IHS Markit, S&P Global Agree to Sell OPIS, Related Assets to News Corp for $1.15 Billion

02 Agosto 2021 - 7:06AM

Noticias Dow Jones

By Dave Sebastian

IHS Markit Ltd. and S&P Global Inc. said they agreed to sell

IHS Markit's Oil Price Information Service and related assets to

News Corp for $1.15 billion.

The businesses being sold also include Coal, Metals and Mining

and PetroChem Wire, the companies said Monday. S&P Global in

late 2020 agreed to buy IHS Markit for about $44 billion, a

landmark deal that would combine two of the largest providers of

data to Wall Street.

S&P Global and IHS Markit said the sale marks the

culmination of their decision to explore a divestiture of the

businesses as it works to get regulatory approval for the

combination. They said they expect to complete the sale at the

close of the combination in the fourth quarter.

News Corp, which owns The Wall Street Journal, HarperCollins

Publishers and news organizations in the U.K. and Australia, among

other assets, said the data, analytics and insights provider will

become part of Dow Jones' professional information business, which

includes Dow Jones Risk & Compliance, Dow Jones Newswires and

Factiva.

News Corp said it expects to get an estimated tax benefit of

$180 million as part of the deal.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

August 02, 2021 08:06 ET (12:06 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

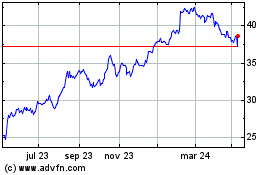

News (ASX:NWS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

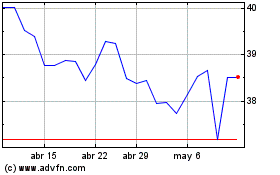

News (ASX:NWS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024