UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, For Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material under § 240.14a-12 |

Kellanova

(Name of

Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11 |

This Schedule 14A relates solely to preliminary communications made prior to furnishing security holders of

Kellanova (the “Company”) with a definitive proxy statement related to a proposed transaction with Mars, Incorporated (“Parent”), in which Merger Sub 10VB8, LLC, a Delaware limited liability company (“Merger Sub”) will

merge with and into the Company, with the Company continuing as the surviving corporation, such that following the merger, the Company will be a wholly-owned direct or indirect subsidiary of Acquiror 10VB8, LLC, a Delaware limited liability company

(“Acquiror”) (collectively, the “Transaction”), upon the terms and subject to the conditions set forth in the Agreement and Plan of Merger, dated as of August 13, 2024 (the “Merger Agreement”), by and among the

Company, Merger Sub, Acquiror and, solely for the limited purposes specified in the Merger Agreement, Parent.

This Schedule 14A filing consists of the

following documents relating to the Transaction:

| 1. |

Questions and Answers provided to Company employees and posted to the Company’s website,

futureofsnacking.com (the “Transaction Website”), on August 14, 2024. |

| 2. |

An email from the Company’s CEO provided to employees on August 14, 2024. |

| 3. |

An email from the CEO and Global President of Parent provided to the Company’s employees on

August 14, 2024. |

| 4. |

A message from the Company provided to all global employees on August 14, 2024. |

| 5. |

An employee news post provided to employees on August 14, 2024. |

| 6. |

An infographic made available on the Transaction Website on August 14, 2024. |

| 7. |

A timeline infographic made available on the Transaction Website on August 14, 2024.

|

| 8. |

A notification letter provided by the Company to retirees on August 14, 2024. |

| 9. |

An internal Viva Engage post provided to employees on August 14, 2024. |

| 10. |

The contents of the Transaction Website, which were made available on August 14, 2024.

|

| 11. |

A transcript of the video from the Company’s CEO and Parent’s CEO provided to employees on

August 14, 2024. |

| 12. |

An email from the Company’s CEO provided to certain employees in leadership positions on August 14,

2024. |

| 13. |

An email from the Company provided to certain employees in management positions on August 14, 2024.

|

| 14. |

A communications guide for managers of the Company provided on August 14, 2024. |

| 15. |

Global Town Hall slides from the presentation provided to employees on August 14, 2024.

|

| 16. |

A transcript of the interview among the Company’s CEO, the Parent’s CEO and Sara Eilsen, which

originally aired on CNBC on August 14, 2024. |

| 17. |

A transcript of the Global Town Hall presentation provided to employees on August 14, 2024.

|

* * *

Mars to Acquire Kellanova

Frequently Asked Questions

| |

1. |

What did Kellanova and Mars announce today? |

| |

• |

|

On August 14, Mars and Kellanova announced that they entered into a definitive agreement under which Mars

has agreed to acquire Kellanova. |

| |

• |

|

The transaction would unite two iconic businesses with complementary categories, markets and portfolios of

differentiated and beloved brands. |

| |

• |

|

The combination would bring together world-class talent with leading brand-building experience to further develop

a sustainable snacking business that is fit for the future. |

| |

• |

|

With compelling cultural and strategic fit, the combined company would provide Kellanova’s brands with

dedicated investment and resources that will help them grow for future generations. |

| |

2. |

What was the sale price? What was the premium? |

| |

• |

|

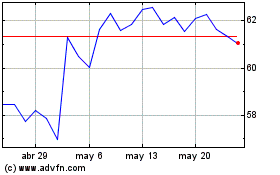

Mars has agreed to acquire Kellanova for $83.50 per share in cash, for a total consideration of

$35.9 billion. |

| |

• |

|

The transaction price represents a premium of approximately 44% to Kellanova’s unaffected 30-trading day volume weighted average price and a premium of approximately 33% to Kellanova’s unaffected 52 week high as of August 2, 2024. |

| |

• |

|

The total consideration represents an acquisition multiple of 16.4x LTM adjusted EBITDA as of June 30, 2024.

|

| |

3. |

Why is Kellanova merging with Mars? |

| |

• |

|

Kellanova has been on a transformation journey to become the world’s best

snacks-led company, and this opportunity to join Mars enables us to accelerate the realization of our full potential and our vision. |

| |

• |

|

The transaction would unite two iconic businesses with complementary categories, markets, and portfolios of

differentiated and beloved brands. |

| |

• |

|

The combination would bring together world-class talent with leading brand-building experience to further develop

a sustainable business that is fit for the future. |

| |

• |

|

With compelling cultural and strategic fit, the combined company would provide Kellanova’s brands with

dedicated investment and resources that will help them grow for future generations. |

| |

4. |

As a shareowner, what happens to my current shares of Kellanova upon closing of this transaction?

|

| |

• |

|

At closing, all Kellanova shareowners will receive $83.50 per share for each share of Kellanova stock they own.

|

| |

5. |

How do the Mars and Kellanova geographic footprints compare? |

| |

• |

|

Mars and Kellanova have largely complementary geographic operations. |

| |

• |

|

Geographically, this deal will expand our combined presence in places like Africa and China, creating the #1 route-to-market in snacking, as well as leapfrog Mars to the #1 position with the acquisition of complementary products and with improved profitability in key Latin American

markets. |

| |

6. |

What is the manufacturing overlap between Kellanova and Mars? |

| |

• |

|

Kellanova and Mars have largely complementary manufacturing and operations, given Kellanova’s geographic

presence and expertise in snacking while Mars has a legacy and expertise in chocolate and confections, chewing gum, and food. |

| |

• |

|

Geographically, this deal will expand our combined presence in places like Africa and China, creating the #1 route-to-market in snacking, as well as leapfrog Mars to the #1 position with the acquisition of complementary products and with improved profitability in key Latin American

markets. |

| |

• |

|

We look forward to leveraging best practices from both businesses upon closing. |

| |

7. |

Will any of Kellanova’s products be changing as a result of this announcement?

|

| |

• |

|

Consumers will continue to enjoy the Kellanova brands they know and love, and those brands will build on their

legacies to meet evolving snacking needs. |

| |

• |

|

In addition, the companies remain independent until closing and it will be business as usual until then.

|

| |

8. |

Will Mars keep all of the Kellanova brands? |

| |

• |

|

Kellanova’s iconic brands and their strong legacies are part of what made Kellanova so attractive to Mars.

