Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

22 Mayo 2024 - 5:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

IDENTIV, INC.

(Name of

Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11 |

Talking Points First Used May 22, 2024

| 1) |

Strategic Review and Transaction Items |

| |

• |

|

Strategic Options Overview |

| |

• |

|

We undertook a strategic review of our business starting early last year. We looked at every combination of our

business assets, including market opportunities and our competitive positioning, with one criterion: What is the highest expected value creation opportunity available to us to deliver to our investors? |

| |

• |

|

Identiv analyzed multiple potential alternatives, including evaluating the possibility of selling the entire

company; the possibility of selling the IoT Business with Identity Readers to focus on Physical Security or selling the Physical Security Business with Identity Readers to focus on the IoT Business; potential partnering opportunities; and the

possibility of continuing to retain both businesses. |

| |

• |

|

Following a review of potential buyers for part or all of the Company, including conversations with an entity

that had product offerings related to both of the Company’s businesses, the Company, in consultation with its financial advisor, concluded that potential bidders would value either the Physical Security Business or the IoT Business, but not

both. As a result, Identiv’s Board of Directors determined that the best way to maximize value would be to explore a sale of one or both businesses separately. |

| |

• |

|

Asset Sale Transaction Summary, Goals, Close Timing |

| |

• |

|

On April 2, 2024, Identiv entered into a definitive asset purchase agreement to sell its physical security,

access card, and identity reader operations and assets to a wholly owned subsidiary of Vitaprotech, a security solutions provider. |

| |

• |

|

Under the terms of the agreement, Identiv will receive a cash payment of $145 million upon closing of the

transaction, subject to customary adjustments. |

| |

• |

|

Goals of Asset Sale Transaction |

| |

• |

|

The goals of the asset sale transaction were to raise the maximum capital possible to invest in and focus on our

specialty IoT business; ensure a strong balance sheet for that specialty IoT business; and to bring on highly experienced leadership to direct this investment and navigate the company’s future growth trajectory. |

| |

• |

|

The transaction is expected to close in the third quarter of 2024, subject to stockholder approval and other

customary closing conditions. |

| |

• |

|

The transaction is also subject to review and approval by the Committee on Foreign Investment in the United

States (CFIUS) and the Federal Trade Commission (FTC) under the Hart-Scott-Rodino (HSR) Act. |

| |

• |

|

The HSR waiting period expired on Friday, May 17, 2024. |

| |

• |

|

Discussions between Identiv and CFIUS. |

| |

• |

|

Stockholder vote scheduled for Friday, June 28, 2024. |

| 2) |

Kirsten Newquist Introduction |

| |

• |

|

Professional background |

| |

• |

|

Kirsten Newquist came to Identiv after nearly 17 years with Avery Dennison. She started out in Corporate Strategy

analyzing new growth platforms, including RFID. |

| |

• |

|

She joined the Avery Dennison Medical division, first as VP, Business Development and ultimately as VP/GM, which

she led for six years. During her tenure, she was able to double the sales and significantly increase the EBITDA of the business. |

| |

• |

|

She led the launch of many new, innovative products, including wound dressings and surgical films containing

active ingredients, and skin adhesive components for wearable devices such as continuous glucose monitors, all utilizing complex coating, converting, and finishing capabilities under the strict quality and regulatory standards required to produce

finished medical devices. |

| |

• |

|

Her last year at Avery Dennison was spent within the RFID division, Avery Dennison Smartrac, where she led the

healthcare strategy and market development efforts and provided leadership to the product management team. |

| |

• |

|

Her decision to join Identiv was driven by the opportunity to lead an entrepreneurially-oriented public company

with a strong portfolio of products and solutions in an exciting and growing IoT industry. |

| |

• |

|

Identiv’s focus and initial traction in the healthcare sector were particularly compelling, given her

background in this space. Having worked for many years with the major players involved in the medical device and healthcare industry, she understood and appreciated the position that Identiv had built. |

| |

• |

|

Views on healthcare trends and driver sustainability |

| |

• |

|

As noted on the Q1 2024 Earning call, there are further compelling trends in healthcare, such as the shift of

care from hospital to the home, the growth in personalized medicine, and the rise in large molecule drugs requiring careful temperature, moisture, and location monitoring that, collectively, create a growing opportunity space. |

| |

• |

|

As the healthcare industry embarks on its digital transformation journey, Identiv sees many opportunities for

RFID-enabled solutions to become a critical asset in this transformation. |

| |

• |

|

At present, our expected net cash use over the next 12 months (net of interest impact) is in the range of

$15 million to $18 million, assuming the asset sale transaction closes. This reflects investment into the current IoT business, investment in accelerating the transition from Singapore to Thailand, investment in organic growth initiatives

including the development of strategic options, and investment in business development, sales and marketing, and R&D resources post-transaction close. |

| |

• |

|

Identiv may also use the funds for other purposes, including, without limitation, to pay dividends and

distributions on or redeem or repurchase its capital stock; for working capital and other general corporate purposes; to invest in or acquire complementary businesses, products, services, technologies or assets; or to otherwise execute its growth

strategy. |

| |

• |

|

Tax aspects of the transaction proceeds. |

| |

• |

|

We are continuing to work through our tax analysis. We expect most of our US federal tax liability to be covered

by our net operating loss (“NOL”) carryforwards. |

| |

• |

|

Positive milestones have been achieved as we progress toward the closing of the transaction.

