TIDMW7L

RNS Number : 9833M

Warpaint London PLC

20 September 2023

20 September 2023

Warpaint London PLC

("Warpaint", the "Company" or the "Group")

Interim Results for the six months ended 30 June 2023

Record performance driven by significant growth in all

regions

Warpaint London plc (AIM: W7L), the specialist supplier of

colour cosmetics and owner of the W7 and Technic brands is pleased

to announce its unaudited interim results for the six months ended

30 June 2023.

Financial Highlights

-- Strong growth in sales during the period across all geographic

regions, to achieve a record first half, reflecting the focus

on growing sales of the Group's branded products

-- Group sales increased by 46% to GBP36.7 million in H1 2023

(H1 2022: GBP25.2 million)

-- UK revenue increased by 28% to GBP13.3 million (H1 2022:

GBP10.4 million)

-- International revenue increased by 58% to GBP23.4 million

(H1 2022: GBP14.8 million)

-- Gross profit margin increased to 39.1% (H1 2022: 39.0%), due

to successful management of continued supply side inflation

-- Adjusted EBITDA of GBP7.9 million (H1 2022: GBP4.4 million)*

-- Statutory profit from operations of GBP6.3 million (H1 2022:

GBP3.5 million)

-- Cash of GBP7.1 million as at 30 June 2023 (30 June 2022: GBP4.3

million) and no debt

-- Statutory basic EPS was 6.22p (H1 2022: 3.54p)

-- The board has declared an increased interim dividend of 3.0p

per share (2022 interim dividend 2.6p per share)

-- Consistent with previous years due to Christmas gifting orders

and its momentum, the Group's sales are expected to again

be second half weighted

* Adjusted for foreign exchange movements, share based payments

and exceptional items. Adjusted numbers are close to the underlying

cash flow performance of the business which is regularly monitored

and measured by management.

Operational Highlights

-- Significant growth in all geographic areas: sales in the UK

increased 28%, Europe by 56%, the US by 83% and the rest of

the world by 53% in H1 2023, compared to H1 2022.

-- W7 brand sales increased by 67% and Technic brand sales increased

by 37% in H1 2023, compared to H1 2022

-- A range of 158 Technic products have launched in an initial

four Asda superstores on a trial basis ahead of Asda's cosmetic

range review undertaken in Q4 2023

-- Significant further expansion in the US with H-E-B stores,

CVS BIRL stores, where initial sales have been ahead of expectations,

as well as launching in Sallys and Nordstrom Rack

-- Online sales continue to accelerate in the UK, EU, China and

the US, increasing by 212% to GBP2.0 million in H1 2023, compared

to H1 2022

Post-Period End Highlights

-- Continued positive business momentum post period end, with

unaudited Group sales for the eight months to 31 August 2023

of GBP54.5 million (8 months to 31 August 2022: GBP37.5 million)

-- After an initial trial of W7 products in 20 New Look stores,

the Group is now rolling out W7 product to a further 200 New

Look stores in the UK during 2023

-- The W7 brand has been launched in an initial 73 Superdrug

stores in September 2023

-- The Group's expansion strategy continues, with further planned

launches in H2 2023 and 2024 with new major retailers and

the expansion of the range of products stocked with certain

existing customers, particularly in the UK and the US

Commenting, Sam Bazini Chief Executive, said:

"I am delighted with the Group's continuing strong performance

in the first half of 2023, with a record level of sales and profits

delivered. I believe the Group is very well positioned to achieve

further growth and I remain confident that margins can be

maintained going forward.

"Warpaint is a global business with the capacity, expertise and

strategy, coupled with balance sheet strength, to drive future

growth from both our existing and new customers. Whilst we continue

to experience good growth in the UK, I am particularly pleased with

the growth we are seeing in Europe and the US. As in previous

years, the Group's sales are expected to remain second half

weighted, reflecting Christmas seasonal sales as well as ongoing

momentum.

"We look forward to updating further as the year progresses, and

with significant opportunities for continued growth, both already

secured with our existing retailers and in discussion with

additional major retailers globally, I am confident that the Group

will continue to perform well for the remainder of the year and

beyond."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which is part of UK law

by virtue of the European Union (Withdrawal) Act 2018

Enquiries:

Warpaint London c/o IFC

Sam Bazini - Chief Executive Officer

Eoin Macleod - Managing Director

Neil Rodol - Chief Financial Officer

Shore Capital (Nominated Adviser & Broker)

Patrick Castle, Daniel Bush - Corporate

Advisory

Fiona Conroy - Corporate Broking 020 7408 4090

IFC Advisory (Financial PR & IR)

Tim Metcalfe, Graham Herring, Florence

Chandler 020 3934 6630

Warpaint London plc

Warpaint sells branded cosmetics under the lead brand names of

W7 and Technic. W7 is sold in the UK primarily to retailers and

internationally to local distributors or retail chains. The Technic

brand is sold in the UK and Europe with a significant focus on the

gifting market, principally for high street retailers and

supermarkets. The Group also sells cosmetics using its other brand

names of Man'stuff, Body Collection and Chit Chat.

