TIDMPGH

RNS Number : 9531T

Personal Group Holdings PLC

26 March 2019

PERSONAL GROUP HOLDINGS PLC

("Personal Group", "Company" or "Group")

Preliminary Results For the Year Ended 31 December 2018

Another year of solid growth

Personal Group Holdings Plc, a leading provider of employee

services in the UK, is pleased to announce its Preliminary Results

for the year to 31 December 2018.

Highlights

Financial

-- Group revenue increased by 22% to GBP55.3m (2017: GBP45.2m)

-- Adjusted EBITDA* increased by 5.8% to GBP11.4m (2017: GBP10.8m)

-- Profit before tax increased by 7.4% to GBP10.2m (2017: GBP9.5m)

-- Earnings per share of 27.2p (2017: 26.9p)

-- Dividend increased by 1.3% to 23.0p

-- Strong balance sheet and no debt

Operational

-- Further year of strong new insurance sales, despite performance being impacted by GDPR

-- PG Let's Connect revenue increased by 33%, with client numbers increasing by 36%

-- SaaS related revenue increased by 229%, driven by the

increase in customer spend through the Hapi platform combined with

several new client wins, including some SaaS-only

-- Launched the Sage Employee Benefits (SEB) product to Sage's wider client base in Q4

-- Invested in sales and marketing to drive additional revenue opportunities

-- Accelerated plans to bring the supply chain in-house

Post period end

-- On 28(th) February, the Company acquired Innecto People

Consulting Limited for a cash consideration of GBP3.0m

-- In February 2019, the Company received information from HMRC

in relation to the PG Let's Connect tax provision which will result

in a further GBP0.5m being released in 2019

*Adjusted EBITDA is defined as earnings before interest, tax,

depreciation, amortisation of intangible assets, goodwill

impairment, share-based expense payments, corporate acquisition

costs, restructuring costs, write back of contingent consideration

and release of tax provision.

A reconciliation from PBT to this adjusted EBITDA can be seen in

note 1

Deborah Frost, Chief Executive of Personal Group, commented:

"2018 saw a good performance across the Group, with adjusted

EBITDA* of GBP11.4m broadly in line with market expectations,

reflecting the strength of the underlying business. We achieved

another year of strong new insurance sales whilst PG Let's Connect

showing clear signs of recovery, combined with continued growth in

SaaS revenue. This performance reflects investments made by the

Group which have strengthened our client offer, supported by our

proven team and ability to innovate to meet market needs. As we

move into 2019, we continue to be well placed to respond to the

opportunities being created.

"I would like to take the opportunity to thank the team at

Personal Group, clients and investors for the welcome I've received

since taking over as CEO a few weeks ago. I am very much encouraged

by what I have seen and look forward to building on the tremendous

contribution Mark Scanlon has made to the business."

Notes to Editors:

Personal Group Holdings Plc (AIM: PGH) is a technology enabled

employee services business, working with employers to drive

productivity though better employee engagement and a more motivated

workforce. With over 30 years' experience, the Company provides

employee benefits and services to over 2 million employees across

the UK.

Personal Group's offer comprises in-house services including

employee insurance products (hospital, convalescence plans and

death benefit), the provision of home technology via salary

sacrifice (iPads, computers, laptops, smart phones and smart TVs).

Third party services include retail discounts, e-payslips, employee

assistance programmes, wellbeing programmes and salary sacrifice

cars and bikes.

The offer is provided via the Company's proprietary technology

platform, Hapi. The platform is intuitive, designed primarily for

app deployment and also accessible via web and tablet, driving

better engagement, communication and value recognition. Hapi is

flexible and can quickly integrate additional services, such as

existing employee services and partner platforms. Hapi is a digital

Saas product.

Through technology and select acquisitions, the Company has

grown its addressable market from 6m to over 27m UK employees;

including 15.6m SME employees targeted via its partnership with

Sage, the UK's largest software company.

Personal Group's innovative approach to using technology to

deliver its programmes, combined with its face-to-face method of

communicating with employees, makes its offer compelling to blue

chip clients across the UK as a way of attracting, retaining and

motivating employees. The acquisition of Innecto in February 2019

allows Personal Group to engage with clients earlier in their

thinking around Pay and Reward, and to interact with a new base of

blue-chip and fast growth clients typically at HR Director and CEO

level.

