Paternoster Resources PLC Equity placing (7889F)

31 Octubre 2018 - 1:00AM

UK Regulatory

TIDMPRS

RNS Number : 7889F

Paternoster Resources PLC

31 October 2018

31 October 2018

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION EU 596/2014 ("MAR"). IN

ADDITION, MARKET SOUNDINGS (AS DEFINED IN MAR) WERE TAKEN IN

RESPECT OF THE MATTERS CONTAINED IN THIS ANNOUNCEMENT, WITH THE

RESULT THAT CERTAIN PERSONS BECAME AWARE OF SUCH INSIDE INFORMATION

AS PERMITTED BY MAR. THAT INSIDE INFORMATION IS SET OUT IN THIS

ANNOUNCEMENT AND HAS BEEN DISCLOSED AS SOON AS POSSIBLE IN

ACCORDANCE WITH PARAGRAPH 7 OF ARTICLE 17 OF MAR. UPON THE

PUBLICATION OF THIS ANNOUNCEMENT, THE INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL

THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION IN

RELATION TO THE COMPANY AND ITS SECURITIES

Paternoster Resources plc

("Paternoster" or the "Company")

Equity placing

On 19 September 2018, the Company announced its interim results

for the six months to 30 June 2018. These results recorded a

significant improvement in the financial performance of the Company

as a result of its partnership with RiverFort Global Capital

Limited ("RiverFort"), the specialist arranger of funding solutions

to junior companies. On 10 October 2018, the Company announced that

it had now deployed over GBP1.8 million in Riverfort-arranged

investments. At the Company's Annual General Meeting held on 26

October 2018, shareholders overwhelmingly approved all resolutions,

including a change in the Company's name to RiverFort Global

Opportunities plc, in order to present a clearer market presence

for investment and to better reflect the Company's investment focus

going forward.

Given the significant progress that has been achieved by the

Company to date, there has been increased interest in the Company

from its institutional shareholder base. Against the background of

this increased investor interest, the Company has decided to raise

some additional funds. The Board believes that it is in the

interests of the Company to increase the depth of its shareholder

base. Furthermore, with markets becoming increasingly uncertain,

the number of investment opportunities available to the Company is

expected to increase and so it makes sense to raise additional

investment funds to take advantage of such opportunities.

Paternoster is therefore pleased to announce that the Company

has placed (subject to admission to trading on AIM) 500,000,000 new

ordinary shares in the Company (the "Placing Shares") at a price of

0.1 pence per share to raise gross proceeds of GBP500,000 (the

"Placing"). The Placing Shares have been placed at the same price

that funds were raised at in June 2018 and at a price equivalent to

the closing mid price of the shares on 30 October 2018.

Nicholas Lee, Chairman said:

"I am delighted that the progress of the Company is being

recognised and that our strategy is being well supported by our

shareholders. We are continuing to see a number of exciting

investment opportunities and are confident in being able to deploy

our investment funds effectively "

Application will be made for the Placing Shares to be admitted

to trading on AIM ("Admission") and it is expected that Admission

will become effective on or around 6 November 2018. The Placing

Shares will rank pari passu with the existing ordinary shares of

0.1 pence par value each ("Ordinary Shares").

Following the issue of the Placing Shares, the Company will have

6,789,335,226 Ordinary Shares in issue, each share carrying the

right to one vote. The Company does not hold any Ordinary Shares in

treasury. The above figure of 6,789,335,226 Ordinary Shares may be

used by shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

share capital of the Company under the Financial Conduct

Authority's Disclosure Guidance and Transparency Rules.

For more information please contact:

Paternoster Resources plc: +44 20 7580 7576

Nicholas Lee, Chairman

Nominated Advisor:

Beaumont Cornish +44 20 7628 3396

Roland Cornish

Joint Broker:

Shard Capital Partners LLP +44 20 7186 9950

Damon Heath

Erik Woolgar

Joint Broker to the Placing:

WH Ireland +44 207 220 1666

Harry Ansell

Joint Broker:

Peterhouse Corporate Finance +44 20 7562 3351

Lucy Williams

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEMMBTTMBTJTFP

(END) Dow Jones Newswires

October 31, 2018 03:00 ET (07:00 GMT)

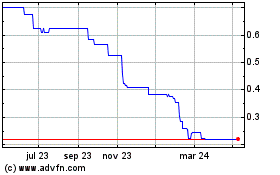

Riverfort Global Opportu... (LSE:RGO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

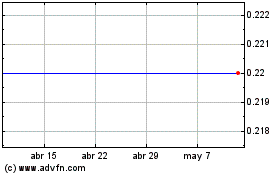

Riverfort Global Opportu... (LSE:RGO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024