Bayer Reports Surge in Roundup Plaintiffs -- 3rd Update

30 Octubre 2019 - 9:52AM

Noticias Dow Jones

By Ruth Bender

BERLIN -- Bayer AG said the number of plaintiffs claiming its

Roundup herbicides caused cancer had more than doubled to 42,700 in

the past three months, adding pressure on the

chemicals-to-pharmaceuticals company to resolve the legal battle

that has raised questions about its future.

Bayer was thrown into one of the worst crises in its

156-year-old history after its $63 billion acquisition of Roundup

inventor Monsanto Co. last year, only to face thousands of lawsuits

about the herbicides.

Since August 2018, three juries have found Bayer's products

caused non-Hodgkin lymphoma, chopping roughly 30% off the company's

market value.

While uncertainty over the legal outcome still cloud the

company's future, Bayer shares rose more than 2% Wednesday after it

posted better-than-expected third-quarter sales and profit.

"Bayer is on track, both operationally and strategically," Chief

Executive Werner Baumann said. Mr. Baumann, who has faced heavy

criticism from shareholders angry with their recent losses,

highlighted progress the company has made on selling assets, making

its business more profitable and boosting oversight of legal

strategy.

The spike in plaintiffs, from 18,400 in early July, comes as

Bayer and plaintiff lawyers discuss a potential settlement. Some

investors, including activist hedge fund Elliott Management Corp.,

have urged Bayer to consider settling.

Bayer had warned about a sharp rise in plaintiffs earlier in

October, but played down the significance, saying the numbers said

nothing about the size of any settlement payment or the merits of

the claims.

It blamed the spike on an advertising push by lawyers seeking to

recruit more plaintiffs before any settlement is reached. Investors

worried the surge could push up the final bill for Bayer.

Besides engaging "constructively" in settlement talks, Bayer has

continued to defend itself in appeals and would do so in any new

trial, Mr. Baumann told reporters.

Bayer has argued that Roundup and its active ingredient

glyphosate are safe and that this view is backed by hundreds of

regulatory decisions around the world.

Investors' hopes of a settlement have helped the stock recover

slightly since the start of this year. Several trials scheduled to

take place this summer and fall have been delayed, fueling hopes

that settlement talks are moving forward.

"We continue to think that a settlement is the most likely and

beneficial outcome for investors," Bernstein Research said in a

client note. Baader Bank's Markus Mayer said a settlement below $20

billion would be a positive share-price trigger.

Reaching a settlement is complicated, especially as Roundup

continues to be sold in stores, making it hard to reach an

agreement that would prevent future plaintiffs from coming forward.

The spike in plaintiffs has made a resolution even more

challenging, as Bayer faces more plaintiff lawyers, said Thomas

Claps, a litigation analyst for Susquehanna Financial Group.

Mr. Baumann repeated Wednesday that the company would only agree

to a "financially reasonable" settlement. He slightly changed tone

on his expectation that any settlement should reach "finality,"

saying a settlement must come as close as possible to

"finality."

According to a person familiar with the mediation discussions,

Bayer and plaintiff lawyers are still far apart on the amount and

scope of a potential settlement. Mr. Baumann declined to comment on

the current state of the talks.

Meanwhile, Bayer's business is improving. Sales in its

crop-science unit recovered from last quarter's weakness, growing

5.8% to EUR3.95 billion ($4.4 billion), driven by growth in Latin

and North America.

This helped the company post an overall rise in sales to EUR9.8

billion, slightly beating analysts' expectations, according to

estimates from FactSet. The number excludes the company's

animal-health business, which it is selling to Elanco Animal Health

Inc.

Sales in the pharmaceuticals unit, which counts for a little

more than half of group sales, rose 8.2% to EUR4.5 billion, driven

mostly by its two blockbuster drugs, blood thinner Xarelto and eye

treatment Eylea.

Net income dropped 65% in the quarter to EUR1 billion, due

mostly to a large divestment gain recorded in the comparable period

last year.

Bayer confirmed its full-year outlook of a 4% rise in sales.

This reassured analysts, given that Bayer warned in July that the

severe weather that affected its crop-science division could put

its sales target out of reach.

Sara Randazzo contributed to this article.

Write to Ruth Bender at Ruth.Bender@wsj.com

(END) Dow Jones Newswires

October 30, 2019 11:37 ET (15:37 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

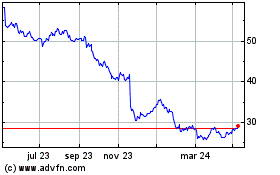

Bayer (TG:BAYN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

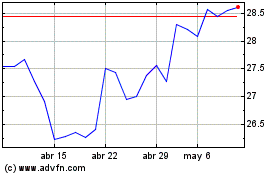

Bayer (TG:BAYN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024