|

| |

• |

|

Mars has no plans at this time to sunset any Kellanova brands. |

| |

9. |

Will Mars keep Kellanova’s brand names on products going forward (i.e., Kellogg’s, Pringles,

Cheez-It)? |

| |

• |

|

Yes. Mars intends to honor the heritage and innovation behind Kellanova’s incredible brands while combining

our respective strengths to deliver more choice and innovation to consumers and customers. |

| |

• |

|

Consumers will continue to enjoy the Kellanova brands they know and love, and those brands will build on their

legacies to meet evolving snacking needs. |

| |

• |

|

Mars has a strong track record of growing hugely successful global brands – with 15 brands each having

surpassed $1 billion in annual sales – and will provide Kellanova’s brands with additional investment and resources that will help them grow for future generations. |

| |

10. |

How has Kellanova built a more growth-orientated portfolio? |

| |

• |

|

Kellanova has built a focused, growth-oriented, profitable business, with 80% of our net sales are in

growth-advantaged categories (snacks) and markets (emerging markets). |

| |

• |

|

We have continually explored opportunities to capitalize on consumer and market trends to transform our portfolio

and create a leader in global snacking, international cereal and noodles, and North American frozen foods. Strategic actions to achieve this have included: |

| |

• |

|

The acquisitions of Pringles (2012) and RXBAR (2017); |

| |

• |

|

The divestiture of the Keebler business (2019); and |

| |

• |

|

The spin-off of the North American cereal business (2023).

|

| |

• |

|

As a result of these strategic actions, Kellanova’s profit margins are growing and continue to improve.

|

| |

• |

|

We’ve also made tough decisions to effectively execute productivity initiatives, including:

|

| |

• |

|

Exiting the Direct Store Delivery migrated process to shared services; |

| |

• |

|

Extracting stranded costs after our divestiture and spin-off;

|

| |

• |

|

Boosting automation and digitization of our supply chain; and |

| |

• |

|

Commencing optimization of our manufacturing network. |

| |

• |

|

We’ve also invested in and advanced our capabilities in Revenue Growth Management, Kellogg Work Systems,

Data & Analysis, and the digitization of supply chain and marketing. |

| |

• |

|

In addition, Mars and Kellanova are values-based and purpose-led

organizations that have a similar culture of respect, integrity, and passion for our foods and brands, as well as strong reputations as leaders in the snacking industry. |

| |

11. |

Post close, how does Mars intend to run the combined business? |

| |

• |

|

After closing, the plan is to bring Kellanova fully into Mars Snacking and combine our businesses.

|

| |

• |

|

Andrew Clarke, Global President of Mars Snacking, will lead the combined business. |

| |

• |

|

A joint integration team of leaders from both Mars and Kellanova will be assembled at the appropriate time to

determine how best to combine Kellanova with the Mars Snacking business. |

| |

12. |

Post close, where will the combined business be run from? |

| |

• |

|

Mars Snacking remains headquartered in Chicago. The company has always had a large Chicagoland presence –

Wrigley started in Chicago in 1891 and Mars has been in the city for almost 100 years. |

| |

• |

|

A joint integration team of leaders from both Mars and Kellanova will be assembled at the appropriate time to

determine how best to combine Kellanova with the Mars Snacking business. |

| |

13. |

Post close, what will happen to the Kellanova name? |

| |

• |

|

After closing, all of Kellanova will be fully combined with Mars Snacking and will no longer be known as

Kellanova. |

| |

14. |

What will happen to Kellanova’s Battle Creek headquarters? Will the combined company maintain a

presence in Battle Creek? |

| |

• |

|

After closing, Battle Creek, MI, will remain a core location for the combined organization.

|

| |

• |

|

As a company with a long history and deep roots into the communities in which they operate, Mars understands and

appreciates the special role Battle Creek plays in the Kellanova culture, as well as the highly complementary category expertise that Kellanova talent brings. |

| |

• |

|

This announcement is the first step toward uniting Kellanova and Mars – there are many specifics that we

will determine as part of the integration process, which will begin at closing. |

| |

• |

|

A joint integration team of leaders from both Mars and Kellanova will be assembled at the appropriate time to

determine how best to combine Kellanova with the Mars Snacking business. |

| |

• |

|

Mars’s long-term goal is to grow all aspects of the business. |

| |

15. |

What will happen to Kellanova’s Chicago headquarters? Will the combined company maintain a presence in

Chicago? |

| |

• |

|

Mars Snacking remains headquartered in Chicago. The company has always had a large Chicagoland presence –

Wrigley started in Chicago in 1891 and Mars has been in the city for almost 100 years. |

| |

• |

|

This announcement is the first step toward uniting Kellanova and Mars – there are many specifics that we

will determine as part of the integration process, which will begin at closing. |

| |

• |

|

A joint integration team of leaders from both Mars and Kellanova will be assembled at the appropriate time to

determine how best to combine Kellanova with the Mars Snacking business. |

| |

• |

|

We will keep our teams updated as the integration progresses. |

| |

16. |

Will Mars honor Kellanova’s union contracts? |

| |

• |

|

Yes. All of the collective bargaining agreements covering the union-represented facilities will remain in place

and there will be no change to those bargaining relationships in connection with the transaction. |

| |

• |

|

Mars fully respects employees’ rights to be represented by labor organizations and looks forward to

developing productive relationships with each of the organizations representing Kellanova’s employees. |

| |

17. |

What will happen to Kellanova’s Better Days Promise between signing and close? Once the transaction

closes? |

| |

• |

|

Kellanova has been a leader in advancing sustainable and equitable access to food globally, already achieving

Better Days for 3 billion people towards our goal of creating Better Days for 4 billion people by the end of 2030. |

| |

• |

|

Between signing and closing, Kellanova will continue to make progress against our goals to advance sustainable

and equitable access to food by addressing the intersection of wellbeing, hunger, sustainability and equity, diversity and inclusion. |

| |

• |

|

Upon close, Kellanova would become part of the Mars Net Zero commitment and align with the Mars Responsible

Marketing code. |

| |

18. |

How will this affect Kellanova’s community commitments in all communities where it operates?

|

| |

• |

|

We see this as a positive for all stakeholders. |

| |

• |

|

Mars and Kellanova share a strong focus on delivering sustainable growth that benefits their people, communities,

customers, and suppliers. |

| |

• |

|

After closing, the combined company will continue to play an active role in the communities in which it operates.

