0000790051false00007900512024-10-242024-10-240000790051us-gaap:CommonStockMember2024-10-242024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________

FORM 8-K

_____________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

_____________________________________________________

Date of Report (Date of earliest event reported): October 24, 2024

www.carlisle.com

CARLISLE COMPANIES INCORPORATED

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 001-09278 | | 31-1168055 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

16430 North Scottsdale Road, Suite 400, Scottsdale, Arizona 85254

(Address of principal executive offices, including zip code)

480-781-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

| Common stock, $1 par value | | CSL | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02. Results of Operations and Financial Condition.

On October 24, 2024, Carlisle Companies Incorporated (the “Company”) issued a press release regarding the Company’s financial results for the third quarter ended September 30, 2024. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1, is being furnished herewith and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number | | Exhibit Title |

| | | |

| | Press release of Carlisle Companies Incorporated dated October 24, 2024. |

| 104 | | Cover page interactive data file (embedded within the inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | CARLISLE COMPANIES INCORPORATED |

| | | |

| Date: | October 24, 2024 | By: | /s/ Kevin P. Zdimal |

| | | Kevin P. Zdimal |

| | | Vice President and Chief Financial Officer |

10/24/24

Carlisle Companies Reports Third Quarter Results

SCOTTSDALE, ARIZONA, October 24, 2024 - Carlisle Companies Incorporated (NYSE:CSL) today announced its third quarter 2024 financial results.

•Record third quarter diluted EPS of $5.30 and adj. EPS of $5.78, +24% year-over-year

◦Revenue of $1.3 billion, an increase of 6% YoY

◦Operating margin of 23.7% and Q3 record adj. EBITDA margin of 27.6%, +60 bps YoY

◦CCM grew revenue 9% and expanded adj. EBITDA margin 110 bps to Q3 record of 32.8%

◦Continued headwinds in residential markets negatively impacted CWT

•Repurchased 1.1 million shares for $466 million and increased quarterly dividend by 18%

•Signed agreement to acquire Plasti-Fab

•Awarded Home Depot's Building Materials Partner of the Year for the 2nd time since 2022

Comments from Chris Koch, Chair, President and Chief Executive Officer

“Carlisle delivered another quarter of strong performance, despite a continued decline in residential markets along with the well-known weather-related and port strike events, which negatively impacted shipping days, contractor days on the roof and manufacturing output. We continued to execute on our Vision 2030 strategies, and we are pleased with our third quarter performance against our 2030 goal of $40 of adjusted EPS, growing 24% year-over-year and adjusted EBITDA margins expanding to 27.6%.

“CCM continued its strong momentum with its 2024 accomplishments into the third quarter, driven by healthy contractor backlogs, robust re-roofing activity, and excellent margin performance. CCM sales were up 9% year-over-year assisted by the inventory normalization in the channel and the acquisition of MTL. CCM's impressive 32.8% adjusted EBITDA margin in the third quarter reflected strong volume leverage, a positive raw material environment, and excellent operating execution through the Carlisle Operating System (COS).

“As we look at CWT’s performance, while we were pleased with progress on share gain initiatives within CWT, a higher interest rate environment, low housing turnover, and affordability challenges resulted in a further slowing of housing activity in the quarter. For the quarter, these challenges impacted sales and drove a decline of 3% year-over-year. Despite the near-term challenges facing CWT, we remain extremely pleased and optimistic about the prospects for this segment.

“We continue to be encouraged by the positive long-term outlook in the North America building products markets and the strength of the Carlisle business model. Our pivot to a “pure play” building products company is delivering the expected outcomes and demonstrating our commitment to being superior capital allocators. Additionally, we believe that leveraging the megatrends around energy efficiency and labor savings, along with growing re-roof demand, and our introduction of innovative new products are creating additional catalysts for growth. Similar to Vision 2025, we believe Vision 2030 positions us well to drive above-market growth and earn a premium in the marketplace.

“Carlisle remains committed to generating superior shareholder returns through our balanced capital deployment approach. This quarter, we repurchased 1.1 million shares for $466 million and increased our dividend by 18%, marking the 48th consecutive annual dividend increase.

“We are excited about our recent agreement to acquire Plasti-Fab, which aligns perfectly with our Vision 2030 strategy to enhance our “best-in-class” building envelope product portfolio following the completion of our pivot to a “pure play” building products company earlier this year. The acquisition of Plasti-Fab establishes Carlisle as a leading manufacturer in the $1.5 billion North American expanded polystyrene insulation market and provides vertically integrated polystyrene capabilities to our Insulfoam business while adding scale, supporting retail channel growth, and filling key geographic gaps in the U.S. and

Canada. We expect this acquisition to generate approximately $14 million in annual cost synergies and be accretive to our adjusted EPS by approximately $0.30 in 2025.

“As we look forward to the remainder of the year, we expect the residential headwinds experienced this year to continue. Based on that outlook, we expect to deliver approximately 10% revenue growth and increase adjusted EBITDA margin by approximately 150 bps for 2024. We are confident in our ability to continue delivering value for all our stakeholders as we progress further towards our Vision 2030 goals, demonstrating the strength of margin resiliency through the Carlisle Experience and driving superior returns on capital through our strategic initiatives."

