TIDMXPS

RNS Number : 3884U

XPS Pensions Group PLC

23 November 2023

23 November 2023

XPS Pensions Group plc

Unaudited interim results for the half year ended 30 September

2023

Continuing to deliver strong and sustainable growth

Financial highlights:

Half year ended 30 September 2023 2022 YoY

Pensions Actuarial and Consulting GBP44.4m GBP34.4m 29%

--------- --------- ------

Pensions Investment Consulting GBP10.2m GBP8.1m 26%

--------- --------- ------

Total Advisory GBP54.6m GBP42.5m 28%

--------- --------- ------

Pensions Administration GBP32.4m GBP28.0m 16%

--------- --------- ------

SIP GBP5.4m GBP4.4m 23%

--------- --------- ------

NPT GBP2.1m GBP2.1m -

--------- --------- ------

Total Group revenue GBP94.5m GBP77.0m 23%

--------- --------- ------

Adjusted EBITDA(1) GBP22.7m GBP17.8m 28%

--------- --------- ------

Profit before tax GBP8.1m GBP6.8m 19%

--------- --------- ------

Basic EPS 2.6p 2.9p (10%)

--------- --------- ------

Adjusted diluted EPS 5.9p 5.3p 11%

--------- --------- ------

Interim dividend 3.0p 2.7p 11%

--------- --------- ------

(1) Adjusted measures exclude the impact of exceptional and

non-trading items: acquisition related amortisation, share based

payments, corporate transaction costs, restructuring costs and

other items considered exceptional by virtue of nature, size and

incidence. See note 3 for further details.

-- High levels of client activity, new wins, inflationary fee

increases and bolt on M&A drove 23% growth in Group revenues to

GBP94.5 million (organic growth of 19% year on year)

-- Operational gearing continuing with adjusted EBITDA of

GBP22.7 million (+28% YoY) despite continuing inflationary

pressures in our cost base in addition to investment in people and

technology

-- Eighth consecutive half year of YoY growth in revenues across Advisory and Administration:

o Highest YoY growth in Pensions Actuarial and Consulting

revenues (+29% YoY, +22% organic)

o Continued strong growth in Investment Consulting revenues

(+26% YoY)

o Pensions Administration revenue growth of 16% YoY with

continued success in new business wins and strong growth in project

work

-- SIP revenues increased 23% YoY due to bank base rate

increases and growth in underlying SIP sales

-- Adjusted diluted EPS was up 11% YoY to 5.9 pence (despite

higher interest and increased rate of corporation tax)

-- Increased interim dividend of 3.0 pence (2022: 2.7 pence) per

share declared by the Board, reflecting XPS's progressive dividend

policy and our continued confidence in the Group's prospects

Operational highlights:

-- Strong client demand, continued success in winning new

business and inflationary fee increases continue to drive

profitable and sustainable growth

-- Continued strengthening of the brand, enhanced by industry

awards - 'Third Party Administrator of the Year', 'Fiduciary

Evaluator of the Year' and 'Diversity and Inclusion Excellence

Award'

-- Our proprietary administration platform Aurora delivered on

time and on budget with first new large client onboarded. Aurora is

also driving success in winning new appointments

-- Continued focus on ESG within the business, notable milestones achieved:

o Retained signatory to the FRC's Stewardship Code in the

period

o Reduced our own emissions and remain fully carbon neutral

(Scope 1, 2 and 3 emissions)

Post period end:

-- Continued success in the first-time administration

outsourcing market with the landmark appointment to the John Lewis

Partnership pension scheme

-- Sale of NPT to SEI (completed 20 November 2023) has

significantly reduced leverage while creating a valuable long term

commercial relationship with SEI

Outlook

The strong first half financial performances underscores the

resilience and predictability of the XPS business model. We expect

the demand for our services to remain high underpinned by both

market and regulatory tailwinds as well as the strength of our

brand. The business continues to trade well in H2 and combined with

the completion earlier this week of the EPS accretive sale of NPT,

the Board are confident of achieving overall full year results

ahead of its previous expectations.

Paul Cuff, Co-CEO of XPS Pensions Group, commented:

"We are very pleased with the first half performance of the

Group, with strong profitable growth being achieved across all core

divisions. To continue to achieve growth at these levels, even when

measured against what was a very strong prior year, is really

pleasing.

We made progress in many areas during the half year, as we

continued to invest in our business, welcoming new people and new

clients, and successfully implementing new technology. A real

highlight though was the awards we won for our culture - all our

people should be really proud, as put simply our culture is all of

us.

The future for XPS looks very exciting. There is much discussion

of the need for change in our industry, and we are pleased to be at

the heart of the debate as it develops, with wide ranging

capabilities to help our clients with all their needs."

For further information, contact:

XPS Pensions Group

Snehal Shah

Chief Financial Officer +44 (0)20 3978 8626

Canaccord Genuity (Joint Broker) +44 (0)20 7523 8000

Adam James

Alex Orr

RBC Capital Markets (Joint Broker) +44 (0)20 7653 4000

James Agnew

Jamil Miah

Media Enquiries:

Camarco

Gordon Poole +44 (0)20 3757 4997

Rosie Driscoll +44 (0)20 3757 4981

Notes to Editors:

XPS Pensions Group is a leading pension consulting and

administration business focused on UK pension schemes. XPS combines

expertise, insight and technology to address the needs of over

1,500 pension schemes and their sponsoring employers on an ongoing

and project basis. We undertake pensions administration for over

one million members and provide advisory services to schemes and

corporate sponsors in respect of schemes of all sizes, including 81

with assets over GBP1bn.

Forward Looking Statements

This announcement may include statements that are forward

looking in nature. Forward looking statements involve known and

unknown risks, assumptions, uncertainties and other factors which

may cause the actual results, performance or achievements of the

Group to be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements. These forward-looking statements are made only

as at the date of this announcement. Nothing in this announcement

should be construed as a profit forecast. Except as required by the

Listing Rules and applicable law, the Group undertakes no

obligation to update, revise or change any forward-looking

statements to reflect events or developments occurring after the

date such statements are published.

CO-CHIEF EXECUTIVES' REVIEW

We are very pleased with the performance of the Group in the

first six months of the financial year. Revenue growth of 23%, of

which 19% is organic, has been delivered with impressive growth

rates across all our business units. This was a significant

achievement against what was a strong comparator in HY23 - the

momentum we have been carrying for a couple of years now has been

sustained and has even strengthened.

