TIDMQBT

26 September 2023

Quantum Blockchain Technologies plc

("Quantum Blockchain Technologies", "the Group" or "the Company")

INTERIM RESULTS

For the Six Months Ended 30 June 2023

Quantum Blockchain Technologies plc (AIM: QBT) announces its unaudited Interim

Results for the six months ended 30 June 2023.

For further information please contact:

Quantum Blockchain Technologies Plc

Francesco Gardin, CEO and Executive Chairman +39 335 296573

SP Angel Corporate Finance(Nominated Adviser & Broker)

Jeff Keating +44 (0)20 3470 0470

Kasia Brzozowska

Leander(Financial PR)

Christian Taylor-Wilkinson +44 (0) 7795 168 157

About Quantum Blockchain Technologies Plc

QBT (AIM: QBT) is an AIM listed investment company which has recently realigned

its strategic focus to technology related investments, with special regard to

Quantum computing, Blockchain, Cryptocurrencies and AI sectors. The Company has

commenced an aggressive R&D and investment programme in the dynamic world of

Blockchain Technology, which includes cryptocurrency mining and other advanced

blockchain applications.

Chairman's Statement

During the first half of 2023 ("Period"), Quantum Blockchain Technologies Plc

maintained focus on its research and development ("R&D") strategy, but also

started to set the basis for the commercialisation of the products under

development.

In addition, the Company continues its endeavours to recover damages and legal

expenses from its legacy legal actions taken in the Italian courts.

Bitcoin Mining R&D

The bitcoin mining industry has, in the past, sought mainly to achieve

improvements by regularly optimising hardware and its integrated firmware, which

is a capital-intensive endeavour. The Company, with its R&D team of senior

researchers from leading European universities, has instead taken a different

approach. QBT is focusing its intensive R&D efforts on identifying and utilising

certain key predictive properties in the operation of bitcoin's SHA-256

cryptographic hash functions an area that the Company believes is not currently

being addressed on the same scale by any other market participant.

To enhance its research and development capabilities and eventually its

commercial prospects, the Company announced in January 2023 that it had

appointed Dr Lov Kumar Grover as a special consultant. He is now working with

QBT's Quantum Computing Team. Specifically, Dr Grover and the team are focused

on improving the already developed proprietary quantum version of SHA-256, also

known as the "Quantum Mining Algorithm", being the translation of the bitcoin

("BTC") mining algorithm for quantum computers. As previously discussed in the

Company's recent announcements, currently there are no quantum computers with

sufficient qubits to run QBT's Quantum Mining Algorithm, but once these become

available, the Company expects to be in a highly advantageous position to offer

a BTC mining method that could offer significant improvements and efficiency to

the industry.

During the first half of 2023, the Company also announced its Machine Learning

teams had developed two unique methods (Method A and Method B) that could

potentially lead to immediate performance improvements for existing BTC miners.

A third improvement ("Method C") is currently being assessed by a different QBT

R&D group.

With regard to Method B, during the Period, the Company completed a key testing

phase that demonstrated Method B theoretically increases the rate of successful

bitcoin mining by approximately 2.6 times compared to standard bitcoin mining

industry practices widely used over the same time period. The Company's

algorithm also theoretically reduced electricity consumption by 4.3%.

The Company's current main focus is to complete the development of software that

will permit the use of Method A and Method B (and possibly Method C) for use by

existing BTC miners. It is anticipated that this will enable the relevant QBT

R&D groups to run real time tests (both, simulated experiments and pool based

real time mining for testing and experimental purposes) at current mining

degrees of difficulty and thereby allow QBT to commence the commercialisation

phase of its discoveries. As announced in September 2023, QBT successfully

redesigned part of Method B specifically for application on the Chinese market

-leading mining rig, significantly expanding its addressable market.

Towards this commercialisation, in May 2023, QBT engaged Mr Vladimir

Kusznirczuk, as Marketing and Business Development Manager. Mr Kusznirczuk was

appointed to seek commercial opportunities with large US and Canadian bitcoin

miners and manufacturers of mining rigs.. The Company is currently in

discussions with a number of the largest North American cryptocurrency miners

which provided the Company with a number of the most commonly used mining rigs

to analyse and implement the porting of Method A and Method B.