CHIEF EXECUTIVE'S REVIEW

I am delighted to report that in H1 2023 the Group achieved a

record level of first half sales and profits, reflecting the

success of the Group's strategy of focusing on growing sales of its

branded products globally. Over 95% of Group sales in the first

half (H1 2022: 88%) were from the sale of the Group's branded

products as we focused on our core W7, Technic, Body Collection,

Man'stuff and Chit Chat brands. These brands encompass a wide range

of high-quality cosmetics and toiletries at an affordable price,

with each brand having its own unique offering.

In H1 2023, Group sales increased by 46% to GBP36.7 million (H1

2022: GBP25.2 million), at an increased gross margin of 39.1% (H1

2022: 39.0%), despite continued supply side inflation, and resulted

in statutory profit from operations of GBP6.3 million (H1 2022:

GBP3.5 million) .

Our strategy remains to grow sales through our existing

customers' outlets and winning new customers with significant sales

footprints, both in the UK and internationally, together with

continuing to grow our online sales. In H1 2023, we saw significant

growth in all our geographic regions with sales in the UK

increasing by 28%, in Europe by 56%, in the US by 83% and in the

rest of the world by 53%, compared to H1 2022. Direct online sales

also continue to be an important growth area, with a 212% increase

online sales in H1 2023 versus H1 2022, and they now represent over

5% of total Group sales.

The global cosmetics market continues to see customers

transferring to more value orientated brands, such as those

produced by the Group, and I believe we are very well placed with

our high-quality focused offering to capture further market share

and to continue to grow sales and profits. The Group is in active

discussions with new major retailers globally and with certain

existing customers regarding expansion of the range of the Group's

products stocked.

W7

The Group's lead brand remains W7, with W7 sales in H1 2023

increasing by 67% to GBP24.2 million (H1 2022: GBP14.5 million),

accounting for 66% of total Group revenue (H1 2022: 57%).

Strong growth was seen in all sales regions, with W7 sales in

the UK increasing by 51% to represent 31% of W7 sales in the period

(H1 2022: 34%), as even stronger growth was experienced in regions

outside of the UK. W7 sales in the UK continue to see substantial

growth and will be furthered following the launch of W7 products in

an initial 73 Superdrug stores earlier this month, alongside growth

with existing retailers, including Tesco, Boots and New Look.

W7 sales to Europe grew by 77% in H1 2023, to represent 54% of

W7 sales in H1 2023(H1 2022: 51%). The sales growth in Europe was

assisted by additional sales to existing customers, particularly as

they expanded the size of their estates, and to new customers.

W7 sales in the US grew by 87% in H1 2023, to represent 8% of W7

sales, driven by growth with H-E-B stores and CVS BIRL stores,

where initial sales have been ahead of expectations, as well as

launching in Sallys and Nordstrom Rack.

Sales of W7 in the rest of the world grew by 51% in H1 2023

compared to H1 2022, to represent 6% of overall W7 sales.

Technic

In H1 2023 sales of Technic (which includes Technic and the

other Retra brands, including Body Collection and retailer own

brand white label cosmetics) grew by 37% to GBP10.9 million (H1

2022: GBP7.9 million), with sales growth seen in all geographic

regions.

In H1 2023, UK revenues from the Technic brands were up 38% on

H1 2022, with strong growth also seen in Europe, with sales up

31%.

Sales of the Technic brands in the US and the rest of the world

remain small in the context of the Group as a whole, representing

approximately 2% of Group revenues, although the Technic brands

continue to gain traction outside their traditional markets, with

US sales increasing by 334% and rest of the world sales growing by

58% in H1 2023, compared to H1 2022.

Overall sales of the Technic brands were 30% of total Group

revenue in H1 2023 (H1 2022: 31%).

E-commerce

Online sales grew in all regions in H1 2023 to reach GBP1.97

million (H1 2022: GBP0.63 million), an increase of 212%, at a

similar margin to other Group sales. Direct online sales, as a

proportion of the Group's overall sales, have grown significantly,

to represent 5.4% of Group sales in H1 2023 (H1 2022: 2.5%).

The Group continues to focus on growing sales through the W7 and

Technic brands' own bespoke e-commerce sites, and in the UK, Europe

and the US on Amazon, and in China through official W7 brand stores

owned by the Group on Taobao Mall (Tmall), the most visited B2C

online retail platform in China and Xiaohongshu (Red), one of

China's foremost social media, fashion and luxury shopping

platforms. Growth in online sales continued post period-end. For

the eight months to 31 August 2023 online sales were up by 200% to

GBP2.7 million, compared to the same period in 2022 (eight months

to 31 August 2022: GBP0.9 million).

Close-out

Close-out sales are not a core focus for the Group, although

advantage is taken of profitable close-out opportunities as they

become available, and they continue to provide a significant and

profitable source of intelligence in the colour cosmetics market.

In H1 2023, close-out division sales reduced by 42% to GBP1.6

million (H1 2022: GBP2.8 million) and represented only 4% of the

overall revenue of the Group (H1 2022: 11%).

Customers & Geographies

The largest markets for sales of the Group's brands are in

Europe and the UK, with a growing presence in the US, as well as

significant sales to Australia, coupled with global online sales.