Our growth has been profitable - 23% revenue growth has given

rise to a 28% increase in adjusted EBITDA on the prior period,

reflecting both a mix of business effect, with our strongest growth

in higher margin activities, and work done to increase efficiency

in our business.

Validation and development of our business model

As we have stated in previous releases, our ambition is to

achieve strong profitable growth against any economic backdrop.

Given the current challenging economic backdrop it is worth

repeating the key features of our business model that give rise to

this opportunity.

At the core of our business, we provide non-discretionary

recurring advisory and administration services to pension scheme

clients. We also provide high value consulting services to help

clients improve the position for pension scheme members or address

the challenges created by regulatory changes and market volatility.

As such we are a non-cyclical business. Furthermore, our contracts

typically enable us to pass on inflationary increases meaning we

have an inherent protection against a high inflation environment.

The half year we are reporting on today is a validation of this

business model.

We are of course pleased to have grown total group revenues

materially above inflation rates. This has been achieved by keeping

close to our clients, and continually ensuring we evolve to have

the expertise and experience to be able to provide support to them

against a backdrop of market and regulatory volatility. This leads

to high levels of client demand for the wide range of services we

now offer.

We have been particularly pleased with the progress we have made

in the risk transfer market, where we have proven that we are now

capable of winning large mandates against tough competition. This

had been achieved by a combination of senior hires and the

development of talented junior colleagues to create a formidable

team that continues to grow strongly.

As this market evolves, there is increasing activity from

insurers, particularly as the bulk annuity market grows and they

take on the risk from pension funds. We have been developing our

capability to provide the support that both established firms and

potential new entrants need, across our advisory and administration

businesses. We have had initial success with this strategy and

expect to continue to grow in this area.

As we look forwards, we continue to develop new services to meet

market demands. A simple example is our GMP offering which we are

expanding against a backdrop of high market demand, and in the area

of public sector pensions administration, where clients need

support on large rectification projects in response to recent court

cases that have ruled that changes to member benefits need to be

implemented.

We are growing our administration business. For example, there

continues to be a large opportunity to take on the administration

of large defined benefit schemes through 'first time outsourcing'.

We were delighted to announce our partnership with the John Lewis

Partnership to do just this, the latest large scheme we will take

on - once onboarded it will be our largest administration client,

with over 160,000 members, an increase of 15% on our current

total.

Delivery of our new administration system

We achieved a significant milestone in the development of our

new administration system (called 'Aurora') during H1, with our

first client successfully onboarded. The first phase of this large

IT project has been delivered on time and on budget.

We continue to develop the system and will be working through

our clients in an orderly fashion to move them to the new system

over the coming years. In time this will deliver efficiencies, as

we will cease to pay license fees to third parties whose systems we

currently use.

We have also begun to use Aurora in new business opportunities,

including the successful John Lewis Partnership discussions

referenced above.

The sale of NPT, and the de-leveraging of our balance sheet

During H1 we announced the sale of our defined contribution

master trust, National Pension Trust (NPT), to the US asset

management and technology firm SEI. This transaction completed on

20 November, and we have received the initial GBP35m consideration

payable (with an additional GBP7.5m payable contingently based on

future performance of NPT). This has materially reduced our

borrowing by approximately a half.

This was not however simply a sale of a business unit -

retaining exposure to the growing Mastertrust market through

provision of core services was a key objective and so, as part of

the deal, we have signed a long-term contract with SEI to remain a

service provider to NPT (including continuing to provide

administration and investment advisory services) and more widely.

We will remain very close to NPT and will provide support to help

it thrive long into the future.

The combination of the reduction in interest costs and the

continuation of parts of the NPT revenue through our partnership

with SEI mean that the transaction is expected to be immediately

EPS accretive.

Continued industry recognition, and a strong culture

We have had success in recent years in winning industry awards

for what we do, and this year was no different. We were delighted

to win 'Third Party Administrator of the Year' at the Professional

Pensions Awards - the second year in a row we have won this. At the

same event, our investment consulting business also won an award,

and we were delighted to win an award recognising our work on the

diversity and inclusion agenda. This latter award is important to

us, as it reflects the wide ranging effort, we put in to being a

great place to work, for everyone.

On the topic of culture, we have just seen the first cut of the

data from our annual staff survey. We are delighted to have

achieved an employee net promoter score of +31, a figure that we

are told is very high indeed for a professional services firm. This

year we entered The Sunday Times 'best companies to work for' and

were pleased to be an award winner in the 'best large companies'

category. This is truly a win for everyone at XPS - we are all our

culture, and we should all be really proud of the firm that

together we have created.

We are passionate about this - it is the right thing to do, and

it also drives good retention and recruitment and good business

performance more widely. Happy, motivated people look after each

other and our clients well.

A sustainable business

As well as advancing sustainability across our business, we

continue to work with our clients, communities, suppliers, and

colleagues to do the right thing, focusing on areas that are

material to all our stakeholders and where, as a business, we can

make an impact.

Our sustainability framework and ambitions have strong alignment

with the UN Sustainable Development Goals. Our Investment

Consulting business advises on pension assets in excess of GBP94

billion. We incorporate sustainability into our investment strategy

solutions, and we continue to be signatory to the FRC's UK

Stewardship Code.

As a large employer, we recognise that we have a responsibility

to address the environmental impacts of our operations and our

investments. In line with the Paris Agreement, we are committed to

a science-based net zero strategy that limits our operational

emissions to a level consistent with or below a 1.5degC global

temperature rise. We have continued to reduce our own emissions and

have continued to invest in high quality UN approved carbon offsets

to achieve carbon neutrality across our entire value chain,

covering our Scope 1, 2 and 3 emissions.

Developments in our wider market

During the last two years we have seen significant changes in

the economic backdrop, with material increases in both long term

interest rates and inflation. These changes have had profound

impacts on UK pension schemes of all types.

In general, most defined benefit schemes are in a healthier

financial position than they were. Schemes continue to need to

re-look at their long-term objectives and strategies to reflect the

'new world' of higher long term interest rates and funding levels.

This has driven significant demand for advisory services, and we

expect this to continue. XPS is well placed to meet this demand

with the depth of capability we have.

Pension funds have also been the subject of Government scrutiny

and newspaper headlines, with focus on asset allocation and whether

changes could be made so that the very large sums of money in the

pension system make an increased contribution to long term growth

in the UK economy. This is a live, ongoing debate with cross party

support for change and we have been pleased to be an active

participant including attending meetings with Treasury and the Bank

of England. The timing and extent of future developments is still

unclear, however any changes to the system are expected to drive

demand for advice from our clients.

