TIDMN4P

RNS Number : 9680D

N4 Pharma PLC

25 February 2020

25 February 2020

N4 Pharma plc

("N4 Pharma", the "Company" or the "Group")

Final Results

N4 Pharma Plc (AIM: N4P), the specialist pharmaceutical company

developing Nuvec(R), a novel delivery system for cancer treatments

and vaccines, is pleased to announce its audited results for the

year ended 31 December 2019.

Nigel Theobald, Chief Executive Officer of N4 Pharma Plc,

commented:

"The Directors believe we have made considerable progress in

understanding how Nuvec(R) works in the last 12 months which will

put us in a stronger position for potential collaboration

discussions as we continue to present our data to potential

licensing partners. Having demonstrated that Nuvec(R) can load and

transfect a range of DNA and mRNA antigens in vitro and also

produce an in vivo antibody response with a good safety profile, we

have recently worked on improving the dispersion of Nuvec(R) with a

view to addressing some of the inconsistencies seen in previous in

vivo work.

"Our next focus is to assess the improved dispersion with

further in vitro and in vivo testing of Nuvec(R) using OVA plasmid

DNA whilst, in parallel, working with Nanomerics on producing

stable Nuvec(R) formulations.

"We believe the work we have done in the last 12 months,

together with our ongoing studies, puts our Nuvec(R) delivery

system in a stronger position than it was when we first announced

our positive in vivo antibody results and we remain excited about

the potential for Nuvec(R) to become a credible delivery system in

the field of cancer therapeutics and vaccines."

Enquiries:

N4 Pharma Plc

Nigel Theobald, CEO Via Scott PR

Allenby Capital Limited Tel: +44(0)203 328 5656

James Reeve/Asha Chotai

Scott PR Tel: +44(0)1477 539 539

Georgia Smith

About N4 Pharma

N4 Pharma is a specialist pharmaceutical company developing a

novel delivery system for cancer and vaccine treatments using its

unique silica nanoparticle delivery system called Nuvec(R).

N4 Pharma's business model is to partner with companies

developing novel antigens for cancer and vaccine treatments to use

Nuvec(R) as the delivery vehicle to get their antigen into cells to

express the protein needed for the required immunity. As these

products progress through pre clinical and clinical programs, N4

Pharma will seek to receive up front payments, milestone payments

and ultimately royalty payments once products reach the market.

N4 Pharma plc

Chairman's Report

N4 Pharma Plc (the "Company"), is the holding company of N4

Pharma UK Limited ("N4 UK") and N4 Biotech Limited ("N4 Biotech")

which together at the date of these accounts form the group (the

"Group"). N4 Biotech was dissolved on 14 January 2020. N4 UK is a

specialist pharmaceutical company engaged in the development of a

mesoporous silica nanoparticle delivery system ("Nuvec(R)") to

improve the cellular delivery and potency of cancer treatments and

vaccines.

Review of operations for the financial year ended 31 December

2019

During the year to 31 December 2019, as anticipated, no revenue

was generated by the Group.

The operating loss for the year was GBP947,340 (31 December

2018: GBP1,417,089 loss).

In the year, GBP1,050,000 of new funds were raised through the

placing of 10,500,000 new ordinary shares (the "Placing").

Cash at the year-end stood at GBP965,752 (31 December 2018: GBP

793,141) .

Board Changes

During the period the Company appointed John Chiplin as

non-executive Chairman and Chris Britten as a non-executive

Director. Paul Titley stood down as a director and employee of the

Company. David Templeton became an executive director, taking

responsibility for the technical aspects of Nuvec(R)'s development.

These changes bring considerable experience and expertise to the

Board in order to take the Group forward.

Key Operational Events and Opportunities

The Group continues to confirm and extend the Nuvec(R) dataset

to enable it to undertake discussions with large pharmaceutical and

Biotech companies to license Nuvec(R) for their own pre-clinical

and clinical programs using nucleic acids. We now have a

significant amount of positive data giving a clear understanding

that:

-- a range of DNA and mRNA antigens can be loaded onto the

Nuvec(R) particles and successfully transfect cells in vitro;

-- Nuvec(R)'s mechanism of action to transfect cells is via

endocytosis into the cell and the release of payload into the

cytoplasm;

-- Nuvec(R) has a good safety profile: it degrades naturally in

the body and does not track to the liver;

-- importantly, Nuvec(R) works for pDNA and mRNA having shown an

in vivo antibody response for both; and

-- Nuvec(R) currently delivers a good response from two or three

injections but has shown inconsistent or negative responses when

just one injection is used.

The data we have generated so far is encouraging and shows that

Nuvec(R) has the potential to be an effective delivery system for

nucleic acids.

Due to inconsistencies identified in third party pre-clinical

studies, the Company decided to undertake a repeat of its

pre-clinical study with the University of Queensland, using OVA

pDNA. The repeat study added an additional arm to investigate

responses from one injection as well as three injections. The

repeat study confirmed a good response using Nuvec(R) at higher

doses using three injections but no response with just one

injection. This was a significant finding, as the previous studies

showing inconsistencies had all used just one injection, indicating

that the inconsistencies shown in the previous studies may have

been as a result of the dosing.

This work also showed that once the Nuvec(R) particles were

loaded with OVA pDNA, the formulation was not ideally dispersed.

This lack of dispersion is not an issue for in vitro work as the

particles are well dispersed in the experiment but due to the

concentrations used for in vivo experiments, is the dispersion is

likely to be a further explanation for the inconsistency seen when

using Nuvec(R) in vivo.

On 20 August 2019, the Company announced that it would undertake

a program of work to investigate how to improve the dispersity of

Nuvec(R) formulations once loaded with DNA and RNA. By improving

dispersity, the Company believes it will be able to demonstrate a

stronger more consistent in vivo response which will make it much

more attractive to third-parties for licensing opportunities.

The focus of this work is not to alter the basic silica

nanoparticle, but rather to look at the processes of how we load a

linker to the silica particle to enable DNA or RNA to be loaded to

the particle and also how the DNA or RNA itself is then loaded onto

the Nuvec(R) particle. The objective of the work is to improve

these processes so that a more even dispersion of DNA loaded

Nuvec(R) is achieved.

As announced in January 2020, we have now successfully completed

the first two phases of this work, with alterations to the

manufacturing process, demonstrating improved dispersion of Nuvec

(R) and how best to measure this dispersion. We have now begun the

phase to investigate how to add the DNA and maintain this improved

dispersion with the ongoing work programme, the expected timings of

which are as follows:

-- Q1 2020 - Nuvec(R) improved DNA loading process

-- Q2 2020 - in vitro testing of improvements

-- Q2-Q3 2020 - in vivo testing of improved transfection and immune response

-- Q3-Q4 2020 - conduct in vivo cancer model

Assuming a successful conclusion to this program of work, the

Directors believe the subsequent data pack and improved consistency

will put the Group in a much stronger position to embark on

licensing discussions with prospective partners.

