0000933972false--12-31Q12024false500000000.000100002000000000.00011326671071326704460000001.3315228500009339722024-01-012024-03-310000933972us-gaap:SubsequentEventMemberscwo:MrGannonMember2024-04-012024-04-190000933972us-gaap:LicensingAgreementsMember2024-01-012024-03-310000933972scwo:ConsultantMember2023-01-012023-03-310000933972scwo:ConsultantMember2024-01-012024-03-310000933972scwo:EquityDistributionAgreementMember2024-03-3100009339722020-10-300000933972scwo:EquityDistributionAgreementMember2024-01-012024-03-310000933972scwo:EquityDistributionAgreementMember2023-01-012023-03-310000933972srt:MaximumMemberus-gaap:OptionMember2024-01-012024-03-310000933972srt:MinimumMemberus-gaap:OptionMember2024-01-012024-03-310000933972scwo:OptionsMember2024-03-310000933972scwo:OptionsMember2023-12-310000933972scwo:ServiceRevenueMember2023-01-012023-03-310000933972scwo:ServiceRevenueMember2024-01-012024-03-310000933972scwo:EquipmentRevenuesMember2023-01-012023-03-310000933972scwo:EquipmentRevenuesMember2024-01-012024-03-310000933972us-gaap:PatentsMember2024-03-310000933972us-gaap:PatentsMember2024-01-012024-03-310000933972us-gaap:PatentsMember2023-12-310000933972scwo:LicenseAgreementMember2024-03-310000933972scwo:LicenseAgreementMember2024-01-012024-03-310000933972scwo:LicenseAgreementMember2023-12-310000933972scwo:WarrantsMember2023-01-012023-03-310000933972scwo:WarrantsMember2024-01-012024-03-310000933972scwo:OptionsMember2024-01-012024-03-310000933972scwo:OptionsMember2023-01-012023-03-310000933972scwo:OneCustomerMemberscwo:RevenueMember2023-01-012023-12-310000933972scwo:OneCustomerMemberscwo:RevenueMember2024-01-012024-03-3100009339722023-01-012023-12-310000933972us-gaap:ComputerEquipmentMember2023-12-310000933972us-gaap:ComputerEquipmentMember2024-03-310000933972us-gaap:OfficeEquipmentMember2023-12-310000933972us-gaap:OfficeEquipmentMember2024-03-310000933972us-gaap:VehiclesMember2023-12-310000933972us-gaap:VehiclesMember2024-03-310000933972us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000933972us-gaap:RetainedEarningsMember2024-03-310000933972us-gaap:AdditionalPaidInCapitalMember2024-03-310000933972us-gaap:CommonStockMember2024-03-310000933972us-gaap:PreferredStockMember2024-03-310000933972us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000933972us-gaap:RetainedEarningsMember2024-01-012024-03-310000933972us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000933972us-gaap:CommonStockMember2024-01-012024-03-310000933972us-gaap:PreferredStockMember2024-01-012024-03-310000933972us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000933972us-gaap:RetainedEarningsMember2023-12-310000933972us-gaap:AdditionalPaidInCapitalMember2023-12-310000933972us-gaap:CommonStockMember2023-12-310000933972us-gaap:PreferredStockMember2023-12-3100009339722023-03-310000933972us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000933972us-gaap:RetainedEarningsMember2023-03-310000933972us-gaap:AdditionalPaidInCapitalMember2023-03-310000933972us-gaap:CommonStockMember2023-03-310000933972us-gaap:PreferredStockMember2023-03-310000933972us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000933972us-gaap:RetainedEarningsMember2023-01-012023-03-310000933972us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000933972us-gaap:CommonStockMember2023-01-012023-03-310000933972us-gaap:PreferredStockMember2023-01-012023-03-3100009339722022-12-310000933972us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000933972us-gaap:RetainedEarningsMember2022-12-310000933972us-gaap:AdditionalPaidInCapitalMember2022-12-310000933972us-gaap:CommonStockMember2022-12-310000933972us-gaap:PreferredStockMember2022-12-3100009339722023-01-012023-03-3100009339722023-12-3100009339722024-03-3100009339722024-05-15iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Form 10-Q

☒ | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Quarterly Period ended March 31, 2024

☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission file number: 000-27866

374WATER INC. |

(Exact name of Registrant as specified in its charter) |

Delaware | | 88-0271109 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

701 W Main Street, Suite 410

Durham, NC 27701

(Address of principal executive offices)

(919) 888-8194

(Registrant’s telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.0001 | | SCWO | | The Nasdaq Capital Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

☐ | Large accelerated filer | ☐ | Accelerated filer |

☒ | Non-accelerated Filer | ☒ | Smaller reporting company |

| | ☒ | Emerging Growth Company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: As of May 15, 2024, the issuer had 132,670,446 shares of common stock outstanding.

Index to Form 10-Q

Cautionary Note Regarding Forward-Looking Information

This Quarterly Report on Form 10-Q (the “Form 10-Q”) contains certain statements related to future results of 374 Water, Inc. (the “Company”) that are considered “forward-looking statements'' within the meaning of the Private Litigation Reform Act of 1995. Actual results may differ materially from those expressed or implied as a result of certain risks and uncertainties, including, but not limited to, changes in political and economic conditions; interest rate fluctuation; competitive pricing pressures within the Company’s market; equity and fixed income market fluctuation; technological changes; changes in law; changes in fiscal, monetary, regulatory, and tax policies; monetary fluctuations as well as other risks and uncertainties detailed elsewhere in this Form 10-Q or from time-to-time in the filings of the Company with the Securities and Exchange Commission. Such forward-looking statements speak only as of the date on which such statements are made, and the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

PART I FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

374Water Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

March 31, 2024 (Unaudited) and December 31, 2023

| | March 31, 2024 | | | December 31, 2023 | |

Assets | | | | | | |

Current Assets: | | | | | | |

Cash | | $ | 7,936,161 | | | $ | 10,445,404 | |

Accounts receivable, net of allowance | | | 84,324 | | | | 64,792 | |

Unbilled accounts receivable | | | 1,771,609 | | | | 1,494,553 | |

Other accounts receivable | | | 34,161 | | | | 39,749 | |

Inventory, net | | | 2,601,658 | | | | 2,276,677 | |

Prepaid expenses | | | 921,365 | | | | 581,085 | |

Total Current Assets | | | 13,349,278 | | | | 14,902,260 | |

Long-Term Assets: | | | | | | | | |

Property, and Equipment, net | | | 223,339 | | | | 230,971 | |

Intangible asset, net | | | 971,691 | | | | 988,029 | |

Total Long-Term Assets | | | 1,195,030 | | | | 1,219,000 | |

Total Assets | | $ | 14,544,308 | | | $ | 16,121,260 | |

| | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | |

Current Liabilities: | | | | | | | | |

Accounts payable and accrued expenses | | $ | 755,721 | | | $ | 572,297 | |

Accrued contract loss provision | | | 600,000 | | | | 500,000 | |

Accrued legal settlement | | | 135,000 | | | | 135,000 | |

Unearned revenue | | | 132,768 | | | | 130,000 | |

Other liabilities | | | 10,408 | | | | 36,787 | |

Total Current Liabilities | | | 1,633,897 | | | | 1,374,084 | |

Total Liabilities | | | 1,633,897 | | | | 1,374,084 | |

Commitments and contingencies (Note 9) | | | | | | | | |

Stockholders’ Equity | | | | | | | | |

Preferred stock: 50,000,000 convertible Series D preferred shares authorized; par value $0.0001 per share, nil issued and outstanding at March 31, 2024 and December 31, 2023 | | | — | | | | — | |

