TIDMTIGT

RNS Number : 3258Y

Troy Income & Growth Trust Plc

04 May 2023

To: RNS

From: Troy Income & Growth Trust plc

LEI: 213800HLNMQ1R6VBLU75

Date: 4 May 2023

TROY INCOME & GROWTH TRUST PLC

INTERIM RESULTS FOR THE SIX MONTHS TO 31 MARCH 2023

The investment objective of Troy Income & Growth Trust plc

is to achieve rising income and long-term capital growth through

investment in a portfolio of predominantly UK equities.

Financial Highlights

30 September

31 March 2023 2022 Change

Equity shareholders' funds GBP186,264,000 GBP193,315,000 (3.6)%

Net asset value per share 72.05p 68.48p 5.2%

Share price (mid-market) 70.60p 67.00p 5.4%

Discount to net asset value (2.0)% (2.2)%

Total Return* (for the periods to 31 March 2023)

Three

Six Months One Year Years Five Years Ten Years

Share price 7.7% (5.0)% 9.5% 11.5% 61.1%

Net asset value per

share 8.9% (3.6)% 16.0% 15.8% 68.1%

FTSE All-Share Index 12.3% 2.9% 47.4% 27.9% 75.9%

* Total return includes reinvesting the net dividend in the month

that the share price goes ex-dividend.

INTERIM BOARD REPORT

Introduction

I am pleased to have joined Troy Income and Growth Trust plc

('the Company') as a non-executive Director and Chair. On behalf of

myself and the rest of the Board, I would like to thank my

predecessor, David Warnock, for his committed stewardship of the

Company.

The Company has a clear proposition. It is a UK equity

investment trust that invests in high-quality, predominantly

UK-listed companies, capable of providing dividend growth every

year. The Company aims to offer its Shareholders progressive annual

dividend growth and good total returns with lower share price

volatility than the FTSE All Share Index. Uniquely in the AIC UK

Equity Income sector, it also offers Shareholders the ability to

purchase and sell shares in the Company whenever they want at close

to net asset value due to the implementation of a strict discount

control mechanism.

Company Aims

Since my arrival, the Board has focused on setting clearer

objectives for the Company and has spent a full day's working

session with the Managers to gain their input. We have agreed the

Company will aim to provide the following:

-- Share price total return above the FTSE All Share Index over a 5-year period

Recent performance has fallen short of this target, with the

portfolio lagging the wider market return. Calendar year 2022 in

particular was a challenging period, with the rapid rise in

interest rates and inflation leading to significant polarisation

within equity markets. Sectors typically eschewed by the Managers

for their cyclicality and capital intensity, particularly Energy

and Mining, performed very strongly. Concurrently, many highly

profitable and growth-oriented companies held in the portfolio

suffered share price declines. The Managers see a considerably more

balanced market today, with the environment well-suited to the

Company's quality, dividend growth focused approach. Recent results

and dividends reported by holdings provide reassurance on the

strength of the portfolio and the outlook for returns in a variety

of market scenarios.

-- Dividend growth of 4% per annum for Shareholders

Having paid a dividend of 0.5p for the first quarter of the

financial year, the Company paid 0.51p in the second quarter. This

represents growth of c.4% on last year's second quarter dividend.

It is the Board's intention going forward to target annual dividend

growth of 4%, market conditions permitting.

Over recent years, the Company's portfolio has evolved. The

Managers have prioritised companies able to deliver progressive

dividend growth and sold out of companies with higher yields that

lack the potential for long term dividend growth. It is encouraging

for the Board to see income growth from the portfolio feeding

through to revenues. Given the Managers' confidence in the

robustness of the portfolio's dividends, and the Company's strong

revenue reserves, the Board has decided to increase the rate of

dividend growth for the Company.

-- Share price volatility lower than the FTSE All Share Index

The Managers emphasise high-quality, resilient, dividend-paying

businesses that should drive consistent returns, avoiding the worst

of market volatility. In particular, they believe a portfolio

suffering fewer and less destructive drawdowns will be in a better

position to compound returns over the long run. The Company has

consistently fared better than the FTSE All-Share Index during

market sell-offs and has continued to provide a return with lower

share price volatility. The discount control mechanism has played

an important role in this, ensuring the Company's share price

remains closely aligned with net asset value.