At the end of 2018, the Company announced the Nuvec(R) delivery

system was accepted for characterisation by the European

Nanomedicine Characterisation Library ("EUNCL"). Due to delays at

EUNCL's end, the actual work did not start until the end of Q3 2019

and initially focused on endotoxin assessments and dispersion. The

endotoxin assay used by EUNCL was discovered not to be suitable for

Nuvec(R) so no results were possible. The Company has separately

undertaken its own endotoxin tests on Nuvec(R) and found no

endotoxins present so this is not considered by the Directors to be

an issue. EUNCL's dispersion tests confirmed what the Company had

already discovered, namely that there appears to be agglomeration

of the Nuvec(R) particle.

Unfortunately, funding for the EUNCL programme has not been

continued beyond 2019 so we will not undertake any further work

with EUNCL. The Group is yet to receive a final report from EUNCL,

however it is not expected to contain any further significant

information above what has already been shared with us around

endotoxin analysis and dispersion. In light of the work we are now

doing, which addresses a lot of the EUNCL findings, the Directors

do not believe that the closure of the program will negatively

impact the Group, Nuvec(R) work or its prospects.

Following the successful completion of the first phase of the

CMC program showing the ability to improve Nuvec(R) dispersion, in

January 2020 the Company entered into a research collaboration

agreement with Nanomerics Ltd, who have considerable expertise in

the field of nanoparticle formulation and development. This

provides the Group with access to the laboratories at the London

School of Pharmacy, part of the University College of London (UCL),

where we can undertake more accelerated work on the development of

Nuvec(R) and perform our planned in vivo efficacy studies.

The agreement with Nanomerics will allow the Group to build on

the previously announced work and undertake full formulation

assessment, including freeze drying, reconstitution and stability

of the formulation. Achieving a stable formulation capable of being

re-constituted for injection is an important aspect of making Nuvec

(R) easier to use and will allow the Group to broaden how it can

interact with potential partners as the access to UCL labs will

allow us to do the formulation and testing work ourselves rather

than relying on partners, thereby giving greater control over the

early phases of collaborative research agreements.

Future Prospects

The Company is restructuring its chemistry, manufacturing and

controls ("CMC") operations and Dr Allan Hey will be stepping down

as Head of CMC Development at the end of February 2020. Allan will

be replaced by Rob Harris, a CMC Consultant with considerable

experience of working with nanoparticles. Rob will advise the

Company on all the strategic aspects of the Nuvec(R) CMC

program.

The Group has already demonstrated that Nuvec(R) is capable of

loading and transfecting both DNA and mRNA and producing

antibodies. The next phase of work is focused on making Nuvec(R)

more consistent, easier to handle and therefore more

efficacious.

The use of DNA and RNA in the life science sector is a major

growth area and a consistent theme in all discussions about the

potential for DNA and RNA is the need for a safe and effective

delivery system. The Board remains very optimistic about the future

of the Group and its prospects and believes the successful

conclusion of its CMC and in vivo efficacy studies will make it an

attractive alternative to current delivery systems being used in

this area.

In addition to our primary focus of optimizing Nuvec(R), the

Board has considered a number of investment and acquisition

opportunities to widen our asset base. Whilst discussions have not

resulted in the conclusion of any transaction, we remain open to

diversifying our portfolio if an attractive proposition presents

itself on favourable terms.

On behalf of the Board, I would like to thank all of our

shareholders for their continued patient support and look forward

to providing further updates on our progress.

By order of the Board

John Chiplin

Chairman

N4 Pharma Plc

Consolidated Statement of Comprehensive Income for the year

ended 31 December 2019

Notes 2019 2018

GBP GBP

------------ ------------------------------------

Government grant income - 72,832

Gross profit - 72,832

Research and development

costs (216,948) (846,176)

General and administration

costs (730,392) (643,745)

Operating loss for the

year (947,340) (1,417,089)

Finance expenditure (1,385) (981)

Gain on sale of investment - 27,693

Loss for the year before

tax 4 (948,725) (1,390,377)

Taxation 5 72,352 205,534

Loss for the year after

tax (876,373) (1,184,843)

Other comprehensive income

net of tax - -

Total comprehensive loss

for the year attributable

to equity owners of N4

Pharma Plc (876,373) (1,184,843)

------------------------------ ------ ------------ ------------------------------------

Loss per share attributable

to owners of the parent

Weighted average number

of shares:

Basic 100,168,016 89,440,373

Diluted 100,168,016 91,305,287

Basic loss per share (0.87p) (1.32p)

Diluted loss per share (0.87p) (1.30p)

All activities derive from continuing operations.

N4 Pharma Plc

Consolidated Statement of Financial Position as at 31 December

2019

Notes 2019 2018

GBP GBP

------------- -------------

Assets

Non-current assets

Investments 6 - -

----------------------------- ------ ------------- -------------

-

Current assets

Trade and other receivables 7 99,269 276,926

Cash and cash equivalents 965,752 793,141

1,065,021 1,070,067

Total Assets 1,065,021 1,070,067

----------------------------- ------ ------------- -------------

Liabilities

Current liabilities

Trade and other payables 8 (51,547) (159,666)

Accruals and deferred

income (26,136) (30,457)

----------------------------- ------ ------------- -------------

(77,683) (190,123)

Total assets less

current liabilities 987,338 879,944

----------------------------- ------ ------------- -------------

Net Assets 987,338 879,944

----------------------------- ------ ------------- -------------

Equity

Share capital 10 8,676,675 8,634,675

Share premium 10 10,327,258 9,328,848

Share option reserve 10 25,266 81,909

Reverse acquisition

reserve (14,138,244) (14,138,244)

Merger reserve 279,347 279,347

Retained earnings (4,182,964) (3,306,591)

----------------------------- ------ ------------- -------------

Total Equity 987,338 879,944

----------------------------- ------ ------------- -------------

N4 Pharma Plc

Consolidated Statement of Changes in Equity for the year ended

31 December 2019

(i) Year ended Share Share Share Option Reverse Merger Retained Total Equity

31 December Capital Premium Reserve Acquisition Reserve Earnings

2019 Reserve

GBP GBP GBP GBP GBP GBP GBP

----------- ------------- ------------- -------------- ------------- ------------ -------------

Balance at 1

January 2019 8,634,675 9,328,848 81,909 (14,138,244) 279,347 (3,306,591) 879,944

Total

comprehensive

loss for

the year - - - - - (876,373) (876,373)

Share issue 42,000 998,410 - - - - 1,040,410

Share option

reserve - - (56,643) - - - (56,643)

----------- ------------- ------------- -------------- ------------- ------------ -------------