It is worth noting that, as announced in January 2023, although the main focus

of the R&D programme is to develop the fastest and most energy efficient BTC

mining products, the Company is confident it is possible to extend its

improvements to miners of the two BTC `hard forks', namely, Bitcoin Cash ("BCH")

and Bitcoin SV ("BSV") without significant additional R&D effort. This would

further enlarge the Company's target market.

Legacy Investment Assets

During the first half of 2023, the Company continued to deal with its legacy

assets. These assets consist of pending court actions in Italy in relation to

Sipiem in Liquidazione S.p.A ("Sipiem") and Sosushi Srl ("Sosushi") and QBT's

investments in PBV Monitor Srl ("PBV"), Forcrowd Srl ("Forcrowd") and Geosim

Systems Ltd ("Geosim"). With regard to the court actions, despite ongoing

efforts by the Company's lawyers, there has not been significant updates during

the Period.

In relation to the Company's claim against the previous management and internal

audit committee of Sipiem, held by its wholly owned subsidiary Clear Leisure

2017 ("CL17"), as previously reported the Venice Court ruled in favour of CL17

in November 2022 and ordered the defendants to pay CL17 an award payment

amounting to ?6,188,974 in damages (exclusive of interest and adjustments for

inflation), and ?85,499 in legal fees. CL17 has commenced the process to collect

the award payment from the main defendant.

CL17 also maintains a circa ?1 million claim against Sosushi's previous

management in Italy, which is currently continuing via an arbitration process.

As previously reported, the process has, unfortunately, been subject to severe

procedural delays outside of CL17's control. The Company is not expecting the

claim to be settled in the short term.

The Company's legacy investment portfolio comprises the following three

companies: PBV, an Italian start-up which has developed an online international

legal directory, Forcrowd, an Italian crowdfunding company, and Geosim, an

Israeli company which has developed a proprietary high resolution 3D mapping

technology used to develop realistic 3D models of cities and airports.

During the period under review, as announced on 1 June 2023, QBT completed a

placing which raised a total of £1m (before expenses) pursuant to the issue of

71,428,571 new ordinary shares of 0.25 pence each in the Company ("Ordinary

Shares").

Additionally, as disclosed on 31 May 2023, QBT granted seven million new options

over new Ordinary Shares. As a result, the Company has outstanding options over

138,500,000 Ordinary Shares exercisable at 5 pence and options over 133,500,000

Ordinary Shares exercisable at 10 pence, set to expire between 2024 and 2026.

The Company believes it is in an excellent position to capture potential market

opportunities in the bitcoin market in the near term, mostly due to the

development of Methods A and B. In the longer term QBT aims to be able to build

its own more efficient mining chip (embedding all the improvements developed so

far) whilst waiting to exploit its potentially revolutionary Quantum Mining

Algorithm. The Company will continue to pursue its legal claims in respect of

legacy assets and the monetisation of its existing investments.

Financial Review

The Group reported a total comprehensive loss for the period of ?1.4 million (30

June 2022: loss ?2.8m). The operating loss for the period was ?1.2 million (30

June 2022: operating loss ?2.1m).

Included within administrative expenses are charges relating to the recognition

of share options totalling ?370,000 (2022: ?1.3m) and within finance costs are

charges for the revaluation of derivatives totalling ?142,000 (2022: ?700K). The

difference of these items is strictly dependent on the volatility of the

Company's share price during the first half of 2023, used for the calculation

according to the relevant accounting standards.

At 30 June 2023, the Group's net liabilities had improved to ?3.1 million,

compared to net liabilities of ?3.2 million at 31 December 2022. Net current

assets of the Group also improved during the period under review, to ?4.8

million compared to net current assets of ?4.4 million at 31 December 2022.

Post 30 June 2023 Events

On 7 July 2023, the Company announced that, with regards to its Zero-Coupon Bond

("Bond") originally announced on 9 November 2020, the Company had received a

conversion notice from MC Strategies AG to convert ?1 million of the Bond into

new Ordinary Shares at a conversion price of 1 pence per share (EUR: GBP

exchange rate of 0.89 - fixed per terms and conditions of the Bond). As a

result, the Company issued 89,000,000 new Ordinary Shares on 14 July 2023.