Common stock: 200,000,000 common shares authorized, par value $0.0001 per share, 132,670,446 and 132,667,107 shares outstanding at March 31, 2024 and December 31, 2023, respectively | | | 13,266 | | | | 13,266 | |

Additional paid-in capital | | | 30,872,643 | | | | 30,684,943 | |

Accumulated deficit | | | (17,977,969 | ) | | | (15,953,504 | ) |

Accumulated other comprehensive loss | | | 2,471 | | | | 2,471 | |

Total Stockholders’ Equity | | | 12,910,411 | | | | 14,747,176 | |

Total Liabilities and Stockholders’ Equity | | $ | 14,544,308 | | | $ | 16,121,260 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

374Water, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

For the three months ended March 31, 2024 and 2023

(Unaudited)

| | Three months ended March 31, | |

| | 2024 | | | 2023 | |

| | | | | | |

Revenue | | $ | 315,278 | | | $ | 801,458 | |

Cost of goods sold | | | 617,298 | | | | 720,146 | |

Gross margin | | | (302,020 | ) | | | 81,312 | |

Operating Expenses | | | | | | | | |

Research and development | | | 535,147 | | | | 355,905 | |

Compensation and related expenses | | | 651,604 | | | | 718,760 | |

Professional fees | | | 252,705 | | | | 99,572 | |

General and administrative | | | 459,727 | | | | 585,659 | |

Total Operating Expenses | | | 1,899,183 | | | | 1,759,896 | |

| | | | | | | | |

Loss from Operations | | | (2,201,203 | ) | | | (1,678,584 | ) |

| | | | | | | | |

Other Income | | | | | | | | |

Interest income | | | 104,620 | | | | 37,859 | |

Other income | | | 72,118 | | | | 382 | |

Total Other Income | | | 176,738 | | | | 38,241 | |

Net Loss before Income Taxes | | | (2,024,465 | ) | | | (1,640,343 | ) |

Provision for Income Taxes | | | — | | | | — | |

| | | | | | | | |

Net Loss | | $ | (2,024,465 | ) | | $ | (1,640,343 | ) |

| | | | | | | | |

Other comprehensive income | | | | | | | | |

Foreign currency translation gain | | | - | | | | 824 | |

Unrealized gain on marketable securities | | | - | | | | 18,967 | |

Total other comprehensive loss | | | - | | | | 19,791 | |

Total comprehensive loss | | | (2,024,465 | ) | | | (1,620,552 | ) |

Net Loss per Share - Basic and Diluted | | $ | (0.02 | ) | | $ | (0.01 | ) |

| | | | | | | | |

Weighted Average Common Shares Outstanding - Basic and Diluted | | | 132,668,777 | | | | 127,146,695 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

374Water Inc. and Subsidiaries

Condensed Consolidated Changes in Stockholders’ Equity

For the three months ended March 31, 2024 and 2023

(Unaudited)

For the three months ended March 31, 2024

| | Preferred Stock | | | Common Stock | | | Additional | | | | | | Other | | | Total | |

| | Number of | | | | | | Number of | | | | | | Paid in | | | Accumulated | | | Comprehensive | | | Stockholders’ | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Income | | | Equity | |

Balances, December 31, 2023 | | | — | | | $ | — | | | | 132,667,107 | | | $ | 13,266 | | | $ | 30,684,943 | | | $ | (15,953,504 | ) | | $ | 2,471 | | | $ | 14,747,176 | |

Issuance of shares for services | | | — | | | | — | | | | 3,339 | | | | — | | | | 4,500 | | | | — | | | | — | | | | 4,500 | |

Stock-based compensation | | | — | | | | — | | | | — | | | | — | | | | 183,200 | | | | — | | | | — | | | | 183,200 | |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (2,024,465 | ) | | | — | | | | (2,024,465 | )) |

Balances, March 31, 2024 | | | — | | | | — | | | | 132,670,446 | | | $ | 13,266 | | | $ | 30,872,643 | | | $ | (17,977,969 | ) | | $ | 2,471 | | | $ | 12,910,411 | |

For the three months ended March 31, 2023

| | Preferred Stock | | | Common Stock | | | Additional | | | | | | Other | | | Total | |

| | Number of | | | | | | Number of | | | | | | Paid in | | | Accumulated | | | Comprehensive | | | Stockholders’ | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Income | | | Equity | |

Balances, December 31, 2022 | | | — | | | $ | — | | | | 126,702,545 | | | $ | 12,669 | | | $ | 16,110,221 | | | $ | (7,849,982 | ) | | $ | (19,296 | ) | | $ | 8,253,612 | |

Issuance of shares of common stock for cash | | | — | | | | — | | | | 2,137,876 | | | | 214 | | | | 8,294,494 | | | | — | | | | — | | | | 8,294,708 | |

Stock-based compensation | | | — | | | | — | | | | — | | | | — | | | | 214,924 | | | | — | | | | — | | | | 214,924 | |

Foreign currency gain | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 824 | | | | 824 | |

Unrealized gain on investments | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 18,967 | | | | 18,967 | |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1,640,343 | ) | | | — | | | | (1,640,343 | ) |

Balances, March 31, 2023 | | | — | | | | — | | | | 128,840,421 | | | $ | 12,883 | | | $ | 24,619,639 | | | $ | (9,490,325 | ) | | | 495 | | | $ | 15,142,692 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

374Water Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

For the three months ended March 31, 2024 and 2023 (Unaudited)

| | 2024 | | | 2023 | |

Cash Flows from Operating Activities | | | | | | |

Net loss | | $ | (2,024,465 | ) | | $ | (1,640,343 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Depreciation and amortization expense | | | 24,560 | | | | 29,105 | |

Issuance of common stock for services | | | 4,500 | | | | - | |

Stock-based compensation | | | 183,200 | | | | 214,924 | |

Gain on foreign currency translation | | | - | | | | 824 | |

Increase in inventory reserve | | | 50,000 | | | | - | |

Changes in operating assets and liabilities: | | | | | | | | |

Accounts receivable | | | (19,532 | ) | | | (26,188 | ) |

Unbilled accounts receivable | | | (277,056 | ) | | | (754,290 | ) |

Other receivables | | | 5,588 | | | | (308,374 | ) |

Inventory | | | (374,981 | ) | | | (127,309 | ) |

Prepaid expenses | | | (340,280 | ) | | | 23,285 | |

Accounts payable and accrued expenses | | | 183,424 | | | | (581,582 | ) |

Accrued contract loss provision | | | 100,000 | | | | - | |

Unearned revenue | | | 2,768 | | | | 5,000 | |

Other liabilities | | | (26,379 | ) | | | (13,528 | ) |

Net Cash Used In Operating Activities | | | (2,508,653 | ) | | | (3,178,176 | ) |

| | | | | | | | |

Cash Flows from Investing Activities | | | | | | | | |

Purchase of equipment | | | - | | | | (7,303 | ) |

Increase in intangible assets | | | (590 | ) | | | (2,705 | ) |

| | | | | | | | |

Cash Used In Investing Activities | | | (590 | ) | | | (10,008 | ) |

| | | | | | | | |

Cash Flow from Financing Activities | | | | | | | | |

Proceeds from the sale of common stock | | | - | | | | 8,294,708 | |

Cash Provided by Financing Activities | | | - | | | | 8,294,708 | |

| | | | | | | | |

Net (Decrease) Increase in Cash | | | (2,509,243 | ) | | | 5,106,224 | |

Cash, Beginning of the Period | | | 10,445,404 | | | | 4,046,937 | |

Cash, End of the Period | | $ | 7,936,161 | | | $ | 9,153,161 | |

| | | | | | | | |

SUPPLEMENTAL CASH FLOW DISCLOSURES: | | | | | | | | |

Cash paid for interest | | $ | — | | | $ | — | |

Cash paid for taxes | | $ | — | | | $ | — | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

374Water Inc. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

Note 1 – Nature of Business and Presentation of Financial Statements

Description of the Company

374Water Inc. (the “Company”, “374Water”, “We”, or “Our”) is a Delaware corporation which was formed in September 2005 as PowerVerde, Inc. At that time, the Company was focused on developing, commercializing and marketing a series of unique electric generating power systems designed to produce electrical power with zero emissions or waste byproducts, based on a pressure-driven expander motor and related organic rankine cycle technology.