In H1 2023 the Group's top ten customers represented 67% of

revenues (H1 2022: 66%).

UK

Sales in the UK accounted for 36% of Group sales in H1 2023 (H1

2022: 41%). Overall, UK sales grew by 28% in H1 2023, with

increased sales of both the Group's lead brand W7, up 51%, and the

Technic brands, up by 38% compared to H1 2022.

The top ten UK Group customers accounted for 73% of UK sales in

H1 2023 (H1 2022: 80%).

Strong growth was seen during the period with many UK retailers.

Additionally, after an initial trial of W7 product in 20 New Look

stores, the Group is now rolling out W7 products to a further 200

New Look stores during 2023. We are also in continued talks with

other major UK retailers who stock W7 product to increase the W7

offering in their stores and anticipate further expansion across

their estates this year and into 2024.

Europe

Europe has grown in recent years to become the largest sales

area for the Group, accounting for 51% of sales in H1 2023 (H1

2022: 48%). During the first half, European sales increased by 56%

compared to H1 2022, with growth seen both through existing

customers and those new to the Group. Sales for the Group's brands

into Europe are mainly to Denmark, Spain and Sweden.

US

Sales in the US in H1 2023, in Sterling terms, increased by 83%,

accounting for 7% of Group sales (H1 2022: 5%). The Group has

significantly widened its presence in the US, including the recent

additions of H-E-B stores and CVS BIRL stores, where initial sales

have been ahead of expectations, as well as launching in Sallys and

Nordstrom Rack during the period. Additionally, there is continued

focus on growing US online sales via Amazon FBA.

In the US, 97% of sales in H1 2023 (H1 2022: 88%) were from the

sale of the Group's brands.

Rest of the World

Sales in the rest of the world for the Group in the period

increased by 53%, to account for 6% of overall Group sales (H1

2022: 6%). The focus continues to be on Australia, China and other

countries where profitable sales in appropriate volumes can be

made.

The Group has no suppliers in either Russia or Ukraine, and no

significant historic sales to either country.

Dividend

In accordance with the Group's policy to continue to pay

appropriate dividends, the board is pleased to declare an increased

interim dividend of 3.0p per share (2022 interim dividend: 2.6p per

share) which will be paid on 24 November 2023 to shareholders on

the register at 10 November 2023. The shares will go ex-dividend on

9 November 2023.

Summary and Outlook

I am delighted with the Group's continuing strong performance in

the first half of 2023, with a record level of sales and profits

delivered. I believe the Group is very well positioned to achieve

further growth and I remain confident that margins can be

maintained going forward.

Warpaint is a global business with the capacity, expertise and

strategy, coupled with balance sheet strength, to drive future

growth from both our existing and new customers. Whilst we continue

to experience good growth in the UK, I am particularly pleased with

the growth we are seeing in Europe and the US. We have put in place

a robust supply chain and distribution network to ensure that we

are able to supply our retailer's outlets on time with the product

that their customers are demanding.

As in previous years, the Group's sales are expected to remain

second half weighted, reflecting Christmas seasonal sales and

ongoing sales momentum. We anticipate updating further on trading

later in the year, and with significant opportunities for continued

growth, both already secured with our existing retailers and in

discussion with additional major retailers globally , I am

confident that the Group will continue to perform well for the

remainder of the year and beyond.

Sam Bazini

Chief Executive Officer

20 September 2023

CHIEF FINANCIAL OFFICER'S REVIEW

The first half of 2023 was a record for the Group and

significantly ahead of the first half of 2022, with improved sales,

gross margin and profit before tax. The Group continues its

strategy of building the W7 and Technic brands in the UK and

internationally, and we remain focused on margin, being debt free,

and generating cash.

Headline results, shown below, represent the performance

comparisons between the consolidated statements of income for the

half years ended 30 June 2023 and 30 June 2022. Adjusted numbers

are closer to the underlying cash flow performance of the business

which is regularly monitored and measured by management, the

adjustments made to the statutory numbers are as follows:

Statutory Results 6 Months ended 6 Months ended

30 June 2023 30 June 2022

Revenue GBP36.7m GBP25.2m

--------------- ---------------

Earnings before interest, corporation GBP7.3m GBP5.4m

tax, depreciation and amortisation

("EBITDA")

