UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

Pineapple Energy Inc.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PINEAPPLE

ENERGY INC.

Supplement to Proxy Statement for the

2024 Annual Meeting of Shareholders

To be Held on July 1, 2024

The following information supplements the Definitive Proxy Statement on

Schedule 14A (the “Proxy Statement”) that was filed by Pineapple Energy Inc. (the “Company,” “we,”

“us” and “our”) with the Securities and Exchange Commission (the “SEC”) on May 29, 2024 and provided

to the Company’s shareholders in connection with the solicitation of proxies by the Company’s Board of Directors for the Company’s

2024 Annual Meeting of Shareholders (the “2024 Annual Meeting”) to be held on July 1, 2024. This supplement to the Proxy Statement

(this “Supplement”) is being filed with the SEC on June 12, 2024. All capitalized terms not otherwise defined herein shall

have the respective meanings as set forth in the Proxy Statement.

The information in this Supplement is in addition to the information provided

by the Proxy Statement, and except for the changes herein, this Supplement does not modify any other information set forth in the Proxy

Statement. The Proxy Statement contains important additional information and this Supplement should be read in conjunction with the Proxy

Statement.

The Company is providing this Supplement solely to provide supplemental

disclosure regarding the implementation of the Company’s 1-for-15 reverse stock split, which took effect on June 12, 2024.

Nasdaq Listing Compliance

On October 27, 2023, the Company received a notice from the Listing Qualifications

Department (the “Staff”) of Nasdaq informing the Company that because the closing bid price for the Company’s common

stock listed on Nasdaq was below $1.00 per share for the last 31 consecutive business days, the Company did not comply with the minimum

closing bid price requirement for continued listing on The Nasdaq Capital Market under Nasdaq Marketplace Rule 5550(a)(2) (the “Minimum

Bid Rule”). In accordance with Nasdaq’s Listing Rules, the Company had a period of 180 calendar days, or until April 24, 2024,

to regain compliance with the Minimum Bid Rule.

On February 27, 2024, the Staff issued another notice notifying the Company

that the Company’s common stock had a closing bid price of $0.10 or less for 10 consecutive trading days. Accordingly, the Company

is subject to the provisions contemplated under Nasdaq Listing Rule 5810(c)(3)(A)(iii) (the “Low Priced Stock Rule”). As a

result, the Staff had determined to delist the Company’s securities from Nasdaq effective as of the opening of business on March

7, 2024, unless the Company requested an appeal before the Nasdaq Hearings Panel, which the Company requested. Subsequently,

the Company was granted an expedited review process and extension as described below, and received notice that an oral hearing was not

necessary.

Following

the Company’s Special Meeting of Shareholders that was held on April 12, 2024, at which a reverse stock split proposal was not approved,

the Company provided Nasdaq with an update on the Company’s plan to regain compliance with the Minimum Bid Rule and an extension

request until July 24, 2024. On April 19, 2024, the Company was granted an extension to regain compliance with the Minimum Bid Rule until

July 24, 2024, conditioned upon:

| · | the Company obtaining shareholder approval for a reverse stock split that satisfies the Minimum Bid Rule

by July 1, 2024; and |

| · | the Company effecting the reverse stock split by July 11, 2024 and maintaining a $1.00 closing bid price

or more for a minimum of ten consecutive trading days by July 24, 2024. |

As a result, one of the proposals for the

2024 Annual Meeting is for shareholders to approve an amendment to the Company’s Amended and Restated Articles of Incorporation

to effect a reverse stock split of the issued and outstanding shares of the Company’s common stock at a ratio within a range of

1-for-2 to 1-for-200 (as may be determined by the Board) (the “2024 Annual Meeting Reverse Stock Split Proposal”).

June 2024 Reverse Stock Split

As previously disclosed, on January 3, 2024, the Company held its second

reconvened 2023 Annual Meeting of Shareholders, and the Company’s shareholders approved a reverse stock split of the outstanding

shares of the Company’s common stock, at a ratio within a range of 1-for-2 to 1-for-15, as determined by the Board (the “Prior

Reverse Stock Split Approval”). At the time the Company scheduled the 2024 Annual Meeting and established the proposals for such

meeting, including the 2024 Annual Meeting Reverse Stock Split Proposal, based on recent stock prices of the Company’s common stock,

the maximum ratio under the approved range of 1-for-15 pursuant to the Prior Reverse Stock Split Approval would not have been sufficient

to cause the stock price to increase or be maintained at a level that would satisfy the Minimum Bid Rule. As a result, the Board determined

to ask its shareholders to approve the 2024 Annual Meeting Reverse Stock Split Proposal at the 2024 Annual Meeting.

