by the London Stock Exchange. They do not

include all the information and disclosures required in the annual

financial statements and should be read in conjunction with the

Group's annual financial statements as at 25 December 2022, which

were prepared using IFRS, in accordance with The International

Accounting Standards and European Public Limited-Liability Company

(Amendment etc.) (EU Exit) Regulations 2019.

The accounting policies used in preparation of the financial

information for the 6 months ended 25 June 2023 are the same

accounting policies applied to the Group's financial statements for

the 18 months ended 25 December 2022, with the exception of income

tax which has been calculated using the forecast effective tax rate

for the 12 months ending 31 December 2023 applied to the loss

before tax for the 6 months ending 25 June 2023. These policies

were disclosed in the 2022 Annual Report.

NOTES to the INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

3. SEGMENTAL INFORMATION

Management has determined the operating segments based on the

reports reviewed by the Chief Operating Decision Maker ("CODM")

comprising the Board of Directors. During the 6 month period ended

25 June 2023, the Group changed its measurement method of reported

segment profit or loss, with depreciation charges on property,

plant and equipment and right-of-use assets, amortisation charges

on intangible assets and net finance costs arising on lease

liabilities now allocated between the relevant operating segments,

having previously been grouped within head office costs.

The segmental information is split on the basis of those same

profit centres - however, management report only the contents of

the consolidated statement of comprehensive income and therefore no

balance sheet information is provided on a segmental basis in the

following tables.

6 month period ended Brighton Head June

25 June 2023 Palace Lightwater Total office 2023 consolidated

Pier Golf Bars Valley segments costs total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- --------- -------- -------- ----------- ---------- -------- -------------------

Revenue 7,507 3,147 4,105 1,445 16,204 - 16,204

Cost of sales (1,353) (57) (762) (168) (2,340) - (2,340)

------------------------------- --------- -------- -------- ----------- ---------- -------- -------------------

Gross profit 6,154 3,090 3,343 1,277 13,864 - 13,864

Gross profit % 82% 98% 81% 88% 86% - 86%

Operating expenses

(excluding depreciation

and amortisation) (5,639) (1,678) (2,966) (1,574) (11,857) (639) (12,496)

Other income - - - - - 21 21

------------------------------- --------- -------- -------- ----------- ---------- -------- -------------------

Divisional earnings/(loss) 515 1,412 377 (297) 2,007 (618) 1,389

Highlighted items - - (1,888) (1,070) (2,958) - (2,958)

Depreciation and amortisation

(excluding right-of-use

assets) (222) (219) (181) (159) (781) - (781)

Depreciation of right

of use assets (3) (430) (363) (51) (847) (19) (866)

------------------------------- --------- -------- -------- ----------- ---------- -------- -------------------

Operating profit/(loss) 290 763 (2,055) (1,577) (2,579) (637) (3,216)

Net finance cost (excluding

interest on lease

liabilities) - - - - - (343) (343)

Net finance cost arising

on lease liabilities - (138) (143) (88) (369) (2) (371)

Profit/(loss) before

tax 290 625 (2,198) (1,665) (2,948) (982) (3,930)

Income tax - - - - - 333 333

------------------------------- --------- -------- -------- ----------- ---------- -------- -------------------

Profit/(loss) after

tax 290 625 (2,198) (1,665) (2,948) (649) (3,597)

EBITDA 515 1,412 377 (297) 2,007 (618) 1,389

------------------------------- --------- -------- -------- ----------- ---------- -------- -------------------

NOTES to the INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

3. SEGMENTAL INFORMATION (continued)

6 month period ended Brighton Head June

26 June 2022 Palace Lightwater Total office 2022 consolidated

Pier Golf Bars Valley segments costs total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- --------- -------- -------- ----------- ---------- -------- -------------------

Revenue 7,341 3,407 5,113 1,471 17,332 - 17,332

Cost of sales (1,116) (50) (943) (129) (2,238) - (2,238)

------------------------------- --------- -------- -------- ----------- ---------- -------- -------------------

Gross profit 6,225 3,357 4,170 1,342 15,094 - 15,094

Gross profit % 85% 99% 82% 91% 87% - 87%

Operating expenses

(excluding depreciation

and amortisation) (5,578) (1,482) (3,088) (1,499) (11,647) (582) (12,229)