--------------- ---------------

Profit from operations GBP6.3m GBP3.5m

--------------- ---------------

Profit margin from operations 17.1% 14.0%

--------------- ---------------

Profit before tax ("PBT") GBP6.2m GBP3.5m

--------------- ---------------

Earnings per share ("EPS") 6.2p 3.5p

--------------- ---------------

Cash and cash equivalents GBP7.1m GBP4.3m

--------------- ---------------

Adjusted Statutory Results 6 Months ended 6 Months ended

30 June 2023 30 June 2022

Adjusted EBITDA GBP7.9m* GBP4.4m*

--------------- ---------------

Adjusted EPS 6.5p* 5.2p*

--------------- ---------------

6 Months ended 6 Months ended

30 June 2023 30 June 2022

Statutory profit from operations GBP6.3m GBP3.5m

--------------- ---------------

Depreciation GBP0.9m GBP0.8m

--------------- ---------------

Amortisation GBP0.1m GBP1.1m

--------------- ---------------

EBITDA GBP7.3m GBP5.4m

--------------- ---------------

Foreign exchange movements GBP0.6m -GBP1.1m

--------------- ---------------

Exceptional items GBPnil GBP0.1m

--------------- ---------------

Share based payments GBP0.1m GBP0.1m

--------------- ---------------

*Adjusted EBITDA GBP7.9m GBP4.4m

--------------- ---------------

Statutory profit attributable GBP4.8m GBP2.7m

to equity holders

--------------- ---------------

Exceptional items GBPnil GBP0.1m

--------------- ---------------

Amortisation GBP0.1m GBP1.1m

--------------- ---------------

Share based payments GBP0.1m GBP0.1m

--------------- ---------------

Adjusted profit attributable GBP5.0m GBP4.0m

to equity holders

--------------- ---------------

Weighted number of ordinary

shares 76,802,439 76,751,187

--------------- ---------------

*Adjusted EPS 6.5p 5.2p

--------------- ---------------

Note: numbers rounded to the nearest GBP0.1 million.

Revenue

Total revenue increased by 46% from GBP25.2 million in H1 2022

to GBP36.7 million in H1 2023.

Company branded sales were GBP35.0 million in the first half of

the year (H1 2022: GBP22.1 million). Our W7 brand had sales in the

first half of the year of GBP24.2 million (H1 2022: GBP14.5

million). Our Technic brand, excluding sales of retailer own brand

white label cosmetics, contributed sales of GBP10.8 million in the

first half of the year (H1 2022: GBP7.6 million).

Our Retra subsidiary business had sales of retailer own brand

white label cosmetics of GBP0.05 million in the first half of the

year (H1 2022: GBP0.33 million). The white label business is

traditionally cost competitive and Retra chooses which projects to

undertake based on commercial viability, in particular margin.

The close-out business had sales in the first half of the year

of GBP1.6 million (H1 2022: GBP2.8 million), as the Group, in line

with its strategy, continued to reduce its focus on close-out

opportunities.

In the UK, sales increased by 28% to GBP13.3 million (H1 2022:

GBP10.4 million). Internationally, revenue increased by 58%, from

GBP14.8 million in H1 2022 to GBP23.4 million in H1 2023. In

Europe, Group sales increased by 56% to GBP18.9 million (H1 2022:

GBP12.1 million). In the US, Group sales increased by 83% to GBP2.4

million (H1 2022: GBP1.3 million). In the rest of the world, Group

sales increased by 53% to GBP2.1 million (H1 2022: GBP1.4

million).

E-commerce sales continued to grow in the first half of the year

and now represent 5.4%, or GBP2.0 million, of Group revenue (H1

2022: 2.5% / GBP0.6 million).

Product Gross Margin

Gross margin was 39.1% for the half year, compared to 39.0% in

H1 2022.

Our management teams across the Group were swift to recognise

and navigate cost headwinds that started in 2021 and continued into

2022. New product development, sourcing product from new factories

and falling freight rates, have all helped achieve a slight gross

margin improvement in the first half of 2023, without the need for

an inflationary price increase to customers at the start of the

year.

The cost of freight from the Far East is a significant cost of

goods throughout the Group. Container freight rates which increased

dramatically in 2021, started to slowly fall in 2022. As we end the

first half of 2023, freight rates have fallen to record lows, which

will help to improve our gross margin for the full year.

We remain focused on improving gross margin where possible in

all our businesses and are making good use of our Hong Kong buying

office to ensure this happens. To counter currency pressure, we

continue to move production to new factories of equal quality to

retain or improve margin and have a natural hedge from our US

dollar revenue which is growing.

Towards the end of 2022 we purchased various currency options to

help protect the Group's gross margin in 2023, these included

traditional forward purchase foreign exchange options for US$3

million at US$1.2146, and more complex forward purchase foreign

exchange options which will now deliver in 2023 a minimum of US$27

million to a maximum of US$36 million at an average rate for 2023

of $1.1984/GBP. Since the start of this year we have purchased more

forward options to help protect our gross margin in 2023 and into

2024.

The currency options we have for the current year, the low

container rates, new product development, sourcing, and growing

sales in the US, will all help to protect our margin in 2023.

Operating Expenses

Total operating expenses before exceptional items, amortisation

costs, depreciation, foreign exchange movements and share based

payments, increased at a lower rate than the growth in sales,

increasing by 20.2% to GBP6.5 million in the first half of the year

(H1 2022: GBP5.4 million). Operating costs as a percentage of sales

reduced from 21% to 18%.

The overall increase of GBP1.1 million year on year was

necessary to support the growth of the business and was made up of

increases in wages and salaries, the spend on PR and marketing as

e-commerce sales continue to grow, travel costs, and a small

increase in office costs of GBP0.03 million in relation to utility

charges.

Warpaint remains a business with most operating expenses

relatively fixed and evenly spread across the whole year. We

continue to monitor and examine significant costs to ensure they

are controlled and strive to reduce them. In addition, the

increased scale of the business has given the Group increased

buying power.

