false

0001847398

0001847398

2024-05-23

2024-05-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): May 23, 2024

NORTHEAST COMMUNITY BANCORP, INC.

(Exact Name of Registrant as Specified in Its

Charter)

| Maryland |

001-40589 |

86-3173858 |

| (State or other jurisdiction of |

(Commission |

(IRS Employer |

| incorporation or organization) |

File Number) |

Identification No.) |

325 Hamilton Avenue, White Plains, New York 10601

(Address of principal executive offices) (Zip Code)

(914) 684-2500

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

NECB |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 7.01 | Regulation FD Disclosure. |

On May 23, 2024, Kenneth A.

Martinek, Chairman and Chief Executive Officer of NorthEast Community Bancorp, Inc. (the “Company”), the holding company for

NorthEast Community Bank, delivered a slide presentation at the Company’s 2024 annual meeting of stockholders. The presentation

materials will also be posted to the Company’s website on May 23, 2024. Pursuant to Regulation FD, the presentation materials are

attached hereto as Exhibit 99.1 and are furnished herewith.

| Item 9.01 | Financial Statements and Other Exhibits. |

| | |

| (d) | Exhibits |

| | |

| | Number |

Description |

| | |

|

| | 99.1 |

Presentation

Materials |

| | |

|

| | 104 |

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

NORTHEAST COMMUNITY BANCORP, INC. |

| |

|

| |

|

| Date: May 23, 2024 |

By: |

/s/ Kenneth A. Martinek |

| |

|

Kenneth A. Martinek |

| |

|

Chairman and Chief Executive Officer |

Exhibit 99.1

ANNUAL MEETING OF STOCKHOLDERS MAY 23, 2024

Safe Harbor Statement This Presentation may contain statements that constitute forward - looking statements (within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended), which involve significant risks and uncertainties. NorthEast Community Financial, Inc. (t he “Company”) intends such forward - looking statements to be covered by the safe harbor provisions for forward - looking statements co ntained in the Private Securities Litigation Reform Act of 1995, and is including this statement for purposes of invoking these safe har bor provisions. Forward - looking statements, which are based on certain assumptions and describe future plans, strategies and expectations of the Company, are generally identifiable by the use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “plan, ” o r similar expressions. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain and actua l r esults may differ from those predicted. The Company undertakes no obligation to update these forward - looking statements in the future. The Company cautions readers of this report that a number of important factors could cause the Company’s actual results to di ffe r materially from those expressed in forward - looking statements or historical statements. Factors that could cause actual results to differ from those predicted and could affect the future prospects of the Company include, but are not limited to: ( i ) general economic conditions, including higher inflation, either nationally or in our market area, that are worse than expected; (ii) changes in the interest rate en vir onment that reduce our interest margins, reduce the fair value of financial instruments or reduce the demand for our loan products; (iii) increa sed competitive pressures among financial services companies; (iv) changes in consumer spending, borrowing and savings habits; (v) changes in th e quality and composition of our loan or investment portfolios and the adequacy of credit loss reserves; (vi) changes in real estate ma rke t values in our market area; (vii) decreased demand for loan products, deposit flows, competition, or decreased demand for financial services in our market area; (viii) major catastrophes such as earthquakes, floods or other natural or human disasters and pandemics or infectious d ise ase outbreaks, the related disruption to local, regional and global economic activity and financial markets, and the impact that any of the foregoing may have on us and our customers and other constituencies; (ix) legislative or regulatory changes that adversely affect our b usi ness or changes in the monetary and fiscal policies of the U.S. government, including policies of the U.S. Treasury and the Federal R ese rve Board; (x) technological changes that may be more difficult or expensive than expected; (xi) success or consummation of new business ini tia tives may be more difficult or expensive than expected; (xii) the inability to successfully integrate acquired businesses and financial in stitutions into our business operations; (xiii) adverse changes in the securities markets; (xiv) the impact of failures or disruptions in or brea che s of the Company’s operational or security systems, data or infrastructure, or those of third parties, including as a result of cybera tta cks or campaigns; (xv) the inability of third party service providers to perform; and (xvi) changes in accounting policies and practices, as ma y b e adopted by bank regulatory agencies or the Financial Accounting Standards Board. This Presentation also includes interim and unaudited financial information that is subject to further review review by the C omp any’s independent registered public accounting firm. 2