On April 16, 2021, the Company entered into an Agreement and Plan of Merger (the “Merger”) with 374Water Inc., a privately held company based in Durham, North Carolina, (“374Water Private Company”) and 374Water Acquisition Corp., a newly-formed wholly-owned subsidiary of PowerVerde.

Following the Merger, 374Water offers a technology that transforms wet wastes such as sewage sludge, biosolids, food waste, hazardous and non-hazardous waste, and forever chemicals (e.g., “per-and polyfluoroalkyl substances” or “PFAS”) into recoverable resources by focusing on waste as a valuable resource for water, energy, and minerals. We are developing AirSCWO, a proprietary treatment system based on “supercritical water oxidation.”

Presentation of Financial Statements

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules and regulations of the United States Securities and Exchange Commission (the “SEC”) for interim financial information. It is management’s opinion that the accompanying unaudited condensed consolidated financial statements are prepared in accordance with instructions for Form 10-Q and include all adjustments (consisting only of normal recurring accruals) which are necessary for a fair presentation of the results for the periods presented. Certain information and footnote disclosures normally included in the consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") have been condensed or omitted. It is suggested that these condensed consolidated financial statements be read in conjunction with the Annual Report on Form 10-K of 374Water Inc. as of and for the year ended December 31, 2023 filed with the SEC on March 29, 2024.

The results of operations for the three months ended March 31, 2024, are not necessarily indicative of the results to be expected for the full year or for future periods. The condensed consolidated financial statements include the accounts of 374Water Inc., 374Water Systems Inc, and 374Water Sustainability Israel LTD, each a wholly-owned subsidiary of 374 Water. Intercompany balances and transactions have been eliminated in consolidation.

Note 2 – Summary of Significant Accounting Policies

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. The Company held $7,936,161 and $10,445,404 in cash and cash equivalents as of March 31, 2024 and December 31, 2023, respectively.

Accounts Receivable and Unbilled Accounts Receivable

Accounts receivables consist of balances due from service revenues. Unbilled accounts receivables are from revenues earned but not yet billed. The Company monitors accounts receivable and provides allowances for expected credit losses when considered necessary. As of March 31, 2024 and December 31, 2023, accounts receivable were considered to be fully collectible but in accordance with the allowance for credit losses, the Company recorded an allowance for credit losses based on a reserve of current and aged receivables which was not significant as of March 31, 2024 and December 31, 2023.

Other Accounts Receivable

Other accounts receivable consist of accrued interest income from the cash held in an interest bearing money market account with a financial institution. We typically receive payment for accrued interest one month in arrears.

Inventories

Inventories are stated at the lower of cost or net realizable value. Cost is determined on a first-in, first-out basis. The majority of our inventory is raw materials and work in progress. Net realizable value is the value of an asset that can be realized upon the sale of the asset, less a reasonable estimate of the costs associated with either the eventual sale or the disposal of the asset in question. We utilize third-party suppliers to produce our products. Costs associated with fabrication, and other costs associated with the manufacturing of products, are recorded as inventory. We periodically evaluate the carrying value of our inventories in relation to estimated forecasts of product demand, which takes into consideration the life cycle of product releases. Further, as we continue to hence and develop are AirSCWO systems we may replace materials and parts with upgrades to enhance the units. If it is not probable that the replacement part will be used , we establish a reserve against the material or part or dispose of it. When quantities on hand exceed estimated sales forecasts, we perform an analysis to determine if a write-down for such excess inventories is required. Once inventory has been written down, it creates a new cost basis for inventory. Inventories are classified as current assets in accordance with recognized industry practice. Based on our evaluation we estimated an inventory allowance of $50,000 and $0 as of March 31, 2024 and December 31, 2023, respectively.

Property and Equipment

Property and Equipment is recorded at cost. Depreciation is computed using the straight-line method and an estimated useful life of three years. Expenses for maintenance and repairs are charged to expense as incurred.

The following table presents property and equipment as of March 31, 2024 and December 31, 2023:

| | March 31, 2024 | | | December 31, 2023 | |

Computers | | $ | 16,489 | | | $ | 16,489 | |

Equipment | | | 190,748 | | | | 190,748 | |

Vehicles | | | 44,510 | | | | 44,510 | |

Total property and equipment | | | 251,747 | | | | 251,747 | |

Less: accumulated depreciation | | | (28,408 | ) | | | (20,776 | ) |

Total property and equipment, net | | $ | 223,339 | | | $ | 230,971 | |

Depreciation expense related to property and equipment was as follows:

| | Period Ended March 31, | |

| | 2024 | | | 2023 | |

Depreciation | | $ | 7,632 | | | $ | 9,525 | |

Intangible Assets

Intangible assets are subject to amortization, and any impairment is determined in accordance with ASC 360, “Property, Plant, and Equipment.” Intangible assets are stated at historical cost and amortized over their estimated useful lives. The Company uses a straight-line method of amortization unless a method that better reflects the pattern in which the economic benefits of the intangible asset are consumed or otherwise used up can be reliably determined. As of March 31, 2024 and December 31, 2023, there was no impairment.

Long-Lived Assets

The Company reviews long-lived assets, including intangible assets with finite lives, for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company uses an estimate of the undiscounted cash flows over the remaining life of its long-lived assets, or related group of assets where applicable, in measuring whether the assets to be held and used will be realizable. Recoverability of assets held and used is measured by a comparison of the carrying amount to the future undiscounted expected net cash flows to be generated by the asset. As of March 31, 2024 and December 31, 2023, there were no impairments.

Concentrations of Credit Risk

Financial instruments that potentially subject the Company to credit risk consist of cash and cash equivalents, and marketable securities. Deposits with financial institutions are insured, up to certain limits, by the Federal Deposit Insurance Corporation (“FDIC”). The Company’s cash deposits often exceed the FDIC insurance limit; however, all deposits are maintained with high credit quality institutions and the Company has not experienced any losses in such accounts. The financial condition of financial institutions is periodically reassessed, and the Company believes the risk of any loss is minimal. Furthermore, we perform ongoing credit evaluations of our customers and generally do not require collateral.

Significant customers and suppliers are those that account for greater than 10% of the Company’s revenues and purchases. One customer made up approximately 94% and 99% of revenue for the three month periods ended March 31, 2024 and 2023, respectively.

During the three months ended March 31, 2024 and 2023, the Company purchased a substantial portion of manufacturing services from one third party vendor, Merrell Bros Fabrication, LLC (“Merrell Bros.”) (see Note 8).

Refer to Note 9 for a license agreement we have with Duke University for the SCWO technology used in our systems.