Personal Group has a strong client base across a range of

sectors including passenger transport, healthcare, logistics and

food manufacturing. Clients include: Stagecoach, Four Seasons

Health Care, Priory Group, Spire Healthcare, Bibby, 2 Sisters Food

Group and Young's Seafood.

For further information, please see www.personalgroup.com

For more information please contact:

Personal Group Holdings Plc

Deborah Frost

Mike Dugdale +44 (0)1908 605 000

Philip Dennis (Investor Relations) +44 (0)7947 868 206

Cenkos Securities Plc

Max Hartley / Callum Davidson (Nomad) +44 (0)20 7397 8900

Russell Kerr (Sales)

Hudson Sandler (Financial PR)

Nick Lyon / Sophie Lister / Lucy Wollam +44 (0)20 7796 4133

Chairman's Introduction:

Personal Group was founded 35 years ago and continues to be

successful - we are profitable, growing and, once again, increasing

our dividend to shareholders.

Over the years, our market has changed, and we have faced

external challenges both of which have required thoughtful and

sometimes rapid response. 2018 was no different. We achieved

success in all three of our divisions, with trading ahead of that

for the previous year, despite facing some strong headwinds. The

change in the laws relating to personal data (GDPR) and a

subsequent security issue at one of our major third-party suppliers

led to a notable short term impact on our business, that was

swiftly and efficiently resolved. Despite such challenges, we were

able to deliver results for the year broadly in line with market

expectations.

Personal Group is well placed to respond to the opportunities

being created within our market. We believe that we have a market

proposition that is unrivalled amongst our peers and a team with a

depth of proven experience. Having invested substantially in the

business, we are well positioned to capitalise on opportunities

presented by an adapting labour market, which continues to increase

focus on a positive employment culture.

As a Board and Company, it is our job to unlock that opportunity

and value. To that end, in February 2019 we acquired Innecto, a

leading independent pay and reward consultancy. This acquisition

both broadens the services Personal Group has to offer, as well as

strengthening our position across all our services with clients. We

can now offer much more to each of our clients, be they Innecto

clients, Personal Group clients or those new to the Group. That

investment is now in place and we look forward to seeing the

benefits of it as 2019 progresses and beyond. Our focus is on

driving additional sales.

Personal Group entered 2019 in very good health and I thank

everyone for their hard work. I would particularly like to thank

Mark Scanlon, our departing CEO, who joined us in 2012. Mark has

provided leadership and drive that has materially reshaped Personal

Group. His personal energy and enthusiasm were infectious and I

thank him for his dedication, passion and overall tremendous

contribution. We have, in our new CEO, Deborah Frost, another

highly talented individual who is perfectly placed to lead the

company in its 35th year and beyond.

Our opportunity is to exploit Personal Group's strengths - old

and new - and make 2019 a year worthy of significant

celebration.

Business Divisions

The Company's core insurance business continued to perform well

with strong new insurance sales achieved throughout the year. This

reflects the strength of the Company's insurance offer which

continues to resonate well with clients' employees. Five of the

last six years have seen record new insurance sales results, with

2018 very close to a best-ever performance. The offer comprises a

core hospital cash plan, a convalescence plan and a death benefit

plan.

The impact of GDPR in May 2018 resulted in clients delaying

their decision making, both in terms of existing business and

winning new clients. As the year progressed, the impact lessened as

clients became more familiar and comfortable with the legislation.

The core platform, Hapi, requires pre-loading of employee data to

operate most efficiently and the sensitivity of employers to

providing this information was significantly heightened, making the

decision process longer and more convoluted. The positive to this

is that we have met a very high standard and established stronger

ties with our customers as we have become an even more trusted

partner.

The security issues in the Company's third-party supply chain in

late 2018 also impacted our client relationships. The team

undertook immediate and effective remedial action to rectify

these.

The Company's strong technological capability through Hapi, its

proprietary platform, meant that it could effectively deal with the

inbound issue but not without some client impact.