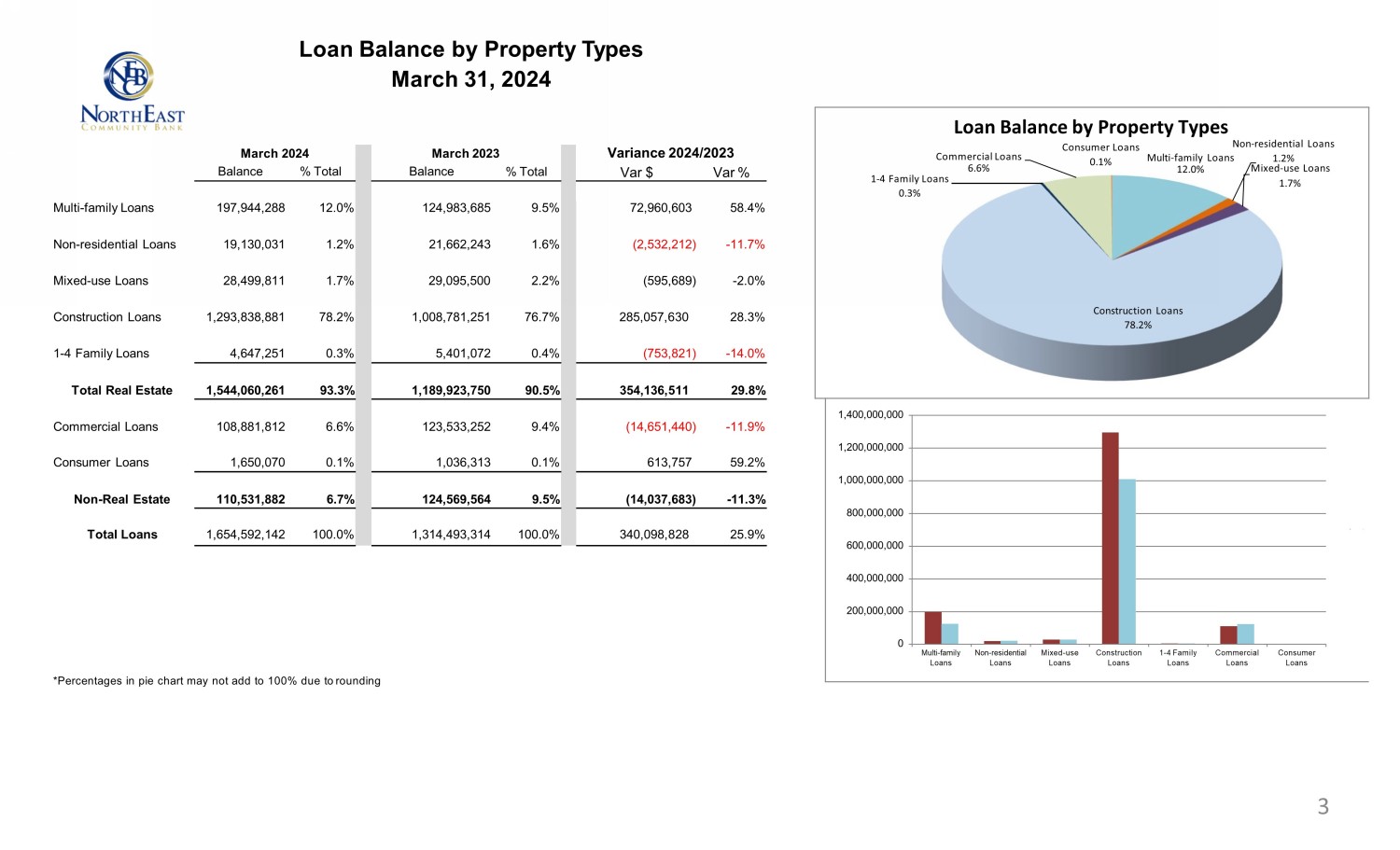

% Total March 2023 Balance March 2024 Balance % Total Loan Balance by Property Types March 31, 2024 *Percentages in pie chart may not add to 100% due to rounding Variance 2024/2023 Var $ Var % Multi - family Loans 197 , 944 , 288 12 . 0% 124 , 983 , 685 9 . 5% 72 , 960 , 603 58 . 4% Non - residential Loans 19 , 130 , 031 1 . 2% 21 , 662 , 243 1 . 6% (2 , 532 , 212) - 11 . 7% Mixed - use Loans 28 , 499 , 811 1 . 7% 29 , 095 , 500 2 . 2% (595 , 689) - 2 . 0% Construction Loans 1 , 293 , 838 , 881 78 . 2% 1 , 008 , 781 , 251 76 . 7% 285,057,630 28 . 3% 1 - 4 Family Loans 4 , 647 , 251 0 . 3% 5 , 401 , 072 0 . 4% (753 , 821) - 14 . 0% Total Real Estate 1 , 544 , 060 , 261 93 . 3% 1 , 189 , 923 , 750 90 . 5% 354,136,511 29 . 8% Commercial Loans 108 , 881 , 812 6 . 6% 123 , 533 , 252 9 . 4% (14 , 651 , 440) - 11 . 9% Consumer Loans 1 , 650 , 070 0 . 1% 1 , 036 , 313 0 . 1% 613 , 757 59 . 2% Non - Real Estate 110 , 531 , 882 6 . 7% 124 , 569 , 564 9 . 5% (14 , 037 , 683) - 11 . 3% Total Loans 1 , 654 , 592 , 142 100 . 0% 1 , 314 , 493 , 314 100 . 0% 340,098,828 25 . 9% Loan Balance by Property Types Consumer Loans Non - residential Loans Commercial Loans 0.1% Multi - family Loans 1.2% 6.6% 12.0% Mixed - use Loans 1 - 4 Family Loans 1.7% 0.3% Construction Loans 78.2% 1 , 400 , 000 , 000 1 , 200 , 000 , 000 1 , 000 , 000 , 000 800 , 000 , 000 600 , 000 , 000 400 , 000 , 000 200 , 000 , 000 0 Multi - family Non - residential Mixed - use Construction 1 - 4 Family Commercial Consumer Loans Loans Loans Loans Loans Loans Loans 3