|

| |

• |

|

This announcement is the first step toward uniting Kellanova and Mars – there are many specifics that we

will determine as part of the integration process, which will begin at closing. |

| |

• |

|

A joint integration team will be assembled at the appropriate time to determine how best to combine Kellanova

with the Mars Snacking business. |

| |

• |

|

We will keep our teams updated as the integration progresses. |

| |

19. |

How will this affect Kellanova’s customer / supplier / partner relationships?

|

| |

• |

|

We see this as a positive for all stakeholders. |

| |

• |

|

This announcement is the first step toward uniting Kellanova and Mars – there are many specifics that we

will determine as part of the integration process, which will begin at closing. |

| |

• |

|

A joint integration team of leaders from both Mars and Kellanova will be assembled at the appropriate time to

determine how best to combine Kellanova with the Mars Snacking business. |

| |

• |

|

We will keep our customers, suppliers, partners, and other stakeholders updated as the integration progresses.

|

| |

20. |

What are the next steps in the transaction? When is the transaction expected to close?

|

| |

• |

|

The agreement has been unanimously approved by the Board of Directors of Kellanova. |

| |

• |

|

The transaction is subject to Kellanova shareholder approval and other customary closing conditions, including

regulatory approvals, and is anticipated to close within the first half of 2025. |

Forward-Looking Statements

This communication includes statements that are forward-looking statements made pursuant to the safe harbor provisions of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed acquisition (the “Merger”) of Kellanova (the “Company”) by Mars, Inc., stockholder and

regulatory approvals, the expected timetable for completing the Merger, the excepted continued benefits to employees in light of the Merger, and any other statements regarding the Company’s future expectations, beliefs, plans, objectives,

financial conditions, assumptions or future events or performance that are not historical facts. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These

risks and uncertainties include, but are not limited to: failure to obtain the required vote of the Company’s stockholders in connection with the Merger; the timing to consummate the Merger and the risk that the Merger may not be completed at

all or the occurrence of any event, change, or other circumstances that could give rise to the termination of the merger agreement, including circumstances requiring a party to pay the other party a termination fee pursuant to the merger

agreement; the risk that the conditions to closing of the Merger may not be satisfied or waived; the risk that a governmental or regulatory approval that may be required for the Merger is not obtained or is obtained subject to conditions that are

not anticipated; potential litigation relating to, or other unexpected costs resulting from, the Merger; legislative, regulatory, and economic developments; risks that the proposed transaction disrupts the Company’s current plans and

operations; the risk that certain restrictions during the pendency of the proposed transaction may impact the Company’s ability to pursue certain business opportunities or strategic transactions; the diversion of management’s time on

transaction-related issues; continued availability of capital and financing and rating agency actions; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the Company’s common

stock, credit ratings or operating results; and the risk that the proposed transaction and its announcement could have an adverse effect on the ability to retain and hire key personnel, to retain customers and to maintain relationships with business

partners, suppliers and customers. The Company can give no assurance that the conditions to the Merger will be satisfied, or that it will close within the anticipated time period.

All statements, other than statements of historical fact, should be considered forward-looking statements made in good faith by the Company, as applicable,

and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. When used in this communication, or any other documents, words such as “anticipate,” “believe,”

“estimate,” “expect,” “forecast,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” “will” and

similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such

forward-looking statements are subject to risks and uncertainties that could cause the Company’s actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as

other risks and uncertainties that could cause the actual results to differ materially from those expressed in the forward-looking statements, are described in greater detail under the heading “Item 1A. Risk Factors” in the

Company’s Annual Report on Form 10-K for the year ended December 30, 2023 filed with the United States Securities and Exchange Commission (the “SEC”) and in any other SEC filings made by the Company. The Company

cautions that these risks and factors are not exclusive. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking

statements speak only as of the date of this communication, and, except as required by applicable law, the Company does not undertake any obligation to update or supplement any forward-looking statements to reflect actual results, new information,

future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made.

Additional Information about the Proposed Merger and Where to Find It

A meeting of stockholders of the Company will be announced as promptly as practicable to seek Company stockholder approval in connection with the Merger. The

Company intends to file a preliminary and definitive proxy statement, as well as other relevant materials, with the SEC relating to the Merger. Following the filing of the definitive proxy statement with the SEC, the Company will mail the definitive

proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the Merger. This communication is not intended to be, and is not, a substitute for the proxy statement or any other document that the Company

expects to file with the SEC in connection with the Merger. THE COMPANY URGES INVESTORS TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND THESE OTHER MATERIALS FILED WITH THE SEC OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT

(INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE MERGER. Any vote in respect of resolutions to be proposed at the

Company’s stockholder meeting to approve the Merger or other responses in relation to the Merger should be made only on the basis of the information contained in the proxy statement. Investors will be able to obtain free copies of the proxy

statement (when available) and other documents that will be filed by the Company with the SEC at http://www.sec.gov, the SEC’s website, or from the Company’s website (https://investor.Kellanova.com). In addition, the proxy statement and

other documents filed by the Company with the SEC (when available) may be obtained from the Company free of charge by directing a request to Investor Relations at https://investor. Kellanova.com.

No Offer or Solicitation

This communication is for

information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities,

or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of

securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the Solicitation

The Company, its

directors and certain of its officers and employees, may be deemed to be participants in the solicitation of proxies from Company stockholders in connection with the Merger. Information about the Company’s directors and executive officers is

set forth under the captions “Proposal 1–Election of Directors,” “Corporate Governance,” “Board and Committee Membership,” “2023 Director Compensation and Benefits,” “Directors’ Compensation

Table,” “Compensation and Talent Management Committee Report–Compensation Discussion and Analysis,” “Executive Compensation,” “Retirement and Non-Qualified Defined Contribution and Deferred Compensation

Plans,” “Potential Post-Employment Payments,” “Pay versus Performance,” “CEO Pay Ratio” and “Stock Ownership–Officer and Director Stock Ownership” sections of the definitive proxy statement for the

Company’s 2024 annual meeting of shareowners, filed with the SEC on March 4, 2024, under the caption “Executive Officers” of Item 1 of

the Company’s Annual Report on Form 10-K for the fiscal year ended December 30, 2023, filed with the SEC on February 20, 2024, in the

Company’s Current Reports on Form 8-K filed with the SEC on January

12, 2024, February 22, 2024, and May 1, 2024 and

in the Company’s January 12, 2024 press release found on its Investor Relations page at https://investor.Kellanova.com, relating to the appointment of President Kellanova North America and President, Kellanova Latin America. Additional

information regarding ownership of the Company’s securities by its directors and executive officers is included in such persons’ SEC filings on Forms 3 and 4. These documents may be obtained free of charge at the SEC’s web site

at www.sec.gov and on the Investor Relations page of the Company’s website located at https://investor. Kellanova.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the Merger

will be included in the proxy statement that the Company expects to file in connection with the Merger and other relevant materials the Company may file with the SEC.