These challenges had a knock-on effect on the Company's

insurance sales team and as such the Company exited the year with

fewer frontline sales people in the field. A core focus early in

2019 has been to grow the team, with a goal of recruiting and

training several new sales people as early in the year as possible.

Despite this challenge the team still saw around 160,000 employees

face-to-face in 2018.

The Company's SaaS business achieved very strong growth in 2018,

with related revenues increasing by 229% during the year, this

follows a 77% increase the year before. Revenue is being driven by

the increase in customer spend through the Hapi platform, which now

has over 320,000 active users, combined with several key client

wins, including St John Ambulance and Randstad. The last quarter of

the year saw a record day and month for spend though the Hapi

platform.

The Company delivered on plans to launch a standalone version of

the Sage Employee Benefits (SEB) offer to Sage's wider client base

in the fourth quarter. This was later than initially planned, due

to conflicting priorities within Sage, but early indications are

encouraging. Sage has dedicated sales people to support the offer

and a team from Personal Group has been onsite to assist and

provide background support. In December, Sage undertook an email

marketing campaign of the product to some 1,800 clients, which saw

significantly higher click through rates and interest than they

would normally expect.

The revised version of SEB reflects our improved understanding

of working alongside Sage and a better appreciation of the SME

market. Sage has reaffirmed its commitment to the offer despite the

changes they've made to their overall proposition. Sage cite

Personal Group as the perfect example of how to work with a

third-party supplier and are recommending that similar initiatives

should follow our lead.

The value opportunity to both Personal Group and Sage of SEB

remains significant and well worth pursuing. Sage remains a natural

channel partner for the Company, with established direct

relationships covering a very large percentage of UK SMEs.

Targeting this market via a channel partner is a cost effective and

efficient approach which, in the fullness of time, will also

provide additional opportunity to our insurance business as those

SMEs seek to take on our products. Sage's target customers span

their Payroll, Accounting, Enterprise and Payments businesses which

collectively interface with companies who employ some 16 million

people in the UK.

PG Let's Connect saw revenue increase 33% and client numbers

increased by 36% year on year. The business had a very strong start

to the year, benefitting from Royal Mail's decision to run the

offer to its employees consistently from March, helping to

alleviate the traditional reliance on the Christmas period. We are

seeing this pattern again in 2019.

In addition to the impact of GDPR, in the fourth quarter, a

number of clients from within the Government's Crown Commercial

Services purchasing framework deferred running the offer to their

employees in 2018 for internal logistical reasons. The Company will

see the benefit of the deferred business in 2019 and enters the

year with improved visibility.

PG Let's Connect is recovering, post the impact of the HMRC

review into Salary Sacrifice, albeit more slowly than we had hoped.

Of those customers served in the fourth quarter many outperformed

their forecast which, post the legislative changes, bodes well for

the future. In addition to its direct financial contribution, the

business supports the wider Group. It strengthens the overall

market proposition, creates cross-selling opportunities, opens new

markets, particularly within the Public Sector, and encourages

client retention.

Operations

Technology is key to the Group. It drives internal productivity,

brings our offer together via the Hapi platform and supports SaaS

revenue. Over the last five years the Company's core insurance team

has seen a 34% increase in productivity through the introduction of

technology. Client feedback from the revised app has been very

positive. The app is also driving additional client engagement,

supporting client retention and creating additional potential sales

opportunities for products like video doctor services and Reward

and Recognition.

During 2018, a key initiative was to rationalise the Company's

supply chain. This was accelerated in the second half of the year.

Accelerating the Company's plans required additional investment

during 2018 but brings forward advantages including much reduced

system risk and far greater data security. Bringing the supply

chain in house is expected to provide commercial benefit, including

additional revenue and improved margin.

The Company has also continued to invest in system security,

having adopted the OutSystems technology on which Hapi was

developed. In 2019 we have continued to invest, with a significant

upgrade to the system early in 2019.

A key point of contact and client relationship is our claims

function. During the year, the team again performed extremely well,

paying 76% of insurance claims within 72 hours. The Company has an

enviable record, with minimal complaints, which are sufficiently

few in number that each one is reviewed by a member of the Senior

Management Team.