Revenue Recognition

The Company follows the revenue standards of Codification (ASC) Topic 606: “Revenue from Contracts with Customers (Topic 606).” The core principle of this Topic is that an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. Revenue is recognized in accordance with that core principle by applying the following five steps: 1) identify the contracts with a customer; 2) identify the performance obligations in the contract; 3) determine the transaction price; 4) allocate the transaction price to the performance obligations; and 5) recognize revenue when (or as) we satisfy a performance obligation using the input method.

The Company generates revenue from the sale of equipment (AirSCWO units) and services, specifically the completion of treatability studies. In the case of equipment revenues, the Company’s performance obligations are satisfied over time over the life of the contract which are typically long-term fixed price contracts. Revenue is recognized over time by measuring the progress toward complete satisfaction of the performance obligation using specific milestones. These milestones within the contract are assigned revenue recognition percentages, based on overall expected cost-plus margin estimates of those milestones compared to the total cost of the contract. Equipment sale related contract revenues are recognized in the proportion that contract costs incurred bear to total estimated costs. This method is used because management considers the input method to be the best available measure of progress on these contracts.

Changes in our overall expected cost estimates are recognized as a cumulative adjustment for the inception-to-date effective of such change. If these changes in estimates result in a possible loss being incurred on the contract, we accrue for such a loss in the period such an outcome becomes probable.

Services revenues are recognized when all five revenue recognition criteria have been completed which is generally when we deliver a completed treatability study report to the customer.

Contract costs include all direct material, labor and subcontractor costs and those indirect costs related to contract performance, such as indirect labor, supplies, tools, repairs, and depreciation. General, selling, and administrative costs are charged to expenses as incurred.

Revenues for the three-month period ended March 31, 2024 in the amount of $296,096 was generated from the progress towards completion of the AirSCWO system and $19,182 was generated from the sale of treatability services.

Revenues for the three-month period ended March 31, 2023 in the amount of $793,458 was generated from the sale of the AirSCWO system and $8,000 was generated from the sale of treatability services.

Accrued Contract Loss Provision and Onerous Contracts

Onerous contracts are those where the costs to fulfill a contract exceed the consideration expected to be received under the contract. The revenue standard does not provide guidance on the accounting for onerous contracts or onerous performance obligations. US GAAP contains other applicable guidance on the accounting for onerous contracts, and those requirements should be used to identify and measure onerous contracts.

Our outstanding equipment manufacturing contract is a fixed price contract. Due to the nature of the contract, including customer specific equipment design, we applied ASC 605-35, Revenue Recognition—Provision for Losses on Construction-Type and Production-Type Contract (ASC 605-35). ASC 605-35 requires the recognition of a liability for anticipated losses on contracts prior to those losses being incurred when a loss is probable and can be estimated.

As of March 31, 2024 and December 31, 2023, we evaluated the total costs incurred on this contract to date and the estimated costs we anticipate incurring to complete the contract. Based on this analysis, we accrued a total accrued loss provision of $600,000 and $500,000 as of March 31, 2024 and December 31, 2023, respectively, which has been presented on the accompanying unaudited condensed consolidated balance sheets and is recorded within cost of revenues on the accompanying unaudited condensed consolidated statements of operations.

Stock-based Compensation and Change in Accounting Policy

The Company has accounted for stock-based compensation under the provisions of ASC Topic 718 – “Stock Compensation” which requires the use of the fair-value based method to determine compensation for all arrangements under which employees and others receive shares of stock or equity instruments (stock options and common stock purchase warrants). The fair value of each stock option award is estimated on the date of grant using the Black-Scholes valuation model that uses assumptions for expected volatility, expected dividends, expected term, and the risk-free interest rate. Expected volatilities are based on historical volatility of peer companies and other factors estimated over the expected term of the stock options. The expected term of options granted is derived using the “simplified method” which computes expected term as the average of the sum of the vesting term plus the contract term. The risk-free rate is based on the U.S. Treasury yield curve in effect at the time of grant for the period of the expected term.

Prior to January 1, 2024, the Company had elected to estimate options granted for which the requisite service period would not be rendered, due to the option being forfeited or expiring. The forfeiture rate estimate was based on the percentage of cumulative forfeitures to the total award grants. During the quarter ended December 31, 2023, we compared our actual forfeiture rate to our estimated forfeiture rate and made a cumulative adjustment of approximately $55,000 in the quarter ended December 31, 2023 to reduce our forfeiture rate estimate to approximately 5% of the total stock-based compensation recognized during the year.

Effective January 1, 2024, the Company made a change in their accounting policy to recognize forfeitures on service-based stock award instruments as they occur. Due to the lack of history available to adequately estimate our forfeiture rate and the fact that the majority of our serviced based options include a one-year cliff vesting and monthly vesting after, we believe recognizing forfeitures as they occur will result in more accurate financial reporting. The change in this accounting policy did not have a significant impact on the current or prior period financial statements. During the three months ended March 31, 2024, no forfeitures occurred.

Income Tax Policy

The Company accounts for income taxes using the liability method prescribed by ASC 740 - Income Taxes. Under this method, deferred tax assets and liabilities are determined based on the difference between the financial reporting and tax bases of assets and liabilities using enacted tax rates that will be in effect in the year in which the differences are expected to reverse. The Company records a valuation allowance to offset deferred tax assets if, based on the weight of available evidence, it is more-likely-than-not that some portion, or all, of the deferred tax assets will not be realized. The effect on deferred taxes of a change in tax rates is recognized as income or loss in the period that includes the enactment date.

Accounting for Uncertainty in Income Taxes

The Company follows the provisions of ASC Topic 740-10, “Accounting for Uncertainty in Income Taxes” which clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements and prescribes a recognition threshold and measurement process for financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. This topic also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition. There were no uncertain tax positions as of March 31, 2024 and December 31, 2023.

Research and Development Costs

The Company’s research and development costs are expensed in the period in which they are incurred. Such expenditures amounted to $535,147 and $355,905 for the three months ended March 31, 2024 and 2023, respectively.

Loss Per Share

Loss per share is computed in accordance with ASC Topic 260, “Earnings per Share” Basic weighted-average number of shares of common stock outstanding for the three- months ended March 31, 2024 and 2023 include the shares of the Company issued and outstanding during such periods, each on a weighted average basis. The basic weighted average number of shares of common stock outstanding excludes common stock equivalent incremental shares, while diluted weighted average number of shares outstanding includes such incremental shares. However, as the Company was in a loss position for all periods presented, basic and diluted weighted average shares outstanding are the same, as the inclusion of the incremental shares would be anti-dilutive. As of March 31, 2024 and March 31, 2023, there were the following potentially dilutive securities that were excluded from diluted net loss per share because their effect would be antidilutive: options for 10,740,250 and 13,025,000 shares of common stock and 1,235,000 and 1,250,000 warrants, respectively.

Financial Instruments

The Company carries cash, accounts, unbilled and other receivables, accounts payable and accrued expenses, at historical costs. The respective estimated fair values of these assets and liabilities approximate carrying values / useful lives of equipment and intangible assets due to their current nature.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“US GAAP”) requires management to make estimates and assumptions that affect reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates in the accompanying financial statements include the fair value of equity-based compensation, service revenue, accrued contract loss provisions, and valuation allowance against deferred tax assets.