The Board will closely monitor the Company's progress against

these aims and will report on this in the annual report and

accounts.

Performance

The Company delivered a Net Asset Value ('NAV') per share total

return of +8.9% and a share price total return of +7.7% over the

six months to 31 March 2023. Over the same period, the FTSE All

Share Index produced a total return of +12.3%. The average NAV

total return for the AIC UK Equity Income sector was +12.6% for the

same period. Looking back over time, it has not been unusual for

the Company to lag the index and peers in periods of particularly

strong markets. The two most significant drags were the Company's

holdings in large, low cyclicality Consumer Staples companies, and

sterling's strong appreciation against the dollar impacting the

Company's US-listed holdings.

There was strong performance from a range of large, stable

holdings within the portfolio over the six-month period. RELX,

Unilever, National Grid, Compass and AstraZeneca contributed most

strongly to returns. Other areas of strength came from UK

domestically focused businesses such as Next and Domino's Pizza, as

these stocks recovered from the dislocation caused by the UK's

September 2022 mini-budget. Another notable theme across markets

over the period related to China's re-opening following over two

years of strict COVID lockdowns. This was most obviously manifested

within the portfolio by the sharp rise in the share price of

InterContinental Hotels Group, a company with a strong exposure to

Chinese travel. Across the broader index, commodity producers,

which the Company does not hold, were also beneficiaries of this

trend.

Background

The market continued to digest the impact of high inflation and

higher interest rates over the six-month period. UK inflation (CPI

growth) hit 11.1% in October 2022, the highest level since the

1970's. Whilst it is likely that this reading represented peak

inflation for this current cycle, the path for inflation returning

to the Bank of England's ('BOE') 2% target is highly uncertain. In

response to such readings, the BOE continued to hike interest

rates. On the 23 March 2023, the UK base rate was raised for the

eleventh consecutive time to 4.25%, having been as low as 0.1% in

December 2021.

The magnitude and speed of interest rate rises in response to

inflation is having acute and unpredictable impacts on the market.

In September 2022, we witnessed a crisis in UK pensions. More

recently, in March 2023, significant stress emerged in the US

regional banking system. This resulted in Silicon Valley Bank's

collapse, in what was the first major US bank run since the global

financial crisis. Other banks across the world, including Credit

Suisse, suffered varying degrees of contagion and whilst there has

been limited direct read across so far to the UK banks, these

events provided a reminder as to the risks associated with highly

levered business models.

The Managers have chosen not to invest in banks, due to the

leverage and cyclicality inherent in their business models.

Instead, they seek to invest in resilient, high-quality dividend

growth companies that have relatively lower levels of share price

volatility.

Portfolio

Large, high-quality, low cyclicality businesses continue to make

up the core of the portfolio. Some of the Company's largest

allocations include a c.30% weighting to Consumer Staples (e.g.

Unilever, Diageo and Reckitt), c.20% to non-discretionary

B2B-focused businesses (e.g. Compass Group, RELX and Bunzl) and

c.10% to the relatively non-cyclical Healthcare sector (e.g.

AstraZeneca and GSK).

Over the period, the Managers took advantage of market

volatility to make new investments in London Stock Exchange Group,

Sage, Smiths Group, Imperial Brands and Howden Joinery. All five

are resilient, leading companies in their respective industries and

have strong balance sheets and well-covered, growing dividends.

The Managers exited positions in Haleon, Halma and Aveva Group.

Aveva was subject to a bid by its majority shareholder Schneider

Electric, following which the position was sold. Haleon and Halma

were sold on valuation and dividend yield grounds.

While the team follow a long-term, low turnover strategy, they

will continue to seek to improve the growth of capital values and

dividends within the portfolio.