Following that determination, the stock prices of the Company’s common

stock were such that a reverse stock split at the maximum ratio under the approved range of 1-for-15 pursuant to the Prior Reverse Stock

Split Approval could be sufficient to cause the stock price to increase at a level that might satisfy the Minimum Bid Rule, depending

on stock prices on the date such reverse stock split is effective. As a result, the Board approved the implementation of a reverse stock

split pursuant to the Prior Reverse Stock Split Approval, at the maximum ratio under the approved range of 1-for-15, which took effect

on June 12, 2024 (the “June 2024 Reverse Stock Split”).

Upon the effectiveness of the June 2024 Reverse Stock Split, every 15 shares

of issued and outstanding Company common stock at the close of business on June 11, 2024 were automatically combined into one issued and

outstanding share of common stock, with no change in par value per share. Proportionate adjustments were made to the conversion and exercise

prices of the Company’s outstanding stock purchase warrants, stock options, and to the number of shares issued and issuable under

the Company’s equity incentive plans.

The June 2024 Reverse Stock Split proportionally reduced the number of

shares of the Company’s authorized common stock from 112,500,000 to 7,500,000. No fractional shares were issued as a result of the

June 2024 Reverse Stock Split. Any fractional shares that resulted from the June 2024 Reverse Stock Split will be settled in cash. The

June 2024 Reverse Stock Split affected all common shareholders uniformly and did not alter any shareholder’s percentage interest

in the Company’s common stock, except to the extent that the June 2024 Reverse Stock Split resulted in some shareholders experiencing

an adjustment of a fractional share as described above.

2024 Annual Meeting Reverse Stock Split Proposal

Notwithstanding the implementation of the June 2024 Reverse Stock Split,

the Board continues to recommend that shareholders vote in favor of the 2024 Annual Meeting Reverse Stock Split Proposal at the 2024 Annual

Meeting.

In particular, the June 2024 Reverse Stock Split may not be sufficient

to cause the Company’s stock price to be maintained at a level that would satisfy the Minimum Bid Rule. Even if the June 2024 Reverse

Stock Split were to satisfy the Minimum Bid Rule for a period of time, given the regular fluctuation of the Company’s stock price,

and the fact that a 1-for-15 split ratio leaves minimal cushion above the minimum $1.00 closing bid price requirement under the Minimum

Bid Rule, approval of the 2024 Annual Meeting Reverse Stock Split Proposal is important to the Company and in the best interests of its

shareholders, to provide the Company the ability to effectuate an additional stock split if necessary to regain compliance with the Nasdaq

listing standards.

If shareholders do not approve the 2024 Annual Meeting Reverse Stock Split

Proposal and if the Company’s stock price does not increase to, or be maintained at, greater than $1.00 per share for at least 10

consecutive trading days, either prior to the July 24, 2024 deadline or at a later time, we expect the common stock to be subject to a

delisting action by Nasdaq. We believe that the 2024 Annual Meeting Reverse Stock Split Proposal is the most likely way to assist the

stock price in reaching the level under the Minimum Bid Rule, although effecting any such Reverse Stock Split cannot guarantee that the

common stock would be in compliance with the Minimum Bid Rule for even the minimum 10-day trading period.

Voting by Proxy for the 2024 Annual Meeting

If you have already voted by Internet, telephone, or mail, you do not need

to take any action unless you wish to change your vote. Proxy voting instructions already returned by shareholders (via Internet, telephone,

or mail) will remain valid and will be voted at the 2024 Annual Meeting unless revoked. Important information regarding how to change

your vote and revoke proxies is available in the Proxy Statement under the caption “Questions

and Answers about the Meeting – May I change my vote?” of the Proxy Statement.

Forward Looking Statements

The Proxy Statement and this Supplement include certain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the Company’s

current expectations or beliefs and are subject to uncertainty and changes in circumstances, including the Company’s expectations

regarding the 2024 Annual Meeting Reverse Stock Split Proposal and any ability to regain compliance with Nasdaq’s continued listing

standards. While the Company believes its plans, intentions, and expectations reflected in those forward-looking statements are reasonable,

these plans, intentions, or expectations may not be achieved. For information about the factors that could cause such differences, please

refer to the Company’s filings with the Securities and Exchange Commission, including, without limitation, the statements made under

the heading “Risk Factors” in the Company's Annual Report on Form 10-K for the year ended December 31, 2023 and in subsequent

filings. The Company does not undertake any obligation to update or revise these forward-looking statements for any reason, except as

required by law.

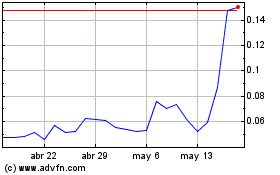

Pineapple Energy (NASDAQ:PEGY)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Pineapple Energy (NASDAQ:PEGY)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024