Third Quarter 2024 Financial Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in millions, except per share amounts) | | 2024 | | 2023 | | Change % | | 2024 | | 2023 | | Change % |

| Revenues | | $ | 1,333.6 | | | $ | 1,259.8 | | | 5.9 | % | | $ | 3,880.7 | | | $ | 3,459.4 | | | 12.2 | % |

| | | | | | | | | | | | |

| Operating income | | 316.4 | | | 299.9 | | | 5.5 | % | | 919.1 | | | 729.2 | | | 26.0 | % |

| Operating margin | | 23.7 | % | | 23.8 | % | | -10 bps | | 23.7 | % | | 21.1 | % | | 260 bps |

| Income from continuing operations | | 246.6 | | | 216.9 | | | 13.7 | % | | 702.7 | | | 527.2 | | | 33.3 | % |

| Adjusted EBITDA | | 367.9 | | | 339.7 | | | 8.3 | % | | 1,051.0 | | | 855.7 | | | 22.8 | % |

| Adjusted EBITDA margin | | 27.6 | % | | 27.0 | % | | 60 bps | | 27.1 | % | | 24.7 | % | | 240 bps |

| Diluted EPS | | 5.30 | | | 4.32 | | | 22.7 | % | | 14.74 | | | 10.32 | | | 42.8 | % |

| Adjusted diluted EPS | | 5.78 | | | 4.68 | | | 23.5 | % | | 15.71 | | | 11.35 | | | 38.4 | % |

Third Quarter 2024 Segment Highlights

Carlisle Construction Materials ("CCM")

•Revenue of $998 million, increased 9% (+6% organic) year-over-year, driven by the acquisition of MTL, the normalization of inventory in the channels, and robust re-roof activity from pent up demand.

•Operating income was $303 million, up 11% year-over-year. Adjusted EBITDA was $328 million, up 13% year-over-year, reflecting an adjusted EBITDA margin of 32.8%. The 110 basis point increase compared to the prior year was driven by volume leverage on strong sales growth, favorable raw materials and operating efficiencies achieved through COS.

Carlisle Weatherproofing Technologies ("CWT")

•Revenue of $335 million, declined 3% (-4% organic) year-over-year, primarily due to softer residential end markets and price declines in select product categories, partially offset by growth in commercial categories, share gain initiatives and the acquisition of Polar Industries.

•Operating income was $47 million, down 20% year-over-year. Adjusted EBITDA was $69 million, down 14% year-over-year, reflecting an adjusted EBITDA margin of 20.7%. The 270 basis point decrease compared to the prior year was primarily due to strategic investments in the business to support longer term growth initiatives in addition to lower sales in the quarter as a result of broader residential market weakness from higher interest rates.

Cash Flow

Operating cash flow from continuing operations for the nine months ended September 30, 2024, was $662 million, no change versus the prior year. Free cash flow from continuing operations was $597 million, an increase of $22 million versus the prior year (defined as cash provided by operating activities less capital expenditures and comprised of continuing operations). This increase was driven by a decrease in capital expenditures due to timing of projects from continuing operations.

During the nine months ended September 30, 2024, we deployed $1.2 billion toward share repurchases, including $466 million in the current quarter, and paid $127 million in cash dividends, including $46 million in the current quarter. As of September 30, 2024, we had 4.5 million shares available for repurchase

under our share repurchase program with $1.5 billion of cash and cash equivalents and $1 billion of availability under our revolving credit facility.

2024 Fourth Quarter Outlook

•Revenues to increase LSD

◦CCM - up MSD

◦CWT - down LSD

•Adjusted EBITDA margin ~ 25%

Conference Call and Webcast

Carlisle will discuss third quarter 2024 results on a conference call at 5:00 p.m. ET today. The call can be accessed via webcast, along with related materials, at www.carlisle.com/investors/events-and-presentations and via telephone as follows:

Domestic toll free: 800-549-8228

International: 646-564-2877

Conference ID: 82118

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally use words such as "expect," "foresee," "anticipate," "believe," "project," "should," "estimate," "will," "plans," "intends," "forecast," and similar expressions, and reflect our expectations concerning the future. Such statements are made based on known events and circumstances at the time of publication and, as such, are subject in the future to unforeseen risks and uncertainties. It is possible that our future performance may differ materially from current expectations expressed in these forward-looking statements, due to a variety of factors such as: increasing price and product/service competition by foreign and domestic competitors, including new entrants; technological developments and changes; the ability to continue to introduce competitive new products and services on a timely, cost-effective basis; our mix of products/services; increases in raw material costs that cannot be recovered in product pricing; domestic and foreign governmental and public policy changes including environmental and industry regulations; the ability to meet our goals relating to our intended reduction of greenhouse gas emissions, including our net zero commitments; threats associated with and efforts to combat terrorism; protection and validity of patent and other intellectual property rights; the identification of strategic acquisition targets and our successful completion of any transaction and integration of our strategic acquisitions; our successful completion of strategic dispositions; the cyclical nature of our businesses; the impact of information technology, cybersecurity or data security breaches at our businesses or third parties; the outcome of pending and future litigation and governmental proceedings; the emergence or continuation of widespread health emergencies such as the COVID-19 pandemic, including, for example, expectations regarding their impact on our businesses, including on customer demand, supply chains and distribution systems, production, our ability to maintain appropriate labor levels, our ability to ship products to our customers, our future results, or our full-year financial outlook; and the other factors discussed in the reports we file with or furnish to the Securities and Exchange Commission from time to time. In addition, such statements could be affected by general industry and market conditions and growth rates, the condition of the financial and credit markets and general domestic and international economic conditions, including inflation and interest rate and currency exchange rate fluctuations. Further, any conflict in the international arena, including the Russian invasion of Ukraine and war in the Middle East, may adversely affect general market conditions and our future performance. Any forward-looking statement speaks only as of the date on which that statement is made, and we undertake no duty to update any forward-looking statement to reflect events or circumstances, including unanticipated events, after the date on which that statement is made, unless otherwise required by law. New factors emerge from time to time and it is not possible for management to predict all of those factors, nor can it assess the impact of each of those factors on the business or the

extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

Non-GAAP Disclosure

Carlisle reports its financial results in accordance with the U.S. generally accepted accounting principles (GAAP). This press release also contains certain financial measures such as adjusted diluted EPS, adjusted EBITDA, adjusted EBITDA margin, organic revenue, return on invested capital (ROIC) and free cash flow that are not recognized under GAAP. Management believes that adjusted diluted EPS, adjusted EBITDA, adjusted EBITDA margin, organic revenue and ROIC are useful to investors because they allow for comparison to Carlisle’s and its segments' performance in prior periods without the effect of items that, by their nature, tend to obscure core operating results due to potential variability across periods based on the timing, frequency and magnitude of such items. Management also believes free cash flow is useful to investors as an additional way of viewing Carlisle's liquidity and provides a more complete understanding of factors and trends affecting Carlisle's cash flows. As a result, management believes that these measures enhance the ability of investors to analyze trends in Carlisle’s businesses and evaluate Carlisle’s performance relative to similarly-situated companies. Reconciliations of these measures to amounts reported in Carlisle's consolidated financial statements are in the supplemental schedules of this press release. These non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies. Carlisle is not providing reconciliations for forward-looking non-GAAP financial measures because Carlisle does not provide GAAP financial measures on a forward-looking basis as Carlisle is unable to predict with reasonable certainty the ultimate outcome of adjusted items with unreasonable effort. There items are uncertain, depend on various factors, and could be material to Carlisle's financial results computed in accordance with GAAP.

About Carlisle Companies Incorporated

Carlisle Companies Incorporated is a leading supplier of innovative building envelope products and solutions for more energy efficient buildings. Through its building products businesses – Carlisle Construction Materials ("CCM") and Carlisle Weatherproofing Technologies ("CWT") – and family of leading brands, Carlisle delivers innovative, labor-reducing and environmentally responsible products and solutions to customers through the Carlisle Experience. Carlisle is committed to generating superior shareholder returns and maintaining a balanced capital deployment approach, including investments in our businesses, strategic acquisitions, share repurchases and continued dividend increases. Leveraging its culture of continuous improvement as embodied in the Carlisle Operating System ("COS"), Carlisle has committed to achieving net-zero greenhouse gas emissions by 2050.

*EPS referenced in this release is from continuing operations unless otherwise noted.

| | | | | |

| CONTACT: | Mehul Patel |

| | Vice President, Investor Relations |

| (310) 592-9668 |

| | mpatel@carlisle.com |

Carlisle Companies Incorporated

Unaudited Consolidated Statements of Income

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in millions, except per share amounts) | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | $ | 1,333.6 | | | $ | 1,259.8 | | | $ | 3,880.7 | | | $ | 3,459.4 | |

| | | | | | | | |

| Cost of goods sold | | 819.2 | | | 793.7 | | | 2,398.5 | | | 2,244.9 | |

| Selling and administrative expenses | | 191.8 | | | 161.7 | | | 547.9 | | | 467.6 | |

| Research and development expenses | | 8.1 | | | 7.2 | | | 26.6 | | | 20.7 | |

| | | | | | | | |

| Other operating income, net | | (1.9) | | | (2.7) | | | (11.4) | | | (3.0) | |

| Operating income | | 316.4 | | | 299.9 | | | 919.1 | | | 729.2 | |

| Interest expense, net | | 18.6 | | | 19.4 | | | 56.0 | | | 57.0 | |

| | | | | | | | |

| Interest income | | (22.6) | | | (3.6) | | | (44.3) | | | (12.5) | |

| Other non-operating income, net | | (1.1) | | | 0.6 | | | (1.5) | | | (1.2) | |

| Income from continuing operations before income taxes | | 321.5 | | | 283.5 | | | 908.9 | | | 685.9 | |

| Provision for income taxes | | 74.9 | | | 66.6 | | | 206.2 | | | 158.7 | |

| Income from continuing operations | | 246.6 | | | 216.9 | | | 702.7 | | | 527.2 | |

| | | | | | | | |

| Discontinued operations: | | | | | | | | |

| Income (loss) before income taxes | | (4.4) | | | 43.2 | | | 497.7 | | | 20.2 | |

| Provision for (benefit from) income taxes | | (2.1) | | | (5.5) | | | 51.4 | | | (14.5) | |

| Income (loss) from discontinued operations | | (2.3) | | | 48.7 | | | 446.3 | | | 34.7 | |