Discount Control Mechanism

The discount control mechanism ('DCM') is one way in which the

Company sets itself apart from other trusts in the sector. The DCM

materially improves the liquidity of the Company's shares and

ensures Shareholders can purchase and sell shares in the Company at

a price that closely reflects the NAV. This is particularly

important during times of market stress, where it is not uncommon

for other trusts to trade at a material discount to their

NAV's.

The Company has operated the DCM since Troy became the Company's

Manager in 2009 and it continues to be a key aspect of the

Company's proposition.

Dividends

The Board announced in March that the Company would pay a second

interim dividend of 0.51p per share (2022 - 0.49p). This represents

a step up in the rate of the Company's dividend growth to c.4%

compared the prior year's second interim. Absent any unforeseen

circumstances, it is the Board's objective to maintain this rate of

dividend growth going forward.

This increase in the dividend signals the Managers' confidence

in the underlying portfolio and the Board's strong desire to

deliver dividend growth to Shareholders. The Company's dividend

growth can be expected to be sustainable through a wide variety of

market environments, with the current annual dividend covered by

almost 11 months of revenue reserves.

Recent corporate results continue to demonstrate strong dividend

growth from some significant portfolio holdings. Highlights

included +10% growth in the final dividends from RELX and

InterContinental Hotels Group, +8% from Croda and LSE Group, and

+11% from Bunzl.

Outlook

The Managers believe that the lagged impact of higher interest

rates and high inflation will continue to affect companies,

consumers, and certain parts of the financial system. March brought

significant volatility to markets, with pockets of stress emerging

in the US and European banking systems. Regulators have acted fast

to avoid contagion, but after more than a decade of low rates, the

Managers are braced for further speed bumps, as well as possible

recessions in Europe and the US.

The Board is confident that the companies held in the portfolio

are resilient and adaptable. Over recent months, the Managers have

digested encouraging results from a range of the Company's

businesses. Strong operations are feeding through to strong

dividend growth from several core holdings; 10% growth in RELX's

latest dividend, 9% from Reckitt, 8% from Croda, and 10% from Bunzl

- the latter marking 30 years of unbroken growth at a 10% compound

annual rate. These are reassuring signals by management teams on

the outlook for their businesses. All of these businesses have

proven to be reliable, long-term income payers over many years, and

are typical of the companies preferred by the Managers. The Board

believes that the consistent, compounding dividend returns possible

from such businesses support a robust outlook for total returns

from your Company.

Bridget Guerin

Chairman

3 May 2023

Principal Risks and Uncertainties

The principal risks facing the Company relate to the Company's

investment activities and include performance risk, market risk,

resource risk and operational risk. Other risks faced by the

Company include breach of regulatory rules which could lead to

suspension of the Company's Stock Exchange Listing, financial

penalties, or a qualified audit report. Breach of Section 1159 of

the Corporation Tax Act 2010 could lead to the Company being

subject to tax on capital gains.

An explanation of these principal risks and how they are managed

is contained in the Strategic Report within the Annual Report and

Accounts for the year ended 30 September 2022.

The Company's principal risks and uncertainties have not changed

materially since the date of the Annual Report and no material

changes are foreseen over the remainder of the year.

Going Concern

The Directors have undertaken a rigorous review of the Company's

ability to continue as a going concern. This review included

consideration of the Company's investment objective, its principal

risks, the nature and liquidity of the portfolio, current

liabilities and expenditure forecasts.

The Company's investments consist mainly of readily realisable

securities which can be sold to maintain adequate cash balances to

meet expected cash flows. In assessing the Company's ability to

meet its liabilities as they fall due, the Directors took into

account the economic and market outlook. They also considered

ongoing investor interest in the continuation of the Company,

looking specifically at feedback from meetings and conversations

with Shareholders by the Company's advisers, and the operation of

the DCM, which the Directors believe enhances the Company's appeal

to investors.

Based on their assessment and considerations, the Directors

believe it is appropriate to continue to adopt the going concern

basis in preparing the financial statements.

Directors' Responsibility Statement

The Directors are responsible for preparing the half yearly

financial report in accordance with applicable law and regulations.