CEO Email with Video Message

From: Steve Cahillane

To: Global employees

For Emailing: 08/14/24 at 7:01 am

Subj: Important company update

Today we are announcing

big news. We are continuing our journey to unleash Kellanova’s potential, and Kellanova will be acquired by Mars in a combination that will shape the future of snacking.

I want to tell you more about it, and I know you want to hear more about how this came to be, why this is the right move for us, and the opportunities that

now lie ahead. Please join me for Global Town Halls today at 10:00 am ET and 7:00 pm ET. Poul Weihrauch, CEO and Office of the President of Mars, Incorporated, will also be joining me today for a fireside chat at 5:00 pm ET. Those invitations to

follow.

In the meantime, please watch this video message and read the press release for more detail.

I know this news will elicit a range of emotions and affect each of you differently. I ask that you do what we do at Kellanova, be kind and supportive of one

another. As we work to combine these two great companies, it will be business as usual for us both until closing, which is expected within the first half of 2025.

I look forward to connecting with you soon.

Steve

Forward-Looking Statements

This communication includes

statements that are forward-looking statements made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements

regarding the proposed acquisition (the “Merger”) of Kellanova (the “Company”) by Mars, Inc., stockholder and regulatory approvals, the expected timetable for completing the Merger, the excepted continued benefits to employees in

light of the Merger, and any other statements regarding the Company’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. This information may involve

risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: failure to obtain the required vote of the Company’s stockholders

in connection with the Merger; the timing to consummate the Merger and the risk that the Merger may not be completed at all or the occurrence of any event, change, or other circumstances that could give rise to the termination of the merger

agreement, including circumstances requiring a party to pay the other party a termination fee pursuant to the merger agreement; the risk that the conditions to closing of the Merger may not be satisfied or waived; the risk that a governmental or

regulatory approval that may be required for the Merger is not obtained or is obtained subject to conditions that are not anticipated; potential litigation relating to, or other unexpected costs resulting from, the Merger; legislative, regulatory,

and economic developments; risks that the proposed transaction disrupts the Company’s current plans and operations; the risk that certain restrictions during the pendency of the proposed transaction may impact the Company’s ability to

pursue certain business opportunities or strategic transactions; the diversion of management’s time on transaction-related issues; continued availability of capital and financing and rating agency actions; the risk that any announcements

relating to the proposed transaction could have adverse effects on the market price of the Company’s common stock, credit ratings or operating results; and the risk that the proposed transaction and its announcement could have an adverse effect

on the ability to retain and hire key personnel, to retain customers and to maintain relationships with business partners, suppliers and customers. The Company can give no assurance that the conditions to the Merger will be satisfied, or that it

will close within the anticipated time period.

All statements, other than statements of historical fact, should be considered forward-looking statements

made in good faith by the Company, as applicable, and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. When used in this communication, or any other documents, words such

as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,”

“strategy,” “target,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these

statements were prepared and are inherently uncertain. Such forward-looking statements are subject to risks and uncertainties that could cause the Company’s actual results to differ materially from those expressed or implied in the

forward-looking statements. These risks and uncertainties, as well as other risks and uncertainties that could cause the actual results to differ materially from those expressed in the forward-looking statements, are described in greater detail

under the heading “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 30, 2023 filed with the United States Securities and Exchange Commission (the “SEC”) and in any other SEC

filings made by the Company. The Company cautions that these risks and factors are not exclusive. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present

or prior earnings levels. Forward-looking statements speak only as of the date of this communication, and, except as required by applicable law, the Company does not undertake any obligation to update or supplement any forward-looking statements to

reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made.

Additional Information about the Proposed Merger and Where to Find It

A meeting of stockholders of the Company will be announced as promptly as practicable to seek Company stockholder approval in connection with the Merger. The

Company intends to file a preliminary and definitive proxy statement, as well as other relevant materials, with the SEC relating to the Merger. Following the filing of the definitive proxy statement with the SEC, the Company will mail the definitive

proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the Merger. This communication is not intended to be, and is not, a substitute for the proxy statement or any other document that the Company

expects to file with the SEC in connection with the Merger. THE COMPANY URGES INVESTORS TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND THESE OTHER MATERIALS FILED WITH THE SEC OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT

(INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE MERGER. Any vote in respect of resolutions to be proposed at the

Company’s stockholder meeting to approve the Merger or other responses in relation to the Merger should be made only on the basis of the information contained in the proxy statement. Investors will be able to obtain free copies of the proxy

statement (when available) and other documents that will be filed by the Company with the SEC at http://www.sec.gov, the SEC’s website, or from the Company’s website (https://investor.Kellanova.com). In addition, the proxy statement and

other documents filed by the Company with the SEC (when available) may be obtained from the Company free of charge by directing a request to Investor Relations at https://investor. Kellanova.com.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation

of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there

be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933,

as amended.

Participants in the Solicitation

The

Company, its directors and certain of its officers and employees, may be deemed to be participants in the solicitation of proxies from Company stockholders in connection with the Merger. Information about the Company’s directors and executive

officers is set forth under the captions “Proposal 1–Election of Directors,” “Corporate Governance,” “Board and Committee Membership,” “2023 Director Compensation and Benefits,” “Directors’

Compensation Table,” “Compensation and Talent Management Committee Report–Compensation Discussion and Analysis,” “Executive Compensation,” “Retirement and Non-Qualified Defined Contribution and Deferred

Compensation Plans,” “Potential Post-Employment Payments,” “Pay versus Performance,” “CEO Pay Ratio” and “Stock Ownership–Officer and Director Stock Ownership” sections of the definitive proxy

statement for the Company’s 2024 annual meeting of shareowners, filed with the SEC on March 4, 2024,

under the caption “Executive Officers” of Item 1 of the Company’s Annual Report on Form 10-K for the fiscal year ended December

30, 2023, filed with the SEC on February 20, 2024, in the Company’s Current Reports on Form 8-K filed

with the SEC on January 12, 2024,

February

22, 2024, and May 1, 2024 and in the Company’s January 12, 2024 press release found on its

Investor Relations page at https://investor.Kellanova.com, relating to the appointment of President Kellanova North America and President, Kellanova Latin America. Additional information regarding ownership of the Company’s securities by its

directors and executive officers is included in such persons’ SEC filings on Forms 3 and 4. These documents may be obtained free of charge at the SEC’s web site at www.sec.gov and on the Investor Relations page of the Company’s

website located at https://investor. Kellanova.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the Merger will be included in the proxy statement that the Company expects to file

in connection with the Merger and other relevant materials the Company may file with the SEC.