| Net income | | $ | 244.3 | | | $ | 265.6 | | | $ | 1,149.0 | | | $ | 561.9 | |

| | | | | | | | |

| Basic earnings per share attributable to common shares: | | | | | | | | |

| Income from continuing operations | | $ | 5.36 | | | $ | 4.37 | | | $ | 14.93 | | | $ | 10.43 | |

| Income (loss) from discontinued operations | | (0.05) | | | 0.98 | | | 9.48 | | | 0.69 | |

| Basic earnings per share | | $ | 5.31 | | | $ | 5.35 | | | $ | 24.41 | | | $ | 11.12 | |

| | | | | | | | |

| Diluted earnings per share attributable to common shares: | | | | | | | | |

| Income from continuing operations | | $ | 5.30 | | | $ | 4.32 | | | $ | 14.74 | | | $ | 10.32 | |

| Income (loss) from discontinued operations | | (0.05) | | | 0.97 | | | 9.36 | | | 0.68 | |

| Diluted earnings per share | | $ | 5.25 | | | $ | 5.29 | | | $ | 24.10 | | | $ | 11.00 | |

| | | | | | | | |

| Average shares outstanding: | | | | | | | | |

| Basic | | 45.9 | | | 49.5 | | | 47.0 | | | 50.4 | |

| Diluted | | 46.5 | | | 50.1 | | | 47.6 | | | 51.0 | |

| | | | | | | | |

| Dividends declared and paid per share | | $ | 1.00 | | | $ | 0.85 | | | $ | 2.70 | | | $ | 2.35 | |

Carlisle Companies Incorporated

Unaudited Condensed Consolidated Statements of Cash Flows

| | | | | | | | | | | | | | |

| | | Nine Months Ended

September 30, |

| (in millions) | | 2024 | | 2023 |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Net cash provided by operating activities | | $ | 659.7 | | | $ | 812.4 | |

| | | | |

| Investing activities: | | | | |

| Proceeds from sale of discontinued operation, net of cash disposed | | 1,998.0 | | | — | |

| Acquisitions, net of cash acquired | | (414.3) | | | — | |

| Capital expenditures | | (76.7) | | | (106.3) | |

| Investment in securities | | 0.6 | | | 0.9 | |

| Other investing activities, net | | 1.3 | | | 18.7 | |

| Net cash provided by (used in) investing activities | | 1,508.9 | | | (86.7) | |

| | | | |

| Financing activities: | | | | |

| | | | |

| Repayments of notes | | — | | | (300.0) | |

| Borrowings from revolving credit facility | | 22.0 | | | 84.0 | |

Repayments of revolving credit facility | | (22.0) | | | (84.0) | |

| | | | |

| Repurchases of common stock | | (1,166.1) | | | (580.0) | |

| Dividends paid | | (127.4) | | | (119.3) | |

| Proceeds from exercise of stock options | | 73.1 | | | 17.7 | |

| Withholding tax paid related to stock-based compensation | | (17.7) | | | (10.4) | |

| Other financing activities, net | | (4.8) | | | (2.5) | |

| Net cash used in financing activities | | (1,242.9) | | | (994.5) | |

| | | | |

Effect of foreign currency exchange rate changes on cash and cash equivalents | | (0.6) | | | — | |

| Change in cash and cash equivalents | | 925.1 | | | (268.8) | |

| Less: change in cash and cash equivalents of discontinued operations | | (28.8) | | | (12.0) | |

| Cash and cash equivalents at beginning of period | | 576.7 | | | 364.8 | |

| Cash and cash equivalents at end of period | | $ | 1,530.6 | | | $ | 108.0 | |

Carlisle Companies Incorporated

Unaudited Selected Consolidated Balance Sheet Data

| | | | | | | | | | | | | | |

| (in millions) | | September 30,

2024 | | December 31,

2023 |

| Cash and cash equivalents | | $ | 1,530.6 | | | $ | 576.7 | |

| Long-term debt, including current portion | | 2,290.2 | | | 2,289.4 | |

| Total stockholders' equity | | 2,762.9 | | | 2,829.0 | |

Carlisle Companies Incorporated

Unaudited Non-GAAP Financial Measures - Organic Revenue

Organic revenue (defined as revenue excluding acquired revenues within the last 12 months and the impact of changes in foreign exchange rates versus the U.S. Dollar) is intended to provide investors and others with information about Carlisle's and its segments' recurring operating performance. This information differs from revenue determined in accordance with accounting principles generally accepted in the United States of America ("GAAP") and should not be considered in isolation or as a substitute for measures of performance determined in accordance with GAAP. Carlisle's and its segments' organic revenue follows, which may not be comparable to similarly titled measures reported by other companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, |

| (in millions, except percentages) | | CSL | | CCM | | CWT | | |

2023 Revenue (GAAP) | | $ | 1,259.8 | | | | $ | 914.0 | | | | $ | 345.8 | | | | | |

| Organic | | 35.9 | | 2.9 | % | | 50.8 | | 5.6 | % | | (14.9) | | (4.3) | % | | | |

| Acquisitions | | 38.1 | | 3.0 | % | | 33.3 | | 3.6 | % | | 4.8 | | 1.4 | % | | | |

| FX impact | | (0.2) | | — | % | | 0.1 | | — | % | | (0.3) | | (0.1) | % | | | |

| Total change | | 73.8 | | 5.9 | % | | 84.2 | | 9.2 | % | | (10.4) | | (3.0) | % | | | |