|

| |

• |

|

Our definitive proxy was filed with the SEC on May 13, 2024, and the stockholder meeting is scheduled for

June 28, 2024. |

| |

• |

|

The HSR waiting period expired on Friday, May 17, 2024. |

| |

• |

|

We feel the upside opportunity is significant. |

| |

• |

|

Higher value/margin sub-segments. |

| |

• |

|

Given Kirsten’s background, she is excited about the potential for Identiv in the healthcare and

pharmaceutical industries, which is our longer-term opportunity. It is an area where there are large unmet needs – ranging from medication non-adherence, to drug

mix-ups, to pharmaceutical counterfeiting – in which RFID can play an important role. |

| |

• |

|

For example, studies have shown that as much as 25% of first-time prescriptions are not filled and only 50% of

prescriptions for chronic illnesses are taken as prescribed; NFC/HF technology can help to address these shortfalls. |

| |

• |

|

Newer markets and applications should require customized designs that are unique to the use case. For those

custom designs, we expect higher margins and the opportunity for competitive advantage. |

| |

• |

|

In the medium-term, there are opportunities in three other high value segments: specialty retail, smart

packaging, and smart home devices. As these industries do not have the same regulatory and quality hurdles, we expect their ability to adopt new solutions will be quicker than those we see in the healthcare segment. |

| |

• |

|

Within smart packaging, there are NFC-enabled labels that enhance the

consumer experience. |

| |

• |

|

Within specialty retail, there are our Life of Garment tags that can withstand the stringent wash and dry cycles

requirements for garments and footwear. |

| |

• |

|

Within smart home devices, there are embedded and highly secure authentication tags of consumables. As discussed

in our Q1 2024 Earnings call, we recently secured a 2-year contract with an IoT customer for a smart home application. |

| |

• |

|

Thailand manufacturing switchover milestones. |

| |

• |

|

As we noted on our recent Q1 2024 Earnings call, one of our most critical short-term initiatives is to accelerate

the transition of the majority of our RFID production to our Thailand facility, to capitalize on its much lower cost structure. |

| |

• |

|

We have a highly experienced team who have proven their ability to produce our most complex products; 40% of Q1

2024 RFID volume was produced in Thailand. |

| |

• |

|

We expect the production transition from Singapore to Thailand to be largely complete by the end of Q1 2025.

|

| |

• |

|

After that, our primary manufacturing will occur in Thailand with a smaller R&D and engineering focused

operation in Singapore. Additionally, some customers may require additional time to requalify. We will be able to support our customers’ qualification process and continue to manufacture in Singapore until that work is complete.

|

| |

• |

|

In a significant milestone for our Thailand site, the facility recently achieved ISO certification for ISO

9001:2015 and ISO 14001:2015. |

| |

• |

|

Some of our very low margin business has already been exited. |

| |

• |

|

Over the coming months, there are a few customers with whom we will be discussing the path forward. Our hope is

that we can get to a place where it makes sense for us to continue supporting them in Thailand, but if we are unable to achieve adequate margins, we expect to no longer continue to support that business by early next year. We anticipate these

ongoing discussions will take place over the next approximately 6 months. |

| |

• |

|

As noted on our Q4 2023 Earnings call, Wiliot is currently on pause for at least a few quarters. We intend to

explore high value applications using Wiliot’s technology and platform. For example, there are applications in cold chain management for pharmaceuticals that could be compelling. We will also explore other BLE technologies that are not tied to

the Wiliot software platform. We need to explore new use cases and how to make the tag unique to Identiv. |

| |

• |

|

As we increasingly shift our production to Thailand, exit low margin business, and Wiliot remaining on pause, our

margins are and will continue to be under pressure. This is primarily due to underutilization and the overhead cost of maintaining 2 production sites for this overlap period until the majority of volume is produced in Thailand.

|

| |

• |

|

There are significant cost savings by transitioning our RFID manufacturing to Thailand. For example, direct labor

cost in Thailand is roughly 40% of what it costs in Singapore, and facilities costs are approximately one-fifth the cost in Thailand versus Singapore. |

| |

• |

|

Upon completion of this transition, we expect to add approximately 5% to 10% of incremental margin compared to

when we were producing exclusively in Singapore. |

| |

• |

|

Operational excellence plan and strategic growth plan. |

| |

• |

|

There are several elements to our business and operational excellence plan: strengthen and grow our core IoT

business; focusing on overall operational excellence; and accelerating our growth into higher value segments; and transform the business with expanded business model including data management for specific high value healthcare applications.