Outlook

The strong first half financial performances underscores the

resilience and predictability of the XPS business model. We expect

the demand for our services to remain high underpinned by both

market and regulatory tailwinds as well as the strength of our

brand. The business continues to trade well in H2 and combined with

the completion earlier this week of the EPS accretive sale of NPT,

the Board are confident of achieving overall full year results

ahead of its previous expectations.

Financial Review

Change

Half year ended 30 September 2023 2022 YoY

Revenue GBP94.5m GBP77.0m 23%

----------- ----------- -------

Adj. Administration expenses(1) (GBP71.8m) (GBP59.2m) (21%)

----------- ----------- -------

Adj. EBITDA(1) GBP22.7m GBP17.8m 28%

----------- ----------- -------

Adj. Depreciation & amortisation(1) (GBP2.8m) (GBP2.6m) (8%)

----------- ----------- -------

Adj. operating profit (1) GBP19.9m GBP15.2m 31%

----------- ----------- -------

Exceptional and non-trading items (GBP9.2m) (GBP7.0m) (31%)

----------- ----------- -------

Operating profit GBP10.7m GBP8.2m 30%

----------- ----------- -------

Net finance expense (GBP2.6m) (GBP1.4m) 86%

----------- ----------- -------

Profit before tax GBP8.1m GBP6.8m 19%

----------- ----------- -------

Tax (GBP2.6m) (GBP0.9m) (189%)

----------- ----------- -------

Profit after tax GBP5.5m GBP5.9m (7%)

----------- ----------- -------

Basic EPS 2.6p 2.9p (10%)

----------- ----------- -------

Adj. diluted EPS 5.9p 5.3p 11%

----------- ----------- -------

Interim dividend 3.0p 2.7p 11%

----------- ----------- -------

(1) Adjusted measures exclude the impact of exceptional and

non-trading items: acquisition related amortisation, share based

payments, corporate transaction costs, restructuring costs and

other items considered exceptional by virtue of nature, size and

incidence.

Group revenue

Group revenue for the six months ended 30 September 2023 was up

23% year on year to GBP94.5 million (2022: GBP77.0 million).

Organically, group revenue grew 19%.

Pension Actuarial and Consulting

Revenue has grown 29% YoY (22% organically) to GBP44.4 million

(2022: GBP34.4 million). The growth reflects continued high levels

of client activity, driven in part by continued regulatory changes

and demand for advice in response to volatility in financial

markets and changes in pension scheme funding levels. Inflationary

fee increases have also contributed to the growth. The Penfida

acquisition completed in September 2022 has contributed GBP2.5

million to revenue in H1.

Pension Investment Consulting

Continued high client demand in the face of regulatory and

financial market changes, combined with inflationary fee increases,

has helped revenues grow 26% YoY to GBP10.2 million (2022: GBP8.1

million).

Pension Administration

Revenue has grown 16% year on year to GBP32.4 million (2022:

GBP28.0 million) on the back of new client wins coming on stream,

strong demand for project work and inflationary fee increases.

Number of members under administration were c. 1,048,000 at 30

September 2023 (2022: c. 990,000) and average fee per member has

grown 7% year on year.

SIP

Revenue has grown 23% to GBP5.4 million (2022: GBP4.4 million),

driven by strong underlying sales and the impact of the increase in

the bank base rate.

NPT

Revenues were flat year on year impacted by competitive price

pressures. We announced the sale of the NPT business to SEI in July

2023 pending regulatory approvals. The Pensions Regulator approved

the sale in October 2023 and the sale completed on 20 November

2023.

Operating costs

Total operating costs (excluding exceptional and non-trading

items) for the Group grew by 21% or GBP12.6 million year on year.

Organically, total operating costs grew 18% year on year, below the

organic growth in group revenues evidencing the continued

improvement in operational gearing. Factors contributing to the

cost growth include higher number of employees from ongoing

recruitment as well as bolt on acquisitions, higher bonus accrual

commensurate with trading performance, and inflationary increases

in other cost lines.

Adjusted EBITDA

Adjusted EBITDA of GBP22.7 million is up 28% YoY (2022: GBP17.8

million) with an increase in the margin to 24.0% (2022: 23.1%).

Exceptional and non-trading items

During the half year ended 30 September 2023 the Group incurred

GBP9.2 million (2022: GBP7.0 million) of exceptional and

non-trading charges (see note 3 for further details).

Net finance expenses

Net finance expense of GBP2.6 million was GBP1.2 million higher

than the prior year, largely due to increases in the bank interest

rate and a higher average net debt in the period.

Taxation

Tax charge on adjusted profit before tax for the half year was

GBP4.4 million (2022: GBP2.6 million) equating to an effective

corporation tax rate of 25.4% (2022: 18.7%).

The tax charge on statutory profits was GBP2.6 million (2022:

GBP0.9 million). The increase is largely due to the impact of the

increase in corporation tax rate from 19% to 25% from April 2023,

and the increase in taxable profits.

Basic EPS

Basic EPS in the half year ended 30 September 2023 was 2.6p

(2022: 2.9p). The variance is largely due to the impact of the

increase in corporation tax rates to 25% from April 2023. On a like

for like 19% corporate tax rate, basic EPS was 3.0p.

Adjusted fully diluted EPS

Adjusted fully diluted EPS in the half year ended 30 September

2023 was 5.9p (2022: 5.3p). On a like for like basis at 19%

corporate tax rate, adjusted fully diluted EPS was 6.3p.

Dividend

An interim dividend of 3.0p has been declared by the Board

(2022: 2.7p), reflecting XPS's progressive dividend policy and our

confidence in the Group's prospects. The interim dividend amounting

to GBP6.2 million (2022: GBP5.6 million), will be paid on 5

February 2024 to those shareholders on the register on 12 January

2024.

Cash-flow, capital expenditure and net debt

The Group generated GBP11.3 million from operating activities.

After GBP4.1 million on capital expenditure; paying GBP11.8 million

dividends; GBP2.2 million of interest, GBP1.3 million of lease

liabilities; GBP0.4 million dividend equivalents on vesting of

employee share schemes; GBP4.3 million on repurchasing own shares,

GBP0.4 million net payments relating to previous period

acquisitions, GBP0.2 million on fees relating to extension of the

loan facility for a further year, partially offset by a GBP6.0

million drawdown of committed facility, the net decrease in cash

was GBP7.4 million at 30 September 2023.