2024 Revenue (GAAP) | | $ | 1,333.6 | | | | $ | 998.2 | | | | $ | 335.4 | | | | | |

| | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| (in millions, except percentages) | | CSL | | CCM | | CWT | | |

2023 Revenues (GAAP) | | $ | 3,459.4 | | | | $ | 2,437.5 | | | | $ | 1,021.9 | | | | | |

| Organic | | 353.1 | | 10.2 | % | | 378.1 | | 15.5 | % | | (25.0) | | (2.4) | % | | | |

| Acquisitions | | 69.0 | | 2.0 | % | | 55.2 | | 2.3 | % | | 13.8 | | 1.3 | % | | | |

| FX impact | | (0.8) | | — | % | | (0.1) | | — | % | | (0.7) | | (0.1) | % | | | |

| Total change | | 421.3 | | 12.2 | % | | 433.2 | | 17.8 | % | | (11.9) | | (1.2) | % | | | |

2024 Revenues (GAAP) | | $ | 3,880.7 | | | | $ | 2,870.7 | | | | $ | 1,010.0 | | | | | |

Carlisle Companies Incorporated

Unaudited Non-GAAP Financial Measures - Free Cash Flow

Free cash flow is intended to provide investors and others with information about Carlisle's liquidity and provides a more complete understanding of factors and trends affecting Carlisle's cash flows. This information differs from operating cash flow determined in accordance with GAAP and should not be considered in isolation or as a substitute for measures of performance determined in accordance with GAAP. Carlisle's free cash flow follows, which may not be comparable to similarly titled measures reported by other companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Operating cash flow (GAAP) | | $ | 312.8 | | | $ | 441.7 | | | $ | 659.7 | | | $ | 812.4 | |

| Less: operating cash flow from discontinued operations | | (15.9) | | | 51.6 | | | (1.8) | | | 150.5 | |

| Operating cash flow from continuing operations | | $ | 328.7 | | | $ | 390.1 | | | $ | 661.5 | | | $ | 661.9 | |

| | | | | | | | |

| Capital expenditures (GAAP) | | $ | (19.3) | | | $ | (36.2) | | | $ | (76.7) | | | $ | (106.3) | |

| Less: capital expenditures from discontinued operations | | — | | | (6.2) | | | (12.4) | | | (19.3) | |

| Capital expenditures from continuing operations | | $ | (19.3) | | | $ | (30.0) | | | $ | (64.3) | | | $ | (87.0) | |

| | | | | | | | |

| Operating cash flow from continuing operations | | $ | 328.7 | | | $ | 390.1 | | | $ | 661.5 | | | $ | 661.9 | |

| Capital expenditures from continuing operations | | (19.3) | | | (30.0) | | | (64.3) | | | (87.0) | |

| Free cash flow from continuing operations | | $ | 309.4 | | | $ | 360.1 | | | $ | 597.2 | | | $ | 574.9 | |

| | | | | | | | |

Carlisle Companies Incorporated

Unaudited Non-GAAP Financial Measures - EBIT, Adjusted EBIT, Adjusted EBITDA and Adjusted EBITDA Margin

Earnings before interest and taxes ("EBIT"), adjusted EBIT, adjusted earnings before interest, taxes, depreciation and amortization ("EBITDA") and adjusted EBITDA margin are intended to provide investors and others with information about Carlisle's and its segments' performance without the effect of items that, by their nature, tend to obscure core operating results due to potential variability across periods based on the timing, frequency and magnitude of such items. As a result, management believes that these measures enhance the ability of investors to analyze trends in Carlisle's businesses and evaluate Carlisle's performance relative to similarly-situated companies. This information differs from net income and operating income determined in accordance with GAAP and should not be considered in isolation or as a substitute for measures of performance determined in accordance with GAAP. Carlisle's and its segments' EBIT, adjusted EBIT, adjusted EBITDA and adjusted EBITDA margin follows, which may not be comparable to similarly titled measures reported by other companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in millions, except percentages) | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income (GAAP) | | $ | 244.3 | | | $ | 265.6 | | | $ | 1,149.0 | | | $ | 561.9 | |

| Less: (Loss) income from discontinued operations | | (2.3) | | | 48.7 | | | 446.3 | | | 34.7 | |

| Income from continuing operations (GAAP) | | 246.6 | | | 216.9 | | | 702.7 | | | 527.2 | |

| Provision for income taxes | | 74.9 | | | 66.6 | | | 206.2 | | | 158.7 | |

| Interest expense, net | | 18.6 | | | 19.4 | | | 56.0 | | | 57.0 | |

| Interest income | | (22.6) | | | (3.6) | | | (44.3) | | | (12.5) | |

| EBIT | | 317.5 | | | 299.3 | | | 920.6 | | | 730.4 | |

| Exit and disposal, and facility rationalization costs | | 1.9 | | | 1.7 | | | 2.7 | | | 4.5 | |

| Inventory step-up amortization and transaction costs | | 2.7 | | | — | | | 4.8 | | | 1.6 | |

| Impairment charges | | — | | | 0.5 | | | — | | | 1.8 | |

| (Gains) losses from acquisitions and disposals | | (0.3) | | | (0.7) | | | (0.6) | | | 1.8 | |