|

| |

• |

|

We think about our go-to-market

plan in three phases: |

| |

• |

|

In the short term, we intend to grow our core business and leverage the products and designs currently in our

portfolio. |

| |

• |

|

In the medium term, we expect to accelerate our growth in high-value segments, including smart packaging,

specialty retail, and smart home devices, through targeted business and market development activities and the expansion of our product portfolio to meet the evolving needs of these segments and ensure a competitive advantage. |

| |

• |

|

In the longer term (what we consider our transformational growth plan), we anticipate transforming the business

by focusing on specific high value applications within the healthcare industry. We expect to develop and implement an expanded business model to capitalize on emerging opportunities and trends in this segment, which could include expanding data

management and software application capabilities targeted for specific use cases and applications. |

| |

• |

|

We currently support a wide breadth of healthcare opportunities. We intend to be very proactive in managing our

NRE pipeline, focusing on the opportunities with high value and high margin potential. |

| |

• |

|

Our goal is to focus on 3 to 4 opportunities to proactively develop, build partnerships with key OEMs, and expand

our technology roadmap to support those key opportunities. Ultimately, as we gain traction in the healthcare industry with our device offerings, we could look at offering a full solution, including data management services and specific application

software. In that case, we would evaluate a range of additional growth options, including the potential for small-scale inorganic investment that would be highly accretive. |

| |

• |

|

Currently, we do not have any immediate plans to pursue M&A. Our primary objective is to gain strategic

clarity and drive towards operational excellence so that any future M&A will be built upon a strong business foundation and aligned closely with our strategic objectives. |

| |

• |

|

We brought on a fantastic operations leader with deep expertise in RFID production. |

| |

• |

|

We are bringing in industry specific resources with whom Kirsten has worked extensively in the past to provide an

outside perspective and complement our internal talent to drive the operational excellence initiatives and strategic process. |

| |

• |

|

We plan to ensure that we can execute on our current business with excellence and that our longer-term business

model has a truly strong foundation. |

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

are those involving future events and future results that are based on current expectations as well as the current beliefs and assumptions of management of Identiv and can be identified by words such as “anticipate,” “believe,”

“continue,” “plan,” “will,” “intend,” “expect,” “outlook,” and similar references to the future. Any statement that is not a historical fact is a forward-looking statement, including

statements regarding: Identiv’s expectations regarding future operating and financial outlook and performance; Identiv’s strategy, opportunities, focus and goals, including plans for its IoT business; Identiv’s expectations regarding

the goals and benefits of the transaction; Identiv’s expectations with respect to the amount and use of proceeds from the transaction; the terms and conditions related to the transaction, including stockholder and regulatory approvals; the

timing of the closing of the transaction; opportunities in the markets and industries in which Identiv operates, including healthcare, specialty retail, smart packaging, and smart home devices, and Identiv’s plans to expand its offerings within

such markets and industries; beliefs regarding the strengths of Identiv’s business, including the belief that its design, development, and production capabilities are well-suited across a wide range of segments; Identiv’s plans to

accelerate the transition of RFID manufacturing to its Thailand facility, including the expected timing and benefits thereof, including potential cost savings; expectations with respect to management and management following the

completion of the proposed transaction, including the belief that Ms. Newquist’s background creates value creation opportunities and is ideal to drive the growth of Identiv’s

business; Identiv’s beliefs regarding cost savings, cash needs and usage and access to future capital; Identiv’s expectations relating to the growth of its IoT business and the development of its technology and partnerships; and

Identiv’s expectations with respect to demand and customer orders. Forward-looking statements are only predictions and are subject to a number of risks and uncertainties, many of which are outside Identiv’s control, which could cause

actual results to differ materially and adversely from those expressed in any forward-looking statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: the

failure of the asset sale to close for any reason; risks that the asset sale disrupts current business, plans and operations of Identiv or its business prospects; diversion of management’s attention from Identiv’s ongoing business; the

ability of Identiv to retain and hire key personnel; the effect of the change in management following the completion of the asset sale; competitive responses to the asset sale; potential adverse reactions or changes to business relationships

resulting from the announcement or completion of the asset sale; Identiv’s ability to continue the momentum in its business; Identiv’s ability to successfully execute its business strategy, including with respect to its IoT business;

changes in its business strategy; Identiv’s ability to capitalize on trends in its business and penetrate the healthcare and other specialty markets; the effect of competition on Identiv’s business; Identiv’s ability to satisfy

customer demand and expectations; the level and timing of customer orders and changes/cancellations; issues related to the transition to lower cost manufacturing; the loss of customers, suppliers or partners; the success of Identiv’s products

and strategic partnerships; industry trends and seasonality; actual cost savings, if any and cash usage; the impact of macroeconomic conditions, customer demand and inflation; and the other factors discussed in its periodic and other reports and

documents filed with the U.S. Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, definitive proxy statement filed with on May 13, 2024 and subsequent reports filed with the SEC. All forward-looking statements are based on information available

to Identiv on the date hereof, and Identiv assumes no obligation to update such statements.

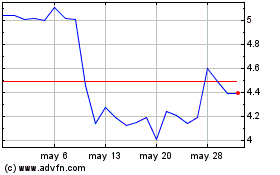

Identiv (NASDAQ:INVE)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Identiv (NASDAQ:INVE)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024