Northgate PLC Pre-close Trading Update (8870Y)

14 Mayo 2019 - 1:00AM

UK Regulatory

TIDMNTG

RNS Number : 8870Y

Northgate PLC

14 May 2019

NORTHGATE PLC

Pre-close Trading Update

"Financial performance in line with management expectations"

Northgate plc ("Northgate", the "Company" or the "Group"), the

leading specialist in light commercial vehicle hire in the UK,

Spain and Ireland, today announces its pre-close trading update for

the year ended 30 April 2019, ahead of its full year results

announcement on 25 June 2019.

Group

The Group is pleased to report fourth quarter growth in Vehicles

on Hire(1) (VOH) of 8.0%, delivering 11.1% VOH(1) growth for the

full year, in line with guidance. Full year rental margins are also

expected to be in line with guidance. Profits from vehicle sales(2)

during the year will reflect the implementation of the fleet

optimisation policy and extension of holding periods. The Group

expects to report financial performance for the year ended 30 April

2019 in line with guidance.

Average Vehicles FY'18 FY'18 FY'19 FY'19 FY'19 FY'19 FY'19

on Hire (VOH) Q3 Q4 Q1 Q2 Q3 Q4

------- ------ ------ ------ ------

UK & Ireland

('000) 44.3 44.2 48.0 48.3 49.8 47.5 48.4

y-o-y % growth (2.2%) 2.6% 12.0% 13.5% 12.5% 7.5% 11.3%

Spain ('000) 41.0 41.5 44.2 45.0 44.7 45.0 44.8

y-o-y % growth 14.2% 14.1% 14.3% 12.1% 9.1% 8.6% 10.9%

Group ('000) 85.3 85.7 92.2 93.3 94.5 92.6 93.2

y-o-y % growth 5.0% 7.8% 13.1% 12.8% 10.8% 8.0% 11.1%

------------------ ------- ------ ------ ------ ------ ------ ------

UK & Ireland

Full year VOH(1) growth of 11.3%, in line with the guidance for

low double-digit growth given in December 2018, was primarily

driven by increasing demand for our minimum-term proposition.

VOH(1) growth moderated in the fourth quarter to 7.5%, as expected,

reflecting both the strong growth in the prior year, as well as

some softening in the conversion of our pipeline, which remains

strong, from Brexit uncertainty in the market. Closing VOH at the

end of the period was 47,100, 3.4% higher than the prior year.

The rental margin grew steadily throughout the year, reflecting

the successful price increases to the flexible and minimum-term

products earlier in the year, higher utilisation, workshop

efficiency improvements, and ongoing customer selectivity. We

expect the business to report a full year rental margin of 7.5% -

8.0%, in line with guidance. Disposal profits(2) continue to be

supported by firm residual values and high sales prices achieved

through our Van Monster retail channel.

Spain

Full year VOH(1) growth of 10.9% was driven by increased market

penetration with our minimum-term product. VOH(1) growth in the

fourth quarter of 8.6%, which has continued to slow sequentially

during the year, reflects a strong prior year performance as well

as our increasing customer selectivity in response to greater

competition across both flexible and minimum-term products. Closing

VOH at the end of the period was 46,000, 7.5% higher than at the

same time last year.

We continue to expect the full year rental margin to be

significantly higher versus the prior year, reflecting the

depreciation rate change, as previously guided. Behind this we have

seen a sequential weakening in the rental margin from the first to

the second half of the year, primarily driven by increasing price

competition. Disposal profits(2) are expected to be lower, in line

with guidance, reflecting lower disposal volumes as we transition

to longer vehicle holding periods. Management remain confident in

the Group's strategic positioning in Spain and are continuing to

evolve our proposition to protect our attractive returns in a

growing and competitive market.

Cash flow and financing

The Group's financial position remains strong, with solid

operating cash flow generation before capex, and room for further

growth provided by the headroom under its debt facilities.

Next results

Northgate will announce its Preliminary Results for the full

year ended 30 April 2019 on Tuesday 25 June 2019.

(1) Vehicles on Hire is an average number unless otherwise

stated

(2) Profits from vehicle sales/disposal profits is a non-GAAP

measure used to describe the adjustment in the depreciation charge

made in the year for vehicles sold at an amount different to their

net book value at the date of sale, net of attributable selling

costs

Contact details

For further information please contact:

Northgate plc +44 (0)118 207 3535

Kirsty Law, Investor Relations +44 (0)7808 212 964

MHP +44 (0)203 128 8771

Andrew Jaques, Simon Hockridge,

Ollie Hoare

Notes to Editors:

Northgate plc is the leading light commercial vehicle hire

business in the UK, Spain and Ireland by fleet size and has been

operating in the sector since 1981.

Northgate's core business is the hire of light commercial

vehicles to businesses on a flexible or minimum-term basis, giving

customers the ability to manage their fleet requirements in a way

which can adapt best to changing business needs.

Further information regarding Northgate plc can be found on the

Company's website.

www.northgateplc.com

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTDMGMKNFGGLZM

(END) Dow Jones Newswires

May 14, 2019 02:00 ET (06:00 GMT)

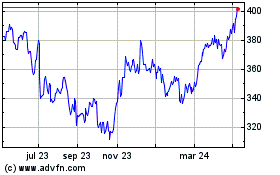

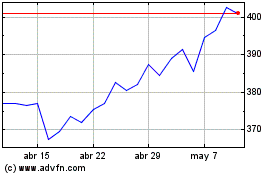

Redde Northgate (LSE:REDD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Redde Northgate (LSE:REDD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024