| Gains from insurance | | — | | | — | | | (5.0) | | | — | |

| Losses (gains) from litigation | | 1.5 | | | (0.1) | | | 1.9 | | | (0.2) | |

| | | | | | | | |

| Total non-comparable items | | 5.8 | | | 1.4 | | | 3.8 | | | 9.5 | |

| Adjusted EBIT | | 323.3 | | | 300.7 | | | 924.4 | | | 739.9 | |

| Depreciation | | 17.5 | | | 16.8 | | | 51.7 | | | 48.9 | |

| Amortization | | 27.1 | | | 22.2 | | | 74.9 | | | 66.9 | |

| Adjusted EBITDA | | $ | 367.9 | | | $ | 339.7 | | | $ | 1,051.0 | | | $ | 855.7 | |

| Divided by: | | | | | | | | |

| Total revenues | | $ | 1,333.6 | | | $ | 1,259.8 | | | $ | 3,880.7 | | | $ | 3,459.4 | |

| Adjusted EBITDA margin | | 27.6 | % | | 27.0 | % | | 27.1 | % | | 24.7 | % |

Carlisle Companies Incorporated

Unaudited Non-GAAP Financial Measures - EBIT, Adjusted EBIT, Adjusted EBITDA and Adjusted EBITDA Margin

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2024 |

| (in millions, except percentages) | | CCM | | CWT | | | | Corporate and unallocated |

| Operating income (loss) (GAAP) | | $ | 303.0 | | | $ | 46.8 | | | | | $ | (33.4) | |

Non-operating (income) expense, net(1) | | (0.5) | | | 0.3 | | | | | (0.9) | |

| EBIT | | 303.5 | | | 46.5 | | | | | (32.5) | |

| Exit and disposal, and facility rationalization costs | | 1.3 | | | 0.6 | | | | | — | |

| Inventory step-up amortization and transaction costs | | 0.1 | | | — | | | | | 2.6 | |

| | | | | | | | |

| Gains from acquisitions and disposals | | (0.1) | | | (0.2) | | | | | — | |

| | | | | | | | |

| Losses from litigation | | 1.0 | | | 0.5 | | | | | — | |

| | | | | | | | |

| Total non-comparable items | | 2.3 | | | 0.9 | | | | | 2.6 | |

| Adjusted EBIT | | 305.8 | | | 47.4 | | | | | (29.9) | |

| Depreciation | | 13.0 | | | 4.1 | | | | | 0.4 | |

| Amortization | | 8.8 | | | 17.8 | | | | | 0.5 | |

| Adjusted EBITDA | | $ | 327.6 | | | $ | 69.3 | | | | | $ | (29.0) | |

| Divided by: | | | | | | | | |

| Total revenues | | $ | 998.2 | | | $ | 335.4 | | | | | $ | — | |

| Adjusted EBITDA margin | | 32.8 | % | | 20.7 | % | | | | NM |

(1)Includes other non-operating (income) expense, net, which may be presented in separate line items on the unaudited Consolidated Statements of Income.

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2023 |

| (in millions, except percentages) | | CCM | | CWT | | | | Corporate and unallocated |

| Operating income (loss) (GAAP) | | $ | 272.5 | | | $ | 58.8 | | | | | $ | (31.4) | |

Non-operating expense (income), net(1) | | 0.3 | | | (0.2) | | | | | 0.5 | |

| EBIT | | 272.2 | | | 59.0 | | | | | (31.9) | |

| Exit and disposal, and facility rationalization costs | | 1.7 | | | — | | | | | — | |

| | | | | | | | |

| Impairment charges | | — | | | 0.5 | | | | | — | |

| Gains from acquisitions and disposals | | (0.2) | | | (0.5) | | | | | — | |

| | | | | | | | |

| Gains from litigation | | — | | | — | | | | | (0.1) | |

| | | | | | | | |

| Total non-comparable items | | 1.5 | | | — | | | | | (0.1) | |

| Adjusted EBIT | | 273.7 | | | 59.0 | | | | | (32.0) | |

| Depreciation | | 11.7 | | | 4.1 | | | | | 1.0 | |

| Amortization | | 4.0 | | | 17.7 | | | | | 0.5 | |

| Adjusted EBITDA | | $ | 289.4 | | | $ | 80.8 | | | | | $ | (30.5) | |

| Divided by: | | | | | | | | |

| Total revenues | | $ | 914.0 | | | $ | 345.8 | | | | | $ | — | |

| Adjusted EBITDA margin | | 31.7 | % | | 23.4 | % | | | | NM |

(1)Includes other non-operating (income) expense, net, which may be presented in separate line items on the unaudited Consolidated Statements of Income.