Recent Accounting Pronouncements - Not Yet Adopted

In December 2023 FASB issued Accounting Standards Update (ASU) 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (ASU 2023-09). The ASU focuses on income tax disclosures around effective tax rates and cash income taxes paid. ASU 2023-09 requires public business entities to disclose, on an annual basis, a rate reconciliation presented in both dollars and percentages. The guidance requires the rate reconciliation to include specific categories and provides further guidance on disaggregation of those categories based on a quantitative threshold equal to 5% or more of the amount determined by multiplying pretax income (loss) from continuing operations by the applicable statutory rate. For entities reconciling to the US statutory rate of 21%, this would generally require disclosing any reconciling items that impact the rate by 1.05% or more. ASU 2023-09 is effective for public business entities for annual periods beginning after December 15, 2024 (generally, calendar year 2025) and effective for all other business entities one year later. Entities should adopt this guidance on a prospective basis, though retrospective application is permitted. The adoption of ASU 2023-09 is expected to have a financial statement disclosure impact only and is not expected to have a material impact on the Company’s financial statements.

In November 2023 the FASB issued ASU 2023-07, Segment Reporting – Improvements to Reportable Segment Disclosures. The ASU will now require public entities to disclose its significant segment expenses categories and amounts for each reportable segment. Under the ASU, a significant segment expense is an expense that is:

| · | significant to the segment, |

| · | regularly provided to or easily computed from information regularly provided to the chief operating decision maker (CODM), and |

| · | included in the reported measure of segment profit or loss. |

The ASU is effective for public entities for fiscal years beginning after December 15, 2023 and interim periods in fiscal years beginning after December 15, 2024 (calendar year public entity will adopt the ASU in its 2024 Form 10 K). The ASU should be adopted retrospectively unless it’s impracticable to do so. Early adoption of the ASU is permitted, including in an interim period. The adoption of ASU 2023-07 is expected to have a financial statement disclosure impact only and is not expected to have a material impact on the Company’s financial statements.

The Company considers the applicability and impact of all recently issued accounting pronouncements. Recent accounting pronouncements not specifically identified in our disclosures are either not applicable to the Company or are not expected to have a material effect on our financial condition or results of operations.

Note 3 – Liquidity, Capital Resources and Going Concern

As of March 31, 2024, the Company had working capital of $11,715,381 and an accumulated deficit of $17,977,969. For the three months ended March 31, 2024, the Company incurred a net loss of $2,024,465 and used $2,508,653 of net cash in operations for the period. These conditions raise substantial doubt regarding our ability to continue as a going concern.

Since inception, we have financed our operations principally through the sale of debt and equity securities and operating cash flows. We have an at-the-market (ATM) equity offering under which we may issue up to $100 million of common stock, which is not currently active. However, we are in the process of activating the ATM. During the year end December 31, 2023, we raised approximately $13.4 million of net proceeds through this ATM.

While no assurance can be provided, management believes that these actions provide the opportunity for the Company to continue as a going concern and to grow its business and achieve profitability with access to additional capital funding. Ultimately, the success of the Company as a going concern is dependent upon the ability of the Company to continue executing its plan and obtaining capital that will enable the Company to complete its in-process AirSCWO units and begin manufacturing further units. If the Company is unable to obtain additional financing in sufficient amounts or under acceptable terms, the Company's operating results could be adversely affected.

These consolidated financial statements do not include any adjustments related to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Based upon the Company’s current business plan, we believe that our current cash balance and access to liquidity are sufficient for the Company to meet its financial obligations as they become due for at least the next 12 months from the date of the report.

Note 4 – Inventory

Inventory, net consists of:

Name | | Balance at March 31, 2024 | | | Balance at December 31, 2023 | |

Raw materials | | $ | 717,052 | | | $ | 457,393 | |

Work-in-process | | | 1,934,606 | | | | 1,819,284 | |

Less: inventory reserves | | | (50,000 | ) | | | — | |

Total | | $ | 2,601,658 | | | $ | 2,276,677 | |

Note 5 – Intangible Assets

Intangible assets, net, are comprised of the following as of March 31, 2024 and December 31, 2023 :

Name | | Estimated Life | | Balance at December 31, 2023 | | | Additions | | | Amortization | | | Balance at March 31, 2024 | |

License agreement | | 17 Years | | $ | 901,929 | | | $ | — | | | $ | (15,732 | ) | | $ | 886,197 | |

Patents | | 20 Years | | | 86,100 | | | | 590 | | | | (1,196 | ) | | | 85,494 | |

Total | | | | $ | 988,029 | | | $ | 590 | | | $ | (16,928 | ) | | $ | 971,691 | |

Amortization expense for the three months ended March 31, 2024 and 2023, was $16,928 and $16,910, respectively.

Estimated future amortization expense as of March 31, 2024:

| | March 31, | |

| | 2024 | |

2024 (remaining) | | $ | 50,784 | |

2025 | | | 67,933 | |

2026 | | | 67,933 | |

2027 | | | 67,933 | |

2028 | | | 67,933 | |

Thereafter | | | 649,175 | |

Intangible assets, Net | | $ | 971,691 | |

Note 6 – Revenue

The following is a summary of our revenues by type for the period ended March 31, 2024 and March 31, 2023:

Name | | March 31, 2024 | | | % | | | March 31, 2023 | | | % | |

Equipment revenue | | $ | 296,096 | | | | 94 | % | | $ | 793,458 | | | | 99 | % |

Service revenue | | | 19,182 | | | | 6 | % | | | 8,000 | | | | 1 | % |

Total | | $ | 315,278 | | | | 100 | % | | $ | 801,458 | | | | 100 | % |

Unearned Revenue

The following is a summary of our unearned revenue activity for the period ended March 31, 2024 and year ended December 31, 2023:

Name | | Balance at March 31, 2024 | | | Balance at December 31, 2023 | |

Unearned revenue at beginning of the period | | $ | 130,000 | | | $ | 200,109 | |

Billings deferred | | | 2,768 | | | | 58,000 | |

Recognition of prior unearned revenue | | | — | | | | (128,109 | ) |

Unearned revenue at end of period | | $ | 132,768 | | | $ | 130,000 | |

Unbilled Accounts Receivable

The following is a summary of our unbilled accounts receivable activity for the period ended March 31, 2024 and the year ended December 31, 2023:

Name | | Balance at March 31, 2024 | | | Balance at December 31, 2023 | |

Unbilled accounts receivable at beginning of the period | | $ | 1,494,553 | | | $ | 918,164 | |

Services performed but unbilled | | | 296,096 | | | | 1,061,612 | |

Services billed | | | (19,040 | ) | | | (485,223 | ) |

Unbilled accounts receivable at end of the period | | $ | 1,771,609 | | | $ | 1,494,553 | |

Note 7 – Stockholder’ Equity

The Company is authorized to issue 50,000,000 preferred stock shares and 200,000,000 common stock shares both with a par value of $0.0001.

Preferred Stock

On October 30, 2020, the Company designated 1,000,000 shares as Series D Convertible Preferred Stock with a par value of $0.0001.

As of March 31, 2024, there were no shares of Preferred Stock issued and outstanding.

Common Stock

The holders of common stock are entitled to one vote per share on all matters submitted to a vote of shareholders, including the directors’ election. There is no right to cumulative voting in the election of directors. The holders of common stock are entitled to any dividends that may be declared by the board of directors out of funds legally available for payment of dividends subject to the prior rights of holders of preferred stock and any contractual restrictions the Company has against the payment of dividends on common stock. In the event of our liquidation or dissolution, holders of common stock are entitled to share ratably in all assets remaining after payment of liabilities and the liquidation preferences of any outstanding shares of preferred stock. Holders of common stock have no preemptive rights and have no right to convert their common stock into any other securities. As of March 31, 2024, there were 132,670,446 shares of common stock issued and outstanding.

