TIDMSEQI

RNS Number : 5043W

Sequoia Economic Infra Inc Fd Ld

18 April 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN OR INTO THE UNITED STATES

18(th) April 2023

Sequoia Economic Infrastructure Income Fund Limited

("SEQI" or the "Company")

NAV update

The NAV per share for SEQI, the specialist investor in economic

infrastructure debt, increased to 93.26 per share from the prior

month's NAV per share of 93.10 pence per share, representing an

increase of 0.16 pence per share. A full attribution of the changes

in the NAV per share is as follows:

pence

per share

--------------------------------- -----------

February NAV 93.10

--------------------------------- -----------

Interest income, net of expenses 0.74

Asset valuations, FX movements

net of hedges -0.64

Subscriptions/Redemptions 0.06

March NAV 93.26

================================= ===========

As the Company is approximately 100% currency hedged, it does

not expect to realise any material FX gains or losses over the life

of its investments. However, the Company's NAV may include

unrealised short-term FX gains or losses, driven by differences in

the valuation methodologies of its FX hedges and the underlying

investments - such movements will typically reverse over time.

Capital Markets Day - 10 May 2023

The Investment Adviser will be holding a Capital Markets Day for

institutional investors and analysts on Wednesday 10th May 2023 at

15:00 BST until 17:00 BST. The aim of the event is to provide

investors with an insight to international infrastructure and

credit investment themes and an update on the positioning of SEQI

against the current market backdrop. There will also be an

opportunity for investors to meet members of the SEQI Board and the

broader Investment Adviser team.

Those interested in joining SEQI's Capital Markets Day

virtually, please register via the following link: (

https://www.lsegissuerservices.com/spark/SequoiaEconomicInfrastructureIncomeFundLtd/events/4b6c6d4e-46a9-4db2-8be9-a445965021dc

). Those interested in attending in-person should email:

Sequoia@teneo.com

Dividends and share buyback

The next expected dividend declaration date will be on 20 April

2023. This will be the second quarterly dividend at the new, higher

dividend target, which was increased by 10% in November 2022 to

6.875 pence p.a. At the closing share price of 82.90 on 17 April

2023, the dividend yield on the Company's share price is 8.29%.

During March 2023 the Company purchased 9,440,784 of its

ordinary shares in the market at an average purchase price of 81.64

pence per share. Following this, the Company holds 33,419,445

ordinary shares in Treasury following the commencement of a share

buyback programme in July 2022. The Board and the Investment

Adviser remain confident in the Company's NAV, including uplifts

over time expected from the pull-to-par effect (see below).

Portfolio update

As at 31 March 2023, the Company had cash of GBP68.1m and had

drawn GBP181.8m on its GBP325.0m revolving credit facility with the

remaining balance available to support the Company's working

capital and liquidity requirements. The Company also had undrawn

commitments on existing investments collectively valued at

GBP49.5m.

The Company's invested portfolio consisted of 61 private debt

investments and 7 infrastructure bonds across 8 sectors and 26

sub-sectors. It had an annualised yield-to-maturity (or

yield-to-worst in the case of callable bonds) of 11.85% and a cash

yield of 7.5%. The yield-to-maturity has been rising, which is

mainly attributable to the higher interest rate environment and the

Company's exposure to floating rate investments, which comprise 58%

of the portfolio as of March 2023. The weighted average portfolio

life is approximately 3.5 years. Private debt investments

represented 98% of the total portfolio. The Company's invested

portfolio remains geographically diverse with 50.1% located across

the US, 25.6% in the UK, 24.2% in Europe, and 0.1% in Australia/New

Zealand.

Recent reductions in asset values continue to be primarily due

to increases in risk-free rates and credit spreads. Investors are

reminded that these declines are unrealised mark-to-market

adjustments that should reverse over time as the investments

approach their repayment date (the "pull-to-par" effect). As at

March 2023, the pull-to-par is estimated to be worth approximately

6.8p/share over the course of the life of the Company's

investments.

The Company's pipeline of economic infrastructure debt

investments remains strong and is diversified by sector,

sub-sector, and jurisdiction. At month end, approximately 100% of

the Company's NAV consisted of either Sterling assets or was hedged

into Sterling. The Company has adequate liquidity to cover margin

calls on its hedging book.

The following investments settled in March 2023 (excluding small

loan drawings of less than GBP0.5m):

-- The purchase of Samhällsbyggnadsbolaget (SBB) i Norden AB

2026 and SBB i Norden AB 2027 senior corporate bonds for EUR6.0m

and EUR8.3m respectively. SBB is a social infrastructure property

company listed on the Nasdaq Stockholm (Large Cap) and their

yield-to-maturity is approximately 10.8%;

-- The Company has exchanged approximately GBP11.3m of Bulb

Energy's loan for a majority shareholding in Zoa (see further

details below)

-- An additional senior loan for GBP5.08m to Project Octopus, a

telecom infrastructure services provider based in the UK; and

-- An additional senior loan for GBP1.7m to Clyde Street, a

hotel construction project in Scotland .