Carlisle Companies Incorporated

Unaudited Non-GAAP Financial Measures - EBIT, Adjusted EBIT, Adjusted EBITDA and Adjusted EBITDA Margin | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2024 |

| (in millions) | | CCM | | CWT | | | | Corporate and unallocated |

| Operating income (loss) (GAAP) | | $ | 861.0 | | | $ | 148.2 | | | | | $ | (90.1) | |

Non-operating income, net(1) | | — | | | — | | | | | (1.5) | |

| EBIT | | 861.0 | | | 148.2 | | | | | (88.6) | |

| Exit and disposal, and facility rationalization costs | | 1.6 | | | 1.1 | | | | | — | |

| Inventory step-up amortization and acquisition costs | | 1.9 | | | — | | | | | 2.9 | |

| | | | | | | | |

| Gains from acquisitions and disposals | | (0.2) | | | (0.4) | | | | | — | |

| Gains from insurance | | (5.0) | | | — | | | | | — | |

| Losses from litigation | | 1.0 | | | 0.9 | | | | | — | |

| | | | | | | | |

| Total non-comparable items | | (0.7) | | | 1.6 | | | | | 2.9 | |

| Adjusted EBIT | | 860.3 | | | 149.8 | | | | | (85.7) | |

| Depreciation | | 38.1 | | | 12.4 | | | | | 1.2 | |

| Amortization | | 20.2 | | | 53.2 | | | | | 1.5 | |

| Adjusted EBITDA | | $ | 918.6 | | | $ | 215.4 | | | | | $ | (83.0) | |

| | | | | | | | |

| Total revenues | | $ | 2,870.7 | | | $ | 1,010.0 | | | | | $ | — | |

| Adjusted EBITDA margin | | 32.0 | % | | 21.3 | % | | | | NM |

(1)Includes other non-operating (income) expense, net, which may be presented in separate line items on the unaudited Consolidated Statements of Income.

| | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2023 |

| (in millions) | | CCM | | CWT | | | | Corporate and unallocated |

| Operating income (loss) (GAAP) | | $ | 675.6 | | | $ | 142.4 | | | | | $ | (88.8) | |

Non-operating income, net(1) | | — | | | — | | | | | (1.2) | |

| EBIT | | 675.6 | | | 142.4 | | | | | (87.6) | |

| Exit and disposal, and facility rationalization costs | | 1.8 | | | 2.7 | | | | | — | |

Inventory step-up amortization and acquisition costs | | — | | | — | | | | | 1.6 | |

| Impairment charges | | — | | | 1.8 | | | | | — | |

| (Gains) losses from acquisitions and disposals | | (0.5) | | | 2.4 | | | | | (0.1) | |

| | | | | | | | |

| Gains from litigation | | — | | | — | | | | | (0.2) | |

| | | | | | | | |

| Total non-comparable items | | 1.3 | | | 6.9 | | | | | 1.3 | |

| Adjusted EBIT | | 676.9 | | | 149.3 | | | | | (86.3) | |

| Depreciation | | 32.8 | | | 13.2 | | | | | 2.9 | |

| Amortization | | 12.2 | | | 53.0 | | | | | 1.7 | |

| Adjusted EBITDA | | $ | 721.9 | | | $ | 215.5 | | | | | $ | (81.7) | |

| | | | | | | | |

| Total revenues | | $ | 2,437.5 | | | $ | 1,021.9 | | | | | $ | — | |

| Adjusted EBITDA margin | | 29.6 | % | | 21.1 | % | | | | NM |

(1)Includes other non-operating (income) expense, net, which may be presented in separate line items on the unaudited Consolidated Statements of Income.

Carlisle Companies Incorporated

Unaudited Non-GAAP Financial Measures - Adjusted Net Income and Adjusted Diluted EPS

Adjusted net income and adjusted diluted earnings per share is intended to provide investors and others with information about Carlisle's performance without the effect of items that, by their nature, tend to obscure Carlisle's core operating results due to potential variability across periods based on the timing, frequency and magnitude of such items. This information differs from net income and diluted earnings per share determined in accordance with GAAP and should not be considered in isolation or as a substitute for measures of performance determined in accordance with GAAP. Carlisle's adjusted net income and adjusted diluted earnings per share follows, which may not be comparable to similarly titled measures reported by other companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, 2024 | | Three Months Ended

September 30, 2023 |

| (in millions, except per share amounts) | | Pre-tax

Impact | | After-tax Impact(1) | | Impact to Diluted EPS(2) | | Pre-tax

Impact | | After-tax Impact(1) | | Impact to Diluted EPS(2) |

| Net income (GAAP) | | | | $ | 244.3 | | | $ | 5.25 | | | | | $ | 265.6 | | | $ | 5.29 | |

| Less: Income (loss) from discontinued operations (GAAP) | | | | (2.3) | | | (0.05) | | | | | 48.7 | | | 0.97 | |

| Income from continuing operations (GAAP) | | | | 246.6 | | | 5.30 | | | | | 216.9 | | | 4.32 | |

| Exit and disposal, and facility rationalization costs | | 1.9 | | | 1.5 | | | 0.03 | | | 1.7 | | | 1.1 | | | 0.02 | |

| Inventory step-up amortization and transaction costs | | 2.7 | | | 2.0 | | | 0.04 | | | — | | | — | | | — | |

| Impairment charges | | — | | | — | | | — | | | 0.5 | | | 0.3 | | | 0.01 | |

| Gains from acquisitions and disposals | | (0.3) | | | (0.2) | | | — | | | (0.7) | | | (0.4) | | | (0.01) | |

| Losses from insurance | | — | | | — | | | — | | | — | | | — | | | — | |

| Losses from litigation | | 1.5 | | | 1.1 | | | 0.03 | | | — | | | — | | | — | |

| | | | | | | | | | | | |

Acquisition-related amortization(3) | | 25.4 | | | 19.2 | | | 0.41 | | | 20.9 | | | 15.8 | | | 0.32 | |

Discrete tax items(4) | | — | | | (1.3) | | | (0.03) | | | — | | | 1.1 | | | 0.02 | |

| Total adjustments | | | | 22.3 | | | 0.48 | | | | | 17.9 | | | 0.36 | |

| Adjusted net income | | | | $ | 268.9 | | | $ | 5.78 | | | | | $ | 234.8 | | | $ | 4.68 | |

(1)The impact to net income reflects the tax effect of noted items, which is based on the statutory rate in the jurisdiction in which the expense or income is deductible or taxable.