In December 2022, the Company entered into an equity distribution agreement with an underwriter pursuant to which the Company may offer and sell shares of its common stock from time to time through the underwriter as its sales agent. Sales of common stock, if any, will be made at market prices by any method permitted by law deemed to be an “at-the-market” offering as defined in Rule 415 promulgated under the Securities Act of 1933, as amended. The Company has no obligation to sell any shares of common stock under the equity distribution agreement, and may at any time suspend offers under the equity distribution agreement, in whole or in part, or terminate the equity distribution agreement.

During the three months ended March 31, 2024, we issued 3,339 fully vested shares of common stock to a service provider with a fair value of $4,500 based on the market price of our common stock on date of grant.

During the three months ended March 31, 2023, a total of 2,137,876 shares of common stock were sold pursuant to the open market sale agreement resulting in a total of $8.35 million in proceeds, net of $0.11 million of commission fees and $0.05 million of accounting and legal fees. No such common stock sales occurred during the three months ended March 31, 2024.

As of March 31, 2024, a total of 3,766,422 shares of common stock have been sold pursuant to the open market sale agreement and approximately 86,560,000 remained available under the Company’s at-the-market public facility, subject to various limitations.

Stock-based compensation

During the three months ended March 31, 2024, and 2023, the Company recorded stock-based compensation of $183,200 and $214,924, respectively, related to common stock issued or vested options to employees and various consultants of the Company. For the three months ended March 31, 2024, $138,586 was charged as general and administrative expenses and $44,614 as research and development expenses in the accompanying unaudited condensed consolidated statements of operations. For the three months ended March 31, 2023, $189,283 was charged as general and administrative expenses and $25,641 as research and development expenses in the accompanying unaudited condensed consolidated statements of operations.

Stock Options

Stock option activity for the three months ended March 31, 2024 is summarized as follows:

| | Shares | | | Weighted Average Exercise Price | | | Aggregate Intrinsic Value | | | Weighted Average Remaining Contractual Life (Years) | |

Options outstanding at December 31, 2023 | | | 10,828,174 | * | | $ | 0.83 | | | $ | 6,374,433 | | | | 4.66 | |

Granted | | | 50,000 | | | $ | 1.40 | | | | — | | | | — | |

Exercised | | | — | | | | — | | | | — | | | | — | |

Expired/forfeit | | | (137,924 | ) | | $ | 2.65 | | | | — | | | | — | |

Options outstanding at March 31, 2024 | | | 10,740,250 | * | | $ | 0.81 | | | $ | 4,826,248 | | | | 4.35 | |

Options Exercisable at March 31, 2024 | | | 8,696,519 | * | | $ | 0.50 | | | $ | 6,609,354 | | | | 1.74 | |

*Includes 6,700,000 options granted in connection with the Merger (see Note 1) and were not granted under the 2021 Plan.

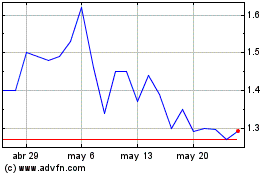

As of March 31, 2024, intrinsic value is computed based on the difference between weighted average exercise price and the market price of our common stock as of March 31, 2024 of $1.26 per share multiplied by the total common stock options outstanding and exercisable.

Total unrecognized compensation associated with these unvested options is approximately $1,696,066 which will be recognized over a period of 2.82 years.

The fair value of these options granted were estimated on the date of grant, using the Black-Scholes option-pricing model with the following assumptions:

| | March 31, 2024 | |

Dividend yield | | | 0.00% | |

Expected life | | 6.25 Years | |

Expected volatility | | 26.36–26.38% | |

Risk-free interest rate | | 4.09–4.31% | |

Stock Warrants

As of March 31, 2024, there were 1,235,000 warrants outstanding which relate to the Series 1 offering executed in December 2021, where investors were offered a warrant for every two common shares purchased during the offering at an exercise price of $2.50 per share.

During the three months ended March 31, 2024 and 2023, no warrants were issued or exercised.

A summary of warrant activity during the three months ended March 31, 2024, is as follows:

| | Shares | | | Weighted Average Exercise Price | | | Aggregate Intrinsic Value | | | Weighted Average Remaining Contractual Life (Years) | |

Balance at December 31, 2023 | | | 1,235,000 | | | | 2.50 | | | $ | — | | | | 0.96 | |

Issued | | | — | | | | — | | | | — | | | | — | |

Exercised | | | — | | | | — | | | | — | | | | — | |

Balance at March 31, 2024 | | | 1,235,000 | | | | 2.50 | | | $ | — | | | | 0.71 | |

Note 8 - Related Party Transactions

In 2021, the Company entered into a manufacturing and service agreement to fabricate and manufacture the AirSCWO systems (the “Original M&S Agreement”) with Merrell Bros. The initial term of the Original M&A Agreement ends July 7, 2024 with a one-year automatic renewal unless terminated by either party with at least a sixty-day notice prior to expiration. As part of the agreement, the Company appointed Terry Merrell to its board of directors. As of March 31, 2024, Merrell Bros. or their affiliates own stock below 5% of the outstanding common stock.

During the period ended March 31, 2024, the Company incurred $130,321 in related party expenses related to the manufacturing of the AirSCWO systems. As of March 31, 2024, accounts payable and accrued expenses includes $119,343 of amounts owed to Merrell Bros. for the manufacturing services provided.

On March 27, 2024, we executed a supplemental manufacturing and services agreement (the “Supplemental M&S Agreement”) with Merrell Bros. as Merrell Bros. has indicated to us their intent to not renew the Original M&S Agreement and we have indicated our desire to relocate to a larger manufacturer facility with more square footage dedicated to expanding our manufacturing operations. Simultaneous to executing the Supplement M&S Agreement, Merrell Bros. provided us with a written non-renewal notice. Accordingly, the manufacturing and service agreement will terminate on its original expiration date of July 7, 2024 and will not be renewed.

The Supplemental M&S Agreement will become effective on July 7, 2024 and will replace the Original M&S Agreement. Under the Supplemental M&S Agreement, our relationship and the manufacturing services provided by Merrell Bros. will continue on an as needed basis based on statements of work to be agreed upon by both parties to fulfill future and current manufacturing orders. The term of the Supplemental M&S Agreement is one year from July 7, 2024 with a one-year renewal upon a mutually executed written extension. Either party may terminate this Supplement M&S Agreement upon written notice of such a termination, specifying the extent to which performance of work is terminated and the effective date of termination.

Note 9 - Commitments

License Agreement

The patented technology underlying 374Water’s supercritical water oxidation (SCWO) units, which was developed principally through the efforts of Messrs. Nagar and Deshusses at the facilities of Duke University, Durham, North Carolina (“Duke”), where Dr. Deshusses is a professor. The SCWO technology is licensed to 374Water pursuant to a worldwide license agreement with Duke executed on April 16, 2021 (the “License Agreement”). In connection with the License Agreement, 374Water also executed an equity transfer Agreement with Duke pursuant to which Duke received a small number of common stock in the Company (See Note 5). Under the terms of the License Agreement, the Company is required to make royalty payments based on a percentage of licensed product sales, as defined in the License Agreement which is triggered by the sale of licensed products. Further, the Company is also required to pay royalties on a percentage of sublicensing fees. The Company will reimburse Duke for any ongoing patent expenses incurred. As of March 31, 2024, the Company has not incurred any expenses in connection with this License Agreement. The Company may terminate the license agreement anytime by providing Duke 60 days’ written notice.

Legal Settlement

In 2023, the Company was named in a lawsuit filed against our former stock transfer agent (“Former TA”) by certain unrelated individuals asserting claims for negligence, conversion, and various breaches. Our Former TA issued 175,000 shares of our common stock to the State of Delaware in accordance with escheat laws after the Former TA was unable to issue the shares of common stock to the individuals. While the Company was not at fault in the matter, due to certain indemnification clauses between the Company and the Former TA, we are in the process of settling the matter with the individuals.

