TIDMPET

RNS Number : 1701N

Petrel Resources PLC

23 September 2019

23(rd) September 2019

Petrel Resources plc

("Petrel" or "the Company")

Interim Statement for the six months ended 30 June 2019

Petrel Resources plc (AIM: PET) today announces financial

results for the six months ended 30(th) June 2019.

Petrel's main focus in the period under review was on

re-building its Iraqi presence, the Ghanaian Tano 2A Block

Petroleum Agreement, and the Irish Atlantic Porcupine Basin:

Aware of the need to strengthen Petrel's balance sheet so as to

facilitate re-qualification in Iraq, and ratification in Ghana,

Petrel welcomed an influential group of substantial investors on

board for an initial 29.99% of the enlarged share capital. The net

proceeds will be utilised to acquire and develop assets in the

Middle East, particularly Iraq, and North Africa. The Middle East

& North Africa (MENA) region offers unique oil & gas

opportunities for those able to operate. Petrel has worked in the

Middle East since 1999, and has shown the ability to operate in

challenging circumstances, without loss of life or equipment.

The group of new investors in Petrel are nominating two

directors. They bring significant financial and hydrocarbon

experience in the MENA region, and may inject additional capital

and projects on agreed terms.

Iraq:

While challenges remain, the Iraqi government encourages

international investors with Iraqi operating experience. The

security situation has dramatically improved since 2018. Iraq

remains exempt from OPEC quotas, and Iraqi oil output has reached

4.7 million barrels of oil daily.

The next Iraqi bidding round (for exploration of blocks with gas

potential) is expected during 2020. The model contract is expected

to be an updated version of the Iraqi hybrid exploration and

development contract, incorporating aspects of service contract and

production sharing. These terms are more attractive for

international explorers than in prior bid rounds.

The improving security situation in western Iraq has again made

possible field-work on prime western desert exploration blocks,

including Block 6, on which we worked from 2002. Similarly, the

Merjan oil discovery, by Mobil in 1982, which has recently been

packaged with Kifl & west Kifl oilfields, has arisen as a

possible development project. The Merjan oilfield and surroundings,

on which Petrel operated a Technical Cooperation Agreement in joint

venture with Japanese giant Itochu from 2004 through 2007, has

recently been covered by 1,000 km sq a 3d seismic survey conducted

by the Iraqi Oil Exploration Company. This enhanced data should

further minismise the risks & costs of development.

Ghana:

Separately, Petrel and its partners are making slow progress

with the Ghanaian authorities. Petrel and its partners have entered

into discussions with prospective partners, whose resources may

expedite and ease the planned ratification of Tano 2A Block in the

prospective Ghana western basin, where circa 200,000 barrels of oil

daily are now being produced.

Irish Atlantic Porcupine Basin:

Despite 3d seismic programmes by several majors, the anticipated

multi-well drilling programme in the Irish Atlantic has been

delayed by a politically-inspired private members' bill hoping to

ban future licence rounds and extensions. There were only 3 wells

since 2013, including an unsuccessful ultra-deep Iolar well by

CNOOC & Exxon Mobil during 2019.

The bill was recently rejected by the Irish government, but

there is no guarantee that a future government would not adopt a

different approach.

In terms of prospectivity, the Porcupine Basin has established

source rock, moderate to excellent reservoirs, but the historical

issue has been top-seal. The industry expects discoveries but it

needs several wells to test the many plays.

There are 2 basic plays which attracted bigger players since

2013: Cretaceous plays similar to west Africa, e.g. Ghana, and the

'Conjugate Margin' Jurassic play modelled on eastern Canadian

discoveries.

The re-arrival of majors (ExxonMobil, Equinor, CNOOC/Nexen, ENI,

Total, etc. since 2015 is mainly due to the 'eastern Canadian

Jurassic play' which should equally apply to the Irish Atlantic

(which was joined to Canada until the Jurassic).

The province is frontier (with only 33 wells so far in the

Porcupine basin), with several sub-economic discoveries (Connemara,

Spanish Point, Burren, etc. (as well as the Corrib gas-field

further north in the Slyne Trough).