The Directors confirm that to the best of their knowledge:

- the condensed set of interim financial statements contained

within the half yearly financial report have been prepared in

accordance with International Accounting Standard 34; and

- the Interim Board Report includes a fair review of the

information required by 4.2.7R (indication of important events

during the first six months of the financial year and description

of principal risks and uncertainties for the remaining six months

of the year) and 4.2.8R (disclosure of related party transactions

and changes therein) of the FCA's Disclosure Guidance and

Transparency Rules.

The half yearly financial report for the six months to 31 March

2023 comprises the Interim Board Report, the Directors'

Responsibility Statement and a condensed set of financial

statements.

For and on behalf of the Board

Bridget Guerin

Chairman

3 May 2023

STATEMENT OF COMPREHENSIVE INCOME

Six months ended Six months ended

31 March 2023 31 March 2022

(unaudited) (unaudited)

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Capital

Gains on investments

held at fair value - 12,337 12,337 - 882 882

Net foreign currency

gains - 18 18 - 21 21

Revenue

Income from listed

investments 2 2,500 - 2,500 2,601 - 2,601

Other income 7 - 7 - - -

_______ ______ _______ _______ ______ _______

2,507 12,355 14,862 2,601 903 3,504

_______ ______ _______ _______ ______ _______

Expenses

Investment management (187) (347) (534) (258) (479) (737)

fees

Other administrative (324) - (324) (351) - (351)

expenses

Finance costs of

borrowing (50) (93) (143) - - -

_______ ______ _______ _______ ______ _______

Profit before taxation 1,946 11,915 13,861 1,992 424 2,416

Taxation 3 (74) - (74) (58) - (58)

_______ ______ _______ _______ ______ _______

Total comprehensive

income 1,872 11,915 13,787 1,934 424 2,358

_______ ______ _______ _______ ______ _______

Earnings per Ordinary 5 0.68 4.35 5.03 0.61 0.14 0.75

share (pence) _______ ______ _______ _______ ______ _______

The total column of this statement represents the Statement of Comprehensive

Income prepared in accordance with UK-adopted international accounting

standards.

The revenue return and capital return columns are supplementary to

this and are prepared under guidance published by the Association of

Investment Companies.

No operations were acquired or discontinued during the period.

STATEMENT OF COMPREHENSIVE INCOME Year ended

(CONTINUED) 30 September 2022

(audited)

Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000

Capital

Losses on investments held at fair value - (25,889) (25,889)

Net foreign currency gains - 52 52

Revenue

Income from listed investments 2 6,666 - 6,666

Other income - - -

______ ______ ______

6,666 (25,837) (19,171)

______ ______ ______

Expenses

Investment management fees (465) (864) (1,329)

Other administrative expenses (686) - (686)

Finance costs of borrowing (19) (35) (54)

______ _______ ______

Profit before taxation 5,496 (26,736) (21,240)

Taxation 3 (109) - (109)

______ _______ ______

Total comprehensive income/(expense) 5,387 (26,736) (21,349)

______ _______ ______

Earnings per Ordinary share (pence) 5 1.77 (8.80) (7.03)

______ _______ ______

STATEMENT OF FINANCIAL POSITION

As at As at As at

31 March 31 March 30 September

Notes 2023 2022 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Investments in ordinary shares 6 189,428 229,141 194,448

______ ______ ______

Investments held at fair value

through profit or loss 189,428 229,141 194,448

______ ______ ______

Current assets

Accrued income and prepayments 850 878 890

Trade and other receivables 551 36 3,665

Cash and cash equivalents 3,027 5,388 4,710

______ ______ ______

Total current assets 4,428 6,302 9,265

______ ______ ______

Total assets 193,856 235,443 203,713

Current liabilities

Bank loan (5,000) - (5,000)

Trade and other payables (2,592) (940) (5,398)

______ ______ ______

Total current liabilities (7,592) (940) (10,398)