At 30 September 2023 net debt (as defined for RCF covenants and

therefore excluding IFRS 16) was GBP68.2 million (2022: GBP72.9

million. The leverage ratio for financing covenants was 1.55x

(2022: 2.09x). At 30 September 2023, the Group had GBP26.0 million

of undrawn committed facility. The Group's RCF expires in October

2026.

As a result of the completion of the NPT sale, current net debt

is approximately GBP30 million, representing a significant

reduction in the Group's leverage ratio to approximately 0.7x.

Principal risks and uncertainties affecting the business

The principal risks and uncertainties affecting the Group's

business activities remain those detailed within the Principal

Risks and Uncertainties section of the Annual Report and Accounts

for the year ended 31 March 2023 (pages 46-51).

Condensed Consolidated Statement of Comprehensive Income

for the period ended 30 September 2023

6 month period ended 30 September 2023 6 month period ended 30 September 2022

Trading items Non-trading and Total Trading items Non-trading and Total

exceptional exceptional

items items

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ ----- -------------- ----------------- ---------- -------------- ----------------- ---------

Revenue 4 94,510 - 94,510 76,998 - 76,998

Other operating

income 3 - 92 92 - - -

Administrative

expenses (74,650) (9,247) (83,897) (61,784) (7,050) (68,834)

------------------ ----- -------------- ----------------- ---------- -------------- ----------------- ---------

Profit/(loss) from

operating

activities 19,860 (9,155) 10,705 15,214 (7,050) 8,164

Finance income 20 - 20 - - -

Finance costs (2,577) - (2,577) (1,334) - (1,334)

------------------ ----- -------------- ----------------- ---------- -------------- ----------------- ---------

Profit/(loss)

before tax 17,303 (9,155) 8,148 13,880 (7,050) 6,830

------------------ ----- -------------- ----------------- ---------- -------------- ----------------- ---------

Income tax

(expense)/credit (4,375) 1,693 (2,682) (2,646) 1,703 (943)

------------------ ----- -------------- ----------------- ---------- -------------- ----------------- ---------

Profit/(loss)

after tax and

total

comprehensive

income for the

period 12,928 (7,462) 5,466 11,234 (5,347) 5,887

------------------ ----- -------------- ----------------- ---------- -------------- ----------------- ---------

Memo

EBITDA 22,733 (5,634) 17,099 17,799 (3,706) 14,093

Depreciation and

amortisation (2,873) (3,521) (6,394) (2,585) (3,344) (5,929)

Profit/(loss) from

operating

activities 19,860 (9,155) 10,705 15,214 (7,050) 8,164

Pence Pence Pence Pence

------------------ ----- -------------- ----------------- ---------- -------------- ----------------- ---------

Earnings per share Adjusted Adjusted

attributable to

the ordinary

equity holders of

the Company:

Profit or loss:

Basic earnings per

share 5 6.2 2.6 5.5 2.9

Diluted earnings

per share 5 5.9 2.5 5.3 2.8

Condensed Consolidated Statement of Financial Position

as at 30 September 2023

31 March

30 September 2023

2023 Unaudited Audited

Note GBP'000 GBP'000

--------------------------------------------- ---- --------------- --------

Assets

Non-current assets

Property, plant and equipment 4,006 3,079

Right-of-use assets 8,664 9,684

Intangible assets 210,834 212,103

Other financial assets 1,847 1,847

--------------------------------------------- ---- --------------- --------

225,351 226,713

--------------------------------------------- ---- --------------- --------

Current assets

Trade and other receivables 46,783 43,765

Cash and cash equivalents 5,796 13,285

--------------------------------------------- ---- --------------- --------

52,579 57,050

--------------------------------------------- ---- --------------- --------

Total assets 277,930 283,763

--------------------------------------------- ---- --------------- --------

Liabilities

Non-current liabilities

Loans and borrowings 6 73,248 67,310

Lease liabilities 6,682 7,234

Provisions for other liabilities and charges 1,297 1,869

Trade and other payables - 845

Deferred tax liabilities 17,049 18,445

--------------------------------------------- ---- --------------- --------

98,276 95,703

--------------------------------------------- ---- --------------- --------

Current liabilities

Lease liabilities 2,540 2,701

Provisions for other liabilities and charges 2,115 2,009

Trade and other payables 30,285 31,218

Current income tax liabilities 3,310 2,280

Deferred consideration - 568

38,250 38,776

--------------------------------------------- ---- --------------- --------

Total liabilities 136,526 134,479

--------------------------------------------- ---- --------------- --------

Net assets 141,404 149,284

--------------------------------------------- ---- --------------- --------

Equity

Equity attributable to owners of the parent

Share capital 7 104 104

Share premium 8 1,786 1,786

Merger relief reserve 8 48,687 48,687

Investment in own shares held in trust 8 (2,805) (1,350)

Retained earnings 8 93,632 100,057

--------------------------------------------- ---- --------------- --------

Total equity 141,404 149,284

--------------------------------------------- ---- --------------- --------

Condensed Consolidated Statement of Changes in Equity

for the period ended 30 September 2023

Accumulated

Merger relief Investment in own deficit/ retained

Share capital Share premium reserve shares earnings Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Balance at 1

April 2023 104 1,786 48,687 (1,350) 100,057 149,284

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Profit after tax

and total

comprehensive

income for the

period - - - - 5,466 5,466

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Contributions by

and distributions

to owners

Shares purchased

by employee

benefit trust

for cash - - - (4,277) - (4,277)

Dividends paid

(note 9) - - - - (11,825) (11,825)

Dividend

equivalents paid

on exercised

share options - - - - (438) (438)

Share-based

payment expense

- equity settled

from employee

benefit trust - - - 2,822 (2,806) 16

Share-based

payment expense

- IFRS2 charge - - - - 2,408 2,408

Deferred tax

movement in

respect of

share-based

payment expense - - - - 466 466

Current tax

movement in

respect of

share-based

payment expense - - - - 304 304

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Total

contributions by

and

distributions to

owners - - - (1,455) (11,891) (13,346)

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Unaudited balance

at 30 September

2023 104 1,786 48,687 (2,805) 93,632 141,404

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Balance at 1

April 2022 103 116,804 48,687 (4,157) (17,002) 144,435

Profit after tax

and total

comprehensive

income for the

period - - - - 5,887 5,887

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Contributions by

and distributions

to owners

Share capital

issued 1 1,786 - - - 1,787

Shares purchased

by employee

benefit trust

for cash - - - (1,000) - (1,000)