Based on the settlement discussions currently in process, we believe this matter will be settled with 275,000 common stock options with an exercise price equal to the market price when granted and an exercise period of five years. As of March 31, 2024 and December 31, 2023, we have $135,000 as an accrued legal settlement, as presented on the accompanying unaudited condensed consolidated balance sheet, for this pending settlement based on the estimated grant-date fair value of these options using a Black-Scholes valuation model and the following assumptions: stock price and exercise price of $1.33, risk free rate 4.43%, expected term five years, and volatility of 26.36%.

We note that in the ordinary course of business we may be the subject of, or party to, various pending or threatened legal actions which could result in a material adverse outcome for which the related damages may not be estimable. We do not believe any legal action would have a significant impact on the financials other than the matter disclosed above. However, there is inherent uncertainty regarding such matters.

Note 10 - Subsequent Events

Employment Agreement

On April 19, 2024, 374Water Inc. the Company entered into an employment agreement with Christian Gannon (the “Employment Agreement”), for Mr. Gannon to serve as President and Chief Executive Officer of the Company effective April 22, 2024 (the “Start Date”). The Employment Agreement provides for an initial annual salary for Mr. Gannon of $450,000. Mr. Gannon is also eligible to earn an annual fiscal year performance bonus for each whole or partial fiscal year of his employment period with the Company; for the initial year under the Employment Agreement in accordance with certain milestones set forth by the Company, and thereafter as determined by the compensation Committee of the Company and the Board of Directors of the Company. Mr. Gannon is eligible to earn a performance bonus up to 125% of Mr. Gannon's then-current base salary (the “Annual Bonus”) if certain milestones are met as defined in the Employment Agreement.

Under the Employment Agreement and subject to the terms of the Company's 2021 Equity Incentive Plan (the “Plan”), Mr. Gannon was granted up to 2,250,000 Restricted Stock Units (as defined in the Plan) under the Plan, vesting as follows: (a) 250,000, on the first annual anniversary of the Start Date; (b) 750,000, in equal increments on the last day of every month thereafter over the following 36 months, subject to Mr. Gannon's continued employment with the Company on each vesting date; and (c) 1,250,000, pursuant to certain milestones set forth by the Company and defined in the Employment Agreement (collectively, the “Gannon Restricted Stock Units”). Additionally, pursuant to the Employment Agreement and the terms of the Plan, Mr. Gannon was granted 5,250,000 Options (as defined in the Plan) under the Plan vesting as follows: (a) 625,000, on the first annual anniversary of the Start Date; (b) 1,875,000, in equal installments on the last day of every month thereafter over the following 36 months subject to Mr. Gannon's continued employment with the Company on each vesting date; and (c) 2,750,000, pursuant to certain milestones set forth by the Company and defined in the Employment Agreement (collectively, the “Gannon Options”, and together with the Gannon Restricted Stock Units, the “Gannon Equity Awards”).

If the Employment Agreement is terminated by the Company without “Cause” or by Mr. Gannon for “Good Reason” (each as defined in the Employment Agreement, subject to the Company’s right to cure), he will be entitled to termination benefits, pursuant to which the Company will be obligated to (i) pay Mr. Gannon 100% of his then-current annual base salary in 12 equal installments; (ii) any earned but unpaid Annual Bonus; (iii) coverage to Mr. Gannon and his dependents under the Company’s then current medical, health, and vision insurance plans for 12 months; and (iv) if such separation occurs on the day of Mr. Gannon’s first year anniversary of employment or after the first anniversary of the Start Date, (x) a pro-rated Annual Bonus for the fiscal year in which the employment is terminated equal to the pro-rated Annual Bonus that Mr. Gannon would have received based on actual performance for such fiscal year if Mr. Gannon was employed by the Company, and (y) accelerated vesting with respect to the Gannon Equity Awards as if Mr. Gannon had remained employed by the Company through the first anniversary of the date of such separation.

The Employment Agreement contains covenants for the benefit of the Company relating to the protection of the Company’s confidential information and standard Company indemnification obligations.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward Looking Statements

Readers are cautioned that the statements in this Report that are not descriptions of historical facts may be “forward-looking statements” that are subject to risks and uncertainties. This Report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements are based on the beliefs of our management, as well as on assumptions made by and information currently available to us as of the date of this Report. When used in this Report, the words “plan,” “will,” “may,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “project” and similar expressions are intended to identify such forward-looking statements. Although we believe these statements are reasonable, actual actions, operations and results could differ materially from those indicated by such forward-looking statements as a result of the risk factors included in our 2023 Annual Report on Form 10-K filed with the SEC on March 29, 2024, or other factors. We must caution, however, that this list of factors may not be exhaustive and that these or other factors, many of which are outside of our control, could have a material adverse effect on us and our ability to achieve our objectives. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above.

The following discussion and analysis should be read in conjunction with the financial statements and notes thereto appearing elsewhere herein.

Critical Accounting Policies

In preparing the condensed consolidated financial statements, we have made estimates, assumptions and judgments that affect the reported amounts of assets, liabilities, revenues, costs, and expes, and the disclosure of contingent assets and liabilities as in our condensed consolidated financial statements. Actual results may differ from these estimates. A summary of our critical accounting estimates and policies is included in our 2023 Form 10-K under "Management’s Discussion and Analysis of Financial Condition and Results of Operations." During the three months ended March 31, 2024, there have been no significant changes to these estimates and policies previously disclosed in our 2023 Form 10-K. For disclosure regarding recent accounting pronouncements and the anticipated impact they will have on our operations, please refer to Note 2 of the condensed consolidated financial statements included in this Form 10-Q.

Overview

374Water offers a technology that transforms wet wastes such as sewage sludge, biosolids, food waste, hazardous and non-hazardous waste, and forever chemicals (e.g., PFAS) into recoverable resources by focusing on waste as a valuable resource for water, energy, and minerals. We consider ourselves pioneers in a new era of waste management that supports a circular economy and enables organizations to achieve their environment, social, and governance (ESG) goals. Our vision is a world without waste and our mission is to help create and preserve a clean and healthy environment that sustains life.

We have developed proprietary waste stream treatment systems based on Supercritical Water Oxidation (SCWO). The term used for the process is AirSCWOTM. SCWO leverages the unique properties of water in its supercritical phase (above 374 oC and 221 Bar) to convert organic matter to energy and safe products that can be recovered and used. The AirSCWOTM systems are essentially waste stream agnostic and able to treat a variety of complex, hazardous and non-hazardous waste streams, opening up opportunities for multiple applications in diverse market verticals on an international scale. Most pertinently, the technology is shifting the landscape in addressing environmental challenges that, until now, have been considered unsurmountable (due to science/engineering or cost barriers), one good example being the global PFAS crisis.

We currently outsource manufacturing of the AirSCWOTM systems to our strategic partner in the US, Merrell Bros., Inc., that have the facilities and capability to rapidly ramp-up manufacturing volumes and also support system modifications and deployment as required per market and clients. We envision in the future applying an outsourced manufacturing model in a few territories,and may consider establishing our own manufacturing capability in geographies where this is needed to adequately grow our market share.

The systems will be supplied to multiple market verticals, and our revenue model includes both capital equipment sales and long-term service agreements based on throughput and capacity (Waste Purchase Agreements). Our market penetration strategy is combined of direct client and channel partner sales routes, depending on the specific market and territory. In some cases, the systems may be white labeled and sold as part of a broader solution package.