Sales and Marketing

The Company delivered on plans to invest in its sales and

marketing functions during the year. This included the addition of

several new sales individuals, all from blue-chip software and

sector specific backgrounds, and a 35% increase in the marketing

team budget.

With the Company's offer and backend systems in place, the

investment in sales and marketing is to drive additional market

opportunities. Building on initiatives in 2017 and with the

expanded team and budget in place, the sales message has evolved,

and the approach has become again more targeted. It has also

created the capacity to undertake wider direct marketing

initiatives.

In addition to direct sales and marketing, the Company also

invested in its customer relations function during the year. The

aim of the investment is to further support client retention and

create additional sales opportunities through broader client

engagement.

Team

The performance of the Company is underpinned by the strength of

its employees and their commitment. This was demonstrated during

2018 in the way they reacted to the challenges we faced. Their

speed of reaction and dedication to the success of the business was

key in minimising any negative impacts.

Our Senior Management Team is very experienced and effective in

both the operational and, most importantly, the strategic running

of the company. As Deborah Frost, our new Chief Executive, begins

her new role it is clear to me that she will be well supported in

her future endeavours.

As part of our initiative to invest in our people, a long

overdue refurbishment of the Company's head office was completed in

the early part of 2019. Supported by improvements in our IT

systems, the refreshed office space affords a far better working

environment.

Market

The market for employee services remains strong and there are

signs that momentum will continue. Key drivers have included a

restricted labour market, with the commercial value of investing in

and retaining staff becoming increasingly evident. The uncertainty

surrounding Brexit raises concerns regarding hiring and retention

of skilled labour and has further reinforced this view. Employers

cannot rely on pay alone, especially at National Living Wage

levels, which has created a completely level playing field. Extra

value for employees in the form of easy access to valuable

discounts, home technology and face-to-face presentations on 'fair

deal' insurance services, helps employers improve employee

retention rates. The Company's increased focus on 'financial

wellness' plays to the strength of Hapi and our fair deal insurance

products.

Financials

Group revenue for the year increased 22% to GBP55.3m (2017:

GBP45.2m) with growth in all three business segments, despite the

challenges the Company faced in the latter part of the year as

detailed above.

Adjusted EBITDA for the year was GBP11.4m (2017: GBP10.8m),

including a beneficial impact of GBP0.4m due to the application of

IFRS16, relating to leases. The Company elected to be an early

adopter of IFRS16 to coincide with the replacement of the majority

of the Company car fleet in January 2018.

The key driver for the increase in adjusted EBITDA* was the

improved trading performance from PG Let's Connect of GBP0.9m. The

insurance business, which continues to contribute the majority of

Adjusted EBITDA*, was GBP0.2m down on last year, following slight

increases in the claims' ratio and overheads.

The Company continued to retain a prudent focus on costs, which

were below budget for the year but up on the prior year. The

increase in costs primarily related to the planned investment in

sales and marketing to drive additional sales opportunities and the

unplanned costs associated with accelerating the plans to bring the

third-party supply chain in-house.

Profit before tax was GBP10.2m during the year (2017: GBP9.5m).

Basic EPS increased to 27.2p (2017: 26.9p), representing the second

year of EPS growth.

The Company again maintained its progressive dividend policy,

paying a total dividend of 23p per share over the year (2017:

22.7p), representing a 1.3% increase over the prior year. The first

dividend of 2019, of 5.825p per share, is again in line with the

Company's commitment to a progressive dividend policy and

represents a 1.3% increase over the corresponding period in 2018.

The dividend will be paid to shareholders on 29(th) March 2019.

The Group's balance sheet remains strong, with cash and deposits

at the year end of GBP17.7m and no debt. The Company's main

underwriting subsidiary, Personal Assurance Plc, has a conservative

solvency ratio of 260% (unaudited), with a surplus over its

Solvency Capital Requirement of GBP6.9m.

Outlook

The challenges the Company faced in the latter part of 2018 are

expected to have some further effect in 2019. We also face a more

uncertain business environment with the full impact of Brexit still

unknown, however, the Company remains confident we will see further

progress in the year ahead.