(2)The per share impact of adjustments to each period is based on diluted shares outstanding using the two-class method.

(3)Acquisition-related amortization includes the amortization of customer relationships, technology, trade names and other intangible assets recorded in purchase accounting in connection with a business combination. These intangible assets contribute to revenue generation and the amortization of these assets will recur until such intangible assets are fully amortized.

(4)Discrete tax items include current period tax expense or benefit related to prior year items, excess tax benefits from stock compensation, the tax impact of foreign currency gains and losses, or changes in tax laws or rates.

Carlisle Companies Incorporated

Unaudited Non-GAAP Financial Measures - Adjusted Net Income and Adjusted Diluted EPS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended

September 30, 2024 | | Nine Months Ended

September 30, 2023 |

| (in millions, except per share amounts) | | Pre-tax

Impact | | After-tax Impact(1) | | Impact to Diluted EPS(2) | | Pre-tax

Impact | | After-tax Impact(1) | | Impact to Diluted EPS(2) |

| Net income (GAAP) | | | | $ | 1,149.0 | | | $ | 24.10 | | | | | $ | 561.9 | | | $ | 11.00 | |

| Less: Income (loss) from discontinued operations (GAAP) | | | | 446.3 | | | 9.36 | | | | | 34.7 | | | 0.68 | |

| Income from continuing operations (GAAP) | | | | 702.7 | | | 14.74 | | | | | 527.2 | | | 10.32 | |

| Exit and disposal, and facility rationalization costs | | 2.7 | | | 2.1 | | | 0.04 | | | 4.5 | | | 3.3 | | | 0.06 | |

| Inventory step-up amortization and acquisition costs | | 4.8 | | | 3.6 | | | 0.08 | | | 1.6 | | | 1.2 | | | 0.02 | |

| Impairment charges | | — | | | — | | | — | | | 1.8 | | | 1.3 | | | 0.03 | |

| (Gains) losses from acquisitions and disposals | | (0.6) | | | (0.4) | | | (0.01) | | | 1.8 | | | 1.4 | | | 0.03 | |

| Gains from insurance | | (5.0) | | | (3.8) | | | (0.08) | | | — | | | — | | | — | |

| Losses (gains) from litigation | | 1.9 | | | 1.4 | | | 0.03 | | | (0.2) | | | (0.1) | | | — | |

| | | | | | | | | | | | |

Acquisition-related amortization(3) | | 70.5 | | | 53.1 | | | 1.11 | | | 63.0 | | | 47.4 | | | 0.93 | |

Discrete tax items(4) | | — | | | (9.8) | | | (0.20) | | | — | | | (1.8) | | | (0.04) | |

| Total adjustments | | | | 46.2 | | | 0.97 | | | | | 52.7 | | | 1.03 | |

| Adjusted net income | | | | $ | 748.9 | | | $ | 15.71 | | | | | $ | 579.9 | | | $ | 11.35 | |

(1)The impact to net income reflects the tax effect of noted items, which is based on the statutory rate in the jurisdiction in which the expense or income is deductible or taxable.

(2)The per share impact of adjustments to each period is based on diluted shares outstanding using the two-class method.

(3)Acquisition-related amortization includes the amortization of customer relationships, technology, trade names and other intangible assets recorded in purchase accounting in connection with a business combination. These intangible assets contribute to revenue generation and the amortization of these assets will recur until such intangible assets are fully amortized.

(4)Discrete tax items include current period tax expense or benefit related to prior year items, the tax impact of foreign currency gains and losses, or changes in tax laws or rates.

v3.24.3

Cover Page Statement

|

Oct. 24, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 24, 2024

|

| Entity Registrant Name |

CARLISLE COMPANIES INCORPORATED

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-09278

|

| Entity Tax Identification Number |

31-1168055

|

| City Area Code |

480

|

| Local Phone Number |

781-5000

|

| Entity Address, Address Line One |

16430 North Scottsdale Road

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Scottsdale

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85254

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000790051

|

| Amendment Flag |

false

|

| Common stock, $1 par value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, $1 par value

|

| Trading Symbol |

CSL

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementEquityComponentsAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

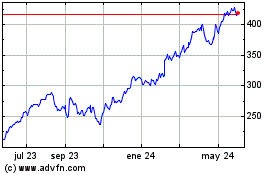

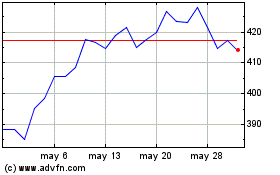

Carlisle Companies (NYSE:CSL)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

Carlisle Companies (NYSE:CSL)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024