______ ______ ______

Net assets 186,264 234,503 193,315

______ ______ ______

Issued capital and reserves attributable

to

equity holders

Called-up share capital 7 86,878 86,878 86,878

Share premium account 53,817 53,882 53,851

Special reserves - 25,542 9,684

Capital reserve - unrealised 25,317 51,377 18,854

Capital reserve - realised 15,595 11,899 17,152

Revenue reserve 4,657 4,925 6,896

______ ______ ______

Equity shareholders' funds 186,264 243,503 193,315

______ ______ ______

Net asset value per Ordinary share

(pence) 5 72.05 77.53 68.48

______ ______ ______

STATEMENT OF CHANGES IN EQUITY

Six months ended 31

March 2023 (unaudited) Share Capital Capital

reserve reserve

Share premium Special - - Revenue

capital account reserves unrealised realised reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 October

2022 86,878 53,851 9,684 18,854 17,152 6,896 193,315

Profit and total

comprehensive

income for the period - - - 6,463 5,452 1,872 13,787

Equity dividends - - - - - (4,111) (4,111)

Shares bought back into

treasury - - (16,693) - - - (16,693)

Discount control costs - (34) - - - - (34)

Transfer from capital

reserves - - 7,009 - (7,009) - -

______ _______ ______ ______ ______ _______ ______

Balance at 31 March

2023 86,878 53,817 - 25,317 15,595 4,657 186,264

______ _______ ______ ______ ______ _______ ______

Six months ended 31

March 2022 (unaudited) Share Capital Capital

reserve reserve

Share premium Special - - Revenue

capital account reserves unrealised realised reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 October

2021 86,878 53,909 38,890 54,428 8,424 6,092 248,621

(Loss)/profit and total

comprehensive income

for the period - - - (3,051) 3,475 1,934 2,358

Equity dividends - - - - - (3,101) (3,101)

Shares bought back into

treasury - - (13,348) - - - (13,348)

Discount control costs - (27) - - - - (27)

______ _______ ______ ______ ______ _______ ______

Balance at 31 March

2022 86,878 53,882 24,542 51,377 11,899 4,925 234,503

______ _______ ______ ______ ______ _______ ______

Year ended 30 September

2022 (audited) Share Capital Capital

reserve reserve

Share premium Special - - Revenue

capital account reserves unrealised realised reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 October

2021 86,878 53,909 38,890 54,428 8,424 6,092 248,621

(Loss)/profit and total

comprehensive income

for the year - - - (35,574) 8,838 5,387 (21,349)

Equity dividends - - (1,444) - - (4,583) (6,027)

Shares bought back into

treasury - - (27,872) - - - (27,872)

Discount control costs - (58) - - - - (58)

Transfer from capital

reserves - - 110 - (110) - -

______ ______ ______ ______ ______ ______ ______

Balance at 30 September

2022 86,878 53,851 9,684 18,854 17,152 6,896 193,315

______ _______ ______ ______ ______ _______ ______

The revenue reserve, special reserves and capital reserve -

realised are distributable. The full amount of each of these

reserves is available for distribution.

CASH FLOW STATEMENT

Six months Six months Year

ended ended ended

31 March 31 March 30 September

2023 2022 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Investment income received 2,570 2,700 6,876

Administrative expenses paid (872) (1,182) (2,140)

______ ______ ______

Cash generated from operations 1,698 1,518 4,736

Finance costs paid (116) - (60)

Taxation (106) (58) (179)

______ ______ ______

Net cash inflows from operating activities 1,476 1,460 4,497

______ ______ ______

Cash flows from investing activities

Purchases of investments (23,280) (14,677) (51,123)

Sales of investments 42,290 30,960 73,668

Capital distributions received from

investee companies - - 113

______ ______ ______

Net cash inflow from investing activities 19,010 16,283 22,658

______ ______ ______

Net cash inflow before financing 20,486 17,743 27,155

______ ______ ______

Financing activities

Proceeds from loan - - 5,000

Cost of share buybacks (19,365) (13,199) (25,365)

Dividends paid (2,791) (3,101) (6,027)

Discount control costs (31) (27) (56)

______ ______ ______

Net cash outflows from financing activities (22,187) (16,327) (26,448)