We have created near and long-term opportunities for growth

which we are well placed to exploit and see potential opportunity

in this less predictable business environment. We will continue to

take a prudent approach to costs and maintain and nurture those

parts of the business that underpin it, including our core

insurance division.

2018 2017

GBP'000 GBP'000

Continuing Operations

Gross premiums written 31,445 30,739

Outward reinsurance premiums (231) (272)

Change in unearned premiums 28 233

Change in reinsurers' share

of unearned premiums (10) (21)

(_________) (_________)

Earned premiums net of reinsurance 31,232 30,679

Other insurance related income 218 391

IT salary sacrifice income 14,970 11,292

SaaS income 8,729 2,648

Other non-insurance income 115 106

Investment income 83 117

(_________) (_________)

Revenue 55,347 45,233

(_________) (_________)

Claims incurred (7,175) (6,780)

Insurance operating expenses (15,073) (14,239)

Other insurance related expenses (261) (244)

IT salary sacrifice expenses (13,851) (11,034)

SaaS costs (8,561) (2,459)

Share-based payment expenses (117) (192)

Charitable donations (100) (100)

Amortisation of intangible assets (661) (673)

(___________) (___________)

Expenses (45,799) (35,721)

(___________) (___________)

Operating profit from continuing

operations 9,548 9,512

Finance costs (148) -

Release of provisions 646 -

Share of profit/(loss) of equity-accounted

investee net of tax 164 (2)

(_________) (_________)

Profit before tax from continuing

operations 10,210 9,510

Tax (1,819) (1,486)

(_________) (_________)

Profit for the year from continuing

operations 8,391 8,024

Profitfrom discontinued operation - 238

Profit 8,391 8,262

(_________) (_________)

The profit for the year is attributable to equity holders

of Personal Group Holdings Plc

Earnings per share Pence Pence

Basic 27.2 26.9

Diluted 27.2 26.4

Earnings per share - continuing operations Pence Pence

Basic 27.2 26.1

Diluted 27.2 25.7

Consolidated Statement of Comprehensive Income

2018 2017

GBP'000 GBP'000

Profit for the year 8,391 8,262

Items that may be reclassified subsequently to the income statement

Available for sale financial assets:

Valuation changes taken to equity - 106

Reclassification of gains on available for sale financial assets on

derecognition - (40)

Tax on unrealised valuation changes taken to equity - (11)

(________) (________)

Total comprehensive income for the year 8,391 8,317

(_________) (_________)

The total comprehensive income for the year is attributable to

equity holders of Personal Group Holdings Plc.

Consolidated Balance Sheet at 31 December 2018

2017 2017

GBP'000 GBP'000

ASSETS

Non-current assets

Goodwill 10,575 10,575

Intangible assets 500 986

Property, plant and equipment 6,040 4,747

Investment property 130 130

Equity-accounted investee - 638

(_________) (_________)

17,245 17,076

(__) (______) (________)

Current assets

Financial assets 2,530 4,492

Trade and other receivables 16,532 14,619

Equity-accounted investee 50 -

Reinsurance assets 187 180

Inventories - Finished Goods 643 560

Cash and cash equivalents 15,148 12,641

(_________) (_________)

35,090 32,492

(___) (______) (_________)

Total assets 52,335 49,568

(__________) (__________)

Consolidated Balance Sheet at 31 December 2018

2018 2017

GBP'000 GBP'000

EQUITY

Equity attributable to equity

holders

of Personal Group Holdings

Plc

Share capital 1,544 1,540

Capital redemption reserve 24 24

Amounts recognised directly

into equity

relating to non-current available

for sale assets - 85

Other reserve (210) (310)

Profit and loss reserve 33,937 32,417

(_________) (_________)

Total equity 35,295 33,756

(_________) (_________)

LIABILITIES

Non-current liabilities

Deferred tax liabilities 102 21

Trade and other payables 356 -

Current liabilities

Provisions 1,259 1,905

Trade and other payables 12,233 10,698

Insurance contract liabilities 2,376 2,507

Current tax liabilities 714 681

(_________) (_________)

16,582 15,791

(_________) (_________)

(_________) (_________)