Dividends paid

(note 9) - - - - (9,763) (9,763)

Dividend

equivalents paid

on exercised

share options - - - - (413) (413)

Share-based

payment expense

- equity settled

from employee

benefit trust - - - 3,066 (2,669) 397

Share-based

payment expense

- IFRS2 charge - - - - 1,571 1,571

Deferred tax

movement in

respect of

share-based

payment expense - - - - 20 20

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Total

contributions by

and

distributions to

owners 1 1,786 - 2,066 (11,254) (7,401)

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Unaudited balance

at 30 September

2022 104 118,590 48,687 (2,091) (22,369) 142,921

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Balance at 1

April 2022 103 116,804 48,687 (4,157) (17,002) 144,435

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Profit after tax

and total

comprehensive

income for the

year - - - - 15,837 15,837

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Contributions by

and distributions

to owners

Share capital

issued 1 1,786 - - - 1,787

Share premium

reduction - (116,804) - - 116,804 -

Dividends paid - - - - (15,331) (15,331)

Dividend

equivalents paid

on exercised

share options - - - - (549) (549)

Shares purchased

by employee

benefit trust

for cash - - - (2,200) - (2,200)

Share-based

payment expense

- equity settled

from employee

benefit trust - - - 5,007 (4,137) 870

Share-based

payment expense

- IFRS2 charge - - - - 3,892 3,892

Deferred tax

movement in

respect of

share-based

payment expense - - - - 258 258

Current tax

movement in

respect of

share-based

payment expense - - - - 285 285

Total

contributions by

and

distributions to

owners 1 (115,018) - 2,807 101,222 (10,988)

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Balance at 31

March 2023 104 1,786 48,687 (1,350) 100,057 149,284

----------------- ------------- ------------- ----------------- ----------------- ----------------- ------------

Condensed Consolidated Statement of Cash Flows

for the period ended 30 September 2023

Period ended Period ended

30 September 30 September

2023 2022

Unaudited Unaudited

Note GBP'000 GBP'000

---------------------------------------------------------------------- ---- ------------- -------------

Cash flows from operating activities

Profit for the period 5,466 5,887

Adjustments for:

Depreciation 394 442

Depreciation of right-of-use assets 1,572 1,288

Amortisation 4,374 4,198

Loss on disposal of right-of-use assets 54 -

Finance income (20) -

Finance costs 2,577 1,334

Share-based payment expense 2,408 1,571

Other operating income (92) -

Income tax expense 2,682 943

---------------------------------------------------------------------- ---- ------------- -------------

19,415 15,663

---------------------------------------------------------------------- ---- ------------- -------------

Increase in trade and other receivables (3,025) (3,608)

Decrease in trade and other payables (2,187) (3,014)

Decrease in provisions (621) (281)

---------------------------------------------------------------------- ---- ------------- -------------

13,582 8,760

---------------------------------------------------------------------- ---- ------------- -------------

Income tax paid (2,280) (2,209)

---------------------------------------------------------------------- ---- ------------- -------------

Net cash inflow from operating activities 11,302 6,551

---------------------------------------------------------------------- ---- ------------- -------------

Cash flows from investing activities

---------------------------------------------------------------------- ---- ------------- -------------

Acquisition of a subsidiary, net of cash acquired - (8,267)

Payment of deferred consideration (406) -

Purchases of property, plant and equipment (743) (219)

Purchases of software (3,369) (2,125)

Net cash outflow from investing activities (4,518) (10,611)

---------------------------------------------------------------------- ---- ------------- -------------

Cash flows from financing activities

Proceeds from the issue of share capital on exercise of share options - 1,787

Proceeds from existing loans 6 6,000 11,000

Payment relating to extension of loan facility (200) -

Repurchase of own shares (4,277) (1,000)

Proceeds from the exercise of share options settled by EBT shares 16 397

Interest paid (2,235) (1,037)

Lease interest paid (119) (149)

Payment of lease liabilities (1,195) (1,236)

Dividends paid to the holders of the parent 9 (11,825) (9,763)

Dividend equivalents paid on vesting of share options (438) (413)

---------------------------------------------------------------------- ---- ------------- -------------

Net cash outflow from financing activities (14,273) (414)

---------------------------------------------------------------------- ---- ------------- -------------

Net decrease in cash and cash equivalents (7,489) (4,474)

Cash and cash equivalents at start of the period 13,285 10,150

---------------------------------------------------------------------- ---- ------------- -------------

Cash and cash equivalents at end of period 5,796 5,676

---------------------------------------------------------------------- ---- ------------- -------------

Notes to the Condensed Consolidated Financial Statements

for the period ended 30 September 2023

1 Accounting policies

XPS Pensions Group plc (the "Company") is a public limited

company incorporated in the UK. The principal activity of the Group

is that of an employee benefit consultancy and related business

services. The registered office is Phoenix House, 1 Station Hill,

Reading RG1 1NB. The Condensed Group Financial Statements

consolidate those of the Company and its subsidiaries (together

referred to as the "Group").

Basis of preparation and statement of compliance with IFRS

The annual financial statements are prepared in accordance with

UK adopted International Accounting Standards ("IAS"). These

condensed financial statements have been prepared in accordance

with UK adopted IAS 34 'Interim Financial Reporting'. They do not

include all disclosures that would otherwise be required in a

complete set of financial statements and should be read in

conjunction with the latest audited financial statements, for the

year ended 31 March 2023.

The accounting policies adopted in the preparation of the

interim condensed consolidated financial statements are consistent

with those followed in the preparation of the Group's annual

consolidated financial statements for the year ended 31 March 2023,

except for the following amendments which apply for the first time

in 2023/24. However, the below are not expected to have a material

impact on the Group's financial statements as they are either not

relevant to the Group's activities or require accounting which is

consistent with the Group's current accounting policies.

The following new standards and amendments are effective for the

period beginning 1 April 2023:

-- IFRS 17 Insurance Contracts;

-- Disclosure of Accounting Policies (Amendments to IAS 1

Presentation of Financial Statements and IFRS Practice Statement

2);

-- Definition of Accounting Estimates (Amendments to IAS 8

Accounting policies, Changes in Accounting Estimates and

Errors);

-- Deferred Tax related to Assets and Liabilities arising from a

Single Transaction (Amendments to IAS 12 Income Taxes); and

-- International Tax Reform - Pillar Two Model Rules (Amendment

to IAS 12 Income Taxes)

Going concern

IFRS accounting standards require the Directors to consider the

appropriateness of the going concern basis when preparing the

interim financial statements. The Directors have taken notice of

the Financial Reporting Council guidance 'Guidance on the going

concern basis of accounting and reporting on solvency and liquidity

risks' which requires the reasons for this decision to be

explained.