Kellanova Team,

On behalf

of everyone at Mars, Incorporated we wanted to write you to share how excited we are to have the Kellanova team join our company. We have long admired Kellanova and the incredible legacy you have built. Your hard work and dedication has solidified

Kellanova as a snacking leader with iconic brands and a remarkable global presence, and we deeply respect your commitment to quality manufacturing and making delicious snacks people all over the world enjoy. Your innovation and marketing are

world-class, and we admire your ability to adapt and meet evolving taste preferences in the markets where you operate.

We believe there are many reasons

that make Mars a natural home for Kellanova. We each have 100-year-plus storied histories and beloved brands with complementary portfolios and geographic footprints. Both businesses are performing well and have had success over many decades. But

beyond our business results, we both have incredible people at the heart of our businesses, and they are what drive our cultures and the values that make our two companies successful. We also share a deep commitment to making a positive impact on

society and helping make a difference to both people and the planet. Together, we have a real opportunity to help both our businesses achieve their full potential and collectively create a broad global snacking business to meet the needs of billions

of consumers with trusted, loved and innovative products.

As part of our Mars Snacking segment, Kellanova will be a cornerstone of our strategic vision.

Under Andrew Clarke’s leadership, we have a history of successfully expanding our portfolio through M&A and respecting and nurturing the brands that join Mars. We are excited to leverage our combined strengths, learn from each other, and

build our capabilities together. We will also have opportunities to unlock growth and innovation with our consumer and sustainability goals in mind.

By

way of background, our Mars Snacking Segment is home to leading brands including SNICKERS®, M&M’S®, TWIX®, DOVE®, EXTRA®, KIND®

and Nature’s Bakery®, with over 30,000 employees, which we call Associates. We have a clear Snacking Purpose – to inspire moments of everyday happiness – which connects

well with your Kellanova purpose of Creating better days and a place at the table for everyone through your trusted food brands. Our Snacking Purpose drives our bold Snacking ambition: to grow the snacking category responsibly by expanding

into more snacking occasions and double our Snacking business within the next decade.

More broadly, Mars is a privately held business and we maintain a

uniquely long-term view – thinking in generations, not quarters. Our organization is guided by the Mars Purpose, our Mars Compass and grounded in our Five Principles: Quality, Responsibility, Mutuality, Efficiency and Freedom. These Principles

have served as the foundation of who we are for over a century, and we are confident that Kellanova will join and contribute significantly to our culture.

We speak for all of Mars when we share our enthusiasm for the future and all that we will build together. We’re looking forward to welcoming Kellanova to

Mars Snacking and to working with you all very soon.

Regards,

|

|

|

|

Poul Weihrauch CEO and Office

of the President Mars, Incorporated |

|

Andrew Clarke Global

President Mars Snacking |

Forward-Looking Statements

This communication includes statements that are forward-looking statements made pursuant to the safe harbor provisions of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed acquisition (the “Merger”) of Kellanova (the “Company”) by Mars, stockholder and

regulatory approvals, the expected timetable for completing the Merger, the excepted continued benefits to employees in light of the Merger, and any other statements regarding the Company’s future expectations, beliefs, plans, objectives,

financial conditions, assumptions or future events or performance that are not historical facts. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These

risks and uncertainties include, but are not limited to: failure to obtain the required vote of the Company’s stockholders in connection with the Merger; the timing to consummate the Merger and the risk that the Merger may not be completed at

all or the occurrence of any event, change, or other circumstances that could give rise to the termination of the merger agreement, including circumstances requiring a party to pay the other party a termination fee pursuant to the merger agreement;

the risk that the conditions to closing of the Merger may not be satisfied or waived; the risk that a governmental or regulatory approval that may be required for the Merger is not obtained or is obtained subject to conditions that are not

anticipated; potential litigation relating to, or other unexpected costs resulting from, the Merger; legislative, regulatory, and economic developments; risks that the proposed transaction disrupts the Company’s current plans and operations;

the risk that certain restrictions during the pendency of the proposed transaction may impact the Company’s ability to pursue certain business opportunities or strategic transactions; the diversion of management’s time on

transaction-related issues; continued availability of capital and financing and rating agency actions; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the Company’s common

stock, credit ratings or operating results; and the risk that the proposed transaction and its announcement could have an adverse effect on the ability to retain and hire key personnel, to retain customers and to maintain relationships with business

partners, suppliers and customers. The Company can give no assurance that the conditions to the Merger will be satisfied, or that it will close within the anticipated time period.

All statements, other than statements of historical fact, should be considered forward-looking statements made in good faith by the Company, as applicable,

and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. When used in this communication, or any other documents, words such as “anticipate,” “believe,”

“estimate,” “expect,” “forecast,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” “will” and

similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such

forward-looking statements are subject to risks and uncertainties that could cause the Company’s actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as

other risks and uncertainties that could cause the actual results to differ materially from those expressed in the forward-looking statements, are described in greater detail under the heading “Item 1A. Risk Factors” in the Company’s

Annual Report on Form 10-K for the year ended December 30, 2023 filed with the United States Securities and Exchange Commission (the “SEC”) and in any other SEC filings made by the Company. The Company cautions that these risks and

factors are not exclusive. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of

the date of this communication, and, except as required by applicable law, the Company does not undertake any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its

expectations or other circumstances that exist after the date as of which the forward-looking statements were made.