Total liabilities 17,040 15,812

(_________) (_________)

(_________) (_________)

Total equity and liabilities 52,335 49,568

(_________) (_________)

Consolidated Statement of Changes in Equity for the year ended

31 December 2018

Equity attributable to equity holders of Personal Group Holdings

Plc

Share Capital Available Other Profit Total

capital redemption for sale reserve and loss equity

reserve financial reserve

assets

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 1 January

2018 as previously reported 1,540 24 85 (310) 32,417 33,756

Adjustment on initial

adoption IFRS 9 - - (85) - 85 -

Restated balance as

at 1 January 2018 1,540 24 - (310) 32,502 33,756

(________) (______) (______) (______) (________) (________)

Dividends - - - - (7,087) (7,087)

Employee share-based

compensation - - - - 94 94

Proceeds of SIP* share

sales - - - - 132 132

Cost of SIP shares sold - - - 179 (179) -

Cost of SIP shares purchased - - - (79) - (79)

Deferred tax reserve

movement - - - - 88 88

Nominal value of LTIP**

shares issued 4 - - - (4) -

(________) (________) (________) (________) (________) (________)

Transactions with owners 4 - - 100 (6,956) (6,940)

(________) (________) (________) (________) (________) (________)

Profit for the year - - - - 8,391 8,391

(________) (________) (________) (________) (________) (________)

Total comprehensive income for

the year - - - - 8,391 8,391

(________) (_______) (________) (________) (________) (________)

Balance as at 31 December

2018 1,544 24 - (210) 33,937 35,295

(________) (______) (______) (________) (__________) (_________)

*PG Share Ownership Plan (SIP)

**Long Term Incentive Plan (LTIP)

Equity attributable to equity holders of Personal Group Holdings

Plc

Share Capital Available Other Profit Total

capital redemption for sale reserve and loss equity

reserve financial reserve

assets

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 1

January 2017 1,540 24 30 (330) 31,061 32,325

(________) (______) (______) (______) (________) (________)

Dividends - - - - (6,979) (6,979)

Employee share-based

compensation - - - - 166 166

Proceeds of SIP*

share sales - - - - 51 51

Cost of SIP shares

sold - - - 94 (94) -

Cost of SIP shares

purchased - - - (74) - (74)

Deferred tax reserve

movement - - - - (50) (50)

(________) (________) (________) (________) (________) (________)

Transactions with

owners - - - 20 (6,906) (6,886)

(________) (________) (________) (________) (________) (________)

Profit for the year - - - - 8,262 8,262

Other comprehensive

income

Available for sale

financial assets:

Change in fair

value of assets

classified as held

for sale - - 106 - - 106

Transfer to income

statement - - (40) - - (40)

Current tax on

unrealised valuation

changes taken to

equity - - (11) - - (11)

(________) (________) (________) (________) (________) (________)

Total comprehensive

income for the

year - - 55 - 8,262 8,317

(________) (_______) (________) (________) (________) (________)

Balance as at 31

December 2017 1,540 24 85 (310) 32,417 33,756

(________) (______) (______) (________) (__________) (_________)

* PG Share Ownership Plan (SIP)

Consolidated Cash Flow Statement

2018 2017

GBP'000 GBP'000

Net cash from operating activities

(see next page) 8,325 9,928

(__________) (__________)

Investing activities

Additions to property, plant and equipment (1,024) (120)

Additions to intangible assets (178) (182)

Proceeds from disposal of property, plant and

equipment 9 25

Proceeds from disposal of investment property - 933

Purchase of financial assets (105) (195)

Proceeds from disposal of financial

assets 2,056 1,995

Interest received 82 30

Dividends received from equity accounted

investee 750 -

Dividends received 8 23

(__________) (__________)

Net cash used in investing activities 1,598 2,509

(__________) (__________)

Financing activities

Interest paid (28) -

Purchase of own shares by the SIP (79) (74)

Proceeds from disposal of own shares

by the SIP 132 51

Payment of lease liabilities (354) -

Dividends paid (7,087) (6,979)

(__________) (__________)

Net cash used in financing activities (7,416) (7,002)

(__________) (__________)