The Directors have prepared cash flow forecasts up to 31 March

2025, which includes the 12-month period from the date of approval

of these interim financial statements which show that during that

period the Group is expected to generate sufficient cash from its

operations to settle its liabilities as they fall due without the

requirement for additional borrowings. The period to 31 March 2025

has been chosen as it covers the current and next financial years

and includes the 12-month period from the date of signing these

interim accounts. Inflationary increases have been modelled using

the OBR inflation forecasts for that period, and interest rate

increases have been included in the forecast based on latest market

projections. Additionally, the Directors have modelled a scenario

at which the banking covenants could potentially be breached, which

is the point at which going concern would be threatened. In this

scenario, revenue is modelled to decrease significantly, partially

offset with a reduction in staff bonuses. The headroom between this

scenario and current performance, and the budget and latest

forecast, is significant and a decrease of this magnitude is

considered to be extremely unlikely. In addition, the Group has

several additional cost reduction and cash preservation levers it

could utilise, which include managing staff costs through a hiring

freeze or a reduction in workforce, a reduction in capital

expenditure, and a reduction of dividends.

The cash flow forecasts discussed above do not factor in the

impact of the sale of the NPT business (see note 12). The impact on

EBTIDA for the Group is expected to be immaterial, however the cash

received on completion of the sale of the business would result in

a reduction in Group debt. This would lead to interest saving and a

related improvement in banking covenant test outcomes, which

already showed a position of headroom.

The Group's current revolving credit facility is in place until

October 2026 and gives the Group access to a Revolving Credit

Facility of GBP100 million with an accordion of GBP50 million. The

facility is subject to two covenants - net leverage and interest

cover. These covenants were not breached during the period, nor are

any breaches forecast. The Group does not have any non-financial

covenants.

Notes to the Condensed Consolidated Financial Statements

(continued)

1 Accounting policies (continued)

The Directors have reviewed the historical accuracy of the

Group's budgets/forecast. The Group's prior year performance was

compared to the budget/forecast, and actual revenue was within 3%

of the forecast figure, and adjusted profit after tax was within 8%

of the forecast figure. Actual results were ahead of forecast in

both cases. This demonstrates that the Group's forecasting process

is at a sufficient standard to be able to place reliance on it when

making a going concern assessment. The financial performance in the

current period has been favourable when compared to budget. The

Directors, after reviewing the Group's budget and longer-term

forecast models, including the worst case scenario referred to

above, conclude that the Group has adequate resources to continue

in operational existence for the foreseeable future and they

continue to adopt the going concern basis of accounting in

preparing these interim financial statements.

In terms of the wider macroeconomic and financial situation, the

main impact on the Group is the high level of inflation currently

being experienced in the UK, and also the related increases in

interest rates, albeit the interest rates are now expected to

stabilise. The Group is largely protected from a high inflation

environment because of its contractual ability to increase revenue

from the majority of customers by an amount linked to inflation.

Whilst higher interest rates have led to higher finance expenses

this has been modelled in the Group's forecasts and is not

considered a significant risk.

Non-trading and exceptional items

To assist in understanding its underlying performance, the Group

has defined the following items of pre-tax income and expense as

non-trading and exceptional items as they either reflect items

which are exceptional in nature or size or are associated with the

amortisation of acquired intangibles and share based payments.

Items treated as non-trading and exceptional include:

-- corporate transaction and restructuring costs;

-- amortisation of acquired intangibles;

-- changes in the fair value of contingent consideration;

-- share-based payments;

-- profits or losses on disposal of assets or businesses; and

-- the related tax effect of these items.

Any other non-recurring items are considered individually for

classification as non-trading or exceptional by virtue of their

nature or size.

The separate disclosure of these items allows a clearer

understanding of the trading performance on a consistent and

comparable basis.

The non-trading and exceptional items have been included within

the appropriate classifications in the consolidated income

statement. Further details are given in note 3.

Critical accounting estimates and judgments

The Group makes certain estimates and assumptions regarding the

future. Estimates and judgments are continually evaluated based on

historical experience and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances.

There have been no material revisions to the nature and amount

of estimates of amounts reported since 31 March 2023 except for the

estimates relating to the business combination that related

specifically to the comparative period.

The sale of the NPT business has been reviewed, and it is the

Director's assessment that at 30(th) September 2023, the NPT

business is not classified as held for sale, as the criteria under

IFRS 5 had not been met. This judgement is due to several factors,

but the key element was that the Pensions Regulator had not given

their approval at this date, and approval could not be considered

to be customary.

Functional and presentation currency

The Financial Statements are presented in British Pounds which

is the functional currency of all Group entities. Figures are

rounded to the nearest thousand.

Notes to the Condensed Consolidated Financial Statements

(continued)

2 Financial information

The financial information in this report was formally approved

by the Board of Directors on 22 November 2023. The financial

information set out in this document does not constitute statutory

accounts within the meaning of section 434 of the Companies Act

2006.

Statutory accounts prepared under UK adopted IFRS for the year

ended 31 March 2023 for XPS Pensions Group plc have been delivered

to the Registrar of Companies. The auditor's report on these

accounts was not qualified, did not draw attention to any matters

by way of emphasis and did not contain statements under section

498(2) or (3) of the Companies Act 2006.

The financial information in respect of the period ended 30

September 2023 is unaudited but has been reviewed by the Group's

auditor. Their report is included at the end of this document. The

financial information in respect of the period ended 30 September

2022 was unaudited but was reviewed by the Group's auditor.