At 31 December

2019 8,676,675 10,327,258 25,266 (14,138,244) 279,347 (4,182,964) 987,338

(ii) Year Share Share Share Option Reverse Merger Retained Total Equity

ended 31 Capital Premium Reserve Acquisition Reserve Earnings

December Reserve

2018

GBP GBP GBP GBP GBP GBP GBP

----------- ------------ --------------- --------------- ------------ ------------- ------------------

Balance at 1

January 2018 8,579,396 8,513,670 147,635 (14,138,244) 299,045 (2,121,748) 1,279,754

Total

comprehensive

loss for

the year - - - - - (1,184,843) (1,184,843)

Share issue 55,279 815,178 - - (19,698) - 850,759

Share option

reserve - - (65,726) - - - (65,726)

At 31 December

2018 8,634,675 9,328,848 81,909 (14,138,244) 279,347 (3,306,591) 879,944

N4 Pharma Plc

Consolidated Statement of Cash Flow for the year ended 31

December 2019

2019 2018

GBP GBP

----------------------------------- ------------ --------------

Operating activities

Loss before tax (948,725) (1,390,377)

Finance expenditure 1,385 981

Share based payments to employees 3,767 629

Gain on sale of investments - (27,693)

Operating loss before changes

in working capital (943,573) (1,416,460)

Movements in working capital:

Decrease/(increase) in trade

and other receivables 29,441 (9,266)

(Decrease)/increase in trade,

other payables and accruals (112,440) 10,905

Taxation 220,568 70,574

Cash used in operations (806,004) (1,344,247)

------------------------------------ ------------ --------------

Net cash flows used in operating

activities (806,004) (1,344,247)

------------------------------------ ------------ --------------

Investing activities

Sale of investments - 27,693

Net cash flows from investing

activities - 27,693

------------------------------------ ------------ --------------

Financing activities

Finance expenditure (1,385) (981)

Net proceeds of ordinary share

issue 980,000 784,404

Net cash flows from financing

activities 978,615 783,423

------------------------------------ ------------ --------------

Net increase/(decrease) in

cash and cash equivalents 172,611 (533,131)

Cash and cash equivalents

at beginning of the year 793,141 1,326,272

Cash and cash equivalents

at 31 December 965,752 793,141

Notes to the consolidated financial statements for the year

ended 31 December 2019

1. Accounting policies

1.1 Reporting entity

N4 Pharma Plc (the "Company"), is the holding company for N4

Pharma UK Limited ("N4 UK"), and N4 Biotech Limited ("N4 Biotech"),

and together form the group (the "Group"). N4 Pharma UK Limited is

a specialist pharmaceutical company engaged in the development of

mesoparticulate silica delivery systems to improve the cellular

delivery and potency of vaccines . The nature of the business is

not deemed to be impacted by seasonal fluctuations and as such

performance is expected to be consistent.

The Company is domiciled in England and Wales and was

incorporated and registered in England and Wales on 6 July 1979 as

a public limited company and its shares are admitted to trading on

AIM (LSE: N4P). The Company's registered office is located at 6th

Floor, 60 Gracechurch Street, London, EC3V 0HR.

The consolidated financial statements have been prepared and

approved by the Directors in accordance with International

Financial Reporting Standards as adopted by the EU ("Adopted

IFRSs"). The consolidated financial statements comply with the

Companies Act 2006 and give a true and fair view of the state of

affairs of the Group.

The accounting policies set out below have, unless otherwise

stated, been applied consistently to all periods presented in these

consolidated financial statements.

1.2 Measurement convention

The consolidated financial statements are prepared on the

historical cost basis, except for the following items:

-- Share-based payments related to investment acquisition are

measured at fair value shown in the Merger Reserve.

-- Share-based payments related to employee costs are measured

at fair value shown in the Statement of Comprehensive Income.

-- Share Warrants and Options are measured at fair value using

the Black Scholes model (see note 9).

-- Equity investments are measured at fair value.

The consolidated financial statements are presented in Great

British Pounds ("GBP" or "GBP").

1.3 Going concern

These consolidated financial statements have been prepared on

the basis of accounting principles applicable to a going concern.

The Directors consider that the Group will have access to adequate

resources, as set out below, to meet both operational requirements

for at least 12 months from the date of approval of these

consolidated financial statements. For this reason, they continue

to adopt the going concern basis in preparing the consolidated

financial statements.

The Group prepares regular business forecasts and monitors its

projected cash flows, which are reviewed by the Board. Forecasts

are adjusted for reasonable sensitivities that address the

principal risks and uncertainties to which the Group is exposed,

thus creating a number of different scenarios for the Board to

challenge. In those cases, where scenarios deplete the Group's cash

resources too rapidly, consideration is given to the potential

actions available to management to mitigate the impact of one or

more of these sensitivities, in particular the discretionary nature

of costs incurred by the Group, in order to ensure the continued

availability of funds.

As the Group did not have access to bank debt and future funding

is reliant on issues of shares in the parent Company, the Board has

derived a mitigation plan for the scenarios modelled as part of the

going concern review.

On the basis of this analysis, the Board has concluded that

there is a reasonable expectation that the Company will have

adequate resources to continue in operational existence for the

foreseeable future being a period of at least twelve months from

the balance sheet date.

The Group currently has no source of operating cash inflows,

other than interest and grant income, and has incurred net

operating cash outflows for the year ended 31 December 2019 of

GBP806,004 (2018: GBP1,344,247 outflow). At 31 December 2019, the

Group had cash balances of GBP965,752 (2018: GBP793,141) and a

surplus in net working capital (current assets, including cash,

less current liabilities) of GBP987,338 (2018: GBP879,944).

The Group continues to take steps to manage operational

expenditure effectively and to manage the cash required for

budgeted activities and working capital for at least 12 months from

the date of approval of the consolidated financial statements.

Close monitoring of current and forecast expenditure is undertaken

by the board and key executive decisions discussed at monthly board

meetings.

1.4 Basis of consolidation

Intra-Group balances and transactions, and any unrealised income

and expenses arising from intra-Group transactions, are eliminated

in preparing the consolidated financial statements.

1.5 Revenue

Revenue is recognised to the extent this it is probable that

economic benefit will flow to the Group and the revenue can be

reliably measured. Revenue is measured at the lower of value of the

consideration received or receivable for the sale of goods or

services, excluding discounts, rebates, VAT and other sales taxes

and duties.

The Group has not recognised any revenue to date.

1.6 Government grant income

Government grants are recognised only when there is reasonable

assurance that the Group will comply with the conditions attaching

to them and that the grants will be received.

Government grants are recognised in the consolidated statement

of comprehensive income on a systematic basis over the periods in

which the Group recognises and expenses the related costs for which

the grants are intended to compensate.

Government grants that are receivable as compensation for

expenses or losses already incurred or for the purpose of giving

immediate financial support to the Group with no future related

costs are recognised in the consolidated statement of comprehensive

income in the period in which they become receivable.

