TIDMWBI

RNS Number : 3558P

Woodbois Limited

10 October 2019

10 October 2019

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014.

Woodbois Limited

("Woodbois", the "Group" or the "Company")

(AIM: WBI)

Quarterly Update

Woodbois, the African focused forestry and timber trading

company, is pleased to provide a quarterly update on operations for

the three months ended 30 September 2019 (Q3 of the Group's 2019

financial year). All numbers below from unaudited management

accounts.

-- Record quarterly revenues with $4.9m generated in Q3 2019.

-- Record quarterly revenues of $3.4m in Q3 from trading division.

-- Record quarter of export of own production sawn timber and

veneer with 120 containers shipped.

-- New kilns completed on schedule and operational in Gabon

-- Upgraded sawmill in Gabon on track to be fully operational during Q4 2019

-- Membership of Congo Basin Forest Partnership

Consistent revenue growth

Record quarterly revenues of $4.9m during Q3 represented a 44%

increase from 2018's average quarterly run-rate, and continued

quarter on quarter growth. The trading division performed

particularly strongly with $3.4m in revenues. Revenues from our own

production were $1.5m, but were impacted adversely by the halting

of timber exports from Gabon during the summer due to the

'kevazingogate' scandal created by the attempted illegal export of

logs. The export from Gabon of logs of all species has been banned

since 2010. With the export situation for processed timber products

returning to normal, our pace of shipments picked up sharply by the

end of the quarter, with revenues from these later shipments due to

fall within Q4.

Trading division

Record quarterly revenues of $3.4m from the trading division

represent a 70% increase from the average quarterly run-rate of

2018. With the balance of the Internal Trade Finance Facility

raised earlier in 2019 being put to work during Q3, further revenue

growth from the trading division is expected.

By way of context, while pricing of some more expensive species

has fallen by around 10% during 2019, global demand for African

hardwood logs has remained consistent despite the backdrop of an

economic slowdown in China, which typically accounts for around 50%

of total demand. Overseas access to this raw material is

diminishing however, as the IMF and other foreign donors exert

pressure on African governments to implement sustainable harvesting

policies and restrict or completely ban the export of logs in order

to encourage in-country processing. Equatorial Guinea became the

latest country to implement such a ban in May 2019, with Congo and

Cameroon, traditionally large exporters of logs, implementing a

quota system whereby the majority of logs of specific species must

be processed in-country prior to export. These moves are strongly

to the advantage of Woodbois due to our strong network of suppliers

who are already processing timber in-country.

Our trading strategy is to actively engage with and support

suppliers who operate within clearly defined sustainability

guidelines verified by accredited independent 3rd party auditors.

Advising these suppliers on technical specifications, and how to

achieve the standards of compliance required in order to access

international markets helps to improve their margins and enables us

to lock in long-term contracts, increasing certainty for both

parties.

Forestry division

The completion of the installation of drying kilns at our

sawmill in Mouila in September saw a major milestone reached and

shareholder value created. We anticipate margin improvement of

around 8% from sawn timber as a result of bringing this activity in

house, with a further 2% margin increase from reduced logistics

costs.

Thanks to months of research and planning, the lead-time from

order to installation was impressively quick. I'm also pleased to

report that the level of support throughout the process from

Techdry, the Chinese manufacturer, has been nothing short of

excellent. I look forward to ordering more kilns from Techdry as we

expand capacity in Gabon, or elsewhere in the future.

Focus is now on installation of the new production lines to

upgrade the sawmill in Mouila which are scheduled for completion

during the current quarter. Once all of these major works are

completed, and with a year of 'learning by doing' under our belts

at the veneer factory, an expectation of revenue and profitability

growth from our production facilities in 2020 would appear to be

justified.

Mozambique

While management focus has understandably been largely on

expanding the trading operation and upgrading facilities in West

Africa, where the rapid payback on allocated resource is proven,

the team in Mozambique has been driving a domestic-based agenda,

centred on opportunities emerging from the large-scale

infrastructure installations that are underway to support the

multi-billion dollar Mozambique LNG project. To date, we have

supplied several trial orders for dunnage, which is used to

separate large oil and gas pipes and have contributed to tender

proposals for timber-based solutions for worker accommodation.

These areas have the potential to lead to significant levels of

demand and we will continue to push hard on both of these

fronts.

Tanzania

Envision, the Tanzanian entity which purchased the Tanzanian

agriculture business from us, has not yet paid the initial proceeds

in accordance with the payment schedule agreed in the Sale and

Purchase agreement ("SPA"). The legal action that we had commenced

against Envision has now been stayed until the end of 2019 to allow

for mediation between the parties with the objective of giving

Envision the time required to secure the funds required to meet

their commitments as set out within the SPA. The Group is still

settling outstanding creditors (circa $182,000 at 30 June 2019) and

apart from minimal winding up expenses, the Group has no ongoing

cost commitment in Tanzania.

Preference Share Restructure into 4% Convertible Bond

The board resolved to approve the proposed restructure of the 5%

perpetual preference shares in Woodbois subsidiary Argento. The

preference shares will be repurchased in exchange for the issue of

Bonds by the Company, at a ratio of US$400 in nominal value of

Bonds for every one Preference Share for an aggregate value of

US$30m. A Trust Deed has been entered into between the Company and

Woodside Corporate Services Limited acting as the trustee for the

bonds and the Company is currently in the process of exchanging

contracts with each of the Preference Shareholders.

A Closing Date of 20th October 2019 has been detailed for the

purpose of the 4% interest payment due which will be calculated per

annum by reference to the principal amount thereof and is payable

annually in arrears within ten business days following 30 December

in each year with the exception of 30 December 2019.

Congo Basin Forest Partnership

Finally, I'm very pleased to announce that Woodbois has joined

the Congo Basin Forest Partnership (CBFP). The CBFP is an

international association of more than forty governments,

international organizations, private sector and civil society

representatives, is designed to enhance the sustainable management

of the Congo Basin ecosystem. Membership of the CBFP will allow

Woodbois to engage in discussions and initiatives that promote the

sustainable management of forests in the Congo Basin.

The partnership promotes economic development, poverty

alleviation, and effective governance through the conservation and

sustainable management of natural resources, including forests and

wildlife. The CBFP, established at the 2002 World Summit on

Sustainable Development, operates within the framework of the

Council of Ministers in charge of the Forests of Central Africa

(COMIFAC) and in accordance with COMIFAC's strategic plan, the Plan

de Convergence.

Given the importance that our customers attach to using only

sustainable hardwood products, it is both important and valuable

for Woodbois to work alongside key sustainability-driven

organisations such as the CBFP.

We still have much to achieve this year as we enter the home

straight of 2019, but we draw great encouragement from all that has

been achieved during the year to date and the consistent

progression and evolution of the business. Thank you for taking the

time to read this report and for your ongoing support.

Paul Dolan

CEO

Woodbois Limited

Paul Dolan - CEO

Kevin Milne - Interim Chairman

www.woodbois.com +44 (0)20 7099 1940

Arden Partners Plc (Nominated adviser and broker)

Tom Price +44 (0)20 7614 5900

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTCKCDPPBDDAKK

(END) Dow Jones Newswires

October 10, 2019 02:00 ET (06:00 GMT)

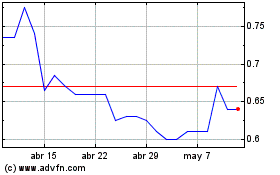

Woodbois (LSE:WBI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Woodbois (LSE:WBI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024