Adjusted EBITDA

The board considers Adjusted EBITDA (adjusted for foreign

exchange movements, share based payments and exceptional items) a

key measure of the performance of the Group and one that is more

closely aligned to the success of the business. Adjusted EBITDA for

the half year to 30 June 2023 was GBP7.9 million (H1 2022: GBP4.4

million).

Profit Before Tax

Group profit before tax for the half year to 30 June 2023 was

GBP6.2 million (H1 2022: GBP3.5 million). The material changes in

profitability between 30 June 2022 and 2023 were:

Effect on Profit

GBP4.5 million

* Gross margin on increase in sales in H1 2023

(GBP1.1) million

* Increase in operating expenses

(GBP1.7) million

* FX loss in H1 2023 of GBP0.55 million (gain in H1

2022: GBP1.13 million)

GBP1.0 million

* Decrease in the charge for amortisation costs on

acquisition*

*Acquisition costs are amortised over five years. The reduction

in 2023 reflects the end of the write off period since the purchase

of Retra in November 2017.

Exceptional Items

Exceptional costs in H1 2023 of GBPnil (H1 2022 included a

GBP0.11 million provision for content use and associated legal

fees).

In 2022 the Group agreed a settlement regarding a dispute with a

third party relating to the historic use of content on the Group's

social media platforms in the period from 2018 through to early

2021. The total settlement including associated legal costs was

GBP0.52 million, of which GBP0.37 million was provided for in the

year to 31 December 2021. The payment and the restriction of

content use will not affect the ongoing operations of the Group's

businesses.

Earnings Per Share

The statutory interim basic and diluted earnings per share were

6.22p and 6.20p respectively in H1 2023 (H1 2022: 3.54p and

3.53p).

The adjusted interim basic and diluted earnings per share before

exceptional items, amortisation costs and share based payments were

6.46p and 6.44p respectively in H1 2023 (H1 2022: 5.18p and

5.16p).

LTIP, EMI & CSOP Share Options

On the 9 May 2023 a block listing of 385,633 ordinary shares of

25p each ("Ordinary Shares") was made to satisfy the future

exercises of options granted over Ordinary Shares at an exercise

price of 49.5p on 20 May 2020 under the Warpaint London plc Company

Share Option Plan ("CSOP").

The LTIP, EMI & CSOP share options had an immaterial

dilutive impact on earnings per share in the period. The

share-based payment charge of the LTIP, EMI and CSOP share options

for the half year to 30 June 2023 was GBP0.06 million (H1 2022:

GBP0.09 million) and has been taken to the share option

reserve.

Cash Flow and Cash Position

Net cash flow generated from operating activities was GBP1.9

million compared to GBP(0.4) million in H1 2022. The Group's cash

balance increased by GBP2.8 million to GBP7.1 million as at 30 June

2023 (30 June 2022: GBP4.3 million).

We expect capital expenditure requirements of the Group to

remain low, however as part of our strategy to grow market share in

the UK and US there will be occasions where investment in store

furniture is required to secure that business.

In H1 2023, GBP0.3 million (H1 2022: GBP0.4 million) was spent

on store furniture, on new computer software and equipment,

warehouse racking, and other general office fixtures and fittings

and plant upgrades.

As the Group continues to grow it is both necessary and prudent

to have bank facilities available to help fund day to day working

capital requirements. Accordingly, the Group maintains a GBP9.5

million invoice and stock finance facility which is used to help

fund imports in our gifting business during the peak season. At 30

June 2023 the balance outstanding on the invoice and stock finance

facility was GBPnil (30 June 2022: GBP1.4 million). In addition, in

February 2023 the Group added a new "general purpose" facility of

GBP3.0 million, the balance at 30 June 2023 was GBPnil. These

facilities, together with the Group's positive cash generation and

the growing cash balance held, ensure that future growth can be

funded.

Balance Sheet

Inventories at 30 June 2023 were GBP25.7 million (30 June 2022:

GBP21.9 million). The rise in inventory is a function of growth in

the business and to ensure delivery disruption is avoided for our

customers. One of the Group's unique selling propositions is that

it can deliver a full range of colour cosmetics to its customers,

in good time all year round. Having appropriate inventory levels is

vital to providing that service.

The provision for old and slow inventory was GBP0.4 million/1.4%

at 30 June 2023 (30 June 2022: GBP0.4 million/1.9%). Across the

Group we have worked hard in the last year to sell through older

stock lines, allowing our provision for old and slow inventory to

fall 0.5% in percentage terms. Our Group policy is to provide for

50% of the cost of perishable items that are over two years old.

However, we remain comforted by the fact that many such items in

the normal course of business are eventually sold through our

close-out division without a loss to the Group.

Trade receivables are monitored by management to ensure

collection is made to terms, to reduce the risk of bad debt and to

control debtor days, which have improved on the prior half year.

Trade receivables, excluding other receivables, at 30 June 2023

were GBP10.7 million (30 June 2022: GBP7.4 million). The provision

for bad and doubtful debts carried forward at 30 June 2023 is

GBP0.15 million/1.4% of gross trade receivables (30 June 2022:

GBP0.12 million/1.6%).