1.7 Expenses

Financing income and expenses

Financing expenses comprise interest payable and finance charges

and net foreign exchange losses that are recognised in the

consolidated statement of comprehensive income (see foreign

currency accounting policy note 1.13). Financing income comprises

interest receivable on funds invested and net foreign exchange

gains.

Interest income and interest payable is recognised in the

consolidated statement of comprehensive income as it accrues, using

the effective interest method. Foreign currency gains and losses

are reported on a net basis.

Research and development

Research costs are charged against the consolidated statement of

comprehensive income as they are incurred. Certain development

costs will be capitalised as intangible assets when it is probable

that the future economic benefits will flow to the Group. Such

intangible assets will be amortised on a straight-line basis from

the point at which the assets are ready for use, over the period of

the expected benefit, and are reviewed for impairment at each year

end date. Other development costs are charged against income as

incurred since the criteria for their recognition as an asset is

not met.

The criteria for recognising expenditure as an asset are:

-- It is technically feasible to complete the product;

-- Management intends to complete the product and use or sell

it;

-- There is an ability to use or sell the product;

-- It can be demonstrated how the product will generate probable

future economic benefits;

-- Adequate technical, financial and other resources are

available to complete the development, use and sale of the product;

and

-- Expenditure attributable to the product can be reliably

measured.

The costs on an internally generated intangible asset comprise

all directly attributable costs necessary to create, produce and

prepare the asset to be capable of operating in the manner intended

by management. Directly attributable costs include employee costs

incurred on technical development, testing and certification,

materials consumed and any relevant third-party cost. The costs of

internally generating developments are recognised as intangible

assets and are subsequently measured in the same way as externally

acquired intangible assets. However, until completion of the

development project, the assets are subject to impairment testing

only.

1.8 Taxation

Taxation

Taxation for the year comprises current and deferred tax. Tax is

recognised in the consolidated statement of comprehensive income,

except to the extent that it relates to items recognised directly

in equity.

Current or deferred taxation assets and liabilities are not

discounted.

Current tax

Current tax is recognised at the amount of tax payable using the

tax rates and laws that have been enacted or substantively enacted

by the consolidated statement of financial position date.

Deferred tax

Deferred tax is recognised in respect of all timing differences

that have originated but not reversed at the consolidated statement

of financial position date.

Timing differences arise from the inclusion of income and

expenses in tax assessments in periods different from those in

which they are recognised in consolidated financial statements.

Deferred tax is measured using tax rates and laws that have been

enacted or substantively enacted by the year end and that are

expected to apply to the reversal of the timing difference.

Unrelieved tax losses and other deferred tax assets are

recognised only to the extent that it is probable that they will be

recovered against the reversal of deferred tax liabilities or other

future taxable profits.

1.9 Earnings per share

The Group presents basic and diluted earnings or loss per share

data for its ordinary shares. Basic earnings/loss per share is

calculated by dividing the profit or loss attributable to ordinary

shareholders of the Company by the weighted average number of

ordinary shares outstanding during the period, adjusted for own

shares held. Diluted earnings/loss per share is determined by

adjusting the profit or loss attributable to ordinary shareholders

and the weighted average number of ordinary shares outstanding,

adjusted for own shares held, for the effects of all dilutive

potential ordinary shares, which comprise share options and

warrants granted.

1.10 Operating segments

Segment results that are reported to the Chief Executive Officer

include items directly attributable to a segment as well as those

that can be allocated on a reasonable basis. Unallocated items

comprise mainly corporate assets, head office expenses, and income

tax assets and liabilities.

Segment capital expenditure is the total cost incurred during

the period to acquire plant and equipment, and intangible assets

other than goodwill.

The Group operated in one business segment, that of the

development and commercialisation of medicines via its delivery

system called Nuvec(R). No revenue has yet been generated by any of

the work undertaken by the Group.

The Directors consider that there are no identifiable business

segments that are subject to risks and returns different to the

core business. The information reported to the Directors, for the

purposes of resource allocation and assessment of performance, is

based wholly on the overall activities of the Group.

1.11 Classification of financial instruments issued by the Group

In accordance with IAS 32, financial instruments issued by the

Group are treated as equity only to the extent that they meet the

following two conditions:

(a) they include no contractual obligations upon the Group to

deliver cash or other financial assets or to exchange financial

assets or financial liabilities with another party under conditions

that are potentially unfavourable to the Group; and

(b) where the instrument will or may be settled in the Company's

own equity instruments, it is either a non-derivative that includes

no obligation to deliver a variable number of the Company's own

equity instruments or is a derivative that will be settled by the

Company's exchanging a fixed amount of cash or other financial

assets for a fixed number of its own equity instruments.

To the extent that this definition is not met, the proceeds of

issue are classified as a financial liability. Where the instrument

so classified takes the legal form of the Company's own shares, the

amounts presented in these consolidated financial statements for

called up share capital and share premium account exclude amounts

in relation to those shares.

Where a financial instrument that contains both equity and

financial liability components exists these components are

separated and accounted for individually under the above

policy.

1.12 Non-derivative financial instruments

Non-derivative financial instruments comprise investments, trade

and other receivables, cash and cash equivalents and trade and

other payables.

Investments

Investments are equity investments recognised initially at cost

and subsequently revalued to their fair value. Fair value is

determined by reference to published price quotations in the AIM

market. Gains and losses arising from changes in the fair value are

recognised in profit or loss within other income or other

expenses.

Trade and other payables

Trade and other payables are recognised initially at fair value.

Subsequent to initial recognition they are measured at amortised

cost using the effective interest method.

Cash and cash equivalents

Cash and cash equivalents are basic financial assets and

comprise cash in hand, deposits held at call with banks, other

short-term liquid investments with original maturities of three

months or less, and bank overdrafts. Any overdrafts are shown

within borrowings in current liabilities.

1.13 Foreign currency

Foreign currency transactions

Transactions in foreign currencies are translated to the

respective functional currencies of the Group's entities at the

foreign exchange rate ruling at the date of the transaction.

Monetary assets and liabilities denominated in foreign currencies

at the consolidated statement of financial position date are

retranslated to the functional currency at the foreign exchange

rate ruling at that date. Foreign exchange differences arising on

translation are recognised in the consolidated statement of

comprehensive income. Non-monetary assets and liabilities that are

measured in terms of historical cost in a foreign currency are

translated using the exchange rate at the date of the

transaction.

1.14 Impairment

A financial asset not carried at fair value through profit or

loss is assessed at each reporting date to determine whether there

is objective evidence that it is impaired. A financial asset is

impaired if objective evidence indicates that a loss event has

occurred after the initial recognition of the asset, and that the

loss event had a negative effect on the estimated future cash flows

of that asset that can be estimated reliably.