3 Non-trading and exceptional items

Period ended Period ended

30 September 30 September

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

--------------------------------------------------- ------------ ------------

Corporate transaction costs (1) (2,611) (1,894)

---------------------------------------------------- ------------ ------------

Exceptional items (2,611) (1,894)

Contingent consideration write back (2) 92 -

Share-based payment costs (3,115) (1,812)

Amortisation of acquired intangibles (3,521) (3,344)

Non-trading items (6,544) (5,156)

Total exceptional and non-trading items before tax (9,155) (7,050)

---------------------------------------------------- ------------ ------------

Tax on adjusting items (3) 1,693 1,703

---------------------------------------------------- ------------ ------------

Non-trading and exceptional items after taxation (7,462) (5,347)

---------------------------------------------------- ------------ ------------

(1) Included within this is GBP845,000 of contingent

consideration in respect of the acquisition of Penfida Limited (H1

2022/23: GBPnil). The maximum contingent consideration of

GBP3,379,000 would be payable on the second anniversary of the

acquisition subject to business performance which includes

retention of clients as well as continued employment of key

employees. As continued employment is one part of the contingent

consideration test, according to IFRS 3, the entire contingent

consideration must be treated as a post transaction employment cost

accruing over the deferment period of two years. The contingent

consideration is material in size and it is one-off in nature. As

such, in line with the Group's accounting policies, it has been

classified as an exceptional item. If the entire contingent

consideration is not payable at the end of the two year period, any

resulting credit will also flow through the exceptional category.

The remainder of the costs in the current period largely relate to

the disposal of the NPT business (see note 12). The costs in H1

2022/23 relate to the Penfida acquisition, as well as other

potential M&A opportunities explored by the Group in the

period.

(2) Contingent consideration revaluation credit of GBP92,000

relating to the reduction in the deferred cash-settled

consideration for the MJF acquisition (H1 2022/23: GBPnil).

(3) The tax credit on exceptional and non-trading items of

GBP1.7 million (H1 2022/23: GBP1.7 million) represents a credit of

18% (H1 2022/23: 24%) of the non-trading and exceptional items

incurred of GBP9.2 million (H1 2022/23 GBP7.1 million).

Notes to the Condensed Consolidated Financial Statements

(continued)

4 Operating segments

In accordance with IFRS 8 'Operating Segments', an operating

segment is defined as a business activity whose operating results

are reviewed by the chief operating decision maker ('CODM') and for

which discrete information is available. The Group's CODM is the

Board of Directors.

The Group has one operating segment, and one reporting segment

due to the nature of services provided across the whole business

being the same, pension and employee benefit solutions. The Group's

revenues, costs, assets, liabilities and cash flows are therefore

totally attributable to this reporting segment. The table below

shows the disaggregation of the Group's revenue, by product

line.

Period ended Period ended

30 September 30 September

2023 2022

Unaudited Unaudited

Revenue from external customers GBP'000 GBP'000

---------------------------------- ------------ ------------

Pensions Actuarial and Consulting 44,422 34,432

Pensions Administration 32,370 27,990

Pensions Investment Consulting 10,185 8,123

National Pension Trust (NPT) 2,118 2,063

SIP (1) 5,415 4,390

---------------------------------- ------------ ------------

Total 94,510 76,998

---------------------------------- ------------ ------------

(1) Self Invested Pensions (SIP) business, incorporating both

SIPP and SSAS products.

In the second half of the prior year, there was a change in the

way that divisional revenues are reported to the CODM which is more

reflective of the responsibilities and operations of the business.

As a result related revenue to the period ended 30 September 2022

of GBP0.7 million has been reallocated from the Pensions Actuarial

and Consulting division to the Pensions Administration division.

The above prior year comparative has been restated to reflect this

reallocation.

5 Earnings per share

30 September 30 September

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

--------------------------------------------------- ------------ ------------

Profit for the period 5,466 5,887

--------------------------------------------------- ------------ ------------

Weighted average number of shares: '000 '000

--------------------------------------------------- ------------ ------------

Weighted average number of shares in issue 206,947 204,091

Effects of:

Outstanding share options 12,687 9,464

Diluted weighted average number of ordinary shares 219,634 213,555

--------------------------------------------------- ------------ ------------

Basic earnings per share (pence) 2.6 2.9

--------------------------------------------------- ------------ ------------

Diluted earnings per share (pence) 2.5 2.8

--------------------------------------------------- ------------ ------------

The calculation of basic earnings per share is based on the

earnings attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the period.

Notes to the Condensed Consolidated Financial Statements

(continued)

5 Earnings per share (continued)

Adjusted earnings per share

30 September 30 September

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

---------------------------------------------------- ------------ ------------

Adjusted profit after tax 12,928 11,234

---------------------------------------------------- ------------ ------------

Adjusted basic earnings per share (pence) 6.2 5.5

---------------------------------------------------- ------------ ------------

Diluted adjusted earnings per share (pence) - total 5.9 5.3

---------------------------------------------------- ------------ ------------

The adjusted profit after tax is the trading profit after tax

and excludes the exceptional and non-trading items disclosed in

note 3.

6 Loans and borrowings

At 30 September 2023, the Group had drawn down GBP74 million (31

March 2023: GBP68 million) of its GBP100 million revolving credit

facility. The current Revolving Facility Agreement was entered into

on 12 October 2021 and had a 4 year term, which was extended in

April 2023 by one year to October 2026. Interest is calculated at a

margin above SONIA (Sterling Overnight Index Average), subject to a

net leverage test.

The related fees for access to the facility were capitalised at

the point they were incurred and are amortised over the life of the

loan to which they relate.

Total debt net of capitalised arrangement fees was GBP73.2

million (31 March 2023: GBP67.3 million).

7 Share capital

Ordinary Ordinary Ordinary Ordinary

shares shares shares shares

('000) (GBP'000) ('000) (GBP'000)

30 September 30 September 31 March 31 March

2023 2023 2023 2023

In issue at the beginning of the year 207,443 104 205,151 103

Issued during the year 102 - 2,292 1

In issue at the end of the year 207,545 104 207,443 104

-------------------------------------- ------------ ------------ -------- ---------

30 September 30 September 31 March 31 March

2023 2023 2023 2023

('000) (GBP'000) (000) (GBP'000)

Allotted, called up and fully paid

Ordinary shares of 0.05p (March 2023: 0.05p) each 206,027 103 206,427 103

Shares held by the Group's Employee Benefit Trust

Ordinary shares of 0.05p (March 2023: 0.05p) each 1,518 1 1,016 1

-------------------------------------------------- ------------ ------------ -------- ---------

Shares classified in shareholders' funds 207,545 104 207,443 104

-------------------------------------------------- ------------ ------------ -------- ---------

The Group has invested in the shares for its Employee Benefit

Trust ('EBT'). These shares are held on behalf of employees and

legal ownership will transfer to those employees on the exercise of

an award. This investment in own shares held in trust is deducted

from equity in the consolidated statement of changes in equity.