Results of Operations

The following table sets forth, for the periods presented, the consolidated statements of operations data, which is derived from the accompanying unaudited condensed consolidated financial statements:

| | Three Month Period Ended March 31, | |

| | 2024 | | | 2023 | | | $ Change | | | % Change | |

Revenue | | $ | 315,278 | | | $ | 801,458 | | | $ | (486,180 | ) | | (61 | %) |

Cost of revenues | | | 617,298 | | | | 720,146 | | | | (102,848 | ) | | (14 | %) |

Net revenue | | | (302,020 | ) | | | 81,312 | | | | (383,332 | ) | | (471 | %) |

Operating expenses: | | | | | | | | | | | | | | | |

Research and development | | | 535,147 | | | | 355,905 | | | | 179,242 | | | | 50 | % |

Compensation and related expenses | | | 651,604 | | | | 718,760 | | | | (67,156 | ) | | (9 | %) |

Professional fees | | | 252,705 | | | | 99,572 | | | | 153,133 | | | | 154 | % |

General and administrative | | | 459,727 | | | | 585,659 | | | | (125,932 | ) | | (22 | %) |

Total operating expenses | | | 1,899,183 | | | | 1,759,896 | | | | 139,287 | | | | 8 | % |

Loss from operations | | | (2,201,203 | ) | | | (1,678,584 | ) | | | (522,619 | ) | | | 31 | % |

Other income, net | | | 176,738 | | | | 38,241 | | | | 138,497 | | | | 362 | % |

Loss before income taxes | | | (2,024,465 | ) | | | (1,640,343 | ) | | | (384,122 | ) | | | 23 | % |

Provision for income taxes | | | — | | | | — | | | | — | | | | 0 | % |

Net loss | | $ | (2,024,465 | ) | | $ | (1,640,343 | ) | | $ | (384,122 | ) | | | 23 | % |

Three Months Ended March 31, 2024, as Compared to the Three Months Ended March 31, 2023

Our business has been focused on development and commercialization of 374Water’s supercritical water oxidation (SCWO) systems. We generated $315,278 and $801,458 in revenue from manufacturing assembly services and from treatability services during the three months ending March 31, 2024 and March 31, 2023, respectively. During the three months ended March 31, 2024, we reached fewer milestones and thus incurred less direct contract costs. Costs associated with our sold unit have started to decline as we reach the end of our fabrication and testing, which have had a direct correlation to the reduced revenue recognized this year. This has had a direct impact on our change in revenue year-over-year.

Our general and administrative expenses decreased to $459,727 during the three months ending March 31, 2024, as compared to $585,659 in the same period of 2023, primarily because of decreased stock-based compensation expense and a decrease in advertising and marketing expenses due to our onsite SCWO system demonstration in Kokomo, Indiana for employees, contractors and customers during the three months ended March 31, 2023.

Our compensation and related expenses decreased to $651,604 during the three months ending March 31, 2024, as compared to $718,760 in the same period of 2023, primarily because of decreased payroll and fringe benefit expenses due to fluctuations in headcount and bonuses paid during the three months ended March 31, 2023 that were not provided during the three months ended March 31, 2024.

Our professional fees increased to $252,705 during the three months ending March 31, 2024, as compared to $99,572 in the same period of 2023, primarily because of increased legal fees as a result of a litigation settlement and an increase in audit related fees.

Our research and development expenses increased to $535,147 during the three months ending March 31, 2024, as compared to $355,905 in the same period of 2023, primarily because of the increase in engineering expenses and our continued efforts to commercialize our systems.

Liquidity, Capital Resources and Going Concern

As of March 31, 2024, the Company had working capital of $11,715,381 and an accumulated deficit of $17,977,969. For the three months ended March 31, 2024, the Company incurred a net loss of $2,024,465 and used $2,508,653 of net cash in operations for the period. These conditions raise substantial doubt regarding our ability to continue as a going concern.

Since inception, we have financed our operations principally through the sale of debt and equity securities and operating cash flows. We have an at-the-market (ATM) equity offering under which we may issue up to $100 million of common stock, which is not currently active. However, we are in the process of activating the item. During the year end December 31, 2023, we raised approximately $13.4 million of net proceeds through this ATM.

While no assurance can be provided, management believes that these actions provide the opportunity for the Company to continue as a going concern and to grow its business and achieve profitability with access to additional capital funding. Ultimately, the success of the Company as a going concern is dependent upon the ability of the Company to continue executing its plan and obtaining capital that will enable the Company to complete its in-process AirSCWO units and begin manufacturing further units. If the Company is unable to obtain additional financing in sufficient amounts or under acceptable terms, the Company operating results could be adversely affected.

These consolidated financial statements do not include any adjustments related to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Based upon the Company’s current business plan, we believe that our current cash balance and access to liquidity are sufficient for the Company to meet its financial obligations as they become due for at least the next 12 months from the date of the report.

Item 3. Quantitative and Qualitative Disclosures about Market Risk.

Not applicable.

Item 4. Controls and Procedures.

Disclosure Controls and Procedures

The Company, under the supervision and with the participation of its management, including the Chief Executive Officer and Chief Financial Officer, evaluated the effectiveness of the design and operation of the Company’s “disclosure controls and procedures” (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as of the end of the period covered by this report. Based on that evaluation, the Chief Executive Officer and the Chief Financial Officer concluded that the Company’s disclosure controls and procedures were effective.

Management’s Annual Report on Internal Control Over Financial Reporting

Our management, with the participation of our principal executive officer and principal financial officer, evaluated the effectiveness of our internal control over financial reporting as of March 31, 2024. Our management’s evaluation of our internal control over financial reporting was based on the framework in Internal Control-Integrated Framework (2013), issued by the Committee of Sponsoring Organizations of the Treadway Commission.

Based on this evaluation, our management concluded that our internal control over financial reporting was effective as of March 31, 2024.

No Attestation Report

This quarterly report does not include an attestation report of the Company’s independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this quarterly report.

Changes in Internal Control Over Financial Reporting

There have been no other changes in our internal control over financial reporting during the first three months of 2024 that materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II OTHER INFORMATION

Item 1. Legal Proceedings.

Plaintiffs, Peter Somers and Peter Schalken, filed a lawsuit against Defendants 374Water and Computershare in the United States District Court for the District of Delaware, C.A. No. 23- 969-JLH (the “Lawsuit”) asserting claims for negligence, conversion, breach of contract, breach of the implied covenant of good faith and fair dealing, breach of fiduciary duty (against 374Water only), violations of state securities laws, and violations of 42. U.S.C. § 1983, relating to the alleged escheatment of Plaintiffs’ shares of PowerVerde stock to the State of Delaware. The Lawsuit alleged damages in the combined amount of $562,500. 374Water and Computershare deny the allegations in the Lawsuit and specifically deny any wrongdoing or liability regarding the claims alleged in the Lawsuit. A settlement has been agreed to in principle which involves providing Plaintiffs certain stock options. However, under the terms of the current settlement, no money would be paid to Plaintiffs by 374Water.

Item 1A. Risk Factors.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

None

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Other Information.

Not applicable

Item 6. Exhibits.

SIGNATURES

In accordance with Section 13(a) or 15(d) of the Exchange Act, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| 374WATER INC | |

| | | |

Dated: May 15, 2024 | By: | /s/ Christian Gannon | |

| | Christian Gannon | |

| | Chief Executive Officer | |

| | | |

Dated: May 15, 2024 | By: | /s/ Adrienne Anderson | |

| | Adrienne Anderson | |

| | Chief Financial Officer | |

Exhibit Index

nullnullnullnull

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|