Other income 6 35 49 - 90 - 90

------------------------------- --------- -------- -------- ----------- ---------- -------- -------------------

Divisional earnings/(loss) 653 1,910 1,131 (157) 3,537 (582) 2,955

Highlighted items - (158) 202 - 44 - 44

Depreciation and amortisation

(excluding right-of-use

assets) (246) (219) (152) (169) (786) - (786)

Depreciation of right

of use assets (5) (430) (400) (46) (881) (16) (897)

------------------------------- --------- -------- -------- ----------- ---------- -------- -------------------

Operating profit/(loss) 402 1,103 781 (372) 1,914 (598) 1,316

Net finance cost (excluding

interest on lease

liabilities) - - - - - (247) (247)

Net finance cost arising

on lease liabilities (1) (138) (135) (92) (366) (2) (368)

Profit/(loss) before

tax 401 965 646 (464) 1,548 (847) 701

Income tax - - - - - (281) (281)

------------------------------- --------- -------- -------- ----------- ---------- -------- -------------------

Profit/(loss) after

tax 401 965 646 (464) 1,548 (1,128) 420

EBITDA 653 1,910 1,131 (157) 3,537 (582) 2,955

------------------------------- --------- -------- -------- ----------- ---------- -------- -------------------

4. HIGHLIGHTED ITEMS

6 months to 6 months to

25 June 2023 26 June 2022

GBP'000 GBP'000

-------------------------------------------------------------------------------- ------------- -------------

Impairment charge - goodwill 1,070 643

Impairment charge/(credit) - property, plant and equipment 303 (424)

Impairment charge/(credit) - right-of-use assets 1,585 (489)

Turnover rent charge - 107

Charge on recognition of in-substance fixed rent - 264

Gain on derecognition of lease liabilities using IFRS 9 derecognition criteria - (145)

Total 2,958 (44)

-------------------------------------------------------------------------------- ------------- -------------

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

4. HIGHLIGHTED ITEMS (continued)

The above items have been highlighted in order to provide users

of the financial statements visibility of non-comparable costs

included in the Consolidated Statement of Comprehensive Income for

this period.

6 month period ended 25 June 2023

The Group performed an impairment test in June 2023, resulting

in total impairments applied of GBP2,958,000, split between

goodwill (GBP1,070,000), property, plant and equipment (GBP303,000)

and right-of-use assets (GBP1,585,000). See Note 8 for further

details.

6 month period ended 26 June 2022

The Group performed an impairment test in June 2022, resulting

in an impairment of GBP643,000 in the Rushden site, and a reversal

of impairments applied to property, plant and equipment of

GBP424,000 (2021: nil) and right-of-use assets of GBP489,000 (2021:

nil). These reversals were in respect of impairments that were

applied as part of management's 2020 impairment review.

At June 2022, management reviewed the lease arrangements in

place across the Group in conjunction with the forecast performance

at each leased site. With most sites once again trading at or above

pre-pandemic levels, management assessed that the payment of

turnover rent at some sites in the Bars division was sufficiently

certain as to make them in-substance fixed payments. In accordance

with IFRS 16, rent payments totalling GBP264,000 were added back to

the lease liability on the balance sheet, with the corresponding

entry being recognised within highlighted items in the Statement of

Comprehensive Income for the 6 month period ended 26 June 2022 in

order to ensure consistency with the treatment of previously

derecognised liabilities in prior periods.Prior to this assessment

having been made, turnover rent recognised within highlighted items

totalled GBP107,000.

As a result of the COVID-19 pandemic, the Group agreed temporary

lease variations that amounted, in substance, to forgiveness of

rent payable without materially changing the present value of total

cash outflows over the life of the lease. Consequently, the Group

de-recognised the appropriate portion of its total liability in

accordance with the provisions of IFRS 9: Financial Instruments.

The value of these extended waivers is recognised in the Statement

of Comprehensive Income. The Group recognised total credits of

GBP144,000 within highlighted items in the Statement of

Comprehensive Income during the period ended 26 June 2022.

5. TAXATION

The tax credit of GBP0.3 million (2022: charge of GBP0.3

million) has been calculated by reference to the expected effective

current and deferred tax rates for the 12 month period to the 31

December 2023 applied against the loss before tax for the period

ended 25 June 2023. The full year effective tax charge on the

underlying trading profit is estimated to be GBPnil (18 months

ended 25 December 2022: GBP1.3 million).