No investments sold or prepaid in March 2023

Non-performing loans

There has been ongoing progress over the past month in relation

to the Company's non-performing loans.

The amount owed under the Company's loan to Bulb Energy has been

reduced by GBP11.3 million during the month, following the partial

debt-for-equity swap in relation to Zoa, which, as announced

previously, is a new pioneering business that owns all the software

developed by Bulb and has about 100 employees focused on further

developing the software, which will be marketed for sale to energy

supply companies in the UK and elsewhere. The Company now owns

preference shares in Zoa (in an amount of GBP11.3 million) and the

majority of the ordinary shares in the business, with the balance

being owned by management and employees of Zoa.

Further updates will be provided to shareholders in the future

when developments occur.

Ordinary Portfolio Summary (15 largest settled investments)

Investment name Currency Type Ranking Value Sector Sub-sector Cash-on-cash Yield

GBPm(1) yield to

(%) maturity

/ worst

(%)

Bannister Senior

Secured 2025 GBP Private Senior 61.0 Accommodation Health care 11.69 12.99

AP Wireless

Junior EUR Private Mezz 58.7 TMT Telecom towers 4.62 8.04

AP Wireless US

Holdco USD Private HoldCo 58.6 TMT Telecom towers 6.21 9.37

Montreux HoldCo

Facility GBP Private HoldCo 57.4 Accommodation Health care 14.20 14.20

Lightspeed Fibre

Group Ltd GBP Private Senior 56.4 TMT Broadband 6.64 14.54

Landfill

Infinis Energy GBP Private Senior 56.2 Renewables gas 5.79 7.10

Transport Specialist

Project Tyre USD Private Senior 56.0 assets shipping 10.43 10.43

Tracy Hills TL Residential

2025 USD Private Senior 55.6 Other infra 11.12 11.12

Hawkeye Solar

HoldCo

2030 USD Private HoldCo 54.1 Renewables Solar & wind 8.96 9.82

Expedient Data

Centers Senior USD Private Senior 51.5 TMT Data centers 10.54 11.01

Workdry GBP Private Senior 50.0 Utility Utility Services 7.72 7.72

Project Spinnaker GBP Private Senior 49.3 TMT Broadband 9.69 10.01

GenOn Bowline

Senior

Secured USD Private Senior 49.3 Power Energy transition 11.83 11.82

EIF Van Hook TL

B 2024 USD Private Senior 48.0 Utility Midstream 10.09 10.02

Transport

Madrid Metro EUR Private HoldCo 46.8 assets Rolling stock 1.39 7.19

Note (1) - excluding accrued interest

Disclaimer: the dividend increase is a target and not a profit

forecast

The Company's monthly investor report and additional portfolio

disclosure will be made available at http://www.seqifund.com/ .

LEI: 2138006OW12FQHJ6PX91

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States,

except pursuant to an applicable exemption from registration. No

public offering of securities is being made in the United

States.

For further information please contact:

Sequoia Investment Management Company +44 (0)20 7079 0480

Steve Cook

Dolf Kohnhorst

Randall Sandstrom

Greg Taylor

Anurag Gupta

Jefferies International Limited +44 (0)20 7029 8000

Gaudi Le Roux

Stuart Klein

Teneo (Financial PR) +44 (0)20 7353 4200

Martin Pengelley

Elizabeth Snow

Sanne Fund Services Guernsey Limited +44 (0) 20 3530 3107

(Company Secretary)

Matt Falla

Lisa Garnham

About Sequoia Economic Infrastructure Income Fund Limited

The Company seeks to provide investors with regular, sustained,

long-term distributions and capital appreciation from a diversified

portfolio of senior and subordinated economic infrastructure debt

investments. The Company is advised by Sequoia Investment

Management Company Limited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVBCGDSXSBDGXR

(END) Dow Jones Newswires

April 18, 2023 02:00 ET (06:00 GMT)

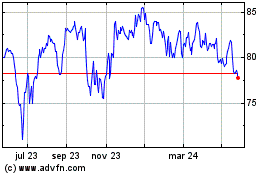

Sequoia Economic Infrast... (LSE:SEQI)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

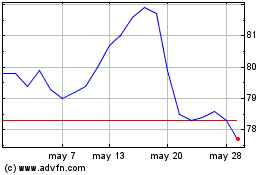

Sequoia Economic Infrast... (LSE:SEQI)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024