______ ______ ______

Net (decrease)/increase in cash and

cash equivalents (1,701) 1,416 707

Cash and cash equivalents at the start

of the period 4,710 3,951 3,951

Effect of foreign exchange rate changes 18 21 52

______ ______ ______

Cash and cash equivalents at the end

of the period 3,027 5,388 4,710

______ ______ ______

Reconciliation of operating profit

to operating cash flows

Profit/(loss) before taxation 13,861 2,416 (21,240)

Add interest payable 143 - 54

Adjustments for:

(Gains)/losses on investments (12,337) (882) 25,889

Currency gains (18) (21) (52)

Decrease in accrued income and prepayments 62 89 200

Decrease in trade and other payables (13) (84) (115)

______ ______ ______

Cash generated from operations 1,698 1,518 4,736

______ ______ ______

Distribution of Assets and Liabilities

Valuation Purchases Sales Appreciation/ Valuation

at (depreciation) at

30 September 31 March

2022 2023

GBP'000 % GBP'000 GBP'000 GBP'000 GBP'000 %

Listed investments

Ordinary shares 194,448 100.6 21,819 (39,176) 12,337 189,428 101.7

Current assets 9,265 4.8 4,428 2.4

Current liabilities (10,398) (5.4) (7,592) (4.1)

______ _____ ______ _____

Net assets 193,315 100.0 186,264 100.0

______ _____ ______ _____

Net asset value

per share 68.48p 72.05p

______ ______

NOTES TO THE ACCOUNTS

1. Accounting policies

(a) Basis of accounting

The financial statements have been prepared in accordance

with International Financial Reporting Standards (IFRS)

IAS 34 - 'Interim Financial Reporting', as adopted by the

International Accounting Standards Board (IASB), and interpretations

issued by the International Financial Reporting Interpretations

Committee of the IASB (IFRIC). They have also been prepared

using the same accounting policies applied for the year

ended 30 September 2022 financial statements

(b) Dividends payable

Dividends are recognised on the ex-dividend date.

2. Income

Six months Six months Year

ended ended ended

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Income from listed investments

UK dividend income 1,950 2,221 5,783

Overseas dividend income 550 380 883

______ ______ ______

2,500 2,601 6,666

______ ______ ______

Other income from investment

activity

Deposit interest 7 - -

______ ______ ______

Total income 2,507 2,601 6,666

______ ______ ______

3. Taxation

The taxation charge for the period represents withholding tax

suffered on overseas dividend income.

4. Revenue and Dividends

The following table shows the revenue for each period less the

dividends declared and payable from revenue in respect of the

financial period to which they relate.

Six months Six months Year

ended ended ended

31 March 31 March 30 September

2023(*) 2022(+) 2022(++)

GBP'000 GBP'000 GBP'000

Revenue 1,872 1,934 5,387

Dividends declared and payable

from revenue (2,700) (3,017) (4,430)

______ ______ ______

(828) (1,083) 957

______ ______ ______

(*) Dividends declared relate to the first two interim dividends

(of 0.50p and 0.51p) declared in respect of the financial year

2022/2023.

(+) Dividends declared relate to the first two interim dividends

(both 0.49p) declared in respect of the financial year 2021/2022.

(++) Dividends declared relate to the first, second and fourth

interim dividends declared in respect of the financial year

2021/2022 totalling 1.48p and paid from revenue. The third interim

dividend of 0.49p was paid from the distributable capital reserve.

Six months Six months Year

ended ended ended

31 March 31 March 30 September

2023 2022 2022

5. Return and net asset value

per share p p p

Revenue return 0.68 0.61 1.77

Capital return 4.35 0.14 (8.80)

______ ______ ______

Total return 5.03 0.75 (7.03)

______ ______ ______

The figures above are based

on the following:

GBP'000 GBP'000 GBP'000

Revenue return 1,872 1,934 5,387

Capital return 11,915 424 (26,736)

______ ______ ______

Total return 13,787 2,358 (21,349)

______ ______ ______

Weighted average number of

Ordinary shares in issue 273,794,251 313,192,468 303,874,343

__________ __________ __________

The net asset value per share is based on net assets attributable

to shareholders of GBP186,264,000 (31 March 2022 - GBP234,503,000;

30 September 2022 - GBP193,315,000) and on 258,507,487 (31 March

2022 - 302,462,487; 30 September 2022 - 282,284,487) Ordinary

shares in issue at the period end.