Additional Information about the Proposed Merger and Where to Find It

A meeting of stockholders of the Company will be announced as promptly as practicable to seek Company stockholder approval in connection with the Merger. The

Company intends to file a preliminary and definitive proxy statement, as well as other relevant materials, with the SEC relating to the Merger. Following the filing of the definitive proxy statement with the SEC, the Company will mail the definitive

proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the Merger. This communication is not intended to be, and is not, a substitute for the proxy statement or any other document that the Company

expects to file with the SEC in connection with the Merger. THE COMPANY URGES INVESTORS TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND THESE OTHER MATERIALS FILED WITH THE SEC OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT

(INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE MERGER. Any vote in respect of resolutions to be proposed at the

Company’s stockholder meeting to approve the Merger or other responses in relation to the Merger should be made only on the basis of the information contained in the proxy statement. Investors will be able to obtain free copies of the proxy

statement (when available) and other documents that will be filed by the Company with the SEC at http://www.sec.gov, the SEC’s website, or from the Company’s website (https://investor.Kellanova.com). In addition, the proxy statement and

other documents filed by the Company with the SEC (when available) may be obtained from the Company free of charge by directing a request to Investor Relations at https://investor. Kellanova.com.

No Offer or Solicitation

This communication is for

information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities,

or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of

securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the Solicitation

The Company, its

directors and certain of its officers and employees, may be deemed to be participants in the solicitation of proxies from Company stockholders in connection with the Merger. Information about the Company’s directors and executive officers is

set forth under the captions “Proposal 1–Election of Directors,” “Corporate Governance,” “Board and Committee Membership,” “2023 Director Compensation and Benefits,” “Directors’ Compensation

Table,” “Compensation and Talent Management Committee Report–Compensation Discussion and Analysis,” “Executive Compensation,” “Retirement and Non-Qualified Defined Contribution and Deferred Compensation

Plans,” “Potential Post-Employment Payments,” “Pay versus Performance,” “CEO Pay Ratio” and “Stock Ownership–Officer and Director Stock Ownership” sections of the definitive proxy statement for the

Company’s 2024 annual meeting of shareowners, filed with the SEC on March 4, 2024, under the caption

“Executive Officers” of Item 1 of the Company’s Annual Report on Form 10-K for the fiscal year ended December

30, 2023, filed with the SEC on February 20, 2024, in the Company’s Current Reports on Form 8-K filed

with the SEC on January 12, 2024,

February

22, 2024, and May 1, 2024 and in the Company’s January 12, 2024 press release found on its

Investor Relations page at https://investor.Kellanova.com, relating to the appointment of President Kellanova North America and President, Kellanova Latin America. Additional information regarding ownership of the Company’s securities by its

directors and executive officers is included in such persons’ SEC filings on Forms 3 and 4. These documents may be obtained free of charge at the SEC’s web site at www.sec.gov and on the Investor Relations page of the Company’s

website located at https://investor. Kellanova.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the Merger will be included in the proxy statement that the Company expects to file

in connection with the Merger and other relevant materials the Company may file with the SEC.

Global K Connect Article

Audience: Global Employees

For posting: August 14, 2024, 7:01am ET

Kellanova to Combine with Mars, Incorporated

This is a

historic day for Kellanova. Today, Mars and Kellanova announced that they entered into a definitive agreement under which Mars will acquire Kellanova in a combination that will shape the future of snacking.

Mars will acquire Kellanova for $83.50 per share in cash, for a total consideration of $35.9 billion.

| |

• |

|

This transaction unites two iconic businesses with complementary categories, markets, and portfolios of

differentiated and beloved brands. |

| |

• |

|

The combination is also a strong cultural fit, bringing together two values-based and purpose-led businesses.

|

| |

• |

|

The transaction is subject to Kellanova shareholder approval and other customary closing conditions, including

regulatory approvals, and is anticipated to close within the first half of 2025. |

Mars is a family-owned, global leader in pet care,

snacking, and food.

| |

• |

|

Mars’ portfolio includes billion-dollar snacking and confectionery brands like SNICKERS®, M&M’S®, TWIX®,

DOVE®, and EXTRA®, as well as KIND® and Nature’s Bakery®. |

| |

• |

|

With more than 150,000 Associates across its Petcare, Snacking and Food businesses, Mars had 2023 Net Sales of

more than $50 billion. |

Like Kellanova, Mars has been on their own journey to build a global snacking leader. The combination will

bring together world-class talent with leading brand-building experience to further develop a sustainable snacking business that is fit for the future.

| |

• |

|

The portfolios of Kellanova and Mars are highly complementary, and Mars deeply values the complementary category

expertise that Kellanova talent brings. |

| |

• |

|

Mars aspires to grow the snacking category in a responsible way and win with more consumers in more snacking

occasions. Kellanova will be a cornerstone of that strategic vision, into which Mars will place an intense focus and investment in the years ahead. |

| |

• |

|

Mars has a strong track record of growing hugely successful global brands – with 15 brands each having

surpassed $1 billion in annual sales – and they will provide Kellanova’s brands with dedicated investment and resources that will help them grow for future generations. |

There is a strong cultural fit between Kellanova and Mars. The combination will bring together two values-based, purpose-led businesses.

| |

• |

|

Kellanova and Mars share people-focused cultures, a commitment to sustainability, a true sense of purpose, and a

deep history of success lasting more than a century. |

| |

• |

|

Like Kellanova through our Better Days Promise, Mars has made ambitious commitments to improve the lives of

people in communities where they source materials, as well as the lives of employees, customers and pets by working towards their science-based goals. |

| |

• |

|

The Mars culture is deeply rooted in its Five Principles – Quality, Responsibility, Mutuality, Efficiency

and Freedom. These principles are part of the Mars DNA and guide every employee, which they call Associates, in how they do business. |

As part of Mars, there will be substantial opportunity to shape the future of snacking.

| |

• |

|

Mars has tremendous respect for Kellanova’s legacy, brands and people and is excited to welcome us.

|

| |

• |

|

Mars has a proven track record of successfully protecting, respecting and nurturing acquired businesses and looks

forward to all we can achieve together. |

| |

• |

|

Over the long term, we expect the combination to increase investment in innovation and new capabilities –

and create the enhanced career opportunities for employees that come with doing so. |

This announcement is the first step toward

uniting Kellanova and Mars. The companies will remain entirely independent prior to closing, and it will continue to be business as usual in the meantime.

| |

• |

|

A joint integration team of leaders from both Mars and Kellanova will be assembled at the appropriate time to

determine how best to combine Kellanova with the Mars Snacking business. |

| |

• |

|

We will keep you updated as the process moves forward. |

Please review the comprehensive suite of resources to learn more.