Frontier Exploration Licence (FEL) 11/18:

Petrel's Joint Venture with Woodside Energy is now focused on

the key FEL 11/18 - with several shallow water and rock targets,

located only 150km southwest of Kerry/Cork. There are a wide

variety of potential drill targets, especially of mid-depth of late

Jurassic / early Cretaceous age.

Petrel acquired this 10% working interest at no cost, as part of

the resolution of prior issues under arbitration. FEL 11/18 covers

circa 1,579km2 of acreage, combining a number of play types in

reasonable water and rock depths.

Our 10% stake brings access to all historic data, as well as

circa 1,600km2 of state-of-the-art 3D seismic data.

Frontier Exploration Licence (FEL) 3/14:

Petrel's 100% operated FEL 3/14 work programme from 8/2018 (when

Woodside exited their 85% operating working interest) until end

8/2019 is nearing completion.

We have applied for a further extension to seek drilling

partners, but this has not yet been granted.

Licensing Option (LO) 16/24:

Petrel has proposed a work programme for the conversion of our

recently expired Licensing Option 16/24 into a Frontier Exploration

Licence - but Petrel is not yet ready to commit to drilling a well

until this acreage has been farmed down.

Licensing Option 16/24 includes 664km2 bordering the Connemara

oil-field discovered by BP in 1983. Though sufficient oil did not

flow to be commercial, the proximity to mobile oil enhances our

acreage.

John Teeling

Chairman

20(th) September 2019

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

S

For further information please visit

http://www.petrelresources.com/ or contact:

Petrel Resources

John Teeling, Chairman +353 (0) 1 833 2833

David Horgan, Director

Nominated Adviser and Broker

Beaumont Cornish - Nominated Adviser

Felicity Geidt

Roland Cornish +44 (0) 020 7628 3396

Novum Securities Limited - Broker

Colin Rowbury +44 (0) 20 399 9400

Blytheweigh - PR +44 (0) 20 7138 3206

Julia Tilley +44 (0) 207 138 3553

Fergus Cowan +44 (0) 207 138 3208

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

Petrel Resources plc

Financial Information (Unaudited)

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

Year

Six Months Ended Ended

30 June 30 June 31 Dec

2019 2018 2018

unaudited unaudited audited

CONTINUING OPERATIONS EUR'000 EUR'000 EUR'000

Administrative expenses (115) (104) (239)

------------ ----------- --------------

OPERATING LOSS (115) (104) (239)

LOSS BEFORE TAXATION (115) (104) (239)

Income tax

expense - - -

------------ ----------- --------------

LOSS FOR THE PERIOD (115) (104) (239)

Other comprehensive income

Exchange

differences 24 57 96

TOTAL COMPREHENSIVE PROFIT FOR

THE PERIOD (91) (47) (143)

============ =========== ==============

LOSS PER SHARE - basic

and diluted (0.11c) (0.10c) (0.27c)

============ =========== ==============

CONDENSED CONSOLIDATED BALANCE 30 June 30 June 31 Dec

SHEET 2019 2018 2018

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

ASSETS:

NON-CURRENT ASSETS

Intangible

assets 2,593 2,357 2,523

------------ ----------- --------------

2,593 2,357 2,523

------------ ----------- --------------

CURRENT ASSETS

Trade and other

receivables 59 39 58

Cash and cash

equivalents 178 108 330

------------ ----------- --------------

237 147 388

TOTAL ASSETS 2,830 2,504 2,911

------------ ----------- --------------

CURRENT LIABILITIES

Trade and other payables (643) (558) (633)

------------ ----------- --------------

(643) (558) (633)

------------ ----------- --------------

NET CURRENT ASSETS (406) (411) (245)

NET ASSETS 2,187 1,946 2,278

============ =========== ==============

EQUITY

Share capital 1,307 1,246 1,307

Capital conversion reserve

fund 8 8 8

Capital redemption

reserve 209 0 209

Share premium 21,601 21,416 21,601

Share based payment reserve 27 27 27

Translation

reserve 519 456 495

Retained

deficit (21,484) (21207) (21,369)