An impairment loss in respect of a financial asset measured at

amortised cost is calculated as the difference between its carrying

amount and the present value of the estimated future cash flows

discounted at the asset's original effective interest rate.

Interest on the impaired asset continues to be recognised through

the unwinding of the discount. When a subsequent event causes the

amount of impairment loss to decrease, the decrease in impairment

loss is reversed through profit or loss.

The carrying amounts of the Group's non-financial assets are

reviewed at each reporting date to determine whether there is any

indication of impairment. If any such indication exists, then the

asset's recoverable amount is estimated.

The recoverable amount of an asset is the greater of its value

in use and its fair value less costs to sell. In assessing value in

use, the estimated future cash flows are discounted to their

present value using a pre-tax discount rate that reflects current

market assessments of the time value of money and the risks

specific to the asset. For the purpose of impairment testing,

assets that cannot be tested individually are grouped together into

the smallest Group of assets that generates cash inflows from

continuing use that are largely independent of the cash inflows of

other assets or Groups of assets (the "cash-generating unit").

An impairment loss is recognised if the carrying amount of an

asset or its cash generating unit exceeds its estimated recoverable

amount. Impairment losses are recognised in profit or loss.

Impairment losses recognised in respect of cash generated units are

allocated first to reduce the carrying amount of any goodwill

allocated to the units, and then to reduce the carrying amounts of

the other assets in the unit (Group of units) on a pro rata

basis.Impairment losses recognised in prior periods are assessed at

each reporting date for any indications that the loss has decreased

or no longer exists. An impairment loss is reversed if there has

been a change in the estimates used to determine the recoverable

amount. An impairment loss is reversed only to the extent that the

asset's carrying amount does not exceed the carrying amount that

would have been determined, net of depreciation or amortisation, if

no impairment loss had been recognised.

1.15 Share based payment arrangements

Share-based payment arrangements in which the Group receives

goods or services as consideration for its own equity instruments

are accounted for as equity-settled share-based payment

transactions, regardless of how the equity instruments are obtained

by the Group.

Share-based transactions, other than those with employees, are

measured at the value of goods or services received where this can

be reliably measured. Where the services received are not

identifiable, their fair value is determined by reference to the

grant date fair value of the equity instruments provided. Should it

not be possible to measure reliably the fair value of identifiable

goods and services received, their fair value shall be determined

by reference to the fair value of the equity instruments provided

measured over the period of time that the goods and services are

received.

The expense is recognised in the consolidated statement of

comprehensive income or capitalised as part of an asset when the

goods are received or as services are provided, with a

corresponding increase in equity.

The grant date fair value of share-based payment awards granted

to employees is recognised as an employee expense, with a

corresponding increase in equity, over the period that the

employees become unconditionally entitled to the awards. The fair

value of the options granted is measured using an option valuation

model, taking into account the terms and conditions upon which the

options were granted. The amount recognised as an expense is

adjusted to reflect the actual number of awards for which the

related service and non-market vesting conditions are expected to

be met, such that the amount ultimately recognised as an expense is

based on the number of awards that do meet the related service and

non-market performance conditions at the vesting date. For

share-based payment awards with non-vesting conditions, the grant

date fair value of the share-based payment is measured to reflect

such conditions and there is no "true-up" for differences between

expected and actual outcomes.

Share-based payment transactions in which the Group receives

goods or services by incurring a liability to transfer cash or

other assets that is based on the price of the Group's equity

instruments are accounted for as cash-settled share-based payments.

The fair value of the amount payable to recipients is recognised as

an expense, with a corresponding increase in liabilities, over the

period in which the recipients become unconditionally entitled to

payment. The liability is re-measured at each consolidated

statement of financial position date and at settlement date. Any

changes in the fair value of the liability are recognised in the

consolidated statement of comprehensive income.

1.16 Adoption of new and revised International Financial Reporting Standards

The following IFRS standards, amendments or interpretations

became effective during the year ended 31 December 2019 but have

not had a material effect on this consolidated financial

information:

IFRS 16 Leases

IFRIC 23 Uncertainty over Income Tax Treatments

IFRS 9 Prepayments Features with Negative Compensation

IAS 28 Long-term Interests in Associates and Joint Ventures

IAS19 Plan amendment, Curtailment and Settlement

All new standards and amendments to standards and

interpretations effective for annual periods beginning on or after

1 January 2019 that are applicable to the Group have been applied

in preparing these consolidated financial statements.

The standards and interpretations that are issued, but not yet

effective, up to the date of issuance of the consolidated financial

statements are disclosed below. The Group intends to adopt these

standards, if applicable, when they become effective.

Effective

Standard date

------------------------------------------------------ ----------

Amendments to References to the Conceptual Framework 1 January

in IFRS Standards 2020

Amendments to IFRS 3 Business Combinations 1 January

2020

Amendments to IAS 1 and IAS 8: Definition of Material 1 January

2020

Interest Rate Benchmark Reform: amendments to IFRS 1 January

9, IAS 39 and IFRS 7 2020

The Directors are continuing to assess the potential impact that

the adoption of the standards listed above will have on the

consolidated financial statements for the year ended 31 December

2019.

1.17 Use of estimates and judgements

The preparation of consolidated financial statements in

conformity with IFRSs requires management to make certain

judgements, estimates and assumptions that affect the application

of accounting policies and the reported amounts of assets,

liabilities, income and expenses during the period. Actual results

may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimates are revised and in any future periods

affected.

In the process of applying the Group's accounting policies,

management has decided the following estimates and assumptions are

material to the carrying amounts of assets and liabilities

recognised in the consolidated financial statements.

Critical judgements

Research and development expenditure

The key estimates and judgements surrounding the capitalisation

of Research & Development expenditure is such that this

expenditure will only be capitalised when the recognition criteria

is met and is otherwise written off to the consolidated statement

of comprehensive income. The recognition criteria include the

identification of a clearly defined project with separately

identifiable expenditure where the outcome of the project, in terms

of its technical feasibility and commercial viability, can be

measured or assessed with reasonable certainty and that sufficient

resources exist to complete a profitable project. In the event that

these criteria are met, and it is probable that future economic

benefit attributable to the product will flow to the Group, then

the expenditure will be capitalised.

Impairment of investments and intercompany debtors

The subsidiary has sustained losses and the balance sheet is in

deficit. This is a potential indicator of impairment. The

recoverability of intercompany debtor and the cost of investment is

dependent on the future profitability of the entity. No provision

for impairment has been made in these accounts and this is a

significant judgement.

2. Risk management

Overview

The Group has exposure to the following risks:

-- Credit risk;

-- Liquidity risk;

-- Tax risk;

-- Market risk; and

-- Operational risk

This note presents information about the Group's exposure to

each of the above risks, its objectives, policies and processes for

measuring and managing risk, and its management of capital. Further

quantitative disclosures are included throughout these consolidated

financial statements.