| |

• |

|

Video message from Kellanova CEO Steve Cahillane and Mars CEO and Office of the President Poul Weihrauch [LINK]

|

| |

• |

|

Global Town Halls today at 10 am ET [LINK] and 7 pm ET [LINK] |

| |

• |

|

Fireside chat with Kellanova CEO Steve Cahillane and Mars CEO and Office of the President Poul Weihrauch at 5 pm

ET [LINK] |

| |

• |

|

Dedicated website: futureofsnacking.com |

Forward-Looking Statements

This communication includes

statements that are forward-looking statements made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements

regarding the proposed acquisition (the “Merger”) of Kellanova (the “Company”) by Mars, stockholder and regulatory approvals, the expected timetable for completing the Merger, the anticipated benefits of the Merger, and any other

statements regarding the Company’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. This information may involve risks and uncertainties that could

cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: failure to obtain the required vote of the Company’s stockholders in connection with the Merger; the

timing to consummate the Merger and the risk that the Merger may not be completed at all or the occurrence of any event, change, or other circumstances that could give rise to the termination of the merger agreement, including circumstances

requiring a party to pay the other party a termination fee pursuant to the merger agreement; the risk that the conditions to closing of the Merger may not be satisfied or waived; the risk that a governmental or regulatory approval that may be

required for the Merger is not obtained or is obtained subject to conditions that are not anticipated; potential litigation relating to, or other unexpected costs resulting from, the Merger; legislative, regulatory, and economic developments; risks

that the proposed transaction disrupts the Company’s current plans and operations; the risk

that certain restrictions during the pendency of the proposed transaction may impact the Company’s ability to pursue certain business opportunities or strategic transactions; the diversion

of management’s time on transaction-related issues; continued availability of capital and financing and rating agency actions; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price

of the Company’s common stock, credit ratings or operating results; and the risk that the proposed transaction and its announcement could have an adverse effect on the ability to retain and hire key personnel, to retain customers and to

maintain relationships with business partners, suppliers and customers. The Company can give no assurance that the conditions to the Merger will be satisfied, or that it will close within the anticipated time period.

All statements, other than statements of historical fact, should be considered forward-looking statements made in good faith by the Company, as applicable,

and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. When used in this communication, or any other documents, words such as “anticipate,” “believe,”

“estimate,” “expect,” “forecast,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” “will” and

similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such

forward-looking statements are subject to risks and uncertainties that could cause the Company’s actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as

other risks and uncertainties that could cause the actual results to differ materially from those expressed in the forward-looking statements, are described in greater detail under the heading “Item 1A. Risk Factors” in the Company’s

Annual Report on Form 10-K for the year ended December 30, 2023 filed with the United States Securities and Exchange Commission (the “SEC”) and in any other SEC filings made by the Company. The Company cautions that these risks and

factors are not exclusive. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of

the date of this communication, and, except as required by applicable law, the Company does not undertake any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its

expectations or other circumstances that exist after the date as of which the forward-looking statements were made.

Additional Information about the

Proposed Merger and Where to Find It

A meeting of stockholders of the Company will be announced as promptly as practicable to seek Company stockholder

approval in connection with the Merger. The Company intends to file a preliminary and definitive proxy statement, as well as other relevant materials, with the SEC relating to the Merger. Following the filing of the definitive proxy statement with

the SEC, the Company will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the Merger. This communication is not intended to be, and is not, a substitute for the proxy

statement or any other document that the Company expects to file with the SEC in connection with the Merger. THE COMPANY URGES INVESTORS TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND THESE OTHER MATERIALS FILED WITH THE SEC OR

INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE MERGER. Any

vote in respect of resolutions to be proposed at the Company’s stockholder meeting to approve the Merger or other responses in relation to the Merger should be made only on the basis of the information contained in the proxy statement.

Investors will be able to obtain free copies of the proxy statement (when available) and other documents that will be filed by the Company with the SEC at http://www.sec.gov, the SEC’s website, or from the Company’s website

(https://investor.Kellanova.com). In addition, the proxy statement and other documents filed by the Company with the SEC (when available) may be obtained from the Company free of charge by directing a request to Investor Relations at

https://investor. Kellanova.com.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation

of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there

be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933,

as amended.

Participants in the Solicitation

The

Company, its directors and certain of its officers and employees, may be deemed to be participants in the solicitation of proxies from Company stockholders in connection with the Merger. Information about the Company’s directors and executive

officers is set forth under the captions “Proposal 1–Election of Directors,” “Corporate Governance,” “Board and Committee Membership,” “2023 Director Compensation and Benefits,” “Directors’

Compensation Table,” “Compensation and Talent Management Committee Report–Compensation Discussion and Analysis,” “Executive Compensation,” “Retirement and Non-Qualified Defined Contribution and Deferred

Compensation Plans,” “Potential Post-Employment Payments,” “Pay versus Performance,” “CEO Pay Ratio” and “Stock Ownership–Officer and Director Stock Ownership” sections of the definitive proxy

statement for the Company’s 2024 annual meeting of shareowners, filed with the SEC on March 4, 2024,

under the caption “Executive Officers” of Item 1 of the Company’s Annual Report on Form 10-K for the fiscal year ended December

30, 2023, filed with the SEC on February 20, 2024, in the Company’s Current Reports on Form 8-K filed

with the SEC on January 12, 2024,

February

22, 2024, and May 1, 2024 and in the Company’s January 12, 2024 press release found on its

Investor Relations page at https://investor.Kellanova.com, relating to the appointment of President Kellanova North America and President, Kellanova Latin America. Additional information regarding ownership of the Company’s securities by its

directors and executive officers is included in such persons’ SEC filings on Forms 3 and 4. These documents may be obtained free of charge at the SEC’s web site at www.sec.gov and on the Investor Relations page of the Company’s

website located at https://investor. Kellanova.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the Merger will be included in the proxy statement that the Company expects to file

in connection with the Merger and other relevant materials the Company may file with the SEC.

Kellanova to Combine with Mars, Incorporated

This is a historic day for Kellanova. Today, Mars and Kellanova announced that they entered into a definitive agreement under which Mars will acquire Kellanova

in a combination that will shape the future of snacking.