6. Financial instruments

Level Level 2023

Level 1 2 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

Financial assets at fair value

through profit or

loss as at 31 March 2023

Investments 189,428 - - 189,428

______ ______ ______ ______

In accordance with International Financial Reporting Standards,

investments are classified using the fair value hierarchy:

Level 1 reflects financial instruments quoted in an active

market.

Level 2 reflects financial instruments the fair value of which

is evidenced by comparison with other observable current market

transactions in the same instrument or based on a valuation

technique whose variables include only data from observable

markets.

Level 3 reflects financial instruments the fair value of which

is determined in whole or in part using a valuation technique

based on assumptions that are not supported by prices from

observable market transactions in the same instrument and not

based on available observable market data.

There were no transfers of investments between levels during

the six months ended 31 March 2023.

The fair value of the Company's financial assets and liabilities

as at 31 March 2023 was not materially different from the carrying

value.

As at As at As at

31 March 31 March 30 September

2023 2022 2022

(unaudited) (unaudited) (audited)

7. Ordinary share capital

No. of No. of No. of

Ordinary shares of 25p each shares shares shares

Allotted, called-up and fully

paid 258,507,487 302,462,487 282,284,487

Held in treasury 89,004,500 45,049,500 65,227,500

____________ ____________ ___________

347,511,987 347,511,987 347,511,987

____________ ____________ ____________

During the six months to 31 March 2023, the six months to 31

March 2022 and the year to 30 September 2022, the Company did

not issue any new shares and no shares were re-issued from treasury.

During the six months to 31 March 2023 23,777,000 shares were

repurchased by the Company at a total cost of GBP16,693,000

and placed in treasury. During the six months to 31 March 2022

17,426,500 shares were repurchased by the Company at a total

cost of GBP13,348,000 and placed in treasury. During the year

to 30 September 2022 37,604,500 shares were repurchased by the

Company at a total cost of GBP27,872,000 and placed in treasury.

During the six months to 31 March 2023, the six months to 31

March 2022 and the year to 30 September 2022, no Ordinary shares

were purchased for cancellation.

8. Transaction costs

During the period expenses were incurred in acquiring or disposing

of investments classified as held at fair value through profit

or loss. These have been expensed through capital and are included

within profits on investments in the Statement of Comprehensive

Income. The total costs were as follows:

Six months Six months Year

ended ended ended

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Purchases 92 70 243

Sales 14 11 29

______ ______ ______

106 81 272

______ ______ ______

9. Publication of non-statutory accounts

The financial information contained in this Half Yearly Financial

Report does not constitute statutory accounts as defined in

Sections 434-436 of the Companies Act 2006. The financial information

for the six months ended 31 March 2023 and 31 March 2022 has

not been audited.

The information for the year ended 30 September 2022 has been

extracted from the latest published audited financial statements

which have been filed with the Registrar of Companies. The report

of the auditors on those accounts contained no qualification

or statement under Section 498 (2), (3) or (4) of the Companies

Act 2006.

10. Approval

This Half Yearly Financial Report was approved by the Board

on 3 May 2023.

11. This Half Yearly Financial Report will shortly be available

for viewing on the Company's website (www.tigt.co.uk) and will

be posted to shareholders in May 2023.

For Troy Income & Growth Trust plc

Juniper Partners Limited, Company Secretary

3 May 2023

Enquiries: 0131 378 0500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QXLFBXELBBBB

(END) Dow Jones Newswires

May 04, 2023 02:00 ET (06:00 GMT)

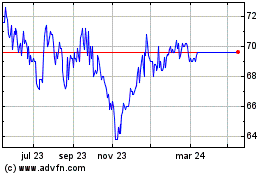

Troy Income & Growth (LSE:TIGT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Troy Income & Growth (LSE:TIGT)

Gráfica de Acción Histórica

De May 2023 a May 2024