------------ ----------- --------------

TOTAL EQUITY 2,187 1,946 2,278

============ =========== ==============

CONDENSED CONSOLIDATED STATEMENT OF CHANGES

IN EQUITY

Share

Capital Capital based

Share Share Redemption Conversion Payment Translation Retained Total

Capital Premium Reserves Reserves Reserves Reserves Losses Equity

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

As at 1

January

2018 1,246 21,416 0 8 27 399 (21,103) 1,993

Total

comprehensive

income - 57 (104) (47)

-------- -------- ----------- ----------- ------------------ ------------ ----------- --------------

As at 30 June

2018 1,246 21,416 0 8 27 456 (21,207) 1,946

Shares issued 270 185 455

Share issue

expenses (27) (27)

Shares

cancelled (209) 209 0

Total

comprehensive

loss - 39 (135) (96)

-------- -------- ----------- ----------- ------------------ ------------ ----------- --------------

As at 31

December

2018 1,307 21,601 209 8 27 495 (21,369) 2,278

Total

comprehensive

loss - 24 (115) (91)

----------- ----------- ------------------ ------------

As at 30 June

2019 1,307 21,601 209 8 27 519 (21,484) 2,187

======== ======== =========== =========== ================== ============ =========== ==============

CONDENSED CONSOLIDATED Year

CASH FLOW Six Months Ended Ended

30 June 30 June 31 Dec

2019 2018 2018

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

CASH FLOW FROM OPERATING

ACTIVITIES

Loss for the period (115) (104) (239)

------------ ----------- --------------

(115) (104) (239)

Movements in Working Capital 9 (38) (27)

------------ ----------- --------------

CASH USED IN OPERATIONS (106) (142) (266)

NET CASH USED IN OPERATING ACTIVITIES (106) (142) (266)

------------ ----------- --------------

INVESTING ACTIVITIES

Payments for exploration and evaluation

assets (47) (120) (196)

------------ ----------- --------------

NET CASH USED IN INVESTING

ACTIVITIES (47) (120) (196)

------------ ----------- --------------

FINANCING ACTIVITIES

Shares issued 0 0 455

Share issue

expenses 0 0 (27)

------------ ----------- --------------

NET CASH GENERATED FROM FINANCING

ACTIVITIES 0 0 428

------------ ----------- --------------

NET DECREASE IN CASH AND CASH EQUIVALENTS (153) (262) (34)

Cash and cash equivalents at beginning

of the period 330 371 371

Effect of exchange rate changes on cash

held in foreign currencies 1 (1) (7)

CASH AND CASH EQUIVALENT AT THE OF

THE PERIOD 178 108 330

============ =========== ==============

Notes:

1. INFORMATION

The financial information for the six months ended 30 June 2019

and the comparative amounts for the six months ended 30 June 2018

are unaudited.

The interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union. The interim financial statements have been

prepared applying the accounting policies and methods of

computation used in the preparation of the published consolidated

financial statements for the year ended 31 December 2018.

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the audited consolidated

financial statements of the Group for the year ended 31 December

2018, which are available on the Company's website

www.petrelresources.com

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. No dividend is proposed in respect of the period.

3. LOSS PER SHARE

30 June 30 June 31 Dec

19 18 18

EUR EUR EUR

Loss per share - Basic and Diluted (0.11c) (0.10c) (0.27c)

Basic and diluted loss per share

The earnings and weighted average number of ordinary shares

used in the calculation of basic loss per share are as follows:

EUR'000 EUR'000 EUR'000

Loss for the period attributable

to equity holders (115) (104) (239)

Weighted average number of ordinary

shares for the purpose of basic

earnings per share 104,557,246 99,681,992 87,733,283

Basic and diluted loss per share are the same as the effect of

the outstanding share options is anti-dilutive.