At 30 June 2023 the Group has no borrowings ( 30 June 2022:

borrowings outstanding on the invoice and stock finance facility of

GBP1.4 million) or lease liabilities outstanding (30 June 2022:

GBPnil), apart from those associated with right-of-use assets as

directed by IFRS 16 (see below). The Group was therefore debt free

at 30 June 2023.

Working capital increased by GBP8.6 million from 30 June 2022 to

30 June 2023. The main components were an increase in inventory of

GBP3.8 million, an increase in trade and other receivables of

GBP3.2 million, an increase in cash of GBP2.8 million, an increase

in trade and other payables of GBP2.6 million, and a decrease in

the invoice and stock finance facility of GBP1.4 million.

The Group's balance sheet remains in a very healthy position.

Net assets totalled GBP42.9 million at 30 June 2023, with the

majority made up of liquid assets of inventory, trade receivables

and cash.

Included in the balance sheet is GBP7.3 million of goodwill and

GBP0.2 million of intangible fixed assets arising from acquisition

accounting.

Goodwill represents the excess of consideration over the fair

value of the Group's share of the net identifiable assets of the

acquired business / cash generating units at the date of

acquisition. The carrying value at 30 June 2023 of GBP7.3 million

included Treasured Scents Limited (Close-out business) of GBP0.5

million, Retra Holdings Limited of GBP6.2 million and Marvin Leeds

Marketing Services, Inc. of GBP0.6 million. Management have

performed a mid-year review at 30 June 2023 and have concluded that

no impairment is indicated for Treasured Scents Limited, Retra

Holdings Limited or Marvin Leeds Marketing Services, Inc. as the

recoverable amount exceeds the carrying value.

The balance sheet also includes GBP5.1 million of right-of-use

assets, this is the inclusion of the Group leasehold properties,

now recognised as right-of-use assets as directed by IFRS 16. An

equivalent lease liability is included of GBP5.4 million at the

balance sheet date.

Foreign Exchange

The Group imports most of its finished goods from China, paid

for in US dollars, which are purchased throughout the year at spot

as needed, or by taking forward purchase foreign exchange options

when rates are deemed favourable, and with consideration for the

budget rate set by the board for the year. Similarly, foreign

exchange options are taken to sell forward our expected Euro income

in the year to ensure our sales margin is protected.

We started 2023 with various options in place to help protect

our gross margin in 2023, these included traditional forward

purchase foreign exchange options for US$3 million at US$1.2146,

and more complex forward purchase foreign exchange options known as

Window Barrier Accruals and Counter TARFs which will now deliver a

minimum of US$27 million to a maximum of US$36 million (depending

on the dollar rate at maturity of each option) at an average rate

for 2023 of US$1.1984/GBP. We also sold forward EUR3.8 million at

EUR1.1340. (1 January 2022: US$27 million @ US$1.3849/GBP, and

EUR3.9 million @ EUR1.1558/GBP).

We have a natural hedge from sales to the US which are entirely

in US dollars; in H1 2023 these sales were US$3.0 million (H1 2022:

US$1.7 million).

Together with sourcing product from new factories where it makes

commercial sense to do so, new product development, and by buying

US dollars when rates are favourable, we are able to mitigate the

effect of a strong US dollar against sterling.

Dividend

The board is pleased to have declared an increased interim

dividend of 3.0p per share which will be paid on 24 November 2023

to shareholders on the register at 10 November 2023. The shares

will go ex-dividend on 9 November 2023.

Neil Rodol

Chief Financial Officer

20 September 2023

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Unaudited Unaudited Audited

6 months 6 months Year ended

ended ended 31 December

Notes 30 June 30 June 2022

2023 2022

GBP'000 GBP'000 GBP'000

------------------------------------ -------- ------------------- ------------------- -------------

Revenue 36,685 25,197 64,058

Cost of sales (22,331) (15,359) (40,724)

------------------------------------ -------- ------------------- ------------------- -------------

Gross profit 14,354 9,838 23,334

Administrative expenses 3 (8,089) (6,305) (15,367)

Analysed as:

Adjusted profit from operations(1) 6,445 4,791 10,307

Amortisation (118) (1,063) (1,995)

Exceptional items 3 - (109) (152)

Share based payments (62) (86) (193)

------------------------------------ -------- ------------------- ------------------- -------------

Profit from operations 6,265 3,533 7,967

------------------------------------ --------

Finance expenses 4 (101) (79) (277)

------------------------------------ -------- ------------------- ------------------- -------------

Profit before tax 3 6,164 3,454 7,690

Tax expense 5 (1,384) (737) (1,440)

------------------------------------ -------- ------------------- ------------------- -------------

Profit for the period attributable

to equity holders of the

parent company 4,780 2,717 6,250

Other comprehensive income

(net of tax):

Exchange gain on translation

of foreign subsidiary 64 54 (135)

Total comprehensive income

for the period attributable

to equity holders of the

parent company 4,844 2,771 6,115

=================== =================== =============

Basic earnings per share

(pence) 6 6.22 3.54 8.14

------------------- ------------------- -------------

Diluted earnings per share

(pence) 6 6.20 3.53 8.11

------------------- ------------------- -------------

Note 1 - Adjusted profit from operations is calculated as

earnings before interest, taxation, amortisation, impairment costs,

share based payments and exceptional items .