Net change in cash and cash equivalents 2,507 5,435

Cash and cash equivalents, beginning

of year 12,641 7,206

Cash and cash equivalents, end of year 15,148 12,641

(_________) (_________)

Consolidated Cash Flow Statement 2018 2017

GBP'000 GBP'000

Operating activities

Profit after tax 8,391 8,262

Adjustments for

Depreciation 797 437

Amortisation of intangible assets 661 673

Loss on disposal of property, plant

and equipment 59 7

Loss on disposal of investment property - 7

Realised net investment (profit) /

loss 10 (101)

Interest received (82) (30)

Dividends received (8) (23)

Interest charge 148 -

Share of (profit)/ loss of equity-accounted

investee, net of tax (164) 2

Share-based payment expenses 94 192

Taxation expense recognised in income

statement 1,819 1,543

Changes in working capital

Trade and other receivables (1,920) 5,711

Trade and other payables 865 (5,493)

Provisions (646) -

Inventories (83) (132)

Taxes paid (1,616) (1,127)

(__________) (__________)

Net cash from operating activities 8,325 9,928

(__________) (__________)

Notes to the Financial Statements

1 Segment analysis

The segments used by management to review the operations of the

business are disclosed below.

1) Core Insurance

Personal Assurance Plc (PA), a subsidiary within the Group, is a

PRA regulated general insurance Company and is authorised to

transact accident and sickness insurance. It was established in

1984 and has been underwriting business since 1985. In 1997

Personal Group Holdings Plc (PGH) was created and became the

ultimate parent undertaking of the Group.

Personal Assurance (Guernsey) Limited (PAGL), a subsidiary

within the Group, is regulated by the Guernsey Financial Services

Commission and has been underwriting death benefit policies since

March 2015.

This operating segment derives the majority of its revenue from

the underwriting by PA and PAGL of insurance policies that have

been bought by employees of host companies via bespoke benefit

programmes.

2) IT Salary Sacrifice

IT salary sacrifice refers to the trade of PG Let's Connect, a

salary sacrifice technology Company purchased in 2014.

3) SaaS

Revenue in this segment relates to the annual subscription

income and other related income arising from the licensing of Hapi,

the Group's employee benefit platform. This includes sales to both

the large corporate and SME sectors.

4) Other

The other operating segment consists exclusively of revenue

generated by Berkeley Morgan Group (BMG) and its subsidiary

undertakings along with any investment and rental income obtained

by the Group.

The discontinued segment is:

Mobile

Mobile refers to the trade of Personal Group Mobile a mobile

phone salary sacrifice Company set up from the trade and assets of

Shebang Technologies purchased in 2015, which ceased trading in

December 2016.

The revenue and net result generated by each of the Group's

operating segments are summarised as follows:

IT Salary Continuing Discontinued

Core Insurance Sacrifice SaaS Other - Group Mobile

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Operating segments

2018

Revenue

Earned premiums net

of reinsurance 31,219 - 13 - 31,232 -

Other income - Insurance

Related (9) - - 227 218 -

Other income - IT Salary

Sacrifice - 14,970 - - 14,970 -

Other income - Platform - - 1,800 - 1,800 -

Other income - Transactional

and commission - - 6,929 - 6,929 -

Other income - - - 114 114

Investment property - - - 1 1 -

Investment income - - - 83 83 -

(_________) (_________) (_________) (_________) (_________) (_________)

31,210 14,970 8,742 425 55,347 -

Total revenue (_________) (_________) (_________) (_________) (_________) (_________)

Net result for year

before tax 8,869 1,350 29 (38) 10,210 -

PG Let's Connect - Tax

provision - (646) - - (646) -

PG Let's Connect - Amortisation

of intangibles - 330 - - 330 -

Acquisition costs - - - 150 150 -

Interest 110 28 10 - 148 -

Share based payments - - - 117 117 -

Depreciation 665 108 15 9 797 -

Amortisation (other) 133 56 142 - 331 -

Adjusted EBITDA* 9,777 1,226 196 238 11,437 -

(_________) (_________) (_________) (_________) (_________) (_________)