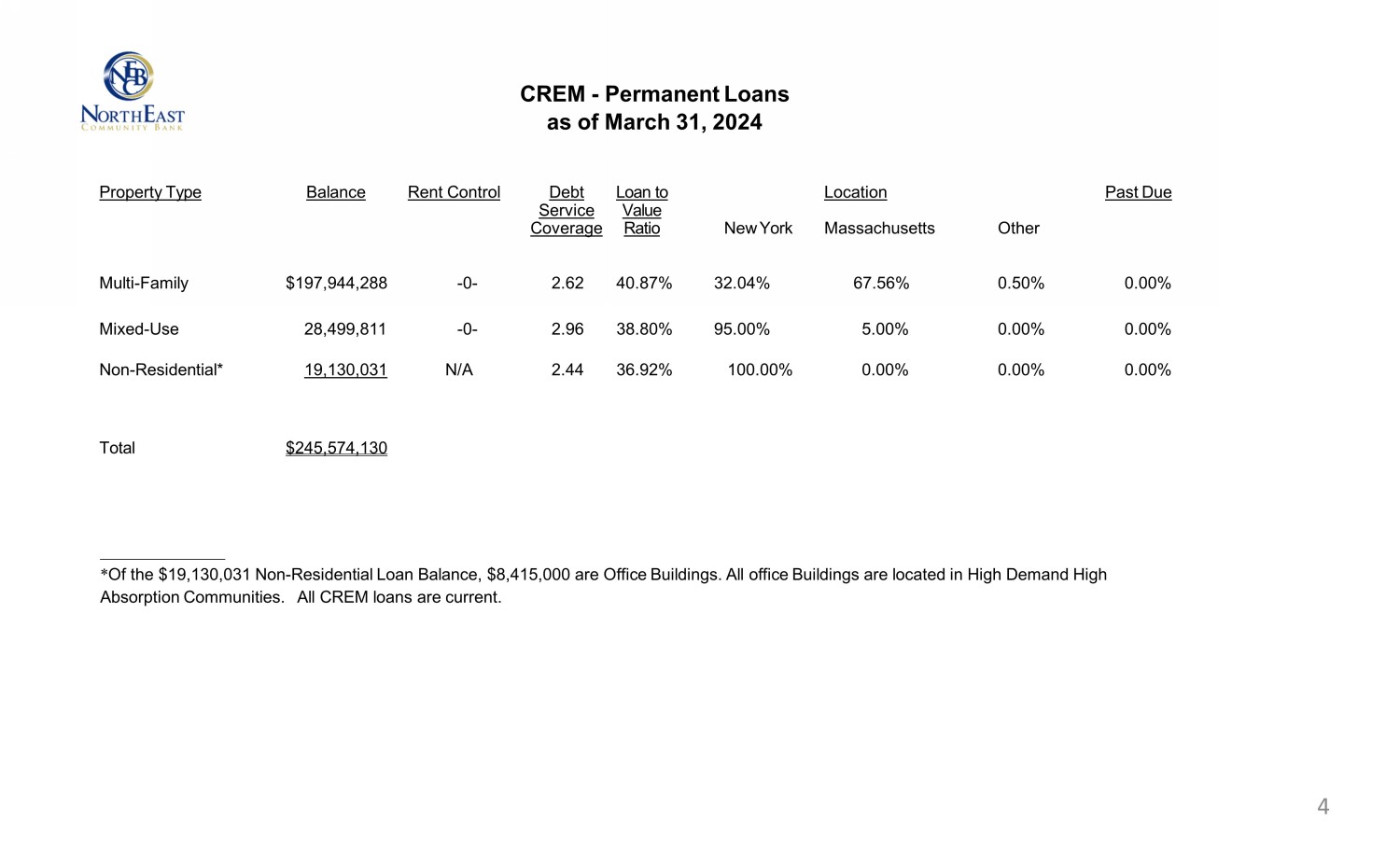

CREM - Permanent Loans as of March 31, 2024 Property Type Balance Rent Control D ebt Service Coverage L oan to Value Ratio New York Location Massachusetts Other Past Due Multi - Family $197,944,288 - 0 - 2.62 40.87% 32.04% 67.56% 0.50% 0.00% Mixed - Use 28,499,8 1 1 - 0 - 2.96 38.80% 95.00% 5.00% 0.00% 0.00% Non - Residential * 19,130,031 N/A 2.44 36.92% 100.00% 0.00% 0.00% 0.00% Total $245,574,130 _______________ * Of the $19,130,031 Non - Residential Loan Balance, $8,415,000 are Office Buildings. All office Buildings are located in High Demand High Absorption Communities. All CREM loans are current. 4