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

----------------------------- -------------- -------------- -------------

ASSETS

Non-current assets

Goodwill 7,274 7,274 7,274

Intangible assets 159 1,188 277

Property, plant and

equipment 1,338 1,409 1,432

Right-of-use assets 5,147 5,382 5,659

Deferred tax assets 352 580 429

-------------- -------------- -------------

14,270 15,833 15,071

Current assets

Inventories 25,720 21,944 18,715

Trade and other receivables 13,439 10,203 11,693

Cash and cash equivalents 7,066 4,313 5,865

Derivative financial

instruments - 1,158 8

--------------

46,225 37,618 36,281

-------------- -------------- -------------

Total assets 60,495 53,451 51,352

-------------- -------------- -------------

LIABILITIES

Current liabilities

Trade and other payables 9,876 6,100 5,988

Borrowings and lease

liabilities 1,005 2,184 1,015

Corporation tax payable 1,295 999 943

Derivative financial

instruments 938 - 600

--------------

13,114 9,283 8,546

Non-current liabilities

Borrowings and lease

liabilities 4,350 4,803 4,847

Deferred tax liabilities 160 355 180

--------------

4,510 5,158 5,027

-------------- -------------- -------------

Total liabilities 17,624 14,441 13,573

-------------- -------------- -------------

NET ASSETS 42,871 39,010 37,779

============== ============== =============

EQUITY

Share capital 19,282 19,188 19,188

Share premium 19,452 19,360 19,360

Merger reserve (16,100) (16,100) (16,100)

Foreign exchange reserve 14 139 (50)

Share option reserve 1,980 1,896 2,003

Retained earnings 18,243 14,527 13,378

-------------- -------------- -------------

Total equity attributable

to

shareholders 42,871 39,010 37,779

============== ============== =============

CONSOLIDATED STATEMENT OF CASH FLOW

Unaudited Unaudited Audited

6 Months ended 6 Months ended Year ended

30 June 2023 30 June 2022 31 December

Notes 2022

GBP'000 GBP'000 GBP'000

---------------------------------- ------- --------------- --------------- ------------

Profit before tax for the

period 6,164 3,454 7,690

Adjusted by:

Interest paid 4 101 79 278

Depreciation of property,

plant and equipment 3 357 393 761

Depreciation on right of

use assets 512 377 965

Loss on disposal of property,

plant, and equipment - - 1

Amortisation of intangible

assets 3 118 1,077 1,995

Share based payment 62 86 193

Movement in inventories (7,005) (3,805) (576)

Movement in trade and other

receivables (1,746) 39 (1,370)

Movement in trade and other

payables 3,888 (561) (981)

Movement in derivative financial

instruments 346 (613) 1,139

Foreign exchange translation

differences 24 54 (117)

--------------- --------------- ------------

Cash inflow generated from

operations 2,821 580 9,978

Income tax paid (935) (990) (1,546)

Cash flows from operating

activities 1,886 (410) 8,432

Purchase of property, plant

and equipment (263) (417) (831)

Purchase of intangible assets - (6) (12)

Cash flows used by investing

activities (263) (423) (843)

Proceeds from issued share

capital 186 - -

Principal elements of lease

payments (507) (279) (836)

Increase in stock and invoice

finance facilities - 1,432 -

Interest paid (101) (79) (278)

Dividends - - (4,682)

--------------- --------------- ------------

Cash flows used by financing

activities (422) 1,074 (5,796)

Net change in cash and cash

equivalents 1,201 241 1,793

Cash and cash equivalents

at beginning of period 5,865 4,072 4,072

--------------- --------------- ------------

Cash and cash equivalents

at end of period 7,066 4,313 5,865

=============== =============== ============

Cash and cash equivalents

consists of:

Cash and cash equivalents 7,066 4,313 5,865

--------------- --------------- ------------

7,066 4,313 5,865

=============== =============== ============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Merger Foreign Share Retained

capital Premium reserve exchange option earnings Total

reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- -------- -------- -------- --------- -------- --------- -------

As at 1 January 2022 19,188 19,360 (16,100) 85 1,810 11,810 36,153

On translation of foreign

subsidiary - - - 54 - - 54

Profit for the period - - - - - 2,717 2,717

---------------------------- -------- -------- -------- --------- -------- --------- -------

Total comprehensive income

for the period - - - 54 - 2,717 2,771

---------------------------- -------- -------- -------- --------- -------- --------- -------

Transactions with owners

Share based payments - - - - 86 - 86

Total transactions with

owners - - - - 86 - 86

---------------------------- -------- -------- -------- --------- -------- --------- -------

As at 30 June 2022 19,188 19,360 (16,100) 139 1,896 14,527 39,010

---------------------------- ======== ======== ======== ========= ======== ========= =======

As at 1 January 2022 19,188 19,360 (16,100) 85 1,810 11,810 36,153

Equity shares issued - - - - - - -

On translation of foreign

subsidiary - - - (135) - - (135)