Risk management framework

The Board of Directors has overall responsibility for the

establishment and oversight of the risk management framework and

developing and monitoring the Group's risk management policies. Key

risk areas have been identified and the Group's risk management

policies and systems will be reviewed regularly to reflect changes

in market conditions and the Group's activities.

The Audit Committee oversees how management monitors compliance

with the Group's risk management policies and procedures and

reviews the adequacy of the risk management framework in relation

to the risks faced by the Group.

Credit risk

Credit risk is the risk of financial loss to the Group if a

customer or counterparty to a financial instrument fails to meet

its contractual obligations and arises principally from the Group's

bank deposits and receivables. See note 12 for further detail. The

risk of non-collection is considered to be low. This risk is deemed

low at present due to the Group not yet trading and generating

revenue but is a consideration for future risks.

Liquidity risk

Liquidity risk is the risk that the Group will encounter

difficulty in meeting the obligations associated with its financial

liabilities that are settled by delivering cash or another

financial asset. The Group's approach to managing liquidity is to

ensure, as far as possible, that it will always have sufficient

liquidity to meet its liabilities when due, under both normal and

stressed conditions, without incurring unacceptable losses or

risking damage to the Group's reputation.

Tax risk

Any change in the Group's tax status or in taxation legislation

or its interpretations could affect the value of the investments

held by the Group or the Group's ability to provide returns to

shareholders or alter post-tax returns to shareholders.

Market risk and competition

The Group operates as a specialist pharmaceutical company

engaged in the development of mesoparticulate silica delivery

systems to improve the cellular delivery and potency of vaccines.

The Group is entering into a market with existing competitors and

the prospect of new entrants entering the current market. There is

no guarantee that current competitors or new entrants to the market

will not appeal to a wider portion of the Group's target market or

command broader band awareness.

In addition, the Group's future potential revenues from product

sales will be affected by changes in the market price of

pharmaceutical drugs and could also be subject to regulatory

controls or similar restrictions.

Operational risk

The Group is at an early stage of development and is subject to

several operational risks. The commencement of the Group's material

revenues is difficult to predict and there is no guarantee the

Group will generate material revenues in the future.

The Group has a limited operational history upon which its

performance and prospects can be evaluated and faces the risks

frequently encountered by developing companies. The risks include

the uncertainty as to which areas of pharmaceuticals to target for

growth.

Regulatory and legislative risk

The operations of the Group are such that it is exposed to the

risk of litigation from its suppliers, employees and regulatory

authorities. Exposure to litigation or fines imposed by regulatory

authorities may affect the Group's reputation even though monetary

consequences may not be significant.

Changes to legislation, regulations, rules and practices may

change and is often the case in the pharmaceutical industry which

is highly regulated and susceptible to regular change. Any changes

may have an adverse effect on the Group's operations.

Protection of intellectual property

The Group's ability to compete significantly relies upon the

successful protection of its intellectual property, in particular

its licenced and owned patent applications for Nuvec(R). The Group

seeks to protect its intellectual property through the filing of

worldwide patent applications, as well as robust confidentiality

obligations on its employees. However, this does not provide

assurance that a third party will not infringe on the Group's

intellectual property, release confidential information about the

intellectual property or claim technology which is registered to

the Group.

Capital management

The Group has no loans or borrowings and has sufficient

resources, in the view of the Directors, to meet its working

capital requirements for the next 12 months.

The Group manages its capital through the preparation of

detailed forecasts, and tracks actual receipts and outlays against

the forecasts on a regular basis, to ensure that the Group will be

able to continue as a going concern while maximising the return to

shareholders.

The capital structure of the Group consists of cash and cash

equivalents and equity comprising, capital, reserves and

accumulated losses.

3. Employees and directors

The average monthly number of employees during the year was

5(2018: 4). The directors of the Group are employed by N4 Pharma UK

Limited UK and as such are included in the employee figure. Total

directors remuneration is detailed in note 13 of these consolidated

financial statements.

2019 2018

GBP GBP

Wages and Salaries 270,472 233,282

Social security costs 34,956 22,556

Pension costs 1,209 807

-------- --------

306,637 256,645

4. Loss before tax

2019 2018

GBP GBP

Loss before taxation is arrived

after charging:

Fees payable to the Group's auditors

for the audit

of the Group's financial statements 21,200 20,600

Other fees payable to auditors:

* Other assurance services 700 1,000

* Tax advisory services - 3,550

------- -------

5. Taxation

2019 2018

GBP GBP

Current tax

Research and development tax credit

receivable for the current period (72,352) (222,066)

Adjustments in respect of prior

periods - 16,532

--------- ----------

(72,352) (205,534)

Deferred tax

Origination and reversal of temporary

differences - -

--------- ----------

Tax in income statement (72,352) (205,534)

--------- ----------

The tax charge for the year can be reconciled to the loss in the

Consolidated Statement of Comprehensive Income as follows:

2019 2018

GBP GBP

Loss before taxation (948,725) (1,390,377)

---------- ------------

Tax at the UK corporation tax rate

of 19% (2018: 19%) (180,258) (264,171)

Expenses not deductible - (5,320)

Net Research and development tax

credits (72,352) (96,406)

Changes in unrecognized deferred

tax 180,258 143,831

Prior year adjustment - 16,532

---------- ------------

Tax charge for the year (72,352) (205,534)

---------- ------------

At the year end the Group had trading losses carried forward of

GBP1,706,986 (2018: GBP1,257,239) for use against future

profits.

6. Investments

Inventory of securities

The Company held 1,388,889 Ferring warrants and 542,233 Valirx

warrants both of which had no value as at the year-end 31 December

2018. These were legacy holdings from Onzima Plc prior to the RTO.

These warrants expired during the financial year ended 31 December

2019.

7. Trade and other receivables

2019 2018

GBP GBP

Prepayments 11,758 11,861

VAT receivable 13,660 42,998

Corporation tax debtor 72,352 220,568

R&D expenditure credit 1,499 1,499

Loan interest receivable - -

Other debtors - -

------- --------

99,269 276,926

8. Trade and other payables

2019 2018

GBP GBP

Trade creditors 27,157 113,093

Employee creditors 8,152 9,107

Loan due to directors 16,000 36,000

Other creditors 238 1,466

------- --------

51,547 159,666

9. Share-based payments

a) Options

The Company has the ability to issue options to Directors to compensate

them for services rendered and incentivise them to add value to

the Group's longer-term share value. Equity settled share-based

payments are measured at fair value at the date of grant. The fair

value determined is unwound on a straight-line basis over the vesting

period based on the Group's estimate of the number of shares that

will vest and recognised as share premium. The value of the change

is adjusted to reflect the expected and actual levels of vesting.