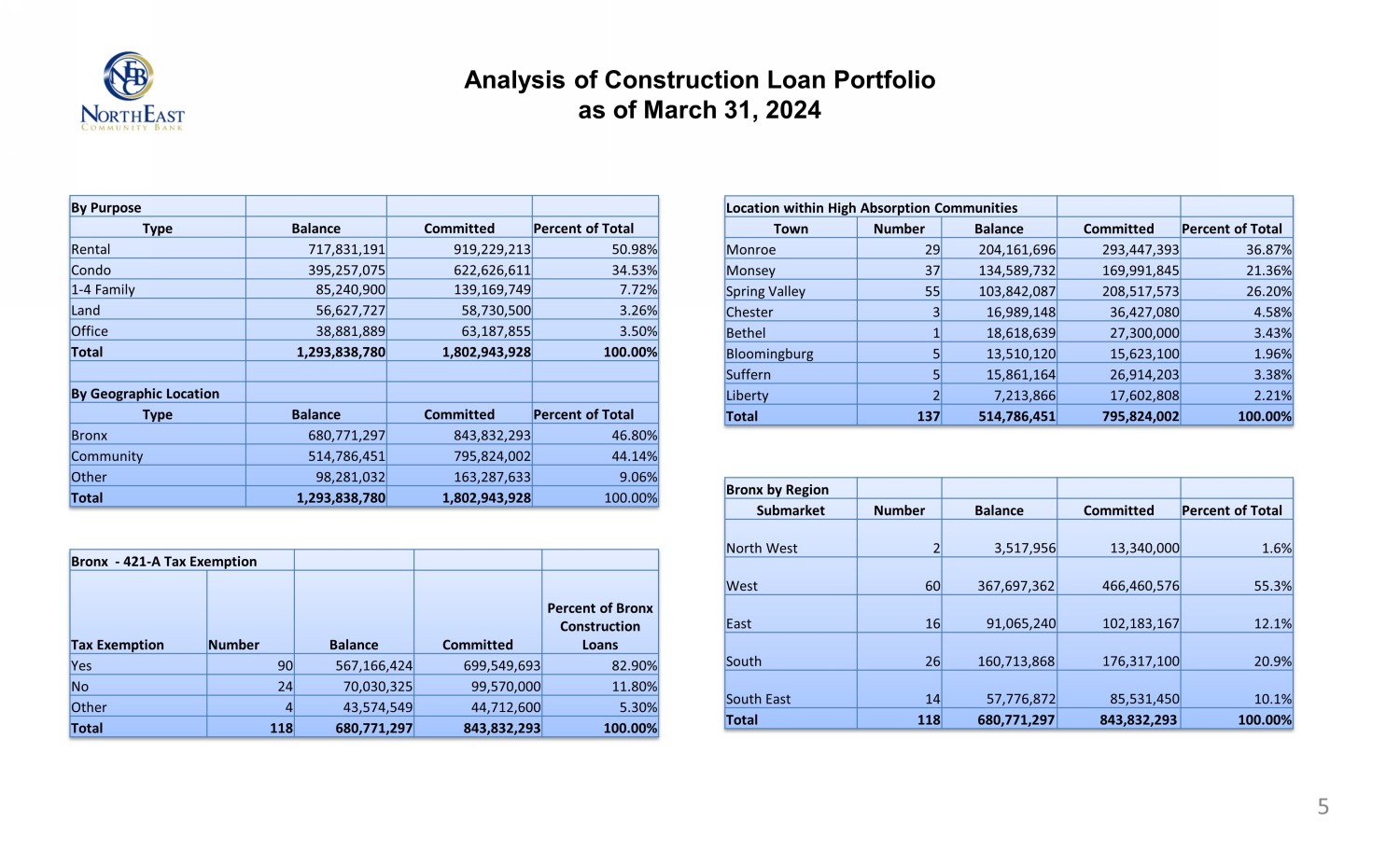

Analysis of Construction Loan Portfolio as of March 31, 2024 By Purpose Type Balance Committed Percent of Total Rental 717,831,191 919,229,213 50.98% Condo 395,257,075 622,626,611 34.53% 1 - 4 Family 85,240,900 139,169,749 7.72% Land 56,627,727 58,730,500 3.26% Office 38,881,889 63,187,855 3.50% Total 1,293,838,780 1,802,943,928 100.00% By Geographic Location Type Balance Committed Percent of Total Bronx 680,771,297 843,832,293 46.80% Community 514,786,451 795,824,002 44.14% Other 98,281,032 163,287,633 9.06% Total 1,293,838,780 1,802,943,928 100.00% Location within High Absorption Communities Town Number Balance Committed Percent of Total Monroe 29 204,161,696 293,447,393 36.87% Monsey 37 134,589,732 169,991,845 21.36% Spring Valley 55 103,842,087 208,517,573 26.20% Chester 3 16,989,148 36,427,080 4.58% Bethel 1 18,618,639 27,300,000 3.43% Bloomingburg 5 13,510,120 15,623,100 1.96% Suffern 5 15,861,164 26,914,203 3.38% Liberty 2 7,213,866 17,602,808 2.21% Total 137 514,786,451 795,824,002 100.00% Bronx by Region Submarket Number Balance Committed Percent of Total North West 2 3,517,956 13,340,000 1.6% West 60 367,697,362 466,460,576 55.3% East 16 91,065,240 102,183,167 12.1% South 26 160,713,868 176,317,100 20.9% South East 14 57,776,872 85,531,450 10.1% Total 118 680,771,297 843,832,293 100.00% Bronx - 421 - A Tax Exemption Tax Exemption Number Balance Committed Percent of Bronx Construction Loans Yes 90 567,166,424 699,549,693 82.90% No 24 70,030,325 99,570,000 11.80% Other 4 43,574,549 44,712,600 5.30% Total 118 680,771,297 843,832,293 100.00% 5