Profit for the year - - - - - 6,250 6,250

Total comprehensive income

for the year - - - (135) - 6,250 6,115

---------------------------- -------- -------- -------- --------- -------- --------- -------

Transactions with owners

Share based payments - - - - 193 - 193

Dividends paid - - - - - (4,682) (4,682)

Total transactions with

owners - - - - 193 (4,682) (4,489)

---------------------------- -------- -------- -------- --------- -------- --------- -------

As at 31 December 2022 19,188 19,360 (16,100) (50) 2,003 13,378 37,779

---------------------------- -------- -------- -------- --------- -------- --------- -------

As at 1 January 2023 19,188 19,360 (16,100) (50) 2,003 13,378 37,779

Equity shares issued 94 92 - - - - 186

On translation of foreign

subsidiary - - - 64 - - 64

Transfer to the profit or

loss reserve - - - - (85) 85 -

Profit for the period - - - - - 4,780 4,780

Total comprehensive income

for the period 94 92 - 64 (85) 4,865 5,030

---------------------------- -------- -------- -------- --------- -------- --------- -------

Transactions with owners

Share based payments - - - - 62 - 62

Total transactions with

owners - - - - 62 - 62

---------------------------- -------- -------- -------- --------- -------- --------- -------

As at 30 June 2023 19,282 19,452 (16,100) 14 1,980 18,243 42,871

============================ ======== ======== ======== ========= ======== ========= =======

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. Basis of preparation

The consolidated interim financial information for the 6 months

to 30 June 2023 has been prepared in accordance with the

measurement and recognition principles of UK adopted international

accounting and accounting policies that are consistent with the

Group's Annual report and Accounts for the year ended 31 December

2022 and that are expected to be applied in the Group's Annual

Report and Accounts for the year ended 31 December 2023. They do

not include all of the information required for the full financial

statements and should be read in conjunction with the 2022 Annual

Report and Accounts which were prepared in accordance with UK

adopted international accounting standards.

The comparative financial information for the year ended 31

December 2022 in this interim report does not constitute statutory

accounts for that period under section 435 of the Companies Act

2006. Statutory accounts for the year ended 31 December 2022 have

been reported on by the Group's auditors and delivered to the

Registrar of Companies.

The auditors' report on the accounts for the year ended 31

December 2022 was unqualified, did not draw attention to any

matters by way of emphasis, and did not contain a statement under

498(2) or 498(3) of the Companies Act 2006.

2. Changes in significant accounting policies

The accounting policies applied in these interim financial

statements are the same as those applied in the Group's

consolidated financial statements as at and for the year ended 31

December 2022.

3. Profit from operations

Profit from operations is arrived at after charging/

(crediting):

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------ ---------------- ---------------- -------------

Depreciation of property,

plant and equipment 357 393 761

Amortisation of right-of-use

assets 512 377 965

Amortisation of intangible

assets 118 1,077 1,995

Write down inventories at

net realisable value (8) (90) (151)

Exchange differences 545 (1,126) (133)

Exceptional costs - 109 152

================ ================ =============

4. Finance expenses

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

-------------------------- ---------------- ---------------- -------------

Lease liability interest 94 63 185

Other interest 7 16 92

---------------- ---------------- -------------

Finance expenses 101 79 277

================ ================ =============

5. Tax expenses

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------------ ---------------- ---------------- -------------

Current tax expense

Current income tax charge 1,121 939 1,817

Adjustment in respect of 206 - -

previous periods

---------------- ---------------- -------------

1,327 939 1,817

Deferred tax expense

Relating to original and

reversal of temporary differences (20) (202) (377)

Adjustment in respect of 77 - -

previous periods

---------------- ---------------- -------------

Total tax in income statement 1,384 737 1,440

================ ================ =============

6. Earnings per share

Profit for the period used in the calculation of the basic and

diluted earnings per share:

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

-------------------------- ---------------- ---------------- -------------

Profit after tax for the

period 4,780 2,717 6,250

================ ================ =============

The weighted average number of shares for the purposes of

diluted earnings per share reconciles to the weighted average

number of shares used in the calculation of basic earnings per

share as follows:

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

30 June 30 June 31 December

2023 2022 2022

--------------------------------- ---------------- ---------------- -------------

Weighted average number

of shares

Weighted number of ordinary

shares for the purpose of

basic earnings per share 76,802,439 76,751,187 76,752,355

Potentially dilutive shares

awarded 253,678 278,693 296,256

----------------

Weighted number of ordinary

shares for the purpose of

diluted earnings per share 77,056,117 77,029,880 77,048,611

---------------- ---------------- -------------

Basic Earnings per share

(pence) 6.22 3.54 8.14

Diluted earnings per share

(pence) 6.20 3.53 8.11

================ ================ =============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVTAFIALIV

(END) Dow Jones Newswires

September 20, 2023 02:00 ET (06:00 GMT)

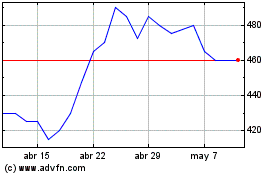

Warpaint London (LSE:W7L)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Warpaint London (LSE:W7L)

Gráfica de Acción Histórica

De May 2023 a May 2024