On 24 July 2023, QBT announced it had filed a patent application in relation to

ASIC EnhancedBoost developed by the Company's cryptography expert and

Cryptographic Optimisation team. This novel approach, called Message Scheduling

For Cryptographic Hashing addresses one of the most challenging problems in BTC

mining: partial pre-computing of future blockchains' blocks. The Company

believes the process has the potential to achieve a potential area savings of

approximately 8%.

On 20 September 2023, QBT announced it was focusing its current R&D efforts on

the most commonly used mining rigs available in the market for the Company to

study and implement the porting of its Method A and Method B chip enhancements

to these machines. The Company is targeting not only Intel's Blockscale based

miners, but also the most popular mining rigs produced in China, which are used

by more than 75% of the global Bitcoin market[1].

The Company also announced it is currently in discussions with a number of the

largest North American cryptocurrency miners which provided the Company with a

number of the most commonly used mining rigs to analyse and implement the

porting of Method A and Method B.

Outlook

The Board remains committed to return value to its shareholders by:

i. continuing to focus on its R&D programme, which is providing promising and

consistent results;

ii. investing in the technology sector (both in a direct and an indirect

manner);

iii. managing the Legacy Assets portfolio, where positive outcomes are expected

from the Company's claims; and

iv. further reduction of the debt position (if and when the conditions are

deemed appropriate)

The Board remains positive as the technology investments are deemed sound and

promising in fast growth markets, while the legal claims have strong merit

against defendants that are expected to remain solvent, thereby enhancing the

prospect of collection of the judgment debts.

1 https://www.coindesk.com/tech/2023/06/13/bitmains-s19-bitcoin-miners-account

-for-bulk-of-network-hashrate-says-new-research/

GROUP STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 JUNE 2023

Note Six months to Six months to Year ended

30 June 2023 30 June 2022 31 December

2022

(Unaudited) (Unaudited) (Audited)

Continuing ?'000 ?'000 ?'000

operations

Revenue - - -

- - -

Administrative (1,190) (2,067) (4,547)

expenses

Other operating 1 - -

income

Operating loss (1,189) (2,067) (4,547)

Share of loss from - - (69)

equity-accounted

associates

Finance charges (292) (797) (636)

Loss before tax (1,481) (2,864) (5,252)

Taxation 42 74 226

Loss for the (1,439) (2,790) (5,026)

period

attributable to

owners of the

parent

Other - - -

comprehensive

income/(loss)

TOTAL (1,439) (2,790) (5,026)

COMPREHENSIVE LOSS

FOR THE

PERIOD

ATTRIBUTABLE TO

OWNERS OF THE

PARENT

Earnings per

share:

Basic loss per 3 (?0.143) (?0.281) (?0.508)

share (cents)

Diluted loss per 3 (?0.090) (?0.213) (?0.312)

share (cents)

GROUP STATEMENTS OF FINANCIAL POSITION

AT 30 JUNE 2023

Note As at As at

As at

30 June 30 June

31

De

cember

2023 2022

2022

?'000 ?'000

?'000

(Unaudited) (Unaudited)

(Audited)

Non-current

assets

Property, 198 234

226

plant and

equipment

Investments 689 714

677

Investments 66 211

60

in equity

-accounted

associates

Total non 953 1,159

963

-current

assets

Current

assets

Trade and 4,643 5,029

4,626

other

receivables

Cash and 752 1,307

463

cash

equivalents

Total 5,395 6,336

5,089

current

assets

Current

liabilities

Trade and (369) (311)

(465)

other

payables

Provisions (210) -

(210)

Total (579) (311)

(675)

current

liabilities

Net current 4,816 6,025

4,414

assets/(liabi

l

ities)

Total assets 5,769 7,184

5,377

less

current

liabilities

Non-current

liabilities

Borrowings (8,286) (8,439)

(8,131)

Derivative (610) (870)

(468)

financial

instruments

Total non (8,896) (9,309)

(8,599)

-current

liabilities

Total (9,475) (9,620)

(9,274)

liabilities

Net (3,127) (2,125)

(3,222)

liabilities

Equity

Share 8,586 8,378

8,378

capital

Share 51,497 50,541

50,541

premium

account

Other 14,182 12,673

13,812

reserves

Retained (77,392) (73,717)

(75,953)

losses

Equity (3,127) (2,125)

(3,222)

attributable

to

owners of

the

Company

Total equity (3,127) (2,125)

(3,222)