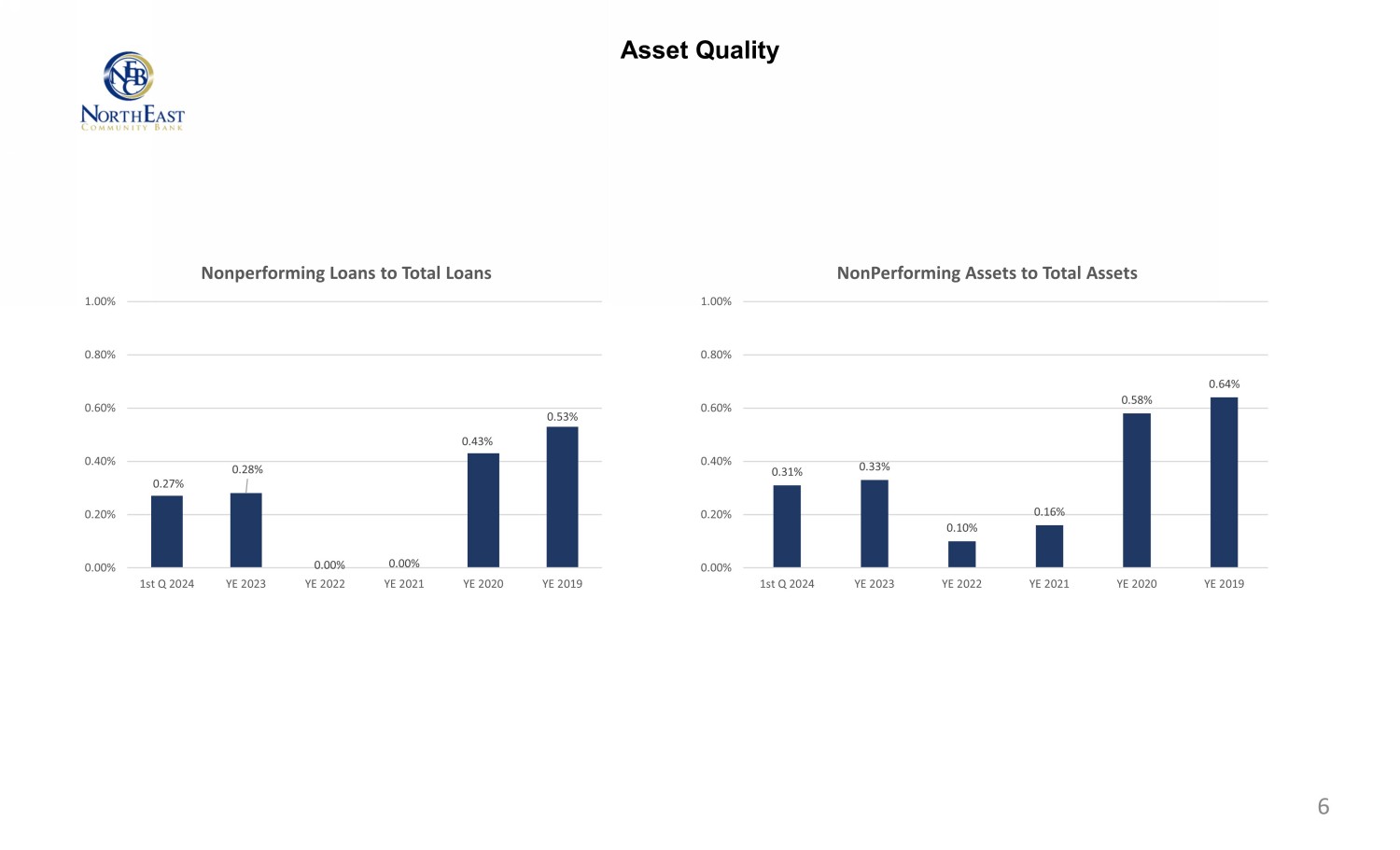

Asset Quality 0.27% 0.28% 0.00% 0.00% 0.43% 0.53% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1st Q 2024 YE 2023 YE 2022 YE 2021 YE 2020 YE 2019 Nonperforming Loans to Total Loans 0.31% 0.33% 0.10% 0.16% 0.58% 0.64% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1st Q 2024 YE 2023 YE 2022 YE 2021 YE 2020 YE 2019 NonPerforming Assets to Total Assets 6

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

NorthEast Community Banc... (NASDAQ:NECB)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

NorthEast Community Banc... (NASDAQ:NECB)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024