Cancellations of equity instruments are treated as an acceleration

of the vesting period and any outstanding charge is recognised in

full immediately.

Fair value is measured using a Black Scholes pricing model. The

key assumptions used in the model have been adjusted based on management's

best estimate for the effects of non-transferability, exercise restrictions

and behavioral considerations. The inputs into model were as follows:

2017 Options 2018 Options 2019 Options

Share price 6.375p 6.6p 3.55p

Exercise price 7p 6.6p 3.55p

Expected volatility 27.2% 45.2% 37.4%

Expected option

life 3 years 6.5 years 6.5 years

Risk free rate 4.75% 5.00% 5.00%

As at 31 December 2019, there were 7,679,370 (2018: 7,249,084) options

in existence over ordinary shares of the Company allocated as follows:

Ordinary Exercise

Date of shares under Price

Name Grant option Expiry Date GBP

2015 Options

Gavin Burnell 14.10.15 2,701,210 14.10.25 0.028

Luke Cairns 14.10.15 675,302 14.10.25 0.028

2017 Options

Luke Cairns 03.05.17 717,143 14.10.25 0.070

David Templeton 03.05.17 717,143 14.10.25 0.070

Paul Titley 03.05.17 717,143 14.10.25 0.070

2018 Options

Alan Hey 26.09.18 717,143 26.09.28 0.066

2019 Options

John Chiplin 21.05.19 717,143 21.05.29 0.0355

Christopher Britten 21.05.19 717,143 21.05.29 0.0355

Total options 7,679,370

--------------

The aggregate fair value of the share options issued is as

follows:

2019 2018

GBP GBP

2015 Options 17,831 20,910

2017 Options 3,037 6,040

2018 Options 2,999 630

2019 Options 1,399 - -

------- -------

25,266 27,580

------- -------

Each option entitles the holder to subscribe for one ordinary

share in N4 Pharma Plc. Options do not confer any voting rights on

the holder.

In the case of the 2017 share options granted to Paul Titley, a

total of 1,434,286 were granted, the exercise of options over

717,143 ordinary shares were subject to certain performance

conditions. These options were exercisable at a price of 7 pence

per share (post-Share Re-Organisation) at any time before 14

October 2025. However, these share options lapsed prior to the

final reporting date of 31 December 2019 due to his departure from

the Company and those targets not being met. This leaves Paul

Titley with 717,143 options which are exercisable on the 3rd

anniversary of Admission, being 3 May 2020.

On 26 September 2018 a further 1,004,000 options over ordinary

shares were granted under the Company's share option scheme to

Andrew Leishman and Alan Hey, and are exercisable at a price of

6.60p per share.

The share options granted to Andrew Leishman lapsed on 1 January

2019 due to his departure from the Company.

The share options granted to Alan Hey lapsed subsequent to year

end 31 December 2019 due to his departure from the Company.

On 21 May 2019 717,143 options over ordinary shares were granted

to both John Chiplin and Christopher Britten under the Company's

share option scheme and are exercisable at a price of 3.55p per

share.

a) Warrants

As part of the Placing on 3 May 2017 which raised GBP1,500,000

before fees and expenses, the Company issued warrants on a 1 for 1

basis at an exercise price of 8.5p per warrant. This resulted in

the issue of 21,428,571 warrants exercisable at 8.5p. The Company

also issued warrants, exercisable at 8.5p, to the Company's brokers

on the transaction in lieu of fees (together, the "Placing

Warrants"). This resulted in the total number of Placing Warrants

in issue immediately following the Placing being 22,710,923.

The warrants entitled holders to subscribe for new ordinary

shares at any time in the period of two years following the grant

of the warrants. The expiry date of the placing warrants was 3 May

2019.

2019

Date of Grant Warrant E xp i E xerc Exercised Number of Remaining

balance ry Date ise Pr Warrants Shares issued Warrants

at 1 January i ce GBP (1:1) at 31 December

2019 2019

03.05.2017 11,054,071 03.05.2019 0.085 - - -

--------------- -------------- ----------- ---------- ---------- --------------- ----------------

2018

Date of Grant Warrant E xp i E xerc Exercised Number of Remaining

balance ry Date ise Pr Warrants Shares issued Warrants

at 1 January i ce GBP (1:1) at 31 December

2018 2018

03.05.2017 20,282,351 03.05.2019 0.085 9,228,280 9,228,280 11,054,071

--------------- -------------- ----------- ---------- ---------- --------------- ----------------

During the year ended 31 December 2019 none of the warrants

issued on 3 May 2017 were exercised (2018: 9,228,280). The

remaining balance of the warrants totaling 11,054,071 expired on 3

May 2019.

During the year, an amount of GBP54,329 (2018: GBP792,846),

representing the expired warrants (2018: exercised warrants), has

been recognised against share premium and GBPnil (2018: GBP36,913)

to share capital. The fair value of the warrants in issue and not

yet exercised was determined using the Black Scholes model. The

fair value of the warrants at 31 December 2019 is GBPnil (2018:

GBP54,329).

10. Capital and reserves

2019 2018

GBP GBP

101,462,537 Ordinary Shares of

0.4p each (2018: 90,962,537 Ordinary

Shares of 0.4p each) 405,850 363,850

137,674,431 Deferred Shares of

0.4p each (2018: 137,674,431 Deferred

Shares of 0.4p each) 5,506,977 5,506,977

279,176,540 Deferred Shares of

0.099p each (2018: 279,176,540

Deferred Shares of 0.099p each) 2,763,848 2,763,848

---------- ----------

8,676,675 8,634,675

========== ==========

All ordinary shares rank equally in all respects, including for

dividends, shareholder attendance and voting rights at meetings, on

a return of capital and in a winding-up.

During the year 10,500,000 new ordinary shares of 0.4p each were

issued.

The 137,674,431 deferred shares of 0.4p, have no right to

dividends nor do the holders thereof have the right to receive

notice of or to attend or vote at any general meeting of the

Company. On a return of capital or on a winding up of the Company,

the holders of the deferred shares shall only be entitled to

receive the amount paid up on such shares after the holders of the

ordinary shares have received the sum of GBP1,000,000 for each

ordinary share held by them.

The 279,176, 540 deferred shares of 0. 099p shall be entitled to

receive a special dividend, which is payable upon the repayment to

the Company of any amount owed under certain loan agreement, after

which the Company shall, in priority to any distribution to any

other class of share, pay to the holders of the Special Deferred

Shares an aggregate amount equal to the amount repaid pro rata

according to the number of such shares paid up as to their nominal

value held by each shareholder. They shall be entitled to no other

distribution save for a special dividend and shall not be entitled

to receive notice of or attend or vote at a general meeting of the

Company. On a return of capital on a winding up of the Company,

shall only be entitled to receive the amount paid up on such shares

up to a maximum of 0.9 pence per share after the holders of the

Ordinary Shares and the Deferred Shares have received their return

on capital .