GROUP AUDITED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

Group Share Share Other Retained losses Total equity

capital premium reserves ?'000 ?'000

?'000 account ?'000

?'000

At 1 January 2022 8,221 49,442 11,409 (71,896) (2,824)

Total - - - (5,026) (5,026)

comprehensive loss

for the year

Grant of warrants

Exercise of 157 1,099 - 969 2,225

warrants

Grant of share - - 1,854 - 1,854

options

Modification of - - 549 - 549

bond

At 31 December 8,378 50,541 13,812 (75,953) (3,222)

2022

GROUP UNAUDITED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS TO 30 JUNE 2022

Group Share Share Other Retained losses Total equity

capital premium reserves ?'000 ?'000

?'000 account ?'000

?'000

At 1 January 2022 8,221 49,442 11,409 (71,896) (2,824)

Total comprehensive - - - (2,790) (2,790)

loss for the period

Exercise of 157 1,099 - 969 2,225

warrants

Grant of share - - 1,264 - 1,264

options

At 30 June 2022 8,378 50,541 12,673 (73,717) (2,125)

GROUP UNAUDITED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS TO 30 JUNE 2023

Group Share Share Other Retained losses Total equity

capital premium reserves ?'000 ?'000

?'000 account ?'000

?'000

At 1 January 2023 8,378 50,541 13,812 (75,953) (3,222)

Total comprehensive - - - (1,439) (1,439)

loss for the period

Issue of shares 208 956 - - 1,164

Share based payment - - 370 - 370

expense

At 30 June 2023 8,586 51,497 14,182 (77,392) (3,127)

GROUP UNAUDITED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2022

Six months to Six months to Year ended 31

30 June 2023 30 June 2022 December 2022

(Unaudited) (Unaudited) (Audited)

?'000 ?'000 ?'000

Cash used in operations

Loss before tax (1,189) (2,864) (5,252)

Impairment of investments - - 154

Share of post-tax losses of - - 69

equity accounted associates

Non cash foreign exchange 10 (50) (35)

movements

Finance charges (142) 800 637

Decrease/(increase) in (25) (49) 474

receivables

(Decrease)/increase in 95 (18) 346

payables

Impairment of intercompany - - 33

receivables

Share based payments 370 1,264 1,854

Depreciation 28 20 49

Net cash (outflow)/inflow (853) (897) (1,671)

from operating activities

Cash flows from investing

activities

Purchase of investments (28) - (50)

Purchase of property, plant - (90) (111)

and equipment

Interest received 6 - -

Net cash inflow from (22) (90) (161)

investing activities

Cash flows from financing

activities

Proceeds from capital issue 1,164 1,255 1,256

Net cash inflow/(outflow) 1,164 1,255 1,256

from financing activities

Net increase in cash for 289 268 (576)

the period

Cash and cash equivalents 463 1,039 1,039

at beginning of year

Cash and cash equivalents 752 1,307 463

at end of period

NOTES TO THE FINANCIAL STATEMENTS

1. General Information

Quantum Blockchain Technologies plc is a company incorporated and domiciled in

England and Wales. The Company's ordinary shares are traded on the AIM market of

the London Stock Exchange. The address of the registered office is 22 Great

James Street, London, WC1N 3ES.

2. Accounting policies

The principal accounting policies are summarised below. They have all been

applied consistently throughout the period covered by these consolidated

financial statements.

Basis of preparation

The interim financial statements of Quantum Blockchain Technologies Plc are

unaudited consolidated financial statements for the six months ended 30 June

2023 which have been prepared in accordance with UK adopted international

accounting standards. They include unaudited comparatives for the six months

ended 30 June 2022 together with audited comparatives for the year ended 31

December 2022.

The interim financial statements do not constitute statutory accounts within the

meaning of section 434 of the Companies Act 2006. The statutory accounts for the

year ended 31 December 2022 have been reported on by the company's auditors and

have been filed with the Registrar of Companies. The report of the auditors was

qualified in respect of the valuation of the investment in Geosim Systems Ltd.

The report of the auditor also contained an emphasis of matter paragraph in

respect of a material uncertainty regarding going concern. Aside from the

limitation of scope relating to Geosim Systems Ltd, the auditor's report did not

contain any statement under section 498 of the Companies Act 2006.

The interim consolidated financial statements for the six months ended 30 June

2023 have been prepared on the basis of accounting policies expected to be

adopted for the year ended 31 December 2023, which are consistent with the year

ended 31 December 2022.