4. INTANGIBLE ASSETS

30 June 30 June 31 Dec

19 18 18

Exploration and evaluation assets: EUR'000 EUR'000 EUR'000

Opening balance 2,523 2,179 2,179

Additions 47 120 241

Exchange translation adjustment 23 58 103

________ ________ ________

Closing balance 2,593 2,357 2,523

Exploration and evaluation assets at 30 June 2019 represent

exploration and related expenditure in respect of projects in

Ireland and Ghana. The directors are aware that by its nature there

is an inherent uncertainty in relation to the recoverability of

amounts capitalised on the exploration projects.

Relating to the remaining exploration and evaluation assets at

the financial year end, the directors believe there were no facts

or circumstances indicating that the carrying value of the

intangible assets may exceed their recoverable amount and thus no

impairment review was deemed necessary by the directors. The

realisation of these intangible assets is dependent on the

successful discovery and development of economic reserves and is

subject to a number of significant potential risks, as set out

below:

-- Licence obligations;

-- Funding requirements;

-- Political and legal risks, including title to licence, profit

sharing and taxation;

-- Exchange rate risk;

-- Financial risk management;

-- Geological and development risks;

Directors' remuneration of EUR15,000 (December 2018: EUR30,000)

and salaries of EUR7,500 (December 2018: EUR15,000) were

capitalised as exploration and evaluation expenditure during the

period.

Regional Analysis 30 Jun 19 30 Jun 18 31 Dec 18

EUR'000 EUR'000 EUR'000

Ghana 918 866 911

Ireland 1,675 1,491 1,612

_______ _______ _______

2,593 2,357 2,523

5. SHARE CAPITAL

2019 2018

EUR'000 EUR'000

Authorised:

800,000,000 (Dec 18: 200,000,000) ordinary shares of EUR0.0125 10,000 2,500

Allotted, called-up and fully paid:

Number Share Capital Premium

EUR'000 EUR'000

At 1 January 2018 99,681,992 1,246 21,416

Issued during the period 21,622,622 270 185

Shares cancelled (16,747,368) (209) -

At 31 December 2018 104,557,246 1,307 21,601

Issued during the period - - -

At 30 June 2019 99,681,992 1,246 21,416

Movements in issued share capital

On 25 July 2018 the company received shareholder approval for

the following transaction:

(i) the contract between Amira Petroleum N.V., Amira

International Holding Limited and the Company for the purchase of

16,147,368 ordinary shares of EUR0.0125 each in the capital of the

Company for nominal consideration; and

(ii) the contract between Hannam & Partners (Advisory) Group

Services Ltd and the Company for the purchase of 600,000 ordinary

shares of 0.0125 each in the capital of the Company for nominal

consideration.

The aggregate 16,747,368 ordinary shares of EUR0.0125 each were

immediately cancelled upon their repurchase by the Company.

The purchase consideration of GBP20 was funded by the issue of

1000 Ordinary shares of EUR0.0125 at 2p per share.

On 11 October 2018 a total of 21,621,622 shares were placed at a

price of 1.85 pence per share. Proceeds were used to provide

additional working capital and fund development costs.

6. POST BALANCE SHEET EVENTS

On 30 July 2019 the company announced that the Company had

arranged a placing at EUR0.0125 per share raising EUR559,861 by the

issue of 44,788,913 new ordinary shares in the Company representing

29.99% of the enlarged share capital.

The net proceeds from the placing will be utilised by the

Company to acquire and develop assets in the Middle East and North

Africa.

7. The Interim Report for the six months to 30(th) June 2019 was

approved by the Directors on 20(th) September 2019.

8. The Interim Report will be available on the Company's website at www.petrelresources.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EALNEAEKNEFF

(END) Dow Jones Newswires

September 23, 2019 02:00 ET (06:00 GMT)

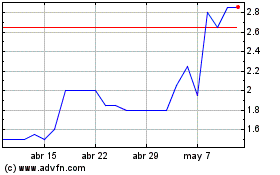

Petrel Resources (LSE:PET)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Petrel Resources (LSE:PET)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024