Reserves

Share premium reserve

The share premium reserve comprises the excess of consideration

received over the par value of the shares issued, plus the nominal

value of share capital at the date of redesignation at no par

value.

Share option reserve

The share option reserve comprises the fair value of warrants

and options granted, less the fair value of lapsed and expired

warrants and options.

Reserves in the consolidated statement of financial position

comprise the share option reserve, reverse acquisition reserve and

the merger reserve.

11. Earnings per share

The calculation of basic loss per share at 31 December 2019 was

based on the loss of GBP876,373 (2018: GBP1,184,843), and a

weighted average number of ordinary shares outstanding of

100,168,016 (2018: 89,440,373), calculated as follows:

2019 2018

GBP GBP

Losses attributable to ordinary shareholders 876,373 1,184,843

Weighted average number of ordinary shares

Issued ordinary shares at 1 January 89,440,373 64,783,082

Effect of shares issued during the year 10,727,643 24,657,291

------------ -----------

Weighted average number of shares at 31 December 100,168,016 89,440,373

------------ -----------

2019 pence 2018 pence

per share per share

Basic loss per share (0.87) (1.32)

----------- -------------

Diluted loss per share

Diluted earnings per share is calculated by adjusting the

weighted average number of shares outstanding to assume conversion

of all potential dilutive shares, namely share options. All of the

options existing at 31 December 2019 have an exercise price that is

greater than the market price of the shares and as a result are non

dilutive and excluded from the diluted loss per share

calculation.The calculation of diluted loss per share at 31

December 2019 was based on the loss of GBP876,373 (31 December

2018: GBP1,184,843), and a weighted average number of ordinary

shares outstanding of 100,168,016 (2018: 91,305,287).

2019 pence 2018 pence

per share per share

Diluted loss per share (0.87) (1.30)

----------- -----------

12. Financial instruments

(a) Fair values of financial instruments

The fair values of all financial assets and financial

liabilities are equal to their carrying amounts shown in the

consolidated statement of financial position.

Trade and other receivables

The fair value of trade and other receivables is estimated as

the present value of future cash flows, discounted at the market

rate of interest at the reporting date if the effect is

material.

Trade and other payables

The fair value of trade and other payables is estimated as the

present value of future cash flows, discounted at the market rate

of interest at the reporting date if the effect is material.

Cash and cash equivalents

The fair value of cash and cash equivalents is estimated as its

carrying amount where the cash is repayable on demand. Where it is

not repayable on demand then the fair value is estimated at the

present value of future cash flows, discounted at the market rate

of interest at the reporting date.

(b) Credit risk

Financial risk management

Credit risk is the risk of financial loss to the Group if a

customer or counterparty to a financial instrument fails to meet

its contractual obligations and arises principally from the Group's

receivables and cash and cash equivalents. The carrying amount of

cash, cash equivalents and term deposits represents the maximum

credit exposure on those assets. The cash and cash equivalents are

held with UK bank and financial institution counterparties which

are rated at least A .

Exposure to credit risk

The carrying amount of financial assets represents the maximum

credit exposure. Therefore, the maximum exposure to credit risk at

the reporting date of the Group was GBP99,269 (2018: GBP276,926),

being the total of the carrying amount of financial assets, shown

in the consolidated statement of financial position.

(c) Liquidity risk

Liquidity risk is the risk that the Group will not be able to

meet its financial obligations as they fall due.

The following are the contractual maturities of financial

liabilities, including estimated interest payments and excluding

the impact of netting agreements.

Group:

Financial liabilities Carrying Contractual 6 months 6-12 1 -2 years

amount cash flows or less months

GBP GBP GBP GBP GBP

31 December 2019

Trade and other

payables 51,547 51,547 51,547 - -

--------- ------------ --------- -------- -----------

31 December 2018

Trade and other

payables 159,666 159,666 159,666 - -

--------- ------------ --------- -------- -----------

(d) Currency risk

The Group does not have significant exposure to foreign currency

risk at present. The Group does not have any monetary financial

instruments which are held in a currency that differs from that

entity's functional currency.

(e) Interest rate risk

Profile

At the reporting date the interest rate profile of

interest-bearing financial instruments was:

Carrying amount

Group:

2019 2018

GBP GBP

Variable rate instruments

-------- --------

Cash and cash equivalents 965,752 793,141

-------- --------

Cash flow sensitivity analysis for variable rate instruments

The Group's interest-bearing assets at the reporting date were

invested with financial institutions in the United Kingdom with a

S&P rating of A2 and comprised solely bank accounts.

A change in interest rates would have increased/(decreased)

profit or loss by the amounts shown below. This analysis assumes

that all other variables, in particular, foreign currency rates,

remain constant. This analysis is performed on the same basis for

2018.

Group: 2019 2018

Profit or loss Profit or loss

100 bp increase 100 bp decrease 100 bp increase 100 bp decrease

Variable rate instruments 9,658 (9,658) 7,931 (7,931)

---------------- ---------------- ---------------- ----------------

13. Related parties

Key management personnel

As at the year end, there are no key management personnel

employed by the Group in addition to the Directors.

Directors' remuneration and interests

2019 Remuneration Interests

Cash-based Share-based Shares Options

Director payments payments Totals

GBP GBP GBP No. No.

Nigel Theobald (Chief

Executive Officer) 70,000 - 70,000 16,981,319 -

Paul Titley (resigned

20 May 2019) 15,282 - 15,282 142,857 717,143

David Templeton 38,310 - 38,310 - 717,143

Luke Cairns 24,000 - 24,000 142,857 1,392,445

Christopher Britten 14,923 - 14,923 - 717,143

John Chiplin 14,667 - 14,667 - 717,143

177,182 - 177,182 17,267,033 4,261,017

=========== ============ ========= =========== ==========

The above remuneration relates to N4 Pharma Plc (and N4 Pharma

UK Limited) directors.

An amount of GBP16,000 (2018: GBP36,000) is payable to Nigel

Theobald by N4 Pharma UK Limited. This forms part of the Trade and

Other payables.

No contributions are paid by the Group to a pension scheme on

behalf of the Directors.

There are no further related parties identified.

14. Subsequent events

N4 Biotech Limited was dissolved on 14 January 2020.

The share options granted to Alan Hey totaling 717,143 options

lapsed subsequent to year end 31 December 2019 due to his departure

from the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR BRGDDDUDDGGS

(END) Dow Jones Newswires

February 25, 2020 02:00 ET (07:00 GMT)

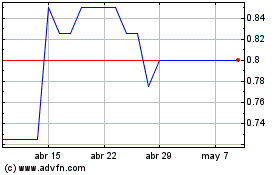

N4 Pharma (LSE:N4P)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

N4 Pharma (LSE:N4P)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024