Going concern

The Group's activities generated a loss of ?1,439,000 (June 2022: ?2,790,000)

and had net current assets of ?4,816,000 as at 30 June 2023 (June 2022:

?6,025,000). The Group's operational existence is still dependent on the ability

to raise further funding either through an equity placing on AIM, or through

other external sources, to support the on-going working capital requirements.

After making due enquiries, the Directors have formed a judgement that there is

a reasonable expectation that the Group can secure further adequate resources to

continue in operational existence for the foreseeable future and that adequate

arrangements will be in place to enable the settlement of their financial

commitments, as and when they fall due.

For this reason, the Directors continue to adopt the going concern basis in

preparing the interim accounts. Whilst there are inherent uncertainties in

relation to future events, and therefore no certainty over the outcome of the

matters described, the Directors consider that, based upon financial projections

and dependant on the success of their efforts to complete these activities, the

Group will be a going concern for the next twelve months. If it is not possible

for the Directors to realise their plans, over which there is significant

uncertainty, the carrying value of the assets of the Group is likely to be

impaired.

Notwithstanding the above, the Directors note the material uncertainty in

relation to the Group being unable to realise its assets and discharge its

liabilities in the normal course of business.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of the business. The

key risks that could affect the Company's medium-term performance and the

factors that mitigate those risks have not substantially changed from those set

out in the Company's 2022 Annual Report and Financial Statements, a copy of

which is available on the Company's website:

www.quantumblockchaintechnologies.com. The key financial risks are liquidity and

credit risk.

Critical accounting estimates

The preparation of interim financial statements requires management to make

estimates and assumptions that affect the reported amounts of assets and

liabilities at the end of the reporting period. Significant items subject to

such estimates are set out in note 3 of the Company's 2022 Annual Report and

Financial Statements. The nature and amounts of such estimates have not changed

significantly during the interim period.

3. Loss per share

The basic earnings per share is calculated by dividing the loss attributable to

ordinary shareholders by the weighted average number of ordinary shares

outstanding during the period. Diluted earnings per share is computed using the

same weighted average number of shares during the period adjusted for the

dilutive effect of share options and convertible loans outstanding during the

period.

The loss and weighted average number of shares used in the calculation are set

out below:

Six months to Six months to Year to

30 June 2023 30 June 2022

31

December

2022

(Unaudited) (Unaudited) (Audited)

?'000 ?'000 ?'000

(Loss)/profit attributable to

owners of the parent company:

Basic earnings (1,439) (2,790) (5,026)

Diluted earnings (1,492) (2,762) (5,091)

Basic weighted average number 1,009,060 994,291 989,497

of ordinary shares (000's)

Diluted weighted average 1,664,647 1,295,619 1,632,694

number of ordinary shares

(000's)

Basic and fully diluted

earnings per share:

Basic earnings per share (?0.143) (?0.281) (?0.508)

Diluted earnings per share (?0.090) (?0.213) (?0.312)

IAS 33 requires presentation of diluted earnings per share when a company could

be called upon to issue shares that would decrease earnings per share or

increase net loss per share. No adjustment has been made to diluted earnings per

share for out-of-the money options and warrants.

4. Principal Activity

The principal activities of the Company are focused on the R&D programme

relating to bitcoin and as an investing company with a portfolio in technology

sectors. The main focus of management is to successfully run the R&D programme

and release new products to the market. The management is also pursuing the

monetisation of all of the Company's Legacy Assets, through selected

realisations, court-led recoveries of misappropriated assets and substantial

debt recovery processes.

5. Copies of Interim Accounts

Copies of the interim results are available at the Group's website at

www.quantumblockchaintechnologies.co.uk.

Copies may also be obtained from the Group's registered office: Quantum

Blockchain Technologies PLC, 22 Great James Street, London, WC1N 3ES.

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/quantum-blockchain-technologies-plc/r/interim-results,c3841996

END

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

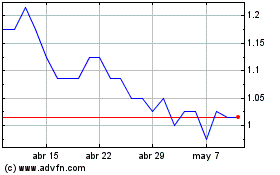

Quantum Blockchain Techn... (LSE:QBT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Quantum Blockchain Techn... (LSE:QBT)

Gráfica de Acción Histórica

De May 2023 a May 2024