Segment assets 25,403 12,567 2,612 11,753 52,335 -

Segment liabilities 6,947 8,035 1,883 175 17,040 -

Depreciation and amortisation 798 494 157 9 1,458 -

IT Salary Continuing Discontinued

Core Insurance Sacrifice SaaS Other - Group Mobile

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Operating segments

2017

Revenue

Earned premiums net

of reinsurance 30,670 - 9 - 30,679 -

Other income - Insurance

Related 57 - - 334 391 -

Other income - IT Salary

Sacrifice - 11,292 - - 14,045 63

Other income - Platform - - 1,528 - 1,528 -

Other income - Transactional

and commission - - 1,120 - 1,120 -

Other income - - - 105 105 -

Investment property - - - 1 1 -

Investment income - - - 117 117 -

(_________) (_________) (_________) (_________) (_________) (_________)

30,727 11,292 2,657 557 45,233 63

Total revenue (_________) (_________) (_________) (_________) (_________) (_________)

Net result for year

before tax 9,406 (111) 197 18 9,510 295

PG Mobile - Reorganisation

costs - - - - - (225)

PG Let's Connect - Amortisation

of intangibles - 330 - - 330 -

Share based payments - - - 192 192 -

Depreciation 392 30 5 10 437 -

Amortisation (other) 162 39 142 - 343 -

EBITDA* 9,960 288 344 220 10,812 70

(_________) (_________) (_________) (_________) (_________) (_________)

Segment assets 21,628 10,979 1,384 15,568 49,560 8

Segment liabilities 6,379 8,035 1,257 139 15,810 2

Depreciation and amortisation 554 399 147 10 1,110 -

2. Taxation comprises United Kingdom corporation tax of

GBP1,650,000 (2017: GBP1,569,000) and a deferred tax charge of

GBP169,000 (2017: credit of GBP26,000)

3. The basic and diluted earnings per share are based on profit

for the financial year of GBP8,391,000 (2017: GBP8,262,000) and on

30,798,840 basic (2017: 30,743,826) and 31,806,261 diluted (2016:

31,282,267) ordinary shares, the weighted average number of shares

in issue during the year.

4. The total dividend paid in the year was GBP7,087,000 (2017: GBP6,979,000)

This preliminary statement has been extracted from the 2018

audited financial statements that will be posted to shareholders in

due course. The statutory accounts for each of the two years to 31

December 2017 and 31 December 2016 received audit reports, which

were unqualified and did not contain statements under section 498

(2) or (3) of the Companies Act 2006. The 2017 accounts have been

filed with the Registrar of Companies but the 2018 accounts are not

yet filed.

Alternative Performance Measures

The Group uses an alternative (non-Generally Accepted Accounting

Practice (non-GAAP)) financial measure when reviewing performance

of the Group, evidenced by executive management bonus performance

targets being measured in relation to Adjusted EBITDA*. As such,

this measure is important and should be considered alongside the

IFRS measures.

For Adjusted EBITDA*, the adjustments taken into account in

addition to the standard IFRS measure, are those that are

considered to be non-underlying to trading activities and which are

significant in size. For example, goodwill impairment is a non-cash

item relevant to historic acquisitions; share-based payments are a

non-cash item which have historically been significant in size, can

fluctuate based on judgemental assumptions made about share price

and have no impact on total equity; corporate acquisition costs and

reorganisation costs are both one-off items which are not incurred

in the regular course of business; and write-back of contingent

consideration and the movement in the PG Let's Connect tax

provision are both considered to be non-underlying items, relates

to a liability inherited on acquisition of that business and have

the potential to fluctuate and be of significant size.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR SEDEFIFUSEFD

(END) Dow Jones Newswires

March 26, 2019 03:01 ET (07:01 GMT)

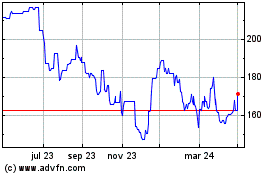

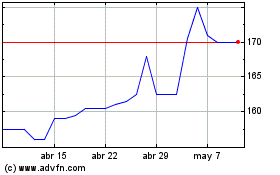

Personal (LSE:PGH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Personal (LSE:PGH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024