Mars will acquire Kellanova for $83.50 per share in cash, for a total consideration of $35.9

billion.

| |

• |

|

This transaction unites two iconic businesses with complementary categories, markets, and portfolios of

differentiated and beloved brands. |

| |

• |

|

The combination is also a strong cultural fit, bringing together two values-based and purpose-led businesses.

|

| |

• |

|

The transaction is subject to Kellanova shareholder approval and other customary closing conditions, including

regulatory approvals, and is anticipated to close within the first half of 2025. |

Mars is a family-owned, global leader in pet care,

snacking, and food.

| |

• |

|

Mars’ portfolio includes billion-dollar snacking and confectionery brands like SNICKERS®, M&M’S®, TWIX®,

DOVE®, and EXTRA®, as well as KIND® and Nature’s Bakery®. |

| |

• |

|

With more than 150,000 Associates across its Petcare, Snacking and Food businesses, Mars had 2023 Net Sales of

more than $50 billion. |

Like Kellanova, Mars has been on their own journey to build a global snacking leader. The combination will bring

together world-class talent with leading brand-building experience to further develop a sustainable snacking business that is fit for the future.

| |

• |

|

The portfolios of Kellanova and Mars are highly complementary, and Mars deeply values the complementary category

expertise that Kellanova talent brings. |

| |

• |

|

Mars aspires to grow the snacking category in a responsible way and win with more consumers in more snacking

occasions. Kellanova will be a cornerstone of that strategic vision, into which Mars will place an intense focus and investment in the years ahead. |

| |

• |

|

Mars has a strong track record of growing hugely successful global brands – with 15 brands each having

surpassed $1 billion in annual sales – and they will provide Kellanova’s brands with dedicated investment and resources that will help them grow for future generations. |

There is a strong cultural fit between Kellanova and Mars. The combination will bring together two values-based, purpose-led businesses.

| |

• |

|

Kellanova and Mars share people-focused cultures, a commitment to sustainability, a true sense of purpose, and a

deep history of success lasting more than a century. |

| |

• |

|

Like Kellanova through our Better Days Promise, Mars has made ambitious commitments to improve the lives of

people in communities where they source materials, as well as the lives of employees, customers and pets by working towards their science-based goals. |

| |

• |

|

The Mars culture is deeply rooted in its Five Principles – Quality, Responsibility, Mutuality, Efficiency

and Freedom. These principles are part of the Mars DNA and guide every employee, which they call Associates, in how they do business. |

As part of Mars, there will be substantial opportunity to shape the future of snacking.

| |

• |

|

Mars has tremendous respect for Kellanova’s legacy, brands and people and is excited to welcome us.

|

| |

• |

|

Mars has a proven track record of successfully protecting, respecting and nurturing acquired businesses and looks

forward to all we can achieve together. |

| |

• |

|

Over the long term, we expect the combination to increase investment in innovation and new capabilities –

and create the enhanced career opportunities for employees that come with doing so. |

This announcement is the first step toward uniting

Kellanova and Mars. The companies will remain entirely independent prior to closing, and it will continue to be business as usual in the meantime.

| |

• |

|

A joint integration team of leaders from both Mars and Kellanova will be assembled at the appropriate time to

determine how best to combine Kellanova with the Mars Snacking business. |

| |

• |

|

We will keep you updated as the process moves forward. |

Forward-Looking Statements

This communication includes statements that are forward-looking statements made pursuant to the safe harbor provisions of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed acquisition (the “Merger”) of Kellanova (the “Company”) by Mars, stockholder and

regulatory approvals, the expected timetable for completing the Merger, the anticipated benefits of the Merger, and any other statements regarding the Company’s future expectations, beliefs, plans, objectives, financial conditions, assumptions

or future events or performance that are not historical facts. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but

are not limited to: failure to obtain the required vote of the Company’s stockholders in connection with the Merger; the timing to consummate the Merger and the risk that the Merger may not be completed at all or the occurrence of any event,

change, or other circumstances that could give rise to the termination of the merger agreement, including circumstances requiring a party to pay the other party a termination fee pursuant to the merger agreement; the risk that the conditions to

closing of the Merger may not be satisfied or waived; the risk that a governmental or regulatory approval that may be required for the Merger is not obtained or is obtained subject to conditions that are not anticipated; potential litigation

relating to, or other unexpected costs resulting from, the Merger; legislative, regulatory, and economic developments; risks that the proposed transaction disrupts the Company’s current plans and operations; the risk that certain restrictions

during the pendency of the proposed transaction may impact the Company’s ability to pursue certain business opportunities or strategic transactions; the diversion of management’s time on transaction-related issues; continued availability

of capital and financing and rating agency actions; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the Company’s common stock, credit ratings or operating results; and the

risk that the proposed transaction and its announcement could have an adverse effect on the ability to retain and hire key personnel, to retain customers and to maintain relationships with business partners, suppliers and customers. The Company can

give no assurance that the conditions to the Merger will be satisfied, or that it will close within the anticipated time period.

All statements, other

than statements of historical fact, should be considered forward-looking statements made in good faith by the Company, as applicable, and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation

Reform Act of 1995. When used in this communication, or any other documents, words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “goal,” “intend,”

“objective,” “plan,” “project,” “seek,” “strategy,” “target,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements

are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such forward-looking statements are subject to risks and uncertainties that could cause the Company’s actual

results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as other risks and uncertainties that could cause the actual results to differ materially from those expressed in

the forward-looking statements, are described in greater detail under the heading “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 30, 2023 filed with the United States Securities

and Exchange Commission (the “SEC”) and in any other SEC filings made by the Company. The Company cautions that these risks and factors are not exclusive. Management cautions against putting undue reliance on forward-looking statements or

projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of the date of this communication, and, except as required by applicable law, the Company does not undertake any

obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were

made.

Additional Information about the Proposed Merger and Where to Find It

A meeting of stockholders of the Company will be announced as promptly as practicable to seek Company stockholder approval in connection with the Merger. The

Company intends to file a preliminary and definitive proxy statement, as well as other relevant materials, with the SEC relating to the Merger. Following the filing of the definitive proxy statement with the SEC, the Company will mail the definitive

proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the Merger. This communication is not intended to be, and is not, a substitute for the proxy statement or any other document that the Company

expects to file with the SEC in connection with the Merger. THE COMPANY URGES INVESTORS TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS

AND THESE OTHER MATERIALS FILED WITH THE SEC OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE MERGER. Any vote in respect of resolutions to be proposed at the Company’s stockholder meeting to approve the Merger or other responses in relation to

the Merger should be made only on the basis of the information contained in the proxy statement. Investors will be able to obtain free copies of the proxy statement (when available) and other documents that will be filed by the Company with the SEC