Paternoster Resources PLC Equity Placing (5250S)

26 Junio 2018 - 1:05AM

UK Regulatory

TIDMPRS

RNS Number : 5250S

Paternoster Resources PLC

26 June 2018

26 June 2018

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION EU 596/2014 ("MAR"). IN

ADDITION, MARKET SOUNDINGS (AS DEFINED IN MAR) WERE TAKEN IN

RESPECT OF THE MATTERS CONTAINED IN THIS ANNOUNCEMENT, WITH THE

RESULT THAT CERTAIN PERSONS BECAME AWARE OF SUCH INSIDE INFORMATION

AS PERMITTED BY MAR. THAT INSIDE INFORMATION IS SET OUT IN THIS

ANNOUNCEMENT AND HAS BEEN DISCLOSED AS SOON AS POSSIBLE IN

ACCORDANCE WITH PARAGRAPH 7 OF ARTICLE 17 OF MAR. UPON THE

PUBLICATION OF THIS ANNOUNCEMENT, THE INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL

THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION IN

RELATION TO THE COMPANY AND ITS SECURITIES

Paternoster Resources plc

("Paternoster" or the "Company")

Equity placing

At the General Meeting of the Company on 8 June 2018,

shareholders approved the necessary authorities to raise additional

funds, should demand from investors arise, to invest in

opportunities that may become available to the Company, given its

arrangement with RiverFort Global Capital Limited ("RiverFort"),

the specialist arranger of funding solutions, primarily to the

natural resources sector. Furthermore, it was anticipated that if

any such new funds were raised this would be done at or around the

prevailing market share price and that an appropriate opportunity

would also be made available to existing shareholders to enable

them to subscribe for new shares in the Company on similar

terms.

Paternoster is therefore very pleased to announce that the

Company has now placed (subject to admission to trading on AIM)

4,500,000,000 new ordinary shares of 0.1 pence each (the "Placing

Shares") at a price of 0.1 pence per share with institutional and

other investors to raise gross proceeds of GBP4,500,000

(the"Placing"). The fundraising was oversubscribed and allocations

were therefore scaled back.

Going forward, the Company will now be working closely with

RiverFort, to invest the funds raised in attractive opportunities

in the natural resources sector.

As part of the Placing, up to GBP180,000 has been allocated to

the Teathers App, which is owned by Teathers Financial plc. This

app will enable qualified retail investors, in particular,

qualifying existing Paternoster shareholders to participate in the

Placing on the same terms as other investors directly involved in

the Placing. In the event that there is an oversubscription through

the Teathers App, preference will be given to applications from

existing shareholders in Paternoster.

The Teathers App is a mobile application designed to give

qualified private investors access to placements and initial public

offerings ("IPOs"), predominantly on the London Stock Exchange AIM

market. To become an onboarded user of the Teathers App, visit the

App Store or Google Play, download the App for free and complete

the account application process. Only onboarded users of the

Teathers App may participate in deals offered through it. Shard

Capital Partners LLP ("Shard Capital") is the broker supporting the

Teathers App and provides the necessary regulatory environment,

including compliance oversight and client identification. Shard

Capital is regulated by the FCA.

Nicholas Lee, Chairman said:

"I am delighted that our strategy to work with RiverFort has

been so well supported by both new and existing investors and we

look forward to working closely with RiverFort going forward to

deploy the funds raised. This is a very significant development for

Paternoster and provides a very clear strategy for the Company for

the future."

Application will be made for the Placing Shares to be admitted

to trading on AIM ("Admission") and it is expected that Admission

will become effective on or around 4 July 2018. The Placing Shares

will rank pari passu with the existing ordinary shares of 0.1 pence

par value each ("Ordinary Shares").

Following the issue of the Placing Shares, the Company will have

6,289,335,226 Ordinary Shares in issue, each share carrying the

right to one vote. The Company does not hold any Ordinary Shares in

treasury. The above figure of 6,289,335,226 Ordinary Shares may be

used by shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

share capital of the Company under the Financial Conduct

Authority's Disclosure Guidance and Transparency Rules.

For more information please contact:

Paternoster Resources plc: +44 20 7580 7576

Nicholas Lee, Chairman

RiverFort Global Capital:

Graham Stirling +44 20 3411 2781

Nominated Advisor:

Beaumont Cornish +44 20 7628 3396

Roland Cornish

Joint Broker:

Shard Capital Partners LLP +44 20 7186 9950

Damon Heath

Erik Woolgar

Joint Broker to the Placing:

WH Ireland +44 207 220 1666

Harry Ansell

Katy Mitchell

James Sinclair-Ford

Joint Broker:

Peterhouse Corporate Finance +44 20 7562 3351

Lucy Williams

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEFKPDPOBKDNAB

(END) Dow Jones Newswires

June 26, 2018 02:05 ET (06:05 GMT)

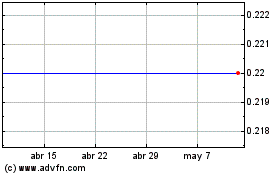

Riverfort Global Opportu... (LSE:RGO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

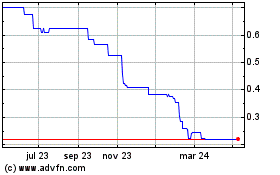

Riverfort Global Opportu... (LSE:RGO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024