Notes to the Condensed Consolidated Financial Statements

(continued)

8 Reserves

The following describes the nature and purpose of each reserve

within equity:

Reserve Description and purpose

---------------------- ------------------------------------------------------------

Retained earnings: All net gains and losses recognised through the consolidated

statement of comprehensive income.

Share premium: Amounts subscribed for share capital in excess of nominal

value.

Merger relief reserve: The merger relief reserve represents the difference

between the fair value and nominal value of shares

issued on the acquisition of subsidiary companies.

Investment in own Cost of own shares held by the EBT.

shares:

9 Dividends

Amounts recognised as distributions to equity holders of the

parent in the period

30 September 30 September

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

----------------------------------------------------------------------------- ------------ ------------

Final dividend for the year ended 31 March 2023: 5.7p per share (2022: 4.8p) 11,825 9,763

----------------------------------------------------------------------------- ------------ ------------

30 September 30 September

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

------------------------------------------------------------------------ ------------ ------------

Interim dividend for the year ending 31 March 2024 of 3.0p (2023: 2.7p) 6,209 5,568

------------------------------------------------------------------------ ------------ ------------

The final dividend for 2022/23 was paid on 21 September 2023.

The final dividend has been reflected in the Statement of Changes

in Equity.

The interim dividend was approved by the Board on 22 November

2023 and has not been included as a liability at 30 September

2023.

10 Related party transactions

Key management emoluments during the year

30 September 30 September

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

------------------------------------------------------ ------------ ------------

Emoluments 536 503

Share-based payments 772 261

Company contributions to money purchase pension plans 15 15

Social security costs 71 73

------------------------------------------------------ ------------ ------------

1,394 852

------------------------------------------------------ ------------ ------------

Directors' bonuses are not included in the emoluments figure at

30 September 2023 or 30 September 2022 as the bonus amount is

dependent on full year results and is also at the discretion of the

Remuneration Committee.

Non-executive emoluments during the year

30 September 30 September

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

---------------------- ------------ ------------

Emoluments 165 162

Social security costs 20 22

---------------------- ------------ ------------

185 184

---------------------- ------------ ------------

Notes to the Condensed Consolidated Financial Statements

(continued)

11 Financial Instruments

The carrying values of financial assets and liabilities

approximates fair value.

Financial assets and financial liabilities measured at fair

value in the statement of financial position are grouped into three

levels of a fair value hierarchy. The three levels are defined

based on the observability of significant inputs to the

measurement, as follows:

-- Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities;

-- Level 2: inputs other than quoted prices included within

level 1 that are observable for the asset or liability, either

directly or indirectly; and

-- Level 3: unobservable inputs for the asset or liability.

The Group's finance team performs valuations of financial items

for financial reporting purposes, including level 3 fair values, in

consultation with third-party valuation specialists for complex

valuations. Valuation techniques are selected based on the

characteristics of each instrument, with the overall objective of

maximising the use of market-based information. The finance team

reports directly to the Chief Financial Officer.

The Group considers that the carrying amount of the following

financial assets and financial liabilities are a reasonable

approximation of their fair value:

-- Trade receivables

-- Trade payables

-- Cash and cash equivalents

-- Loans and borrowings

-- Deferred consideration

12 Post balance sheet events

On 14th July 2023, the Group announced that it has entered into

an option agreement to sell the National Pension Trust ("NPT"), to

SEI. The intention is to create a market leading defined

contribution proposition for employers and pension scheme members.

The deal creates a strategic partnership between XPS Pensions Group

and SEI, under which the Group will provide wide ranging services

to continue to support NPT and SEI. The transaction is subject to

regulatory approval.

The total cash consideration payable to the Group upon

completion following regulatory approval is up to GBP42.5 million,

comprising of GBP35.0 million initial consideration and deferred

earn-out consideration of up to GBP7.5 million based on business

performance over two years.

The Transaction positions the SEI Master Trust to continue

delivering best-of-breed service at increased scale in partnership

with NPT. The Group will continue to provide high-quality pensions

administration and consultancy services to NPT and SEI which will

ensure continuity of service to the members and clients. SEI will

benefit from enhanced opportunities in the growing master trust

space, and XPS will benefit as a key service provider to SEI.

Gross assets attributable to NPT were GBP2.5 million (including

the regulatory capital cash account) and the adjusted EBITDA

contribution from NPT to the XPS Group in the year ended 31 March

2023 was GBP0.9 million.

At 30(th) September 2023 regulatory approval had not yet been

received and the Directors still believed that approval was

uncertain. The agreement received regulatory approval on 13(th)

October 2023, and the sale was completed on 20 November 2023.

Responsibility Statement

We confirm that to the best of our knowledge:

a) the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting' and provide

a true and fair view as required by DTR 4.2.10;

b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of the important

events during the first six months and description of principal

risks and uncertainties for the remaining six months of the year);

and

c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein).

On behalf of the Board,

Snehal Shah

Chief Financial Officer

22 November 2023

INDEPENT REVIEW REPORT TO XPS PENSIONS GROUP PLC

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

September 2023 is not prepared, in all material respects, in

accordance with UK adopted International Accounting Standard 34 and

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 September 2023 which comprises the Condensed

Consolidated Statement of Comprehensive Income, the Condensed

Consolidated Statement of Financial Position, the Condensed

Consolidated Statement of Changes in Equity, the Condensed

Consolidated Statement of Cash Flows and related notes.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with UK adopted International Accounting Standard 34,

"Interim Financial Reporting".

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the group to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the

Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

In preparing the half-yearly financial report, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority and for no other purpose. No person is

entitled to rely on this report unless such a person is a person

entitled to rely upon this report by virtue of and for the purpose

of our terms of engagement or has been expressly authorised to do

so by our prior written consent. Save as above, we do not accept

responsibility for this report to any other person or for any other

purpose and we hereby expressly disclaim any and all such

liability.

BDO LLP

Chartered Accountants

London UK

22 November 2023

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFSTLVLFFIV

(END) Dow Jones Newswires

November 23, 2023 02:00 ET (07:00 GMT)

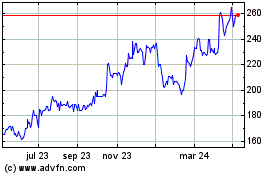

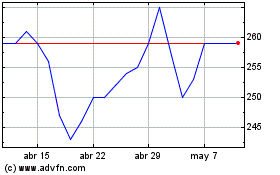

Xps Pensions (LSE:XPS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Xps Pensions (LSE:XPS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024