Polar Capital Holdings PLC AuM Update (2064Z)

09 Enero 2020 - 1:00AM

UK Regulatory

TIDMPOLR

RNS Number : 2064Z

Polar Capital Holdings PLC

09 January 2020

9 January 2020 Polar Capital Holdings plc

AuM Update

Polar Capital Holdings plc ("Polar Capital" or the "Group"), the

specialist active asset management group, today provides its

regular quarterly update of its unaudited statement of its Assets

under Management ("AUM") and performance fees earned for the

calendar year to 31 December 2019.

Group AUM (unaudited)

Polar Capital reports that as at 31 December 2019 its AuM were

GBP14.2bn compared to GBP13.8bn at the end of March 2019, an

increase of 3% over the period. During the period, AuM increased by

GBP0.4bn which comprised net outflows of GBP1.1bn offset by an

increase of GBP1.5bn related to market movement and fund

performance.

AuM movement in nine Long-only Alternative Total

months to 31 December funds funds

2019

AuM at GBP12,529m GBP1,306m GBP13,835m

1 April 2019

------------ ------------ ------------

Net subscriptions GBP(1,132)m GBP61m GBP(1,071)m

------------ ------------ ------------

Market movement GBP1,397m GBP60m GBP1,457m

and performance

------------ ------------ ------------

Total AuM at GBP12,794m GBP1,427m GBP14,221m

31 December 2019

------------ ------------ ------------

Net performance fees (unaudited)

The table below sets out the position relating to net

performance fee profits (after the deduction of staff interests)

earned in the first nine months of the Group's financial year.

Performance fee profit Nine months Year to Nine months to

to

net of staff allocations 31 Dec 18 31 Mar 19 31 Dec 19*

(year-end)

Net performance fee profit GBP23.6m GBP24.0m GBP8.8m*

-------------- -------------- ---------------

*The figures to December 2019 are reduced by what is expected to

be circa GBP1.4m of net deferment that IFRS requires to be deducted

from this year's receipts.

Gavin Rochussen, Chief Executive, commented:

"Although AuM in the nine months has increased by GBP400m from

GBP13.8bn to GBP14.2bn, it has been another challenging quarter.

Net outflows of GBP623m were offset by an increase in AuM of

GBP542m from market and performance movements resulting in a

decline in AuM in the quarter of GBP81m.

"The election result and reduced Brexit uncertainty increased

demand for our UK Value Fund which had net inflows of GBP100m in

December. On the other hand, clients continued to reduce their

exposure to North American equities. This led to net outflows from

our North American Fund of GBP611m in the quarter, which includes

the reallocation of a client mandate away from North American

equities to alternative asset classes.

"The Japan Value Fund continued to perform well and had net

inflows in December of GBP48m marking an end to multi-year monthly

outflows from our Japan funds.

"In the nine month period to 31 December we were not immune to

the challenging conditions experienced by the industry as a whole;

total net outflows amounted to GBP1.1bn which was dominated by net

outflows of GBP453m from the Japan Fund prior to the merger with

the Japan Value Fund, net outflows from our North American strategy

of GBP795m and an aggregate GBP500m redemption by a long-standing

client in our Technology and Healthcare Funds.

"It is pleasing to report net inflows over the nine months into

the majority of our Funds including Global Technology, Japan Value,

UK Value Opportunities, GEM Stars, Asia and China Stars, Global

Insurance, European ex-UK Income, Global Convertible Bonds, Global

(Convertibles) Absolute Return, UK Absolute Equity and China

Mercury.

"Fund performance across the range of our funds was strong in

the last quarter of the calendar year resulting in crystallised net

performance fee profits of GBP8.8m for the period to 31

December.

"Over three years annualised, 67% of our Funds and 81% of AuM

have outperformed their respective benchmarks.

"We have a diverse and complementary range of fund strategies

with proven track records. We remain confident that, over the long

term, our active fundamental strategies will continue to deliver

above average returns for our clients and compelling total returns

for our shareholders."

For further information please contact:

Polar Capital

Gavin Rochussen (Chief Executive)

John Mansell (Executive Director)

Samir Ayub (Finance Director) +44 (0)20 7227 2700

Numis Securities Limited - Nomad and

Joint Broker

Charles Farquhar

Stephen Westgate

Kevin Cruickshank (QE) +44 (0)20 7260 1000

Peel Hunt LLP - Joint Broker

Guy Wiehahn

Andrew Buchanan +44 (0)20 7418 8893

Camarco

Ed Gascoigne-Pees

Monique Perks +44 (0)20 3757 4995

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTEAKFPELSEEFA

(END) Dow Jones Newswires

January 09, 2020 02:00 ET (07:00 GMT)

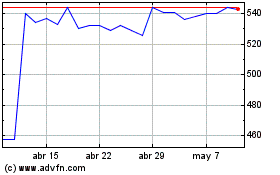

Polar Capital (LSE:POLR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

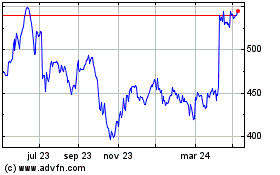

Polar Capital (LSE:POLR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024