TIDMPPC

RNS Number : 8036T

President Energy PLC

25 March 2019

25 March 2019

PRESIDENT ENERGY PLC

("President", "the Company" or "the Group")

Rio Negro Province, Argentina

Fully funded US$50 million 2019/2020 Work Programme

15 New wells, some 20 Workovers with pipeline and infrastructure

works

Programme set to deliver 50% exit production growth year on

year

President Energy (AIM: PPC), the upstream oil and gas company

with a diverse portfolio of production and exploration assets

focused primarily in South America, confirms plans for its work

programme for 2019/20 at its fields in Rio Negro Province,

Argentina (President 90%, Edhipsa 10%).

The estimated cost of the work programme between now and the end

of 2020 is approximately US$50 million and is anticipated to be

funded from President's existing cash flow without recourse to any

additional finance or borrowings ceteris paribus.

Summary Work Programme

2019

-- From now through mid-year an aggregate of at least 10

workovers in Puesto Flores (oil), Estancia Vieja (oil/gas), Puesto

Prado (oil) and Las Bases (gas) will be carried out. The rig is

currently being mobilised to the first well location

-- By end of May, the renovation and commissioning of the oil

treatment plant in Puesto Prado. The commencement of deliveries of

oil from the field direct to local refineries will give enhanced

margins (current production 150 bopd from this area)

-- From end of May through to November the first phase repair,

upgrading and commissioning of the multi-million dollar value gas

plant in Las Bases in order for it to have the capacity to handle

initially up to 250,000 m(3) of gas of President's own gas per day

by end of October. The pipeline is already transporting

approximately 20,000 m(3) per day of third party gas for which a

tariff is payable to President

-- In any event by mid-year gas flow will commence to the market

from the Las Bases and Estancia Vieja fields through temporary

facilities

-- From July through end of the year a target of seven new production/appraisal wells

-- By end September, the erection and completion of 14 km of new

overhead electric lines between Estancia Vieja and Puesto Flores

fields and the commissioning of an electricity generation plant to

power the latter field from the former's gas and to sell surplus

electricity generated to the grid

-- By end October, the commencement of increased volumes of gas

flowing through the building, completion and commissioning of a

brand new 16 km section of 4" steel pipeline to be laid between

Puesto Prado and Las Bases replacing the limited capacity 3"

flexible pipeline between those points

-- The commencement of a further workover programme from

October, details to be advised once the results of the present

campaign are reviewed

-- The continuation of infrastructure works throughout the year

2020

-- The drilling on a rolling continuous programme through the

year of an aggregate of eight new wells in Las Bases (gas), Puesto

Prado (gas/oil), Estancia Vieja (gas) and Puesto Flores (oil). The

wells being a combination of development, appraisal and exploration

wells

-- Phase Two of the upgrading of the Las Bases gas plant will be

completed to increase its capacity to its original design

capability of 1 million m(3) of gas

-- An aggregate of at least eight workovers of wells in the

various fields in Rio Negro will be carried out

Commentary

1. The above programme, estimated to cost approximately US$50

million between now and the end of 2020 is anticipated to be funded

from President's existing cash flow without recourse to additional

finance or further borrowing on current market factors remaining

broadly the same. Further, by end 2020 the Company's financial

borrowings will have reduced by over US$6 million as inter alia

bank borrowing facilities are steadily repaid.

2. Whilst modest in comparison to the total capex spend, the

proceeds from recent fund raise has performed a very helpful role

in enabling President to accelerate this programme as such

additional increment gathers operational momentum later in the

period.

3. The work now planned will power the significant growth of the

Company from its organic assets and is a major step up in activity

from that in 2018 when significant progress was achieved in all key

performance indicators.

4. In addition to the above programme which relates only to the

Company's Rio Negro assets, planning work will continue in parallel

for the drilling of up to two development wells in the Puesto

Guardian Concession, one exploration well in the Pirity Concession,

Paraguay, (President 100%) all targeted for end 2019/early 2020 and

up to four exploration wells at Jefferson Island, Louisiana,

(President 20% and operator) currently projected to commence by mid

2019. It is anticipated that all such work will likewise be funded

from the Company's own resources.

5. The Company is currently targeting 50% exit production growth

year on year in each of 2019 and 2020 and will provide updated

guidance during Q3 2019 as the work programme develops.

Glossary of terms

M(3) - million cubic metre of gas

Bopd- barrels of oil per day

For further information please contact:

President Energy PLC

Peter Levine, Chairman

Rob Shepherd, Group FD +44 (0) 207 016 7950

finnCap (Nominated Advisor)

Christopher Raggett, Scott Mathieson +44 (0) 207 220 0500

Panmure Gordon (Joint Broker)

Charles Lesser, Dominic Morley +44 (0) 207 886 2500

Whitman Howard (Joint Broker)

Hugh Rich, Grant Baker +44 (0) 207 659 1234

Tavistock (Financial PR)

Nick Elwes, Simon Hudson +44 (0) 207 920 3150

Notes to Editors

President Energy is an oil and gas company listed on the AIM

market of the London Stock Exchange (PPC.L) primarily focused in

Argentina, with a diverse portfolio of operated onshore producing

and exploration assets.

The Company has operated interests in the Puesto Flores,

Estancia Vieja, Puesto Prado and Las Bases Concessions, Rio Negro

Province as well as in the Neuquén Basin of Argentina and in the

Puesto Guardian Concession, in the Noroeste Basin in NW Argentina.

Alongside this, President Energy has cash generative production

assets in Louisiana, USA and further significant exploration and

development opportunities through its acreage in Paraguay and

Argentina.

The Group is also actively pursuing value accretive acquisitions

of high-quality production and development assets in Argentina

capable of delivering positive cash flows and shareholder returns.

With a strong institutional base of support, including the IFC,

part of the World Bank Group, an in-country management team as well

as a Board whose interests are aligned to those of its

shareholders, President Energy gives UK investors rare access to

the Argentinian growth story combined with world class standards of

corporate governance, environmental and social responsibility.

This announcement contains inside information for the purposes

of article 7 of Regulation 596/2014

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCCKQDDQBKDNNB

(END) Dow Jones Newswires

March 25, 2019 03:00 ET (07:00 GMT)

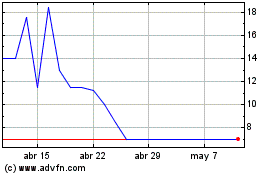

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024