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

6. (LOSSES)/EARNINGS PER SHARE

The weighted average number of shares in the period was:

6 months to 6 months to

25 June 2023 26 June 2022

Thousands of shares Thousands of shares

Ordinary shares 37,286 37,286

------------------------------------------------------- -------------------- --------------------

Weighted average number of shares - basic 37,286 37,286

Dilutive effect on ordinary shares from share options 286 -

------------------------------------------------------- -------------------- --------------------

Weighted average number of shares - diluted 37,572 37,286

------------------------------------------------------- -------------------- --------------------

Basic and diluted (losses)/earnings per share are calculated by

dividing the (loss)/profit for the period into the weighted average

number of shares for the year. In order to provide a measure of

underlying performance, management have chosen to present an

adjusted (loss)/profit for the period, which excludes items that

may distort comparability. Such items arise from events or

transactions that fall within the ordinary activities of the Group

but which management believes should be separately identified to

help explain underlying performance.

6 months to 6 months to

25 June 2023 26 June 2022

(Losses)/earnings per share from (loss)/profit for the period

Basic (pence) (9.6) 1.1

Diluted (pence) (9.6) 1.1

------------------------------------------------------------------------ -------------- --------------

Adjusted (losses)/earnings per share from (loss)/profit for the period

Basic (pence) (1.7) 0.9

Diluted (pence) (1.7) 0.9

------------------------------------------------------------------------ -------------- --------------

7. RECONCILIATION TO EBITDA

Group (loss)/profit before tax for the period can be reconciled

to Group EBITDA as follows:

6 months

to 6 months

25 June to 26 June

EBITDA Reconciliation 2023 2022

----------------------------------------------- --------- ------------

(Loss)/profit before tax for the period (3,930) 701

Add back:

Depreciation of property, plant and equipment 750 751

Depreciation of right-of-use-assets 866 897

Amortisation of intangible assets 31 35

Net finance costs 714 615

Highlighted items 2,958 (44)

----------------------------------------------- ------------

Group EBITDA 1,389 2,955

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

8. IMPAIRMENT REVIEW

The Group performed an impairment test in June 2023, with

continuing inflationary pressures and decline in consumer

confidence being considered by management to be indicators of

impairment, prompting a full review of the recoverable amount of

all CGUs within the Group. The Group considers the relationship

between the trading performance of each cash generating unit

('CGU') and their book value when reviewing for indicators of

impairment. Each of the Group's sites represents a separate CGU,

which were assessed individually for impairment. The carrying value

of each CGU consists of the net book value of goodwill (where

applicable), property, plant and equipment and right-of-use assets.

Goodwill is allocated to the site on which it arose.

Management believes the diversity of the Group's offerings and

strong balance sheet will offer some resilience in the short and

medium-term as these factors are tackled. Longer-term, the Board

remains optimistic about the outlook for the Group.

Based on management's review of the expected performance of the

core estate, an impairment to goodwill of GBP1,070,000 was

identified in Lightwater Valley (2022: GBPnil). Further impairments

were applied to property, plant and equipment of GBP303,000 (2022:

GBPnil) and right-of-use assets of GBP1,585,000 (2022: GBPnil) in

the Bars division. The impairments that were recognised following

the June 2023 Group impairment review, along with their impact on

the carrying value of the Group's CGUs, are detailed in the table

below:

Carrying

Carrying value carried

value prior forward after

to June 2023 June 2023

impairment impairment

review Impairment review

GBP'000 GBP'000 GBP'000

Goodwill 9,272 (1,070) 8,202

Property, plant and equipment 27,767 (303) 27,464

Right-of-use assets 24,463 (1,585) 22,878

Total carrying value of CGUs 61,502 (2,958) 58,544

------------------------------- -------------- ----------- ---------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZLFLXKLXBBV

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

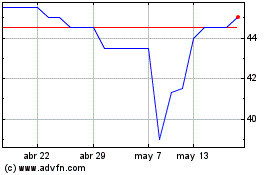

Brighton Pier (LSE:PIER)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Brighton Pier (LSE:PIER)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024